The Geofoam Market Size was valued at USD 764.9 million in 2023 and is expected to reach USD 1466.6 million by 2032 and grow at a CAGR of 7.5% over the forecast period 2024-2032.

Get more information on Geofoam Market - Request Sample Report

The Geofoam market is witnessing significant growth, driven by the increasing demand for lightweight construction materials that offer excellent insulation properties. This demand is supported by various market dynamics, including the rising need for sustainable building practices, advancements in construction technologies, and a growing focus on infrastructure development across the globe. The versatility of Geofoam makes it suitable for numerous applications, such as road and highway construction, lightweight fill in buildings, and insulation in various civil engineering projects. As urbanization accelerates, the requirement for innovative solutions that can effectively manage soil stability and weight distribution becomes critical, further propelling the market's expansion.

Recent developments highlight the ongoing innovation within the Geofoam sector. In July 2024, an initiative was reported that focuses on protecting EPS Geofoam blocks using EIA geomembranes, enhancing their durability and performance in various applications. This advancement demonstrates a commitment to improving the longevity and environmental resilience of Geofoam materials. Additionally, in November 2024, the Department of Public Works and Highways announced the use of Geofoam for flyover repairs, citing its lightweight properties and effectiveness in reducing soil pressure. This strategic decision underscores the growing recognition of Geofoam's benefits in infrastructure projects. In another instance, the Indiana Department of Transportation incorporated Geofoam to stabilize the soil around the IND-252 interchange in May 2021, showcasing the material's utility in addressing engineering challenges while optimizing resource efficiency. These developments reflect a trend towards adopting innovative materials that align with contemporary engineering needs and environmental considerations, emphasizing the Geofoam market's potential for growth and adaptation in various applications.

Market Dynamics:

Drivers:

Rising Demand for Lightweight Construction Materials in Infrastructure Projects Drives Geofoam Market Expansion

The increasing demand for lightweight materials in infrastructure projects is one of the key drivers propelling the growth of the Geofoam market. In modern construction, particularly in areas with limited space or challenging soil conditions, Geofoam's lightweight nature offers a practical solution. Its use in roadways, bridges, and tunnels helps reduce the weight load on soil, making it ideal for projects that require soil stability without the excessive weight of traditional fill materials. Additionally, Geofoam’s lightweight properties also contribute to lower transportation costs, making it a cost-effective choice for large-scale infrastructure projects. In urban construction, where land is scarce and engineering challenges are high, Geofoam is gaining preference due to its ability to handle soil stability and drainage issues efficiently. Moreover, in transportation and construction of underground structures like metro systems, Geofoam helps prevent soil compaction, reducing construction time and costs. As urbanization increases and infrastructure demands rise, Geofoam's ability to address these specific engineering challenges, combined with its cost-effectiveness and ease of use, makes it a material of choice in the construction industry. This growing demand for lighter, more efficient building materials is expected to significantly drive the expansion of the Geofoam market in the coming years.

Increased Focus on Sustainable and Eco-Friendly Building Materials Supports Geofoam Market Growth

Growing Urbanization and Infrastructure Development Globally Boosts Demand for Geofoam Solutions

The rapid pace of urbanization and infrastructure development worldwide is a major driver of the Geofoam market. As cities expand and populations increase, there is a growing need for innovative solutions to manage construction challenges in dense urban environments. Geofoam, due to its lightweight and easy-to-install properties, is well-suited for infrastructure projects in such areas. It helps reduce the overall weight on structures while providing effective insulation and stability, making it a preferred material for projects involving bridges, roads, and tunnels. Additionally, as urban transportation networks such as metro systems and flyovers expand, Geofoam is increasingly being used in these projects to manage soil stability and ensure the longevity of structures. Its use in flyovers, highways, and underpasses helps mitigate challenges such as soil compression, making it ideal for congested urban areas where traditional construction materials would be difficult or costly to implement. Moreover, in regions facing the challenges of high seismic activity or heavy rainfall, Geofoam’s ability to provide lightweight support and reduce the risk of soil movement makes it an essential material for infrastructure development. The ongoing urbanization trend, particularly in emerging economies, will continue to boost the demand for Geofoam as a solution for efficient, cost-effective, and sustainable construction.

