To get more information on Handheld Chemical and Metal Detector Market - Request Free Sample Report

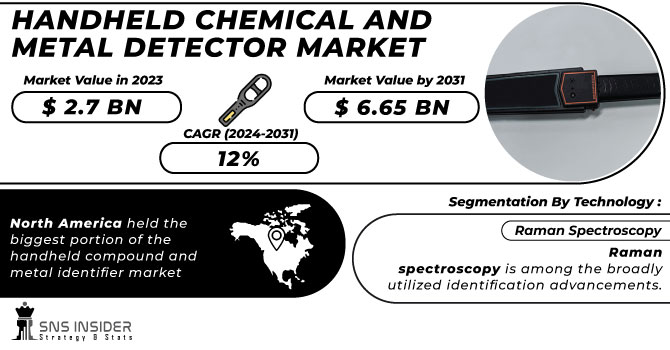

The Handheld Chemical and Metal Detector Market Size was valued at USD 3.29 billion in 2023 and is expected to reach USD 10.03 billion by 2032 and grow at a CAGR of 13.19% over the forecast period 2024-2032. This report offers unique insights into the adoption trends of handheld chemical and metal detectors across different regions, highlighting shifts in demand. It covers the latest technological advancements, including AI integration and sensor improvements, which enhance detection accuracy and usability. The evolving regulatory landscape and compliance requirements are also examined, providing an overview of safety and security standards. Additionally, the report explores export/import data, shedding light on global trade patterns and their influence on the market. Emerging trends such as IoT-connected detectors and user-friendly designs are also featured.

Drivers

Growing global security threats have intensified the demand for handheld chemical and metal detectors across law enforcement, military, and border security applications.

Rising global security threats, including terrorism, smuggling, and illegal trafficking, have significantly increased the demand for handheld chemical and metal detectors across various security sectors. There is ever-increasing pressure on governments and law enforcement agencies to make airports, borders, public events, and critical infrastructure sites even more secure. This tool quickly identifies explosives narcotics, and dangerous chemicals, allowing the security detail to take immediate action. They are also used by military forces for guarantees of battlefield safety and counter-terrorist operations. Border security agencies also use them to stop the illegal transport of weapons, drugs, and contraband. At the same time, the sophistication of criminal activities has also increased, leading to the demand for more advanced, reliable, and user-friendly handheld detection technologies. As geopolitical tensions increase and urban security challenges compound, the uptake of these detectors is likely to accelerate, providing improved safety and threat mitigation in high-risk settings.

Restraint

The high cost of advanced handheld chemical and metal detectors limits adoption in budget-constrained industries and law enforcement, especially in developing regions.

The high cost of advanced handheld chemical and metal detectors poses a significant barrier to widespread adoption, particularly for small-scale industries and law enforcement agencies in developing regions. These advanced devices utilize state-of-the-art technologies, including ion mobility spectrometry, Raman Spectroscopy and X-ray fluorescence, improving detection accuracy and increasing production costs. Also, the basic price before AI and wireless has made most of these machines inaccessible for budget-sensitive firms. Many smaller security forces and industrial customers find it hard to justify the investment, particularly when alternative detection methods at lower cost may be available, albeit with lesser accuracy. What makes it even worse is that the high initial purchase price only goes up with maintenance, calibration, and battery replacement costs long-term ownership is an expensive affair. Consequently, market expansion in cost-sensitive tiers may stall until manufacturers offer low-cost models or governments offer funding and subsidies for adoption in safety and industrial applications.

Opportunities

The development of lightweight, ergonomic, and intuitive handheld detectors enhances portability and ease of use, driving wider adoption across security and industrial sectors.

The development of lightweight and user-friendly handheld chemical and metal detectors is crucial for enhancing usability and efficiency across various industries. Ongoing miniaturization and ergonomic improvements have led to more portable, comfortable-to-use, and accessible devices for first responders, security teams, and industrial workers. This reduced weight and improved grip benefit the detectors they hold, enabling its users to operate the detectors for longer before experiencing fatigue and therefore improve effectiveness in field applications. Intuitive interfaces, touchscreen controls, and wireless connectivity also make operation and data sharing much easier reducing training requirements. AI-driven automation takes this a step further, significantly improving detection accuracy, and allowing for faster threat identification with little to no human intervention. In high-stakes environments like border security, hazardous material detection, and industrial safety, these advancements are particularly valuable as they enable faster and more reliable threat assessment. To encourage widespread adoption of their products, manufacturers are increasingly focusing on user-centric design as demand increases for quick and trustworthy security solutions.

Challenges

Limited awareness and insufficient training on handheld detectors can lead to improper use, impacting their effectiveness and adoption.

The effective use of handheld chemical and metal detectors is highly dependent on proper training and awareness among end users. Such devices, especially those used in mission-critical applications such as security screening or industrial safety, require users to grasp their functionality, calibration, and maintenance for effective detection. Not enough training could bring misuse misinterpretation of results, false alarms, or missed detections, which may have big consequences. Moreover, limited knowledge of these detectors' capabilities or benefits could potentially limit their usage in a few industrial sectors or areas. It may take a while for these technologies to be adopted as many prospective users including small businesses and employees working in remote locations do not see the utility of investing in sophisticated technologies, delaying its ubiquitous application. Therefore, bridging the knowledge gaps and raising awareness is essential to ensure the maximum effectiveness of the handheld chemical and metal detectors market.

By Technology

The Ion Mobility Spectrometers (IMS) segment dominated with a market share of over 42% in 2023, as they offer quicker and better detection of trace chemicals, explosives, and illegal substances. IMS technology does this by ionizing all the molecules of a gas stream before they pass through an electric field as a time of flight, allowing for very accurate results even from small samples. The quick response times that the Theoretical AI provides, combined with its small size and portability, means it is perfect for use in security, military, and Law Enforcement applications. The technology’s reliability and sensitivity to a wide class of chemical compounds at very low levels make it even more appealing. These features have propelled IMS as the detector of choice for handheld detectors, especially during critical moments when effort detection of chemicals in the field is needed quickly and effectively.

By Application

The Chemical Detection segment dominated with a market share of over 38% in 2023, owing to their importance in security, military, and industrial applications. The growing demand for safety in environments exposed to chemical threats around the world has led to an increase in the number of these devices. They are key to detecting dangerous chemical compounds, including chemical warfare agents, toxic industrial chemicals, and illicit chemicals. Therefore, it is applied in military and defense fields, wherein chemical detection devices are used to stop attacks made by hazardous substances, and in industrial areas, they are used to monitor chemical exposure and ensure safety regulatory compliance. The adoption of this wide range of sensor technology has been influenced by increasing security concerns and industrial safety standards and should continue to deliver substantial growth to this segment.

By End-User

The Customs & Borders segment dominated with a market share of over 32% in 2023, due to the pivotal role these devices play in averting threats at border and customs checkpoints. Handheld detectors are widely used by customs and border security agencies to rapidly screen people, luggage, goods, and vehicles for illegal substances, explosives, and contraband materials. By using these portable and easy-to-use detectors, officers can carry out comprehensive inspections in different environments, whether it be airports, ports, or land borders. The end-user segment of the global smart surveillance market is majorly driven by the increasing need for more making better security solutions across the world so that security can be improved is considered to be the major factor fueling the demand for this market due to which the segment is dominating the market.

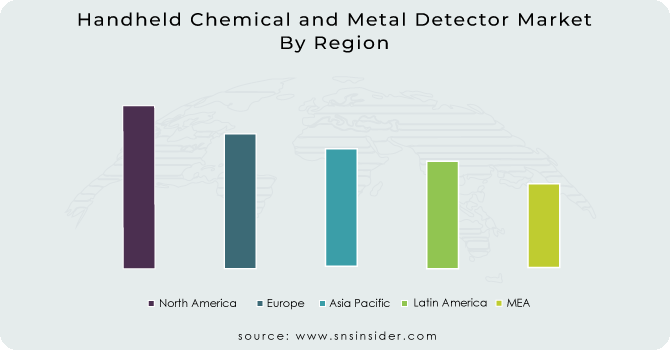

North America region dominated with a market share of over 38% in 2023, due to its well-established technological backbone and well-industrialized landscape. This has resulted in many efficient handheld detectors spread across several sectors in the region where security technologies have advanced significantly. These devices are utilized primarily in law enforcement and defense due to the growing need for improved security systems in the public and private sectors. Furthermore, handheld detectors play a crucial role in sectors involving hazardous materials, including chemical plants and manufacturing facilities, where safety and regulatory adherence are paramount. Moreover, with the presence of prominent players and continuous developments in detection technologies including the incorporation of AI and IoT conveniences North America to emerge as a market leader. Advanced detection devices are also in great demand due to government investments in security and defense technologies, thus further increasing the region's dominance in this market.

Asia-Pacific is witnessing the fastest growth in the Handheld Chemical and Metal Detector Market due to several factors. The growing industrial activities in the region, especially in China, India, and Japan, are driving a significant demand for advanced detection technologies. As these sectors have grown, so have effective safety measures for preventing accidents, hazards, and theft. Increasing security concerns associated with threats such as terrorism, industrial hazards, and environmental protection contribute to the growth of handheld detectors. With public safety and security becoming a top concern for the governments and organizations in the region, a boost in security infrastructure investments is seeing new heights. The rising emphasis on countering threats such as illegal smuggling, environmental pollution, and workplace hazards is also fueling the market for these detection systems.

Need any customization research on Handheld Chemical and Metal Detector Market - Enquiry Now

Some of the major key players in the Handheld Chemical and Metal Detector Market

OSI Systems, Inc (Rapiscan Systems - Handheld Chemical Detectors, Handheld X-ray Systems)

Teledyne Technologies Incorporated (Teledyne FLIR - Handheld Metal Detectors, Chemical Detectors)

Smiths Group plc (Smiths Detection - Handheld Chemical and Explosive Detectors, Handheld Metal Detectors)

Thermo Fisher Scientific Inc (Thermo Scientific - Handheld Chemical Analyzers, Portable Metal Detectors)

Agilent Technologies, Inc. (Agilent - Handheld Chemical Analysis Instruments)

Bruker Corporation,(Bruker - Handheld X-ray Fluorescence Analyzers)

Leidos (Leidos - Portable Chemical and Metal Detection Systems)

Garrett Metal Detectors (Garrett - Handheld Metal Detectors)

908 Devices Inc. (908 Devices - MX908 Handheld Chemical Detector)

Nuctech Company Limited (Nuctech - Handheld X-ray and Chemical Detectors)

B&W Tek, Inc. (B&W Tek - Handheld Raman Spectrometers for Chemical Detection)

FLIR Systems (FLIR - FLIR T-Series Handheld Chemical and Metal Detectors)

Horiba, Ltd. (Horiba - Handheld Chemical and Environmental Detectors)

Chemring Group (Chemring - Handheld Chemical Detectors and Explosive Detection Systems)

Riken Keiki Co., Ltd. (Riken Keiki - Portable Chemical and Gas Detectors)

Kidde-Fenwal, Inc. (Kidde - Handheld Fire and Gas Detectors)

Gimac (Gimac - Handheld Chemical Detection Systems)

Scintrex (Scintrex - Handheld Radiation and Chemical Detection Instruments)

Radiation Detection Company (RDC - Handheld Radiation Detectors and Chemical Analyzers)

Unisensor (Unisensor - Handheld Gas and Chemical Detectors)

Suppliers for (high-performance handheld detectors for detecting chemicals, explosives, and metals, commonly used by first responders, security agencies, and defense organizations) on Handheld Chemical and Metal Detector Market

Thermo Fisher Scientific Inc. (U.S.)

Smith’s Detection (U.K.)

Fluke Corporation (U.S.)

Horiba Ltd. (Japan)

Georgetown Instruments (U.S.)

Kroll Associates Inc. (U.S.)

DetectaChem (U.S.)

Shimadzu Corporation (Japan)

Rapiscan Systems (U.S.)

Chase Research Ltd. (U.K.)

Teledyne Technologies Incorporated-Company Financial Analysis

In May 2023: The security division of OSI Systems, Inc. secured an order worth approximately USD 10 million to supply several units of the Eagle M60 mobile high-energy cargo and vehicle inspection system, as well as the Z Backscatter Van cargo and vehicle inspection system. These systems are intended for international security applications.

In March 2023: OSI Systems, Inc.'s security division received an order valued at around USD 20 million from ANA Aeroportos de Portugal to deliver multiple units of the RTT 110 (Real Time Tomography) explosive detection system. These units are being deployed at airports across Portugal for passenger screening.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.29 Billion |

| Market Size by 2032 | USD 10.03 Billion |

| CAGR | CAGR of 13.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Ion Mobility Spectrometers, Raman Spectroscopy, Metal Identification, Others) • By Application (Chemical Detection, Explosive Detection, Narcotics Detection, Metal Detection) • By End User (Airports, Customs & Borders, Law Enforcement Agencies & Forensic Departments, Military & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | OSI Systems, Inc., Teledyne Technologies Incorporated, Smiths Group plc, Thermo Fisher Scientific Inc., Agilent Technologies, Inc., Bruker Corporation, Leidos, Garrett Metal Detectors, 908 Devices Inc., Nuctech Company Limited, B&W Tek, Inc., FLIR Systems, Horiba, Ltd., Chemring Group, Riken Keiki Co., Ltd., Kidde-Fenwal, Inc., Gimac, Scintrex, Radiation Detection Company, Unisensor |

Ans: The Handheld Chemical and Metal Detector Market is expected to grow at a CAGR of 13.19% during 2024-2032.

Ans: The Handheld Chemical and Metal Detector Market was USD 3.29 billion in 2023 and is expected to Reach USD 10.03 billion by 2032.

Ans: Growing global security threats have intensified the demand for handheld chemical and metal detectors across law enforcement, military, and border security applications.

Ans: The “Chemical Detection” segment dominated the Handheld Chemical and Metal Detector Market.

Ans: North America dominated the Handheld Chemical and Metal Detector Market in 2023

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, By Region (2023)

5.2 Technological Advancements & Innovations

5.3 Regulatory Landscape & Compliance Requirements

5.4 Export/Import Data, By Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Handheld Chemical and Metal Detector Market Segmentation, By Technology

7.1 Chapter Overview

7.2 Ion mobility spectrometers

7.2.1 Ion Mobility Spectrometers Market Trends Analysis (2020-2032)

7.2.2 Ion Mobility Spectrometers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Raman spectroscopy

7.3.1 Raman Spectroscopy Market Trends Analysis (2020-2032)

7.3.2 Raman Spectroscopy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Metal identification

7.4.1 Metal Identification Market Trends Analysis (2020-2032)

7.4.2 Metal Identification Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Handheld Chemical and Metal Detector Market Segmentation, By Application

8.1 Chapter Overview

8.2 Chemical detection

8.2.1 Chemical Detection Market Trends Analysis (2020-2032)

8.2.2 Chemical Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Explosive detection

8.3.1 Explosive Detection Market Trends Analysis (2020-2032)

8.3.2 Explosive Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Narcotics detection

8.3.1 Narcotics Detection Market Trends Analysis (2020-2032)

8.3.2 Narcotics Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Metal detection

8.3.1 Metal Detection Market Trends Analysis (2020-2032)

8.3.2 Metal Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Handheld Chemical and Metal Detector Market Segmentation, By End User

9.1 Chapter Overview

9.2 Airports

9.2.1 Aerospace & Defense Market Trends Analysis (2020-2032)

9.2.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Customs & borders

9.3.1 Chemicals Market Trends Analysis (2020-2032)

9.3.2 Chemicals Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Law Enforcement Agencies & forensic Departments

9.4.1 Law Enforcement Agencies & forensic Departments Market Trends Analysis (2020-2032)

9.4.2 Law Enforcement Agencies & forensic Departments Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Military & Defense

9.5.1 Military & Defense Market Trends Analysis (2020-2032)

9.5.2 Military & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.4 North America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.6.2 USA Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.7.2 Canada Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.2.8.2 Mexico Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.6.2 Poland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.7.2 Romania Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.4 Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.6.2 Germany Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.7.2 France Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.8.2 UK Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.9.2 Italy Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.10.2 Spain Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.13.2 Austria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.6.2 China Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.7.2 India Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.8.2 Japan Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.9.2 South Korea Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.10.2 Vietnam Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.11.2 Singapore Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.12.2 Australia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.4 Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.6.2 UAE Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.4 Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.4 Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.6.2 Brazil Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.7.2 Argentina Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.8.2 Colombia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Handheld Chemical and Metal Detector Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

11. Company Profiles

11.1 OSI Systems, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Teledyne Technologies Incorporated

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Smith’s Group plc

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Thermo Fisher Scientific Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Agilent Technologies, Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Bruker Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Leidos

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Garrett Metal Detectors

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 908 Devices Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Nuctech Company Limited

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Technology

Ion mobility spectrometers

Raman spectroscopy

Metal identification

Others

By Application

Chemical detection

Explosive detection

Narcotics detection

Metal detection

By End User

Airports

Customs & borders

Law enforcement agencies & forensic departments

Military & Defense

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

Economizer Market Size was valued at USD 10.75 Billion in 2023 and is expected to reach USD 17.45 Billion by 2032 and grow at a CAGR of 5.59% over the forecast period 2024-2032.

The Flexible Heater Market Size was valued at USD 1.34 Billion in 2023 and is now anticipated to grow at USD 2.59 Billion by 2032, displaying a compound annual growth rate (CAGR) of 7.59% during the forecast Period 2024-2032.

The Micromachining Market Size was valued at USD 3 Billion in 2023 and is now anticipated to grow $9.19 Billion by 2031, with a CAGR of 5.26% by 2024-2031.

The Automotive Headliner Market Size was estimated at USD 9.85 billion in 2023 and is expected to arrive at USD 14.23 billion by 2032 with a growing CAGR of 4.17% over the forecast period 2024-2032.

The Non-Destructive Testing Market size is value USD 20.56 Billion in 2023 and is expected to reach USD 39.79 Billion by 2032 with a growing CAGR of 7.61 % over the forecast period 2024-2032.

Crane and Hoist Market size was estimated at USD 30.95 billion in 2023 and is expected to reach USD 43.75 billion by 2032, at a CAGR of 3.92% from 2024-2032.

Hi! Click one of our member below to chat on Phone