Grinding Machinery Market Report Scope & Overview:

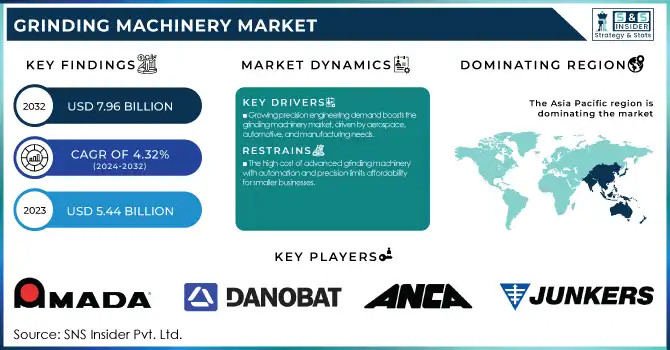

The Grinding Machinery Market size was valued at USD 5.44 Billion in 2023 and is expected to reach USD 7.96 Billion by 2032 with a growing CAGR of 4.32% over the forecast period 2024-2032.

To get more information on Grinding Machinery Market - Request Free Sample Report

This report provides insights into regional manufacturing output and trends, utilization rates across different regions, and maintenance and downtime metrics for assessing operational performance. Additionally, it covers technological adoption rates by region to understand the impact of innovation on the industry. The report also includes a comprehensive analysis of export/import data to highlight global trade patterns and their influence on the market.

Grinding Machinery Market Dynamics

DRIVERS

Rising demand for precision engineering drives the grinding machinery market as industries like aerospace, automotive, and manufacturing require high-quality surface finishes and tight tolerances.

The rising demand for precision engineering is a key driver of growth in the grinding machinery market. Some industries such as aerospace, automotive, and manufacturing operations require high-grade surface finishes. These exacting sectors require highly precise finishes achievable with advanced grinding machinery. And as automotive designs get more complex and aerospace components require tighter tolerances, the demand for high-precision grinding continues to grow. Moreover, precision engineering enables the manufacture of complex parts and components with very few defects, which is critical in industries where even small flaws can lead to severe ramifications. With the growing demand of these industries, manufacturers are investing in superior grinding technologies to sustain their competitive edge, which is leading to perpetual adoption of CNC controlled and automated grinding machines, able to provide better production process accuracy as well as efficiency.

RESTRAINT

The high initial cost of advanced grinding machinery, especially those with automation and precision features, can be a financial barrier for smaller businesses with limited budgets.

The high initial cost of advanced grinding machinery, particularly those equipped with automation and high-precision capabilities, is a significant barrier for many businesses, especially small and medium-sized enterprises (SMEs). They may also have advanced features, such as computerized (CNC) capabilities that increase its precision and efficiency but raise the overall cost. While ideal, the initial capital expenditure can be unaffordable for certain sized businesses meaning they cannot access this state-of-the-art equipment. Furthermore, these machines could need considerable maintenance and training costs, which would also increase the financial cost. Companies, for instance, might choose to invest in less effective, cheaper machines or would postpone capital equipment upgrades, which can undermine their competitiveness in the industries that require high-precision production. This predicament hampers the widespread utilization of cutting-edge grinding equipment, particularly for companies situated in developing markets or with limited budgets.

OPPORTUNITY

Customization and application-specific grinding solutions cater to industries like aerospace, medical, and electronics, addressing their unique precision and surface finish requirements.

Customization and application-specific solutions present a significant opportunity for manufacturers in the grinding machinery market. More advanced industries, like medical, aerospace, and electronics, tend to have specialized grinding processes to achieve exact tolerances and specific product parameters. Aerospace components, for instance, require ultra-precision grinding if they are to meet the performance and safety goals, and medical devices need exacting standards in surface finishes and materials. There are furthermore increasing requirements in the electronics industry for fine, precise grinding of minute, complex workpieces. Manufacturers can specialize in customized grinding equipment designed for the unique requirements of these sectors, positioning themselves in areas of market specific solutions and value addition for niche applications. This trend enables companies to capitalize on their expertise in creating customer-specific products that improve productivity, product quality and performance, while responding to rising demand for high-quality, specialized equipment in advanced manufacturing industries.

CHALLENGES

The grinding machinery market is highly competitive, requiring companies to innovate continuously and differentiate their products to maintain market share.

The grinding machinery market is characterized by intense competition due to the presence of numerous global and regional players. The major players operating in this segment, including Amada Machine Tools, ANCA Pty Ltd and its Danobat, are focused on strengthening and expanding its market share by providing advanced technology-based high quality machine tools. This is why innovation is key when it comes to differentiating yourself in a competitive landscape. Organizations need to focus on R&D (research and development) to deliver required features like automation, precision improvements and energy-efficient solutions to the customer. Similarly, customer attraction largely depends on the variety of customization options, after-sales service and cost-effectiveness. Competition deepens as race technology advances rapidly and machines must be more powerful than ever. Manufacturers also need to ensure they focus on operational efficiency, product reliability, and reach in emerging markets to maintain an edge. There will always be a particular relentless push for innovation and certain changes, which are required for companies to embed themselves in the market.

Grinding Machinery Market Segmentation Analysis

By Type

The Precision Grinder segment dominated with a market share of over 66% in 2023, due to its vital role in industries that demand high accuracy and exceptional surface finishes. Precision grinding is fundamentally essential in sectors such as aerospace, automotive, and electronics, where components are manufactured with tight tolerances, intricate details, and flawless finishes. These sectors typically manufacture components like turbine blades, engine parts, and microelectronics that need to adhere to strict quality standards. Precision grinders are preferred as they ensure these high-performance results thus, they are critical in applications for which quality and precision cannot be compromised. The ongoing technological progress that enables increasingly sophisticated and intricate components for these industries will help maintain the strong demand for precision grinding machinery, solidifying its dominance in the market.

By Application

The Automotive segment dominated with a market share of over 25% in 2023, due to its significant demand for precision and high-quality manufacturing processes. Automotive components consist of highly differentiated components like engine parts, transmission gears, and other mechanical components, all of which need very precise machining. Grinding machines are critical in producing the fine tolerances, surface finishes, and complex shapes required for these parts. Leading industry players are deploying the latest grinding technologies to spend less time on production lines while producing more efficient products. The resultant high efficiency coupled with unmatched quality makes grinding machinery an integral part of the automotive sector propelling its stronghold in the market.

Grinding Machinery Market Regional Outlook

Asia-Pacific region dominated with a market share of over 42% in 2023, largely due to robust manufacturing activities in key countries such as China, Japan, and South Korea. Their economies have grown to be global centers of industrial production with a focus on industries such as automobile, aerospace, and heavy manufacturing. As these industries increasingly require high precision and advanced grinding technologies, their adoption rates of grinding machinery have soared. Numerous key manufacturers in the region and continuous innovations and expansions by companies to serve domestic and international markets also support this trend. This demand coupled with expansive industry growth propels Asia-Pacific’s market leadership.

North America is witnessing rapid growth in the grinding machinery market, driven by several key factors. Grinding machine technology is being really considered system of automation and precision engineering to travel far farther. Precision grinding machines are in higher demand in the pulp and paper industry, automotive, and aerospace & defense due to the increasing demand for high production standards and improved product quality. The trend towards increased automation in production lines also drives the need for more sophisticated grinding technologies. Moreover, the increased investments into the North American manufacturing sector, with a focus especially on upgrading machinery and the construction of new facilities, is further driving the growth of this market.

Need any customization research on Grinding Machinery Market - Enquiry Now

Some of the major key players of the Grinding Machinery Market

-

Amada Machine Tools Co. Ltd (Surface Grinders, CNC Surface Grinders, Cylindrical Grinders)

-

DANOBAT (Grinding Machines, Vertical Grinding Machines, Cylindrical Grinders, Internal Grinders)

-

ANCA Pty Ltd (CNC Tool & Cutter Grinders, Grinding Software, Tool Grinding Solutions)

-

Junker (CBN Grinding Machines, Cylindrical Grinders, Profile Grinding Machines)

-

Körber AG (CNC Grinding Machines, Tool Grinding Solutions, Automatic Grinding Systems)

-

Fives (High-Precision Grinding Machines, CNC Grinding Machines, Grinding Systems for Aerospace)

-

Gleason Corporation (Gear Grinding Machines, CNC Gear Grinders, Gear Production Systems)

-

Hybrid Manufacturing Technologies (Hybrid Additive and Subtractive Manufacturing Systems, Hybrid 3D Printing Solutions)

-

Makino Milling Machine Co. Ltd (Vertical Machining Centers, Grinding Machines for Aerospace)

-

JTEKT Corporation (CNC Cylindrical Grinders, Centerless Grinders, Grinding Machines for Bearings)

-

Okamoto Machine Tool Works (Surface Grinders, Cylindrical Grinders, Precision Grinders)

-

Studer (Cylindrical Grinders, CNC Grinding Machines, Precision Grinding Machines)

-

Kellenberger (Universal Cylindrical Grinders, CNC Grinding Systems)

-

SCHAUDT (Cylindrical Grinders, Internal Grinders, Grinding Machines for Automotive)

-

Ziersch GmbH (Surface Grinders, Cylindrical Grinders, Special Grinding Solutions)

-

Toshiba Machine Co., Ltd. (Surface Grinders, CNC Grinding Machines, Vertical Grinders)

-

Heald Machine Co. (Precision Grinding Machines, Horizontal Grinders, CNC Grinders)

-

Chevalier Machinery Inc. (Surface Grinders, CNC Grinders, Double-Column Grinders)

-

Sunnen Products Company (Honing Machines, Vertical Honing, CNC Honing Systems)

-

Taiwan Grinding Machine Manufacturer (Cylindrical Grinders, CNC Grinding Machines, Surface Grinders)

Suppliers for (grinders, cylindrical grinders, and internal grinders. They are renowned for their ability to offer high-quality, customizable grinding solutions for various industries) on Grinding Machinery Market

-

Amada Machine Tools Co. Ltd

-

DANOBAT

-

ANCA Pty Ltd

-

Junker

-

Körber AG

-

Fives

-

Gleason Corporation

-

Hybrid Manufacturing Technologies

-

Makino Milling Machine Co. Ltd

-

Nidec Corporation

RECENT DEVELOPMENT

In February 2024: Nidec Machine Tool Corporation, a subsidiary of Nidec Corporation, announced the development of the world's first high-precision polishing (grinding) technique for machining internal gears. This method is designed for the mass production of gears used in automobile drive units, transmissions, and robot joints.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.44 Billion |

| Market Size by 2032 | USD 7.96 Billion |

| CAGR | CAGR of 4.32% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Non-precision Grinder (Bench Grinder, Portable Grinder, Pedestal Grinder, Flexible Grinder), (Precision Grinder (Cylindrical Grinding Machines, Surface Grinding Machines, Centre-less Grinding Machines, Tool and Cutter Grinding Machines)) • By Application (Automotive, Aerospace, Medical, Construction, Industrial Manufacturing, Electrical and Electronics, Marine Industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amada Machine Tools Co. Ltd, DANOBAT, ANCA Pty Ltd, Junker, Körber AG, Fives, Gleason Corporation, Hybrid Manufacturing Technologies, Makino Milling Machine Co. Ltd, JTEKT Corporation, Okamoto Machine Tool Works, Studer, Kellenberger, SCHAUDT, Ziersch GmbH, Toshiba Machine Co., Ltd., Heald Machine Co., Chevalier Machinery Inc., Sunnen Products Company, Taiwan Grinding Machine Manufacturer. |