Get More Information on Green Steel Market - Request Sample Report

The Green Steel Market Size was valued at USD 2.53 billion in 2023, and is expected to reach USD 141.67 billion by 2032, and grow at a CAGR of 56.48% over the forecast period 2024-2032.

Several key drivers and trends govern the growth and development of the Green Steel market. In a growing awareness of health and wellness, natural and organic flavors have gained consumer demand. One of the top trends now is towards natural, sustainably sourced products. More specifically, fragrances have had a high shift towards the use of environmentally friendly and organically sourced ingredients. Brands like Young Living and doTERRA are tapping into this trend, with their essential oil-based products and other natural fragrance options, while marketing to those who are environmentally conscientious. Another major driver is the interesting demand for an increase in innovative, exotic flavors in food items and beverages. Interest is soaring in experiencing new, more exotic tastes through food and drinks; this has been driven by the need from Gen Z for bolder and more innovative flavor offerings. Top restaurants are rapidly joining this trend by adding diversified sauces and flavor profiles to their menu—a bigger market trend in which restaurants are working hard to offer new, exciting culinary experiences.

Personalization and customization are also significantly impinging on the Green Steel market. Developments in technology have allowed companies to offer customized fragrance and flavor solutions that can be tailored to every individual's liking. Digital channels through which consumers can create their scent profile themselves are gaining popularity and enhancing customers' experience. Brands such as Scentbird and FragranceX already dominate in light of offering customized fragrance options as brands rapidly turn towards personalized consumer products. The other important driver in the market remains regulatory frameworks. Increasingly tight controls on the use of chemicals and ingredients in formulations have companies reformulating to observe safety and quality standards. For instance, the REACH regulation from the European Union has forced the reformulation of products to avoid restricted substances, furthering the impetus for innovation while continuing to ensure consumer safety throughout the sector.

Additionally, growth in emerging markets has also fueled the growth of the Green Steel market. As economies develop in regions like Asia-Pacific and Latin America, demand for premium and luxury products that come with unique flavors and fragrances increases. Improving economic conditions in these regions bring with them a rise in the middle class, which drives consumption. Companies like Symrise and International Green Steel participate in growth by preparing products for local tastes. On the other hand, technological developments—the encapsulation technique—are also raising the quality and stability of products, further supporting market growth.

Market Dynamics:

Drivers:

Rising regulatory pressures, and carbon pricing mechanisms—both playing the role of incentivizing sustainable steel production.

The increasing regulatory pressures and carbon pricing mechanisms set a positive course for the green steel market. The governments and regulatory bodies of most countries have stringent environmental policies in place, setting a cap on the quantum of greenhouse gas emissions, having targeted the steel industry since it remains one of the greatest contributors to global carbon emissions. For example, the cap of the European Union's Emissions Trading System on the level of greenhouse gases that industries—steel production included—are able to emit guarantees a company must pay for allowances to cover its emissions and creates a financial incentive to reduce one's carbon footprint. Moreover, the European Green Deal aims for Europe to be the first climate-neutral continent by 2050, hence pushing steel producers toward green technologies such as hydrogen-based DRI production and EAFs powered by renewable energy. Similar initiatives are seen in regions elsewhere: Japan and South Korea invest heavily in hydrogen infrastructure in preparation of regulatory changes toward low-carbon steel. The Biden administration is also focused on green energy in the United States, looking at possible carbon border taxes that puts additional pressure on domestic and foreign steel mills to go green. Within these policy frameworks are penalties for high-emission steel production but also subsidies and incentives for firms investing in technologies related to green steel, which may further accelerate the transition toward more sustainable ways of producing steel. For example, companies like ArcelorMittal and SSAB have been involved in initiatives—the XCarb initiative and the HYBRIT project—where the output target is low- or zero-carbon steel. These are almost in line with the regulatory requirements. Such regulatory pressures, coupled with an emerging carbon pricing mechanism, will likely create an overwhelming economic rationale to adopt green steel technologies that accelerate innovation and investment in the sector.

Growing consumer and corporate demand for green and sustainable materials.

Growing customer and corporate demand for green and sustainable materials are additional drivers for the Green Steel Market; hence, this is attributed to the growing scope of societal environmental obligation. This new awareness of world climate change and environmental degradation has put consumers fast shifting focus on sustainably sourced products with low environmental impacts. This trend is clear in industries like automotive, construction, and electronics, in which companies are under pressure to cut their carbon footprint and meet ESG standards. For instance, leading car manufacturers worldwide, including Volvo and BMW, have committed to using green steel as part of their much larger sustainability goals. That means Volvo, along with SSAB, will incorporate fossil-free steel in cars to mitigate CO2 emissions in the supply chain. On the same lines, construction firms are racing to find suppliers of green building materials to meet the booming green building industry—energy-efficient, lower-carbon structures. Another driver is corporate ESG commitments where many firms have ambitious goals to reach carbon neutrality. For example, companies like Apple and Google are working on green steel intended for their data centers and overall infrastructure. Here, too, demand is upped through investors and other stakeholders who reward companies with better ESG profiles, influencing corporate decisions on the sourcing of sustainable materials. This increasing demand is, therefore, being met by the investment of green steel technologies by steel producers, using methods like hydrogen-based reduction and renewable energy-powered electric arc furnaces. Sustainability has ceased to be a regulatory or ethical trend, but it has become a must-have market differentiator. Green steel, then, becomes an extremely compelling option for those companies willing to build brand value and satisfy expectations among consumers who are gradually becoming more eco-sensitive.

Restraints:

High upfront capital costs required for deployment of the Green Steel technologies.

The high upfront capital costs required for deploying Green Steel technologies are a major restraint in the market. This will require massive investment in new infrastructure, equipment, and technology to transition to these green process routes: hydrogen-based direct reduction and electric arc furnaces powered by renewable energy from traditional routes of steel production. Investments in setting up facilities for hydrogen production and plants operating with renewable energy sources are incumbent, for instance. Massive investments in building plants for fossil-free steel production have been announced by companies like SSAB and H2 Green Steel. Both advanced technology and huge capital are required for their establishment and maintenance. High upfront costs may be a hindrance to many steel producers, especially smaller ones, thus limiting the fast adoption and further scaling potential of green steel solutions that hit the market.

Opportunities:

Growing partnerships and collaborations across the value chain to create a strong ecosystem for sustainable steel production.

Increased efforts in climate neutrality and industrial reduction of carbon emissions globally.

By Product Type

Flat steel products dominated the green steel market in 2023 with a revenue share of 63%. The segment holds hot rolled coils, cold rolled coils, and coated steel products that find wide usage in industries such as automotive, construction, and appliances. The domination in flat steel products has been essentially founded on the wide application and high demand from these sectors that more and more pay attention to sustainability and reduction of carbon footprint. For example, in the automotive industry, manufacturers are using green steel due to its lightweight and better strength-to-weight ratio, which helps in fuel efficiency and reduces emissions in vehicles. Furthermore, the construction industry makes huge applications of flat steel products for structural purposes. Growing demand for green, eco-friendly building materials shifts interest towards green steel in this segment. Based on the market share, flat steel products are estimated to have a considerable share owing to their vast usage and trend towards green steel production processes. It is further supported by the fact that continuous innovation and investments in green technologies for the production of these products with low carbon emissions are prominent in this segment.

By Production Technology

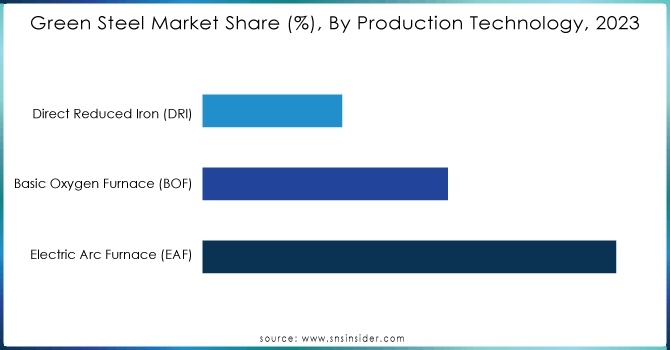

In 2023, Electric Arc Furnace technology dominated the green steel market with a revenue share of 53%. The EAF process is preferred because it is flexible and has a relatively low carbon footprint compared to other methods. This technology increasingly finds application in green steel production because it can make use of scrap steel reutilization, which drastically reduces the total carbon footprint. The EAF process also allows for easier integration with renewable energy sources, such as wind or solar power, thereby improving its sustainability credentials. This dominance will be driven by the increasing adoption of the EAF technology by large steel producers seeking to meet their respective regulatory requirements and sustainability goals. For example, companies like ArcelorMittal and Nucor are ramping up their EAF production of greener steel products and riding on such benefits the technology gives in cutting down emissions and bringing improved energy efficiency. The fact that EAF technology can produce low-carbon steel while maintaining flexibility in raw material use makes it a preferred choice in the transition toward more sustainable steel production.

Need any customization research on Green Steel Market - Enquiry Now

By Application

In 2023, the Building & Construction segment led the green steel market with a share of 47%. This market is huge because of the huge volume of steel that goes into construction projects, including commercial buildings, residential structures, and infrastructure development. Moreover, increasing emphasis on sustainable and eco-friendly construction techniques has been noted; in such sectors, green steel enjoys an added advantage due to its lower carbon emission compared to traditional steel products. Moreover, such dominance is further enhanced by various demands of government legislation and building codes in enforcing or promoting the use of sustainable materials. For instance, the construction industry is shifting towards green steel to ensure it meets green building certification needs, such as LEED and BREEAM. For instance, large construction projects, such as the redevelopment of larger urban areas and infrastructure improvements, where green steel is utilized to improve sustainability and environmental performance linked to such projects. What this only goes to prove is that, at large, there is an emerging trend in the industry—possibly globally—to integrate more sustainable materials into construction practices to reduce the overall carbon footprint of building projects.

By End-use Industry

The Industrial sector dominated the green steel market and accounted for 45% of the Green Steel Market in 2023. This massive contribution is in response to the surge in demand for green steel in industrial uses, driven by the desire of the sector toward sustainable operations. For example, industries such as automotive and heavy machinery are fastly embracing green steel to achieve their sustainability goals through the launch of sustainable products. It dominates due to the extensive applications of the equipment, machinery, and industrial structures in its making. As industries increasingly turn attention to sustainability and lowering carbon footprint, green steel fast becomes a material of preference compared to ordinary steel, which has less potential to affect the environment. Green steel is increasingly applied by companies like Volvo and Caterpillar in their production process so that it can adhere to strict environmental regulations and consumer demand for greener products. This trend underlines the huge contribution of the industrial sector to the rise of green steel technologies.

Regional Analysis

In 2023, Europe dominated the Green Steel Market, with the largest market share of approximately 46%. Ambitious European climate policies and regulatory settings are propelling the green-steel-related sector. The European Union's Green Deal is trying to reach climate neutrality in the year 2050, while the ETS has forced the steel industry to drive change toward greener technologies rapidly. Several European countries are now taking the lead in green steel production. For example, SSAB of Sweden is currently working on the HYBRIT project, which will produce fossil-free steel using hydrogen technology jointly with LKAB and Vattenfall. Not to be left behind, Thyssenkrupp of Germany has focused on electric arc furnace technology in producing low-emission steels. Huge investments in renewable energy facilities and green steel technologies also support European market dominance. These factors all contribute to positioning Europe as the leading region in the green steel market, underlining its aggressive approach toward the achievement of environmentally sustainable development and compliance with regulations.

Moreover, in 2023, the Asia-Pacific is the fastest-growing region with a revenue share of 30% of the green steel market in 2023. This is attributed to heavy industrial expansion, increasing urbanization, and growing investments in sustainable technologies across several key countries in the region. China, the world's number one producer of steel, played a lead role in this growth. The green steel movement has found an open supporter in the Chinese government, inflamed by goals to achieve carbon neutrality by 2060. Large Chinese producers, such as Baowu Steel, have made investments in green technologies and re-changed their production lines to cut emissions and boost sustainability. Similarly, green steel is also expected to find greater adoption in India, driven by the burgeoning construction and infrastructure sectors rapidly turning green given the growing environmental regulations and demand for eco-friendly materials. The rapid growth in the Asia-Pacific green steel industry is further underpinned by rapidly growing investments in renewable energy and technologies that could cut carbon emissions associated with the production process of that metal. Strong industrial demand, supported by government policy and huge investment in green technologies, drives exponential growth in the green steel market of this region.

Recent Developments

April 2024: A new version of the Green Steel Tracker, the key tool for tracking and progress on low-carbon primary steel production globally, has been published by the Leadership Group for Industry Transition. It was indicated that new project announcements were slowing in Europe, and new investments had spread to a wider geography.

March 2024: According to the targets set by the NDRC, high-green and low-carbon quality buildings are supposed to be built from 2027, improving energy-saving and carbon emission reduction in the construction sector.

February 2024: Salzgitter Flachstahl GmbH, a subsidiary of Salzgitter AG, signed a long-term Power Purchase Agreement with Octopus Energy's generation arm to back future green steel production.

March 2023: Kobe Steel subsidiary Midrex Technologies, Inc. announced it would supply and build the MIDREX Flex reduction plant for ThyssenKrupp Steel Europe AG of Germany at its Duisburg site with a capacity to produce 2.5 million tons/year.

Some of the major players in the Green Steel Market are ArcelorMittal, Baowu Steel Group, China Baowu Group, Emirates Steel Arkan Group, H2 Green Steel, Liberty Steel Group, Nippon Steel Corporation, Nucor Corporation, Outokumpu Oyj, POSCO, Salzgitter AG, SSAB AB, Swiss Steel Group, Tata Steel, Thyssenkrupp AG, Voestalpine AG, and others players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.53 Billion |

| Market Size by 2032 | US$ 141.67 Billion |

| CAGR | CAGR of 56.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Flat Steel Products [Hot Rolled Coils, Cold Rolled Coils, Coated Steel Products], Long Steel Products [Rebars, Structural Steel, Wire Rods], Tubular Steel Products [Seamless Pipes, Welded Pipes]) •By Production Technology (Electric Arc Furnace (EAF), Basic Oxygen Furnace (BOF), Direct Reduced Iron (DRI)) •By Application (Building & Construction, Automotive, Renewable Energy Infrastructure, Carbon Capture and Utilization (CCU), Home Appliances, Others) •By End-Use Industry (Residential, Commercial, Industrial, Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, Baowu Steel Group, China Baowu Group, Emirates Steel Arkan Group, H2 Green Steel, Liberty Steel Group, Nippon Steel Corporation, Nucor Corporation, Outokumpu Oyj, POSCO, Salzgitter AG, SSAB AB, Swiss Steel Group, Tata Steel, Thyssenkrupp AG, Voestalpine AG and other players |

| Key Drivers | •Rising regulatory pressures, and carbon pricing mechanisms—both playing the role of incentivizing sustainable steel production •Growing consumer and corporate demand for green and sustainable materials |

| Restraints | •High upfront capital costs required for deployment of the Green Steel technologies. |

Ans: The Europe region dominated the Green Steel Market holding the largest market share of about 46% during the forecast period.

Ans: High upfront capital costs are required for the deployment of the Green Steel technologies.

Ans: Rising regulatory pressures, carbon pricing mechanisms, and growing consumer and corporate demand for green and sustainable materials. are the driving factors that fuel the demand for the Green Steel market

Ans: The Green Steel Market Size was valued at USD 2.53 billion in 2023, and is expected to reach USD 141.67 billion by 2032.

Ans: The Green Steel Market is expected to grow at a CAGR of 56.48%.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Green Steel Market Segmentation, By Product Type

7.1 Introduction

7.2 Flat Steel Products

7.2.1 Hot Rolled Coils

7.2.2 Cold Rolled Coils

7.2.3 Coated Steel Products

7.3 Long Steel Products

7.3.1 Rebars

7.3.2 Structural Steel

7.3.3 Wire Rods

7.4 Tubular Steel Products

7.4.1 Seamless Pipes

7.4.2 Welded Pipes

8. Green Steel Market Segmentation, By Production Technology

8.1 Introduction

8.2 Electric Arc Furnace (EAF)

8.3 Basic Oxygen Furnace (BOF)

8.4 Direct Reduced Iron (DRI)

9. Green Steel Market Segmentation, By Application

9.1 Introduction

9.2 Building & Construction

9.3 Automotive

9.4 Renewable Energy Infrastructure

9.5 Carbon Capture and Utilization (CCU)

9.6 Home Appliances

9.7 Others

10. Green Steel Market Segmentation, By End-Use Industry

10.1 Introduction

10.2 Residential

10.3 Commercial

10.4 Industrial

10.5 Infrastructure

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Green Steel Market by Country

11.2.3 North America Green Steel Market by Product Type

11.2.4 North America Green Steel Market by Production Technology

11.2.5 North America Green Steel Market by Application

11.2.6 North America Green Steel Market by End-Use Industry

11.2.7 USA

11.2.7.1 USA Green Steel Market by Product Type

11.2.7.2 USA Green Steel Market by Production Technology

11.2.7.3 USA Green Steel Market by Application

11.2.7.4 USA Green Steel Market by End-Use Industry

11.2.8 Canada

11.2.8.1 Canada Green Steel Market by Product Type

11.2.8.2 Canada Green Steel Market by Production Technology

11.2.8.3 Canada Green Steel Market by Application

11.2.8.4 Canada Green Steel Market by End-Use Industry

11.2.9 Mexico

11.2.9.1 Mexico Green Steel Market by Product Type

11.2.9.2 Mexico Green Steel Market by Production Technology

11.2.9.3 Mexico Green Steel Market by Application

11.2.9.4 Mexico Green Steel Market by End-Use Industry

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Green Steel Market by Country

11.3.2.2 Eastern Europe Green Steel Market by Product Type

11.3.2.3 Eastern Europe Green Steel Market by Production Technology

11.3.2.4 Eastern Europe Green Steel Market by Application

11.3.2.5 Eastern Europe Green Steel Market by End-Use Industry

11.3.2.6 Poland

11.3.2.6.1 Poland Green Steel Market by Product Type

11.3.2.6.2 Poland Green Steel Market by Production Technology

11.3.2.6.3 Poland Green Steel Market by Application

11.3.2.6.4 Poland Green Steel Market by End-Use Industry

11.3.2.7 Romania

11.3.2.7.1 Romania Green Steel Market by Product Type

11.3.2.7.2 Romania Green Steel Market by Production Technology

11.3.2.7.3 Romania Green Steel Market by Application

11.3.2.7.4 Romania Green Steel Market by End-Use Industry

11.3.2.8 Hungary

11.3.2.8.1 Hungary Green Steel Market by Product Type

11.3.2.8.2 Hungary Green Steel Market by Production Technology

11.3.2.8.3 Hungary Green Steel Market by Application

11.3.2.8.4 Hungary Green Steel Market by End-Use Industry

11.3.2.9 Turkey

11.3.2.9.1 Turkey Green Steel Market by Product Type

11.3.2.9.2 Turkey Green Steel Market by Production Technology

11.3.2.9.3 Turkey Green Steel Market by Application

11.3.2.9.4 Turkey Green Steel Market by End-Use Industry

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Green Steel Market by Product Type

11.3.2.10.2 Rest of Eastern Europe Green Steel Market by Production Technology

11.3.2.10.3 Rest of Eastern Europe Green Steel Market by Application

11.3.2.10.4 Rest of Eastern Europe Green Steel Market by End-Use Industry

11.3.3 Western Europe

11.3.3.1 Western Europe Green Steel Market by Country

11.3.3.2 Western Europe Green Steel Market by Product Type

11.3.3.3 Western Europe Green Steel Market by Production Technology

11.3.3.4 Western Europe Green Steel Market by Application

11.3.3.5 Western Europe Green Steel Market by End-Use Industry

11.3.3.6 Germany

11.3.3.6.1 Germany Green Steel Market by Product Type

11.3.3.6.2 Germany Green Steel Market by Production Technology

11.3.3.6.3 Germany Green Steel Market by Application

11.3.3.6.4 Germany Green Steel Market by End-Use Industry

11.3.3.7 France

11.3.3.7.1 France Green Steel Market by Product Type

11.3.3.7.2 France Green Steel Market by Production Technology

11.3.3.7.3 France Green Steel Market by Application

11.3.3.7.4 France Green Steel Market by End-Use Industry

11.3.3.8 UK

11.3.3.8.1 UK Green Steel Market by Product Type

11.3.3.8.2 UK Green Steel Market by Production Technology

11.3.3.8.3 UK Green Steel Market by Application

11.3.3.8.4 UK Green Steel Market by End-Use Industry

11.3.3.9 Italy

11.3.3.9.1 Italy Green Steel Market by Product Type

11.3.3.9.2 Italy Green Steel Market by Production Technology

11.3.3.9.3 Italy Green Steel Market by Application

11.3.3.9.4 Italy Green Steel Market by End-Use Industry

11.3.3.10 Spain

11.3.3.10.1 Spain Green Steel Market by Product Type

11.3.3.10.2 Spain Green Steel Market by Production Technology

11.3.3.10.3 Spain Green Steel Market by Application

11.3.3.10.4 Spain Green Steel Market by End-Use Industry

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Green Steel Market by Product Type

11.3.3.11.2 Netherlands Green Steel Market by Production Technology

11.3.3.11.3 Netherlands Green Steel Market by Application

11.3.3.11.4 Netherlands Green Steel Market by End-Use Industry

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Green Steel Market by Product Type

11.3.3.12.2 Switzerland Green Steel Market by Production Technology

11.3.3.12.3 Switzerland Green Steel Market by Application

11.3.3.12.4 Switzerland Green Steel Market by End-Use Industry

11.3.3.13 Austria

11.3.3.13.1 Austria Green Steel Market by Product Type

11.3.3.13.2 Austria Green Steel Market by Production Technology

11.3.3.13.3 Austria Green Steel Market by Application

11.3.3.13.4 Austria Green Steel Market by End-Use Industry

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Green Steel Market by Product Type

11.3.3.14.2 Rest of Western Europe Green Steel Market by Production Technology

11.3.3.14.3 Rest of Western Europe Green Steel Market by Application

11.3.3.14.4 Rest of Western Europe Green Steel Market by End-Use Industry

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Green Steel Market by Country

11.4.3 Asia-Pacific Green Steel Market by Product Type

11.4.4 Asia-Pacific Green Steel Market by Production Technology

11.4.5 Asia-Pacific Green Steel Market by Application

11.4.6 Asia-Pacific Green Steel Market by End-Use Industry

11.4.7 China

11.4.7.1 China Green Steel Market by Product Type

11.4.7.2 China Green Steel Market by Production Technology

11.4.7.3 China Green Steel Market by Application

11.4.7.4 China Green Steel Market by End-Use Industry

11.4.8 India

11.4.8.1 India Green Steel Market by Product Type

11.4.8.2 India Green Steel Market by Production Technology

11.4.8.3 India Green Steel Market by Application

11.4.8.4 India Green Steel Market by End-Use Industry

11.4.9 Japan

11.4.9.1 Japan Green Steel Market by Product Type

11.4.9.2 Japan Green Steel Market by Production Technology

11.4.9.3 Japan Green Steel Market by Application

11.4.9.4 Japan Green Steel Market by End-Use Industry

11.4.10 South Korea

11.4.10.1 South Korea Green Steel Market by Product Type

11.4.10.2 South Korea Green Steel Market by Production Technology

11.4.10.3 South Korea Green Steel Market by Application

11.4.10.4 South Korea Green Steel Market by End-Use Industry

11.4.11 Vietnam

11.4.11.1 Vietnam Green Steel Market by Product Type

11.4.11.2 Vietnam Green Steel Market by Production Technology

11.4.11.3 Vietnam Green Steel Market by Application

11.4.11.4 Vietnam Green Steel Market by End-Use Industry

11.4.12 Singapore

11.4.12.1 Singapore Green Steel Market by Product Type

11.4.12.2 Singapore Green Steel Market by Production Technology

11.4.12.3 Singapore Green Steel Market by Application

11.4.12.4 Singapore Green Steel Market by End-Use Industry

11.4.13 Australia

11.4.13.1 Australia Green Steel Market by Product Type

11.4.13.2 Australia Green Steel Market by Production Technology

11.4.13.3 Australia Green Steel Market by Application

11.4.13.4 Australia Green Steel Market by End-Use Industry

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Green Steel Market by Product Type

11.4.14.2 Rest of Asia-Pacific Green Steel Market by Production Technology

11.4.14.3 Rest of Asia-Pacific Green Steel Market by Application

11.4.14.4 Rest of Asia-Pacific Green Steel Market by End-Use Industry

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Green Steel Market by Country

11.5.2.2 Middle East Green Steel Market by Product Type

11.5.2.3 Middle East Green Steel Market by Production Technology

11.5.2.4 Middle East Green Steel Market by Application

11.5.2.5 Middle East Green Steel Market by End-Use Industry

11.5.2.6 UAE

11.5.2.6.1 UAE Green Steel Market by Product Type

11.5.2.6.2 UAE Green Steel Market by Production Technology

11.5.2.6.3 UAE Green Steel Market by Application

11.5.2.6.4 UAE Green Steel Market by End-Use Industry

11.5.2.7 Egypt

11.5.2.7.1 Egypt Green Steel Market by Product Type

11.5.2.7.2 Egypt Green Steel Market by Production Technology

11.5.2.7.3 Egypt Green Steel Market by Application

11.5.2.7.4 Egypt Green Steel Market by End-Use Industry

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Green Steel Market by Product Type

11.5.2.8.2 Saudi Arabia Green Steel Market by Production Technology

11.5.2.8.3 Saudi Arabia Green Steel Market by Application

11.5.2.8.4 Saudi Arabia Green Steel Market by End-Use Industry

11.5.2.9 Qatar

11.5.2.9.1 Qatar Green Steel Market by Product Type

11.5.2.9.2 Qatar Green Steel Market by Production Technology

11.5.2.9.3 Qatar Green Steel Market by Application

11.5.2.9.4 Qatar Green Steel Market by End-Use Industry

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Green Steel Market by Product Type

11.5.2.10.2 Rest of Middle East Green Steel Market by Production Technology

11.5.2.10.3 Rest of Middle East Green Steel Market by Application

11.5.2.10.4 Rest of Middle East Green Steel Market by End-Use Industry

11.5.3 Africa

11.5.3.1 Africa Green Steel Market by Country

11.5.3.2 Africa Green Steel Market by Product Type

11.5.3.3 Africa Green Steel Market by Production Technology

11.5.3.4 Africa Green Steel Market by Application

11.5.3.5 Africa Green Steel Market by End-Use Industry

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Green Steel Market by Product Type

11.5.3.6.2 Nigeria Green Steel Market by Production Technology

11.5.3.6.3 Nigeria Green Steel Market by Application

11.5.3.6.4 Nigeria Green Steel Market by End-Use Industry

11.5.3.7 South Africa

11.5.3.7.1 South Africa Green Steel Market by Product Type

11.5.3.7.2 South Africa Green Steel Market by Production Technology

11.5.3.7.3 South Africa Green Steel Market by Application

11.5.3.7.4 South Africa Green Steel Market by End-Use Industry

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Green Steel Market by Product Type

11.5.3.8.2 Rest of Africa Green Steel Market by Production Technology

11.5.3.8.3 Rest of Africa Green Steel Market by Application

11.5.3.8.4 Rest of Africa Green Steel Market by End-Use Industry

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Green Steel Market by Country

11.6.3 Latin America Green Steel Market by Product Type

11.6.4 Latin America Green Steel Market by Production Technology

11.6.5 Latin America Green Steel Market by Application

11.6.6 Latin America Green Steel Market by End-Use Industry

11.6.7 Brazil

11.6.7.1 Brazil Green Steel Market by Product Type

11.6.7.2 Brazil Green Steel Market by Production Technology

11.6.7.3 Brazil Green Steel Market by Application

11.6.7.4 Brazil Green Steel Market by End-Use Industry

11.6.8 Argentina

11.6.8.1 Argentina Green Steel Market by Product Type

11.6.8.2 Argentina Green Steel Market by Production Technology

11.6.8.3 Argentina Green Steel Market by Application

11.6.8.4 Argentina Green Steel Market by End-Use Industry

11.6.9 Colombia

11.6.9.1 Colombia Green Steel Market by Product Type

11.6.9.2 Colombia Green Steel Market by Production Technology

11.6.9.3 Colombia Green Steel Market by Application

11.6.9.4 Colombia Green Steel Market by End-Use Industry

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Green Steel Market by Product Type

11.6.10.2 Rest of Latin America Green Steel Market by Production Technology

11.6.10.3 Rest of Latin America Green Steel Market by Application

11.6.10.4 Rest of Latin America Green Steel Market by End-Use Industry

12. Company Profiles

12.1 ArcelorMittal

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Baowu Steel Group

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 China Baowu Group

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 Emirates Steel Arkan Group

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 H2 Green Steel

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 Liberty Steel Group

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 Nippon Steel Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 Nucor Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 Outokumpu Oyj

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 POSCO

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

12.11 Salzgitter AG

12.11.1 Company Overview

12.11.2 Financial

12.11.3 Products/ Services Offered

12.11.4 The SNS View

12.12 SSAB AB

12.12.1 Company Overview

12.12.2 Financial

12.12.3 Products/ Services Offered

12.12.4 The SNS View

12.13 Swiss Steel Group

12.13.1 Company Overview

12.13.2 Financial

12.13.3 Products/ Services Offered

12.13.4 The SNS View

12.14 Tata Steel

12.14.1 Company Overview

12.14.2 Financial

12.14.3 Products/ Services Offered

12.14.4 The SNS View

12.15 Thyssenkrupp AG

12.15.1 Company Overview

12.15.2 Financial

12.15.3 Products/ Services Offered

12.15.4 The SNS View

12.16 Voestalpine AG

12.16.1 Company Overview

12.16.2 Financial

12.16.3 Products/ Services Offered

12.16.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Flat Steel Products

Hot Rolled Coils

Cold Rolled Coils

Coated Steel Products

Long Steel Products

Rebars

Structural Steel

Wire Rods

Tubular Steel Products

Seamless Pipes

Welded Pipes

By Production Technology

Electric Arc Furnace (EAF)

Basic Oxygen Furnace (BOF)

Direct Reduced Iron (DRI)

By Application

Building & Construction

Automotive

Renewable Energy Infrastructure

Carbon Capture and Utilization (CCU)

Home Appliances

Others

By End Use Industry

Residential

Commercial

Industrial

Infrastructure

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Asphalt Market size was valued at USD 249.2 million in 2023. It is expected to grow to USD 389.9 million by 2032 and grow at a CAGR of 5.1% by 2024-2032.

The Slip Additives Market size was USD 276.94 million in 2023 and is expected to reach USD 402.20 million by 2032 and grow at a CAGR of 4.23% over the forecast period of 2024-2032.

The Biolubricants Market Size was valued at USD 2.59 billion in 2023 and is expected to reach USD 4.14 Bn by 2032 and grow at a CAGR of 6.13% by 2024-2032

Acoustic Insulation Market was valued at USD 14.85 billion in 2023 and is expected to reach USD 23.14 billion by 2032, growing at a CAGR of 5.08% by 2024-2032.

Plastic Antioxidants Market size was USD 4.16 billion in 2023 and is expected to reach USD 6.93 billion by 2032, growing at a CAGR of 5.84% from 2024-2032.

The Aromatherapy Market Size was valued at USD 7.19 Billion in 2023 and is expected to reach USD 14.55 Bn by 2032, growing at a CAGR of 18.18% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone