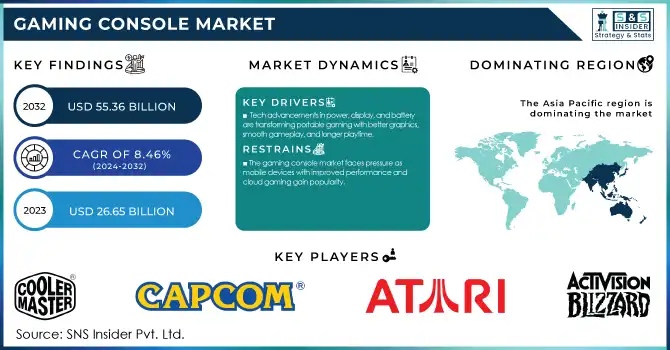

Gaming Console Market Size & Trends:

The Gaming Console Market Size was valued at USD 26.65 billion in 2023 and is expected to grow to USD 55.36 billion by 2032 and grow at a CAGR of 8.46% over the forecast period of 2024-2032.

The gaming console market has seen significant growth driven by the rise of online multiplayer games and e-sports, which have fostered a competitive, engaged community. Improved internet connectivity and the expansion of cloud gaming have broadened the reach of console gaming, making it more accessible.

Get E-PDF Sample Report on Gaming Console Market - Request Sample Report

Additionally, the integration of consoles with streaming services and multimedia functionalities has transformed them into all-in-one entertainment hubs, appealing to a wider demographic. Leading vendors such as Sony and Microsoft are capitalizing on this trend by launching high-performance consoles tailored to the needs of hardcore gamers. Both companies are preparing to release new-generation consoles, utilizing strategic pricing and marketing to maintain their dominance. The evolution of gaming hardware, with iterative console models like Sony’s PlayStation 4 (PS4), PlayStation 4 Pro, and PlayStation Slim, alongside Microsoft's Xbox One S, reflects the industry's shift towards more advanced and versatile devices. Furthermore, advancements in virtual and augmented reality (VR/AR) technologies are reshaping the gaming experience, attracting both existing players and newcomers. The demand for home consoles has also surged as modern games require powerful hardware, and the added appeal of 4K TVs enhances the overall experience. Collaborations like Amazon and Microsoft’s integration of Xbox cloud gaming into Fire TV devices further expand accessibility to premium gaming content, with popular titles such as Starfield, Fallout 4, and Forza Horizon 5 available through the Xbox Game Pass Ultimate subscription. However, growth in the gaming console market is hindered by challenges such as high development costs, supply chain issues, semiconductor shortages, and intense competition from mobile and PC gaming. The increasing shift toward cloud gaming and streaming services, combined with economic uncertainties, presents additional challenges. Despite these hurdles, the continued development of immersive VR/AR technologies is expected to drive further growth, with game developers creating exclusive experiences for advanced consoles and VR/AR peripherals like headsets playing a key role in market expansion.

Gaming Console Market Dynamics

Drivers

-

Tech advancements in power, display, and battery are transforming portable gaming with better graphics, smooth gameplay, and longer playtime.

Technological advancements are transforming the portable gaming console market, driving the demand for more powerful, immersive, and user-centric systems. Among these innovations, improvements in hardware, display technology, and battery life have become crucial in addressing the evolving needs of gamers. One of the most notable trends is the substantial boost in processing power. Modern consoles now feature high-performance processors and GPUs that offer smooth, high-quality graphics, even for demanding games, enabling portable systems to rival traditional home consoles.Display technology has significantly advanced, with portable gaming consoles now equipped with high refresh rates and features like Variable Refresh Rate (VRR), ensuring a fluid, lag-free gaming experience. This is particularly vital for fast-paced games, where smooth visuals directly impact gameplay. Additionally, advancements in battery life are helping portable systems to support longer gaming sessions without the frequent need to recharge, a common limitation of previous models.The latest models now feature powerful processors, such as AMD Ryzen and high-performance GPUs, capable of handling graphically intense games at 1080p with high frame rates. The display technology has also evolved, with consoles boasting 120Hz refresh rates and VRR support to ensure smooth, immersive visuals with minimal screen tearing. This is particularly important for fast-paced games, where fluidity in visual rendering can enhance the overall experience. The advancements in battery life, with powerful 72Wh batteries, enable gamers to enjoy extended gaming sessions without the constant need for recharging. The integration of capacitive joystick technology provides better precision and durability, making these consoles suitable for both casual and competitive gamers. These combined features showcase how portable gaming systems are meeting the growing demand for high-performance, on-the-go gaming experiences that balance power and portability. As the gaming industry embraces more mobile and cloud-based experiences, these innovations signal a new era for portable gaming consoles.

Restraints

-

The gaming console market faces pressure as mobile devices with improved performance and cloud gaming gain popularity.

The gaming console market is facing significant challenges due to competition from mobile devices, which are rapidly enhancing their gaming capabilities. Smartphones and tablets, equipped with powerful processors, high-quality displays, and an expanding library of gaming apps, provide a convenient and versatile alternative to traditional gaming consoles. The increasing performance of mobile devices, including advanced cooling systems and improved graphics, is narrowing the gap between them and dedicated gaming consoles, making them more attractive to consumers. Companies like Samsung and RedMagic are also developing gaming smartphones that can serve as full-fledged gaming systems, further intensifying competition. Additionally, the rise of cloud gaming has made it easier for players to access console-quality games directly on their mobile devices, further diminishing the need for traditional gaming hardware. PC gaming is also gaining momentum, now accounting for 53% of non-mobile gaming sales, which adds to the pressure on the console market. Developers are increasingly prioritizing mobile platforms, with 90% of them planning to develop for iOS and 75% for Android, while only 15% are focusing on Windows Phone. This trend underscores the growing shift towards mobile-first gaming, and as mobile gaming devices continue to improve, established gaming console brands like Nintendo, Sony, and Valve face mounting pressure to innovate in order to remain competitive.

Gaming Console Market Segmentation Overview

By Type

In 2023, the home console segment led the gaming console market, holding a 63% share. This includes popular consoles like PlayStation, Xbox, and Nintendo Switch, designed for stationary use with a TV or monitor. Home consoles remain dominant due to their ability to deliver high-performance gaming, superior graphics, and fast processing speeds, alongside extensive game libraries. Console-exclusive titles, such as The Last of Us, Halo, and Zelda, build strong brand loyalty, influencing consumer choices. Additionally, home consoles offer immersive experiences for both single-player and multiplayer games, which mobile devices and PCs struggle to replicate. They also provide robust online services like PlayStation Network and Xbox Live, supporting multiplayer gaming and exclusive content. The affordability and broad accessibility of home consoles appeal to both casual and serious gamers.

The handheld console segment is projected to see the fastest growth in the gaming console market from 2024 to 2032. Devices like the Nintendo Switch, PlayStation Vita, and upcoming models from companies like AOKZOE offer the advantage of gaming on the go, making them increasingly popular among gamers seeking portability. The segment’s growth is driven by advancements in hardware, such as faster processors, improved GPUs, and higher resolution displays, enabling handheld consoles to deliver experiences similar to traditional home consoles. Additionally, battery life improvements are addressing one of the main limitations of portable devices, allowing for longer gaming sessions. As these devices continue to evolve, they offer both casual and serious gamers a compelling alternative to home consoles and mobile gaming.

By Application

In 2023, the gaming segment dominated the gaming console market, accounting for approximately 79% of total market revenue. This dominance is driven by the widespread demand for high-quality gaming experiences, with consoles like PlayStation, Xbox, and Nintendo Switch leading the charge. The gaming segment remains the primary focus for console manufacturers, as these devices offer immersive gameplay, advanced graphics, and large game libraries that cater to both casual and hardcore gamers. The continuous innovation in gaming technology, including faster processors, enhanced graphics, and exclusive titles, further boosts the appeal of gaming consoles. The growing popularity of online multiplayer gaming and virtual reality experiences has contributed to the sustained growth of the gaming segment, making it the dominant revenue-generating application in the gaming console market.

The non-gaming segment is expected to be the fastest-growing segment in the gaming console market from 2024 to 2032. This growth is largely driven by the increasing adoption of consoles for entertainment purposes beyond gaming, such as streaming services, media consumption, and interactive applications. Devices like PlayStation and Xbox are now equipped with features that support video streaming, music, and even fitness apps, making them multifunctional entertainment hubs. The rise of cloud gaming and services such as Xbox Game Pass and PlayStation Plus, offering access to a library of games and additional entertainment content, is also contributing to this trend. As consumers increasingly seek all-in-one devices for entertainment, the non-gaming segment is expanding rapidly, pushing the gaming consoles to serve as versatile home entertainment systems.

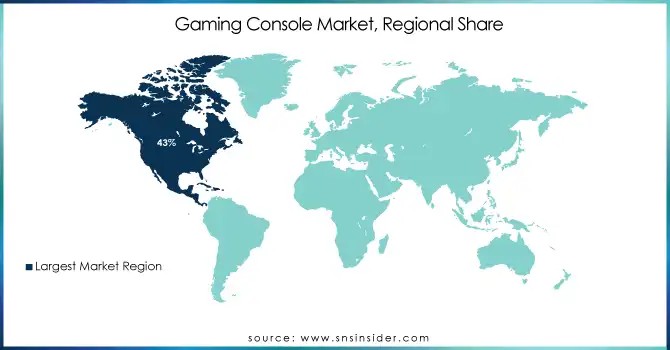

Gaming Console Market Regional Analysis

North America dominated the gaming console market in 2023, accounting for approximately 43% of the global market share. This dominance is driven by a combination of factors, including strong consumer demand, high disposable incomes, and the rapid adoption of gaming technologies. The U.S. and Canada are key contributors to this growth, with leading gaming companies like Sony, Microsoft, and Nintendo having a significant presence in the region. The region benefits from a large, engaged gaming population, including both casual and hardcore gamers. Additionally, the continuous technological advancements in hardware and gaming ecosystems, along with growing interest in online multiplayer gaming and esports, have contributed to the sustained growth of the gaming console market in North America, solidifying its leadership position.

Asia-Pacific is expected to be the fastest-growing region in the gaming console market over the forecast period from 2024 to 2032. This growth is driven by rapid technological advancements, increasing disposable income, and a large, youthful population with a growing interest in gaming. Key markets such as China, Japan, South Korea, and India are at the forefront of this expansion. China, with its massive gaming community and rising middle class, is a significant contributor to the region’s growth. Japan and South Korea, home to major gaming companies like Sony and Nintendo, continue to innovate in gaming hardware and software, strengthening their market presence. India’s expanding digital infrastructure and increasing smartphone penetration are also influencing gaming adoption, making Asia-Pacific a hub for gaming console market expansion.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key Players in Gaming Console Market with their product:

-

Activision Blizzard (Games: Call of Duty, Overwatch, World of Warcraft)

-

Atari Inc. (Retro Consoles: Atari VCS)

-

Capcom Co. Ltd. (Games: Resident Evil, Street Fighter, Monster Hunter)

-

Cooler Master Co. Ltd. (Gaming Peripherals: Cooling Systems, Cases, Keyboards)

-

Corsair Components Inc. (Gaming Peripherals: Headsets, Keyboards, Mice, Memory Modules)

-

Dell Technologies (Alienware Gaming PCs and Peripherals)

-

Gameloft SE (Mobile and Console Games: Asphalt Series, Disney Magic Kingdoms)

-

Hyperkin Inc. (Retro Gaming Accessories: RetroN Series Consoles, Controllers)

-

HyperX (Gaming Headsets, Keyboards, Memory Products)

-

Logitech Inc. (Gaming Peripherals: Keyboards, Mice, Racing Wheels)

-

Mad Catz Global Ltd. (Gaming Accessories: Arcade Sticks, Controllers, Keyboards)

-

Microsoft Corp. (Consoles: Xbox Series X/S, Games: Halo, Forza Horizon)

-

Nintendo Co. Ltd. (Consoles: Nintendo Switch, Games: Mario, Zelda, Pokémon)

-

NVIDIA Corporation (Gaming Hardware: GeForce GPUs, SHIELD TV)

-

Ouya Inc. (Subsidiary of Razer) (Console: Ouya Android Gaming Console)

-

PlayJam (Smart TV Gaming Platforms and Micro-Consoles: GameStick)

-

Razer Inc. (Gaming Peripherals: Keyboards, Mice, Laptops, Razer Kishi)

-

Redragon (Gaming Peripherals: Keyboards, Mice, Headsets)

-

Republic of Gamers (ROG) (ASUS Brand) (Gaming Laptops, Desktops, Accessories)

-

Rockstar Games Inc. (Games: Grand Theft Auto, Red Dead Redemption, Max Payne)

-

Sega Holdings Co. Ltd. (Games: Sonic the Hedgehog, Yakuza Series, Retro Consoles)

-

Sony Corp. (Consoles: PlayStation Series, Games: God of War, The Last of Us)

-

SteelSeries (Gaming Peripherals: Headsets, Mice, Keyboards, Controllers)

-

Tencent Games (Games: PUBG Mobile, Honor of Kings, Call of Duty Mobile)

-

Ubisoft Entertainment SA (Games: Assassin’s Creed, Far Cry, Watch Dogs)

-

Valve Corp. (Games and Hardware: Steam Deck, Half-Life, Dota 2, Steam Platform)

List of suppliers for the gaming console market, which provide components, technology, or services critical to the development and manufacturing of gaming consoles:

-

Foxconn Technology Group

-

Pegatron Corporation

-

Wistron Corporation

-

Samsung Electronics Co., Ltd.

-

Micron Technology, Inc.

-

NVIDIA Corporation

-

AMD (Advanced Micro Devices, Inc.)

-

MediaTek Inc.

-

Murata Manufacturing Co., Ltd.

-

Nidec Corporation

Recent Development

-

3 Dec 2024: Sony CEO Hermen Hulst highlighted AI's transformative impact on gaming, enabling dynamic experiences but emphasized that human creativity remains irreplaceable in storytelling. Sony also marked 30 years of PlayStation, celebrating over 450 million units sold since its 1994 launch.

-

November 13, 2024: Microsoft Gaming CEO Phil Spencer confirmed plans for an Xbox handheld device, currently in prototype stages, aiming to support both local and cloud gaming.

-

January 17, 2025: Nintendo announced the Nintendo Switch 2, set to launch in 2025 with backward compatibility for most original Switch games, but investor concerns over the extended timeline led to a 5% drop in its shares.

| Report Attributes | Details |

| Market Size in 2023 | USD 26.65 Billion |

| Market Size by 2032 | USD 55.36 Billion |

| CAGR | CAGR of 8.46% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Home Console, Handheld Console [Portable, Non-Portable]) • By Application (Gaming, Non-Gaming) • By End Use (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Activision Blizzard, Atari, Capcom, Cooler Master, Corsair, Dell Technologies, Gameloft, Hyperkin, HyperX, Logitech, Mad Catz, Microsoft, Nintendo, NVIDIA, Ouya, PlayJam, Razer, Redragon, Republic of Gamers (ASUS), Rockstar Games, Sega, Sony, SteelSeries, Tencent Games, Ubisoft, and Valve |

| Key Drivers | • Tech advancements in power, display, and battery are transforming portable gaming with better graphics, smooth gameplay, and longer playtime. |

| Restraints | • The gaming console market faces pressure as mobile devices with improved performance and cloud gaming gain popularity. |