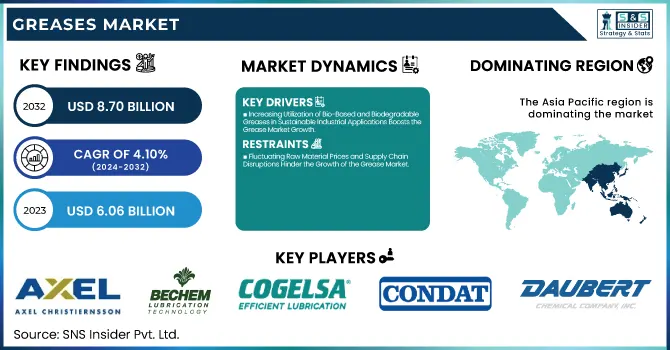

The Greases Market Size was valued at USD 6.06 Billion in 2023 and is expected to reach USD 8.70 Billion by 2032, growing at a CAGR of 4.10% over the forecast period of 2024-2032.

To Get more information on Greases Market - Request Free Sample Report

The Grease Market is undergoing a transformation fueled by evolving raw materials, regulatory shifts, and changing industry needs. Raw Material Analysis delves into the impact of base oils, thickeners, and additives on performance and costs. The balance between OEM vs. Aftermarket Demand shapes supply dynamics, while Grease Consumption per Industry highlights key sectors like automotive, construction, and metal production. Stricter REACH & EPA regulations are driving sustainable formulations, reshaping product innovation. Meanwhile, Investment Trends & Growth Hotspots uncover emerging opportunities across high-demand regions and specialized applications. Our report provides a detailed exploration of these crucial factors, offering a strategic perspective on market trends, challenges, and opportunities shaping the future of the grease industry.

Drivers

Increasing Utilization of Bio-Based and Biodegradable Greases in Sustainable Industrial Applications Boosts the Grease Market Growth

The shift towards sustainability is significantly impacting the grease market, with increasing adoption of bio-based and biodegradable greases. Regulatory bodies such as the European Chemicals Agency (ECHA) and the United States Environmental Protection Agency (EPA) are enforcing stringent policies that encourage industries to transition away from conventional petroleum-based lubricants. Bio-based greases, derived from renewable sources like vegetable oils and synthetic esters, offer several advantages, including reduced toxicity, lower environmental impact, and enhanced biodegradability. Sectors such as marine, forestry, and food processing are increasingly incorporating these greases to comply with environmental regulations while ensuring equipment efficiency. Moreover, advancements in bio-based formulations have led to improved oxidative stability, water resistance, and temperature tolerance, making them viable alternatives to traditional lubricants. Companies investing in sustainable lubrication solutions benefit from reduced carbon footprints and enhanced compliance with international regulations. As environmental concerns continue to shape industrial practices, the market for bio-based greases is projected to expand, creating new opportunities for manufacturers developing eco-friendly lubrication solutions.

Restraints

Fluctuating Raw Material Prices and Supply Chain Disruptions Hinder the Growth of the Grease Market

The grease market is heavily dependent on raw materials such as base oils, thickeners, and performance additives, which are subject to price volatility due to fluctuations in crude oil costs, geopolitical instability, and supply chain disruptions. The rising cost of synthetic and bio-based base oils, along with shortages of essential additives, creates significant challenges for grease manufacturers. Additionally, supply chain inefficiencies, trade restrictions, and environmental regulations further impact production schedules, leading to increased operational costs. The dependency on specific raw material sources makes the market vulnerable to unpredictable price shifts, forcing manufacturers to either absorb costs or pass them onto consumers. This volatility can hinder market growth, particularly for small and mid-sized players who lack the financial flexibility to manage cost fluctuations effectively. Moreover, disruptions in global trade and logistics, such as those experienced during the COVID-19 pandemic, have exposed vulnerabilities in the supply chain, making long-term pricing stability a key challenge for the grease industry.

Opportunities

Rising Adoption of High-Performance Lubricants in Wind Energy and Renewable Power Generation Drives the Grease Market Growth

The expansion of the wind energy sector and the increasing focus on renewable power generation present lucrative opportunities for high-performance greases. Wind turbines operate under extreme conditions, including high humidity, variable temperatures, and heavy mechanical loads, requiring durable lubricants to reduce friction and minimize maintenance. Synthetic and specialty greases with superior thermal stability, anti-corrosion properties, and extended service life are gaining prominence in this sector. Additionally, with governments worldwide investing in renewable energy infrastructure and offering incentives for wind farm development, the demand for efficient lubrication solutions is expected to rise. As the renewable energy industry continues to expand, grease manufacturers have a significant opportunity to develop and market specialized lubricants tailored for sustainable energy applications.

Challenge

Compatibility Issues Between New Grease Formulations and Existing Machinery Pose a Significant Challenge for the Grease Market

The introduction of advanced grease formulations, including bio-based and synthetic alternatives, often leads to compatibility issues with existing machinery and lubrication systems. Many industrial equipment and automotive components are designed to function with specific lubricant compositions, and switching to new formulations can result in operational inefficiencies, increased friction, or premature wear. Industries are often hesitant to transition to newer greases due to concerns regarding equipment performance, potential breakdowns, and additional maintenance costs. Manufacturers must conduct extensive testing and provide compatibility assurances to encourage wider adoption of next-generation greases. Addressing these compatibility concerns through standardized testing procedures and detailed product specifications is critical for overcoming this challenge.

By Thickener Type

Metallic Soap Thickener dominated the greases market in 2023 with a market share of 68.5%, with Lithium-based greases leading within this category, holding an estimated 60% share among metallic soap thickeners. Lithium-based greases are widely preferred due to their excellent water resistance, thermal stability, and compatibility with various industrial and automotive applications. According to the National Lubricating Grease Institute (NLGI), lithium-based greases are the most commonly used worldwide due to their superior performance in high-load and high-temperature conditions. The growing demand for lithium complex greases in electric vehicles, aerospace, and heavy-duty industrial machinery has further solidified their dominance. Additionally, industry reports indicate that lithium-based greases are favored by automotive manufacturers such as Ford and General Motors for use in wheel bearings, chassis components, and engine applications. However, concerns about lithium supply constraints and price volatility have led to research on alternative thickeners, but lithium-based metallic soap greases continue to dominate due to their established market presence and widespread industry preference.

By Base Oil

Mineral Oil-based greases dominated the greases market in 2023, accounting for 65% of the total market share. Despite the growing shift toward synthetic and bio-based greases, mineral oil remains the most widely used base oil due to its cost-effectiveness, easy availability, and satisfactory performance across diverse industrial applications. Organizations such as the Society of Tribologists and Lubrication Engineers (STLE) recognize mineral oil-based greases as the preferred choice for general-purpose lubrication in sectors like automotive, construction, and manufacturing. Major automotive brands, including Toyota and Volkswagen, continue to use mineral oil-based greases for chassis and bearing lubrication due to their proven performance and affordability. Additionally, many industrial applications, such as conveyor belt systems and mechanical bearings, rely on mineral-based greases because of their ability to provide effective lubrication under moderate operating conditions. While synthetic greases offer enhanced longevity and stability, their higher costs and specific application requirements have kept mineral oil-based greases as the dominant choice in the market.

By Application

The automotive industry dominated the greases market in 2023, holding a dominant 42.1% market share. The extensive use of greases in vehicle components, such as wheel bearings, chassis, gears, and electric motor systems, has contributed to this dominance. The International Energy Agency (IEA) has reported a significant increase in vehicle production, particularly in emerging economies, fueling the demand for automotive lubricants, including greases. Additionally, with the rapid expansion of the electric vehicle (EV) sector, major automakers like Tesla, BMW, and Mercedes-Benz are investing in advanced greases with enhanced thermal and electrical insulation properties to improve vehicle performance and longevity. The European Automobile Manufacturers’ Association (ACEA) has also emphasized the importance of high-quality greases in reducing friction and improving fuel efficiency in internal combustion engine (ICE) vehicles. Moreover, the shift toward electric mobility is further driving the adoption of specialized greases for battery components, drivetrains, and high-performance braking systems, reinforcing the automotive sector's leading position in the greases market.

Asia Pacific dominated the greases market in 2023, accounting for 45.3% of the total market share. The region’s leadership is driven by rapid industrialization, expanding automotive production, and robust manufacturing activities across China, India, and Japan. China, as the world's largest automotive producer, significantly influences the demand for greases, with over 27 million vehicle units manufactured in 2023, according to the China Association of Automobile Manufacturers (CAAM). The country’s extensive construction, mining, and heavy machinery sectors further contribute to the high grease consumption. India, with its fast-growing industrial base, witnessed a 9.5% growth in the manufacturing sector, as per the Ministry of Commerce and Industry, fueling demand for high-performance lubricants. Additionally, Japan, home to automotive giants such as Toyota, Honda, and Nissan, heavily relies on specialized greases for precision engineering and electric vehicle advancements. The rising demand for bio-based and synthetic greases, backed by environmental regulations from agencies like China’s Ministry of Ecology and Environment, further solidifies Asia Pacific's dominance in the global greases market.

On the other hand, North America emerged to be the fastest-growing region in the greases market, projected to expand at a significant CAGR during the forecast period. The growth is primarily driven by the increasing demand for high-performance synthetic greases in the automotive, aerospace, and industrial sectors. The United States, as the largest contributor in the region, has seen a surge in the adoption of premium greases in electric vehicles, with over 1.4 million EVs sold in 2023, as per the U.S. Department of Energy. The Biden administration’s push for sustainable lubricants, along with EPA regulations on environmental safety, is also accelerating the shift toward bio-based greases. Canada, with its expanding oil and gas industry, has a rising demand for specialized greases for drilling equipment and pipelines. Additionally, Mexico, as a leading automotive manufacturing hub, is experiencing increased usage of industrial greases, driven by the presence of global automakers like Ford, Volkswagen, and GM, further fueling the region’s growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Axel Christiernsson (Axel Longlife Grease, Axel Biodegradable Grease, Axel Calcium Sulfonate Grease)

BECHEM Lubrication Technology LLC (Berulub FR 43, Berutox VPT 64-2, Berulit GA 250)

Battenfeld-Grease & Oil Corporation of New York (Lithoplex MP2, Litholine HD2, Battenplex EP2)

Carl Bechem GmbH (Berulub KR EP 2, Beruto njx FH 28 EPK, Berulub FK 164-2)

Chemtool Incorporated (Paragon 3000, Omniguard 220, Lubricast 90)

COGELSA Efficient Lubrication (Lubgel Complex EP 2, Lubgel LT 1, Lubgel Bioceramic 2)

CONDAT Group (Condat Biogrease EP2, Condat Grease TP, Condat Extreme Pressure Grease)

Daubert Chemical Company (Tectyl 891D, Tectyl 846, Nox-Rust 5400)

D-A Lubricant Company (D-A Reliant, D-A Syn-Xtreme HD2, D-A Lubricast 50)

Eastern Oil Company (EOC Moly Grease, EOC Lithium Complex Grease, EOC Synthetic Grease)

FUCHS Petrolub SE (Renolit CX-EP 2, Renolit Duraplex EP, Renolit Extreme)

Interflon (Interflon Grease MP2, Interflon Grease OG, Interflon Grease LS2)

JAX Incorporated (JAX Poly-Guard FG2, JAX Magna-Plate 8, JAX Halo-Guard FG2)

Klüber Lubrication (Klüberplex BEM 41-141, Klüberlub BE 41-1501, Klübersynth BHP 72-102)

Lubriplate Lubricants Company (Lubriplate 630-2, Lubriplate SFL-1, Lubriplate Low Temp Grease)

NYCO (Nyco Grease GN 148, Nyco Grease GN 3058, Nyco Grease GN 25013)

Orlen Oil Ltd (Orlen Greasen Complex EP, Orlen Litol 24, Orlen Graphite Grease)

Primrose Oil Company, Inc. (Primrose 357 Moly EP, Primrose 405 Amber, Primrose Syn-O-Gel 680)

RichardsApex, Inc. (RichardsApex Draw Grease 705, RichardsApex Copper Grease 90, RichardsApex Forge Grease)

Royal High-Performance Oil & Greases (Royal Ultra 865 EP, Royal Ultra 8800, Royal Purple Ultra-Performance)

Recent Developments

September 2024: Maxol Lubricants launched the Maxol Agri-Max Plus Grease range for agriculture, marine, and forestry applications. The company also introduced sustainable packaging. Key products include Maxol Agri-Max-Plus Calcium Grease and Agri-Max-Plus EFS Grease, catering to the agricultural and food processing sectors. (mobilityplaza.org)

March 2024: Shell Indonesia announced its first grease manufacturing plant in Bekasi, integrated with its Marunda Lubricants Oil Blending Plant. The facility will produce 12 kilotonnes of grease annually using advanced technology to meet Indonesia’s growing demand.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 6.06 Billion |

| Market Size by 2032 | USD 8.70 Billion |

| CAGR | CAGR of 4.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Thickener Type (Metallic Soap Thickener, Non-soap Thickener [Inorganic, Polyurea, Clay-based]) •By Base Oil (Mineral Oil, Synthetic Oil, Bio-based Oil) •By End-use Industry (Automotive, Construction, Mining, General Manufacturing, Metal Production, Power Generation, Agriculture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | FUCHS Petrolub SE, Klüber Lubrication, Axel Christiernsson, Carl Bechem GmbH, Chemtool Incorporated, CONDAT Group, NYCO, BECHEM Lubrication Technology LLC, Lubriplate Lubricants Company, COGELSA Efficient Lubrication and other key players |

Ans: The Greases Market was valued at USD 6.06 Billion in 2023.

Ans: The Greases Market is projected to reach USD 8.70 Billion by 2032, growing at a CAGR of 4.10%.

Ans: The increasing use of Greases in oil spill remediation is boosting the Greases Market.

Ans: The rising demand for Greases in sustainable nanotechnology applications is expanding the Greases Market.

Ans: North America is the fastest-growing region in the Greases Market due to rising demand for eco-friendly products.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Raw Material Analysis

5.2 OEM vs. Aftermarket Demand Analysis

5.3 Grease Consumption per Industry

5.4 Impact of chemical regulations on grease formulations (REACH & EPA)

5.5 Investment Trends & Growth Hotspots

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Greases Market Segmentation, by Thickener Type

7.1 Chapter Overview

7.2 Metallic Soap Thickener

7.2.1 Metallic Soap Thickener Market Trends Analysis (2020-2032)

7.2.2 Metallic Soap Thickener Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Non-soap Thickener

7.3.1 Non-soap Thickener Market Trends Analysis (2020-2032)

7.3.2 Non-soap Thickener Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Inorganic

7.3.3.1 Inorganic Market Trends Analysis (2020-2032)

7.3.3.2 Inorganic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Polyurea

7.3.4.1 Polyurea Market Trends Analysis (2020-2032)

7.3.4.2 Polyurea Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Clay-based

7.3.5.1 Clay-based Market Trends Analysis (2020-2032)

7.3.5.2 Clay-based Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Greases Market Segmentation, by Base Oil

8.1 Chapter Overview

8.2 Mineral Oil

8.2.1 Mineral Oil Market Trends Analysis (2020-2032)

8.2.2 Mineral Oil Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Synthetic Oil

8.3.1 Synthetic Oil Market Trends Analysis (2020-2032)

8.3.2 Synthetic Oil Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Bio-based Oil

8.4.1 Bio-based Oil Market Trends Analysis (2020-2032)

8.4.2 Bio-based Oil Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Greases Market Segmentation, by End-use Industry

9.1 Chapter Overview

9.2 Automotive

9.2.1 Automotive Market Trends Analysis (2020-2032)

9.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Construction

9.3.1 Construction Market Trends Analysis (2020-2032)

9.3.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Mining

9.4.1 Mining Market Trends Analysis (2020-2032)

9.4.2 Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 General Manufacturing

9.5.1 General Manufacturing Market Trends Analysis (2020-2032)

9.5.2 General Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Metal Production

9.6.1 Metal Production Market Trends Analysis (2020-2032)

9.6.2 Metal Production Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Power Generation

9.7.1 Power Generation Market Trends Analysis (2020-2032)

9.7.2 Power Generation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 Agriculture

9.8.1 Agriculture Market Trends Analysis (2020-2032)

9.8.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Others

9.9.1 Others Market Trends Analysis (2020-2032)

9.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.2.4 North America Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.2.5 North America Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.2.6.2 USA Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.2.6.3 USA Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.2.7.2 Canada Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.2.7.3 Canada Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.2.8.3 Mexico Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.6.3 Poland Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.7.3 Romania Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.5 Western Europe Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.6.3 Germany Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.7.2 France Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.7.3 France Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.8.3 UK Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.9.3 Italy Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.10.3 Spain Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.13.3 Austria Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.5 Asia Pacific Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.6.2 China Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.6.3 China Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.7.2 India Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.7.3 India Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.8.2 Japan Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.8.3 Japan Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.9.3 South Korea Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.10.3 Vietnam Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.11.3 Singapore Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.12.2 Australia Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.12.3 Australia Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.5 Middle East Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.6.3 UAE Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.2.4 Africa Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.2.5 Africa Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Greases Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.6.4 Latin America Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.6.5 Latin America Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.6.6.3 Brazil Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.6.7.3 Argentina Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.6.8.3 Colombia Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Greases Market Estimates and Forecasts, by Thickener Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Greases Market Estimates and Forecasts, by Base Oil (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Greases Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

11. Company Profiles

11.1 FUCHS Petrolub SE

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Klüber Lubrication

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Axel Christiernsson

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Carl Bechem GmbH

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Chemtool Incorporated

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 CONDAT Group

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 NYCO

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 BECHEM Lubrication Technology LLC

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Lubriplate Lubricants Company

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 COGELSA Efficient Lubrication

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Thickener Type

Metallic Soap Thickener

Non-soap Thickener

Inorganic

Polyurea

Clay-based

By Base Oil

Mineral Oil

Synthetic Oil

Bio-based Oil

By End-use Industry

Automotive

Construction

Mining

General Manufacturing

Metal Production

Power Generation

Agriculture

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Aerogel Insulation Market was valued at USD 897.28 million in 2023 and is expected to reach USD 5082.32 million by 2032, at a CAGR of 21.26% from 2024-2032.

Nitrogenous Fertilizer Market size was USD 63.55 Billion in 2023 and is expected to reach USD 105.36 Billion by 2032, growing at a CAGR of 5.78% from 2024-2032.

The Lignin Market Size was valued at USD 1.10 billion in 2023, and is expected to reach USD 1.60 billion by 2032, and grow at a CAGR of 4.3% over the forecast period 2024-2032.

The Polyurea Coatings Market Size was valued at USD 1.6 billion in 2023, and is expected to reach USD 4.7 billion by 2032, and grow at a CAGR of 12.5% over the forecast period 2024-2032.

The Color Cosmetics Market Size was valued at USD 76.8 billion in 2023, and is expected to reach USD 128.7 billion by 2032, and grow at a CAGR of 5.9% over the forecast period 2024-2032.

The Polyimide Films and Tapes Market size was valued at USD 1.9 Billion in 2023. It is expected to grow to USD 3.6 Billion by 2032 and grow at a CAGR of 8.2% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone