Get More Information on Glucose Market - Request Sample Report

The Glucose Market Size was valued at USD 48.2 billion in 2023, and is expected to reach USD 81.4 billion by 2032, and grow at a CAGR of 6.0% over the forecast period 2024-2032.

The glucose market is experiencing dynamic shifts driven by technological advancements, increased awareness of diabetes management, and innovative product developments. These changes are particularly relevant as they directly influence the accessibility and efficacy of glucose monitoring devices, which are vital for patients with diabetes. Recent innovations, such as over-the-counter continuous glucose monitors, are revolutionizing how individuals manage their blood sugar levels. For instance, the FDA recently approved the first over-the-counter continuous glucose monitor, which is expected to make glucose monitoring more accessible to a broader population, particularly those with Type 2 diabetes who might not previously have utilized such technology. This approval underscores a growing trend toward enabling patients to take control of their health through easy-to-use monitoring solutions.

In diabetes management, effective glucose monitoring is crucial for preventing complications associated with the disease. A study conducted by researchers at the University of Oxford revealed that early blood glucose control is vital for reducing complications in individuals with Type 2 diabetes. This emphasizes the importance of timely and accurate glucose measurement, further propelling demand for advanced glucose monitoring devices. Companies are responding to this need with innovative products designed to facilitate better glucose management. For instance, the development of flash glucose monitors has been shown to significantly reduce diabetes-related hospital visits, demonstrating the tangible benefits of enhanced glucose monitoring technology in improving patient outcomes.

Recent advancements in glucose monitoring technology also reflect an increasing emphasis on integrating health monitoring with everyday technology. The introduction of a blood glucose measuring device that utilizes a smartphone for analysis showcases how technology is evolving to meet the needs of modern consumers. This innovation allows for seamless tracking of glucose levels, making diabetes management more convenient and less intrusive for users. Furthermore, the effectiveness of devices that utilize microlaser technology to measure glucose levels in sweat provides an alternative monitoring method that could appeal to those looking for non-invasive solutions.

Real-world evidence supporting the efficacy of these new monitoring technologies continues to emerge. A study highlighted by researchers at McLean Hospital pointed out that fluctuations in glucose levels significantly affect cognitive performance in individuals with Type 1 diabetes, indicating that effective glucose management can have broader implications for health beyond physical symptoms. This finding adds a layer of urgency to the development and distribution of reliable glucose monitoring devices. Additionally, research from NTU Singapore introduced a novel plaster-like microlaser device that accurately measures glucose levels in sweat, paving the way for future innovations in non-invasive glucose monitoring methods that could transform patient experiences.

As the glucose market evolves, companies are focused on meeting the diverse needs of patients while enhancing the overall management of diabetes. An analysis conducted by researchers at Dartmouth College demonstrated that glucose data reveals seasonal patterns in diabetes care, highlighting the necessity for continuous monitoring and tailored approaches to management based on individual patient profiles. This insight encourages manufacturers to develop more sophisticated and adaptable glucose monitoring solutions. The collective advancements across the sector suggest a promising future for glucose monitoring technology, characterized by increased accessibility, improved accuracy, and a stronger focus on patient-centric solutions. These developments not only benefit individuals managing diabetes but also contribute to the broader goal of reducing healthcare costs associated with diabetes-related complications.

Market Dynamics:

Drivers:

The increasing prevalence of diabetes globally is driving demand for effective glucose monitoring solutions, leading to innovations in technology and product offerings.

The growing incidence of diabetes in the world is one significant growth driver that calls for effective glucose-monitoring solutions. Health systems need to curb the rising numbers of patients afflicted with diabetes. International Diabetes Federation projects that, by 2045, the number of people living with diabetes will reach 700 million, hence making it an urgent call to come up with better monitoring and management tools. This increasing prevalence makes healthcare providers and technology firms innovate and improve their product offerings to meet the needs of patients. For example, firms such as Abbott Company have come up with a continuous glucose monitoring device known as the FreeStyle Libre system that permits users to scan their glucose levels. In the same line, Dexcom's G6 CGM system allows direct glucose readings which patients can use to make timely decisions regarding their diet and medication. Another innovative development in data integration is through partnerships of glucose monitoring manufacturers with health app developers, which makes the application smoother in tracking and analyzing glucose levels over time. These innovations are not only valuable for patients' diabetes management but also make the job of a patient to communicate and get a healthcare professional to understand their needs better, thus making the treatment plan more personalized. With the rate at which the prevalence of diabetes is believed to rise, there will be more need for innovative and productive glucose monitoring options, and that's where the pressure will come to continue investment and improvement in this serious healthcare industry.

Rising awareness about diabetes management and self-monitoring practices among patients enhances the adoption of advanced glucose monitoring devices.

Patient awareness concerning diabetes management and self-monitoring practices ensures that advanced glucose monitoring devices are highly adopted because most patients realize that proper blood sugar level regulation is pertinent to their general well-being. As a result of these education programs and health promotion initiatives, the diabetes patient is now empowered to take greater responsibility for their disease management. For instance, the American Diabetes Association organizes education and training programs with its clients on the advantage of constant glucose monitoring and how the lack of such a simple device may lead to complications like neuropathy and kidney damage, amongst others. This increased awareness has fueled the rise in demand for high-tech glucose monitoring devices that include CGMs, which provide real-time glucose levels and alert users. Responding to this trend companies like Medtronic, offer devices that can be conveniently interfaced with mobile applications, and users can monitor their glucose levels as well as get personalized insights into their situation, which improves their adherence to treatment regimens. The growth of online diabetes communities and support groups has thus created a culture of sharing experiences and best practices among the patients further reinforcing the importance of self-monitoring. Therefore, with better quality glucose monitoring devices, patients are willing to spend money on devices that allow them to track their glucose more easily and accurately to improve their quality of life and health care outcomes. This awareness and proactive approach towards the management of diabetes is catapulting the glucose monitoring market forward since more and more patients now look for the latest innovations that can aid them in their daily health management regimens.

Restraint:

High costs associated with advanced glucose monitoring devices can limit accessibility for some patients, hindering market growth.

Advanced glucose monitoring devices are highly costly, thereby limiting their accessibility to many patients. For low-income or uninsured patients, advanced glucose monitoring devices are expensive. Continuous glucose monitoring systems and other advanced technologies are cost-prohibitive, ranging from hundreds of dollars to thousands, which generally discourages a person from investing in such absolute tools for diabetes management. For example, while flash glucose monitors provide the user with valuable real-time information to keep their blood sugar levels under good control, the high up-front costs and, in some cases, recurring costs for sensors as well as accessories may be a cost prohibitor for users. This has harmed health outcome distribution because those who cannot afford such devices end up using less effective monitoring methods, like traditional finger-pricking, which is not so convenient and not as accurate. Due to this, advanced glucose monitoring devices inhibit wider adoption and considerable market growth since many portions of the population continue to be underserved in their diabetes management needs.

Opportunity:

The development of non-invasive glucose monitoring technologies presents a significant opportunity for market expansion, attracting consumers seeking convenient and less intrusive solutions.

Advances in non-invasive glucose monitoring technologies provide a wide scope for the expansion of the glucose market since these innovations are in high demand by consumers seeking less obtrusive and more convenient alternatives to traditional glucose monitoring methods. Non-invasive devices such as infrared spectroscopy or those using microneedle technology remove finger pricks, thus making glucose monitoring more convenient and user-friendly. Thus, these transparent monitoring products should prove to be the most appealing for users with apprehension about using traditional devices- due to discomfort or dislike of the concept of needles- to name just a few examples of wearable technology that might scan the levels of glucose across the human body. Indeed, they shall be scouring diabetes management in a non-tedious manner-continuous and real-time-like data without associated pain-. This will not only encourage adherence for a patient but also expand the market to patients who may not have otherwise been monitored regularly. Since these technologies are becoming more efficient and affordable, they will likely become even more attractive to a wider market of consumers, resulting in growth for the glucose monitoring sector as well as better health care for those suffering from diabetes.

Challenge:

Rapid technological advancements create a challenge for companies to keep pace with innovation, ensuring their products remain competitive and meet evolving consumer needs.

Rapid development in the glucose market brings massive challenges for companies aiming to sustain levels of innovation and competitiveness, as offered by products provided by a firm. Furthermore, with trends like advanced continuous glucose monitors that have artificial intelligence in them, which enables predictive understanding, it also means that manufacturers have to invest heavily into research and development over time so that their offerings remain improved and the introduced features are integrated, respectively. In this fast-paced environment, speed and agility are also required of companies to be responsive to shifting consumer expectations and preferences in monitoring solutions, such as user-friendly and non-invasive monitoring solutions with higher accuracy. Also, the necessity of adhering to stringent regulatory standards offers complexity, as it has to meet health safety, efficacy, and demands for incorporating ever-moving technology in line with market offerings. Failure to innovate in the correct manner will, ultimately take market share away from those organizations which better understand and more accurately measure the changing landscape, thus having an impact on a company's market position in this highly competitive space.

By Source

In 2023, the corn starch segment dominated the glucose market accounting for a market share of around 60%. The reason behind this is the fact that corn starch is widely available and relatively low-priced as a raw material for glucose. Besides, it enjoys extensive acceptance in the majority of applications, such as food and beverages, wherein it is used to sweeten or thicken various products. For example, leading food manufacturers utilize glucose syrups made from corn to enhance the sweetness of carbonated drinks, candies, and pastries. The trend toward consuming products that are plant-based and natural-based has also raised the demand for glucose because it is believed to be more sustainable and healthier compared to other sources. This growing demand for many applications makes corn starch the first source in the market of glucose.

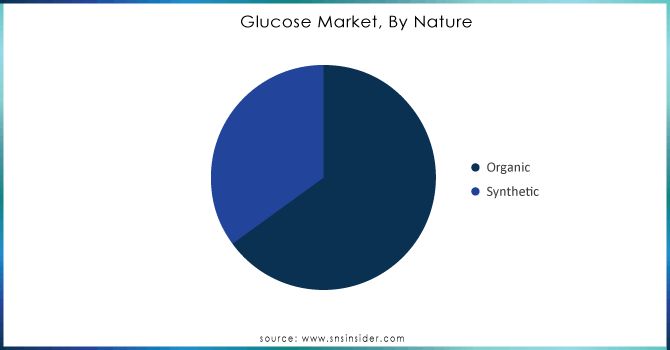

By Nature

The synthetic segment dominated the glucose market in 2023, accounting for about 70% of the total share. The major driver amongst these is that synthetic glucose is used predominantly in most industrial applications like food processing, pharmaceuticals, and biofuel manufacturing. Therefore, consistency and cost are held to be prime factors in such industries. Synthetic glucose is produced commercially from sources like starch hydrolysis. Reliability in the supply chain and usually at a reduced cost, it is favored by most manufacturers. For instance, big beverage companies use synthetic glucose syrups for their soft drinks and energy beverages to achieve the desired level of sweetness in a beverage at a much lesser cost as compared to its organic counterpart. Yet another important source of glucose is in the pharmaceutical industry; they manufacture intravenous solutions and sugar substitute medicine, thus increasing demand. Organic glucose may be gaining popularity as a health-conscious product, but synthetic glucose has such wide-ranging application and affordability that it remains at the top of the demand list.

Get Customized Report as per your Business Requirement - Request For Customized Report

By End-User

The food and beverage segment dominated and accounted for the majority share of around 50% of the glucose market in 2023. Glucose finds application in a wide range of food products as a sweetener, stabilizer, or thickening agent. This mainly accounts for its leading market position. In the beverage sector, large players also use glucose syrups to enhance the sweetness and mouthfeel of soft drinks and energy drinks. Glucose is also used in the food manufacturing industry in combination with confectionery goods, sauces, and baked products to yield desired textures and flavor profiles. The increased consumption of low-calorie and natural sweeteners by the consumer has increased demand for glucose-based products since sometimes manufacturers have to use glucose instead of regular sugar to keep up with these trends. This heavy usage throughout the different applications further solidifies the food and beverages segment as the leader in the glucose market.

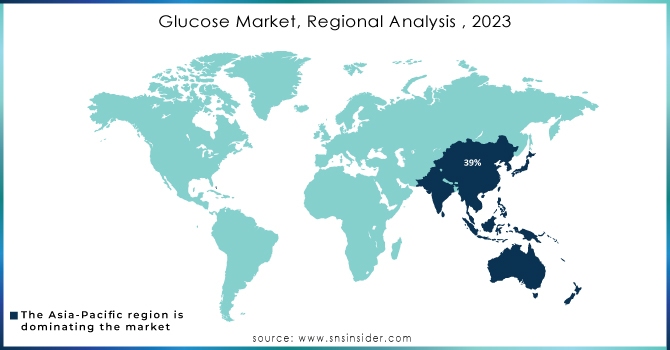

Regional Analysis

The Asia-Pacific region dominated the glucose market in 2023 with an estimated market share of about 40%. The region has witnessed a rapidly increasing population with higher urbanization and growing disposable income, which has resulted in a significant shift in dietary preferences toward processed and convenience foods. For example, in China and India, more and more consumers are using glucose-rich sugary soft drinks and packaged snack foods, resulting in an increasing demand for glucose as it is one of the principal ingredients. Not only that, a developing food and beverage market in the region plus an increasing health-conscious consumer is forcing manufacturers to add glucose as a sweetener to low-calorie and functional foods. The Asia-Pacific region's position in the global glucose market is only enhanced by innovative product offerings and glucose adapted in numerous applications such as pharmaceutical and nutraceuticals.

Moreover, North America emerged as the fastest-growing region in the glucose market during 2023, with an estimated CAGR of around 6.5%. Growth is primarily fueled by the ever-increasing prevalence of diabetes and obesity, increasing demand for glucose monitoring devices, and healthier food alternatives. The presence of a strong pharmaceutical industry in the region has also greatly influenced glucose demand due to the widespread use of glucose in intravenous fluids and medications. The rapidly growing adoption of glucose-based solutions in the nutraceutical industry for energy drinks and supplements accelerates the rate of market growth. Moreover, innovations in production technologies of glucose along with the trend towards environmentally friendly, plant-based glucose products have opened new avenues for growth, primarily in North America, namely the United States and Canada.

Atn Investments Pty Ltd. (Glucose Syrup, Dextrose Monohydrate)

AGRANA (Glucose Syrup, Dextrose)

Archer Daniels Midland Company (ADM Corn Syrup, ADM Glucose)

Avebe Group (Avebe Potato Starch, Avebe Glucose)

Cargill, Inc (Cargill Glucose Syrup, Cargill Dextrose)

Fooding Group Limited (Fooding Glucose Powder, Fooding Glucose Syrup)

Global Sweeteners Holdings (GSH Glucose Syrup, GSH Dextrose)

Grain Processing Corporation (GPC Glucose Syrup, GPC Dextrose)

Gulshan Polyols (Gulshan Glucose Syrup, Gulshan Dextrose Monohydrate)

Ingredion Inc. (Ingredion Glucose Syrup, Ingredion Dextrose)

Pfizer, Inc. (Pfizer Glucose Injection, Pfizer Dextrose)

ProAgro GmbH (ProAgro Glucose Syrup, ProAgro Dextrose)

Roquette Freres (Roquette Glucose Syrup, Roquette Dextrose)

Sigma Aldrich Corporation (Sigma Dextrose, Sigma Glucose)

Tate & Lyle PLC (Tate & Lyle Glucose Syrup, Tate & Lyle Dextrose)

Tereos SCA (Tereos Glucose Syrup, Tereos Dextrose)

ADM (Archer Daniels Midland Company) (ADM Glucose Syrup, ADM Dextrose)

Domo Chemicals (Domo Glucose, Domo Dextrose)

Lantmännen Unibake (Lantmännen Glucose Syrup, Lantmännen Dextrose)

Univar Solutions (Univar Glucose Syrup, Univar Dextrose)

| Report Attributes | Details |

| Market Size in 2023 | US$ 48.2 Billion |

| Market Size by 2032 | US$ 81.4 Billion |

| CAGR | CAGR of 6.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Corn starch, Wheat starch, Others) •By Nature (Organic, Synthetic) •By End-User (Food and Beverage, Bakery Industry, Nutraceuticals Industry, Pharmaceutical Industry, Animal husbandry industry, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Roquette Freres, Cargill, Inc, Tate & Lyle PLC, Ingredion Inc., ProAgro GmbH, Tereos SCA, Grain Processing Corporation, Global Sweeteners Holdings, Fooding Group Limited, Gulshan Polyols, Pfizer, Inc., Sigma Aldrich Corporation, Atn Investments Pty Ltd., Archer Daniels Midland Company, Avebe Group, AGRANA and other key players |

| Key Drivers | • The increasing prevalence of diabetes globally is driving demand for effective glucose monitoring solutions, leading to innovations in technology and product offerings •Rising awareness about diabetes management and self-monitoring practices among patients enhances the adoption of advanced glucose monitoring devices |

| RESTRAINTS | • High costs associated with advanced glucose monitoring devices can limit accessibility for some patients, hindering market growth |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Roquette Freres, Cargill, Inc, Tate & Lyle PLC, , Ingredion, Inc.,ProAgro GmbH, Tereos SCA, Grain Processing Corporation, Global Sweeteners Holdings, Fooding Group Limited, Gulshan Polyols, Pfizer, Inc., Sigma Aldrich Corporation,Atn Investments Pty Ltd., Archer Daniels Midland Company, Avebe Group, AGRANA are the major Key players of Global Glucose Market

Ans: Rapidly Increasing Consumption Of Sugar and Chocolate Confectionery, Rising Demand Of Natural Cosmetics are the Drivers for Fiber Cement Market

Ans: The Global Glucose Market grow at a CAGR of 6.0 % over the forecast period 2022-2028.

Ans: Glucose Market Size was valued at USD 48.2 billion in 2022, and expected to reach USD 81.4 billion by 2032

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Glucose Market Segmentation, by Source

7.1 Chapter Overview

7.2 Corn starch

7.2.1 Corn starch Market Trends Analysis (2020-2032)

7.2.2 Corn starch Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Wheat starch

7.3.1 Wheat starch Market Trends Analysis (2020-2032)

7.3.2 Wheat starch Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

8. Glucose Market Segmentation, by Nature

8.1 Chapter Overview

8.2 Organic

8.2.1 Organic Market Trends Analysis (2020-2032)

8.2.2 Organic Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Synthetic

8.3.1 Synthetic Market Trends Analysis (2020-2032)

8.3.2 Synthetic Market Size Estimates and Forecasts to 2032 (USD Million)

9. Glucose Market Segmentation, by End User

9.1 Chapter Overview

9.2 Food and Beverage

9.2.1 Food and Beverage Market Trends Analysis (2020-2032)

9.2.2 Food and Beverage Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Bakery Industry

9.3.1 Bakery Industry Market Trends Analysis (2020-2032)

9.3.2 Bakery Industry Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Nutraceuticals Industry

9.4.1 Nutraceuticals Industry Market Trends Analysis (2020-2032)

9.4.2 Nutraceuticals Industry Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Pharmaceutical Industry

9.5.1 Pharmaceutical Industry Market Trends Analysis (2020-2032)

9.5.2 Pharmaceutical Industry Market Size Estimates and Forecasts to 2032 (USD Million)

9.6 Animal husbandry industry

9.6.1 Animal husbandry industry Market Trends Analysis (2020-2032)

9.6.2 Animal husbandry industry Market Size Estimates and Forecasts to 2032 (USD Million)

9.7 Others

9.7.1 Others Market Trends Analysis (2020-2032)

9.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.4 North America Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.5 North America Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.6.2 USA Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.6.3 USA Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.7.2 Canada Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.7.3 Canada Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.2.8.2 Mexico Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.2.8.3 Mexico Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.6.2 Poland Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.6.3 Poland Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.7.2 Romania Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.7.3 Romania Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.8.2 Hungary Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.8.3 Hungary Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.9.2 Turkey Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.9.3 Turkey Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.4 Western Europe Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.5 Western Europe Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.6.2 Germany Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.6.3 Germany Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.7.2 France Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.7.3 France Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.8.2 UK Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.8.3 UK Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.9.2 Italy Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.9.3 Italy Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.10.2 Spain Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.10.3 Spain Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.13.2 Austria Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.13.3 Austria Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.4 Asia Pacific Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.5 Asia Pacific Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.6.2 China Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.6.3 China Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.7.2 India Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.7.3 India Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.8.2 Japan Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.8.3 Japan Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.9.2 South Korea Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.9.3 South Korea Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.10.2 Vietnam Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.10.3 Vietnam Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.11.2 Singapore Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.11.3 Singapore Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.12.2 Australia Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.12.3 Australia Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.4 Middle East Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.5 Middle East Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.6.2 UAE Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.6.3 UAE Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.7.2 Egypt Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.7.3 Egypt Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.9.2 Qatar Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.9.3 Qatar Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.4 Africa Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.5 Africa Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.6.2 South Africa Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.6.3 South Africa Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Glucose Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.4 Latin America Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.5 Latin America Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.6.2 Brazil Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.6.3 Brazil Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.7.2 Argentina Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.7.3 Argentina Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.8.2 Colombia Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.8.3 Colombia Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Glucose Market Estimates and Forecasts, by Source (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Glucose Market Estimates and Forecasts, by Nature (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Glucose Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11. Company Profiles

11.1 Roquette Freres

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Cargill, Inc

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Tate & Lyle PLC

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Ingredion Inc.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ProAgro GmbH

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Tereos SCA

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Grain Processing Corporation

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Global Sweeteners Holdings

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Fooding Group Limited

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Gulshan Polyols

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

11.11 Pfizer, Inc.

11.11.1 Company Overview

11.11.2 Financial

11.11.3 Products/ Services Offered

11.11.4 SWOT Analysis

11.12 Sigma Aldrich Corporation

11.12.1 Company Overview

11.12.2 Financial

11.12.3 Products/ Services Offered

11.12.4 SWOT Analysis

11.13 Atn Investments Pty Ltd.

11.13.1 Company Overview

11.13.2 Financial

11.13.3 Products/ Services Offered

11.13.4 SWOT Analysis

11.14 Archer Daniels Midland Company

11.14.1 Company Overview

11.14.2 Financial

11.14.3 Products/ Services Offered

11.14.4 SWOT Analysis

11.15 Avebe Group

11.15.1 Company Overview

11.15.2 Financial

11.15.3 Products/ Services Offered

11.15.4 SWOT Analysis

11.16 AGRANA

11.16.1 Company Overview

11.16.2 Financial

11.16.3 Products/ Services Offered

11.16.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Corn starch

Wheat starch

Others

By Nature

Organic

Synthetic

By End-User

Food and Beverage

Bakery Industry

Nutraceuticals Industry

Pharmaceutical Industry

Animal husbandry industry

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Polyolefin Market size was USD 258.6 Billion in 2023 and is expected to reach USD 388.6 Billion by 2032 and grow at a CAGR of 4.6% over the forecast period of 2024-2032.

Explore the Castor Oil & Derivatives Market, covering applications in cosmetics, pharmaceuticals, and industrial sectors. Learn about trends in bio-based chemicals, sustainable sourcing, and the rising demand for castor oil in diverse industries.

Basalt Fiber Market Size was valued at USD 269.9 million in 2023 and is expected to reach USD 733.5 million by 2032 and grow at a CAGR of 11.8% from 2024-2032.

Industrial Gases Market was USD 105.47 Billion in 2023 and is expected to reach USD 174.13 Billion by 2032, growing at a CAGR of 5.73 % from 2024 to 2032.

The Needle Coke Market Size was valued at USD 4.8 Billion in 2023. It is expected to grow to $9.7 Bn by 2032 and grow at a CAGR of 8.2% by 2024-2032.

Benzenoid Market was valued at USD 804.48 Million in 2023 and is expected to reach USD 1,327.88 Million by 2032, growing at a CAGR of 5.73% from 2024-2032.

Hi! Click one of our member below to chat on Phone