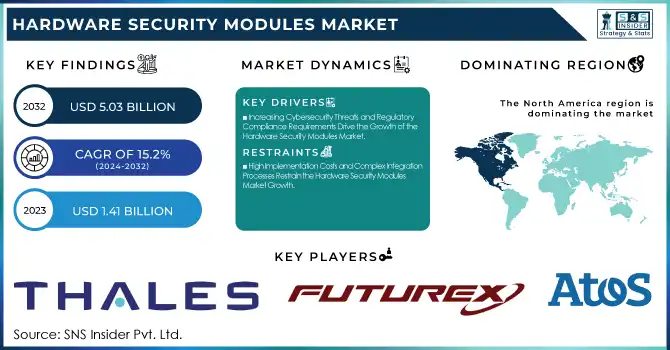

The Hardware Security Modules Market Size was valued at USD 1.41 Billion in 2023 and is expected to reach USD 5.03 Billion by 2032 and grow at a CAGR of 15.2% over the forecast period 2024-2032. The market is growing rapidly due to rising cybersecurity threats, regulatory mandates, and increasing digital transactions. HSMs provide cryptographic key management for payment security, identity authentication, and data protection across banking, government, healthcare, and cloud sectors. The demand for cloud-based HSMs is accelerating with cloud adoption. Industry players focus on innovations, partnerships, and acquisitions while emerging technologies like post-quantum cryptography and blockchain security drive future growth. Despite challenges like high costs and complex integration, the market continues expanding as organizations prioritize robust digital security solutions.

To Get more information on Hardware Security Modules Market - Request Free Sample Report

Key Drivers:

Increasing Cybersecurity Threats and Regulatory Compliance Requirements Drive the Growth of the Hardware Security Modules Market

The growing prevalence of cyber threats, data breaches, and stringent regulatory mandates are major drivers of the Hardware Security Modules (HSM) market. Organizations across industries, including banking, financial services, healthcare, and government, are adopting HSMs to enhance data security, encryption, and authentication. Regulatory frameworks such as PCI-DSS, GDPR, and FIPS 140-2 mandate the use of secure cryptographic modules, further fueling demand. As businesses move towards digital transformation, securing sensitive information has become a top priority, leading to increased HSM adoption.

Additionally, the rise in cloud computing and remote operations has accelerated the need for cloud-based HSM solutions that offer scalable and cost-effective security. Enterprises are investing heavily in cybersecurity infrastructure to safeguard critical assets from data breaches and cyberattacks. This growing emphasis on data protection and regulatory compliance is expected to drive sustained demand for HSMs, making them an essential component of modern security architectures.

Restrain:

High Implementation Costs and Complex Integration Processes Restrain the Hardware Security Modules Market Growth

Despite the increasing demand for HSMs, high implementation costs and complex integration processes pose significant restraints on market growth. Deploying HSMs requires substantial upfront investments in specialized hardware, software, and skilled personnel for installation and maintenance. Many small and medium-sized enterprises (SMEs) find these costs prohibitive, limiting their ability to adopt HSM solutions. Additionally, integrating HSMs into existing IT infrastructure can be challenging, especially for organizations using legacy systems that lack compatibility with modern cryptographic solutions.

The implementation process often involves technical complexities, including configuring encryption protocols, managing cryptographic keys, and ensuring compliance with industry standards. This complexity increases deployment time and costs, discouraging some businesses from investing in HSM technology. Moreover, continuous advancements in cybersecurity threats necessitate regular updates and maintenance, adding to operational expenses. As a result, the high cost and complexity of HSM deployment remain key challenges, particularly for organizations with budget constraints.

Opportunities:

Rising Adoption of Cloud-Based Hardware Security Modules Presents Lucrative Growth Opportunities for the Market

The increasing adoption of cloud-based HSM solutions presents significant growth opportunities for the market. As organizations transition to cloud environments for data storage, processing, and application hosting, the demand for cloud-compatible security solutions is rising. Cloud-based HSMs offer scalable, cost-effective, and easily deployable security solutions compared to traditional on-premises hardware. They eliminate the need for high upfront investments in physical infrastructure while ensuring robust data encryption, authentication, and cryptographic key management. Leading cloud service providers are integrating HSM-as-a-service offerings into their platforms, enabling enterprises to enhance security without complex deployment processes.

Additionally, growing trends such as multi-cloud strategies and remote work models are further driving cloud-based HSM adoption. With businesses prioritizing security in digital operations, cloud HSMs provide a flexible and compliant solution that meets industry standards. This shift towards cloud-based security solutions is expected to create new revenue streams and accelerate market expansion in the coming years.

Challenge:

Rapid Advancements in Quantum Computing Pose a Significant Challenge to the Hardware Security Modules Market

The rapid advancements in quantum computing present a major challenge to the Hardware Security Modules (HSM) market. Quantum computers have the potential to break traditional encryption algorithms, rendering many existing cryptographic security mechanisms obsolete. HSMs primarily rely on public-key cryptography, which quantum computing can easily compromise using algorithms like Shor’s algorithm. As a result, enterprises and government agencies are increasingly concerned about the future security of their encrypted data.

The transition to post-quantum cryptography requires extensive research, development, and standardization efforts, which may take years to implement across industries. Organizations that have already invested heavily in traditional HSMs may face challenges in upgrading or replacing their existing security infrastructure to withstand quantum threats. Additionally, the uncertainty surrounding quantum computing timelines makes it difficult for businesses to plan cybersecurity strategies effectively. To address this challenge, HSM providers must innovate and develop quantum-resistant encryption technologies to ensure long-term data security.

By Type

The USB-based Hardware Security Modules (HSMs) segment dominated the market in 2023, holding a 42% revenue share, driven by its compact design, ease of deployment, and high-security cryptographic capabilities. USB HSMs are widely used across banking, financial services, healthcare, and government sectors for securing sensitive data, managing cryptographic keys, and ensuring secure authentication. Leading companies such as Thales, Yubico, and Utimaco have introduced advanced USB-based HSMs to meet the rising demand for portable security solutions.

In 2023, Thales expanded its Luna USB HSM series, offering FIPS 140-2 Level 3 compliance and enhanced encryption speed, making it an attractive solution for regulatory-driven industries. Yubico’s YubiHSM 2 gained traction among small and medium-sized enterprises (SMEs) due to its cost-effectiveness and ease of integration.

The cloud-based Hardware Security Modules (HSMs) segment is witnessing the highest growth rate, with a CAGR of 16.03%, driven by increasing cloud adoption and the need for scalable cryptographic security solutions. As businesses migrate to cloud environments, cloud-based HSMs provide seamless encryption, authentication, and cryptographic key management without the need for dedicated on-premise hardware. Major cloud providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud have significantly expanded their HSM offerings to meet evolving security demands.

In 2023, AWS enhanced its CloudHSM service, integrating it with AWS Key Management Service (KMS) for streamlined enterprise encryption. Similarly, Microsoft launched Azure Dedicated HSM updates, offering FIPS 140-2 Level 3-certified security for cloud-based applications. Google Cloud introduced external key management (EKM) solutions, allowing enterprises to retain full control over cryptographic keys while securing cloud workloads.

By Application

The Payment Processing segment dominated the Hardware Security Modules (HSM) market in 2023, accounting for 42% of total revenue, driven by the increasing volume of digital transactions and stringent regulatory compliance requirements. Payment security is a critical concern for financial institutions, fintech companies, and payment service providers, as they must comply with PCI DSS (Payment Card Industry Data Security Standard) and other global regulations. HSMs play a vital role in securing payment credentials, encrypting transactions, and preventing fraud. Thales, Entrust, and Utimaco have been at the forefront of developing cutting-edge payment HSM solutions.

In 2023, Thales introduced new enhancements to its payShield HSM series, offering faster transaction processing speeds and enhanced tokenization features for fraud prevention. Similarly, entrust launched nShield HSM updates, focusing on secure cryptographic key management for e-commerce and point-of-sale (POS) systems.

The IoT security segment is experiencing the highest growth rate CAGR of 16.5% in the Hardware Security Modules (HSM) market, fueled by the rapid expansion of Internet of Things (IoT) ecosystems across industries such as smart homes, healthcare, automotive, and industrial automation. With billions of IoT devices connecting to networks, cybersecurity threats such as data breaches, unauthorized access, and ransomware attacks are escalating, creating a critical need for robust cryptographic security. Leading HSM providers, including AWS, Microsoft, and Infineon Technologies, have introduced innovative solutions to address IoT security challenges. In 2023, AWS launched IoT Device Defender with integrated CloudHSM, allowing secure cryptographic key management for large-scale IoT deployments.

