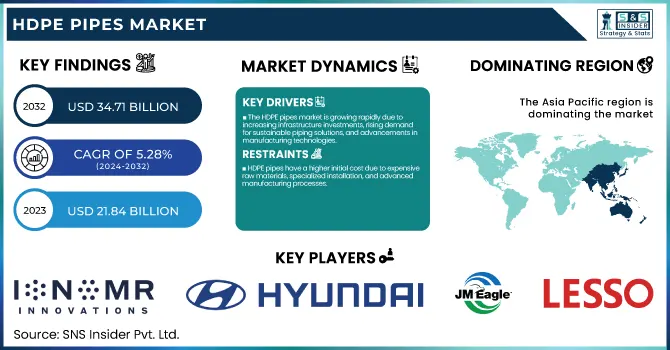

The HDPE Pipes Market Size was estimated at USD 21.84 billion in 2023 and is expected to arrive at USD 34.71 billion by 2032 with a growing CAGR of 5.28% over the forecast period 2024-2032. The HDPE Pipes Market is witnessing a shift towards high-performance and sustainable piping solutions, driven by advancements in polymer technology and increased capacity utilization rates across key regions. Production volumes have surged in Asia-Pacific, while North America maintains high-capacity utilization rates. Technological integration in HDPE manufacturing, including AI-driven quality control and automation, is enhancing efficiency and reducing downtime. Additionally, export-import dynamics indicate a rising demand for premium-grade HDPE pipes, particularly in Europe and the Middle East, reflecting a shift toward durable, corrosion-resistant materials for infrastructure projects.

To Get more information on HDPE Pipes Market - Request Free Sample Report

Drivers

The HDPE pipes market is growing rapidly due to increasing infrastructure investments, rising demand for sustainable piping solutions, and advancements in manufacturing technologies.

The HDPE pipes market is witnessing significant growth, driven by increasing investments in infrastructure development across water supply, sewage, and irrigation systems. Global governments and private sectors alike are increasingly focused on improving water management and sanitation facilities, which is further driving demand for durable piping solutions with a corrosion-resistant coating. The growth of smart cities and industrial zones has increased the demand for well-designed water distribution networks. This growth is also attributed to the modernisation in agriculture with the adoption of advanced irrigation techniques and increasing application of HDPE pipes for their versatility and durability. According to market analysis, there is a growing demand for eco-friendly and recyclable materials within the environment that is conducive to environmental regulations and urbanization planning. The adoption of pipe is further driven by improvements in pipe manufacturing and jointing technologies, which are improving the performance of products. Urbanization in the Asia-Pacific, Latin America, and Africa regions is very rapid, and the consequent demand for HDPE pipes is anticipated to rise due to the expansion of infrastructure facilities, which is a crucial growth factor likely to boost growth in this market.

Restraint

HDPE pipes have a higher initial cost due to expensive raw materials, specialized installation, and advanced manufacturing processes.

HDPE pipes have a higher initial investment cost compared to traditional piping materials such as PVC, steel, or concrete. The high initiation cost limits the usage of these pipes in some applications, but it is compensatory due to the low maintenance requirements and long-term production. In the early stages, costs are associated with acquiring materials like fusion welding equipment and skilled labor for proper installation. Although HDPE pipes provide advantages in terms of long-term durability, corrosion resistance, and low maintenance, the initial investment can be a hurdle for cost-sensitive projects, especially in developing countries. And extensive infrastructure development might require major capital investment, and these alternatives might seem more appealing. But, with higher initial costs come better lifecycle values that save replacement and maintenance costs down the road. With increasing awareness around specific long-term benefits and technological advancements, which drive down the prices, HDPE pipes are expected to be increasingly adopted across various applications.

Opportunities

Advancements in HDPE pipe extrusion, jointing, and multi-layer technology enhance durability, leak resistance, and application versatility.

Technological advancements in HDPE pipe manufacturing have significantly improved performance, durability, and application versatility. Advancements in pipe extrusion technology have improved accuracy, consistent wall thickness, and superior mechanical characteristics, providing longer service life and greater resistance to external pressures. Butt fusion and electrofusion welding are examples of advanced jointing methods that provide seamless and leak-proof connections, leading to lower maintenance costs and improved system reliability. In addition, the improvement of multilayered HDPE pipes provides greater strength, thermal resistance, and chemical compatibility, which make them suitable for possible new applications such as oil and gas, water distribution, and sewage systems. In addition, equipped with the help of automation and real-time monitoring, manufacturing processes have been also optimized, which reduce defects and help maintain quality. These innovations are driving increased quality and making HDPE pipes more attractive than their conventional counterparts, making them suitable for use in important infrastructure projects, while promoting sustainable and cost-effective piping systems.

Challenges

Meeting stringent environmental and quality standards increases production costs and complexity for HDPE pipe manufacturers.

Regulatory compliance and adherence to quality standards are critical challenges for HDPE pipe manufacturers. Strict regulations are implemented by governments and organizations globally to regulate the piping systems to confirm their safety, durability, and environmental of piping systems. Unlike China, where many manufacturers are still struggling to compete with western companies, many compliance standards, including ASTM, ISO, and AWWA, involve hefty testing and certifications that raise production costs. An added layer of complexity comes from environmental regulations which also stress recyclability, emissions, and raw material sourcing and manufacturers must follow suit in its practices. Not meeting these standards can result in product recalls, legal penalties, and loss of market reputation. In addition, the different regulations applicable to different regional areas make it difficult for global manufacturers who must adapt to these constraints and consistently modify their products to make them compliant in a specific region. With sustainability on the agenda, companies will need to research and develop new sustainable products but still adhere to compliance. The biggest hurdle in the HDPE pipes market is the need to balance cost-effectiveness with compliance to regulations.

By Type

HDPE 100 segment dominated with a market share of over 48% in 2023, primarily due to its exceptional strength, durability, and resistance to high pressure. This makes it a preferred material for critical applications, such as in water supply, gas distribution and industrial piping, where reliability and longevity are paramount. The dense structure of the material make it highly resistant to corrosion, chemicals and environmental stress cracking, ensuring a long service life with very little maintenance. Moreover, HDPE 100 pipes provide the utmost flexibility and are resistant to impact, which works remarkably for underground installations and terrains. Increasing need for sustainable and cost-efficient piping solution along with infrastructure development and urbanization is anticipated to boost the adoption of HDPE 100 pipes across sectors, reinforcing their dominancy in the market.

By Application

The Sewage System Pipe segment dominated with a market share of over 32% in 2023, resulting from the increasing demand for durable and effective wastewater management systems. Reliability of HDPE pipes and their high durability, corrosion resistance and flexibility make them the perfect choice for sewage and drainage applications. Due to their unbeatable resistance to leakage, chemicals, and corrosion, these pipes are guaranteed to have a long lifespan, thus lowering maintenance costs. Growing urbanized areas and subsequent government upgrades of outdated sewage systems raise demand potential even higher. Furthermore, the increasing emphasis on the adoption of sustainable & cost-efficient piping systems in municipal & industrial sectors is also supporting the profitability of this segment. With the growth of Megacities, new cities and Urbanization around the globe, HDPE sewage pipes are being increasingly adopted as a solution to the city infrastructures ensuring transport of control & efficient sewage management.

The Asia-Pacific region dominated with a market share of over 38% in 2023, driven by rapid urbanization, robust infrastructure development, and an increasing demand for effective water management systems. China and India lead this trend as increasing government spending on water supply, sewage treatment, and irrigation networks evolves. Growing adoption of HDPE pipes in agriculture, construction and industrial applications also expands the market growth. And therefore, the emphasis on sustainable and cost-effectiveness of piping solutions in the region has been assisting the demand respective market, especially as HDPE pipes are durable, corrosion-resistance, and flexible. The region is predicted to dominate the global HDPE pipes market in the coming years, due to its growing smart city initiatives and rapid pace of industrialization

Europe's HDPE pipes market is witnessing significant growth due to increasing environmental awareness and stringent government regulations promoting sustainable piping solutions. With an increasing focus on carbon footprint reduction and more advanced water management systems, the demand for HDPE pipes in the wastewater treatment, agriculture, and industrial applications is rising in the region. Moreover, this market growth is bolstered by a movement towards durable, corrosion-resistant, and recyclable materials in construction and infrastructure projects. Countries like Germany, UK and France are at the forefront of adopting HDPE pipes backed by strong investments in smart water management and green buildings. As the world increasingly seeks eco-friendly alternatives and embracing the principles of the circular economy, the Europe HDPE pipes market is expected to expand at a steady and long-term pace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the HDPE Pipes Market

Ionomr Innovations Inc. (Canada) – (High-performance HDPE piping solutions)

Hyundai (Japan) – (Industrial-grade HDPE pipes)

JM EAGLE, INC. (US) – (Water, gas, and sewer HDPE pipes)

CHINA LESSO (China) – (Irrigation, water supply, and drainage pipes)

Supreme Industries Ltd. (India) – (Agricultural, plumbing, and industrial HDPE pipes)

Chevron Phillips Chemical Company LLC (US) – (High-density polyethylene resins for HDPE pipes)

AGRU (US) – (HDPE pipes for chemical and industrial applications)

Dyka Group (Netherlands) – (Municipal and construction HDPE pipes)

Jain Irrigation Systems Ltd. (India) – (Agricultural and irrigation HDPE pipes)

Astral Pipes (India) – (Water supply and drainage HDPE pipes)

Advanced Drainage Systems (US) – (Stormwater management and drainage pipes)

ISCO Industries (UAE) – (Industrial and municipal HDPE piping solutions)

Al-Rowad Complex (UAE) – (HDPE pipes for gas and water distribution)

Cosmoplast Industrial Company LLC (UAE) – (Infrastructure and construction HDPE pipes)

Union Pipes Industry LLC (UAE) – (Large-diameter HDPE pipes for water and gas)

Future Pipe Industries (UAE) – (Composite and HDPE piping solutions)

PolyFab Plastic Industry LLC (UAE) – (HDPE pipes for plumbing and construction)

Pipelife International (Austria) – (Water and gas supply HDPE pipes)

Blue Diamond Industries (US) – (Conduit and telecom HDPE pipes)

Aliaxis Group (Belgium) – (HDPE pipes for industrial and infrastructure applications)

Suppliers for (high-quality and durable HDPE pipes for water, sewer, and industrial applications) on HDPE Pipes Market

JM Eagle

Chevron Phillips Chemical

Aliaxis

Jain Irrigation Systems

Pipelife International

Nandi

National Pipe & Plastics

Kubota ChemiX

FLO-TEK

Olayan

Recent Development

In December 2024: WL Plastics acquired Charter Plastics’ HDPE extrusion pipe business to expand its product portfolio and enhance its presence in the HDPE market.

In October 2023: Chevron Phillips Chemical Company LLC made a USD 15 billion offer to acquire Nova Chemicals Corp. If completed, the acquisition would position the company as the third-largest polyethylene producer in North America and the leading high-density polyethylene (HDPE) producer in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.84 Billion |

| Market Size by 2032 | USD 34.71 Billion |

| CAGR | CAGR of 5.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (HDPE 63, HDPE 80, HDPE 100) • By Application (Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ionomr Innovations Inc. (Canada), Hyundai (Japan), JM EAGLE, INC. (US), CHINA LESSO (China), Supreme Industries Ltd. (India), Chevron Phillips Chemical Company LLC (US), AGRU (US), Dyka Group (Netherlands), Jain Irrigation Systems Ltd. (India), Astral Pipes (India), Advanced Drainage Systems (US), ISCO Industries (UAE), Al-Rowad Complex (UAE), Cosmoplast Industrial Company LLC (UAE), Union Pipes Industry LLC (UAE), Future Pipe Industries (UAE), PolyFab Plastic Industry LLC (UAE), Pipelife International (Austria), Blue Diamond Industries (US), Aliaxis Group (Belgium). |

Ans: The HDPE Pipes Market is expected to grow at a CAGR of 5.28% during 2024-2032.

Ans: The HDPE Pipes Market was USD 21.84 billion in 2023 and is expected to reach USD 34.71 billion by 2032.

Ans: The HDPE pipes market is growing rapidly due to increasing infrastructure investments, rising demand for sustainable piping solutions, and advancements in manufacturing technologies.

Ans: The “HDPE 100” segment dominated the HDPE Pipes Market.

Ans: Asia-Pacific dominated the HDPE Pipes Market in 2023

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Volume, by Region (2020-2023)

5.2 Capacity Utilization Rates, by Region (2020-2023)

5.3 Maintenance and Downtime Metrics

5.4 Technological Integration Rates, by Region

5.5 Export/Import Trends, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. HDPE Pipes Market Segmentation, By Type

7.1 Chapter Overview

7.2 HDPE 63

7.2.1 HDPE 63 Market Trends Analysis (2020-2032)

7.2.2 HDPE 63 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 HDPE 80

7.3.1 HDPE 80 Market Trends Analysis (2020-2032)

7.3.2 HDPE 80 Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 HDPE 100

7.4.1 HDPE 100 Market Trends Analysis (2020-2032)

7.4.2 HDPE 100 Market Size Estimates and Forecasts to 2032 (USD Billion)

8. HDPE Pipes Market Segmentation, By Application

8.1 Chapter Overview

8.2 Oil and Gas Pipe

8.2.1 Oil and Gas Pipe Market Trends Analysis (2020-2032)

8.2.2 Oil and Gas Pipe Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Agricultural Irrigation Pipe

8.3.1 Agricultural Irrigation Pipe Market Trends Analysis (2020-2032)

8.3.2 Agricultural Irrigation Pipe Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Water Supply Pipe

8.4.1 Water Supply Pipe Market Trends Analysis (2020-2032)

8.4.2 Water Supply Pipe Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Sewage System Pipe

8.5.1 Sewage System Pipe Market Trends Analysis (2020-2032)

8.5.2 Sewage System Pipe Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America HDPE Pipes Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America HDPE Pipes Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America HDPE Pipes Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 AGRU (US)

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Hyundai (Japan)

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 ISCO Industries (UAE)

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Cosmoplast Industrial Company LLC (UAE)

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Ionomr Innovations Inc. (Canada)

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Supreme Industries Ltd. (India)

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Dyka Group (Netherlands)

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 CHINA LESSO (China)

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Al-Rowad Complex (UAE)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 JM EAGLE, INC. (US)

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Type

HDPE 63

HDPE 80

HDPE 100

By Application

Oil and Gas Pipe

Agricultural Irrigation Pipe

Water Supply Pipe

Sewage System Pipe

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Cryogenic Tanks Market Size was valued at USD 6.78 Billion in 2023 and is expected to reach USD 10.61 Billion by 2032 and grow at a CAGR of 5.17% over the forecast period 2024-2032.

The Safety Valves Market size was estimated at USD 4.86 Billion in 2023 and is expected to reach USD 8.50 Billion by 2032 with a growing CAGR of 6.42% during the forecast period of 2024-2032.

Shape Memory Alloys Market was estimated at USD 13.90 billion in 2023 and is supposed to reach USD 40.61 billion by 2032, at a CAGR of 12.65% from 2024-2032.

The Chillers Market Size was valued at USD 10.71 billion in 2023 and is supposed to reach USD 16.25 billion by 2032, growing CAGR of 4.74% from 2024 to 2032.

The Subsea Pumps Market size was valued at USD 2.35 Billion in 2023 and is now anticipated to grow to USD 5.66 Billion by 2032, displaying a compound annual growth rate (CAGR) of 10.26% during the forecast Period 2024-2032.

The Smart Air Purifier Market size was valued at USD 6.97 billion in 2023 and is expected to reach USD 17.73 billion by 2032 and grow at a CAGR of 10.97% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone