Get More Information on Generative AI in Healthcare Market - Request Sample Report

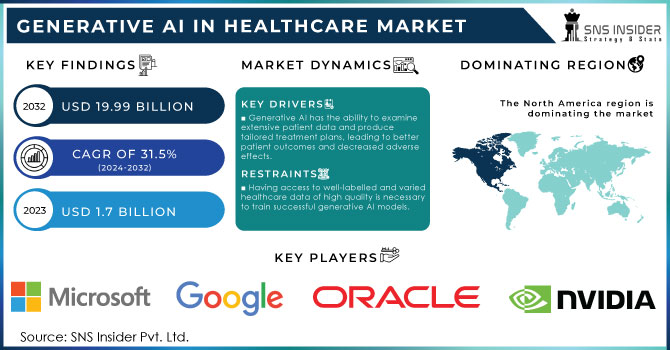

The Generative AI in Healthcare Market size was valued at US$ 1.7 Bn in 2023 and is estimated to US$ 19.99 Bn by 2032 with a growing CAGR of 31.5% Over the Forecast Period of 2024-2032.

Several key factors are driving the demand for Generative AI in healthcare market. The technology's capability to improve diagnostic accuracy and efficiency is a key factor. Generative AI models have the ability to evaluate large quantities of patient data, such as medical images, electronic health records, and genetic information, in order to offer accurate diagnoses and customized treatment strategies. This ability is especially useful in complicated situations where traditional diagnostic techniques may not be sufficient. Moreover, the incorporation of Generative AI in drug discovery and development is hastening research procedures. It allows for quickly identifying potential drugs, refining clinical trial plans, and forecasting drug reactions, thereby cutting down on expenses and time needed to launch new treatments.

Another important factor is the increasing demand for telehealth services and remote patient monitoring. Generative AI tools support remote consultations and live tracking, enabling healthcare providers to provide ongoing care, particularly in areas with limited access to services. Furthermore, the growing focus on value-based care models is leading to the implementation of AI-driven technologies that enhance patient results and reduce expenses. Healthcare professionals are increasingly using generative AI to automate administrative tasks, streamline workflows, and decrease burnout in clinicians, ultimately improving operational efficiency. With an aging population, chronic diseases, and increased demand post-pandemic, healthcare systems worldwide are struggling, but generative AI provides a scalable solution to tackle these issues successfully.

Key Metrics Explaining the Demand Landscape for Generative AI in Healthcare Market:

The National Institutes of Health (NIH) reports that about 37% of clinical trials are currently using AI-based methods to improve patient recruitment and study designs. Moreover, a recent report by the Centers for Medicare & Medicaid Services (CMS) shows that AI algorithms are being used to streamline 24% of Medicare claims processing, leading to a significant decrease in administrative expenses.

The U.S. Department of Health and Human Services (HHS) reports that approximately 52% of public health surveillance systems are incorporating artificial intelligence (AI) technologies to enhance data gathering and real-time analysis, thereby reducing response times to public health crises by up to 45%. Furthermore, data from a study by the FDA reveals that 43% of recent drug development initiatives utilized artificial intelligence (AI) technology, leading to a notable 30% decrease in time-to-market.

Drivers:

Generative AI has the ability to examine extensive patient data and produce tailored treatment plans, leading to better patient outcomes and decreased adverse effects.

Generative AI has the ability to improve medical images, simplifying the process for healthcare providers to identify irregularities and diagnose illnesses.

Generative AI can detect and prevent security breaches by identifying abnormal patterns in data.

Generative AI is revolutionizing the healthcare industry by improving its security systems with the ability to pinpoint abnormal patterns in data, playing a vital role in the detection and prevention of security breaches. Using complex machine learning algorithms, generative AI can detect irregularities in large datasets that could signal unauthorized entry or potential dangers. Studies demonstrate that generative AI models can decrease false-positive alerts by more than 60%, enabling healthcare providers to concentrate on real threats. Hospitals and healthcare institutions that utilize generative AI technology have experienced a 45% enhancement in their ability to detect threats promptly, which has led to a significant decrease in the timeframe for potential vulnerabilities. During a recent trial, a healthcare facility's AI systems identified a phishing attack that went unnoticed, stopping a possible security breach that could have compromised patient information.

Furthermore, these AI models have the ability to constantly acquire new knowledge and adjust to emerging cyber risks, ultimately enhancing the overall strength of healthcare organizations. The capacity of generative AI to capture and comprehend intricate data patterns leads to improved forecasts of potential security incidents, decreasing the chances of data breaches by almost 30%. With the healthcare sector's data expanding, utilizing generative AI to detect anomalies provides a strong defense against cyber threats, safeguarding patient privacy and meeting regulatory requirements.

Restrains:

Having access to well-labelled and varied healthcare data of high quality is necessary to train successful generative AI models. Yet, the availability of data can be restricted by data fragmentation, privacy regulations, and ethical concerns.

Having access to well-structured and varied healthcare data with accurate labels is crucial for developing successful generative AI models. Within the healthcare industry, generative AI models utilize numerous data sources to imitate intricate situations, create diagnostic resources, and improve customized medicine. Nevertheless, the issue of data fragmentation is a major obstacle; healthcare information is frequently stored in separate systems, organizations, and regions, which complicates the process of collecting and merging complete datasets. Privacy regulations, like HIPAA in the US and GDPR in Europe, make data access more complicated. These rules impose stringent rules on sharing and utilizing data that are essential for maintaining patient privacy but may restrict the amount of data accessible for training AI models. Ethical considerations, such as ownership and consent of data, also influence the limitation of data access. Around 65% of healthcare institutions have difficulty finding a balance between data sharing and privacy issues, affecting their capability to effectively utilize generative AI.

By Application

Personalized treatment plans, accounting for roughly 25% of the market, use AI to customize interventions using patient-specific information, improving treatment accuracy. Virtual patient support comes next, holding a 20% portion, by simplifying patient engagements and administrative duties using AI-powered chatbots and virtual health aides. Utilizing AI for patient monitoring and predictive analytics, which make up approximately 22% of the market share, involves tracking real-time health data and predicting potential problems to enhance proactive healthcare.

Generative AI improves imaging techniques and diagnostic accuracy in medical image analysis and diagnostics, representing 18% of the market share by interpreting complex medical data. In conclusion, drug discovery and development account for 15% of the share, speeding up the process of finding new compounds and treatment approaches using AI-driven simulations and data analysis. Together, these apps illustrate the significant influence of generative AI in healthcare, enhancing effectiveness, accuracy, and creativity within the industry. The inclusion of AI in these various fields offers improved patient results and represents a significant move towards data-based healthcare solutions.

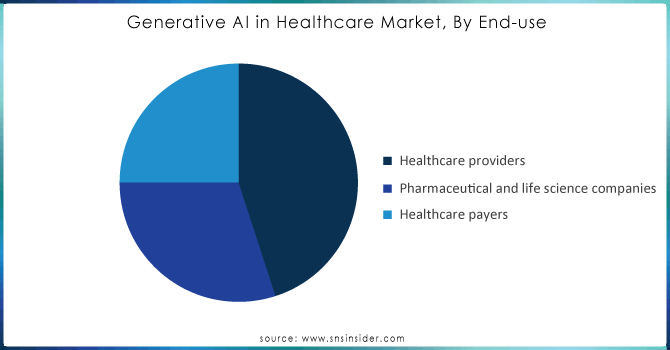

By End-Use

Healthcare providers, who hold about 40% of the market share, are using AI to improve clinical decision-making, simplify processes, and provide individualized patient care. AI technology is utilized in this industry to enhance the precision of diagnoses, streamline office duties, and improve the effectiveness of treatment strategies. Pharmaceutical and life science companies are using generative AI to transform drug discovery and development processes, holding a 35% stake in this advancement. These companies can speed up the discovery of new drug options and improve clinical trials by using AI simulations and predictive analytics. Healthcare insurers, with a 25% stake, are increasingly utilizing AI to improve claims processing, identify fraud, and better manage risk. AI tools in this sector aid in analysing data for managing costs and simplify the reimbursement processes with increased accuracy.

Need any customization research on Generative AI in Healthcare Market - Enquiry Now

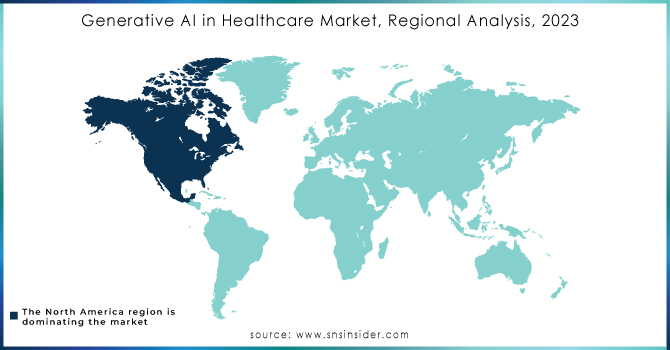

In North America, the rapid growth of generative AI in healthcare is being driven by advanced technological infrastructure, significant investment, and a strong research environment. The forefront of this transformation in healthcare is driven by the United States and Canada's notable contributions to the development and utilization of AI technologies.

The healthcare market in the U.S. is a significant contributor to the development of generative AI, with a considerable portion of the market in the region. High levels of investment from private and public sectors, a favourable regulatory environment, and a high concentration of leading technology firms and research institutions are key factors driving this growth. Generative AI is widely used in the U.S. for personalized treatment plans, customizing medical interventions using detailed patient information. Technology is also revolutionizing the drug discovery and development procedures, resulting in a substantial decrease in time and expenses for introducing new drugs to the market. In addition, AI-powered virtual patient support and cutting-edge medical imaging are improving clinical effectiveness and diagnostic precision.

In general, North America's significant focus on research and development, along with ample financial support and a helpful regulatory environment, places the region at the forefront of incorporating generative AI into healthcare.

The Major players are Epic Systems Corporation, DiagnaMed Holdings Corp., Syntegra Medical Mind, IBM Watson Health Corporation, Google LLC, Oracle Corporation, Microsoft Corporation, Nvidia Corporation, Insilico Medicine, Abridge AI Inc., ELEKS, Persistent Systems and other players.

Epic Systems revealed a partnership with multiple large healthcare organizations to research how generative AI can enhance patient care. This study will concentrate on creating artificial intelligence models that can forecast patient results and help with clinical decision-making.

DiagnaMed Holdings Corp. has unveiled new generative AI capabilities in its diagnostic instruments focused on spotting neurodegenerative disorders at an early stage. The AI tools utilize sophisticated algorithms to examine intricate datasets like medical imaging and genetic information, leading to more precise diagnoses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.7 billion |

| Market Size by 2032 | USD 19.99 Billion |

| CAGR | CAGR of 31.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application: (Personalized treatment plans, Virtual patient assistance, Patient monitoring and predictive analytics, Medical image analysis and diagnostics, Drug discovery and development, Other applications) • By End-use: (Healthcare providers, Pharmaceutical and life science companies, Healthcare payers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe[ Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Epic Systems Corporation, DiagnaMed Holdings Corp., Syntegra Medical Mind, IBM Watson Health Corporation, Google LLC, Oracle Corporation, Microsoft Corporation, Nvidia Corporation, Insilico Medicine, Abridge AI Inc., ELEKS, Persistent Systems |

| Key Drivers |

|

| RESTRAINTS |

|

Ans: The Generative AI in Healthcare Market size is projected to reach USD 19.99 billion by 2032 and was valued at USD 1.7 billion in 2023.

Ans: The Generative AI in Healthcare Market CAGR estimated over 2024-2032 is 31.5%.

Ans: North America region dominated the Generative AI in Healthcare Market in 2023.

Ans: Having access to well-labelled and varied healthcare data of high quality is necessary to train successful generative AI models.

Ans: APAC will be the fastest growing region over the forecast period.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates, 2023

5.2 User Demographics, By User Type and Roles, 2023

5.3 Feature Analysis, by Feature Type

5.4 Cost Analysis, by Software

5.5 Integration Capabilities

5.6 Regulatory Compliance, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Application Benchmarking

6.3.1 Application specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Application launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Generative AI in healthcare Market Segmentation, by Application

7.1 Chapter Overview

7.2 Personalized treatment plans

7.2.1 Personalized treatment plans Market Trends Analysis (2020-2032)

7.2.2 Personalized treatment plans Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Virtual patient assistance

7.3.1 Virtual patient assistance Market Trends Analysis (2020-2032)

7.3.2 Virtual patient assistance Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Patient monitoring and predictive analytics

7.4.1 Patient monitoring and predictive analytics Market Trends Analysis (2020-2032)

7.4.2 Patient monitoring and predictive analytics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Medical image analysis and diagnostics

7.5.1 Medical image analysis and diagnostics Market Trends Analysis (2020-2032)

7.5.2 Medical image analysis and diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Drug discovery and development

7.6.1 Drug discovery and development Market Trends Analysis (2020-2032)

7.6.2 Drug discovery and development Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Other Applications

7.6.1 Other Applications Market Trends Analysis (2020-2032)

7.6.2 Other Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Generative AI in healthcare Market Segmentation, by End Use

8.1 Chapter Overview

8.2 Healthcare providers

8.2.1 Healthcare providers Market Trends Analysis (2020-2032)

8.2.2 Healthcare providers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.1 Hospitals

8.2.1.1 Hospitals Market Trends Analysis (2020-2032)

8.2.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.2 Diagnostic centers

8.2.2.1 Diagnostic centers Market Trends Analysis (2020-2032)

8.2.2.2 Diagnostic centers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2.3 Others

8.2.3.1 Others Healthcare Providers Market Trends Analysis (2020-2032)

8.2.3.2 Others Healthcare Providers Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pharmaceutical and life science companies

8.6.1 Pharmaceutical and life science companies Market Trends Analysis (2020-2032)

8.6.2 Pharmaceutical and life science companies Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Healthcare Payers

8.4.1 Others Market Trends Analysis (2020-2032)

8.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.4 North America Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.5.2 USA Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6.2 Canada Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Mexico Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.5.2 Poland Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6.2 Romania Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.4 Western Europe Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.5.2 Germany Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6.2 France Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7.2 UK Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8.2 Italy Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9.2 Spain Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12.2 Austria Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.4 Asia Pacific Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 China Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 India Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.5.2 Japan Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6.2 South Korea Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7.2 Vietnam Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8.2 Singapore Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9.2 Australia Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.4 Middle East Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.5.2 UAE Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.4 Africa Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Generative AI in healthcare Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.4 Latin America Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.5.2 Brazil Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6.2 Argentina Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7.2 Colombia Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Generative AI in healthcare Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Generative AI in healthcare Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10. Company Profiles

10.1 Epic Systems Corporation

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Groups/ Services Offered

110.1.4 SWOT Analysis

10.2 DiagnaMed Holdings Corp.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Groups/ Services Offered

10.2.4 SWOT Analysis

10.3 Syntegra Medical Mind

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Groups/ Services Offered

10.3.4 SWOT Analysis

10.4 IBM Watson Health Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Groups/ Services Offered

10.4.4 SWOT Analysis

10.5 Google LLC

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Groups/ Services Offered

10.5.4 SWOT Analysis

10.6 Oracle Corp

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Groups/ Services Offered

10.6.4 SWOT Analysis

10.7 Microsoft Corporation

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Groups/ Services Offered

10.7.4 SWOT Analysis

10.8 Nvidia Corporation

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Groups/ Services Offered

10.8.4 SWOT Analysis

10.9 Insilico Medicine

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Groups/ Services Offered

10.9.4 SWOT Analysis

10.10 Others

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Groups/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments:

By Application

Personalized treatment plans

Virtual patient assistance

Patient monitoring and predictive analytics

Medical image analysis and diagnostics

Drug discovery and development

Other applications

By End-use

Healthcare providers

Hospitals

Clinics

Diagnostic centers

Other healthcare providers

Pharmaceutical and life science companies

Healthcare payers

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Psoriasis Treatment Market size was valued at USD 22.38 billion in 2023 and is projected to reach USD 54.40 billion by 2032, growing at a CAGR of 10.4%.

The Companion Animal Vaccines Market Size was valued at USD 3.39 billion in 2023 and is expected to reach USD 5.64 billion by 2032 and grow at a CAGR of 5.83% over the forecast period 2024-2032.

The DNA Synthesizer Market size valued at USD 270.40 million in 2023 and is expected to reach USD 922.11 million by 2032 with a CAGR of 14.62% during the forecast period of 2024-2032.

The Smart Healthcare Market size was USD 166 Billion in 2023 and is expected to Reach USD 441.30 Billion by 2031 and grow at a CAGR of 13% over the forecast period of 2024-2031.

Healthcare Revenue Cycle Management Market Size was USD 137.44 billion in 2023, projected to grow at a CAGR of 11.72%, reaching USD 372.16 billion by 2032.

The Vitamins Market size was valued at USD 5.93 billion in 2023 and is expected to reach USD 10.54 billion by 2032 and grow at a CAGR of 6.64%.

Hi! Click one of our member below to chat on Phone