Gaming Hardware Market Size & Growth:

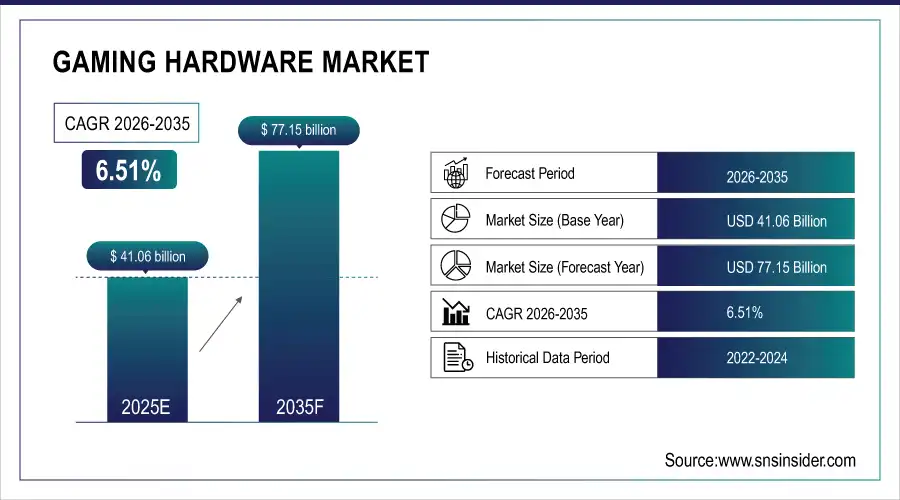

The Gaming Hardware Market was valued at USD 41.06 billion in 2025 and is expected to reach USD 77.15 billion by 2035, growing at a CAGR of 6.51% from 2026-2035.

The gaming hardware market has seen rapid growth due to increasing internet penetration and the rise of esports across key regions. Advanced multiplayer games, backed by significant public coverage and high sponsorship, are pushing gamers to invest in high-end consoles and peripherals as professional esports teams recruit players. Games with superfast frame rates and the integration of the Internet of Things (IoT) in gaming are also driving demand for premium hardware, creating new excitement among gamers. Furthermore, the desire for realistic gaming experiences, alongside advanced consoles like the PlayStation 4 Pro and Xbox One X with enhanced features, is opening up new opportunities in the global gaming market. Key components of this market include gaming consoles, high-performance PCs, laptops, graphics cards, and peripherals such as gaming keyboards, mice, and headsets. The rise in content creation and streaming has further fueled the demand for high-performance hardware. However, supply chain challenges and semiconductor shortages have created constraints, impacting both production and pricing dynamics.

Gaming Hardware Market Size and Growth Projection:

-

Market Size in 2025: USD 41.06 Billion

-

Market Size by 2035: USD 77.15 Billion

-

CAGR (2026–2035): 6.51%

-

Base Year: 202

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

Get More Information on Gaming Hardware Market - Request Sample Report

Gaming Hardware Market Highlights:

-

Intel’s new Core Ultra mobile chips deliver much stronger integrated gaming performance than previous Intel iGPUs, but still don’t match discrete mobile GPUs, making them impressive yet not threatening to dedicated gaming laptops.

-

The Intel Arc B390 iGPU shows solid 1080p gaming performance — especially with upscaling — but still trails entry‑level discrete GPUs in many titles.

-

Windows 11 gaming performance myths are debunked: recent tests show that with updates, Windows 11 can outperform Windows 10 in gaming benchmarks at 1440p and 4K.

-

ASUS Republic of Gamers (ROG) has formed a global esports partnership with DRX, where ROG hardware will power DRX teams and players will help test future ROG gear.

-

Console vs PC gaming trends in 2026 suggest that handheld PCs don’t fully replace consoles — portability comes with trade-offs in simplicity and optimized gaming experiences.

-

Preferring consoles over PC is driven by cost predictability, simplicity, and more optimized game experiences, influencing some gamers to migrate from PC.

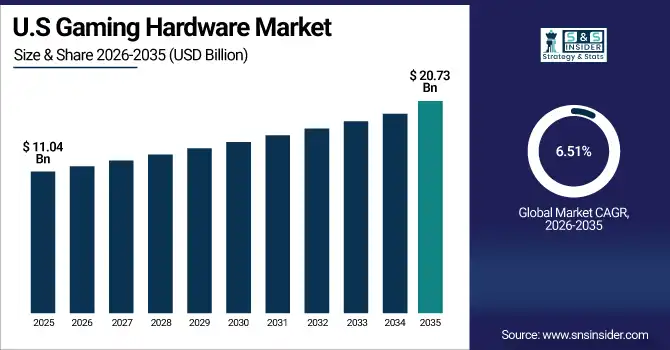

U.S. Gaming Hardware Market Size Outlook

The U.S. Gaming Hardware Market was valued at USD 11.04 billion in 2025 and is expected to reach USD 20.73 billion by 2035, growing at a CAGR of 6.51% from 2026–2035. The market growth is primarily driven by increasing demand for high-performance gaming laptops, desktops, and accessories, rising esports popularity, and the adoption of advanced technologies such as VR/AR, high-refresh-rate displays, and next-generation graphics cards.

Gaming Hardware Market Drivers:

-

Expanding Horizons Through Live Streaming of Multiplayer Gaming Events

Gaming has evolved from a niche pastime to a global entertainment phenomenon. With approximately 3.1 billion gamers worldwide in 2020 and an anticipated increase of 500 million by 2024, nearly half of the global population of 7.7 billion is engaging with video games. In 2021, the industry generated revenues of $175 billion, surpassing the combined earnings of movies, music, and books. Advancements in artificial intelligence and machine learning are driving the gaming sector to new heights, enhancing everything from network efficiency to player matchmaking. These technologies play a crucial role in nurturing new gamers, discouraging toxic behavior, optimizing monetization strategies, and creating expansive environments for players. A significant trend is the rise of live streaming for multiplayer gaming events, which has cultivated a devoted fan base and created a new generation of content consumers. This shift to live and recorded video game streaming necessitates advanced gaming hardware, such as high-quality speakers, responsive joysticks, motion controllers, and robust consoles. The increasing demand for such equipment is vital in supporting these large-scale streaming events, further propelling the growth of the gaming hardware market.

-

The Rise of Cloud-Based Gaming Driving Hardware Advancements.

The market for cloud-streamed gaming is experiencing strong growth, fueled by improved availability and adaptability to meet the needs of a variety of gaming audiences. This phenomenon is particularly noteworthy in developing countries in Latin America, the Middle East and Africa (MEA), and certain parts of Europe, where mobile devices are increasingly becoming the main choice for gaming activities. As stated by IDC's Worldwide Quarterly Gaming Tracker®, cloud-streamed gaming revenue remains strong even with the closure of platforms like Stadia, showing high demand for convenient gaming options. The rise in demand is pushing gamers to look for powerful hardware that can handle advanced streaming features. As gamers shift to cloud services, the need for strong PCs, high-quality monitors, and effective networking gear increases, as these are crucial for providing seamless, lag-free gaming experiences. Additionally, the rise of distinct and varied gaming titles offered on cloud platforms motivates users to enhance their devices for the best possible performance. The link between the rise of cloud-based gaming and the demand for high-end gaming equipment showcases how the gaming industry constantly evolves through technological advancements that improve the gaming experience.

Gaming Hardware Market Restraints:

-

The expensive gaming hardware is hindering the growth of the market.

Although gaming provides many opportunities in different sectors, the expensive equipment and hardware continue to prevent many consumers from fully participating. The shortage of semiconductor chips essential for operating gaming laptops and consoles has worsened in various regions, adding to the challenge. Moreover, certain nations are still struggling with the economic aftermath of the pandemic, which is limiting their capacity to invest in gaming technology. In November 2021, Nintendo Co. Ltd., a major player in the gaming sector, revealed that the worldwide chip shortage compelled the company to reduce its sales projections for the Switch console, potentially hindering gaming hardware advancement. As a reaction, Nintendo is actively trying to replace components to lessen the impact of the chip shortage, modifying current designs to sustain production rates. This scenario emphasizes the double difficulty of expensive expenses and supply chain interruptions, which hinder customer access to cutting-edge gaming technologies and also affect manufacturers' capacity to create new products and meet market needs efficiently.

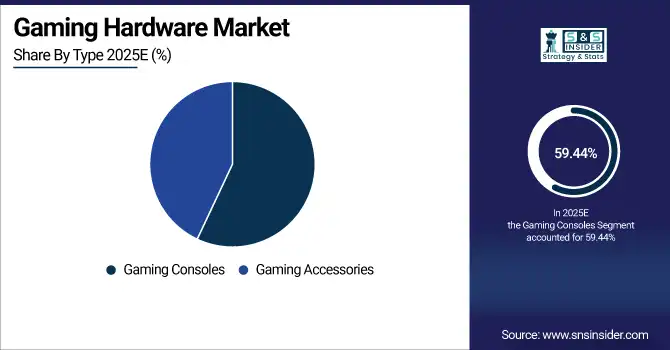

Gaming Hardware Market Segment Analysis:

By Type

In the gaming hardware market, gaming consoles have become the top segment, obtaining a significant 59.44% of the revenue in 2025. Continuous advancements in console technology, coupled with a strong lineup of exclusive games, are the reasons behind this dominant position. Key industry contenders, like Sony and Microsoft, have played a major role in fueling this expansion by releasing their most recent console editions. The PlayStation 5 by Sony, which came out in late 2020, has revolutionized the gaming industry with its cutting-edge hardware, such as a customized SSD for quicker load speeds and improved graphics performance. Microsoft has made significant progress with the Xbox Series X by incorporating robust hardware and services such as Xbox Game Pass, offering subscribers a wide selection of games. Moreover, there is a growing emphasis on cross-platform compatibility among businesses, enabling users to have a cohesive experience on all devices. The increase in popularity of cloud gaming services, which allow gamers to stream games directly to their consoles, enhances the attractiveness of gaming consoles even more. Therefore, the gaming console industry is ready for sustained expansion, fueled by constant improvements in products and a growing gaming ecosystem that enhances the player's experience.

By End User

In 2025, residential gaming hardware remains the leading segment in the gaming hardware market, with a significant 59.56% share. This upsurge is a result of more gamers looking for immersive and high-quality gaming experiences while staying at home. Large corporations have met this need by introducing new and creative products tailored for home gamers. Nvidia's launch of the GeForce RTX 4000 series GPUs has transformed gaming performance through cutting-edge ray tracing tech and AI-driven features, making them top picks for premium gaming setups. Furthermore, Corsair and Razer have also released various accessories such as mechanical keyboards and gaming mice tailored to improve the gaming experience at home. The growth of online gaming platforms and membership services like Xbox Game Pass and PlayStation Plus has prompted more gamers to enhance their home setups. Additionally, the increase in popularity of social gaming and streaming platforms has encouraged home gamers to enhance their hardware for improved performance and visuals. Due to ongoing product innovations and changes in home entertainment, the residential gaming hardware segment is set to continue growing.

Gaming Hardware Market Regional Analysis:

North America Gaming Hardware Market Trends

By 2025, North America has established itself as the gaming hardware market's top revenue-generating region, comprising 34.44% of the overall share. The strong influence comes from a thriving gaming community, advances in technology, and major investments from top gaming firms. Key companies like Nvidia and AMD have introduced advanced graphics cards, like the GeForce RTX 40 series and Radeon RX 7000 series, improving gaming with ray tracing and AI features. Furthermore, Sony and Microsoft have continued to push the boundaries with the PlayStation 5 and Xbox Series X consoles, providing top-notch performance and exclusive games that have further increased hardware sales. The growth of esports in the area has led to a higher need for top-quality gaming systems, causing local businesses to invest in dedicated gaming gear. Nations such as the United States and Canada lead this expansion, due to robust internet infrastructure and a sizable community of passionate gamers. As innovation flourishes in North America and consumer engagement improves, the gaming hardware market is forecasted to grow, solidifying its leading role worldwide.

Need any customization research on Gaming Hardware Market - Enquiry Now

Asia Pacific Gaming Hardware Market Trends

In 2025, the Asia-Pacific region has emerged as the fastest-growing market for gaming hardware, driven by a surge in gaming popularity, rapid technological advancements, and an expanding middle class with disposable income. Countries such as China, Japan, and South Korea are leading this growth, fueled by a vibrant gaming culture and a large population of gamers. The increasing adoption of smartphones and high-speed internet has facilitated the rise of mobile gaming, prompting companies to launch innovative gaming hardware tailored to mobile users. Notable product releases include Tencent's new cloud gaming platform and Sony's expansion of PlayStation services in Asia, catering to the growing demand for high-quality gaming experiences. Additionally, Nvidia and AMD have introduced state-of-the-art graphics cards and gaming accessories, making high-performance gaming more accessible to a broader audience. The rise of esports in the region is further propelling the demand for specialized gaming hardware, with countries investing in gaming infrastructure and hosting international tournaments. As the Asia-Pacific region continues to innovate and attract investment, it is poised to capture an increasingly larger share of the global gaming hardware market in the coming years.

Europe Gaming Hardware Market Trends

Europe holds a substantial position in the global gaming hardware market, driven by a strong base of console and PC gamers, supported by technological advancements and favorable regulations promoting digital entertainment. Key markets such as Germany, the UK, and France are driving demand with increasing adoption of high-performance gaming PCs, consoles, and peripherals. Companies like Sony, Microsoft, and Logitech have strengthened their presence with region-specific promotions and hardware bundles. The rapid rise of esports leagues and cloud-based gaming services, along with enhanced broadband and expanding 5G networks, is further fueling growth across the region.

Latin America Gaming Hardware Market Trends

Latin America continues to develop as a promising market for gaming hardware, driven by an expanding gamer population, increased smartphone penetration, and improved access to digital payment systems. Brazil and Mexico lead the region with strong demand for affordable consoles and mobile gaming peripherals. Despite economic challenges and uneven infrastructure, companies like Microsoft and Sony are focusing on cost-effective subscription services, bundled hardware packages, and localized content to attract users. The growing influence of esports and online multiplayer gaming in urban centers is also boosting demand for mid-range gaming PCs and accessories.

Middle East & Africa (MEA) Gaming Hardware Market Trends

The Middle East & Africa region is gaining traction in the global gaming hardware market, driven by a young, tech-savvy population and increasing investments in digital infrastructure. Countries like the UAE, Saudi Arabia, and South Africa are leading growth with rising adoption of gaming consoles and esports-related equipment. Government initiatives to promote digital transformation and entertainment hubs are further enhancing the market. However, challenges such as limited high-speed internet access in rural areas and high import costs for gaming equipment continue to restrain rapid expansion.

Gaming Hardware Market Competitive Landscape:

Microsoft Corporation, established in 1975, is a global technology leader headquartered in Redmond, Washington, specializing in software, hardware, and cloud services. Renowned for its Windows OS, Office suite, Azure cloud platform, and Xbox gaming consoles, Microsoft drives innovation in AI, productivity solutions, and gaming ecosystems, serving diverse global markets.

-

In March 2023: Microsoft collaborated with cloud gaming service provider Boosteroid to increase the number of games available to consumers worldwide.

NVIDIA Corporation, established in 1993, is a leading technology company headquartered in Santa Clara, California. It specializes in graphics processing units (GPUs), AI computing, and high-performance computing solutions. Known for its GeForce gaming GPUs and data center platforms, NVIDIA drives innovation in gaming, AI, autonomous vehicles, and visual computing worldwide.

-

In February , 2023: Microsoft and NVIDIA announced a 10-year deal to provide Xbox PC titles to the over 25 million NVIDIA users. The GeForce NOWTM cloud gaming service is accessible in over 100 countries. The collaboration will bring popular Xbox titles from Activision, such as Call of Duty and Minecraft, to the NVIDIA GeForce NOW cloud gaming service.

Gaming Hardware Companies are:

-

Microsoft Corporation

-

NVIDIA Corporation

-

Sony Corporation

-

Logitech International S.A.

-

Venom UK Ltd.

-

Oculus VR

-

Sega Games

-

Corsair Gaming, Inc.

-

Razer Inc.

-

Alienware

-

ASUS

-

Acer

-

HP Inc.

-

SteelSeries

-

AMD

-

Valve Corporation

-

Epic Games

-

Tencent Holdings

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 41.06 Billion |

| Market Size by 2035 | USD 77.15 Billion |

| CAGR | CAGR of 6.51 % From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Gaming Consoles, Gaming Accessories) • By End User (Commercial Gaming Hardware, Residential Gaming Hardware) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Microsoft Corporation, Sony Corporation, Nintendo Co., Ltd., NVIDIA Corporation, Logitech International S.A., Venom UK Ltd., Oculus VR, Linden Research, Sega Games, Corsair Gaming, Inc., Razer Inc., Alienware (Dell Technologies), ASUS, Acer, HP Inc., SteelSeries, AMD, Valve Corporation, Epic Games, Tencent Holdings |