Restraint:

High Initial Cost of Geofoam Production May Limit Its Adoption in Low-Budget Projects

Opportunity:

Expanding Use of Geofoam in Landscaping and Environmental Applications Presents New Market Potential

The expanding use of Geofoam in landscaping and environmental applications presents a significant opportunity for market growth. Geofoam’s lightweight and insulating properties make it an ideal material for creating sustainable and efficient landscapes in urban environments. As cities and municipalities continue to focus on sustainable development and creating green spaces, Geofoam offers a solution that addresses both soil stability and environmental concerns. For example, in land reclamation projects or coastal erosion prevention, Geofoam can be used to provide support while preventing soil erosion, thus helping to protect delicate ecosystems. Its use in parks, gardens, and urban spaces allows for the construction of aesthetically pleasing landscapes while reducing the weight and load on the ground, making it a valuable material for green infrastructure projects. Furthermore, its ability to stabilize soil and reduce the need for heavy fill materials positions Geofoam as a viable solution in environmental engineering, where soil stabilization and sustainable development are critical. The growing emphasis on eco-friendly and low-impact construction methods is expected to drive demand for Geofoam in landscaping and environmental applications, opening up new markets and providing long-term growth potential.

Increasing Application of Geofoam in the Renewable Energy Sector Offers Growth Opportunities

Development of Geofoam for Advanced Engineering Solutions in Seismic Zones Unlocks New Potential

Geofoam’s potential for use in seismic zones presents an exciting growth opportunity. In regions prone to earthquakes, Geofoam’s lightweight and compressible properties help reduce the seismic load on buildings and infrastructure, making it an ideal material for earthquake-resistant construction. Geofoam acts as a buffer, absorbing seismic forces and preventing soil displacement during earthquakes, which is crucial for maintaining the stability of structures. As seismic activity increases in certain regions, the demand for materials that can mitigate seismic risk will rise, and Geofoam is well-positioned to meet this need. The use of Geofoam in earthquake-resistant construction projects, such as in building foundations, roadways, and bridges, will continue to grow, particularly in high-risk areas like Japan, California, and parts of South America. This opportunity for Geofoam to be incorporated into seismic engineering solutions not only enhances the safety and resilience of buildings but also provides manufacturers with new avenues for growth in a niche but essential market.

Evolving Customer Demographics and Demand Trends in the Geofoam Market

The Geofoam market is experiencing dynamic shifts driven by diverse customer demographics and emerging demand patterns across industries. Key trends include increasing demand from urban infrastructure projects, growing adoption in environmentally conscious construction, and preferences for lightweight and efficient materials in challenging terrains.

|

Customer Demographic |

Demand Trend |

|

Urban Infrastructure Developers |

High demand for Geofoam in metropolitan areas to support smart city projects and reduce soil loads. |

|

Sustainable Construction Advocates |

Growing preference for eco-friendly Geofoam products to align with green building certifications. |

|

Contractors in Seismic Zones |

Increased use of Geofoam for earthquake-resistant structures, focusing on safety and durability. |

|

Cold Climate Infrastructure Projects |

Rising demand for Geofoam in regions with permafrost due to its excellent insulation properties. |

|

Road and Highway Engineers |

Strong adoption in road embankments and slope stabilization to address challenging soil conditions. |

Urban infrastructure developers are leveraging Geofoam for lightweight solutions in high-density areas. Sustainable construction advocates are aligning with green building standards, driving demand for environmentally friendly Geofoam. Contractors in seismic zones value its properties for mitigating earthquake risks. Infrastructure projects in cold climates benefit from its insulation qualities, especially in permafrost regions. Road and highway engineers are increasingly adopting Geofoam to address challenges like soil instability and load reduction. These trends indicate Geofoam’s versatility and growing importance across diverse applications.

By Type

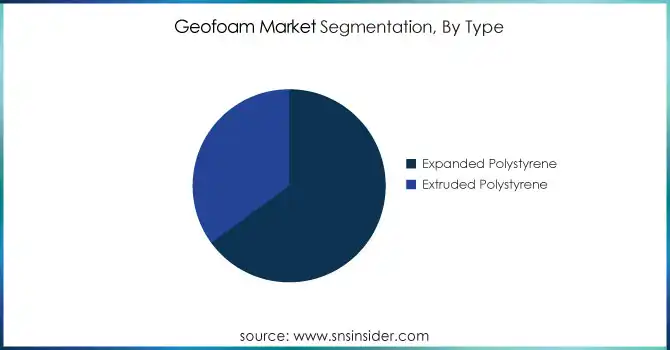

In 2023, the Expanded Polystyrene (EPS) segment dominated the Geofoam market with a market share of approximately 65%. EPS is favored in various construction applications due to its lightweight properties, excellent insulation capabilities, and cost-effectiveness. Its ability to reduce the load on soil makes it ideal for use in roadways, embankments, and structural foundations, where minimizing weight while providing stability is crucial. For instance, projects involving the construction of highways in areas with weak soil conditions often utilize EPS Geofoam to ensure soil stability without the added burden of heavy fill materials. Additionally, EPS's versatility and ease of installation further contribute to its popularity among contractors, solidifying its dominant position in the market.

By Application

In 2023, the Structure Foundation application segment dominated and accounted for the largest market share of about 40% in the Geofoam market. The need for stable and lightweight foundations in construction projects has made this segment particularly prominent. Geofoam is increasingly being used to stabilize foundations in both commercial and residential buildings, especially in regions with challenging soil conditions or seismic risks. For example, in urban areas where heavy fill materials can cause soil instability, Geofoam provides an effective solution by distributing weight evenly and minimizing settlement issues. Its application in structure foundations not only enhances the overall durability of buildings but also reduces construction time and costs, further driving its dominance in the market.

By End-Use

In 2023, the Building & Infrastructure end-use segment dominated the Geofoam market, capturing a market share of around 55%. This dominance is primarily driven by the rising need for sustainable construction materials and innovative solutions in the building sector. Geofoam is increasingly being integrated into various building applications, including foundations, wall systems, and roof insulation, due to its lightweight and insulating properties. For instance, in large-scale infrastructure projects such as bridges and tunnels, Geofoam is used to minimize the weight load on the underlying soil while providing excellent thermal insulation. As urbanization continues to rise globally, the demand for Geofoam in the building and infrastructure sector is expected to grow, further solidifying its leading position in the market.

Regional Analysis

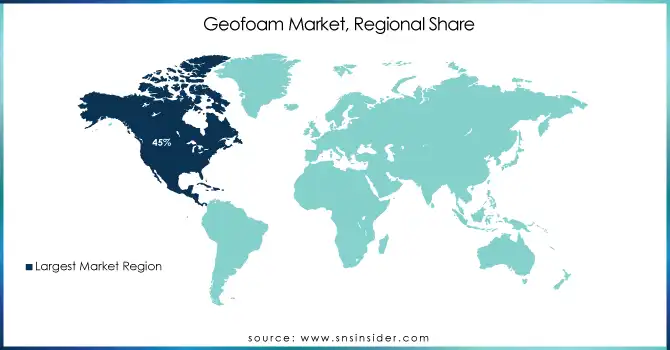

In 2023, North America dominated the Geofoam market with a market share of approximately 45%. The region’s dominance can be attributed to the substantial demand for Geofoam in infrastructure projects, particularly in the United States and Canada. The U.S. has witnessed increased utilization of Geofoam in road and highway construction due to its ability to improve stability in areas with challenging soil conditions. For example, in states prone to expansive soils, such as California and Texas, the use of Geofoam in embankments and roadways significantly reduces the risk of soil instability and settlement. Furthermore, the growing emphasis on sustainable construction materials in the region has contributed to the market's growth, as Geofoam offers both lightweight and eco-friendly alternatives to traditional fill materials. Canada also plays a pivotal role, where infrastructure projects like bridges and tunnels in regions with permafrost conditions benefit from Geofoam’s thermal insulation properties. The extensive application across various sectors, including building and infrastructure, along with government initiatives promoting sustainable construction, has further solidified North America’s leadership in the Geofoam market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the Geofoam market, with a CAGR of 9%. This growth is primarily driven by the rapid urbanization and industrialization taking place in countries like China, India, and Japan, where construction activities have surged in recent years. China, in particular, is seeing a significant increase in infrastructure projects such as highways, railways, and urban construction, where Geofoam’s lightweight and insulation properties are being leveraged to reduce the load on soil and improve construction efficiency. In India, the growing demand for sustainable construction materials in both urban and rural areas has led to an increasing adoption of Geofoam, particularly in roadways and foundation applications. Japan’s advanced construction industry also relies on Geofoam in seismic-sensitive areas, where it helps mitigate the risks of soil settlement and structural damage during earthquakes. As the demand for infrastructure development continues to rise in these countries, the Asia-Pacific region is expected to maintain its rapid growth trajectory in the Geofoam market, driven by its rising adoption in key end-use sectors like road and highway construction, building & infrastructure, and airport runway construction.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

In 2023, Atlas Molded Products announced plans to expand its production capacity at its facilities in the United States. This initiative is fueled by the growing demand for Geofoam products in various construction applications, such as road and highway construction, building foundations, and slope stabilization.

ACH Foam Technologies, LLC (Geofoam Blocks, Geofoam Insulation)

Amvic Building Systems (Amvic Geofoam, Amvic Insulation)

Beaver Plastics (Beaver Foam Blocks, Beaver Geofoam)

Big Sky Insulations, Inc. (Geofoam Insulation, Lightweight Fill)

Carlisle Construction Materials (Carlisle Geofoam, Foam Insulation)

Expol Ltd. (Expol Geofoam, Expol EPS Geofoam)

Groupe Legerlite Inc. (Legerlite Geofoam, Lightweight Fill)

Harbor Foam Inc. (Geofoam Blocks, Geofoam Insulation)

Insulation Corporation of America (Geofoam, Expanded Polystyrene Foam)

Kaimann GmbH (Kaimann Geofoam, Thermal Insulation Foam)

Knauf Insulation (Knauf Geofoam, Thermal Insulation Panels)

L'Isolante K-Flex S.p.A (K-Flex Geofoam, K-Flex Insulation)

LiteForm Technologies, Inc. (LiteForm Geofoam, EPS Geofoam Blocks)

Morgan Advanced Materials (Geofoam Insulation, Polystyrene Foam Blocks)

Owens Corning (Owens Corning Geofoam, Foam Insulation Panels)

Porex Corporation (Porex Geofoam, High-Density Foam)

R-TECH (R-TECH Geofoam, Insulated Foam Products)

Securock (Securock Geofoam, Cementitious Geofoam)

ThermaFoam, LLC (ThermaFoam Geofoam, EPS Geofoam)

UFP Technologies (UFP Geofoam, EPS Geofoam Solutions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 764.9 Million |

| Market Size by 2032 | US$ 1466.6 Million |

| CAGR | CAGR of 7.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Expanded Polystyrene, Extruded Polystyrene) •By Application (Structure Foundation, Embankments, Slope Stabilization, Insulation, Retaining Structures, Others) •By End-Use (Road & Highway Construction, Building & Infrastructure, Airport Runway & Taxiways, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ThermaFoam, LLC, ACH Foam Technologies, LLC, Harbor Foam Inc., Amvic Building Systems, Insulation Corporation of America, Big Sky Insulations, Inc., Carlisle Construction Materials,Beaver Plastics, Groupe Legerlite Inc., Expol Ltd. and other key players |

| Key Drivers | •Increased Focus on Sustainable and Eco-Friendly Building Materials Supports Geofoam Market Growth •Growing Urbanization and Infrastructure Development Globally Boosts Demand for Geofoam Solutions |

| RESTRAINTS | •High Initial Cost of Geofoam Production May Limit Its Adoption in Low-Budget Projects |

Ans: The Geofoam Market is expected to grow at a CAGR of 7.5%

Ans: The Geofoam Market Size was valued at USD 764.9 million in 2023 and is expected to reach USD 1466.6 million by 2032.

Ans: The growing use of Geofoam in landscaping, renewable energy, and seismic engineering offers significant growth opportunities through its lightweight, insulating, and sustainable properties.

Ans: The Geofoam market is hindered by its relatively low recognition and integration into traditional construction practices, where conventional materials remain the preferred choice for many professionals.

Ans: North America dominated the Geofoam market with an estimated 45% share, driven by high demand in infrastructure projects, sustainable construction, and its use in road construction and building foundations in the U.S. and Canada.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Geofoam Market Segmentation, by Type

7.1 Chapter Overview

7.2 Expanded Polystyrene

7.2.1 Expanded Polystyrene Market Trends Analysis (2020-2032)

7.2.2 Expanded Polystyrene Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Extruded Polystyrene

7.3.1 Extruded Polystyrene Market Trends Analysis (2020-2032)

7.3.2 Extruded Polystyrene Market Size Estimates and Forecasts to 2032 (USD Million)

8. Geofoam Market Segmentation, by Application

8.1 Chapter Overview

8.2 Structure Foundation

8.2.1 Structure Foundation Market Trends Analysis (2020-2032)

8.2.2 Structure Foundation Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Embankments

8.3.1 Embankments Market Trends Analysis (2020-2032)

8.3.2 Embankments Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Slope Stabilization

8.4.1 Slope Stabilization Market Trends Analysis (2020-2032)

8.4.2 Slope Stabilization Market Size Estimates and Forecasts to 2032 (USD Million)

8.5 Insulation

8.5.1 Insulation Market Trends Analysis (2020-2032)

8.5.2 Insulation Market Size Estimates and Forecasts to 2032 (USD Million)

8.6 Retaining Structures

8.6.1 Retaining Structures Market Trends Analysis (2020-2032)

8.6.2 Retaining Structures Market Size Estimates and Forecasts to 2032 (USD Million)

8.7 Others

8.7.1 Others Market Trends Analysis (2020-2032)

8.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

9. Geofoam Market Segmentation, by End-Use

9.1 Chapter Overview

9.2 Road & Highway Construction

9.2.1 Road & Highway Construction Market Trends Analysis (2020-2032)

9.2.2 Road & Highway Construction Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 Building & Infrastructure

9.3.1 Building & Infrastructure Market Trends Analysis (2020-2032)

9.3.2 Building & Infrastructure Market Size Estimates and Forecasts to 2032 (USD Million)

9.4 Airport Runway & Taxiways

9.4.1 Airport Runway & Taxiways Market Trends Analysis (2020-2032)

9.4.2 Airport Runway & Taxiways Market Size Estimates and Forecasts to 2032 (USD Million)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.2.3 North America Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.4 North America Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.5 North America Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.6 USA

10.2.6.1 USA Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.6.2 USA Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.6.3 USA Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.7 Canada

10.2.7.1 Canada Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.7.2 Canada Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.7.3 Canada Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.2.8 Mexico

10.2.8.1 Mexico Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.2.8.2 Mexico Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.2.8.3 Mexico Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.1.3 Eastern Europe Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.4 Eastern Europe Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.5 Eastern Europe Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.6 Poland

10.3.1.6.1 Poland Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.6.2 Poland Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.6.3 Poland Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.7 Romania

10.3.1.7.1 Romania Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.7.2 Romania Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.7.3 Romania Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.8.2 Hungary Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.8.3 Hungary Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.9.2 Turkey Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.9.3 Turkey Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.1.10.2 Rest of Eastern Europe Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.1.10.3 Rest of Eastern Europe Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.3.2.3 Western Europe Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.4 Western Europe Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.5 Western Europe Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.6 Germany

10.3.2.6.1 Germany Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.6.2 Germany Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.6.3 Germany Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.7 France

10.3.2.7.1 France Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.7.2 France Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.7.3 France Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.8 UK

10.3.2.8.1 UK Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.8.2 UK Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.8.3 UK Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.9 Italy

10.3.2.9.1 Italy Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.9.2 Italy Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.9.3 Italy Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.10 Spain

10.3.2.10.1 Spain Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.10.2 Spain Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.10.3 Spain Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.11.2 Netherlands Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.11.3 Netherlands Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.12.2 Switzerland Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.12.3 Switzerland Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.13 Austria

10.3.2.13.1 Austria Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.13.2 Austria Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.13.3 Austria Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.3.2.14.2 Rest of Western Europe Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.3.2.14.3 Rest of Western Europe Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.4.3 Asia Pacific Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.4 Asia Pacific Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.5 Asia Pacific Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.6 China

10.4.6.1 China Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.6.2 China Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.6.3 China Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.7 India

10.4.7.1 India Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.7.2 India Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.7.3 India Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.8 Japan

10.4.8.1 Japan Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.8.2 Japan Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.8.3 Japan Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.9 South Korea

10.4.9.1 South Korea Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.9.2 South Korea Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.9.3 South Korea Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.10 Vietnam

10.4.10.1 Vietnam Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.10.2 Vietnam Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.10.3 Vietnam Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.11 Singapore

10.4.11.1 Singapore Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.11.2 Singapore Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.11.3 Singapore Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.12 Australia

10.4.12.1 Australia Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.12.2 Australia Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.12.3 Australia Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.4.13.2 Rest of Asia Pacific Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.4.13.3 Rest of Asia Pacific Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.1.3 Middle East Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.4 Middle East Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.5 Middle East Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.6 UAE

10.5.1.6.1 UAE Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.6.2 UAE Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.6.3 UAE Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.7.2 Egypt Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.7.3 Egypt Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.8.2 Saudi Arabia Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.8.3 Saudi Arabia Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.9.2 Qatar Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.9.3 Qatar Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.1.10.2 Rest of Middle East Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.1.10.3 Rest of Middle East Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.5.2.3 Africa Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.4 Africa Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.5 Africa Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.6.2 South Africa Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.6.3 South Africa Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.7.2 Nigeria Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.7.3 Nigeria Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.5.2.8.2 Rest of Africa Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.5.2.8.3 Rest of Africa Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Geofoam Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

10.6.3 Latin America Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.4 Latin America Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.5 Latin America Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.6 Brazil

10.6.6.1 Brazil Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.6.2 Brazil Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.6.3 Brazil Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.7 Argentina

10.6.7.1 Argentina Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.7.2 Argentina Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.7.3 Argentina Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.8 Colombia

10.6.8.1 Colombia Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.8.2 Colombia Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.8.3 Colombia Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Geofoam Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

10.6.9.2 Rest of Latin America Geofoam Market Estimates and Forecasts, by Application (2020-2032) (USD Million)

10.6.9.3 Rest of Latin America Geofoam Market Estimates and Forecasts, by End-Use (2020-2032) (USD Million)

11. Company Profiles

11.1 ThermaFoam, LLC

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 ACH Foam Technologies, LLC

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Harbor Foam Inc.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Amvic Building Systems

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Insulation Corporation of America

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Big Sky Insulations, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Carlisle Construction Materials

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Beaver Plastics

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Groupe Legerlite Inc.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Expol Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Expanded Polystyrene

Extruded Polystyrene

By Application

Structure Foundation

Embankments

Slope Stabilization

Insulation

Retaining Structures

Others

By End-Use

Road & Highway Construction

Building & Infrastructure

Airport Runway & Taxiways

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Acrylonitrile Market size was USD 12.46 Billion in 2023 and is expected to reach USD 17.04 Billion by 2032, growing at a CAGR of 3.54% from 2024 to 2032.

The Cast Elastomer Market Size was valued at USD 1.3 billion in 2023 and is expected to reach USD 2.0 billion by 2032 and grow at a CAGR of 6.0% by 2024-2032.

Thermoplastic Polyurethane Adhesive Market Size is expected to reach USD 2.43 Billion by 2032, growing at a CAGR of 7.07% from 2024 to 2032.

The CNG, RNG, and Hydrogen Tanks Market Size was USD 2.6 billion in 2023 & is expected to reach USD 6.6 Bn by 2032 & grow at a CAGR of 10.6% by 2024-2032.

The Bio-Based Leather Market Size was valued at USD 110 million in 2023. It is projected to reach USD 380.9 million by 2032 and grow at a CAGR of 14.8% over the forecast period 2024-2032.

The Conformal Coatings Market size was valued at USD 1.02 billion in 2023. It is expected to grow to USD 1.68 billion by 2032 and grow at a CAGR of 5.70% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone