Fungicides Market Report Scope & Overview:

Get More Information on Fungicides Market - Request Sample Report

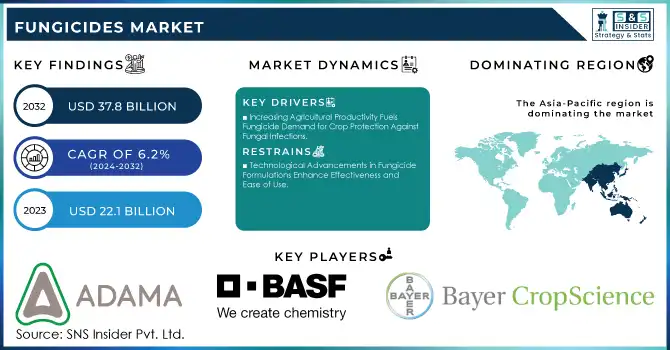

The Fungicides Market Size was valued at USD 22.1 billion in 2023, and is expected to reach USD 37.8 billion by 2032, and grow at a CAGR of 6.2% over the forecast period 2024-2032.

The fungicides market continues to evolve, driven by the rising need for advanced crop protection solutions to combat fungal infections that significantly reduce agricultural productivity. The increasing prevalence of rice diseases like bacterial leaf blight and fungal threats in cereals, oilseeds, and vegetables propels this demand. FMC Corporation has taken a significant step by introducing bio-fungicides in India, specifically targeting bacterial leaf blight in rice as of August 2023, showcasing the industry's shift towards sustainable solutions. Similarly, researchers at the University of Nottingham unveiled an eco-friendly fungicide alternative in January 2024, reflecting a growing emphasis on sustainable and environmentally friendly formulations. The push for innovation is evident as manufacturers and researchers aim to cater to farmer needs while adhering to regulatory demands and environmental concerns.

Major companies are actively launching innovative products to cater to diverse regional and crop-specific needs, underscoring the competitive and dynamic nature of the fungicides market. BASF announced a new soybean fungicide in May 2023, designed to provide enhanced protection and efficacy, particularly addressing issues faced by soybean farmers. In January 2024, Adama expanded its portfolio with five new cereal fungicides across Europe, leveraging advanced formulation technologies to deliver superior results. In parallel, advancements in plant biology are aiding the discovery of promising new fungicides, as highlighted by researchers at UC Davis in February 2024. These developments reflect the industry's commitment to delivering high-performance solutions that address global agricultural challenges while paving the way for more sustainable and targeted pest management practices.

Fungicides Market Dynamics:

Drivers:

-

Increasing Agricultural Productivity Fuels Fungicide Demand for Crop Protection Against Fungal Infections

The rising global population and the subsequent increase in food demand have put immense pressure on agricultural productivity. Fungicides play a crucial role in protecting crops from various fungal diseases that can lead to significant yield losses. Farmers are increasingly relying on fungicides to ensure healthy crop production and to secure their livelihoods. The emergence of new fungal strains and the climate's impact on crop health further intensify the need for effective fungicide solutions. As agricultural practices evolve to meet these demands, the adoption of fungicides is likely to increase, driving growth in the fungicides market.

-

Technological Advancements in Fungicide Formulations Enhance Effectiveness and Ease of Use

-

Expansion of Organic Farming Practices Increases Demand for Bio-Based Fungicides

The growing consumer preference for organic produce has led to a significant shift in farming practices, promoting the use of organic fungicides. Bio-based fungicides are derived from natural sources, making them attractive to farmers and consumers alike. This shift not only supports sustainable agriculture but also addresses environmental concerns associated with synthetic chemicals. As organic farming continues to expand globally, the demand for bio-based fungicides is expected to rise, contributing to the growth of the fungicides market. Farmers are increasingly recognizing the benefits of using organic fungicides to protect crops while maintaining compliance with organic certification standards.

-

Rising Awareness of Plant Health and Integrated Pest Management Strategies Drive Fungicide Adoption

-

Regulatory Support for Sustainable Agricultural Practices Encourages Fungicide Innovation

Restraint:

-

Concerns Over Environmental Impact and Resistance Development May Limit Fungicide Usage

Opportunity:

-

Growing Adoption of Precision Agriculture Technologies Opens New Markets for Advanced Fungicides

-

Emerging Markets in Developing Regions Present Significant Growth Potential for Fungicide Products

-

Innovation in Biopesticides and Biostimulants Provides Opportunities for Fungicide Development

The increasing interest in biopesticides and biostimulants as sustainable alternatives to traditional fungicides presents new opportunities for innovation within the fungicides market. As consumers and farmers prioritize eco-friendly products, the development of biopesticides that harness natural microorganisms to combat fungal diseases is gaining traction. Additionally, biostimulants can enhance plant resilience against diseases, reducing the need for chemical fungicides. This shift toward biological solutions encourages collaboration between researchers, manufacturers, and farmers to create integrated products that improve crop health sustainably. Companies that invest in this area are likely to benefit from the growing demand for environmentally friendly agricultural solutions.

Challenge:

-

Market Volatility and Price Fluctuations in Raw Materials Pose Challenges to Fungicide Production

Sustainability Metrics and Environmental Impact in the Fungicides Market

Sustainability is a key focus in the fungicides market as the industry transitions towards eco-friendly and efficient solutions to meet growing agricultural demands. The table below highlights key metrics used to evaluate the environmental impact of fungicides, emphasizing bio-based innovations, reduced chemical footprints, and eco-label certifications. These metrics are essential for promoting sustainable farming practices and complying with stringent environmental regulations.

| Metric | Description | Impact |

|---|---|---|

| Bio-Based Fungicides Adoption | Share of natural or organic fungicides in the total market. | Reduces chemical pollution and supports organic farming. |

| Carbon Footprint Reduction | Emissions are saved through eco-friendly production and application practices. | Contributes to global carbon neutrality goals. |

| Soil and Water Quality Improvement | Reduction in harmful residues in soil and water post-application. | Ensures long-term agricultural sustainability. |

| Eco-Label Certifications | Number of fungicides certified as eco-friendly by recognized organizations. | Boosts farmer and consumer confidence in sustainable products. |

| Reduction in Synthetic Usage | The decline in the use of synthetic fungicides over time. | Minimizes environmental toxicity and promotes safer farming. |

The fungicides market is steadily adopting sustainability metrics such as bio-based innovations, carbon footprint reduction, and eco-label certifications. These measures are pivotal in mitigating environmental harm while supporting sustainable agriculture. Enhanced soil and water quality, along with reduced dependency on synthetic products, align the industry with global sustainability goals, fostering long-term agricultural viability.

Fungicides Market Segments Analysis

By Type

In 2023, the chemical fungicides segment dominated the market with a market share of approximately 65%. This dominance can be attributed to the widespread use of synthetic fungicides that offer high efficacy against a broad spectrum of fungal pathogens. Farmers prefer chemical fungicides for their immediate results and proven track record in various crops. For instance, traditional products like azoles and strobilurins have been instrumental in managing diseases in major crops such as wheat and corn. Additionally, ongoing innovation in chemical formulations, including the development of combination products, has further solidified the position of chemical fungicides in the market.

By Form

The liquid segment dominated the fungicides market in 2023, holding a market share of around 70%. Liquid formulations are favored by farmers for their ease of application and effectiveness in delivering active ingredients directly to plants. They can be applied through various methods, including foliar sprays and chemigation, which enhances their versatility in the field. For example, many modern fungicides, such as those developed for managing powdery mildew in grapes, are available in liquid forms, allowing for efficient distribution and rapid uptake by plants, thus ensuring better disease control.

By Crop Type

In 2023, the cereals and grains segment dominated the fungicides market, commanding a market share of approximately 45%. This can be attributed to the critical importance of cereal crops, such as wheat and rice, in global food security and the high prevalence of fungal diseases affecting these crops. For instance, the use of fungicides to combat diseases like Fusarium head blight in wheat has become essential for maintaining yields and ensuring food supply. Furthermore, as the demand for cereals continues to rise, so does the need for effective crop protection solutions, further boosting the market share of this segment.

