Get More Information on Head-Up Display Market - Request Sample Report

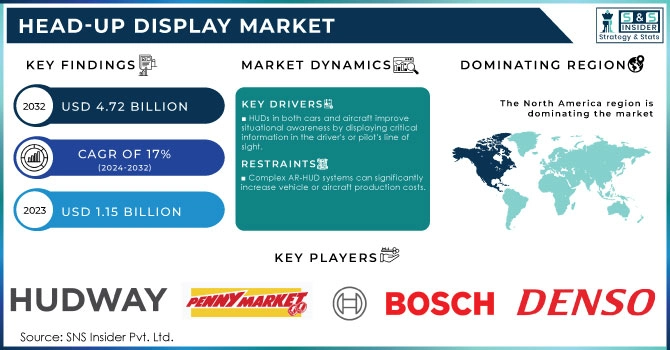

The Head-Up Display Market Size was valued at USD 1.15 billion in 2023 and will reach USD 4.72 billion by 2032 and grow at a CAGR of 17% by 2024-2032

Head-Up Displays (HUDs) are very crucial for safety as they project essential information like speed, navigation, and warnings directly onto the windshield, keeping drivers informed without compromising their focus on the road.

This keeps drivers' eyes focused on the road, reducing distraction and reaction times, leading to safer journeys. The rise of advanced driver-assistance systems (ADAS) and autonomous vehicles is fueling Head-Up Display adoption. As cars become more automated, seamlessly integrating sensor data, navigation cues, and safety alerts onto a HUD becomes crucial. This trend is mirrored in aviation, where advanced HUDs are being developed to display critical flight information and enhance pilot situational awareness.

The advancements in Head-Up Display technology are creating new possibilities. Augmented Reality (AR) HUDs are gaining traction, overlaying virtual objects onto the real world to provide even more intuitive information display. The AR-HUD highlighting pedestrians crossing the street or displaying turn-by-turn navigation arrows directly on the road ahead. Cost remains a factor, with complex AR-HUD systems adding to vehicle prices. The safety regulations regarding projected content and potential driver distraction need to be carefully considered.

KEY DRIVERS:

HUDs in both cars and aircraft improve situational awareness by displaying critical information in the driver's or pilot's line of sight.

The Head-Up Displays (HUDs) are emerging as a transformative technology. They function by projecting essential information directly onto the windshield of a car or the transparent display within an aircraft cockpit. This crucial data, encompassing speed, navigation guidance, and critical warnings, remains constantly within the driver's or pilot's field of view. This eliminates the need to divert attention to instrument panels or traditional navigation systems, significantly enhancing situational awareness. For drivers, this translates to quicker reaction times and a reduced risk of accidents. The pilots benefit from improved awareness of their surroundings and critical flight parameters, leading to safer and more efficient air travel. As advancements in HUD technology continue, we can expect even greater integration with other onboard systems, further solidifying their role as a cornerstone of modern transportation safety.

Augmented reality (AR) HUDs overlay virtual objects onto the real world, offering a more intuitive and user-friendly information experience.

RESTRAINTS:

Complex AR-HUD systems can significantly increase vehicle or aircraft production costs.

Achieving high brightness and resolution for clear visibility can lead to increased power consumption in vehicles.

Balancing clear visibility with efficient power consumption in vehicles proves to be a hurdle. Achieving high brightness and resolution for optimal viewing can lead to increased power draw. This becomes a concern especially for car manufacturers striving for better fuel efficiency. The safety regulations regarding projected content and potential driver distraction require careful consideration. Striking a balance between functionality and responsible use is crucial.

OPPORTUNITIES:

The development of affordable and easy-to-install after-market HUDs can broaden market reach and cater to a wider range of vehicles.

Improvements in microLEDs, microdisplays, and holographic projections can create even more compact, high-resolution, and visually appealing HUDs.

CHALLENGES:

Raising consumer awareness and building trust in HUD technology is crucial for achieving broader market adoption.

by Type

Fixed Mounted

Helmet Mounted

Fixed Mounted is the dominating sub-segment in the Head-Up Display Market by type. This is primarily due to its widespread adoption in the automotive industry, the largest application segment for HUDs. Fixed-mounted HUDs are integrated directly into the vehicle's dashboard, projecting information onto the windshield. This permanent placement offers several advantages, including better image clarity, ease of use, and compatibility with a wider range of vehicle models. While helmet-mounted HUDs are finding niche applications in aviation and personal use, their limited adoption in the high-volume automotive sector keeps them in the secondary position.

by Component

Combiner

Video Generator

Projector Unit

Combiners is the dominating sub-segment in the Head-Up Display Market by component. These transparent elements are positioned in the driver's line of sight and reflect the projected HUD image onto the windshield. The dominance of combiners stems from their critical role in ensuring a clear, high-quality image for the driver. Advancements in combiner technology, such as holographic combiners offering a wider field of view and improved clarity, are further solidifying their position in the market. Video generators and projector units, while crucial components, play a more supporting role in the overall HUD functionality.

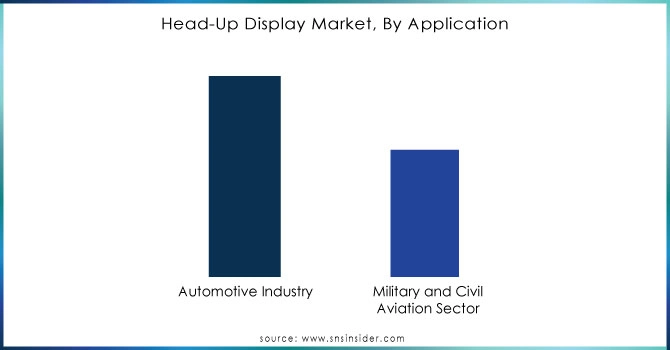

by Application

Automotive Industry

Military and Civil Aviation Sector

Automotive Industry is the dominating sub-segment in the Head-Up Display Market by application holding around 60-65% of market share. The increasing focus on driver safety, coupled with the growing adoption of ADAS features, is fueling the demand for HUDs in cars. These displays provide drivers with crucial information without taking their eyes off the road, enhancing safety and convenience. While the military and civil aviation sectors also utilize HUDs, their application is on a smaller scale due to the more specialized nature of these vehicles and the higher cost associated with integrating complex HUD systems.

Get Customized Report as per Your Business Requirement - Request For Customized Report

by Technology

CRT-based HUD

Digital HUD

Digital HUDs is the dominating sub-segment in the Head-Up Display Market by technology holding around 65-70% of market share. The digital HUD segment is rapidly outpacing its CRT-based counterpart. This shift is driven by the numerous advantages offered by digital technology. Digital HUDs offer superior image quality, resolution, and brightness compared to CRT displays. Additionally, they are lighter, more compact, and consume less power, making them ideal for modern vehicles. The ability of digital HUDs to integrate seamlessly with advanced driver-assistance systems and display a wider range of information further cements their dominance in the market.

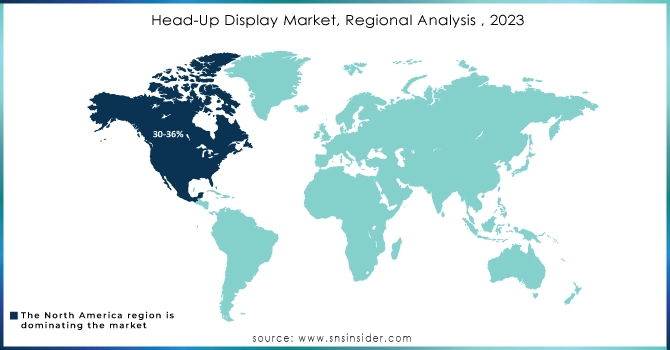

The North America is the dominating region in the Head-Up Display (HUD) Market holding around 30-36% of market share, driven by a thriving automotive market demanding premium features, a strong presence of leading technology companies investing heavily in HUD R&D, and supportive government regulations prioritizing driver safety features.

The Asia Pacific is experiencing the rapid growth fueled by a burgeoning middle class demanding advanced vehicles with features like HUDs. Government initiatives promoting electric vehicles and ADAS further bolster this growth, along with a focus on domestic automotive production. These emerging economies are also transforming into major automotive hubs, attracting investments and production of advanced vehicles that often include HUDs.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Hudway (U.S.), Penny AB (Sweden), Robert Bosch GMBH (Germany), Denso Corporation (Japan), Micro Vision Inc. (U.S.), Yazaki Corporation (Japan), BAE Systems Inc. (U.K.), Honeywell Aerospace (U.S.), Visteon Corporation (U.S.), Continental AG (Germany), Esterline Technologies Corporation (U.S.), Nippon Seiki Co. Ltd (Japan), Saab Automobile AB (Sweden) and other key players.

In Jan. 2024: Air Canada signed a multi-year deal with Airbus to modernize the cockpits of up to 76 A320 planes. The upgrades include advanced displays, Head-Up Displays (HUDs), and various avionics systems. This will enhance pilot situational awareness and improve overall fleet performance.

In Jan. 2024: German automaker BMW announced the all-electric iX3 refresh, featuring a next-generation head-up display. This 2025 model will be built on the new Neue Klasse platform.

In Dec. 2023: The Federal Aviation Administration greenlit a wearable head-up display system for Boeing 737NGs. This AerAware EFVS, developed by a collaboration between Universal Avionics and AerSale, marks the first certified system of its kind.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.15 Billion |

| Market Size by 2032 | US$ 4.72 Billion |

| CAGR | CAGR of 17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Fixed Mounted, Helmet Mounted) • by Component (Combiner, Video Generator, Projector Unit) • by Application (Automotive Industry, Military and Civil Aviation Sector) • by Technology (CRT-based HUD, Digital HUD) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hudway (U.S.), Penny AB (Sweden), Robert Bosch GMBH (Germany), Denso Corporation (Japan), Micro Vision Inc. (U.S.), Yazaki Corporation (Japan), BAE Systems Inc. (U.K.), Honeywell Aerospace (U.S.), Visteon Corporation (U.S.), Continental AG (Germany), Esterline Technologies Corporation (U.S.), Nippon Seiki Co. Ltd (Japan) and Saab Automobile AB (Sweden). |

| Key Drivers | • The market is growing because of the increased safety provided by head-up displays. • The head-up display market is expected to be transformed by advances in augmented reality technologies. |

| RESTRAINTS | • The negative impact of the COVID 19 epidemic is a major limitation for the head-up display market. • The limitations of space in automotive cockpits for AR-based head-up displays. |

Ans: Head-Up Display Market Size was valued at USD 1.15 billion in 2023.

The CAGR of Head-Up Display market is 17% over the forecast period 2024-2031.

The major players are Hudway (U.S.), Penny AB (Sweden), Robert Bosch GMBH (Germany), Denso Corporation (Japan), Micro Vision Inc. (U.S.), Yazaki Corporation (Japan), BAE Systems Inc. (U.K.), Honeywell Aerospace (U.S.), Visteon Corporation (U.S.), Continental AG (Germany), and others.

North America region is dominating the Head-Up Display market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Head-Up Display Market Segmentation, by Type

7.1 Introduction

7.2 Trend Analysis

7.3 Fixed Mounted

7.4 Helmet Mounted

8. Head-Up Display Market Segmentation, by Component

8.1 Introduction

8.2 Trend Analysis

8.3 Combiner

8.4 Video Generator

8.5 Projector Unit

9. Head-Up Display Market Segmentation, by Application

9.1 Introduction

9.2 Trend Analysis

9.3 Automotive Industry

9.4 Military and Civil Aviation Sector

10. Head-Up Display Market Segmentation, by Technology

10.1 Introduction

10.2 Trend Analysis

10.3 CRT-based HUD

10.4 Digital HUD

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Head-Up Display Market, by Country

11.2.3 North America Head-Up Display Market Segmentation, by Type

11.2.4 North America Head-Up Display Market Segmentation, by Component

11.2.5 North America Head-Up Display Market Segmentation, by Application

11.2.6 North America Head-Up Display Market Segmentation, by Technology

11.2.7 USA

11.2.7.1 USA Head-Up Display Market Segmentation, by Type

11.2.7.2 USA Head-Up Display Market Segmentation, by Component

11.2.7.3 USA Head-Up Display Market Segmentation, by Application

11.2.7.4 USA Head-Up Display Market Segmentation, by Technology

11.2.8 Canada

11.2.8.1 Canada Head-Up Display Market Segmentation, by Type

11.2.8.2 Canada Head-Up Display Market Segmentation, by Component

11.2.8.3 Canada Head-Up Display Market Segmentation, by Application

11.2.8.4 Canada Head-Up Display Market Segmentation, by Technology

11.2.9 Mexico

11.2.9.1 Mexico Head-Up Display Market Segmentation, by Type

11.2.9.2 Mexico Head-Up Display Market Segmentation, by Component

11.2.9.3 Mexico Head-Up Display Market Segmentation, by Application

11.2.9.4 Mexico Head-Up Display Market Segmentation, by Technology

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Head-Up Display Market, by Country

11.3.2.2 Eastern Europe Head-Up Display Market Segmentation, by Type

11.3.2.3 Eastern Europe Head-Up Display Market Segmentation, by Component

11.3.2.4 Eastern Europe Head-Up Display Market Segmentation, by Application

11.3.2.5 Eastern Europe Head-Up Display Market Segmentation, by Technology

11.3.2.6 Poland

11.3.2.6.1 Poland Head-Up Display Market Segmentation, by Type

11.3.2.6.2 Poland Head-Up Display Market Segmentation, by Component

11.3.2.6.3 Poland Head-Up Display Market Segmentation, by Application

11.3.2.6.4 Poland Head-Up Display Market Segmentation, by Technology

11.3.2.7 Romania

11.3.2.7.1 Romania Head-Up Display Market Segmentation, by Type

11.3.2.7.2 Romania Head-Up Display Market Segmentation, by Component

11.3.2.7.3 Romania Head-Up Display Market Segmentation, by Application

11.3.2.7.4 Romania Head-Up Display Market Segmentation, by Technology

11.3.2.8 Hungary

11.3.2.8.1 Hungary Head-Up Display Market Segmentation, by Type

11.3.2.8.2 Hungary Head-Up Display Market Segmentation, by Component

11.3.2.8.3 Hungary Head-Up Display Market Segmentation, by Application

11.3.2.8.4 Hungary Head-Up Display Market Segmentation, by Technology

11.3.2.9 Turkey

11.3.2.9.1 Turkey Head-Up Display Market Segmentation, by Type

11.3.2.9.2 Turkey Head-Up Display Market Segmentation, by Component

11.3.2.9.3 Turkey Head-Up Display Market Segmentation, by Application

11.3.2.9.4 Turkey Head-Up Display Market Segmentation, by Technology

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Head-Up Display Market Segmentation, by Type

11.3.2.10.2 Rest of Eastern Europe Head-Up Display Market Segmentation, by Component

11.3.2.10.3 Rest of Eastern Europe Head-Up Display Market Segmentation, by Application

11.3.2.10.4 Rest of Eastern Europe Head-Up Display Market Segmentation, by Technology

11.3.3 Western Europe

11.3.3.1 Western Europe Head-Up Display Market, by Country

11.3.3.2 Western Europe Head-Up Display Market Segmentation, by Type

11.3.3.3 Western Europe Head-Up Display Market Segmentation, by Component

11.3.3.4 Western Europe Head-Up Display Market Segmentation, by Application

11.3.3.5 Western Europe Head-Up Display Market Segmentation, by Technology

11.3.3.6 Germany

11.3.3.6.1 Germany Head-Up Display Market Segmentation, by Type

11.3.3.6.2 Germany Head-Up Display Market Segmentation, by Component

11.3.3.6.3 Germany Head-Up Display Market Segmentation, by Application

11.3.3.6.4 Germany Head-Up Display Market Segmentation, by Technology

11.3.3.7 France

11.3.3.7.1 France Head-Up Display Market Segmentation, by Type

11.3.3.7.2 France Head-Up Display Market Segmentation, by Component

11.3.3.7.3 France Head-Up Display Market Segmentation, by Application

11.3.3.7.4 France Head-Up Display Market Segmentation, by Technology

11.3.3.8 UK

11.3.3.8.1 UK Head-Up Display Market Segmentation, by Type

11.3.3.8.2 UK Head-Up Display Market Segmentation, by Component

11.3.3.8.3 UK Head-Up Display Market Segmentation, by Application

11.3.3.8.4 UK Head-Up Display Market Segmentation, by Technology

11.3.3.9 Italy

11.3.3.9.1 Italy Head-Up Display Market Segmentation, by Type

11.3.3.9.2 Italy Head-Up Display Market Segmentation, by Component

11.3.3.9.3 Italy Head-Up Display Market Segmentation, by Application

11.3.3.9.4 Italy Head-Up Display Market Segmentation, by Technology

11.3.3.10 Spain

11.3.3.10.1 Spain Head-Up Display Market Segmentation, by Type

11.3.3.10.2 Spain Head-Up Display Market Segmentation, by Component

11.3.3.10.3 Spain Head-Up Display Market Segmentation, by Application

11.3.3.10.4 Spain Head-Up Display Market Segmentation, by Technology

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Head-Up Display Market Segmentation, by Type

11.3.3.11.2 Netherlands Head-Up Display Market Segmentation, by Component

11.3.3.11.3 Netherlands Head-Up Display Market Segmentation, by Application

11.3.3.11.4 Netherlands Head-Up Display Market Segmentation, by Technology

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Head-Up Display Market Segmentation, by Type

11.3.3.12.2 Switzerland Head-Up Display Market Segmentation, by Component

11.3.3.12.3 Switzerland Head-Up Display Market Segmentation, by Application

11.3.3.12.4 Switzerland Head-Up Display Market Segmentation, by Technology

11.3.3.13 Austria

11.3.3.13.1 Austria Head-Up Display Market Segmentation, by Type

11.3.3.13.2 Austria Head-Up Display Market Segmentation, by Component

11.3.3.13.3 Austria Head-Up Display Market Segmentation, by Application

11.3.3.13.4 Austria Head-Up Display Market Segmentation, by Technology

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Head-Up Display Market Segmentation, by Type

11.3.3.14.2 Rest of Western Europe Head-Up Display Market Segmentation, by Component

11.3.3.14.3 Rest of Western Europe Head-Up Display Market Segmentation, by Application

11.3.3.14.4 Rest of Western Europe Head-Up Display Market Segmentation, by Technology

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Head-Up Display Market, by Country

11.4.3 Asia-Pacific Head-Up Display Market Segmentation, by Type

11.4.4 Asia-Pacific Head-Up Display Market Segmentation, by Component

11.4.5 Asia-Pacific Head-Up Display Market Segmentation, by Application

11.4.6 Asia-Pacific Head-Up Display Market Segmentation, by Technology

11.4.7 China

11.4.7.1 China Head-Up Display Market Segmentation, by Type

11.4.7.2 China Head-Up Display Market Segmentation, by Component

11.4.7.3 China Head-Up Display Market Segmentation, by Application

11.4.7.4 China Head-Up Display Market Segmentation, by Technology

11.4.8 India

11.4.8.1 India Head-Up Display Market Segmentation, by Type

11.4.8.2 India Head-Up Display Market Segmentation, by Component

11.4.8.3 India Head-Up Display Market Segmentation, by Application

11.4.8.4 India Head-Up Display Market Segmentation, by Technology

11.4.9 Japan

11.4.9.1 Japan Head-Up Display Market Segmentation, by Type

11.4.9.2 Japan Head-Up Display Market Segmentation, by Component

11.4.9.3 Japan Head-Up Display Market Segmentation, by Application

11.4.9.4 Japan Head-Up Display Market Segmentation, by Technology

11.4.10 South Korea

11.4.10.1 South Korea Head-Up Display Market Segmentation, by Type

11.4.10.2 South Korea Head-Up Display Market Segmentation, by Component

11.4.10.3 South Korea Head-Up Display Market Segmentation, by Application

11.4.10.4 South Korea Head-Up Display Market Segmentation, by Technology

11.4.11 Vietnam

11.4.11.1 Vietnam Head-Up Display Market Segmentation, by Type

11.4.11.2 Vietnam Head-Up Display Market Segmentation, by Component

11.4.11.3 Vietnam Head-Up Display Market Segmentation, by Application

11.4.11.4 Vietnam Head-Up Display Market Segmentation, by Technology

11.4.12 Singapore

11.4.12.1 Singapore Head-Up Display Market Segmentation, by Type

11.4.12.2 Singapore Head-Up Display Market Segmentation, by Component

11.4.12.3 Singapore Head-Up Display Market Segmentation, by Application

11.4.12.4 Singapore Head-Up Display Market Segmentation, by Technology

11.4.13 Australia

11.4.13.1 Australia Head-Up Display Market Segmentation, by Type

11.4.13.2 Australia Head-Up Display Market Segmentation, by Component

11.4.13.3 Australia Head-Up Display Market Segmentation, by Application

11.4.13.4 Australia Head-Up Display Market Segmentation, by Technology

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Head-Up Display Market Segmentation, by Type

11.4.14.2 Rest of Asia-Pacific Head-Up Display Market Segmentation, by Component

11.4.14.3 Rest of Asia-Pacific Head-Up Display Market Segmentation, by Application

11.4.14.4 Rest of Asia-Pacific Head-Up Display Market Segmentation, by Technology

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Head-Up Display Market, by Country

11.5.2.2 Middle East Head-Up Display Market Segmentation, by Type

11.5.2.3 Middle East Head-Up Display Market Segmentation, by Component

11.5.2.4 Middle East Head-Up Display Market Segmentation, by Application

11.5.2.5 Middle East Head-Up Display Market Segmentation, by Technology

11.5.2.6 UAE

11.5.2.6.1 UAE Head-Up Display Market Segmentation, by Type

11.5.2.6.2 UAE Head-Up Display Market Segmentation, by Component

11.5.2.6.3 UAE Head-Up Display Market Segmentation, by Application

11.5.2.6.4 UAE Head-Up Display Market Segmentation, by Technology

11.5.2.7 Egypt

11.5.2.7.1 Egypt Head-Up Display Market Segmentation, by Type

11.5.2.7.2 Egypt Head-Up Display Market Segmentation, by Component

11.5.2.7.3 Egypt Head-Up Display Market Segmentation, by Application

11.5.2.7.4 Egypt Head-Up Display Market Segmentation, by Technology

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Head-Up Display Market Segmentation, by Type

11.5.2.8.2 Saudi Arabia Head-Up Display Market Segmentation, by Component

11.5.2.8.3 Saudi Arabia Head-Up Display Market Segmentation, by Application

11.5.2.8.4 Saudi Arabia Head-Up Display Market Segmentation, by Technology

11.5.2.9 Qatar

11.5.2.9.1 Qatar Head-Up Display Market Segmentation, by Type

11.5.2.9.2 Qatar Head-Up Display Market Segmentation, by Component

11.5.2.9.3 Qatar Head-Up Display Market Segmentation, by Application

11.5.2.9.4 Qatar Head-Up Display Market Segmentation, by Technology

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Head-Up Display Market Segmentation, by Type

11.5.2.10.2 Rest of Middle East Head-Up Display Market Segmentation, by Component

11.5.2.10.3 Rest of Middle East Head-Up Display Market Segmentation, by Application

11.5.2.10.4 Rest of Middle East Head-Up Display Market Segmentation, by Technology

11.5.3 Africa

11.5.3.1 Africa Head-Up Display Market, by Country

11.5.3.2 Africa Head-Up Display Market Segmentation, by Type

11.5.3.3 Africa Head-Up Display Market Segmentation, by Component

11.5.3.4 Africa Head-Up Display Market Segmentation, by Application

11.5.3.5 Africa Head-Up Display Market Segmentation, by Technology

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Head-Up Display Market Segmentation, by Type

11.5.3.6.2 Nigeria Head-Up Display Market Segmentation, by Component

11.5.3.6.3 Nigeria Head-Up Display Market Segmentation, by Application

11.5.3.6.4 Nigeria Head-Up Display Market Segmentation, by Technology

11.5.3.7 South Africa

11.5.3.7.1 South Africa Head-Up Display Market Segmentation, by Type

11.5.3.7.2 South Africa Head-Up Display Market Segmentation, by Component

11.5.3.7.3 South Africa Head-Up Display Market Segmentation, by Application

11.5.3.7.4 South Africa Head-Up Display Market Segmentation, by Technology

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Head-Up Display Market Segmentation, by Type

11.5.3.8.2 Rest of Africa Head-Up Display Market Segmentation, by Component

11.5.3.8.3 Rest of Africa Head-Up Display Market Segmentation, by Application

11.5.3.8.4 Rest of Africa Head-Up Display Market Segmentation, by Technology

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Head-Up Display Market, by Country

11.6.3 Latin America Head-Up Display Market Segmentation, by Type

11.6.4 Latin America Head-Up Display Market Segmentation, by Component

11.6.5 Latin America Head-Up Display Market Segmentation, by Application

11.6.6 Latin America Head-Up Display Market Segmentation, by Technology

11.6.7 Brazil

11.6.7.1 Brazil Head-Up Display Market Segmentation, by Type

11.6.7.2 Brazil Head-Up Display Market Segmentation, by Component

11.6.7.3 Brazil Head-Up Display Market Segmentation, by Application

11.6.7.4 Brazil Head-Up Display Market Segmentation, by Technology

11.6.8 Argentina

11.6.8.1 Argentina Head-Up Display Market Segmentation, by Type

11.6.8.2 Argentina Head-Up Display Market Segmentation, by Component

11.6.8.3 Argentina Head-Up Display Market Segmentation, by Application

11.6.8.4 Argentina Head-Up Display Market Segmentation, by Technology

11.6.9 Colombia

11.6.9.1 Colombia Head-Up Display Market Segmentation, by Type

11.6.9.2 Colombia Head-Up Display Market Segmentation, by Component

11.6.9.3 Colombia Head-Up Display Market Segmentation, by Application

11.6.9.4 Colombia Head-Up Display Market Segmentation, by Technology

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Head-Up Display Market Segmentation, by Type

11.6.10.2 Rest of Latin America Head-Up Display Market Segmentation, by Component

11.6.10.3 Rest of Latin America Head-Up Display Market Segmentation, by Application

11.6.10.4 Rest of Latin America Head-Up Display Market Segmentation, by Technology

12. Company Profiles

12.1 Hudway (U.S.)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Penny AB (Sweden)

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 Robert Bosch GMBH (Germany)

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Denso Corporation (Japan)

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Micro Vision Inc. (U.S.)

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 Yazaki Corporation (Japan)

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 BAE Systems Inc. (U.K.)

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 Honeywell Aerospace (U.S.)

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 Visteon Corporation (U.S.)

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 Continental AG (Germany)

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Dashboard Camera Market Size was USD 4.0 Billion in 2023 and is expected to reach $10.8 Billion by 2032, growing at a CAGR of 11.50% from 2024-2032.

Automotive Fasteners Market size was valued at USD 24.13 billion in 2023 and is expected to reach USD 32.41 billion by 2031 and grow at a CAGR of 3.74% over the forecast period 2024-2031.

The All-Weather Tire Market Size was USD 206.2 billion in 2023 and is expected to reach USD 328.20 billion by 2032 and grow at a CAGR of 5.3% by 2024-2032

The Automotive Metal Stamping Market Size was valued at USD 108.41 Bn in 2023 and will reach USD 163.90 Bn by 2032 and grow at a CAGR of 4.7% by 2024-2032

The Automotive Flywheel Market size was valued at USD 14.05 Bn in 2023 and is expected to reach by USD 17.39 Bn by 2031 and grow at a CAGR of 2.74% over the forecast period 2024-2031.

The Automotive Condenser Market Size was USD 10.85 Billion in 2023 and is expected to reach USD 16.12 Bn by 2032 and grow at a CAGR of 4.50% by 2024-2032.

Hi! Click one of our member below to chat on Phone