Get E-PDF Sample Report on Glutaraldehyde Market - Request Sample Report

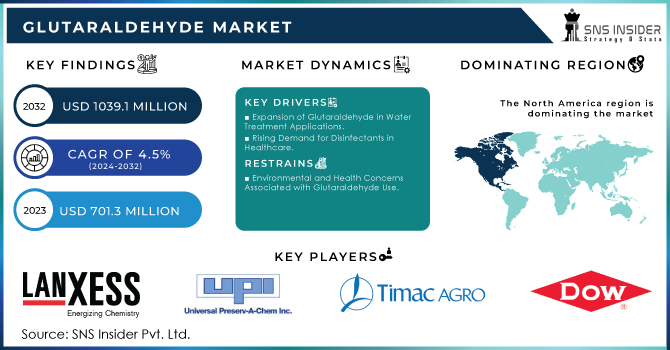

The Glutaraldehyde Market Size was valued at USD 701.3 million in 2023, and is expected to reach USD 1039.1 million by 2032, and grow at a CAGR of 4.5% over the forecast period 2024-2032.

Glutaraldehyde has recently been in high demand due to some of the versatile properties that it exhibits, including being a strong biocide and disinfectant. Major usage areas include healthcare facilities, water treatment, and many other industries. Glutaraldehyde is usually the main ingredient in the sterilization process and generally acts as a fixative in the lab. Much of the demand has been fueled by the healthcare industry itself, due to the common application of glutaraldehyde in the high-level disinfection of medical devices. It is further tethered to very stringent regulations and guidelines and reinforced with stipulated measures that call for adequate sterilization procedures at medical institutions against HAIs, especially where endoscopes and surgical instruments are concerned. Growing concerns and emphasis on hygiene conditions in medical settings also boosted glutaraldehyde applications; it is now considered an essential chemical in the healthcare sector. Other important applications of glutaraldehyde include industry, more specifically in the oil and gas and pulp and paper industries. Glutaraldehyde is used as a biocide in the oil and gas industries to control microbial growth in pipelines and bottom-hole reservoirs, thus avoiding further biofouling and corrosion that might consequently bring about operational inefficiencies and very expensive repairs. Glutaraldehyde also applies in the pulp and paper industries as slimicide to inhibit the growth of slime-forming bacteria and algae in paper mills, ensuring smooth running of production processes. The value and versatility of it are further epitomized by its effectiveness in controlling microorganisms in demanding industrial setups, further fueling its adoption within a host of industries.

Moreover, the glutaraldehyde market is the growing demand for personal care and cosmetic products. Glutaraldehyde finds application in personal care products since it is this chemical that provides the necessary cross-linking of proteins, giving more durability and effectiveness to hair conditioners and nail hardeners. As such, owing to the increasing awareness of consumers about grooming and hygiene, demand for glutaraldehyde from the personal care segment has remained steady. Furthermore, its ability to be an effective preservative for cosmetics ensures product stability and helps to extend shelf life, hence making the chemical quite important to this end-user industry. Moving forward, the demand for glutaraldehyde will still be high when consumers continue looking for premium and durable personal care products.

Additionally, the regulatory environment on the use of glutaraldehyde is a factor that very strongly affects the market dynamics. The use of glutaraldehyde is regulated by very stringent controls over use, exposure, and environmental effect in most regions of the world, with institutions such as the US Environmental Protection Agency and the European Chemicals Agency. Manufacturers and end-users should, therefore, ensure that they adhere to these regulations to avoid penalty, product withdrawal, or bans. These shifting regulatory requirements spur innovation in the formulation of products and safety processes and push companies to come up with safer, more environmentally friendly alternatives or improved formulations of glutaraldehyde. Such interactions between regulatory pressures and market demand further set the growth trajectory of the glutaraldehyde market, keeping it dynamic and evolving.

Market Dynamics:

Drivers:

Expansion of Glutaraldehyde in Water Treatment Applications

One of the major drivers in the Glutaraldehyde Market is its increasing application in water treatment. Keeping in view the global concern for assured pure and safe water supplies, especially in the industrial treatment process, the need for efficient biocides like glutaraldehyde has naturally grown. Hence, companies are looking to expand their capacities to cater to this rising demand. For example, in June 2023, Solenis LLC, one of the largest specialty chemicals manufacturers in the world, announced a plan to hike its glutaraldehyde production capacity in the United States. Growing investments in production capacity were responding to the rising demand in microbial control in cooling towers and other industrial water systems. For such aspects, glutaraldehyde has built a solid reputation for its effectiveness in controlling the formation of biofilm and bacterial growth and become one of the more popular products within the water treatment industry, especially so in areas with tight regulations concerning the environment.

