Global Automotive Industry Market Key Insights:

The Global Automotive Industry Market size is valued at USD 436.89 Bn in 2022 and is expected to reach USD 1789 Bn by 2030 and grow at a CAGR of 19.25% over the period of 2023-2030.

In 2021, the market for electric vehicles was expanding quickly. In order to comply with stricter pollution rules and public demand for cleaner transportation, many traditional manufacturers were making significant investments in electric car technologies. With businesses like Tesla, Waymo, and conventional manufacturers testing and implementing autonomous elements in their vehicles, autonomous vehicles or self-driving technology has continued to advance. Regulation and safety issues remained pressing problems to resolve. The COVID-19 pandemic created supply chain interruptions in numerous industries, including the automotive one. This had an effect on the supply of crucial components like semiconductors. The industry was being influenced by sustainability and environmental issues. By using more efficient vehicle designs and reducing their carbon impact during manufacture, many automakers were making strides in this direction.

Get E-PDF Sample Report on Automotive Industry Market - Request Sample Report

As ride-sharing services and vehicle-sharing platforms gain popularity, they may have an impact on urban regions' car ownership trends. Automakers were putting more of an emphasis on online sales channels and improving the user experience for online customers.

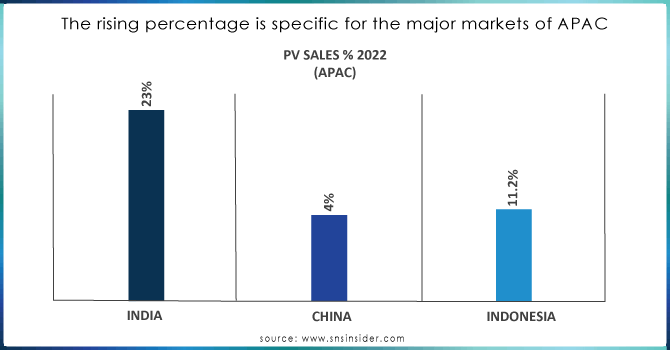

The automotive industry sought to grow in developing nations, especially Asia, where there was a rising middle class and a need for automobiles. Worldwide, governments are providing incentives to encourage the use of electric vehicles, including electric scooters. Tax reductions, financial assistance, and access to special parking and charging locations are a few examples of these incentives. Consumers are becoming more knowledgeable about the advantages electric vehicles have for the environment. Electric scooters have no emissions, which enhances the quality of the air and lowers greenhouse gas emissions. Compared to scooters fuelled by gasoline, electric scooters are more affordable to operate. Due to their increased efficiency and lack of need for gasoline or oil changes, electric scooters can go farther on a single charge. Sales of electric scooters rose by 23% in 2022–2023, the most in more than four years. Traditional automakers were up against competition from startups that were specializing in electric and driverless vehicles, as well as IT giants like Tesla. As customers and governments alike put pressure on the sector to cut emissions, EVs are growing in popularity. This is causing a significant change in how automobiles are created and developed.

The switch to electric vehicles (EVs) and rising costs are two issues that the Indian automotive industry is also dealing with. But in the next years, it's also anticipated that the Indian auto sector would expand dramatically. The Indian auto sector is predicted to grow to a $15 lakh crore (INR 150 trillion) market by 2024–25, according to a forecast by Invest India. Due to its numerous benefits over conventional gasoline-powered vehicles, including lower pollutants and lower running costs, EVs are growing in popularity. The EV industry is anticipated to expand quickly in the upcoming years because to the significant investments automakers are making in EV development.

Moving toward autonomous driving Another significant trend reshaping the automotive sector is autonomous driving. Several self-driving technologies are being developed by automakers, and some cars can already drive themselves in particular circumstances. As autonomous driving has the potential to transform how people travel, it is anticipated to have a significant impact on the automobile industry in the years to come. The car sector continues to be a significant global economic force. The number of vehicles sold worldwide in 2022 increased by 4.7% to 80.1 million units. The industry is also making significant investments in cutting-edge technology like linked automobiles, driverless vehicles, and EVs.

Market Dynamics

Driver:

-

The increase in global sales of vehicles and demand for the passenger vehicles in the rising economies.

People have more money to spend on discretionary items like new cars as their salaries improve. As more people settle in urban areas, the need for personal mobility rises. Better roads and highways make owning and operating a vehicle easier and more convenient. Governments in developing nations frequently enact laws that encourage the purchase of automobiles, such as tax breaks and subsidies.

In general, increased passenger vehicle sales in developing nations are an indication of wealth and economic expansion. However, it is crucial to address the problems brought on by this growth, including clogged roads, air pollution, and infrastructural issues.

Here are some instances of increased electric commercial vehicle sales in developing nations:

Source: SNS Analysis

Opportunity

-

The initiative taken by the government to upscale the actions related to achieving net zero carbon goal.

-

The rising development by the OEMs in order to improve the overall business model by focusing on the sustainability element.

Governments were contributing a sizable amount of money to assist the creation and use of renewable energy sources like hydroelectric, solar, and wind energy. These investments have the dual goals of reducing carbon emissions and relying on fossil resources. To promote the use of electric vehicles, numerous governments have provided incentives and subsidies. This includes subsidies for EV technology research and development, rebates for EV sales, and funding for charging infrastructure. To stay competitive in the future, automotive OEMs must make investments in cutting-edge technology like autonomous driving, connected vehicles, and electrified automobiles. Automotive OEMs can enter new areas, such as emerging countries and growing economies, to take advantage of fresh growth prospects. To expand their customer base and diversify their revenue streams, automotive OEMs can create new business models like subscription services and ride-hailing services. Funding for energy efficiency programs increased. In order to significantly reduce energy use and emissions, this includes measures to enhance the energy efficiency of buildings, industrial operations, and appliances.

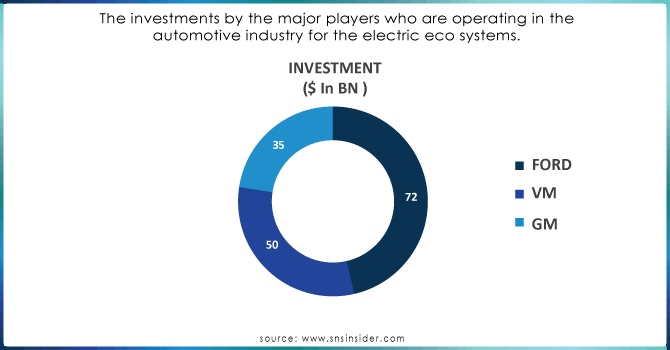

The firm has promised to investing USD 3.5 trillion in EV research and development over the following ten years and expects to introduce 30 new EV models by 2030.

The markets Volkswagen is entering are growing. The business plans to introduce new EV models in these areas while also making significant investments in its operations in China and India. New business models are being created by General Motors. The business has introduced a subscription service called Cadillac Care that charges clients a monthly fee in exchange for access to a fleet of Cadillac vehicles. Additionally, GM is creating Maven, a ride-hailing service. Ford is making operational improvements. Over the following three years, the corporation intends to slash expenditures by USD 3 billion.

Restrains

-

Because of the automotive industry's high degree of globalization, manufacturing has recently been significantly impacted. These disruptions have been caused by a number of events, including the COVID-19 epidemic, the conflict in Ukraine, and others.

Challenges

-

The margins of automakers are under pressure as a result of recent increases in the price of raw materials and components.

-

The world economy is dealing with a number of issues, such as high inflation and rising interest rates.

Key Market Segmentation

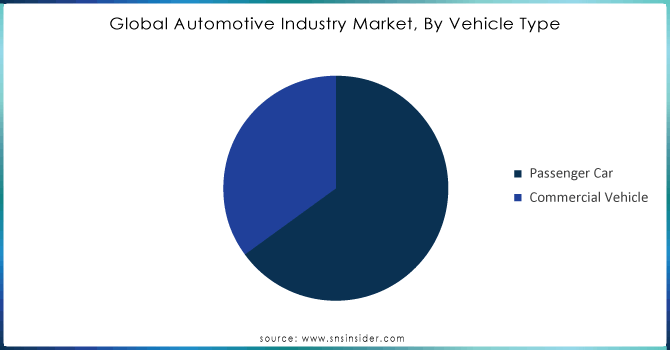

1. Market By Vehicle Type

-

Passenger Car

-

Hatchback

-

Sedan

-

SUV

-

MUV

-

-

Commercial Vehicle

-

LCVs

-

Heavy Trucks

-

Buses & Coaches

-

Get Customized Report as Per Your Business Requirement - Request For Customized Report

2. Market By Propulsion Type

-

ICE Vehicle

-

Electric Vehicle

Impact of Recession:

Because they are more likely to be cutting their spending and saving money during a recession, consumers are less likely to buy new cars. Because the automobile sector employs many people, a recession may result in job losses across the board. During a recession, automakers could cut back on manufacturing and new product development. During a recession, suppliers may find it more difficult to meet the demands of the auto industry. Recession intensity and the particular circumstances of the business at the time can both affect how the recession affects the automotive industry. But during recessions, fewer people buy cars, more jobs are lost, and less money is invested.

Impact of War:

Major raw material and component suppliers to the automotive industry are Russia and Ukraine. The supply chain has been hampered by the war, making it challenging and expensive for manufacturers to acquire the materials they require to build automobiles. As a result of the war, the price of energy and raw materials has dramatically risen. The price of vehicles has increased as a result of this. Demand has decreased as a result of the war's instability and economic uncertainty. Because of this, demand for new cars has decreased, notably in Europe.

Competitive Landscape

Source: SNS Analysis

The investment details of all the major players performing in every segment mentioned in this market will be provided in final report. Also, the completed M&A and possible vertical integration moves which are in the pipeline will be provided.

Governments all across the world are establishing challenging goals for lowering greenhouse gas emissions from the transportation industry. Because electric vehicles are more environmentally friendly than gasoline-powered vehicles, this is motivating automakers to make investments in them. Electric vehicle demand is increasing quickly among consumers. This is a result of a number of things, such as the rising price of fuel, the advantages electric vehicles have for the environment, and the growing quantity of electric vehicles on the market. Electric vehicles are becoming more feasible and inexpensive because to developments in battery technology and electric vehicle design. As a result, buyers are finding electric automobiles to be a more appealing option.

Electric cars, SUVs, trucks, and vans are among the many types of vehicles that automakers are now creating. To guarantee a steady supply of batteries for their electric vehicles, automakers are investing in battery manufacture. To make it simpler for users to charge their electric vehicles, automakers are investing in infrastructure for charging. To create new technologies for their electric vehicles, such as autonomous driving and over-the-air upgrades, automakers are investing in software and digitalization.

REGIONAL ANALYSIS

Exhibit 1

| Region | Market Size 2022 |

|---|---|

| North America | 131 Bn |

| Europe | XX |

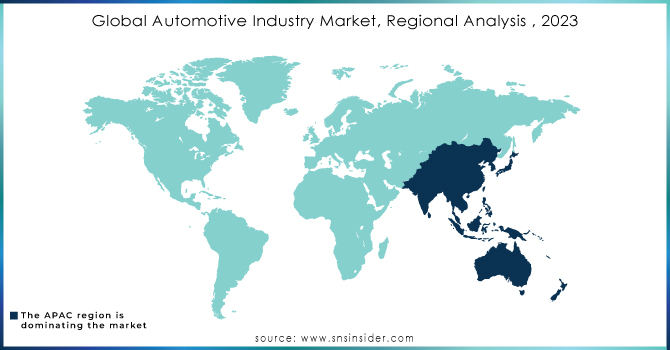

| APAC | 214 Billion |

| LATAM | XX |

| MEA | XX |

Source: SNS Analysis

The COVID-19 pandemic, broken supply chains, and growing inflation are just a few of the difficulties the North American automobile sector has been dealing with lately. The industry is anticipated to rebound in the upcoming years, however, thanks to the significant demand for electric vehicles and other cutting-edge technologies. With over 70% of all car sales in North America, the United States has the largest automotive market in the continent. A broad demographic base and a robust domestic economy sustain the U.S. car sector.

Undoubtedly one of the most significant trends in North America is the electrification of the automotive sector. Governments are providing incentives to encourage the adoption of electric vehicles, and automakers are investing extensively in this technology. Another significant trend in the North American car industry is autonomous driving. Automakers are working on autonomous vehicles, and governments are establishing rules to control their usage. The automotive industry in North America is likewise experiencing a significant rise in connectivity. Vehicles that are connected to the internet and to one another are being developed by automakers. This enables communication between vehicles and the infrastructure, which can increase safety and effectiveness.

The world's largest and fastest-growing automobile market is located in Asia-Pacific (APAC). Some of the top automakers in the world, such as Toyota, Honda, and Hyundai, are based in the area. There is a huge network of suppliers and dealerships that support the APAC automobile sector. The growing demand for electric vehicles and other cutting-edge technology is anticipated to fuel further expansion of the APAC automotive market over the coming years. The sector will nevertheless also have to deal with difficulties including deteriorating supply chains and growing prices.

USED Cases

Introduction

One of the major problems faced by the OEMs and the government is related to rising fatalities all around the globe. Specially the major concerns are associated with the rising urbanisation and accidents happening in highly developed countries. The development of ADAS systems looking at the safety and the rising mobility of autonomous eco system, the development is said to be the game changer and will surely impact the safety factors of the local population. After the primary analysis with the industry experts, we got to know the adoption percentage of the system is way more ahead than forecasted. We have mentioned the key features and the pre concepts about how the system is functioning and the facts related to why it is the most essential element in vehicles in this era.

Exhibit 2

| Country | Fatalities | Increase (%) |

|---|---|---|

| Germany | 2782 | 9 |

| China | 9980000 | 3 |

| US | 42795 | 2 |

| Brazil | 1480000 | 10.8 |

The samples of major economies of respective region have been studied for analysing the present situation. The data abstracted is from the official sources.

Case Analysis:

The driver can be warned if they start to become distracted by ADAS systems, which can track their level of concentration. This may lessen the number of collisions brought on by driver distraction. ADAS systems may automatically rectify errors like lane departure and unwanted acceleration, which helps to reduce driver error. By doing this, the number of accidents brought on by human error may be decreased. ADAS systems can give the driver a 360-degree picture of the area around the vehicle, improving vision. By doing this, the motorist may be able to recognize and steer clear of risks that they might otherwise miss. ADAS systems can react more quickly than people can, which can assist prevent collisions in emergency situations.

If the system senses an impending accident, AEB systems have the ability to autonomously deploy the brakes. Rear-end collision rates have been proven to be significantly decreased by AEB systems. LDW (lane departure warning) systems warn the driver if they begin to veer off course. Lane departure accidents can potentially be decreased with the aid of LDW technologies. Systems for blind spot monitoring (BSM) warn the driver when a car is in their blind area. The probability of lane change collisions can be decreased with the aid of BSM technologies. Pedestrian detection systems can warn the driver if a pedestrian crosses their route in front of their car. Accidents involving pedestrians can be decreased with the aid of pedestrian detecting devices. The vehicle in front of you is automatically kept at a safe distance thanks to ACC technologies. Driver tiredness can be reduced and fuel efficiency can be increased using ACC systems.

Automobile original equipment manufacturers are also creating new, advanced ADAS systems. For instance, several OEMs are creating ADAS systems that can steer the car automatically to prevent collisions. Other OEMs are working on ADAS technologies that will aid drivers in parking and navigating traffic. As ADAS systems spread and become more widely available, they are likely to have a big impact on how we drive. ADAS technologies may help fewer accidents and fatalities occur on the road. Additionally, they can improve the convenience and comfort of driving.

KEY PLAYERS

The major players are Cargo Carriers, UPS, FedEx, Ceva Holdings, Tuma Transport, Swift Transport, Interlogix, Transtech Logistics Procet, Concargo and others playres

Overall, ADAS systems are a useful tool for enhancing traffic safety. To make everyone's safety on the roads, automotive OEMs are devoted to creating and adopting innovative ADAS systems.

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | US$ 436.29 Bn |

| Market Size by 2030 | US$ 1789 Bn |

| CAGR | CAGR of 19.25 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Electric Vehicle, |

| • By Automotive Data Management, | |

| • By Locomotive Market, | |

| • By Electric Scooters, | |

| • By Automotive Electronics, | |

| • By Autonomous Cars, | |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargo Carriers, UPS, FedEx, Ceva Holdings, Tuma Transport, Swift Transport, Interlogix, Transtech Logistics Procet, Concargo and others. |

| Key Drivers | • The increase in global sales of vehicles and demand for the passenger vehicles in the rising economies. |

| Market Restraints | • The margins of automakers are under pressure as a result of recent increases in the price of raw materials and components. |