Health & Hygiene Packaging Market Report Scope & Overview:

Get More Information on Health & Hygiene Packaging Market - Request Sample Report

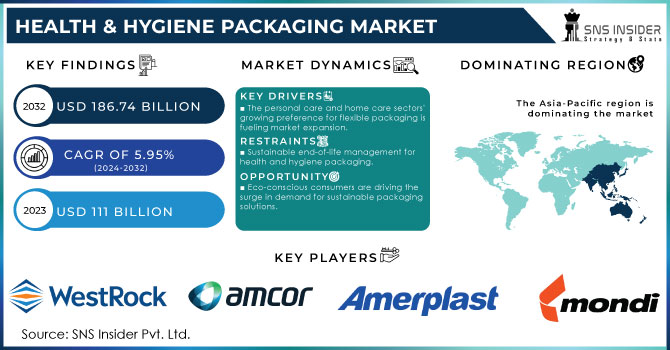

The Health & Hygiene Packaging Market Size was valued at USD 111 billion in 2023 and is projected to reach USD 186.74 billion by 2032 growing at a CAGR of 5.95% from 2024 to 2032.

Heightened awareness of hygiene and the rise of convenient, portable products are fueling demand. Concerns about contamination and food safety further emphasize the need for secure packaging. The COVID-19 pandemic significantly accelerated this trend, as sanitization products and protective gear became essential. Technological advancements like biodegradable materials and smart packaging solutions are enabling the creation of packaging that is not only safe but also sustainable.

This market is particularly promising in regions like India, with its growing healthcare sector and increasing government investment in public health. The Indian government significantly boosted its budget allocation for health and well-being in the Union Budget 2021-22, allocating INR 2,23,846 crore, a substantial hike from the previous year's INR 94,452 crore. As the importance of hygiene and safety rises globally, the health and hygiene packaging market is well-positioned to thrive.

MARKET DYNAMICS

KEY DRIVERS:

The personal care and home care sectors' growing preference for flexible packaging is fueling market expansion.

Flexible packaging is taking over the personal care and home care shelves. This rise in popularity is due to its many benefits. Flexible pouches and containers can fit all shapes and sizes, making them perfect for different products. They're also lightweight, saving space and reducing shipping costs. Plus, they're easy to open and reclose, keeping your favorite shampoo or laundry detergent fresh. No wonder the flexible packaging market is booming.

The increasing importance of preventive healthcare is leading to a heightened focus on health awareness.

RESTRAINTS:

Sustainable end-of-life management for health and hygiene packaging.

High material costs and limited recycling options are making it tough for hygiene packaging companies to compete. Plastic prices are rising, and key parts like polypropylene are hard to find. Plus, most hygiene packaging can't be easily recycled because it's made of different layers stuck together. This is bad for the environment and makes recycling slow and expensive. The hygiene packaging industry needs to find ways to make packaging cheaper and easier to recycle to keep growing.

Developing safe and hygienic packaging solutions can be a financial hurdle.

OPPORTUNITY:

Eco-conscious consumers are driving the surge in demand for sustainable packaging solutions.

Eco-conscious brands are revamping their packaging. Growing concerns about the environment are pushing them to ditch excess plastic and embrace sustainable practices. This means designing smaller, lighter packages that require less space to transport, a win-win for the planet and shipping costs. It's also a response to consumers' demand for eco-friendly products. With hygiene a top priority these days, this trend is particularly hot in the flexible packaging market.

Consumers are increasingly demanding stricter safeguards against contamination throughout the food supply chain.

CHALLENGES:

Advanced technology is revolutionizing Health & Hygiene packaging, bringing exciting new features and functionalities.

Flexible packaging is getting a high-tech makeover. New technology is making it possible to add cool features like built-in inventory trackers and product monitors, which means less manual work for everyone. But that's not all! Manufacturers are also creating eye-catching designs that appeal to a wider range of consumers. This focus on both smart tech and shelf appeal shows how flexible packaging is innovating to keep up with what people want and what technology allows.

Strict regulations for health and hygiene packaging prioritize the safety of consumers and the integrity of the products.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine disrupts the health and hygiene packaging market in two main ways. Firstly, Ukraine is a key supplier of raw materials like polymers and resins. The conflict creates bottlenecks, shortages, and price hikes for these materials, impacting global availability and driving up costs for manufacturers. Secondly, the war's instability leads to currency fluctuations and commodity price variations, making production and transportation more expensive. These factors combine to push up the final price of health and hygiene packaging products, squeezing both manufacturers and consumers. However, the war also creates a countervailing force. Humanitarian crises caused by the conflict, such as displaced populations and damaged healthcare facilities, heighten the need for essential hygiene products. This could lead to a rise in demand for specialized packaging solutions designed for humanitarian aid efforts.

IMPACT OF ECONOMIC SLOWDOWN

Lower consumer spending might lead to a drop in demand for non-essential personal care and home care products, impacting packaging needs. This could force companies to choose cheaper packaging options, potentially putting a strain on innovation and sustainable solutions. Even though hygiene products are essential, consumers may switch to budget-friendly alternatives, further affecting market dynamics. The over-the-counter (OTC) pharmaceutical market could also see changes in buying habits, impacting the types and amounts of packaging needed.

KEY MARKET SEGMENTS

By Product Type

Films and sheets

Bags & Pouches

laminates, labels

Jars & Bottles

Sachets

boxes and cartons

Others

The health and hygiene packaging market is a diverse bunch, with films and sheets reigning supreme with 57.5% of market revenue. This dominance is due to their versatility and protective qualities. They keep healthcare, hygiene, and pharmaceutical products safe from moisture, oxygen, and other threats. Plus, they can be customized with anti-counterfeiting features and tamper-evident designs for extra security. Furthermore, the rise of single-use, convenient packaging like sachets is fueling the demand for these films and sheets even more.

By Form

Rigid Packaging

Molding

Extrusion

Others

Flexible Packaging

Single Layer

Multi-Layer

Flexible packaging holds dominance with 57% of the market revenue. This popularity is due to its lightweight design, ability to bend and conform, and affordability. Plus, advancements in this area are creating innovative and user-friendly options for both consumers and healthcare professionals. Think stand-up pouches and resealable packages are convenient and keeping products fresh.

By Structure

Porous

Non-porous

In health and hygiene packaging, keeping things clean and secure is top priority That's why non-porous packaging is dominating, holding 62% of the market. This type of packaging is especially important for medical supplies, medicine, and personal care items. It blocks out germs and keeps products safe from tampering, making sure they reach consumers in perfect condition. With stricter regulations and people wanting extra protection, non-porous packaging is a must-have for the health and hygiene industry.

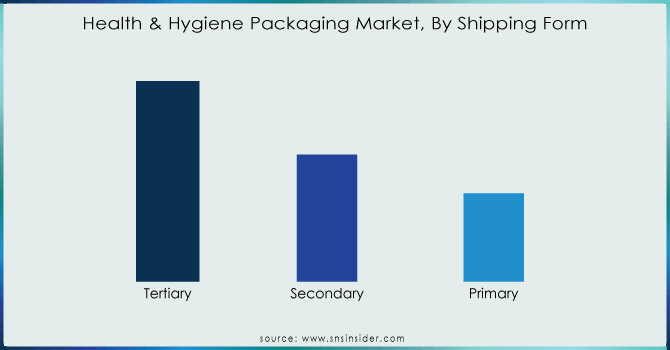

By Shipping Form

Primary

Secondary

Tertiary

The health and hygiene packaging market is all about protecting products for their journey to consumers. The tertiary packaging segment is the biggest at 60% of the market revenue. This is because hospitals and healthcare companies are looking for eco-friendly ways to package things. Tertiary packaging companies are stepping up by creating sustainable solutions that keep products safe without harming the environment.

Do You Need any Customization Research on health and hygiene packaging market - Enquire Now

By Distribution Channel

Hypermarkets/Supermarkets

Online Retailers

Direct Sales

Others

Direct sales reign supreme in health and hygiene packaging, capturing 61% of the market revenue. This distribution channel thrives on its ability to tailor products to individual needs. Unlike one-size-fits-all options found in stores, direct sales cater to specific preferences in the health and hygiene industry. Here, customers often have unique requirements when it comes to product formulas, packaging sizes, and designs. Direct sales channels meet these diverse needs through customization and personalization, ensuring customers get exactly what they're looking for.

REGIONAL ANALYSIS

The Asia-Pacific region is expected to dominate the health and hygiene packaging market with China and India leading the regional market. This growth is fueled by a booming population, growing healthcare sectors, and a rising focus on hygiene. India's impressive digital healthcare infrastructure and China's established market presence further solidify Asia-Pacific's position as a leader in this sector. Additionally, the surge of e-commerce in the region is driving demand for convenient and hygienic packaging solutions, propelling the market to even greater heights.

Europe commands the second-largest slice of the health and hygiene packaging pie, fueled by constant technological advancements. The UK, a leader in this space, boasts an impressive packaging industry that generates billions in sales and employs a significant portion of its workforce. Manufacturers are pouring resources into R&D, focusing on innovative materials that offer superior protection against contamination, leakage, and tampering. One such breakthrough is the rise of antimicrobial packaging, ensuring the safety and integrity of hygiene products. Notably, Germany holds the largest market share within Europe, while the UK is experiencing the fastest growth.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Key players

Some of the major players in the Health & Hygiene Packaging Market are Amcor Plc, Mondi Group, WestRock, Sonoco Products Company, Amerplast Ltd, Kimberly Clark, Berry Global, Comar Packaging Solutions, Glenroy, Inc, Essity And Others Players.

RECENT DEVELOPMENTS

Berry Global partnered with PYLOTE in October 2022 to launch a novel multi dose eye dropper boasting high barrier and antimicrobial protection.

Amcor launched Dairy Seal in September 2022. This innovative PET packaging line with ClearCor technology caters to the growing needs of the RTD, dairy alternatives, and nutritional markets.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 111 Bn |

| Market Size by 2032 | US$ 186.74 Bn |

| CAGR | CAGR of 5.95% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type(Films And Sheets, Bags & Pouches, Laminates, Labels, Jars & Bottles, Sachets, Boxes And Cartons, Others) • By Form[ Rigid Packaging (Molding, Extrusion, Others), Flexible Packaging (Single Layer, Multi-Layer)] • By Structure (Porous, Non-Porous) • By Shipping Form (Primary, Secondary, Tertiary) • By Distribution Channel (Hypermarkets/Supermarkets, Online Retailers, Direct Sales, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, Mondi Group, WestRock, Sonoco Products Company, Amerplast Ltd, Kimberly Clark, Berry Global, Comar Packaging Solutions, Glenroy, Inc, Essity |

| Key Drivers | • The personal care and home care sectors' growing preference for flexible packaging is fueling market expansion. • The increasing importance of preventive healthcare is leading to a heightened focus on health awareness. |

| Key Restraints | • Sustainable end-of-life management for health and hygiene packaging. • Developing safe and hygienic packaging solutions can be a financial hurdle. |

Ans: The Health & Hygiene Packaging Market is expected to grow at a CAGR of 5.95%.

Ans: Health & Hygiene Packaging Market size was USD 111 billion in 2023 and is expected to Reach USD 186.74 billion by 2032.

Ans: The personal care and home care sectors' growing preference for flexible packaging is fueling market expansion.

Ans: Sustainable end-of-life management for health and hygiene packaging.

Ans: Asia-Pacific region is expected to dominate the health and hygiene packaging market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Health & Hygiene Packaging Market Segmentation, By Product Type