By Mode of Application

In 2023, the foliar spray segment dominated the fungicides market with a market share of around 50%. This mode of application is preferred due to its effectiveness in directly targeting fungal infections on the leaves, where most fungal pathogens thrive. Foliar sprays allow for timely intervention, especially during critical growth stages when crops are most susceptible to diseases. For example, the application of fungicides through foliar sprays has been crucial in controlling late blight in potatoes, a disease that can devastate yields if not managed promptly. The efficiency and rapid action of foliar applications make them a preferred choice among farmers worldwide.

Fungicides Market Regional Overview

In 2023, the Asia-Pacific region dominated the fungicides market with a market share of approximately 40%. This dominance can be attributed to the region’s significant agricultural output, particularly in crops like rice, wheat, and vegetables, which are highly susceptible to fungal diseases. Countries like China and India are the major contributors to this market share, driven by their vast agricultural landscapes and heavy reliance on fungicides to combat common crop diseases such as rice blast in India and wheat rust in China. In China, fungicides are extensively used in wheat, rice, and corn crops, with the country accounting for the largest share of fungicide consumption in the region. India, with its diverse agricultural base, also sees widespread fungicide usage to combat diseases like bacterial leaf blight in rice and powdery mildew in vegetables. The availability of affordable and effective chemical fungicides, coupled with increasing awareness among farmers about the importance of crop protection, has further fueled growth in this region. The presence of large multinational corporations in the region, offering both chemical and bio-based fungicide solutions, has further reinforced Asia-Pacific’s market dominance.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Recent Developments

-

November 2024: FMC Corporation launched a new fungicide solution to address plant diseases and enhance crop productivity, focusing on sustainability.

-

June 2024: FMC India introduced plant disease solutions for fruits and vegetables, emphasizing sustainable formulations for higher yields and better quality.

-

May 2024: Syngenta extended its fungicide leadership with the ADEPIDYN technology, offering improved disease control and supporting sustainable agricultural practices.

Key Players in Fungicides Market

-

Adama Agricultural Solutions (Signum, Sencor, Bravo)

-

BASF SE (Headline, Cantus, Teldor)

-

Bayer CropScience (Corbel, Flint, Bayfidan)

-

Cheminova A/S (Carbendazim, Folicur, Topguard)

-

Dow AgroSciences (Quadris, Rally, Inspire Super)

-

DuPont (Chlorothalonil, Fontelis, Cabrio)

-

FMC Corporation (Ridomil Gold, Pristine, Topguard)

-

Lanxess AG (Opera, Amistar, Folicur)

-

Monsanto (Stratego, Pristine, Headline)

-

Nufarm Ltd (Score, Nativo, Mancozeb)

-

Simonis B.V. (Actamaster, Fungaflor, Sporgon)

-

UPL Ltd (Nativo, Folicur, Ridomil Gold)

-

Syngenta AG (Amistar, Elatus, Bravo)

-

Isagro S.p.A. (Siltac, Valbon, Sparviero)

-

Arysta LifeScience (Sercadis, Tebuconazole, Quintec)

-

Corteva Agriscience (Inspire Super, Aproach, Mettle)

-

Sumitomo Chemical Co., Ltd. (Sumilex, Oxycarboxin, Kocide)

-

Nihon Nohyaku Co., Ltd. (Nativo, Folicur, Sercadis)

-

Syngenta Crop Protection (Amistar, Actara, Orondis)

-

Corteva Agriscience (Inspire, Aproach, Velum)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 22.1 Billion |

| Market Size by 2032 | US$ 37.8 Billion |

| CAGR | CAGR of 6.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Biological, Chemical) • By Form (Dry, Liquid) • By Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Others) • By Mode of Application (Seed Treatment, Foliar Spray, Soil Treatment, Chemigation, Post-Harvest, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bayer CropScience, Nufarm Ltd, BASF SE, Dow AgroSciences, FMC Corporation, DuPont, Adama Agricultural Solutions, Lanxess AG, Cheminova A/S, Syngenta AG, Monsanto, Simonis B.V. and other key players |

| Key Drivers | • Technological Advancements in Fungicide Formulations Enhance Effectiveness and Ease of Use • Expansion of Organic Farming Practices Increases Demand for Bio-Based Fungicides |

| RESTRAINTS | • Concerns Over Environmental Impact and Resistance Development May Limit Fungicide Usage |