Gastrointestinal Endoscopic Devices Market Size Analysis

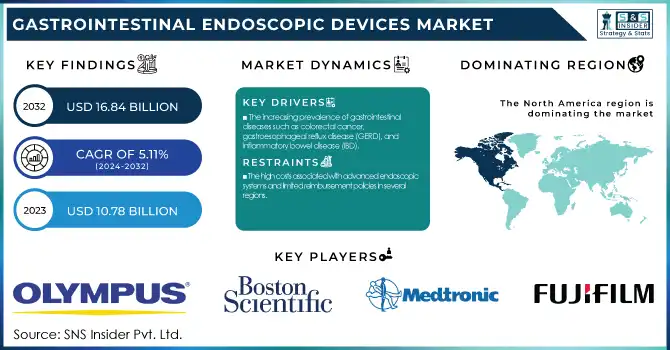

The Gastrointestinal Endoscopic Devices Market Size was USD 10.78 Billion in 2023, projected to reach USD 16.84 Billion by 2032 and grow at a CAGR of 5.11% over the forecast period 2024-2032.

This report identifies the rising incidence and prevalence of gastrointestinal disease, creating demand for more sophisticated diagnostic and therapeutic interventions. The research looks at the volume of gastrointestinal endoscopic procedures, in addition to prescription and use patterns of endoscopic equipment in various regions, mirroring differences in adoption levels and technology innovation.

To Get more information on Gastrointestinal Endoscopic Devices Market - Request Free Sample Report

It also evaluates healthcare expenditure on gastrointestinal endoscopy, including regional breakdown of investment patterns and market growth. The study also discusses pricing trends of gastrointestinal endoscopic equipment, driven by innovation, competition, and reimbursement policies, as well as how changing regulatory and compliance trends affect market accessibility and product approvals.

Gastrointestinal Endoscopic Devices Market Dynamics

Drivers

-

The increasing prevalence of gastrointestinal diseases such as colorectal cancer, gastroesophageal reflux disease (GERD), and inflammatory bowel disease (IBD)

Based on the World Cancer Research Fund, colorectal cancer is the third most prevalent cancer globally, with more than 1.9 million new cases in 2023. Increasing demand for minimally invasive treatments because of their reduced recovery time and shorter hospital stays has further boosted demand for sophisticated endoscopic technologies. Further, technical advancements, including AI-based endoscopy, robot-assisted endoscopic procedures, and disposable endoscopes, have improved diagnostic efficiency and procedural accuracy. Firms like Boston Scientific and Medtronic have launched AI-integrated endoscopic imaging solutions that provide real-time abnormality detection, increasing early diagnosis rates. Additionally, growing government funds and initiatives for gastrointestinal disorder screening and awareness programs are fueling market expansion. For instance, the U.S. Preventive Services Task Force (USPSTF) has broadened colorectal cancer screening guidelines to adults beginning at age 45, propelling increased endoscopy procedure volumes. The increasing use of capsule endoscopy and single-use endoscopes to minimize cross-contamination risks also adds to market growth. All these factors cumulatively reinforce the increasing demand for gastrointestinal endoscopic devices.

Restraints

-

The high costs associated with advanced endoscopic systems and limited reimbursement policies in several regions.

Advanced endoscopy technology, including AI-based platforms and robotic endoscopy, has prices ranging from USD 50,000 to USD 200,000, which exceeds the budget for most small health centers and developing countries. Moreover, an insufficient number of trained endoscopists is a major hindrance to market expansion. Shortages of trained professionals are common in most areas, especially in LMICs, making access to higher-end gastrointestinal diagnostic and therapeutic interventions rare. The World Gastroenterology Organisation reports a large shortage of trained gastroenterologists, particularly in Asia and Africa. Reimbursement issues further slowdown the growth of the market since insurance coverage for sophisticated procedures and disposable endoscopes in some nations is still restricted. Most of the time, the patient pays out-of-pocket, which deters them from undergoing elective endoscopic procedures. In addition, reprocessing and sterilization concerns for reusable endoscopes continue to affect adoption because improper cleaning protocols have caused infection outbreaks in healthcare institutions. These financial and operational constraints pose challenges to broad adoption, especially among next-generation technologies.

Opportunities

-

The gastrointestinal endoscopic devices market presents significant opportunities, especially with the increasing adoption of AI and robotic-assisted endoscopy.

The use of artificial intelligence (AI) in endoscopic imaging has enhanced real-time polyp detection and computer-aided lesion classification, minimizing diagnostic errors. AI-based endoscopy systems, including Medtronic's GI Genius, help doctors identify precancerous lesions with greater accuracy. Moreover, the increasing need for single-use and disposable endoscopes is generating profitable opportunities for manufacturers. The worldwide surge towards infection control has contributed to rising use of Ambu A/S's aScope Gastro, an endoscope with one-time use reducing the threat of cross-contamination. Rising healthcare infrastructure and medical tourism in the developing world are also promising avenues, with India, Thailand, and Brazil being the notable spenders on endoscopic diagnostic units. A potential opportunity is also coming from increased demand for capsule endoscopy, an investigative modality that is non-invasive with good patient compliance. Growing use of tele-endoscopy for distant diagnostics, especially in rural regions, also creates additional growth opportunities. In addition, regulatory sanctions and encouraging policies favorable to endoscopic device innovation develop a conducive landscape for firms to introduce next-generation products. As the need for early diagnosis and minimal procedures increases, manufacturers that develop AI-based, disposable, and robot endoscopy will ride the emerging trends.

Challenges

-

The gastrointestinal endoscopic devices market faces several challenges, including regulatory hurdles, device recalls, and supply chain disruptions.

Strict regulatory standards for new endoscopic technology approval tend to result in market entry delays. For example, the FDA 510(k) clearance process demands substantial clinical data, which raises product development time and expense. Moreover, device recalls for malfunction or safety issues cause delays for manufacturers. Olympus recalled its bronchoscopes in 2023 due to possible contamination risks, sparking concerns regarding endoscopic device safety and reprocessing protocols. Supply chain interruptions, especially following global crises such as the COVID-19 pandemic, have affected the supply of critical endoscopic parts. The lack of semiconductor chips, which are essential for high-resolution imaging devices, has slowed down the manufacturing and delivery of advanced endoscopy systems. Patient reluctance towards endoscopic procedures because of discomfort, anxiety, and fear of complications is another significant challenge. In addition, hospital budgets in public healthcare environments restrict the implementation of costly next-generation endoscopic technology. These challenges must be met through streamlined regulatory channels, increased supply chain resiliency, and improved patient education programs to achieve greater endoscopic procedure acceptance.

Gastrointestinal Endoscopic Devices Market Segmentation Analysis

By Type

Flexible gastrointestinal endoscopes led the market share in 2023, contributing 49.2% of the overall share. Their high usage is attributed to their use for diagnosing and treating a wide variety of gastrointestinal diseases with minimal pain for patients. Their capability to traverse complicated anatomical structures, combined with technological improvements in high-definition images and artificial intelligence-driven diagnostics, has increased their popularity as the first choice among medical professionals.

Disposable gastrointestinal endoscopes are experiencing the highest growth in the market, driven by the mounting focus on infection control and hospital-acquired infection (HAI) prevention. Increased regulatory pressure towards single-use medical devices, coupled with fears of cross-contamination arising from reusable endoscopes, have accelerated adoption in the hospital and outpatient markets. Further, the declining cost of reprocessing and enhanced operational efficiency are the major drivers for their increasing demand.

By End Use

Outpatient facilities dominated the market in 2023 with a 51.6% share, fueled by the growing trend toward ambulatory care and same-day procedures. The popularity of outpatient endoscopic procedures is highly attributed to cost savings, reduced patient waits times, and greater accessibility. Further, advances in minimally invasive technology have allowed more advanced procedures to be carried out outside the confines of conventional hospital facilities, further increasing outpatient endoscopy volumes.

The hospital sector is also expected to witness the highest growth in the coming years owing to the increasing incidence of complicated gastrointestinal diseases with a need for sophisticated endoscopic treatment. The growing implementation of robot-assisted and AI-based endoscopy in hospitals and increased patient flow for serious cases are promoting demand. Additionally, government efforts towards improving healthcare infrastructure and reimbursement policies will drive hospital-endoscopic procedure growth.

Gastrointestinal Endoscopic Devices Market Regional Insights

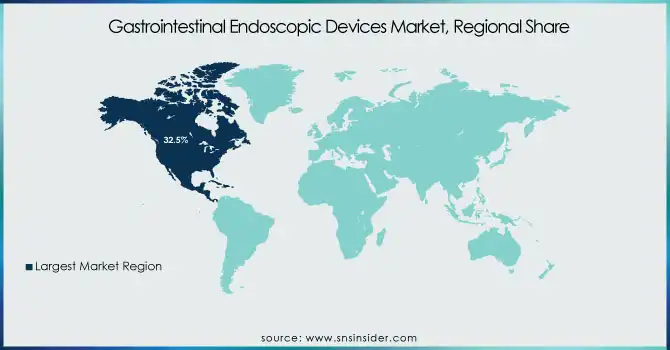

North America was the leading market for gastrointestinal endoscopic devices worldwide in 2023, commanding 32.5% of overall revenue. The region leads due to high incidences of gastrointestinal diseases like colorectal cancer, inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD). The region has a highly developed healthcare system, high acceptance rates of innovative endoscopic devices, and strong reimbursement policies in place that ensure rising procedural volumes. Besides, the competitive presence of key market players like Olympus Corporation, Boston Scientific, and Medtronic has further boosted innovation and penetration into the market. The increasing adoption of AI in endoscopy, coupled with growing demand for minimally invasive interventions, has further boosted North America's dominance in the industry.

The Asia-Pacific region is the region with the highest growth, fueled by increased healthcare expenditures, enhanced medical infrastructure, and growing awareness for early detection of disease. These nations, including China, India, and Japan, are experiencing high growth rates because of the growing geriatric population, which is more prone to gastrointestinal diseases. The growing use of disposable endoscopes to reduce the risk of cross-contamination and increasing medical tourism in nations like India and Thailand is also driving the demand for endoscopic procedures. Furthermore, government programs focused on increasing access to healthcare and enhancing endoscopic training schemes have driven the high market growth. Consequently, the Asia-Pacific region will witness the highest growth in the adoption of gastrointestinal endoscopic devices during the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

Gastrointestinal Endoscopic Devices Market Key Players

-

Olympus Corporation – EVIS X1 Endoscopy System, GIF-HQ190 Gastroscope, CF-HQ190L/I Colonoscope

-

Boston Scientific Corporation – SpyGlass DS Direct Visualization System, Resolution 360 Clip, Expect Slimline Needle

-

Medtronic – PillCam SB3 Capsule Endoscopy System, Barrx Radiofrequency Ablation System, Emprint Ablation System

-

Johnson & Johnson Services, Inc. (Ethicon Inc.) – ENSEAL X1 Large Jaw Tissue Sealer, STRATAFIX Knotless Tissue Control Devices

-

KARL STORZ SE & Co. KG – C-MAC Video Gastroscope, Telepack+ Endoscopic Imaging System

-

Fujifilm Holdings Corporation – ELUXEO Video Endoscopy System, EG-760Z Gastroscope, EC-760R Colonoscope

-

Stryker – 1688 AIM 4K Endoscopic Camera, SPY Portable Handheld Imaging System

-

HOYA Corporation (PENTAX Medical) – i10 Series Video Endoscopes, DEFINA Endoscopy System, MagniView Gastroscope

-

Smith+Nephew – Dyonics RF System (used in GI applications for hemostasis)

-

Cook Medical – Hemospray Endoscopic Hemostasis System, Evolution Stent System, Fusion OMNI ERCP Cannula

-

CONMED Corporation – Beamer Endoscopic Electrosurgical Unit, TruPass Biopsy Forceps

-

Ambu A/S – aScope Gastro Disposable Endoscope, aScope Colon Disposable Endoscope

-

Richard Wolf GmbH – ENDOCAM Logic 4K Endoscopy System, ERAGONmodular Laparoscopic Instruments

-

STERIS plc – Celerity Endoscope Processing System, VaproSure Sterilization System

Recent Developments in the Gastrointestinal Endoscopic Devices Market

In April 2024, Fujifilm launched Tracmotion, its Red Dot award-winning Endoscopic Submucosal Dissection (ESD) device, at Endocon 2024 in Delhi. The event, a key platform for gastroenterology advancements, showcased Tracmotion alongside innovative procedures and discussions shaping the future of endoscopic medicine.

In Jan 2024, the FDA granted 510(k) clearance to EndoSound for its Vision System, an innovative add-on endoscopic ultrasound device designed to attach to upper gastrointestinal endoscopes, enhancing imaging capabilities.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.78 billion |

| Market Size by 2032 | USD 16.84 billion |

| CAGR | CAGR of 5.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type [Rigid Gastrointestinal Endoscopes (Gastroscope (Upper GI Endoscope), Enteroscope, Sigmoidoscope, Duodenoscope), Flexible Gastrointestinal Endoscopes (Gastroscope (Upper GI Endoscope), Enteroscope, Sigmoidoscope, Duodenoscope, Colonoscope), Disposable Gastrointestinal Endoscopes (Gastroscope (Upper GI Endoscope), Enteroscope, Sigmoidoscope, Duodenoscope, Colonoscope)] • By End Use [Hospitals, Outpatient Facilities] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olympus Corporation, Boston Scientific Corporation, Medtronic, Johnson & Johnson Services, Inc. (Ethicon Inc.), KARL STORZ SE & Co. KG, Fujifilm Holdings Corporation, Stryker, HOYA Corporation (PENTAX Medical), Smith+Nephew, Cook Medical, CONMED Corporation, Ambu A/S, Richard Wolf GmbH, STERIS plc. |