9.1 Introduction

9.2 Trend Analysis

9.3 Films and sheets

9.4 Bags & Pouches

9.5 laminates, labels

9.6 Jars & Bottles

9.7 Sachets

9.8 boxes and cartons

9.9 Others

10. Health & Hygiene Packaging Market Segmentation, By Form

10.1 Introduction

10.2 Trend Analysis

10.3 Rigid Packaging

10.3.1 Molding

10.3.2 Extrusion

10.3.3 Others

10.4 Flexible Packaging

10.4.1 Single Layer

10.4.2 Multi-Layer

11. Health & Hygiene Packaging Market Segmentation, By Structure

11.1 Introduction

11.2 Trend Analysis

11.3 Porous

11.4 Non-porous

12. Health & Hygiene Packaging Market Segmentation, By Shipping Form

12.1 Introduction

12.2 Trend Analysis

12.3 Primary

12.4 Secondary

12.5 Tertiary

13. Health & Hygiene Packaging Market Segmentation, By Distribution Channel

13.1 Introduction

13.2 Trend Analysis

13.3 Hypermarkets/Supermarkets

13.4 Online Retailers

13.5 Direct Sales

13.6 Others

14. Regional Analysis

14.1 Introduction

14.2 North America

14.2.1 Trend Analysis

14.2.2 North America Health & Hygiene Packaging Market By Country

14.2.3 North America Health & Hygiene Packaging Market By Product Type

14.2.4 North America Health & Hygiene Packaging Market By Form

14.2.5 North America Health & Hygiene Packaging Market By Structure

14.2.6 North America Health & Hygiene Packaging Market, By Shipping Form

14.2.7 North America Health & Hygiene Packaging Market, By Distribution Channel

14.2.8 USA

14.2.8.1 USA Health & Hygiene Packaging Market By Product Type

14.2.8.2 USA Health & Hygiene Packaging Market By Form

14.2.8.3 USA Health & Hygiene Packaging Market By Structure

14.2.8.4 USA Health & Hygiene Packaging Market, By Shipping Form

14.2.8.5 USA Health & Hygiene Packaging Market, By Distribution Channel

14.2.9 Canada

14.2.9.1 Canada Health & Hygiene Packaging Market By Product Type

14.2.9.2 Canada Health & Hygiene Packaging Market By Form

14.2.9.3 Canada Health & Hygiene Packaging Market By Structure

14.2.9.4 Canada Health & Hygiene Packaging Market, By Shipping Form

14.2.9.5 Canada Health & Hygiene Packaging Market, By Distribution Channel

14.2.10 Mexico

14.2.10.1 Mexico Health & Hygiene Packaging Market By Product Type

14.2.10.2 Mexico Health & Hygiene Packaging Market By Form

14.2.10.3 Mexico Health & Hygiene Packaging Market By Structure

14.2.10.4 Mexico Health & Hygiene Packaging Market, By Shipping Form

14.2.10.5 Mexico Health & Hygiene Packaging Market, By Distribution Channel

14.3 Europe

14.3.1 Trend Analysis

14.3.2 Eastern Europe

14.3.2.1 Eastern Europe Health & Hygiene Packaging Market By Country

14.3.2.2 Eastern Europe Health & Hygiene Packaging Market By Product Type

14.3.2.3 Eastern Europe Health & Hygiene Packaging Market By Form

14.3.2.4 Eastern Europe Health & Hygiene Packaging Market By Structure

14.3.2.5 Eastern Europe Health & Hygiene Packaging Market By Shipping Form

14.3.2.6 Eastern Europe Health & Hygiene Packaging Market, By Distribution Channel

14.3.2.7 Poland

14.3.2.7.1 Poland Health & Hygiene Packaging Market By Product Type

14.3.2.7.2 Poland Health & Hygiene Packaging Market By Form

14.3.2.7.3 Poland Health & Hygiene Packaging Market By Structure

14.3.2.7.4 Poland Health & Hygiene Packaging Market By Shipping Form

14.3.2.7.5 Poland Health & Hygiene Packaging Market, By Distribution Channel

14.3.2.8 Romania

14.3.2.8.1 Romania Health & Hygiene Packaging Market By Product Type

14.3.2.8.2 Romania Health & Hygiene Packaging Market By Form

14.3.2.8.3 Romania Health & Hygiene Packaging Market By Structure

14.3.2.8.4 Romania Health & Hygiene Packaging Market By Shipping Form

14.3.2.8.5 Romania Health & Hygiene Packaging Market, By Distribution Channel

14.3.2.9 Hungary

14.3.2.9.1 Hungary Health & Hygiene Packaging Market By Product Type

14.3.2.9.2 Hungary Health & Hygiene Packaging Market By Form

14.3.2.9.3 Hungary Health & Hygiene Packaging Market By Structure

14.3.2.9.4 Hungary Health & Hygiene Packaging Market By Shipping Form

14.3.2.9.5 Hungary Health & Hygiene Packaging Market, By Distribution Channel

14.3.2.10 Turkey

14.3.2.10.1 Turkey Health & Hygiene Packaging Market By Product Type

14.3.2.10.2 Turkey Health & Hygiene Packaging Market By Form

14.3.2.10.3 Turkey Health & Hygiene Packaging Market By Structure

14.3.2.10.4 Turkey Health & Hygiene Packaging Market By Shipping Form

14.3.2.10.5 Turkey Health & Hygiene Packaging Market, By Distribution Channel

14.3.2.11 Rest of Eastern Europe

14.3.2.11.1 Rest of Eastern Europe Health & Hygiene Packaging Market By Product Type

14.3.2.11.2 Rest of Eastern Europe Health & Hygiene Packaging Market By Form

14.3.2.11.3 Rest of Eastern Europe Health & Hygiene Packaging Market By Structure

14.3.2.11.4 Rest of Eastern Europe Health & Hygiene Packaging Market By Shipping Form

14.3.2.11.5 Rest of Eastern Europe Health & Hygiene Packaging Market, By Distribution Channel

14.3.3 Western Europe

14.3.3.1 Western Europe Health & Hygiene Packaging Market By Country

14.3.3.2 Western Europe Health & Hygiene Packaging Market By Product Type

14.3.3.3 Western Europe Health & Hygiene Packaging Market By Form

14.3.3.4 Western Europe Health & Hygiene Packaging Market By Structure

14.3.3.5 Western Europe Health & Hygiene Packaging Market By Shipping Form

14.3.3.6 Western Europe Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.7 Germany

14.3.3.7.1 Germany Health & Hygiene Packaging Market By Product Type

14.3.3.7.2 Germany Health & Hygiene Packaging Market By Form

14.3.3.7.3 Germany Health & Hygiene Packaging Market By Structure

14.3.3.7.4 Germany Health & Hygiene Packaging Market By Shipping Form

14.3.3.7.5 Germany Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.8 France

14.3.3.8.1 France Health & Hygiene Packaging Market By Product Type

14.3.3.8.2 France Health & Hygiene Packaging Market By Form

14.3.3.8.3 France Health & Hygiene Packaging Market By Structure

14.3.3.8.4 France Health & Hygiene Packaging Market By Shipping Form

14.3.3.8.5 France Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.9 UK

14.3.3.9.1 UK Health & Hygiene Packaging Market By Product Type

14.3.3.9.2 UK Health & Hygiene Packaging Market By Form

14.3.3.9.3 UK Health & Hygiene Packaging Market By Structure

14.3.3.9.4 UK Health & Hygiene Packaging Market By Shipping Form

14.3.3.9.5 UK Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.10 Italy

14.3.3.10.1 Italy Health & Hygiene Packaging Market By Product Type

14.3.3.10.2 Italy Health & Hygiene Packaging Market By Form

14.3.3.10.3 Italy Health & Hygiene Packaging Market By Structure

14.3.3.10.4 Italy Health & Hygiene Packaging Market By Shipping Form

14.3.3.10.5 Italy Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.11 Spain

14.3.3.11.1 Spain Health & Hygiene Packaging Market By Product Type

14.3.3.11.2 Spain Health & Hygiene Packaging Market By Form

14.3.3.11.3 Spain Health & Hygiene Packaging Market By Structure

14.3.3.11.4 Spain Health & Hygiene Packaging Market By Shipping Form

14.3.3.11.5 Spain Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.12 Netherlands

14.3.3.12.1 Netherlands Health & Hygiene Packaging Market By Product Type

14.3.3.12.2 Netherlands Health & Hygiene Packaging Market By Form

14.3.3.12.3 Netherlands Health & Hygiene Packaging Market By Structure

14.3.3.12.4 Netherlands Health & Hygiene Packaging Market By Shipping Form

14.3.3.12.5 Netherlands Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.13 Switzerland

14.3.3.13.1 Switzerland Health & Hygiene Packaging Market By Product Type

14.3.3.13.2 Switzerland Health & Hygiene Packaging Market By Form

14.3.3.13.3 Switzerland Health & Hygiene Packaging Market By Structure

14.3.3.13.4 Switzerland Health & Hygiene Packaging Market By Shipping Form

14.3.3.13.5 Switzerland Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.14 Austria

14.3.3.14.1 Austria Health & Hygiene Packaging Market By Product Type

14.3.3.14.2 Austria Health & Hygiene Packaging Market By Form

14.3.3.14.3 Austria Health & Hygiene Packaging Market By Structure

14.3.3.14.4 Austria Health & Hygiene Packaging Market By Shipping Form

14.3.3.14.5 Austria Health & Hygiene Packaging Market, By Distribution Channel

14.3.3.15 Rest of Western Europe

14.3.3.15.1 Rest of Western Europe Health & Hygiene Packaging Market By Product Type

14.3.3.15.2 Rest of Western Europe Health & Hygiene Packaging Market By Form

14.3.3.15.3 Rest of Western Europe Health & Hygiene Packaging Market By Structure

14.3.3.15.4 Rest of Western Europe Health & Hygiene Packaging Market By Shipping Form

14.3.3.15.5 Rest of Western Europe Health & Hygiene Packaging Market, By Distribution Channel

14.4 Asia-Pacific

14.4.1 Trend Analysis

14.4.2 Asia-Pacific Health & Hygiene Packaging Market By country

14.4.3 Asia-Pacific Health & Hygiene Packaging Market By Product Type

14.4.4 Asia-Pacific Health & Hygiene Packaging Market By Form

14.4.5 Asia-Pacific Health & Hygiene Packaging Market By Structure

14.4.6 Asia-Pacific Health & Hygiene Packaging Market By Shipping Form

14.4.7 Asia-Pacific Health & Hygiene Packaging Market, By Distribution Channel

14.4.8 China

14.4.8.1 China Health & Hygiene Packaging Market By Product Type

14.4.8.2 China Health & Hygiene Packaging Market By Form

14.4.8.3 China Health & Hygiene Packaging Market By Structure

14.4.8.4 China Health & Hygiene Packaging Market By Shipping Form

14.4.8.5 China Health & Hygiene Packaging Market, By Distribution Channel

14.4.9 India

14.4.9.1 India Health & Hygiene Packaging Market By Product Type

14.4.9.2 India Health & Hygiene Packaging Market By Form

14.4.9.3 India Health & Hygiene Packaging Market By Structure

14.4.9.4 India Health & Hygiene Packaging Market By Shipping Form

14.4.9.5 India Health & Hygiene Packaging Market, By Distribution Channel

14.4.10 Japan

14.4.10.1 Japan Health & Hygiene Packaging Market By Product Type

14.4.10.2 Japan Health & Hygiene Packaging Market By Form

14.4.10.3 Japan Health & Hygiene Packaging Market By Structure

14.4.10.4 Japan Health & Hygiene Packaging Market By Shipping Form

14.4.10.5 Japan Health & Hygiene Packaging Market, By Distribution Channel

14.4.11 South Korea

14.4.11.1 South Korea Health & Hygiene Packaging Market By Product Type

14.4.11.2 South Korea Health & Hygiene Packaging Market By Form

14.4.11.3 South Korea Health & Hygiene Packaging Market By Structure

14.4.11.4 South Korea Health & Hygiene Packaging Market By Shipping Form

14.4.11.5 South Korea Health & Hygiene Packaging Market, By Distribution Channel

14.4.12 Vietnam

14.4.12.1 Vietnam Health & Hygiene Packaging Market By Product Type

14.4.12.2 Vietnam Health & Hygiene Packaging Market By Form

14.4.12.3 Vietnam Health & Hygiene Packaging Market By Structure

14.4.12.4 Vietnam Health & Hygiene Packaging Market By Shipping Form

14.4.12.5 Vietnam Health & Hygiene Packaging Market, By Distribution Channel

14.4.13 Singapore

14.4.13.1 Singapore Health & Hygiene Packaging Market By Product Type

14.4.13.2 Singapore Health & Hygiene Packaging Market By Form

14.4.13.3 Singapore Health & Hygiene Packaging Market By Structure

14.4.13.4 Singapore Health & Hygiene Packaging Market By Shipping Form

14.4.13.5 Singapore Health & Hygiene Packaging Market, By Distribution Channel

14.4.14 Australia

14.4.14.1 Australia Health & Hygiene Packaging Market By Product Type

14.4.14.2 Australia Health & Hygiene Packaging Market By Form

14.4.14.3 Australia Health & Hygiene Packaging Market By Structure

14.4.14.4 Australia Health & Hygiene Packaging Market By Shipping Form

14.4.14.5 Australia Health & Hygiene Packaging Market, By Distribution Channel

14.4.15 Rest of Asia-Pacific

14.4.15.1 Rest of Asia-Pacific Health & Hygiene Packaging Market By Product Type

14.4.15.2 Rest of Asia-Pacific Health & Hygiene Packaging Market By Form

14.4.15.3 Rest of Asia-Pacific Health & Hygiene Packaging Market By Structure

14.4.15.4 Rest of Asia-Pacific Health & Hygiene Packaging Market By Shipping Form

14.4.15.5 Rest of Asia-Pacific Health & Hygiene Packaging Market, By Distribution Channel

14.5 Middle East & Africa

14.5.1 Trend Analysis

14.5.2 Middle East

14.5.2.1 Middle East Health & Hygiene Packaging Market By Country

14.5.2.2 Middle East Health & Hygiene Packaging Market By Product Type

14.5.2.3 Middle East Health & Hygiene Packaging Market By Form

14.5.2.4 Middle East Health & Hygiene Packaging Market By Structure

14.5.2.5 Middle East Health & Hygiene Packaging Market By Shipping Form

14.5.2.6 Middle East Health & Hygiene Packaging Market, By Distribution Channel

14.5.2.7 UAE

14.5.2.7.1 UAE Health & Hygiene Packaging Market By Product Type

14.5.2.7.2 UAE Health & Hygiene Packaging Market By Form

14.5.2.7.3 UAE Health & Hygiene Packaging Market By Structure

14.5.2.7.4 UAE Health & Hygiene Packaging Market By Shipping Form

14.5.2.7.5 UAE Health & Hygiene Packaging Market, By Distribution Channel

14.5.2.8 Egypt

14.5.2.8.1 Egypt Health & Hygiene Packaging Market By Product Type

14.5.2.8.2 Egypt Health & Hygiene Packaging Market By Form

14.5.2.8.3 Egypt Health & Hygiene Packaging Market By Structure

14.5.2.8.4 Egypt Health & Hygiene Packaging Market By Shipping Form

14.5.2.8.5 Egypt Health & Hygiene Packaging Market, By Distribution Channel

14.5.2.9 Saudi Arabia

14.5.2.9.1 Saudi Arabia Health & Hygiene Packaging Market By Product Type

14.5.2.9.2 Saudi Arabia Health & Hygiene Packaging Market By Form

14.5.2.9.3 Saudi Arabia Health & Hygiene Packaging Market By Structure

14.5.2.9.4 Saudi Arabia Health & Hygiene Packaging Market By Shipping Form

14.5.2.9.5 Saudi Arabia Health & Hygiene Packaging Market, By Distribution Channel

14.5.2.10 Qatar

14.5.2.10.1 Qatar Health & Hygiene Packaging Market By Product Type

14.5.2.10.2 Qatar Health & Hygiene Packaging Market By Form

14.5.2.10.3 Qatar Health & Hygiene Packaging Market By Structure

14.5.2.10.4 Qatar Health & Hygiene Packaging Market By Shipping Form

14.5.2.10.5 Qatar Health & Hygiene Packaging Market, By Distribution Channel

14.5.2.11 Rest of Middle East

14.5.2.11.1 Rest of Middle East Health & Hygiene Packaging Market By Product Type

14.5.2.11.2 Rest of Middle East Health & Hygiene Packaging Market By Form

14.5.2.11.3 Rest of Middle East Health & Hygiene Packaging Market By Structure

14.5.2.11.4 Rest of Middle East Health & Hygiene Packaging Market By Shipping Form

14.5.2.11.5 Rest of Middle East Health & Hygiene Packaging Market, By Distribution Channel

14.5.3 Africa

14.5.3.1 Africa Health & Hygiene Packaging Market By Country

14.5.3.2 Africa Health & Hygiene Packaging Market By Product Type

14.5.3.3 Africa Health & Hygiene Packaging Market By Form

14.5.3.4 Africa Health & Hygiene Packaging Market By Structure

14.5.3.5 Africa Health & Hygiene Packaging Market By Shipping Form

14.5.3.6 Africa Health & Hygiene Packaging Market, By Distribution Channel

14.5.3.7 Nigeria

14.5.3.7.1 Nigeria Health & Hygiene Packaging Market By Product Type

14.5.3.7.2 Nigeria Health & Hygiene Packaging Market By Form

14.5.3.7.3 Nigeria Health & Hygiene Packaging Market By Structure

14.5.3.7.4 Nigeria Health & Hygiene Packaging Market By Shipping Form

14.5.3.7.5 Nigeria Health & Hygiene Packaging Market, By Distribution Channel

14.5.3.8 South Africa

14.5.3.8.1 South Africa Health & Hygiene Packaging Market By Product Type

14.5.3.8.2 South Africa Health & Hygiene Packaging Market By Form

14.5.3.8.3 South Africa Health & Hygiene Packaging Market By Structure

14.5.3.8.4 South Africa Health & Hygiene Packaging Market By Shipping Form

14.5.3.8.5 South Africa Health & Hygiene Packaging Market, By Distribution Channel

14.5.3.9 Rest of Africa

14.5.3.9.1 Rest of Africa Health & Hygiene Packaging Market By Product Type

14.5.3.9.2 Rest of Africa Health & Hygiene Packaging Market By Form

14.5.3.9.3 Rest of Africa Health & Hygiene Packaging Market By Structure

14.5.3.9.4 Rest of Africa Health & Hygiene Packaging Market By Shipping Form

14.5.3.9.5 Rest of Africa Health & Hygiene Packaging Market, By Distribution Channel

14.6 Latin America

14.6.1 Trend Analysis

14.6.2 Latin America Health & Hygiene Packaging Market By country

14.6.3 Latin America Health & Hygiene Packaging Market By Product Type

14.6.4 Latin America Health & Hygiene Packaging Market By Form

14.6.5 Latin America Health & Hygiene Packaging Market By Structure

14.6.6 Latin America Health & Hygiene Packaging Market By Shipping Form

14.6.7 Latin America Health & Hygiene Packaging Market, By Distribution Channel

14.6.8 Brazil

14.6.8.1 Brazil Health & Hygiene Packaging Market By Product Type

14.6.8.2 Brazil Health & Hygiene Packaging Market By Form

14.6.8.3 Brazil Health & Hygiene Packaging Market By Structure

14.6.8.4 Brazil Health & Hygiene Packaging Market By Shipping Form

14.6.8.5 Brazil Health & Hygiene Packaging Market, By Distribution Channel

14.6.9 Argentina

14.6.9.1 Argentina Health & Hygiene Packaging Market By Product Type

14.6.9.2 Argentina Health & Hygiene Packaging Market By Form

14.6.9.3 Argentina Health & Hygiene Packaging Market By Structure

14.6.9.4 Argentina Health & Hygiene Packaging Market By Shipping Form

14.6.9.5 Argentina Health & Hygiene Packaging Market, By Distribution Channel

14.6.10 Colombia

14.6.10.1 Colombia Health & Hygiene Packaging Market By Product Type

14.6.10.2 Colombia Health & Hygiene Packaging Market By Form

14.6.10.3 Colombia Health & Hygiene Packaging Market By Structure

14.6.10.4 Colombia Health & Hygiene Packaging Market By Shipping Form

14.6.10.5 Colombia Health & Hygiene Packaging Market, By Distribution Channel

14.6.11 Rest of Latin America

14.6.11.1 Rest of Latin America Health & Hygiene Packaging Market By Product Type

14.6.11.2 Rest of Latin America Health & Hygiene Packaging Market By Form

14.6.11.3 Rest of Latin America Health & Hygiene Packaging Market By Structure

14.6.11.4 Rest of Latin America Health & Hygiene Packaging Market By Shipping Form

14.6.11.5 Rest of Latin America Health & Hygiene Packaging Market, By Distribution Channel

15. Company Profiles

15.1 Amcor Plc

15.1.1 Company Overview

15.1.2 Financial

15.1.3 Products/ Services Offered

15.1.4 SWOT Analysis

15.1.5 The SNS View

15.2 Mondi Group

15.2.1 Company Overview

15.2.2 Financial

15.2.3 Products/ Services Offered

15.2.4 SWOT Analysis

15.2.5 The SNS View

15.3 WestRock

15.3.1 Company Overview

15.3.2 Financial

15.3.3 Products/ Services Offered

15.3.4 SWOT Analysis

15.3.5 The SNS View

15.4 Sonoco Products Company

15.4.1 Company Overview

15.4.2 Financial

15.4.3 Products/ Services Offered

15.4.4 SWOT Analysis

15.4.5 The SNS View

15.5 Amerplast Ltd

15.5.1 Company Overview

15.5.2 Financial

15.5.3 Products/ Services Offered

15.5.4 SWOT Analysis

15.5.5 The SNS View

15.6 Kimberly Clark

15.6.1 Company Overview

15.6.2 Financial

15.6.3 Products/ Services Offered

15.6.4 SWOT Analysis

15.6.5 The SNS View

15.7 Berry Global

15.7.1 Company Overview

15.7.2 Financial

15.7.3 Products/ Services Offered

15.7.4 SWOT Analysis

15.7.5 The SNS View

15.8 Comar Packaging Solutions

15.8.1 Company Overview

15.8.2 Financial

15.8.3 Products/ Services Offered

15.8.4 SWOT Analysis

15.8.5 The SNS View

15.9 Glenroy, Inc

15.9.1 Company Overview

15.9.2 Financial

15.9.3 Products/ Services Offered

15.9.4 SWOT Analysis

15.9.5 The SNS View

15.10 Essity

15.10.1 Company Overview

15.10.2 Financial

15.10.3 Products/ Services Offered

15.10.4 SWOT Analysis

15.10.5 The SNS View

16. Competitive Landscape

16.1 Competitive Benchmarking

16.2 Market Share Analysis

16.3 Recent Developments

16.3.1 Industry News

16.3.2 Company News

16.3.3 Mergers & Acquisitions

17. Use Case and Best Practices

18. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Pressure-Sensitive Labels Market size was valued at USD 42.18 billion in 2023. It is expected to grow to USD 74.95 billion by 2032 and grow at a CAGR of 6.60% over the forecast period of 2024-2032.

The Linerless Labels Market size was USD 1.95 billion in 2023 and is expected to Reach USD 2.87 billion by 2031 and grow at a CAGR of 4.95 % over the forecast period of 2024-2031.

The Biodegradable Packaging Market Size was valued at USD 454.68 billion in 2023 and is expected to reach USD 780.73 billion by 2032 and grow at a CAGR of 6.19% over the forecast period 2024-2032.

The Biodegradable Mulch Films Market size was USD 48.61 million in 2023 and is expected to Reach USD 88.67 million by 2031 and grow at a CAGR of 7.8% over the forecast period of 2024-2031.

The Adjustable Boxes Market size was valued at USD 42.70 billion in 2023 and will Reach USD 69.17 billion by 2032 and grow at a CAGR of 5.54% by 2024-2032.

The Rigid Plastic Packaging Market size was USD 147282.50 million in 2023 and is expected to Reach USD 224324.15 million by 2031 and grow at a CAGR of 5.4 % over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone