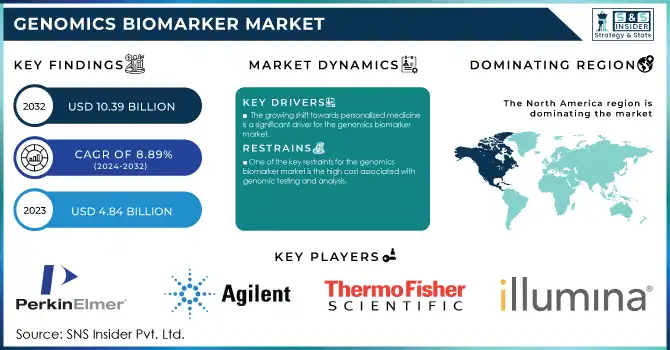

Genomics Biomarker Market Size & Overview:

The Genomics Biomarker Market was valued at USD 4.84 billion in 2023 and is expected to reach USD 10.39 billion by 2032, growing at a CAGR of 8.89% from 2024-2032.

To get more information on Genomics Biomarker Market - Request Free Sample Report

The genomics biomarker market has witnessed significant advancements over the past decade, driven by technological innovations in genomics, the rising prevalence of chronic diseases, and increasing demand for personalized medicine. Genomics biomarkers, which include predictive, diagnostic, and prognostic markers, are revolutionizing the healthcare landscape by enabling early disease detection, improving treatment efficacy, and offering personalized therapeutic approaches. The increasing integration of genomic biomarkers into drug development processes and clinical diagnostics is fueling market growth.

Key advancements in genomic technologies, such as Next-Generation Sequencing (NGS), polymerase chain reaction (PCR), and mass spectrometry, have made genomic biomarker analysis faster, more affordable, and more precise. NGS, in particular, is gaining traction due to its high-throughput capabilities and ability to analyze vast amounts of genetic data. For instance, NGS is widely used in oncology to identify genetic mutations, predict disease progression, and identify potential therapeutic targets.

The oncology application is leading the genomics biomarker market, as genetic profiling plays a crucial role in the development of targeted therapies for various cancers. Increasing research and clinical trials in cancer genomics have contributed to rapid market expansion. For example, companies like Illumina and Thermo Fisher Scientific have recently launched cutting-edge platforms for cancer genomics, including companion diagnostics that help identify mutations and predict treatment responses.

Moreover, the rising adoption of genomics biomarkers for other therapeutic areas, including cardiology, neurology, and infectious diseases, further supports the market's growth trajectory. Academic research institutions, pharmaceutical companies, and diagnostic laboratories are at the forefront of driving innovations in genomics biomarker applications, pushing the boundaries of genetic research and clinical diagnostics.

Recent collaborations and partnerships, such as those between Thermo Fisher Scientific and the National Cancer Institute, are accelerating the integration of genomics biomarkers into precision medicine and clinical trials, signaling a promising future for the market.

Genomics Biomarker Market Dynamics

Drivers

-

The growing shift towards personalized medicine is a significant driver for the genomics biomarker market.

Personalized medicine involves tailoring medical treatment to individual genetic profiles, making the identification of specific biomarkers crucial. As healthcare providers and pharmaceutical companies focus on creating more targeted therapies, the demand for genomic biomarkers has escalated. These biomarkers help in identifying genetic mutations, predicting disease progression, and assessing the effectiveness of treatments, which improves patient outcomes and minimizes adverse effects. Personalized treatments are particularly prominent in oncology, where genomic biomarkers play a critical role in identifying mutations that drive cancer progression, enabling targeted therapies.

-

Continuous improvements in genomic technologies, such as Next-Generation Sequencing (NGS), polymerase chain reaction (PCR), and mass spectrometry, are driving the growth of the genomics biomarker market.

These technologies enable faster, more accurate, and cost-effective analysis of genetic material, making genomic biomarker identification and profiling more accessible. NGS, for example, allows the analysis of large datasets from whole genomes or specific genes, significantly improving the discovery of biomarkers for various diseases. With decreasing costs and increasing accuracy, these technologies are becoming widely adopted in clinical diagnostics and drug development, thus accelerating the growth of the genomics biomarker market.

Restraint

-

One of the key restraints for the genomics biomarker market is the high cost associated with genomic testing and analysis.

While advances in technology have made genomic sequencing more efficient, the expenses related to testing, data analysis, and interpretation remain significant. The cost of specialized equipment, laboratory infrastructure, and skilled professionals necessary for genomic biomarker research and clinical application can be a barrier, particularly in low-resource settings. Additionally, the complexity of genomic data analysis requires advanced bioinformatics tools and platforms, further driving up the overall cost. This high cost limits the widespread adoption of genomic biomarkers, especially in developing regions, and may restrict the pace of market growth.

Genomics Biomarker Market Segmentation Insights

By Technology

Polymerase Chain Reaction (PCR) segment dominated the market with 38% of market share in 2023. It has been a cornerstone of genomic biomarker analysis for several decades. It remains the dominating technology due to its remarkable precision, cost-effectiveness, and reliability in diagnostic applications. PCR enables the amplification of minute quantities of DNA, making it highly useful in a variety of genomic applications such as gene detection, mutation analysis, and pathogen identification. The technology has widespread clinical adoption, especially in areas such as oncology and infectious diseases, where it helps in the early detection and monitoring of genetic alterations. PCR’s long-standing role in clinical diagnostics and its relatively low operational cost make it a preferred choice in many healthcare settings.

Next-Generation Sequencing (NGS) segment is rapidly emerging as the fastest-growing technology in the genomics biomarker market and is expected to grow with the fastest CAGR throughout the forecast period. NGS allows high-throughput sequencing of genomes, enabling the analysis of large volumes of genomic data quickly and accurately. This technology provides a comprehensive view of genetic information, making it indispensable in clinical applications such as oncology, rare genetic disorders, and personalized medicine. NGS's ability to detect mutations, gene expression patterns, and epigenetic changes at a deep level supports its widespread use in research and diagnostics. Additionally, its falling costs and rapid advancements in sequencing technologies are contributing to its increasing adoption across both academic and clinical research environments. The growing focus on personalized medicine, particularly in oncology where precision treatments are essential, is further driving the adoption of NGS.

By Application

Oncology segment dominated the genomic biomarkers market with 35% of market share in 2023 due to the high prevalence of cancer worldwide and the increasing adoption of genomic biomarkers for early diagnosis, prognosis, and therapy selection. Cancer is one of the leading causes of death globally, and genomic biomarkers play a crucial role in detecting genetic mutations that drive cancer development, thus aiding in the identification of targeted therapies and personalized treatment plans. Genomic profiling in oncology also enables the detection of cancer at an early stage, improving patient outcomes by allowing for early intervention. Furthermore, with the advancement of immunotherapy and precision medicine, genomic biomarkers have become even more essential in tailoring individualized treatment regimens. This has solidified oncology as the dominant application for genomic biomarker use.

Rare Genetic Disorders segment expected to show the fastest growth throughout the forecast period. Rare diseases often result from genetic mutations that can be difficult to diagnose, making genomic biomarkers essential tools for identifying these conditions. Advances in genomic sequencing and diagnostic technologies have made it increasingly feasible to pinpoint the genetic basis of rare diseases. With the growing focus on genetic screening and the development of targeted therapies, the demand for genomic biomarkers in the diagnosis and treatment of rare genetic disorders has surged. The increasing number of research programs and the availability of gene therapies for certain rare diseases are propelling this segment's growth. The rapid advancements in gene editing technologies such as CRISPR are also enhancing the speed and accuracy of genetic research, further driving growth in the rare genetic disorders segment.

By End User

Pharmaceutical and biotechnology companies segment dominate the genomics biomarker market with 46% of market share, as they are the primary users of genomic biomarkers in drug discovery, clinical trials, and personalized medicine development. These companies extensively utilize genomic biomarkers to identify potential therapeutic targets, develop companion diagnostics, and optimize clinical trial designs. The ability to utilize biomarkers to predict patient response to treatments allows for the development of more effective and safer drugs, particularly in oncology, cardiovascular diseases, and genetic disorders. Additionally, pharmaceutical and biotech companies are heavily involved in the commercialization of genomic biomarker-based tests, which further strengthens their position as the dominant end-user in the market.

Academic and research institutions segment are the fastest-growing end-users of genomic biomarkers. The growing focus on genomics research, fueled by government funding and institutional investments, is driving this segment’s rapid expansion. These institutions conduct cutting-edge research to understand the genetic underpinnings of diseases, discover new biomarkers, and develop innovative diagnostic and therapeutic solutions. The increase in genomic research projects, particularly in areas like personalized medicine and gene therapy, is accelerating demand for genomic biomarkers. Moreover, academic institutions are integral to the development and validation of new biomarker-based diagnostic tools, contributing to the fast-paced growth of the segment. The increasing collaboration between academia and the pharmaceutical industry also plays a role in boosting the utilization of genomic biomarkers in research settings.

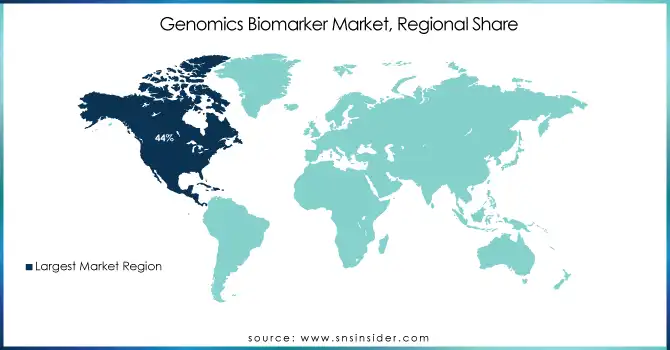

Genomics Biomarker Market Regional Analysis

In 2023, North America dominated the market with 44% of the market share and is expected to maintain its dominance due to the increasing adoption of genomic biomarkers for early disease diagnosis and the expanding number of healthcare and life science research initiatives in the region. Additionally, factors such as rising regulatory approvals from the Food and Drug Administration (FDA), favorable reimbursement and biomarker usage policies, and growing strategic partnerships among market players are contributing to the region's robust market growth.

The Asia Pacific region is anticipated to experience the fastest growth with 10.31% CAGR throughout the forecast period. The expansion of healthcare infrastructure and the presence of advanced research laboratories in countries such as China, India, and Japan are creating significant opportunities for market growth, driving increased demand for genomic biomarkers. Advancements in genomic research, driven by government initiatives and funding, have enhanced the capabilities of genomic medicine in this region. The increases in awareness levels regarding healthcare and the increasing affordability of genetic testing are making these biomarkers more accessible, which further boosts market growth. In addition, growing attention paid to personalized medicine and precision healthcare is further boosting the adoption of genomic biomarkers, especially in countries like China, Japan, and India.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Genomics Biomarker Market

-

Illumina, Inc. (BaseSpace Sequence Hub, TruSeq Genomic Library Prep Kits)

-

Thermo Fisher Scientific, Inc. (Ion AmpliSeq Panels, Oncomine Solutions)

-

QIAGEN N.V. (GeneGlobe Design & Analysis Hub, QIAseq Targeted DNA Panels

-

F. Hoffmann-La Roche Ltd. (AVENIO Tumor Tissue Analysis Kits, Cobas EGFR Mutation Test)

-

Agilent Technologies, Inc. (SureSelect Target Enrichment, GenetiSure Cytogenomics Arrays)

-

PerkinElmer, Inc. (NEXTFLEX DNA Sequencing Kits, Signals Genomics Insights Platform)

-

Bio-Rad Laboratories, Inc. (Droplet Digital PCR System, QX200 AutoDG Droplet Generator)

-

Pacific Biosciences of California, Inc. (Sequel IIe System, SMRTbell Express Template Prep Kit)

-

Oxford Nanopore Technologies (MinION Sequencer, Epi2Me Cloud Analysis Platform)

-

Becton, Dickinson, and Company (BD Biosciences) (FACSDiva Software, BD Rhapsody Single-Cell Analysis System)

-

10x Genomics, Inc. (Chromium Single Cell Gene Expression Kits, Visium Spatial Gene Expression Platform)

-

Genomic Health, Inc. (Oncotype DX Genomic Tests, Oncotype DX Breast Recurrence Score)

-

Myriad Genetics, Inc. (myRisk Hereditary Cancer Test, EndoPredict Breast Cancer Test)

-

Foundation Medicine, Inc. (FoundationOne CDx, FoundationOne Liquid CDx)

-

Guardant Health, Inc. (Guardant360, Guardant Reveal)

-

NeoGenomics Laboratories, Inc. (RaDaR Assay for MRD, Fusion Detection Panels)

-

Invitae Corporation (Invitae Cancer Screen, Invitae Genetic Health Screen

-

BioMérieux S.A. (BioFire FilmArray Panels, VIDAS Biomarker Tests

-

Sysmex Corporation (Plasma-Safe-SeqS Technology, OncoBEAM Liquid Biopsy Tests)

-

GRAIL, Inc. (Galleri Multi-Cancer Early Detection Test, cfDNA Analysis Tools for Biomarker Discovery

Key suppliers

-

Thermo Fisher Scientific, Inc.

-

Illumina, Inc.

-

QIAGEN N.V.

-

Agilent Technologies, Inc.

-

F. Hoffmann-La Roche Ltd.

-

Bio-Rad Laboratories, Inc.

-

PerkinElmer, Inc.

-

Pacific Biosciences of California, Inc.

-

Oxford Nanopore Technologies

-

10x Genomics, Inc.

Recent Developments

-

Aug 2024 – Illumina, Inc., a global leader in DNA sequencing and array-based technologies, announced that the U.S. Food and Drug Administration (FDA) has approved its in vitro diagnostic (IVD) TruSight™ Oncology (TSO) Comprehensive test. The test also received approval for its first two companion diagnostic (CDx) indications. Designed to analyze over 500 genes, the TSO Comprehensive test profiles solid tumors, increasing the likelihood of identifying immuno-oncology biomarkers or clinically actionable biomarkers. This enables targeted therapy options or enrollment in clinical trials, significantly advancing personalized medicine in oncology.

-

July 2024 – Thermo Fisher Scientific Inc., the global leader in scientific services, announced a collaboration with the National Cancer Institute (NCI) under the myeloMATCH precision medicine umbrella trial. Focused on Acute Myeloid Leukemia (AML) and Myelodysplastic Syndrome (MDS), the initiative leverages Thermo Fisher’s next-generation sequencing (NGS) technology to analyze patients’ bone marrow and blood for genetic biomarkers. This approach accelerates patient matching with clinical trials targeting specific mutations, streamlining the development of targeted therapies for these conditions.

-

Jan 2024 – QIAGEN Digital Insights (QDI), the bioinformatics division of QIAGEN, unveiled advancements to its QIAGEN CLC Genomics Workbench Premium software, now featuring LightSpeed technology. This enhanced platform supports next-generation sequencing (NGS) for somatic cancer secondary analysis, enabling rapid and cost-effective conversion of raw sequencing data (FASTQ files) into interpretable genetic variant lists (VCF files). The innovation offers unprecedented speed and affordability, marking a significant leap forward in cancer genomics research and clinical applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.84 billion |

| Market Size by 2032 | US$ 10.39 billion |

| CAGR | CAGR of 8.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Biomarker Type (Predictive Biomarkers, Prognostic Biomarkers, Diagnostic Biomarkers, Therapeutic Biomarkers, Monitoring Biomarkers, Susceptibility/Risk Biomarkers) •By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Microarrays, Mass Spectrometry, Genomic Hybridization, Other Technologies) •By Application (Oncology, Cardiology, Neurology, Infectious Diseases, Rare Genetic Disorders, Other Applications) •By End-user (Pharmaceutical & Biotechnology Companies, Academic & Research Institutions, Hospitals & Diagnostic Laboratories, Contract Research Organizations (CROs), Other End Users) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, Thermo Fisher Scientific, QIAGEN, F. Hoffmann-La Roche, Agilent Technologies, PerkinElmer, Bio-Rad Laboratories, Pacific Biosciences of California, Oxford Nanopore Technologies, Becton, Dickinson, and Company, 10x Genomics, Genomic Health, Myriad Genetics, Foundation Medicine, Guardant Health, NeoGenomics Laboratories, Invitae Corporation, BioMérieux, Sysmex Corporation, GRAIL, Inc., and other players. |

| Key Drivers | •The growing shift towards personalized medicine is a significant driver for the genomics biomarker market. •Continuous improvements in genomic technologies, such as Next-Generation Sequencing (NGS), polymerase chain reaction (PCR), and mass spectrometry, are driving the growth of the genomics biomarker market. |

| Restraints | •One of the key restraints for the genomics biomarker market is the high cost associated with genomic testing and analysis. |