Rising Demand for Disinfectants in Healthcare

Rising demand from the healthcare sector for potent disinfectants has been the major growth driver for the Glutaraldehyde Market. With the rising cases of nosocomial or hospital-acquired infections and the concern over antibiotic-resistant bacteria, demand for potent disinfectants is raised. Glutaraldehyde is actually a broad-spectrum antimicrobial used comprehensively in medical institutions for sterilization and disinfection purposes. Steris Corporation introduced a new glutaraldehyde-based disinfectant for use in hospitals in September 2023, offering better microbial control and faster kill times. Rising demands in more advanced solutions for disinfection rise to the exacting standards of the healthcare industry. Glutaraldehyde forms an important factor in health care disinfection since it kills a large number of viruses, bacteria, and fungi.

Restraint:

Environmental and Health Concerns Associated with Glutaraldehyde Use

Glutaraldehyde is a largely applied disinfectant that enormously suffers from environmental and health concerns it raises. Being cytotoxic at higher concentration, it creates serious health and environmental risks. Regulations are being introduced that limit its use in view of the above-mentioned issues. For example, in December 2023, the European Chemicals Agency tightened the control over glutaraldehyde in consumer products because of its sensitizing and respiratory sensitizer potential. This pressured manufacturers to find substitute biocides or safer formulations for glutaraldehyde, impacting market growth. Balancing efficacy with safety is a challenge the industry will have to encounter in view of stringent regulatory frameworks across regions.

Opportunity:

Development of Eco-friendly Glutaraldehyde Alternatives

Environmental concerns and related regulatory pressures are escalating, hence an opportunity for developers of eco-friendly glutaraldehyde alternatives. The focus of companies is shifting to developing biocides with similar efficacy to glutaraldehyde but less environmental impact. Clariant AG introduced new biodegradable biocide product lines in April 2024 for uses such as water treatment and healthcare, which could replace glutaraldehyde. These new products are designed to meet demands for sustainable solutions without sacrificing effective microbial control. The launch of these alternatives could just be the very beginning of new growth opportunities in the Glutaraldehyde Market, especially among environmentally conscious consumers and industries. In such a shifting market, companies capable of innovating and delivering greener solutions are likely to gain an edge.

Challenge:

Balancing Efficacy and Safety in Glutaraldehyde Formulations

One major challenge in the Glutaraldehyde Market is to establish formulations that balance efficacy with safety. Glutaraldehyde is an extremely effective biocide; however, on the negative side, it is hugely toxic and associated with certain risks that have to be dealt with carefully. This challenge is especially acute in healthcare, where the use of disinfectants should not result in an appreciable risk to patient safety. This, in turn, exerts a heavy pressure on the companies to come up with formulations which retain the high antimicrobial efficacy for glutaraldehyde while reducing its toxic impact. For example, in August 2023, Johnson & Johnson announced the development of a new glutaraldehyde-based disinfectant with reduced toxicity levels for use in health settings more safely. This product forms just part of a wider trend toward safer biocide formulations that underlines the pertinacious efforts the industry is making to master this critical challenge. The ability to innovate in this area will be of prime importance to any company aiming to hold its prevailing position in the respective market.

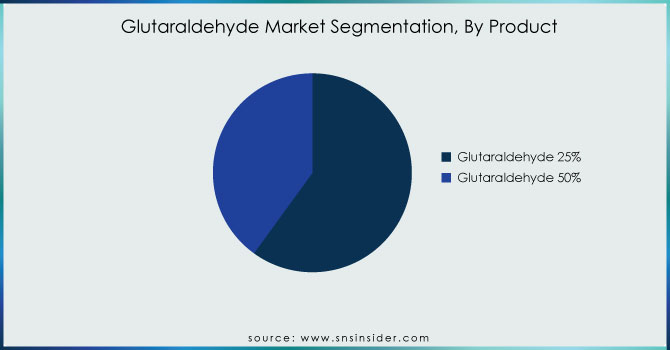

By Product

The Glutaraldehyde 50% segment dominated the glutaraldehyde market, accounting for a share of approximately 60% in 2023. This product in this concentration is of enhanced effectiveness for biocide and disinfectant applications in multiple industries, especially the healthcare and industrial sectors. For instance, Glutaraldehyde 50% is being applied on a large scale for high-level disinfection of surgical instruments and endoscope devices in a healthcare set-up. Again, in the oil and gas industry, this higher concentration is needed for effective application to control microbial growth in pipelines and reservoirs. Lower concentrations could be ineffective in these applications. The need for robust and reliable disinfection and microbial control drives Glutaraldehyde 50% to the top of the market and makes it very dominant in those situations where maximum potency is required.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

The disinfectant segment dominated the glutaraldehyde market in 2023 and is anticipated to hold a share of approximately 45% in the same market. The broad application as a strong disinfectant, particularly within healthcare facilities for the sterilization of various medical instruments like endoscopes and surgical tools, drives this domination. Glutaraldehyde exerts activity against a broad spectrum of microorganisms, ranging from bacteria to viruses and fungi. It forms one of the important constituents in the fight against HAIs and it derives strength from stringent hygiene regulations in hospitals and clinics. All these factors firmly establish disinfectants as the lead application segment for glutaraldehyde in the market.

By End-User

The Healthcare segment dominated the glutaraldehyde market in 2023 by capturing about a 50% share. This has been largely due to the fact that glutaraldehyde finds major application in hospitals and medical centers for sterilizing surgical instruments and medical devices such as endoscopes and dialysis machines to high-level disinfectants. Glutaraldehyde finds application in the protection of patients due to rising demand for sterilization in healthcare sectors, resulting from protection against healthcare-associated infections. Moreover, strict regulations by regulatory agencies for high hygiene standards in healthcare settings further increase its demand, making the healthcare sector the largest end-use industry for glutaraldehyde.

Regional Analysis

In 2023, North America dominated the glutaraldehyde market and held an estimated share of approximately 40%. This domination is majorly fueled by the strong demand coming from the healthcare sector, in which glutaraldehyde finds extensive application for the sterilization of medical instruments and equipment. The United States, because of its rigid healthcare legislations and high infection control standards in healthcare, acts as the prime driver. For example, glutaraldehyde finds extensive application in hospitals and clinics for disinfection purposes of critical medical devices such as endoscopes. Developed healthcare infrastructure with continuous evolution in medical technology is boosting the regional market in North America and further re-establishing its lead in the global glutaraldehyde market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the glutaraldehyde market, accounting for about a 30% share. Growth in this region is fast because of the increasing infrastructure in health care, increasing investments being made for medical and industrial applications, and enhanced awareness of infection control standards—especially in emerging countries such as China and India. For example, in China, increasing healthcare infrastructure and stringent sterilization measures in hospitals result in growing demand for glutaraldehyde. On the other hand, growth in the medical sector of India and technological progress in water treatments accelerate the use of glutaraldehyde. Accelerating industrial base within the region and the rising need for proper hygiene in the healthcare and water treatment applications segments spur market growth.

The major key players are LANXESS, UPI Chem, TIMAC AGRO International, DOW, Finoric LLC, Whiteley Corporation, Neogen Corporation, Grassland Agro, Surfachem Group Ltd, Tianxin Chemical Enterprise, and other key players mentioned in the final report.

Recent Developments

June 2024: US glutaraldehyde prices dropped on oversupply, while prices gained in Asia on tighter supply and rising demand.

April 2023: The European Chemicals Agency (ECHA) proposed including eight substances on Annex XIV of REACH Regulation 1907/2006, which requires authorization. Among these is Glutaral, a preservative in cosmetics.

| Report Attributes | Details |

| Market Size in 2023 | US$ 701.3 Mn |

| Market Size by 2032 | US$ 1039.1 Mn |

| CAGR | CAGR of 4.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Glutaraldehyde 25% and Glutaraldehyde 50%) • By Application (Water Treatment, Disinfectant, Tanning, Animal Husbandry, Electron & Light Microscopy) • By End-user (HealthCare, Cosmetics, R&D Laboratories, Agriculture, Oil & Gas, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | LANXESS, UPI Chem, TIMAC AGRO International, DOW, Finoric LLC, Whiteley Corporation, Neogen Corporation, Grassland Agro, Surfachem Group Ltd, Tianxin Chemical Enterprise |

| Key Drivers | • Expansion of Glutaraldehyde in Water Treatment Applications • Rising Demand for Disinfectants in Healthcare |

| Market Restraints | • Environmental and Health Concerns Associated with Glutaraldehyde Use |

Ans: The Glutaraldehyde Market was valued at USD 701.25 million in 2023.

Ans: The expected CAGR of the global Glutaraldehyde Market during the forecast period is 4.5%.

Ans: The rising awareness regarding the importance of maintaining proper hygiene and preventing the spread of infections has led to a surge in demand for glutaraldehyde-based products.

Ans: The Healthcare segment dominated in the Glutaraldehyde Market.

Ans: It effectively eliminates harmful bacteria, viruses, fungi, and other pathogens that can cause diseases in plants and animals. By using glutaraldehyde-based disinfectants, farmers can maintain a clean and healthy environment for their livestock, crops, and equipment. It helps extend the shelf life of harvested crops, preventing spoilage and reducing post-harvest losses. Moreover, By treating seeds with glutaraldehyde-based solutions, farmers can protect them from various seed-borne diseases and pathogens.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Region, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Glutaraldehyde Market Segmentation, by Product

7.1 Chapter Overview

7.2 Glutaraldehyde 25%

7.2.1 Glutaraldehyde 25% Market Trends Analysis (2020-2032)

7.2.2 Glutaraldehyde 25% Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Glutaraldehyde 50%

7.3.1 Glutaraldehyde 50% Market Trends Analysis (2020-2032)

7.3.2 Glutaraldehyde 50% Market Size Estimates and Forecasts to 2032 (USD Million)

8. Glutaraldehyde Market Segmentation, by Application

8.1 Chapter Overview

8.2 Water Treatment

8.2.1 Water Treatment Market Trends Analysis (2020-2032)

8.2.2 Water Treatment Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Disinfectant

8.3.1 Disinfectant Market Trends Analysis (2020-2032)

8.3.2 Disinfectant Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Tanning

8.4.1 Tanning Market Trends Analysis (2020-2032)

8.4.2 Tanning Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Animal Husbandry

8.5.1 Animal Husbandry Market Trends Analysis (2020-2032)

8.5.2 Animal Husbandry Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Electron & Light Microscopy

8.6.1 Electron & Light Microscopy Market Trends Analysis (2020-2032)

8.6.2 Electron & Light Microscopy Market Size Estimates and Forecasts to 2032 (USD Million)

9. Glutaraldehyde Market Segmentation, by End User

9.1 Chapter Overview

9.2 Healthcare

9.2.1 Healthcare Market Trends Analysis (2020-2032)

9.2.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Cosmetics

9.3.1 Cosmetics Market Trends Analysis (2020-2032)

9.3.2 Cosmetics Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 R&D Laboratories

9.4.1 R&D Laboratories Market Trends Analysis (2020-2032)

9.4.2 R&D Laboratories Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Agriculture

9.5.1 Agriculture Market Trends Analysis (2020-2032)

9.5.2 Agriculture Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Oil & Gas

9.6.1 Oil & Gas Market Trends Analysis (2020-2032)

9.6.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.4 North America Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.6.2 USA Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.7.2 Canada Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.2.8.2 Mexico Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.6.2 Poland Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.7.2 Romania Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.8.2 Hungary Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.9.2 Turkey Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.4 Western Europe Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.6.2 Germany Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.7.2 France Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.8.2 UK Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.9.2 Italy Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.10.2 Spain Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.13.2 Austria Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.4 Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.6.2 China Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.7.2 India Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.8.2 Japan Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.9.2 South Korea Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.10.2 Vietnam Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.11.2 Singapore Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.12.2 Australia Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.4 Middle East Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.6.2 UAE Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.7.2 Egypt Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.9.2 Qatar Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.4 Africa Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.6.2 South Africa Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Glutaraldehyde Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.4 Latin America Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.6.2 Brazil Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.7.2 Argentina Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.8.2 Colombia Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Glutaraldehyde Market Estimates and Forecasts, by Product (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Glutaraldehyde Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Glutaraldehyde Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 LANXESS

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 UPI Chem

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 TIMAC AGRO International

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 DOW

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Finoric LLC

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Whiteley Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Neogen Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Grassland Agro

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Surfachem Group Ltd

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Tianxin Chemical Enterprise

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Product

Glutaraldehyde 25%

Glutaraldehyde 50%

By Application

Water Treatment

Disinfectant

Tanning

Animal Husbandry

Electron & Light Microscopy

By End-user

HealthCare

Cosmetics

R&D Laboratories

Agriculture

Oil & Gas

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Thermoplastic Polyurethane (TPU) Market was valued at USD 2.91 billion in 2023 and is expected to reach USD 5.74 Billion by 2032, growing at a CAGR of 7.87% from 2024-2032.

The High-Performance Polyamides Market size was USD 2.00 billion in 2023 and is expected to reach USD 3.30 billion by 2032 and grow at a CAGR of 5.74% over the forecast period of 2024-2032.

Black Phosphorus Market Size was valued at USD 18.69 Million in 2023 and is expected to reach USD 468.60 Million by 2032, at a CAGR of 43.05% from 2024-2032.

Synthetic Rubber Market Size was valued at USD 33.70 Billion in 2023 and is expected to reach USD 51.39 Billion by 2032, at a CAGR of 4.80% from 2024-2032.

The Hydroxyapatite Market size was USD 2.45 billion in 2023 and is expected to reach USD 4.45 billion by 2032, growing at a CAGR of 6.85% from 2024 to 2032.

The Structural Health Monitoring Market Size was USD 3.5 Billion in 2023 & will reach to USD 13.2 Bn by 2032, growing at a CAGR of 15.9% by 2024-2032.

Hi! Click one of our member below to chat on Phone