Gold Mining Market Report Scope & Overview:

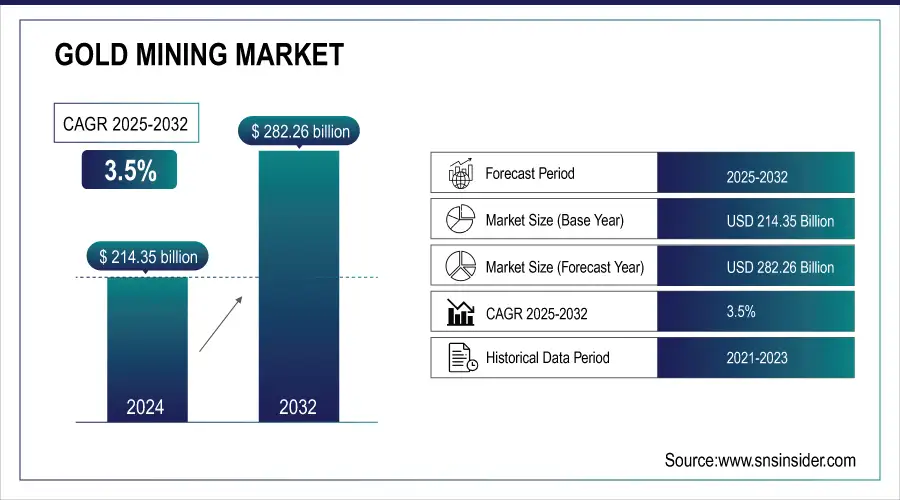

The Gold Mining Market size was valued at USD 214.35 billion in 2024 and is expected to reach USD 282.26 billion by 2032, growing at a CAGR of 3.5% over the forecast period 2025-2032.

To Get more information on Gold Mining Market - Request Free Sample Report

The gold mining market is evolving rapidly, driven by global demand, technological advancements, and geopolitical factors. In January 2025, Polyus Gold International Ltd. reported a discovery of $75 billion in gold reserves in China’s remote mountains, potentially reshaping global supply and enhancing China’s market influence. Meanwhile, illegal gold mining in Africa surged, causing over 100 fatalities and highlighting regulatory and sustainability challenges for companies like Barrick Gold. Firms are adapting strategies, exemplified by Newmont Mining’s exploration of the world’s deepest gold mine, reaching 25 miles underground. Leading gold-producing nations are expanding capabilities, reflecting a competitive and complex industry balancing economic growth, technological innovation, and responsible mining practices.

Key Gold Mining Market Trends

-

Increasing automation in mining operations is improving efficiency and reducing reliance on manual labor.

-

Expansion of underground mining techniques is enabling access to deeper, previously untapped gold deposits.

-

Integration of AI and data analytics is optimizing exploration, extraction, and resource management.

-

Rising use of satellite imagery and geospatial technology is enhancing precision in site selection.

-

Strategic mergers and acquisitions are consolidating resources and increasing market competitiveness.

-

Growth in artisanal and small-scale gold mining is influencing local economies and supply dynamics.

-

Adoption of blockchain for gold traceability is improving transparency and supply chain integrity.

-

Development of hybrid mining equipment combining electric and traditional machinery is reducing carbon emissions.

Gold Mining Market Growth Drivers

-

Growing Investment in Advanced Exploration Technologies Fuels the Expansion of Gold Mining Market Opportunities Worldwide

-

Increasing Demand for Gold in Jewelry and Investment Markets Boosts the Overall Growth of Gold Mining Industry

-

Expanding Gold Mining Activities in Emerging Markets Contributes to the Global Growth of the Gold Mining Industry

The growth of gold mining in emerging markets like Brazil, Indonesia, and Russia is driving global industry expansion. Rising exploration and mining activities, supported by government incentives such as tax breaks, favorable regulations, and infrastructure development, are attracting both local and international investments. Untapped gold reserves and increasing demand across jewelry, electronics, and technology sectors are boosting production and new mining projects. Political stability and improved regulations further enhance investor confidence, promoting global diversification in gold supply. These factors collectively position emerging markets as key contributors to the gold mining industry’s growth in the coming years.

Gold Mining Market Growth Restraints

-

Environmental regulations and sustainability concerns slow down growth in the gold mining market globally

Environmental regulations and sustainability concerns present significant challenges to the gold mining market. Stricter laws on water usage, waste management, and hazardous chemicals increase operational costs and complexities. Mining companies are required to adopt sustainable practices, such as water recycling and using less harmful chemicals, which slow project timelines and raise costs. Additionally, growing scrutiny from environmental groups, especially in sensitive regions like the Amazon, pressures companies to minimize ecological damage. These efforts, while vital for long-term sustainability, create short-term barriers, delaying growth and requiring additional investments in sustainable technologies.

Gold Mining Market Growth Opportunities

-

Increased Gold Exploration in Untapped Regions of Africa and Asia Presents Lucrative Market Potential for Gold Miners

-

Growing Adoption of Green Mining Technologies Opens New Growth Avenues for the Gold Mining Sector

The adoption of green mining technologies offers gold mining companies opportunities to improve sustainability and meet rising demand for eco-friendly practices. Methods like bioleaching and renewable energy-powered operations reduce environmental impact while lowering operational costs. These innovations enhance regulatory compliance and public perception, helping companies gain consumer trust. As industries face increasing pressure to adopt cleaner practices, gold miners integrating green technologies position themselves competitively. Embracing sustainable solutions not only mitigates ecological risks but also strengthens market credibility. Companies leading in eco-conscious mining are likely to benefit from operational efficiency, regulatory advantages, and a stronger reputation in the evolving global market.

Gold Mining Market Growth Challenges

-

Rising Costs of Gold Extraction in Remote Locations Increases Operational Challenges for Mining Companies

The rising costs of gold extraction in remote locations pose significant challenges for mining companies. Many major gold reserves are situated in hard-to-reach areas, requiring heavy investment in infrastructure, technology, and skilled labor. Transportation of equipment and materials to these regions adds further costs, while limited access to resources like water and power complicates operations. Fluctuating gold prices also affect profitability in these areas. As a result, companies must carefully assess the financial viability of projects, balancing long-term potential with the high upfront costs of remote operations.

Safety and Health Trends in the Gold Mining Industry

| Safety/Health Metric | Data/Statistic | Description |

|---|---|---|

|

Fatalities in Gold Mining |

100+ fatalities annually (Global Average) |

Represents the number of fatalities occurring annually across the global gold mining sector due to accidents or hazardous conditions. |

|

Occupational Health Illnesses |

20% of miners report work-related health issues |

Percentage of miners who report suffering from respiratory diseases, musculoskeletal disorders, or other work-related health problems. |

|

Workplace Injury Rate |

1.5 injuries per 1,000 employees |

The frequency of non-fatal injuries per 1,000 employees in the gold mining industry, shows the safety risk. |

|

Fatality Reduction Rate |

10% reduction over 5 years |

Percentage decrease in fatalities within the gold mining industry over the last five years, due to enhanced safety measures. |

|

Mining Safety Initiatives |

25% increase in automation use |

The rise in automation technologies, such as drones and automated equipment, to reduce human exposure to hazardous mining environments. |

Gold mining, while essential for the global economy, poses significant safety and health risks to workers. Fatalities in the industry remain a pressing concern, with over 100 deaths annually on average across the globe due to accidents or hazardous work conditions. Occupational health issues, such as respiratory illnesses and musculoskeletal disorders, are also prevalent, with 20% of miners reporting health issues related to their work. The injury rate in the gold mining industry is another indicator of safety concerns, with 1.5 injuries occurring per 1,000 employees. However, significant efforts to improve safety have led to a reduction in fatalities, with a 10% decrease over the last five years. Furthermore, automation technologies have played a key role in enhancing worker safety by reducing human exposure to dangerous mining environments, with automation usage increasing by 25%. These efforts reflect a growing emphasis on improving both the health and safety of workers in the gold mining industry.

Gold Mining Market Segment Highlights

-

By Mining Type

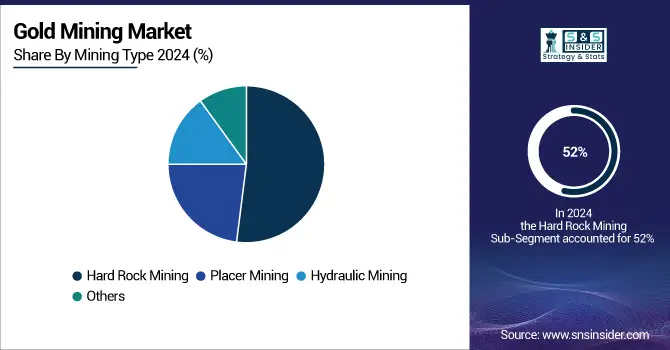

In 2024, Hard Rock Mining dominated the Gold Mining Market, with an estimated market share of 52%. Within this hard rock mining, Open-pit Gold Mining leads the subsegment, contributing around 30% of the market share. Open-pit mining involves large-scale excavation of surface ore deposits, offering a cost-effective method for extracting gold from accessible areas. This method is preferred due to its efficiency, lower operational costs, and the ability to access substantial gold reserves with relatively less risk compared to underground mining. For instance, Barrick Gold operates the Cortez Gold Mine in Nevada, a prominent open-pit gold mine that contributes significantly to its production. The success of open-pit mining has been facilitated by advanced technologies like high-capacity excavators and haul trucks, which enable faster and more efficient extraction. The use of these machines has optimized productivity and further solidified open-pit mining's dominance in gold production, especially in large, open mineral deposits.

-

By Mining Equipment

In 2024, Excavators dominated the Gold Mining Market with a market share of 35%. Excavators are vital in both placer and hard rock gold mining, helping to move large volumes of overburden and ore. The demand for excavators is driven by their ability to efficiently handle tough mining conditions, which is crucial for both surface mining and underground operations. Companies such as Caterpillar and Komatsu provide high-performance excavators that are instrumental in large-scale gold extraction projects. For instance, in open-pit gold mining, excavators are used extensively to extract gold-bearing ore and waste material, significantly increasing the efficiency of mining operations. Their widespread use in extracting both soft and hard rock materials further emphasizes their dominance in the market. Excavators also provide enhanced operational flexibility, enabling miners to adjust to various environmental challenges, making them indispensable in modern mining equipment fleets.

-

By End-use

The Investment segment dominated the gold mining market and accounted for the largest share of the Gold Mining Market in 2024, accounting for approximately 60% of the total market. This dominance is largely driven by the ongoing demand for gold as a safe-haven asset, particularly during times of economic instability. Investors worldwide prefer gold as a hedge against inflation and market volatility. The rise of gold-backed exchange-traded funds (ETFs), such as SPDR Gold Shares, has made it easier for investors to gain exposure to gold without owning physical metal. The popularity of these investment vehicles surged, with central banks and institutional investors increasing their gold reserves. Moreover, individual investors continue to view gold as a secure, long-term investment, especially during geopolitical tensions or financial market uncertainties. This trend of accumulating physical gold, including bars and coins, continues to support the dominance of the investment segment in the gold mining market.

Gold Mining Market Regional Analysis

Asia Pacific Gold Mining Market Insights

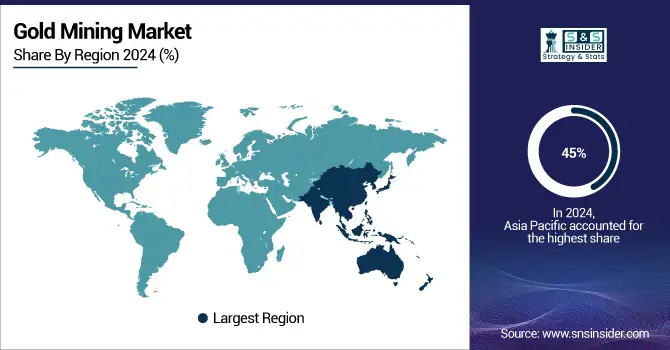

In 2024, the Asia Pacific region dominated the Gold Mining Market, accounting for approximately 45% of the total market share. This dominance can be attributed to several factors, including the region's rich natural resources, significant investments in mining infrastructure, and a growing demand for gold in various sectors. Countries such as China and Australia are leading players in this market. China remains the largest gold producer globally, contributing around 10% of the world's total gold supply in 2023. The country has made substantial investments in advanced mining technologies and expanded its mining operations, particularly in regions like Inner Mongolia and Xinjiang, where large gold deposits are located. Meanwhile, Australia, with its vast mineral wealth, is home to several prominent gold mining companies, including Newcrest Mining and Northern Star Resources. In 2023, Australia produced over 300 tons of gold, making it one of the top three gold-producing countries globally. The region also benefits from favorable government policies that encourage foreign investment and enhance mining operations, contributing to its dominance in the global gold mining sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

Africa Gold Mining Market Insights

In 2024, Africa emerged as the fastest-growing region in the Gold Mining Market, with a CAGR of 6.5%. This growth is driven by the increasing exploration and production activities across the continent, particularly in countries like Ghana, South Africa, and Mali. Ghana, often referred to as the "Gold Coast," has been attracting significant foreign investment due to its rich gold reserves and favorable regulatory framework. The country produced approximately 130 tons of gold in 2023, making it the largest gold producer in Africa and ranking among the top ten globally. South Africa, despite facing challenges such as aging mines and rising operational costs, continues to be a significant player, producing around 100 tons of gold in 2023, primarily from its vast underground mining operations. Meanwhile, Mali has seen a surge in new gold projects, including the Fekola mine, which has rapidly increased production since its opening. The growing interest from international mining companies in African gold resources, coupled with the continent's untapped potential, positions Africa as a key player in the future of the global gold mining market.

Competitive Landscape for Gold Mining Market

Agnico Eagle Mines Ltd is a Canadian-based gold mining company founded in 1953 and headquartered in Toronto. The company specializes in exploration, development, and production of precious metals, including gold, silver, and copper. Agnico Eagle operates multiple mines across Canada, Finland, and Mexico, focusing on sustainable and efficient mining practices. Its business segments include underground and open-pit mining, processing, and reclamation, with offerings spanning gold extraction, refining, and related services. The company emphasizes technological adoption to optimize yield and maintain compliance with environmental and safety regulations.

-

In February 2025, Agnico Eagle expanded its gold processing capacity at the La India mine in Mexico to increase annual output by 10%. In April 2024, it launched a digital transformation program using AI to optimize mining operations.

Kinross Gold Corporation was founded in 1993 and is headquartered in Toronto, Canada. Kinross operates gold mines and facilities across the Americas, West Africa, and Russia. Its offerings include exploration, extraction, processing, and refining of gold, with integrated services spanning project development, environmental management, and technological adoption. The company focuses on sustainable mining, operational efficiency, and safety standards, delivering high-quality gold products to global markets. Kinross continues to expand its portfolio through acquisitions and innovative mining technologies.

-

In March 2025, Kinross commissioned a high-efficiency leaching facility at its Tasiast mine in Mauritania to improve gold recovery. In November 2024, it acquired additional mineral rights in Chile, expanding exploration potential in South America.

Newmont Mining Corporation was founded in 1921 and is headquartered in Denver, Colorado, USA. Newmont is a leading gold producer with operations in North and South America, Africa, and Australia. The company provides gold and copper mining, processing, and exploration services, focusing on sustainable and responsible mining practices. Its offerings include open-pit and underground mining, ore processing, and environmental management, alongside community development initiatives. Newmont emphasizes innovation and technology to enhance efficiency and reduce environmental impact while maintaining global market leadership.

-

In January 2025, Newmont launched a solar-powered energy project at its Boddington mine in Australia to reduce carbon emissions. In September 2024, it expanded gold reserves in Peru by acquiring additional mining claims.

Polyus Gold International Ltd is Russia’s largest gold producer, founded in 2006 and headquartered in Moscow. The company engages in gold exploration, extraction, and processing, with major operations in Siberia and the Russian Far East. Polyus focuses on high-quality gold production for global markets, offering services across open-pit and underground mining, ore processing, and environmental management. It emphasizes operational efficiency, sustainable practices, and technological innovations to enhance recovery rates and maintain compliance with environmental and safety standards.

-

In February 2025, Polyus began operations at the Sukhoi Log project, one of the world’s largest gold deposits. In July 2024, it implemented advanced ore-sorting technology at the Olimpiada mine, increasing extraction efficiency.

Barrick Gold Corporation was founded in 1983 and is headquartered in Toronto, Canada. Barrick is a global leader in gold and copper mining, offering exploration, production, and project development services. The company operates mines in North America, Africa, and South America, providing integrated services including open-pit and underground mining, ore processing, and environmental management. Barrick emphasizes sustainable mining practices, technological innovation, and regulatory compliance to maintain operational efficiency and market leadership, while delivering high-quality gold and copper products worldwide.

-

In March 2025, Barrick launched a new tailings management system at its Pueblo Viejo mine in the Dominican Republic to enhance safety and sustainability. In August 2024, it entered a joint venture in Tanzania to expand gold exploration.

Gold Mining Market Key Players

-

Agnico Eagle Mines Ltd

-

AngloGold Ashanti Ltd

-

Coeur Mining

-

Freeport-McMoRan

-

Golden Star Resources

-

Gold Fields Ltd

-

Gold Reserve

-

Goldcorp Inc.

-

Global Gold Mining Market

-

Homestake Mining Company

-

Newcrest Mining Ltd

-

Newmont Mining Corporation

-

NovaGold Resources

-

North Bloomfield Mining and Gravel Company

-

Polyus Gold International Ltd

-

Royal Gold

-

Sibanye

-

South Deep Gold Mine

| Report Attributes | Details |

|---|---|

|

Market Size in 2024 |

USD 214.35 Billion |

|

Market Size by 2032 |

USD 282.26 Billion |

|

CAGR |

CAGR of 3.50% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Mining Type (Placer Mining, Hard Rock Mining [Underground Gold, Open-pit Gold], Hydraulic Mining, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Barrick Gold Corporation, Newmont Mining Corporation, AngloGold Ashanti Ltd, Goldcorp Inc., Kinross Gold Corporation, Newcrest Mining Ltd, Gold Fields Ltd, Polyus Gold International Ltd, Agnico Eagle Mines Ltd, Coeur Mining and other key players |