Generative AI Coding Assistants Market Report Scope & Overview:

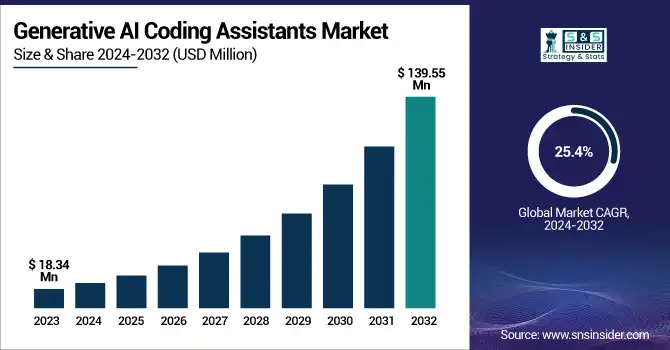

The Generative AI Coding Assistants Market Size was valued at USD 18.34 Million in 2023 and is expected to reach USD 139.55 Million by 2032 and grow at a CAGR of 25.4% over the forecast period 2024-2032.

To Get more information on Generative AI Coding Assistants Market - Request Free Sample Report

The Generative AI Coding Assistants Market is transforming software development by improving coding efficiency, reducing errors, and accelerating project timelines. AI-driven tools offer real-time code suggestions, debugging, refactoring, and error detection, streamlining developer workflows. Adoption is rising among individuals, enterprises, and educational institutions, fueled by advancements in machine learning, NLP, and cloud computing. Companies leverage AI assistants to boost productivity and bridge skill gaps. Key trends include multilingual coding support, AI-driven security, and deeper cloud integrations. As AI evolves, the market will play a crucial role in shaping the future of software engineering and digital transformation.

The U.S. Generative AI Coding Assistants Market size was USD 4.71 million in 2023 and is expected to reach USD 30.97 million by 2032, growing at a CAGR of 23.3% over the forecast period of 2024-2032.

The U.S. Generative AI Coding Assistants Market is experiencing rapid growth, driven by increasing adoption among developers, enterprises, and educational institutions. AI-powered coding tools enhance software development by providing real-time code suggestions, debugging assistance, and automation features. The rising demand for efficiency, reduced development time, and error-free coding is accelerating market expansion. Major tech companies are integrating AI-driven coding assistants into cloud-based platforms and development environments. The market is also benefiting from advancements in machine learning, natural language processing (NLP), and AI-driven security enhancements, making AI coding assistants an essential tool for modern software engineering.

Generative AI Coding Assistants Market Dynamics

Key Drivers:

-

Growing Adoption of AI-Powered Development Tools Accelerates Generative AI Coding Assistants Market Growth

The increasing reliance on AI-driven coding assistants is revolutionizing software development by enhancing efficiency, reducing errors, and improving code quality. Developers and enterprises are rapidly adopting these tools to streamline workflows, automate repetitive coding tasks, and accelerate project timelines. With the rise of machine learning, natural language processing (NLP), and deep learning algorithms, AI coding assistants are becoming more sophisticated, providing real-time code suggestions, debugging assistance, and code optimization.

Additionally, the growing adoption of cloud-based coding environments and AI-assisted DevOps is increasing the demand for intelligent coding solutions. As organizations continue to prioritize cost reduction, productivity enhancement, and software security, the Generative AI Coding Assistants Market is poised for substantial growth in the coming years.

Restrain:

-

Concerns Over AI-Generated Code Security and Compliance Restrain Generative AI Coding Assistants Market Growth

Despite its benefits, the widespread adoption of AI-generated code raises significant concerns regarding security vulnerabilities, intellectual property rights, and regulatory compliance. AI-powered coding assistants rely on vast datasets for training, which may introduce biases, security flaws, or the unintentional replication of copyrighted code. Enterprises operating in highly regulated industries, such as finance, healthcare, and government sectors, face challenges in ensuring that AI-generated code aligns with data privacy laws, cybersecurity standards, and software compliance frameworks.

Moreover, concerns over the transparency of AI decision-making and the risk of introducing undetected bugs or malicious code hinder full-scale adoption. Addressing these challenges requires robust AI governance, ethical AI development practices, and stringent validation mechanisms. As AI-driven coding tools continue to evolve, companies must implement strong security frameworks, legal safeguards, and responsible AI usage policies to mitigate potential risks.

Opportunities:

-

Expanding Integration of Generative AI Coding Assistants with Cloud-Based Development Platforms Creates Growth Opportunities

The increasing shift toward cloud-native development and AI-driven DevOps presents a significant opportunity for the Generative AI Coding Assistants Market. Cloud-based platforms such as AWS, Microsoft Azure, and Google Cloud are integrating AI-powered coding tools to provide seamless software development experiences across distributed teams. These integrations enable developers to collaborate in real-time, leverage scalable AI models, and enhance code efficiency across multiple environments.

Additionally, cloud-based AI coding assistants eliminate the need for high-end computing infrastructure, making them more accessible to small and medium-sized enterprises (SMEs) and independent developers. The growing adoption of containerization, microservices, and AI-assisted DevOps pipelines further boosts the demand for intelligent coding solutions. As more organizations transition to remote and cloud-first development approaches, the integration of AI coding assistants with cloud ecosystems will drive significant market expansion, enabling faster, more secure, and cost-effective software development.

Challenges:

-

Accuracy and Contextual Understanding Challenges in AI-Powered Coding Assistants Hinder Market Growth

The Generative AI Coding Assistants Market is ensuring high accuracy and contextual understanding in AI-generated code. While AI-driven coding assistants provide real-time suggestions and automation, they often struggle with complex coding logic, domain-specific requirements, and contextual relevance. Inaccurate code recommendations or misinterpretation of developer intent can lead to functional errors, inefficient algorithms, and software vulnerabilities.

Additionally, AI models require continuous training and large-scale datasets to improve accuracy, which poses challenges related to data availability, quality control, and computational resource requirements. Developers must also validate and refine AI-generated code manually, increasing the risk of errors if over-reliance on AI occurs. Addressing this challenge requires enhanced AI training methodologies, improved contextual learning models, and better user feedback loops. As the market matures, companies must focus on developing more reliable, intelligent, and context-aware AI coding assistants to maximize their potential.

Generative AI Coding Assistants Market Segment Analysis

By Function

The Code Generation & Autocompletion segment dominates the Generative AI Coding Assistants Market, accounting for 44% of the revenue share in 2023. AI-driven coding assistants enhance developer productivity by providing real-time code suggestions, automated function generation, and intelligent autocompletion. These tools significantly reduce coding time, minimize syntax errors, and improve software development efficiency. Leading companies such as GitHub (Copilot), Tabnine, and AWS (CodeWhisperer) have launched advanced AI-powered code generation models that leverage machine learning (ML) and natural language processing (NLP) to predict and complete code snippets with high accuracy. Microsoft’s GitHub Copilot X has further revolutionized the market with chat-based AI coding support, while Google’s Codey integrates seamlessly with Google Cloud to enhance developer experience.

By Application

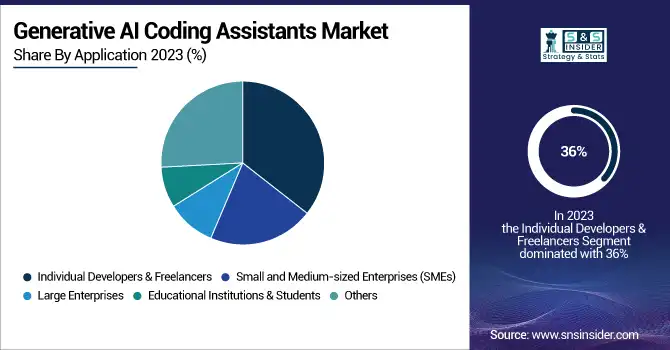

The Individual Developers & Freelancers segment holds the largest market share of 36% in 2023, driven by the rising adoption of AI-powered coding assistants among independent programmers and small development teams. Freelancers and solo developers use AI assistants for faster code generation, debugging, and optimization, allowing them to complete projects efficiently. Platforms like Replit AI, JetBrains AI Assistant, and Sourcegraph Cody offer affordable, subscription-based AI coding tools tailored to individual developers and open-source contributors. GitHub Copilot has seen widespread adoption among freelance software engineers, significantly improving productivity and enabling them to work on multiple projects simultaneously.

The Small and Medium-sized Enterprises (SMEs) segment is witnessing the highest CAGR of 26.4% in the forecasted period, as businesses increasingly adopt AI-powered coding assistants to optimize software development processes, reduce costs, and accelerate time-to-market. SMEs often lack large development teams, making AI-driven coding tools essential for automating repetitive tasks, improving collaboration, and enhancing software security. Companies like Tabnine, CodiumAI, and Microsoft are launching AI solutions tailored for SMEs, integrating automated code reviews, intelligent debugging, and AI-powered DevOps workflows. The adoption of cloud-based AI coding assistants is further enabling SMEs to scale operations without heavy infrastructure investments.

By Deployment

The On-Premises deployment segment holds the largest revenue share in 2023, as enterprises prioritize data security, regulatory compliance, and control over AI-generated code. Large organizations, particularly in finance, healthcare, and government sectors, prefer on-premises AI coding solutions to ensure data privacy, secure integrations, and reduced dependency on third-party cloud services. IBM’s Watson Code Assistant and JetBrains' AI-powered IDE integrations offer on-premise AI-driven coding assistance tailored to enterprise needs. As data protection regulations tighten, businesses are expected to continue investing in on-premise AI coding solutions, reinforcing the segment’s market dominance.

The Cloud-based segment is witnessing the highest CAGR in the forecast period, driven by the increasing adoption of AI-powered coding assistants in SaaS-based development platforms. Cloud-based AI coding assistants offer scalability, remote accessibility, and seamless integration with cloud IDEs, making them ideal for startups, SMEs, and enterprises embracing cloud-native development. The rise of remote development teams and cloud-based software engineering is further boosting demand for cloud-native AI coding assistants. As businesses increasingly shift toward cloud-first development strategies, the cloud segment is poised for significant growth, transforming how developers and enterprises leverage AI in software engineering.

Regional Analysis

North America held the largest market share in 2023, driven by the strong presence of leading technology companies, advanced AI research, and widespread adoption of AI-powered coding tools. The United States is at the forefront, with major players such as Microsoft (GitHub Copilot), Google (Codey), AWS (CodeWhisperer), and IBM (Watson Code Assistant) continuously innovating AI-driven development tools. The region's dominance is further supported by the high adoption rate of AI-assisted software development in enterprises, startups, and educational institutions. Additionally, the integration of AI coding assistants into DevOps, cloud platforms, and enterprise-level IDEs is accelerating market expansion. With a well-established cloud infrastructure, AI expertise, and increasing demand for automation in coding workflows, North America continues to lead the Generative AI Coding Assistants Market.

The Asia-Pacific region is experiencing the highest CAGR, fueled by the rapid adoption of AI-driven software development tools across emerging economies such as China, India, Japan, and South Korea. The region’s growth is driven by the expanding IT sector, increasing number of software developers, and rising investments in AI research and cloud computing. Companies like Alibaba, Baidu, and Tencent are actively investing in AI-powered coding solutions, while global tech leaders such as Google and Microsoft are expanding their presence in Asia-Pacific through AI-driven development platforms. The increasing digitization of businesses, government initiatives for AI adoption, and growing demand for automated software development solutions are contributing to the region’s rapid market expansion. With the rise of tech startups, remote development teams, and AI-driven innovation hubs, the Asia-Pacific is set to become a key player in the future growth of Generative AI Coding Assistants.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Amazon Web Services (AWS) (Amazon CodeWhisperer, AWS Cloud9)

-

CodeComplete (CodeComplete AI Assistant, CodeComplete API)

-

CodiumAI (CodiumAI Test Generator, CodiumAI Code Review Assistant)

-

Databricks (Databricks AI Code Assistant, Databricks Lakehouse AI)

-

GitHub (GitHub Copilot, GitHub Copilot X)

-

GitLab (GitLab Duo, GitLab Code Suggestions)

-

Google LLC (Google Gemini Code Assist, Vertex AI Codey)

-

IBM (IBM Watsonx Code Assistant, IBM AI for Code)

-

JetBrains (JetBrains AI Assistant, JetBrains Fleet)

-

Microsoft (Microsoft Copilot for Azure, Visual Studio IntelliCode)

-

Replit (Replit Ghostwriter, Replit AI Code Chat)

-

Sourcegraph (Sourcegraph Cody, Sourcegraph Code Search)

-

Tableau (Tableau AI Code Generator, Tableau GPT)

-

Tabnine (Tabnine AI Autocomplete, Tabnine Pro)

Recent Trends

-

In March 2025, Databricks entered a five-year, $100 million agreement with Anthropic to offer AI tools to businesses. This partnership aims to integrate Anthropic's Claude models into Databricks' data platform, enhancing the development of AI agents using corporate data.

-

In July 2024, CodiumAI launched its enterprise platform, enabling development teams to leverage generative AI for improving code quality. The platform offers organization-specific code suggestions, tests, and reviews, addressing enterprise concerns about AI-generated code quality.

-

In November 2023, AWS announced significant enhancements to Amazon CodeWhisperer, including AI-powered code remediation, support for Infrastructure as Code (IaC), and integration with Visual Studio. These updates aim to streamline software development by automating tasks and improving security.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 18.34 Million |

| Market Size by 2032 | US$ 139.55 Million |

| CAGR | CAGR of 25.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Function (Code Generation & Autocompletion, Debugging and Error Detection, Code Refactoring & Optimization, Code Explanation, Others) • By Deployment (Cloud, On-premises) • By Application (Individual Developers & Freelancers, Small and Medium-Sized Enterprises (SMEs), Large Enterprises, Educational Institutions & Students, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), CodeComplete, CodiumAI, Databricks, GitHub, GitLab, Google LLC, IBM, JetBrains, Microsoft, Replit, Sourcegraph, Tableau, Tabnine. |