By End Use

The Banking, Financial Services, and Insurance (BFSI) Segment held the largest revenue share in the Hardware Security Modules (HSM) market in 2023, driven by the rapid adoption of digital banking, online transactions, and stringent financial data security regulations. With rising cyber threats such as payment fraud, phishing attacks, and identity theft, financial institutions are heavily investing in HSM-based encryption and authentication solutions to secure sensitive customer data and financial transactions. The BFSI sector’s increasing reliance on contactless payments, blockchain-based financial services, and real-time settlement systems continues to drive demand for high-performance HSMs, reinforcing its position as the leading end-use segment in the market.

The Retail and Consumer Products Segment is witnessing the fastest CAGR in the Hardware Security Modules (HSM) market, fueled by the surge in e-commerce, digital payments, and omnichannel retailing. As retailers embrace point-of-sale (POS) encryption, mobile payment security, and customer data protection, the need for HSM-based security solutions is expanding. With cyber threats targeting retail transactions and personal consumer information, businesses are integrating HSMs for secure payment processing, inventory management, and digital loyalty programs. Major companies, including Amazon Web Services (AWS), IBM, and Futurex, have launched innovative HSM solutions for the retail sector.

In 2023, AWS enhanced its CloudHSM services, enabling retailers to secure customer transactions across multiple digital platforms. IBM introduced a retail-focused HSM-as-a-service solution, providing end-to-end encryption for in-store and online purchases.

In 2023, North America led the Hardware Security Modules (HSM) market, holding an estimated market share of around 37%, driven by strong cybersecurity regulations, high adoption of digital payment systems, and the presence of key industry players. The region has stringent data protection laws such as the California Consumer Privacy Act (CCPA), PCI DSS, and FIPS 140-2, mandating organizations to implement robust encryption and key management solutions using HSMs.

Additionally, major tech giants such as Thales, Entrust, IBM, and Futurex are headquartered in North America, continuously innovating and expanding their HSM product lines. In 2023, IBM launched a next-gen cloud-based HSM-as-a-Service solution, catering to financial institutions and enterprises migrating to hybrid cloud environments. Furthermore, AWS expanded its CloudHSM offerings, providing scalable encryption solutions for businesses transitioning to digital infrastructures.

The Asia-Pacific (APAC) region is experiencing the fastest growth rate in the Hardware Security Modules (HSM) market, with an estimated CAGR of 16.4%, driven by rapid digitalization, increasing cybersecurity threats, and government-led data protection initiatives. Countries like China, India, Japan, and South Korea are witnessing a surge in digital banking, e-commerce, and cloud adoption, necessitating robust cryptographic security solutions. The region’s push for data sovereignty laws, such as China’s Cybersecurity Law and India’s Personal Data Protection Bill, is compelling businesses to deploy HSMs for regulatory compliance. In 2023, Thales launched new HSM models tailored for fintech and cloud service providers in APAC, while Futurex partnered with regional banks to deploy payment security HSMs. The region’s increasing investments in cloud security, smart city projects, and blockchain technology are further accelerating HSM adoption, making APAC the fastest-growing market in the industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Hardware Security Modules Market are:

Thales (Luna HSM, payShield HSM)

Utimaco Management Services GmbH (SecurityServer HSM, PaymentServer HSM)

Futurex (Vormetric Data Security Manager, Excrypt SSP Enterprise v.2)

Entrust Corporation (nShield Connect HSM, nShield Edge HSM)

IBM (IBM Cloud HSM, IBM z16 Crypto Express HSM)

Atos SE (Trustway HSM, Bull Hoox HSM)

Infineon Technologies AG (OPTIGA TPM, SLE 97 Secure HSM)

STMicroelectronics (STSAFE-A110, STM32Trust TEE Security Suite)

Microchip Technology Inc. (CryptoAuthentication HSM, CryptoMemory Secure ICs)

Yubico (YubiHSM 2, YubiKey 5 Series)

DINAMO NETWORKS (DINAMO HSM, DINAMO Key Manager)

Securosys (Primus HSM, CloudsHSM)

Spyrus (Rosetta HSM, Secure Digital Identity HSM)

Adweb Technologies (Adweb Cloud HSM, Adweb SecureKey HSM)

Lattice Semiconductor (MachXO3D Secure Control HSM, ECP5 Cryptographic Security HSM)

ellipticSecure (ellipticSecure Key Manager, ellipticSecure Encryption Engine)

Amazon Web Services, Inc. (AWS CloudHSM, AWS Key Management Service)

ETAS (ESCRYPT CycurHSM, ESCRYPT Key Management HSM)

In February 2025, Quantum Dice and Thales launched a Hardware Security Module (HSM) enhanced with a Quantum Random Number Generator (QRNG), integrating Thales' Luna HSM with Quantum Dice's Quantum Entropy-as-a-Service (QEaaS) and DISC™ protocol. This collaboration aimed to provide real-time verification of cryptographic key security, supporting the transition to post-quantum security by ensuring high-quality entropy for encryption keys.

In February 2023, Utimaco and Digital Realty partnered to offer joint data center security solutions, aiming to enhance mission-critical cybersecurity services by integrating Utimaco's Hardware Security Modules with Digital Realty's infrastructure. This collaboration sought to provide secure and compliant environments for sensitive data, addressing the increasing demand for robust cybersecurity measures in data centers.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.41 Billion |

| Market Size by 2032 | USD 5.03 Billion |

| CAGR | CAGR of 15.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (LAN Based, PCIE Based, USB Based, Cloud-Based HSMs) • By Deployment (Cloud, On-premises) • By Application (Payment Processing, Authentication, Public Key Infrastructure (PKI) Management, Database Encryption, IoT Security, Others) • By End Use (BFSI, Government, Healthcare and Life Sciences, Retail and Consumer Products, Technology and Communication, Industrial and Manufacturing, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thales, Utimaco Management Services GmbH, Futurex, Entrust Corporation, IBM, Atos SE, Infineon Technologies AG, STMicroelectronics, Microchip Technology Inc., Yubico, DINAMO NETWORKS, Securosys, Spyrus, Adweb Technologies, Lattice Semiconductor, ellipticSecure, Amazon Web Services, Inc., ETAS. |

Ans: The Hardware Security Modules Market is expected to grow at a CAGR of 15.2% during 2024-2032.

Ans: The Hardware Security Modules Market size was USD 1.41 billion in 2023 and is expected to Reach USD 5.03 billion by 2032.

Ans: The major growth factor of the Hardware Security Modules (HSM) market is the increasing demand for robust cybersecurity solutions driven by rising digital transactions, stringent regulatory compliance, and growing cloud adoption.

Ans: The based segment dominated the Hardware Security Modules Market.

Ans: North America dominated the Hardware Security Modules Market in 2023.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Market Penetration Rate, 2023

5.2 Growth in Digital Transactions, 2023

5.3 Cybersecurity Breaches & HSM Demand, 2023

5.4 Export & Import Data

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Hardware Security Modules Market Segmentation, By End-Use

7.1 Chapter Overview

7.2 BFSI

7.2.1 BFSI Market Trends Analysis (2020-2032)

7.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Government

7.3.1 Government Market Trends Analysis (2020-2032)

7.3.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Healthcare and Life Sciences

7.4.1 Healthcare and Life Sciences Market Trends Analysis (2020-2032)

7.4.2 Healthcare and Life Sciences Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Retail and Consumer Products

7.5.1 Retail and Consumer Products Market Trends Analysis (2020-2032)

7.5.2 Retail and Consumer Products Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Technology and Communication

7.6.1 Technology and Communication Market Trends Analysis (2020-2032)

7.6.2 Technology and Communication Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Industrial and Manufacturing

7.7.1 Industrial and Manufacturing Market Trends Analysis (2020-2032)

7.7.2 Industrial and Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.8 Automotive

7.8.1 Automotive Market Trends Analysis (2020-2032)

7.8.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.9 Others

7.9.1 Others Market Trends Analysis (2020-2032)

7.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Hardware Security Modules Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 Cloud

8.2.1 Cloud Market Trends Analysis (2020-2032)

8.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 On-premises

8.3.1 On-premises Market Trends Analysis (2020-2032)

8.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Hardware Security Modules Market Segmentation, By Application

9.1 Chapter Overview

9.2 Payment Processing

9.2.1 Payment Processing Market Trends Analysis (2020-2032)

9.2.2 Payment Processing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Authentication

9.3.1 Authentication Market Trends Analysis (2020-2032)

9.3.2 Authentication Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Public Key Infrastructure (PKI) Management

9.4.1 Public Key Infrastructure (PKI) Management Market Trends Analysis (2020-2032)

9.4.2 Public Key Infrastructure (PKI) Management Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Database Encryption

9.4.1 Database Encryption Market Trends Analysis (2020-2032)

9.4.2 Database Encryption Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 IoT Security

9.4.1 IoT Security Market Trends Analysis (2020-2032)

9.4.2 IoT Security Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Others

9.4.1 Others Market Trends Analysis (2020-2032)

9.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Hardware Security Modules Market Segmentation, By Type

10.1 Chapter Overview

10.2 LAN Based

10.2.1 LAN Based Market Trends Analysis (2020-2032)

10.2.2 LAN Based Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 PCIE Based

10.3.1 PCIE Based Market Trends Analysis (2020-2032)

10.3.2 PCIE-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 USB Based

10.4.1 USB Based Market Trends Analysis (2020-2032)

10.4.2 USB-Based Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Cloud-Based HSMs

10.5.1 Cloud-Based HSMs Market Trends Analysis (2020-2032)

10.5.2 Cloud-Based HSMs Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.4 North America Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.5 North America Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.6 North America Hardware Security Modules Market Estimates and Forecasts, By Type(2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.7.2 USA Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.3 USA Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.4 USA Hardware Security Modules Market Estimates and Forecasts, By Type(2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.8.2 Canada Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.3 Canada Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.4 Canada Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.9.2 Mexico Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.3 Mexico Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Type(2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.7.2 Poland Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.3 Poland Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Hardware Security Modules Market Estimates and Forecasts, By Type(2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.8.2 Romania Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.3 Romania Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.4 Western Europe Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.5 Western Europe Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.7.2 Germany Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.3 Germany Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.8.2 France Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.3 France Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.4 France Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.9.2 UK Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.3 UK Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.10.2 Italy Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.3 Italy Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.11.2 Spain Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.3 Spain Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.14.2 Austria Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.3 Austria Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.4 Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.5 Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.7.2 China Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.3 China Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.4 China Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.8.2 India Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.3 India Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.4 India Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.9.2 Japan Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.3 Japan Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.4 Japan Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.10.2 South Korea Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.3 South Korea Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.11.2 Vietnam Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.3 Vietnam Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.12.2 Singapore Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.3 Singapore Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.13.2 Australia Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.3 Australia Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.4 Australia Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.4 Middle East Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.5 Middle East Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.7.2 UAE Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.3 UAE Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.4 Africa Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.5 Africa Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.6 Africa Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Hardware Security Modules Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.4 Latin America Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.5 Latin America Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.6 Latin America Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.7.2 Brazil Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.3 Brazil Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.8.2 Argentina Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.3 Argentina Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.9.2 Colombia Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.3 Colombia Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Hardware Security Modules Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Hardware Security Modules Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Hardware Security Modules Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Hardware Security Modules Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

12. Company Profiles

12.1 Thales

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Utimaco Management Services GmbH

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Futurex

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Entrust Corporation

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 IBM

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Atos SE

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Infineon Technologies AG

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 STMicroelectronics

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Microchip Technology Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Yubico

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

LAN Based

PCIE Based

USB Based

Cloud-Based HSMs

By Deployment

Cloud

On-premises

By Application

Payment Processing

Authentication

Database Encryption

IoT Security

Others

By End Use

BFSI

Government

Healthcare and Life Sciences

Retail and Consumer Products

Technology and Communication

Industrial and Manufacturing

Automotive

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Rugged Tablet Market Size was valued at USD 0.96 Billion in 2023 and is expected to grow at a CAGR of 6.28% to reach USD 1.66 Billion by 2032.

The Near-Eye Display Market Size was valued at USD 2.31 Billion in 2023 and is expected to grow at a CAGR of 24.90% to reach USD 17.08 Billion by 2032.

The Inspection Camera System Market size was valued at USD 351.98 Million in 2023 and is expected to reach USD 933.51 Million by 2032 and grow at a CAGR of 11.47% over the forecast period 2024-2032.

Advanced Metering Infrastructure Market was USD 22.6 Bn in 2023 and is expected to reach USD 59.1 Billion by 2032, growing at a CAGR of 11.28% from 2024-2032.

The IP Intercom Market size was valued at USD 2.04 Billion in 2023 and is now anticipated to reach USD 4.09 Billion by 2032, growing at a CAGR of 8.06% during 2024-2032.

The Full-body Scanners Market Size was valued at USD 351.23 million in 2023 and is expected to reach USD 973.9 million by 2032, growing at a CAGR of 12% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone