To Get More Information on Green Data Center Market - Request Sample Report

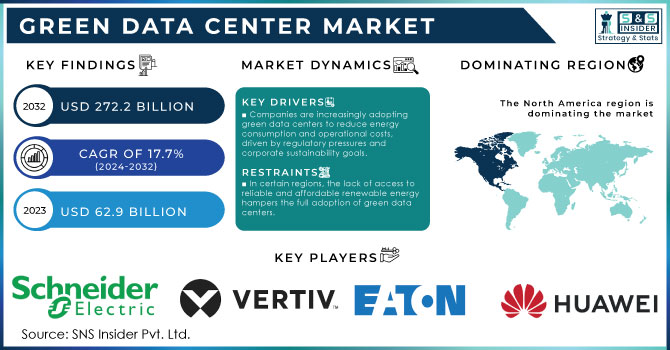

Green Data Center Market size was valued at USD 62.9 billion in 2023 and is expected to reach USD 272.2 billion by 2032 and grow at a CAGR of 17.7% over the forecast period of 2024-2032.

The growth of the green data center market is driven by the increasing government focus on sustainability and energy efficiency. Governments across the globe are implementing strict regulations and providing incentives to encourage the adoption of energy-efficient technologies. As an example, the U.S. Environmental Protection Agency (EPA) revealed that 2% of total U.S. electricity use is attributed to data centers. In response, federal and state governments have implemented energy efficiency programs like the Data Center Optimization Initiative (DCOI) and Energy Star certification for data centers. Further, the European Union has launched initiatives such as the EU Code of Conduct for Data Centres which focuses on minimizing reported power consumption in data centers through adopting energy-saving practices.

According to a report by the International Energy Agency (IEA), global data center energy demand is expected to increase by 4% annually from 2023 to 2030. The IEA has also noted that renewable energy sources are increasingly part of data center operations, with numerous governments requiring new data centers to comply with strict environmental codes. As an example, in 2023, the U.K. government made a target to have all data centers net-zero carbon by 2030 which pushed this market shift towards green infrastructure. Such government policies and the shutdown of carbon emissions will further amplify the demand for green data centers.

The market will expand due to the demand for energy-efficient infrastructure and greater use of renewable sources such as solar, wind, hydro, or geothermal. Data centers powered by green energy produce much lower carbon emissions than those powered by fossil fuels, therefore making them more sustainable. Many data centers also pursue certifications like Leadership in Energy and Environmental Design (LEED) or (BREEAM) Building Research Establishment Environmental Assessment Method, promote environmental sustainability. Nxtra, a subsidiary of Bharti Airtel, in September 2022 announced the installation of low-impact fuel cells at its data center in Karnataka as part of its collaboration with Bloom Energy to move away from fossil-fuel-dependent power and utilize low-carbon, hydrogen-ready fuels for cleaner operations. The popularity of green data center applications has increased as a result of the widespread adoption of cloud computing solutions among small, medium-sized, and big businesses. This is because there is an increasing demand for high-end, secure storage solutions worldwide. For instance, Merlin, a renowned entertainment firm, stated on 22 July 2021, that it will spend over $118 billion to build a 24 MW green data center in Barcelona, Spain. It is anticipated that a strategic investment in cloud computing will increase demand for green data center solutions.

Drivers

Companies are increasingly adopting green data centers to reduce energy consumption and operational costs, driven by regulatory pressures and corporate sustainability goals.

Governments worldwide are implementing stringent regulations to reduce carbon emissions, alongside offering incentives and subsidies for adopting eco-friendly practices, spurring demand for green data centers.

The massive expansion of cloud computing, big data, and IoT requires scalable and sustainable data management solutions, leading companies to prioritize energy-efficient data centers.

