Gas Analyzer, Sensor & Detector Market Report Scope & Overview:

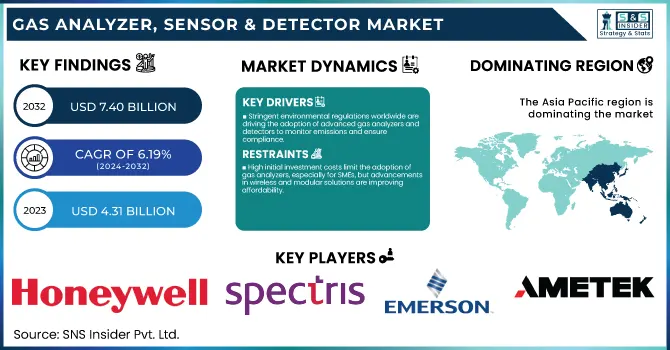

The Gas Analyzer, Sensor & Detector Market Size was estimated at USD 4.31 billion in 2023 and is expected to arrive at USD 7.40 billion by 2032 with a growing CAGR of 6.19% over the forecast period 2024-2032. This report offers a unique perspective on the Gas Analyzer, Sensor & Detector Market by analyzing industry-specific adoption rates, evolving utilization trends across key applications, and technological advancements. It provides insights into production & supply chain dynamics by region, along with export/import data, highlighting trade flows and market shifts. Additionally, the report explores emerging trends such as AI-integrated gas detection, IoT-enabled real-time monitoring, and miniaturized sensors for enhanced accuracy. A deep dive into regulatory impacts, sustainability-driven innovations, and industry collaborations further sets this analysis apart, offering a forward-looking view of market transformations.

To Get more information on Gas Analyzer, Sensor & Detector Market - Request Free Sample Report

Gas Analyzer, Sensor & Detector Market Dynamics

Drivers

-

Stringent environmental regulations worldwide are driving the adoption of advanced gas analyzers and detectors to monitor emissions and ensure compliance.

Stringent environmental regulations are a major driver of the gas analyzer, sensor, and detector market, as governments worldwide enforce strict emission control policies to curb air pollution and ensure workplace safety. Industries like oil & gas, chemicals, and manufacturing need to monitor and control harmful gas emissions, which is resulting in high adoption of advanced gas detection technologies. Compliance with regulatory frameworks, like the U.S. Environmental Protection Agency (EPA) standards and European Union’s Industrial Emissions Directive (IED), is encouraging industries to invest in continuous emission monitoring systems (CEMS) as well as portable gas analyzers. There is a growing market for IoT-enabled and AI-powered gas detection systems that provide real-time monitoring, predictive maintenance, and improved accuracy. The increasing focus on sustainability and stricter compliance regulations are expected to complement the market growth owing to innovations in the wireless and the cloud-connected gas monitoring systems.

Restraint

-

High initial investment costs limit the adoption of gas analyzers, especially for SMEs, but advancements in wireless and modular solutions are improving affordability.

The high initial investment costs associated with gas analyzers, sensors, and detectors pose a significant barrier to market growth, particularly for small and medium enterprises (SMEs). These advanced gas detection systems depend on complex components to build the entire structure including the calibration process and integration with the pre-existing industrial infrastructure, facilitating high startup costs. The total cost of ownership is further compounded by the need for regular maintenance and software updates. Despite this challenge, the market is experiencing steady growth owing to stringent environmental regulations and an increase in safety concerns in industries like oil & gas, manufacturing industries, and healthcare. One of the important trends fueling demand is the emergence of affordable, wireless, and portable gas detection solutions, which simplifies installation and lowers long-term operating costs. Further, everyone gets more affordable and accessible as Industrial IoT (IIoT) and cloud-based monitoring continue to evolve. Scalable and modular solutions for budget-friendly industries are on the rise, as technology continues to grow.

Opportunities

-

The growing need for precise gas monitoring in healthcare and pharmaceutical industries is driven by safety, regulatory compliance, and quality control requirements.

The healthcare and pharmaceutical industries are increasingly relying on gas analyzers, sensors, and detectors to ensure safety, quality control, and regulatory compliance. Within medical facilities, these devices are pivotal to the monitoring of anesthesia gas, oxygen deficiency, and hazardous gas leaks ensuring the safety of patients and healthcare professionals. Gas detection systems are critical for maintaining controlled environments, ensuring drug stability, and preventing contamination during pharmaceutical manufacturing and storage. Strict industry regulations, including the FDA and WHO, are also fueling the growth of advanced gas monitoring technologies. Moreover, the increasing need for medical gases such as oxygen and nitrous oxide among hospital patients, as well as the rise of biopharmaceutical research, is driving the growth of the market. This further emphasizes the increasing integration of IoT and real-time monitoring solutions which improves efficiency and safety and cement gas analyzers and detectors as essential devices in modern healthcare and pharmaceutical applications.

Challenges

-

Regulatory compliance variability increases costs and complexities for manufacturers as they navigate diverse regional standards, certifications, and evolving safety regulations.

Regulatory compliance variability poses a significant challenge in the gas analyzer, sensor, and detector market, as different regions enforce distinct standards and safety regulations. Manufacturers are faced with a variety of individual certification requirements including OSHA and EPA guidelines in the U.S., ATEX in Europe, CCC in China which increases costs and prolongs product development cycles. Meeting compliance across various frameworks necessitates extensive testing, adjustments to the product, and ongoing updates to ensure compliance with changing regulations. Such complexity can potentially slow down market entry and impose trade barriers for global players. These inconsistencies may create interoperability challenges, which would hinder the introduction of cross-platform solutions by businesses. Small and medium-sized enterprises (SMEs) are often limited in global expansion due to the cost of multiple certifications. The specific capabilities for adaptation at each level involving regulations, localization, and adaptation are the challenges that manufacturers will have to face and manage effectively by building compliance processes that are efficient while still being flexible enough to cover regulations varying by region.

Gas Analyzer, Sensor & Detector Market Segmentation Analysis

By Sensor Type

Catalytic sensors segment dominated with a market share of over 34% in 2023, due to their extensive use in detecting combustible gases across various industries. These sensors work on a straightforward but incredibly efficient principle, as gas oxidation is responsible for heat production, causing a change in resistance that can be measured. A cost-effective, reliable solution, they are often preferred for gas leak detection in oil & gas, chemicals and manufacturing industries. Furthermore, as technology to measure several gasses quickly, correctly, and accurately, catalytic sensors have proven effective under various circumstances, including extreme conditions. Their versatility in detecting various flammable gases combined with their robustness and low maintenance make them indispensable in the fields of industrial safety and monitoring.

By Measurement Parameter

The Oxygen Concentration segment dominated with a market share of over 34% in 2023, Sensor & Detector Market owing to its sandy application in most of the industries. Oxygen analyzers also play a vital role in ensuring safe working conditions in industrial applications by preventing hazardous situations that can lead to combustion or asphyxiation. These devices are used by environmental monitoring agencies to check the quality of the air and see whether organizations are complying with regulations. Furthermore, in medicine, oxygen sensors are essential to watch patients, especially in respiratory monitoring and ventilators. Factors contributing to the segment's strong market position include increasing workplace safety concerns, tightening environmental regulations, and growing adoption of medical oxygen monitoring devices. Thus, corporate world advances with gas detecting technologies core of which is oxygen concentration measurement as industries emphasize on safety and productivity.

By Application

The Environmental Monitoring segment dominated with a market share of over 36% in 2023, which can be primarily attributed to the increasing global emphasis on air quality monitoring and pollution control. Governments and regulatory agencies impose strict environmental regulations that require companies to track and reduce emissions. The gas analyzers act as a crucial tool to identify harmful gases, maintain air quality standards, and reduce environmental hazards. Growing worries about climate change, urban air pollution and industrial releases also fuel demand. Sensor technology improvements also enable real-time monitoring, promoting proactive environmental management. The mounting educational and regulatory pressures have led a variety of sectors from industries to municipalities to research institutions to heavily invest in gas analysis solutions, reaffirming the segment’s position as the market leader, and ensuring the segment's long-term growth prospects as well.

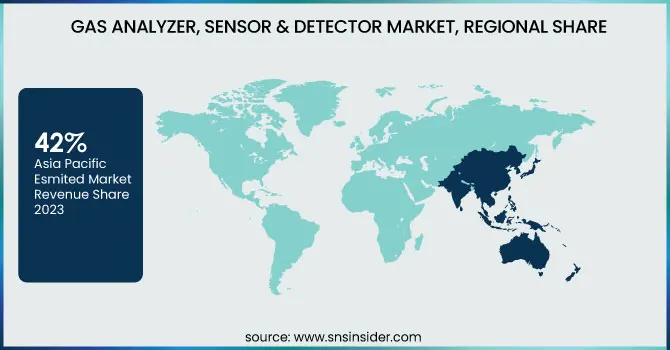

Gas Analyzer, Sensor & Detector Market Regional Outlook

Asia-Pacific region dominated with a market share of over 42% in 2023, due to rapid industrialization and increasing environmental concerns. In addition, the oil & gas, chemicals, and manufacturing industries in countries such as China, India, and Japan are flourishing at a fast pace, which in turn is anticipated to stimulate the overall growth of the gas detection equipment market over the coming years by necessitating enhanced gas detection solutions for workplace safety and regulatory compliance. Stringent government regulations on emissions and air quality monitoring are also driving the need for gas analyzers and sensors. Also, a growing energy sector in Africa, along with increasing investments in the industrial automation field further adds to the growth prospects for the market. Asia-Pacific is the leading region in gas detection systems market.

North America is the fastest-growing region in the Gas Analyzer, Sensor, and Detector Market, driven by several key factors. Gas Detection Market on the Rise Due to IoT Integration in the Region Alarming Trends in the gas detection market would be regional, with penetration of advanced IoT, AI, and real-time monitoring solutions in the region to improve efficiency and safety. Moreover, the rapid implementation of gas detection systems in different verticals such as oil & gas, chemicals, and mining is anticipated to drive the market over the forecast period. Strict workplace safety regulations, enforced by agencies such as OSHA (Occupational Safety and Health Administration) and EPA (Environmental Protection Agency), require the implementation of sophisticated gas monitoring systems to mitigate hazards. Increased investments in industrial infrastructure and the increasing emphasis on the safety of workers also you to more growth of this market in North America.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players in the Gas Analyzer, Sensor & Detector Market

-

Honeywell International (U.S.) – (Gas Detection Systems, Multi-Gas Detectors)

-

Spectris (U.K.) – (Gas Analyzers, Environmental Sensors)

-

Emerson Electric (U.S.) – (Process Gas Analyzers, Combustion Gas Sensors)

-

Ametek (U.S.) – (Infrared Gas Analyzers, Emission Monitoring Systems)

-

Environmental Sensors and Technologies (U.S.) – (Air Quality Sensors, VOC Detectors)

-

MSA Safety (U.S.) – (Portable Gas Detectors, Fixed Gas Detection Systems)

-

Smiths Group (U.K.) – (Explosive Gas Detection, Industrial Gas Sensors)

-

Thermo Fisher Scientific (U.S.) – (Gas Chromatographs, Mass Spectrometers)

-

Sensata Technologies (U.S.) – (Pressure and Gas Sensors, HVAC Gas Detection)

-

Dynisco (U.S.) – (Process Gas Sensors, Industrial Pressure Sensors)

-

Yokogawa (Japan) – (Laser Gas Analyzers, Emission Monitoring Systems)

-

Siemens (Germany) – (Ultrasonic Gas Flow Meters, Infrared Gas Sensors)

-

Bruel Kjaer (Denmark) – (Gas Monitoring Sensors, Acoustic Emission Analyzers)

-

City Technology (U.K.) – (Electrochemical Gas Sensors, Industrial Gas Detectors)

-

Alphasense (U.K.) – (Air Quality Gas Sensors, Optical Gas Detectors)

-

Drägerwerk (Germany) – (Toxic Gas Detectors, Portable Gas Monitors)

-

Teledyne Technologies (U.S.) – (NDIR Gas Analyzers, Flame & Gas Detection)

-

Horiba Ltd. (Japan) – (Stack Gas Analyzers, Automotive Emission Monitors)

-

ABB (Switzerland) – (Laser-Based Gas Analyzers, Continuous Emission Monitoring)

-

Industrial Scientific (U.S.) – (Wireless Gas Detectors, Personal Gas Monitors)

Suppliers for (Industrial and commercial gas detection systems) on Gas Analyzer, Sensor & Detector Market

-

Honeywell

-

Draper Tools

-

RKI Instruments

-

Industrial Scientific

-

Crowcon

-

Trolex

-

Teledyne Gas and Flame Detection

-

Draeger

-

A1-CBISS

-

Kane International

Recent Development

-

In June 2023: Alphasense, a UK-based manufacturer of air quality monitoring and gas detection sensors, introduced a new compact sensor format designed for portable devices.

-

In October 2023: Sensata launched the first A2L leak detection sensor certified for multiple HVAC refrigerants, aiding HVAC manufacturers in transitioning to refrigerants with lower global warming potential.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.31 Billion |

| Market Size by 2032 | USD 7.40 Billion |

| CAGR | CAGR of 6.19% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor Type (Electrochemical Sensors, Solid-State Sensors, Optical Sensors, Catalytic Sensors, Thermal Conductivity Sensors) • By Measurement Parameter (Oxygen Concentration, Carbon Dioxide Concentration, Carbon Monoxide Concentration, Nitrogen Oxide Concentration, Sulfur Dioxide Concentration, Combustible Gas Concentration, Volatile Organic Compounds Concentration, Particulate Matter Concentration) • By Application (Environmental Monitoring, Industrial Process Control, Medical Diagnostics, Automotive Emissions Monitoring, Indoor Air Quality Monitoring, Food and Beverage Processing, Pharmaceutical Production) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Honeywell International, Spectris, Emerson Electric, Ametek, Environmental Sensors and Technologies, MSA Safety, Smiths Group, Thermo Fisher Scientific, Sensata Technologies, Dynisco, Yokogawa, Siemens, Bruel Kjaer, City Technology, Alphasense, Drägerwerk, Teledyne Technologies, Horiba Ltd., ABB, Industrial Scientific. |