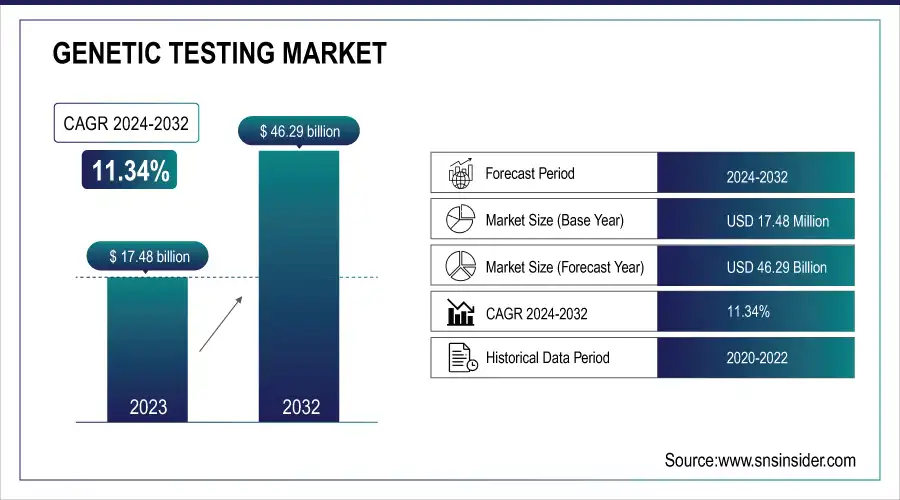

Genetic Testing Market Size & Overview:

The Genetic Testing Market Size, valued at USD 17.48 billion in 2023, is expected to grow to USD 46.29 billion by 2032, with a CAGR of 11.34% during the forecast period 2024-2032.

To Get more information on Genetic Testing Market - Request Free Sample Report

The report provides insights into the Genetic Testing Market, based on test volume and adoption rates for various regions and applications. It emphasizes regional utilization patterns, making a distinction between direct-to-consumer (DTC) and clinical genetic testing. The report also delves into the emerging role of Next-Generation Sequencing (NGS), PCR-based testing, and polygenic risk scoring (PRS) in genetic diagnostics. A breakdown of health expenditure by government, commercial, private, and out-of-pocket sources provides a fiscal overview of market accessibility. Through examination of technology adoption trends between 2020 and 2032, the report provides an integrated picture of innovation, affordability, and market penetration of genetic testing.

Genetic Testing Market Dynamics

Drivers

-

Rising Prevalence of Genetic Disorders and Cancer Driving Demand for Genetic Testing

The rising incidence of genetic disorders and cancer is a key driver for the genetic testing industry. The World Health Organization (WHO) states that around 10 million deaths in 2023 were caused by cancer, with genetic mutations contributing significantly to disease onset. Further, the CDC estimates that more than 6,000 known genetic disorders afflict millions of people worldwide, making early screening and diagnosis imperative. This epidemic of disease burden has resulted in a high uptake of genetic testing for early identification and targeted treatment strategies. Recent advances, including the release of Precise MRD by Myriad Genetics for minimal residual disease detection and Illumina's collaborative endeavors in extensive genomic profiling for oncology, further accentuate the increased role of genetic testing in precision medicine.

-

Technological Advancements Enhancing Accuracy and Accessibility of Genetic Testing

Ongoing innovations in genetic testing technologies, including Next-Generation Sequencing (NGS), CRISPR-based tests, and Artificial Intelligence (AI) analytics, are increasingly enhancing the accuracy, efficiency, and affordability of tests. NGS-based tests have transformed screening through quick whole-genome sequencing with reduced expenditures. As per market reports, the price of sequencing a human genome has declined from USD 10,000 in 2011 to under USD 600 in 2023, making genetic testing more viable. Firms such as 23andMe and Invitae are using AI and big data to create predictive genetic risk reports, continuing to fuel market growth. Lastly, recent FDA clearances of expanded carrier screening tests and Natera's progress in non-invasive prenatal testing (NIPT) demonstrate continued momentum to improve genetic diagnostics and patient outcomes.

Restraint

-

High Cost of Genetic Testing and Limited Insurance Coverage Hindering Adoption in some regions.

Even with technological progress reducing the cost of sequencing, genetic testing is still costly, especially for whole-genome sequencing and full panels. Genetic tests cost between USD100 and more than USD 5,000, depending on the analysis type and complexity. While some insurers cover certain tests, most advanced genetic screenings, direct-to-consumer tests, and personalized genomic testing are not covered or come with high out-of-pocket costs. Restrictive reimbursement policies in some countries, especially for elective and predictive genetic testing, further limit access. In addition, uneven healthcare funding and insurance structures among regions impose economic barriers on patients. This is especially true in emerging markets, where affordability challenges still hinder the broad use of genetic testing services.

Opportunities

-

The growing integration of genetic testing in personalized medicine presents a significant opportunity for market expansion.

As genomics advances, physicians are using genetic profiling to individualize treatment for cancer, orphan diseases, and chronic disorders more and more. Pharmacogenomics, used to predict how an individual responds to drugs, is picking up pace, enabling better and more precise therapies. In addition, regulatory bodies like the FDA and EMA are embracing companion diagnostics based on genetic testing for treatment decision-making. Growth driven by direct-to-consumer (DTC) genetic tests and telemedicine-based genetic counseling is further fueling the market's growth, facilitating greater accessibility and patient involvement in active healthcare management. Technologies like CRISPR and AI-based genomic analysis are improving test precision and efficiency, further stimulating adoption. Consequently, genetic testing is being used as a key tool in preventive medicine with early detection of disease and better patient outcomes.

Challenges

-

One of the major challenges in the genetic testing market is ethical concerns and data privacy issues related to genetic information storage and usage.

Because genetic information is so sensitive, there are increasing fears about abuse by insurers, employers, and third-party organizations. Most people are afraid of genetic discrimination, and thus, they are hesitant to go for genetic screening. Moreover, the possibility of cyberattacks on genetic databases also questions the safety of patient data. Even though laws like HIPAA (U.S.), GDPR (Europe), and GINA (Genetic Information Nondiscrimination Act) try to safeguard genetic information, enforcement is complicated. The absence of international standardization in genetic data regulation also makes compliance challenging, and it is hard for firms to conduct business in several regions. Additionally, issues of consent and ownership of genetic data raise ethical concerns, especially in large-scale biobanking and collaborative research. These challenges will need to be addressed through strict policies, increased transparency, and public education campaigns to establish consumer confidence.

Genetic Testing Market Segmentation Insights

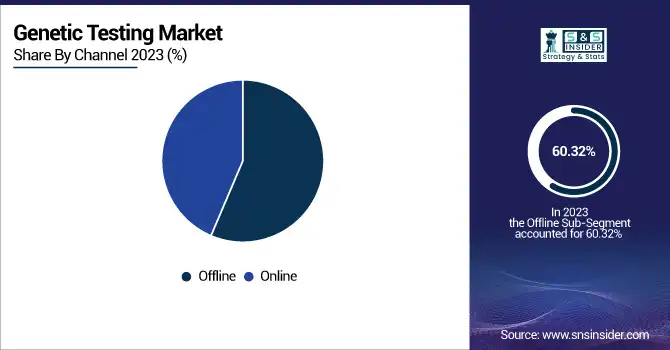

By Channel

The Offline segment dominated the genetic testing market with 60.32% market share in 2023, mainly due to the well-established presence of hospitals, diagnostic labs, and specialized genetic testing facilities. Genetic tests, especially prenatal screening, hereditary disease detection, and oncology diagnosis, mostly need on-site sample collection, medical observation, and laboratory processing. Moreover, the inclination towards conventional healthcare facilities guarantees precision, professional advice, and compliance with regulation, which keeps offline channels at the top as the first preference for intricate and high-risk genetic testing. Brick-and-mortar genetic testing centers are also preferred by most healthcare professionals and payers, supporting their market supremacy. Offline diagnostic services' high reliability and credibility continue to sustain their robust market dominance.

Online business is anticipated to develop at the fastest rate with 12.07% CAGR during the forecast years, fueled by the growing availability and convenience of DTC genetic testing services. Ancestry testing companies, health risk assessment companies, and companies delivering personalized wellness information have developed much traction through websites and e-commerce sites. Improvements in home testing kits, coupled with the convenience of purchasing genetic tests online and getting results via secure digital platforms, are driving this growth. Additionally, the increased use of telehealth and online genetic counseling services further increases the attractiveness of online channels. With growing consumer awareness and regulations changing to favor DTC genetic testing, the online segment is poised to witness high growth in the genetic testing market.

By Technology

The Next-Generation Sequencing (NGS) segment dominated the genetic testing market with a 49.15% market share in 2023, attributed to its unmatched capability to deliver high-throughput, precise, and affordable genetic analysis. NGS facilitates extensive testing across a multitude of applications, such as cancer diagnosis, hereditary disease testing, and pharmacogenomics, making it the technology of choice for clinical and research applications. The rising use of whole-genome and whole-exome sequencing has dramatically enhanced disease risk evaluation and targeted therapy options. Additionally, innovations like Illumina's NovaSeq X series and Thermo Fisher Scientific's Ion Torrent platform have made sequencing faster and more efficient, further cementing NGS as the standard of the industry. Increased demand for non-invasive prenatal testing (NIPT) and increased carrier screening have also fueled the segment's leadership in 2023.

By Application

The Health and Wellness – Predisposition/Risk/Tendency segment dominated the genetic testing market with a 51.23% market share in 2023, as consumer interest in active management of health and customized wellness plans grew. Tests under this category assist individuals in evaluating their risk of developing conditions like cardiovascular diseases, diabetes, neurodegenerative disorders, and metabolic diseases, allowing them to make the right lifestyle and healthcare choices. Increasing consumer acceptance of direct-to-consumer (DTC) genetic testing from companies such as 23andMe, AncestryDNA, and MyHeritage has driven segmental growth. Improvements in polygenic risk scores (PRS) and whole genome sequencing (WGS) have further boosted the predictability of the tests, providing increased accuracy and, thus, reliability to customers who seek to assess early risks and personalize preventive care.

The Genetic Disease Carrier Status segment is anticipated to grow at the fastest rate in the forecast period, led by growing awareness about inherited disorders and family planning. Carrier screening aids in identifying the risk of individuals transmitting genetic diseases like cystic fibrosis, sickle cell anemia, Tay-Sachs disease, and fragile X syndrome to their children. The need for expanded carrier screening (ECS) has increased, aided by guidelines from medical societies such as the American College of Obstetricians and Gynecologists (ACOG). Advances in next-generation sequencing (NGS) have reduced the cost and broadened the scope of carrier testing, making it more accessible globally. Moreover, the increasing use of preconception genetic screening and the expanding number of reproductive genetic counseling services are also driving the expansion of this segment.

By Product

The Consumables segment dominated the market and accounted for 58.21% of the genetic testing market share in 2023 due to the great demand for the reagents, kits, and assay consumables involved in genetic testing processes. These consumables are necessary for carrying out tests on different platforms, such as next-generation sequencing (NGS), polymerase chain reaction (PCR), and microarrays. The growing use of genetic testing processes in research and clinical applications, as well as the proliferation of genomic research studies, has resulted in the constant restocking of consumables, guaranteeing consistent market expansion. Moreover, the growth of newborn screening, prenatal testing, and cancer genetic testing has dramatically increased the demand for test kits and reagents. The repeated pattern of consumables sales makes this segment an important revenue earner for firms in the genetic testing sector.

The Software & Services segment is expected to register the fastest growth with 12.41% CAGR in the forecast period, driven by advances in bioinformatics, data analytics, and AI-based genetic interpretation solutions. With the increasing complexity and prevalence of genetic testing, there is a rising demand for advanced software solutions to interpret large volumes of genomic data quickly. The convergence of cloud-based storage of genetic data, artificial intelligence-driven variant interpretation, and personalized medicine platforms is driving the demand for advanced genetic testing services. The growing uptake of genetic counseling services, especially in oncology, reproductive health, and rare diseases, is also fuelling the growth of the segment. The move to precision medicine and real-time insights from genetics will fuel investment in software solutions as the most rapid-growing category for the genetic test market.

By End Use

The Hospitals & Clinics segment dominated the genetic testing market with 42.13% market share in 2023 because of the pivotal role played by healthcare facilities in providing precise, high-quality genetic testing. Hospitals and clinics offer an extensive infrastructure, sophisticated laboratory equipment, and specialized healthcare experts, ensuring accurate testing for diseases like hereditary diseases, oncology diagnosis, and prenatal tests. Moreover, genetic counseling services frequently exist within hospital settings, thereby permitting professional testing result interpretation as well as tailoring of care to the patient. Hospital and clinic dominance is further supported through insurance reimbursement as well as funding by the government, which discourages patients from receiving genetic tests through independent facilities or direct-to-consumer technology.

The Diagnostic Laboratories business is likely to experience the fastest growth over the forecast years, with growth fueled by advances in genomic sequencing technologies, automation, and cost-effective testing solutions. The labs are high-throughput genetic testing specialists serving healthcare providers as well as direct-to-consumer (DTC) testing firms. Growing usage of liquid biopsy, pharmacogenomic testing, and personalized medicine is driving demand for specialized laboratory services. Furthermore, the increasing trend of outsourcing genetic tests to reference laboratories from cost and infrastructure limitations in hospitals is also driving the growth of this segment even faster. With genetic testing increasingly being made available and part of regular healthcare practice, diagnostic labs are poised to grow rapidly with faster turnaround time and larger test menus at competitive rates.

Genetic Testing Market Regional Analysis

North America dominated the genetic testing market with a 43.25% market share in 2023 due to sophisticated healthcare infrastructure, high rates of adoption of precision medicine, and robust regulatory support. The U.S. has the highest share, followed by major players like Illumina, Quest Diagnostics, and Myriad Genetics, which are constantly developing genetic testing solutions. Government programs, including the All of Us Research Program and genomic research funding, incrementally augmenting, contribute to market growth even further. Furthermore, the spread of awareness, insurance coverage for genetic testing, and occurrence rates of genetic diseases like cancer and rare diseases are among the factors adding to increased demand. The area is also facilitated by the swift adoption of direct-to-consumer (DTC) genetic tests, with firms like 23andMe providing genetic information directly to individuals, accelerating market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

The Asia Pacific region is experiencing the fastest growth in the genetic testing market, with a 13.51% CAGR throughout the forecast period, driven by the rise in healthcare spending, heightened awareness about genetic disorders, and developing infrastructure. Nations like China, Japan, India, and South Korea are seeing tremendous demand rise in light of expanding precision medicine efforts and genomics programs spearheaded by the governments, like China's 100,000 Genomes Project and India's IndiGen Genome Project. The cost of genetic testing is becoming more affordable, with local players providing economical solutions specific to regional populations. High birth rates and increasing anxiety regarding hereditary diseases also fuel the adoption of prenatal and newborn screening. The growing presence of international genetic testing firms, strategic partnerships, and AI-based genomic data analysis are fueling market penetration, making the Asia Pacific a growth hub for the future.

Some of the major key players in the Genetic Testing Market

-

Illumina, Inc. (Verifi Prenatal Test, TruSight NIPT Solution)

-

23andMe, Inc. (Health + Ancestry Service, Carrier Status Reports)

-

Myriad Genetics, Inc. (myRisk Hereditary Cancer Test, GeneSight Psychotropic Test)

-

Invitae Corporation (Comprehensive Carrier Screening, Cancer Screen)

-

Natera, Inc. (Panorama Non-Invasive Prenatal Test, Signature Residual Disease Test)

-

Ambry Genetics (Proactive Health Screenings, Hereditary Cancer Panels)

-

LabCorp (Integrated Genetics, Inheritest Carrier Screen)

-

Quest Diagnostics (QHerit Carrier Screen, BRCAvantage)

-

GeneDx (Whole Exome Sequencing, XomeDxPlus)

-

Fulgent Genetics (Comprehensive Cancer Panel, Carrier Screening Panel)

-

Pathway Genomics (FIT Test, Cardiac DNA Insight)

-

Counsyl, Inc. (Family Prep Screen, Inherited Cancer Screen)

-

Color Genomics (Hereditary Cancer Test, Heart Health Test)

-

Sema4 (Expanded Carrier Screen, Oncology Panels)

-

Genomic Health (Oncotype DX Breast Recurrence Score, Oncotype DX Colon Cancer Assay)

-

Progenity, Inc. (Innatal Prenatal Screen, Riscover Hereditary Cancer Test)

-

Centogene N.V. (CentoGenome, CentoXome)

-

Eurofins Scientific (NIPT Solution, Genetic Predisposition Tests)

-

Blueprint Genetics (Cardiology Panel, Neurology Panel)

-

Prenetics Limited (Circle DNA Test, ColoClear)

Suppliers (These suppliers provide essential reagents, consumables, and technologies required for genetic testing processes.)

-

Thermo Fisher Scientific

-

Agilent Technologies

-

Bio-Rad Laboratories

-

Qiagen N.V.

-

PerkinElmer, Inc.

-

Merck KGaA

-

Promega Corporation

-

LGC Biosearch Technologies

-

Takara Bio Inc.

-

New England Biolabs

Recent Development

-

May 2024 – Illumina is propelling the widespread use of genomic testing as a new standard of care in oncology through shared research at the American Society of Clinical Oncology (ASCO) 2024. The research identifies key areas of emphasis, such as demonstrating the clinical utility of whole-genome sequencing with comprehensive genomic profiling, solving market access hurdles, and innovating with whole-genome solutions for detecting minimal residual disease (MRD). These initiatives uphold Illumina's commitment to increasing the role of genomic testing in cancer treatment and enhancing patient outcomes.

-

March 2024– 23andMe Holding Co., a pioneering genetics and biopharmaceutical firm, announced today three new genetic risk reports for its 23andMe+ members that cover breast, colorectal, and prostate cancer. These reports rely on polygenic risk scores (PRS), sophisticated statistical models created using 23andMe's proprietary research database. By examining thousands of genetic variants associated with these types of cancers, the PRS reports indicate a person's risk of developing the disease, and this increases personalized health risk assessment.

-

In 2024 – Myriad Genetics received three patents for its pioneering minimal residual disease (MRD) platform technology and cell-free DNA preparation technologies. These breakthroughs increase the sensitivity and specificity of tumor-informed, sequencing-based MRD assays, such as Myriad's Precise MRD test. The newly patented technologies support Myriad's focus on pushing precision oncology and enhancing cancer detection using advanced genomic solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.48 Billion |

| Market Size by 2032 | US$ 46.29 Billion |

| CAGR | CAGR of 11.34% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Next Generation Sequencing, Array Technology, PCR-based Testing, FISH, Others) • By Application (Ancestry & Ethnicity, Traits Screening, Genetic Disease Carrier Status, New Baby Screening, Health and Wellness - Predisposition/ Risk / Tendency) • By Product (Consumables, Equipment, Software & Services) • By Channel (Online, Offline) • By End Use (Hospitals & Clinics, Diagnostic Laboratories, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Illumina, 23andMe, Myriad Genetics, Invitae Corporation, Natera, Ambry Genetics, LabCorp, Quest Diagnostics, GeneDx, Fulgent Genetics, Pathway Genomics, Counsyl, Color Genomics, Sema4, Genomic Health, Progenity, Centogene, Eurofins Scientific, Blueprint Genetics, Prenetics Limited, and other players. |