Increased demand for energy-efficient infrastructure is one of the main reasons fuelling growth in the green data center market. According to the International Energy Agency (IEA), data centers are responsible for an estimated 1% of total electricity use worldwide–putting organizations between a rock and a hard place when it comes to reducing their carbon footprint. As data centers develop into a most worrying stage they reduce the operations costs whilst supporting sustainability goals. For example, the Uptime Institute says that around 40% of power consumed by data centers is from cooling systems. This has led to investments in energy-efficient cooling technologies such as Google, which utilizes AI-powered cooling in its data centers to mitigate the issue. The company was able to reduce energy use for cooling by 30% with this system which illustrates the balance of costs and environmental benefits.

Additionally, companies are shifting to renewable energy sources to power their data centers. Corporate Demand for Clean Energy reached 36.7 Gigawatts in 2022, with tech giants such as Amazon, Microsoft, and Facebook leading the charge in green energy investments. For example, Amazon Web Services (AWS) is on track to achieve 100% renewable energy usage by 2025, significantly contributing to adopting energy-efficient, green data centers. Environmental responsibility certainly plays an important role in it; however, the consistency of operational savings makes this trend stronger for the adoption of green data center technologies.

Restraints

Despite long-term savings, the significant upfront costs associated with building green data centers, including renewable energy infrastructure and advanced cooling systems, remain a barrier for smaller companies.

Upgrading conventional data centers to green standards can be complex and costly, discouraging organizations from making the transition.

In certain regions, the lack of access to reliable and affordable renewable energy hampers the full adoption of green data centers.

The high capital expenses involved in constructing and migrating to energy-efficient facilities remain a major constraint in the green data center market. Green data centers may save on expenses in the longer term due to more energy-efficient practices and operational efficiencies, but there are huge upfront costs associated with the installation of eco-friendly infrastructure. This comprises investment in renewable energy like solar panels, energy-efficient cooling solutions, and power management technology such as advanced tools. Smaller organizations, or those with tighter budgets, may find these initial expenses prohibitive, making it challenging to justify the investment despite potential future savings. Then again, it’s not limited to new construction can also be costly and complicated to retrofit existing data centers for green standards. The need for specialized technologies and equipment creates financial barriers, especially for companies that lack the resources to make such significant upfront commitments, slowing down the widespread adoption of sustainable data center solutions.

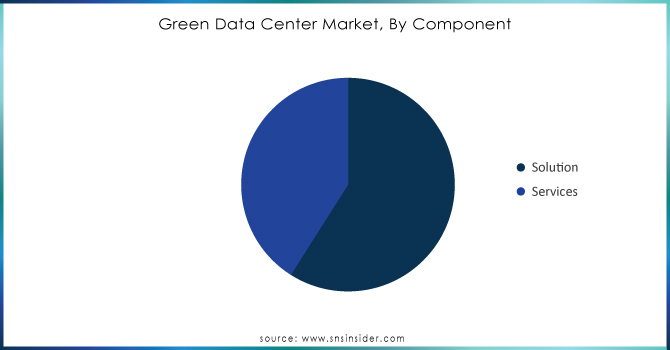

Based on components, the solution segment led the market and accounted 65% of revenue share in 2023. The growing demand for advanced solutions including cooling systems, power management solutions, and energy-efficient hardware. Cooling systems represent almost 40% of a data center's energy usage, according to the U.S. Department of Energy (DOE). Thus, organizations are shifting their focus towards adopting solutions such as liquid cooling and AI-driven energy management systems to maximize the use of energy.

Moreover, governments are introducing regulations that promote energy-efficient solutions. For Example, the European Commission, launched the European Green Deal to promote the implementation of greenhouse gas emission mitigation measures that affect sectors like data centers. By enforcing these regulations, it requires industries to make expenditures on solutions to comply with energy efficiency standards, thus driving the revenue growth of the solution segment.

Do You Need any Customization Research on Green Data Center Market - Enquire Now

By Enterprise Size

In 2023 the large enterprise accounted highest revenue with a market share of 71%. Corporates, especially in IT, telecoms & finance, have a lot of data to store and process. According to a report by the U.S. Federal Energy Regulatory Commission (FERC), large enterprises tend to invest heavily in infrastructure to ensure sustainability and conformity with environmental regulations.

Large corporations are also more likely to invest in sustainable infrastructure, as the pressures for environmental effects are better. Mandatory ESG disclosures for large corporations surrounding the European Union's Corporate Sustainability Reporting Directive (CSRD) beginning 2023 have heightened focus on green technologies.

By End-Use

The BFSI segment accounted for 23% of the revenue in the green data center market in 2023. This growth is driven by the BFSI sector's need to store huge volumes of sensitive data in secure and energy-efficient solutions. A report by the U.S. Federal Reserve states that the rising use of green data centers by financial institutions that are actively engaging in cost-effective measures to minimize operational costs while adhering strictly to the certain regulatory standards for energy usage.

On the other hand, the IT and telecom segment is expected to grow at a significant compound annual growth rate during the forecast period. In a 2023 report of U.S. Federal Communications Commission, the need for data from the telecom sector is estimated to rise at around 10% annually. Rapid digitalization, heightened use of 5G technology, and increasing dependency on cloud service are essentially pushing the need for more green data centers around the world that offer energy-efficient and scalable infrastructure.

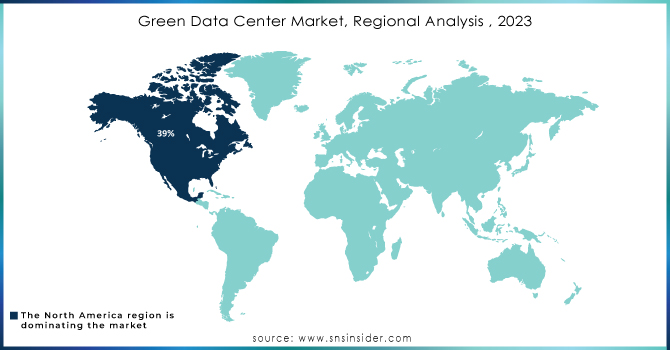

Regional Analysis

In 2023, North America dominated the green data center market, and held a market share of 39%. The region is led by the U.S. primarily because of its technology infrastructure and solid government regulations that encourage energy efficiency. For example, the DCOI driven by the U.S. government is focused on minimizing energy consumption through efficient operations of already established data centers and implementing more energy-efficient technologies. The region's strong presence of major Data Center Operators such as Google, Amazon & Microsoft further boosts market growth.

However, the Asia-Pacific region is projected to grow at a significant CAGR during the forecast period 2024-2032. The China’s Ministry of Industry and Information Technology (MIIT), the country plans to build over 100 green data centers by 2025, aiming to meet its carbon neutrality goals. also saw the Indian government announce incentives for data center operators to adopt renewable energy and energy-efficient technologies through its newly launched National Green Data Center Policy in 2023.

Key Players

Key Service Providers/Manufacturers:

Schneider Electric (EcoStruxure IT, Galaxy VM)

Vertiv Group Corp. (Liebert EXL S1, Trellis)

Eaton Corporation (Power Xpert, 93PM UPS)

Huawei Technologies Co., Ltd. (FusionModule2000, SmartLi UPS)

IBM Corporation (IBM Cloud Paks, Energy Efficiency Solutions)

Rittal GmbH & Co. KG (LCP DX Cooling, RiMatrix S)

Siemens AG (BlueVault Energy Storage, Desigo CC)

Delta Electronics, Inc. (InfraSuite Datacenter Solution, Modulon DPH UPS)

Cisco Systems, Inc. (Cisco Nexus Switches, UCS Power Manager)

Hewlett Packard Enterprise (HPE Synergy, HPE Aruba GreenLake)

Key Users of Green Data Center Services and Products:

Amazon Web Services (AWS)

Google LLC

Microsoft Corporation

Facebook, Inc.

Apple Inc.

Alibaba Group

Tencent Holdings Ltd.

IBM Corporation

Salesforce, Inc.

Bank of America Corporation

Recent Developments

| Report Attributes | Details |

| Market Size in 2023 | USD 62.9 billion |

| Market Size by 2032 | USD 272.2 billion |

| CAGR | CAGR of 17.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Solution, Services) • by Enterprise Size (Large Enterprises, Small and Medium-sized Enterprises) • by Industry Vertical (BFSI, IT, Telecom, Media, Entertainment, Healthcare, Government & Defene, Retail, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Schneider Electric, Vertiv Group Corp., Eaton Corporation, Huawei Technologies Co., Ltd., IBM Corporation, Rittal GmbH & Co. KG, Siemens AG, Delta Electronics, Inc., Cisco Systems, Inc., Hewlett Packard Enterprise |

| Key Drivers | •Companies are increasingly adopting green data centers to reduce energy consumption and operational costs, driven by regulatory pressures and corporate sustainability goals. •Governments worldwide are implementing stringent regulations to reduce carbon emissions, alongside offering incentives and subsidies for adopting eco-friendly practices, spurring demand for green data centers •The massive expansion of cloud computing, big data, and IoT requires scalable and sustainable data management solutions, leading companies to prioritize energy-efficient data centers. |

| Market Restraints | •Despite long-term savings, the significant upfront costs associated with building green data centers, including renewable energy infrastructure and advanced cooling systems, remain a barrier for smaller companies. •Upgrading conventional data centers to green standards can be complex and costly, discouraging organizations from making the transition. •In certain regions, the lack of access to reliable and affordable renewable energy hampers the full adoption of green data centers. |

Ans. The Compound Annual Growth rate for Green Data Center Market over the forecast period is 17.7%.

Ans. USD 272.2 billion is the projected Green Data Center Market size of the Company by 2032.

Ans. The green data center market is segmented based on components, enterprise size, and industry verticals.

Ans. Green data centers aim to use energy more efficiently. Power usage effectiveness It is a metric used to measure the energy efficiency of data centers.

Ans. Factors such as a surge in penetration of high-end cloud computing in enterprises, a rise in green data center complexities due to scalability, and a surge in the expenditure on green data center technology are key factors driving the growth of the Green Data Center market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Green Data Center Market Segmentation, By Component

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Monitoring & Management System

7.2.3.1 Monitoring & Management System Market Trends Analysis (2020-2032)

7.2.3.2 Monitoring & Management System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Cooling System

7.2.4.1 Cooling System Market Trends Analysis (2020-2032)

7.2.4.2 Cooling System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Networking System

7.2.5.1 Networking System Market Trends Analysis (2020-2032)

7.2.5.2 Networking System Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Power Systems

7.2.6.1 Power Systems Market Trends Analysis (2020-2032)

7.2.6.2 Power Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Others

7.2.7.1 Others Market Trends Analysis (2020-2032)

7.2.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Installation & Deployment

7.3.3.1 Installation & Deployment Market Trends Analysis (2020-2032)

7.3.3.2 Installation & Deployment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Consulting

7.3.4.1 Consulting Market Trends Analysis (2020-2032)

7.3.4.2 Consulting Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Support & Maintenance

7.3.5.1 Support & Maintenance Market Trends Analysis (2020-2032)

7.3.5.2 Support & Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Green Data Center Market Segmentation, By Enterprise Size

8.1 Chapter Overview

8.2 Large Enterprises

8.2.1 Large Enterprises Market Trends Analysis (2020-2032)

8.2.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Small & Medium Enterprises (SMEs)

8.3.1 Small & Medium Enterprises (SMEs) Market Trends Analysis (2020-2032)

8.3.2 Small & Medium Enterprises (SMEs) Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Green Data Center Market Segmentation, By End-use

9.1 Chapter Overview

9.2 BFSI

9.2.1 BFSI Market Trends Analysis (2020-2032)

9.2.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Retail

9.3.1 Retail Market Trends Analysis (2020-2032)

9.3.2 Retail Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 IT & Telecom

9.4.1 IT & Telecom Market Trends Analysis (2020-2032)

9.4.2 IT & Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Healthcare

9.5.1 Healthcare Market Trends Analysis (2020-2032)

9.5.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Manufacturing

9.6.1 Manufacturing Market Trends Analysis (2020-2032)

9.6.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Government & Defence

9.7.1 Government & Defence Market Trends Analysis (2020-2032)

9.7.2 Government & Defence Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Others

9.8.1 Others Market Trends Analysis (2020-2032)

9.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.4 North America Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.2.5 North America Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.6.2 USA Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.2.6.3 USA Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.7.2 Canada Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.2.7.3 Canada Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.2.8.2 Mexico Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.2.8.3 Mexico Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.6.2 Poland Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.6.3 Poland Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.7.2 Romania Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.7.3 Romania Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.4 Western Europe Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.5 Western Europe Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.6.2 Germany Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.6.3 Germany Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.7.2 France Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.7.3 France Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.8.2 UK Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.8.3 UK Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.9.2 Italy Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.9.3 Italy Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.10.2 Spain Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.10.3 Spain Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.13.2 Austria Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.13.3 Austria Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.4 Asia Pacific Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.5 Asia Pacific Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.6.2 China Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.6.3 China Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.7.2 India Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.7.3 India Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.8.2 Japan Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.8.3 Japan Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.9.2 South Korea Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.9.3 South Korea Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.10.2 Vietnam Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.10.3 Vietnam Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.11.2 Singapore Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.11.3 Singapore Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.12.2 Australia Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.12.3 Australia Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.4 Middle East Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.5 Middle East Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.6.2 UAE Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.6.3 UAE Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.4 Africa Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.2.5 Africa Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Green Data Center Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.4 Latin America Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.6.5 Latin America Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.6.2 Brazil Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.6.6.3 Brazil Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.7.2 Argentina Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.6.7.3 Argentina Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.8.2 Colombia Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.6.8.3 Colombia Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Green Data Center Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Green Data Center Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Green Data Center Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11. Company Profiles

11.1 Schneider Electric

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Vertiv Group Corp.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Eaton Corporation

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Huawei Technologies Co., Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 IBM Corporation

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Rittal GmbH & Co. KG

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Siemens AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Delta Electronics, Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Cisco Systems, Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Hewlett Packard Enterprise

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Component

Solution

Monitoring & Management System

Cooling System

Networking System

Power Systems

Others

Services

Installation & Deployment

Consulting

Support & Maintenance

By Enterprise Size

Large Enterprises

Small & Medium Enterprises (SMEs)

By End-use

BFSI

Retail

IT & Telecom

Healthcare

Manufacturing

Government & Defence

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Online Dating Application Market was valued at USD 8.51 billion in 2023 and is expected to reach USD 15.56 billion by 2032, growing at a CAGR of 7.00% from 2024-2032.

The Enterprise Network Infrastructure Market was valued at USD 62.2 Billion in 2023 and will reach USD 100.4 Billion by 2032, growing at a CAGR of 5.49% by 2032.

The Retail Cloud Market size was valued at USD 48.55 billion in 2023 and is expected to grow at USD 234.45 billion by 2032 with a growing CAGR of 19.13% over the forecast period of 2024-2032.

The Business Process Automation Market size was USD 13.80 billion in 2023 and is expected to Reach USD 38.48 billion by 2032 and grow at a CAGR of 12.10% over the forecast period of 2024-2032.

The Containerized Data Center Market size was valued at USD 11.4 billion in 2023 and is expected to reach USD 66.9 Billion by 2032, with a growing at CAGR of 21.73% Over the Forecast Period of 2024-2032.

The Graph Database Market size was valued at US$ 2.8 billion in 2023 and is expected to reach US$ 15.94 billion in 2032 with a growing CAGR of 21.32 % over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone