Glycerol Derivatives Market Report Scope & Overview:

Get More Information on Glycerol Derivatives Market - Request Sample Report

The Glycerol Derivatives Market Size was valued at USD 16.0 Billion in 2023 and is expected to reach USD 28.4 Billion by 2032 and grow at a CAGR of 6.6% over the forecast period 2024-2032.

The glycerol derivatives market is experiencing notable growth due to increasing demand for eco-friendly chemicals, sustainable production processes, and the versatile applications of glycerol-based derivatives in various industries such as pharmaceuticals, cosmetics, food and beverages, and biodiesel production. A key dynamic in this market is the growing focus on green chemistry and sustainability, pushing manufacturers to innovate with renewable raw materials, including bio-based glycerol, to produce derivatives like esters, fatty acids, and ethers. This shift is particularly relevant as the demand for biodegradable and non-toxic chemicals continues to rise, aligning with global efforts toward environmental sustainability. For instance, companies are increasingly investing in the development of bio-based glycerol derivatives that offer superior performance while reducing carbon footprints. One example is the technological advancement of producing green glycerol derivatives, like those achieved in the Delfzijl facility in the Netherlands. This facility, operational since early 2024, has begun using renewable glycerol to produce derivatives that significantly lower environmental impact, a move that reflects broader trends toward sustainability in the chemical industry.

In recent developments, industry players are focusing on improving production methods and expanding their product offerings to meet consumer preferences for environmentally friendly options. One notable example is from January 2024, when a company announced its breakthrough in manufacturing glycerol derivatives using green and renewable glycerol at its European facilities. This innovation contributes to both the reduction of waste and the enhanced efficiency of chemical processes. Additionally, several companies are exploring new applications of glycerol derivatives, such as using them in personal care and cosmetic formulations, where they are valued for their moisturizing and anti-aging properties. Such applications are expanding as consumers increasingly demand natural and safe alternatives. Another significant advancement took place in March 2024, when a company unveiled a new line of glycerol-based products designed for the food industry, emphasizing the safety and sustainability of these ingredients in food packaging. These developments show that the glycerol derivatives market is adapting to the evolving demand for environmentally responsible, safe, and efficient solutions across different industries.

Glycerol Derivatives Market Dynamics:

Drivers:

-

Rising Consumer Preference for Biodegradable and Non-Toxic Products Enhances Demand for Glycerol Derivatives

-

Technological Advancements in Production Methods Fuel the Growth of the Glycerol Derivatives Market

-

Increasing Demand for Green Chemicals in Personal Care and Cosmetic Products Drives Market Growth

-

Growth of Biodiesel Production Drives Demand for Glycerol Derivatives as By-products

The expanding production of biodiesel, driven by the global push for renewable energy sources, is creating a steady demand for glycerol derivatives. Glycerol is a by-product of biodiesel production, and as the biodiesel industry grows, so does the availability of glycerol for conversion into value-added derivatives. These derivatives, such as glycerol esters and fatty acids, are utilized in a range of industrial applications, from lubricants and surfactants to cosmetics and personal care products. As governments and corporations increase investments in biodiesel as a cleaner alternative to traditional fuels, the glycerol derivatives market benefits from the rising availability and supply of glycerol. The growing biofuel market is, therefore, a significant factor driving the demand for glycerol derivatives, offering an abundant and sustainable feedstock for manufacturers in various industries.

Restraint:

-

Fluctuating Glycerol Prices and Raw Material Supply Risks Impact Glycerol Derivatives Production Costs

The production of glycerol derivatives is highly dependent on the availability and price of glycerol, which can fluctuate based on global supply and demand factors. Glycerol is often derived from the production of biodiesel, and as such, its price can be impacted by the volatility of the biodiesel industry, which is influenced by the price of crude oil, governmental subsidies, and policy changes. When biodiesel production faces disruptions or pricing volatility, glycerol prices may increase, raising production costs for glycerol derivatives. Additionally, raw material shortages or supply chain disruptions, such as those caused by geopolitical issues or natural disasters, can further compound this challenge. These pricing fluctuations and supply chain risks can limit the profitability of glycerol derivative manufacturers, particularly those that rely heavily on glycerol as a raw material.

Opportunity:

-

Growth in Demand for Green and Bio-Based Chemicals Creates New Opportunities for Glycerol Derivatives

-

Expanding Applications of Glycerol Derivatives in Industrial and Pharmaceutical Sectors Offer Growth Potential

-

Rising Consumer Awareness of Sustainable Products Fuels Market Demand for Glycerol Derivatives

The increasing consumer awareness of the environmental impact of products is creating a strong demand for sustainable and responsibly sourced ingredients. This awareness has prompted companies to replace traditional chemical ingredients with more sustainable alternatives like glycerol derivatives. As consumers demand cleaner, safer, and greener options, the glycerol derivatives market stands to benefit from this shift in preference. With growing awareness about the environmental benefits of glycerol derivatives, such as their biodegradability and minimal toxicity, the market is expected to experience accelerated demand, particularly in the food, cosmetic, and pharmaceutical industries.

Challenge:

-

High Cost of Green Manufacturing Processes and Raw Materials Hinders Glycerol Derivatives Market Growth

While the demand for bio-based and green glycerol derivatives is increasing, one of the major challenges hindering market growth is the high cost of sustainable production methods and raw materials. Manufacturing glycerol derivatives from renewable glycerol sources often requires more advanced, energy-intensive processes, which can drive up production costs compared to traditional petrochemical-based alternatives. Moreover, raw materials derived from renewable sources, while environmentally friendly, can sometimes be more expensive than those derived from fossil fuels. This price gap can limit the adoption of glycerol derivatives in certain industries, especially in price-sensitive markets, and slow the growth of the overall market.

Glycerol Derivatives Market Segmentation

By Grade

In 2023, the bio-based segment dominated the glycerol derivatives market, holding a market share of around 65%. This dominance is largely attributed to the growing demand for sustainable, renewable, and eco-friendly products across various industries. Bio-based glycerol derivatives are derived from renewable sources such as vegetable oils and animal fats, aligning with the global shift toward green chemistry and reducing reliance on fossil fuels. The increasing preference for natural and biodegradable ingredients in sectors like personal care, food, and pharmaceuticals has further fueled the growth of bio-based glycerol derivatives. For instance, products like glycerol esters used in cosmetics and food formulations emphasize natural, non-toxic ingredients, driving the demand for bio-based alternatives.

By Product Type

Polyglycerol dominated the glycerol derivatives market by product type in 2023, with a market share of about 30%. Polyglycerol is widely used in applications such as emulsifiers, surfactants, and stabilizers in industries like food, cosmetics, and pharmaceuticals. Its non-toxic, biodegradable, and skin-friendly properties make it particularly popular in the growing demand for sustainable and green chemicals in personal care products and food additives. The versatility and effectiveness of polyglycerol in improving the texture and shelf life of products further solidify its dominant position in the market.

By End Use Industry

In 2023, the food and beverages segment dominated and accounted for the largest share of the glycerol derivatives market, with a market share of around 40%. Glycerol derivatives are commonly used in the food industry as emulsifiers, stabilizers, and sweeteners, particularly in low-calorie, sugar-free, and organic products. Their role in enhancing the texture, shelf-life, and flavor of various food products drives their demand. With increasing consumer preferences for clean-label, natural, and sustainable food options, the food and beverages sector continues to be a key growth area for glycerol derivatives, highlighting the importance of these ingredients in modern food formulations.

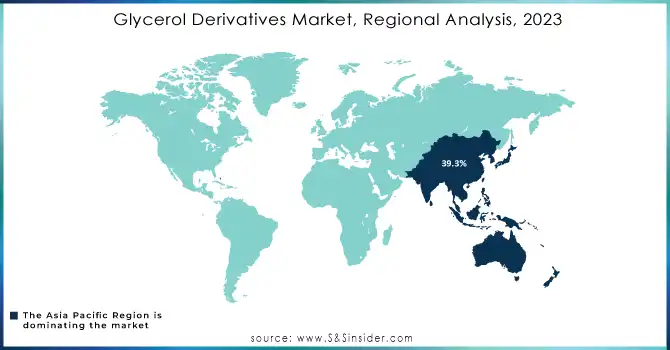

Glycerol Derivatives Market Regional Analysis

In 2023, the Asia Pacific region dominated the glycerol derivatives market, securing the largest revenue share of approximately 39.3%. This dominance was driven by the rapid growth of bio-based products and glycerol derivatives, particularly in key countries like China and India, which are major producers and consumers of biodiesel. The high demand for glycerol derivatives in biodiesel production, alongside significant consumption across industries such as personal care, pharmaceuticals, food & beverages, and chemical manufacturing, further reinforced the region’s position. China, for example, with its vast food processing industry, which boasts over 35,000 facilities, has become a critical driver of market growth, particularly with the rising consumer preference for natural ingredients in both food and cosmetics. This trend is also evident in India, where increasing demand for sustainable and bio-based products is expanding the market opportunities for glycerol derivatives. Meanwhile, the fastest-growing region in 2023 was also Asia Pacific, with a significant CAGR of 7.4%. The region’s pharmaceutical sector is expanding rapidly, driven by the rising prevalence of chronic diseases and the development of healthcare infrastructure. As the middle class continues to grow in countries like India and China, the demand for bio-based pharmaceuticals and other glycerol derivative applications is expected to surge. This trend reflects the region’s potential to not only maintain its dominance but also significantly outpace other regions in the glycerol derivatives market, fueled by a combination of increasing industrial demand and a shift toward sustainable solutions

Need Any Customization Research On Glycerol Derivatives Market - Inquiry Now

Recent Developments

October 2024: Japanese researchers developed a catalyst that converts glycerol derivatives into bio-based propylene, offering a sustainable alternative to fossil fuel-derived propylene. This breakthrough could help reduce dependence on petroleum and advance greener practices in the chemical and biofuel industries.

September 2024: Researchers introduced an efficient method for producing glycerol derivatives, improving production efficiency and reducing costs. This innovation is expected to benefit industries like personal care and pharmaceuticals by providing more sustainable and cost-effective glycerol-based products.

Key Players in Glycerol Derivatives Market

-

Archer Daniels Midland Company (ADM) (Glycerol Esters, Epichlorohydrin)

-

BASF SE (Epichlorohydrin, Glycerol Esters)

-

Cargill, Inc. (Glycerol Esters, Fatty Alcohols)

-

Cognis (Now part of BASF) (Glycerol Esters, Fatty Alcohols)

-

Croda International (Glycerol Esters, Glycerol Monolaurate)

-

DOW Chemical Company (Epichlorohydrin, Glycerol-based Polymers)

-

Dupont (Acrolein, Epichlorohydrin)

-

Emery Oleochemicals (Fatty Alcohols, Glycerol Esters)

-

Evonik Industries (Glycol Ethers, Glycerol Esters)

-

Henkel AG & Co. KGaA (Fatty Alcohols, Glycerol-based Polymers)

-

Kraton Polymers (Glycerol-based Polymers, Fatty Alcohols)

-

LG Chem (Epichlorohydrin, Acrolein)

-

Mitsubishi Chemical Corporation (Epichlorohydrin, Acrolein)

-

Oleon (A subsidiary of AVEBE) (Glycerol Esters, Fatty Alcohols)

-

P&G Chemicals (Fatty Alcohols, Glycerol Esters)

-

Rhodia (Now part of Solvay) (Epichlorohydrin, Glycerol Esters)

-

Solvay SA (Epichlorohydrin, Glycerol-based Polymers)

-

Symrise AG (Glycerol Esters, Glycerol Monolaurate)

-

Tate & Lyle PLC (Glycerol Esters, Fatty Alcohols)

-

Wilmar International Ltd. (Glycerol Esters, Fatty Alcohols)

Chemical Manufacturers

-

BASF

-

Dow Chemical

-

Cargill

-

ExxonMobil

-

LyondellBasell

Bio-based Product Producers

-

Solvay

-

AdvanSix

-

Dupont

-

DSM

-

Arkema

Biodiesel Producers

-

Neste

-

Green Plains

-

Renewable Energy Group

-

Valero Energy

-

Pacific Biodiesel

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.0 Billion |

| Market Size by 2032 | US$ 28.4 Billion |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Grade (Bio-based, Petroleum-based) • By Product Type (4-(hydroxymethyl)-1 3-dioxolan-2-one, Polyglycerol, Propylene Glycol, 1,3-propanediol, Propane-1,2,3-triyl triacetate, Others) • By End-Use Industry (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Agriculture, Chemical Manufacturing, Energy and Biofuels, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cargill, Inc., BASF SE, Dupont, Kraton Polymers, Oleon (A subsidiary of AVEBE), The Dow Chemical Company, LG Chem, Emery Oleochemicals, Solvay SA, Wilmar International Ltd. and other key players |

| Key Drivers | • Increasing Demand for Green Chemicals in Personal Care and Cosmetic Products Drives Market Growth • Increasing Application of Glycerol Derivatives in the Food and Beverage Industry Boosts Market Expansion |

| RESTRAINTS | • Fluctuating Glycerol Prices and Raw Material Supply Risks Impact Glycerol Derivatives Production Costs |