Get E-PDF Sample Report on Fructooligosaccharides Market - Request Sample Report

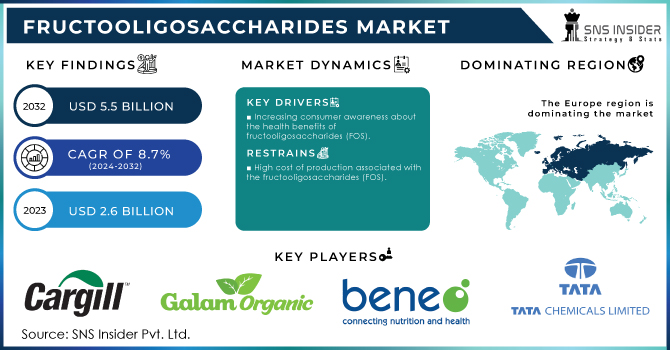

The Fructooligosaccharides Market Size was valued at USD 2.6 billion in 2023, and is expected to reach USD 5.5 billion by 2032, and grow at a CAGR of 8.7% over the forecast period 2024-2032.

Growing interest in healthier diets and demand for functional foods and beverages has basically driven the market for Fructooligosaccharides of late. It has basically been driven by increased awareness regarding health benefits accruing from the consumption of prebiotic fibers, in particular Fructooligosaccharides, towards the enhancement of digestive health and general wellbeing. In line with people going natural and organic, the demand for prebiotics is skyrocketing in general, reflecting a general lean toward ingredients that provide extra health value.

In this regard, current developments indicate a growing application of Fructooligosaccharides across industries. For instance, in June 2024, Danone, one of the largest food and beverage companies globally, launched gut-friendly and Fructooligosaccharides-enriched milk products to keep up with rising customer demand for ingredients providing gut health benefits. In 2024, in April, Ingredion Incorporated presented a fully integrated range of products in the bakery segment enriched with Fructooligosaccharides, which offered healthier bakery product alternatives. The above developments showcase the diversified Fructooligosaccharides and their formulation into a variety of food products.

The other major driving factor has been the rise of digestive disorders. On this note, in March 2024, Cargill revealed a new addition of a Fructooligosaccharides-based feed supplement that would improve gut health and feed efficiency in livestock. This typifies the accelerating role that Fructooligosaccharides is playing in this animal feed industry. One more important driving factor is regulatory and industry support accorded to Fructooligosaccharides in recent years. The EFSA guidelines on the use of Fructooligosaccharides in foodstuffs, updated in February 2024, paved the way for an even wider adoption of the ingredient. In May 2024, IFAA endorsed Fructooligosaccharides as a helpful ingredient in functional food products for promoting digestive health and gave impetus to market growth.

The trends in sustainability and clean label lead the market. Beneo of Switzerland introduced a new line of organic Fructooligosaccharides products in January 2024 in response to rapidly growing consumer demand for eco-friendly and more sustainable ingredient sourcing. That is against the larger backdrop of a market that is shifting toward more natural and less processed ingredients—increasingly demanded by consumers fueled through preferences for transparency and sustainability when it comes to the production of foods. Also, the Fructooligosaccharides market does not stop from the growth trajectory through new applications, changing regulatory frameworks, and emerging consumer trends.

Market Dynamics:

Drivers:

Increasing consumer awareness about the health benefits of fructooligosaccharides (FOS)

Growing consumer awareness about the health benefits derived from fructooligosaccharides consumption is one of the major factors driving the Fructooligosaccharides market. The more that is learned by consumers about digestive health and overall wellness, the more demand grows for products containing fructooligosaccharides as a result of its prebiotic properties. This awareness has been bolstered by various initiatives and product launches from leading companies. For example, new milk with added Fructooligosaccharides, touting the role of gut health and maintenance of a balanced microbiome, will be launched by Danone in June 2024. This launch was a part of the campaign with an unusually strong emphasis on the prebiotic benefit as part of consumer trends toward the natural and functional ingredients segment. Similarly, in April 2024, Ingredion Incorporated came up with bakery products that were rich in Fructooligosaccharrides and positioned them as a healthier solution since the oligosaccharides did not only provide sweetness to the foods but also contributed towards gut health. This positions the foods as capable of offering more than simple nutrition. It was in February 2024 that the EFSA also espoused the claimed health-related benefits of Fructooligosaccharides, boosting consumer confidence in the ingredients. Not without mention in explaining the growing popularity and, consequently, market growth, is the massive sensitization by corporates and regulatory bodies on the health benefits accruable from Fructooligosaccharides, as people seek functional foods that can support their well-being.

The growing prevalence of digestive disorders and the need for natural remedies

The fast-growing number of digestive disorders has increased the demand for natural remedies to a very large extent; one such remedy is that of fructooligosaccharides. Increased suffering from irritable bowel syndrome, constipation, and other conditions affecting the gastrointestinal system have shifted people toward natural solutions that would alleviate these problems without side effects. Due to its prebiotic properties, Fructooligosaccharides has become really popular among those who take their gut health issues seriously. For example, in July 2024, Japanese Meiji Holdings released a new line of functional beverages with added Fructooligosaccharides, aimed at helping people having digestive tract problems. Promotion of such products was positioned not only to help digestion but also to enhance mineral absorption and promote gut flora. In March 2024, Nestlé Health Science extended its portfolio to Fructooligosaccharides-based supplements for those suffering from digestive discomfort. The company said that Fructooligosaccharides is derived from natural origin and is also the real deal for driving a good gut environment, capitalizing on developing consumer demand for natural remedies underpinned by scientific evidence. These developments reflect the greater trend in the food and nutraceutical industries, where firms are more and more turning to Fructooligosaccharides products as a means of answering the growing demands from consumers for natural and effective digestive health solutions. This is also being driven by growing clinical research and recommendations from health professionals that continue to point to the benefits of Fructooligosaccharides as a safe and natural way to manage digestive disorders.

Restraints:

High cost of production associated with the fructooligosaccharides (FOS)

The high production cost is the major hurdle to the growth of the fructooligosaccharides market, as it limits the wide application of this sweetener. Generally, Fructooligosaccharides is extracted from chicory roots, whereby the extraction and purification processes involved are tough and not cheap. This adds to the costs, hence acting as a major barrier for manufacturers, especially considering the fact that the substitute synthetic sweeteners or alternative prebiotics are cheaper. For instance, Tate & Lyle, an international food and beverage ingredients company, was under pressure in February 2024 to raise its Fructooligosaccharides product line due to the high expenses of the raw materials and refining processes being too high. It noted down that with extraction of Fructooligosaccharides through advanced technologies and specialized equipment, the reason for the high production cost is what makes the extraction expensive. Moreover, in April 2024, French ingredient supplier Roquette came forward with similar concerns—that high operational costs hurt pricing strategies and competitive positioning. This not only increases the prices of Fructooligosaccharides-containing end products but also makes it hard for a small company to enter the market since they may not have sufficient capital and relevant technology to be more efficient at producing Fructooligosaccharides. This can therefore turn off price-sensitive consumers from the premium price that Fructooligosaccharides products command, thus hampering market growth, as manufacturers strive to find that sweet middle between quality and affordability.

Opportunities:

The expanding application of Fructooligosaccharides in various industries, such as pharmaceuticals and animal feed

Growing research and development activities to enhance the functionality and applications of Fructooligosaccharides

Challenges

Adhering to strict quality control measures and ensuring product safety

Fluctuating prices of raw materials and the volatility of the global market

By Source

By source, chicory dominated the Fructooligosaccharides market, commanding a share of approximately 60% in 2023. This is mainly due to the high content of inulin present in it which can efficiently get hydrolyzed to produce Fructooligosaccharides. Chicory root is the rich and reliable source of inulin, a polysaccharide which acts as a precursor to Fructooligosaccharides. The extraction process from chicory is well established, cost-effective, and yields high-quality Fructooligosaccharides; therefore it is preferred by manufacturers. For instance, companies such as Beneo have been utilizing the rich inulin content of chicory for the production of Fructooligosaccharides, offering uniform quality and continuous supply. Compared to sucrose and other sources, including inulin from other plants, extraction processes are often more complex or less efficient and thus costly, with varying product quality. This dominance is backed by the scalability and reliability of chicory cultivation and processing, which assures a steady supply of raw material. Moreover, it already had an established infrastructure and technological advances in processing chicory-derived inulin into Fructooligosaccharides, thus further consolidating the leading position.

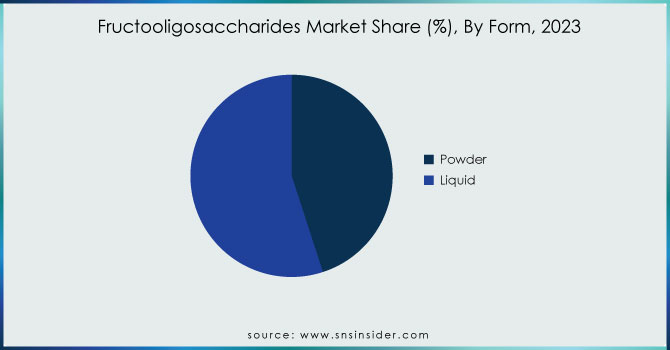

By Form

The liquid segment dominated the FOS market with a 55% share in 2023 due to its versatility and ease of incorporation into a wide range of products. FOS in liquid form is particularly preferred in the food and beverage industries since it easily blends into various formulations without changing the texture or involving any extra processing steps. This form is especially suitable in beverages, milk products, and syrups, in which it may serve as both a sweetener and a prebiotic ingredient. For example, in March 2023, Nestlé released a new range of functional beverages featuring liquid FOS and touting easier integration and improved solubility within liquid formulations. It is also one of the reasons why manufacturers are interested in liquid FOS: the possibility of preserving uniformity and functionality at a range of temperatures and over a range of pH values. This large share is attributed to the growing demand for convenience food and easily digestible food products, and also to the rising trend toward functional beverages. The superiority in usability and stability across a range of products will help it dominate the market over the powder form. Other than this, increasing ready-to-drink products and liquid dietary supplement demand has been contributing to the surging volume growth seen in liquid FOS.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

In 2023, the Food & Beverages segment dominates the Fructooligosaccharides market. This could be assigned to the occurrence of FOS and wide application of this ingredient in most food and beverage products. FOS is such a versatile ingredient that acts as a sweetener and prebiotic agent naturally, naturally making it a very exciting ingredient in improving the nutritional profile of food products without compromising taste or texture. Food & Beverages is expected to account for close to 65% share by 2023. This huge share is primarily driven by the growing demand of consumers for health-oriented food products and increasing trend towards functional and natural ingredients. For instance, in April 2023, The Coca-Cola Company introduced a new line of beverages that are fortified with FOS for digestive health and as a naturally derived alternative to synthetic sweeteners. In February 2023, General Mills introduced FOS-enriched bakery products that focused on an ingredient that could provide health benefits without prejudicing the quality of final products. Such extensive application of FOS in those kinds of products undoubtedly gives it a place in terms of consumer preferences for health and functionality.

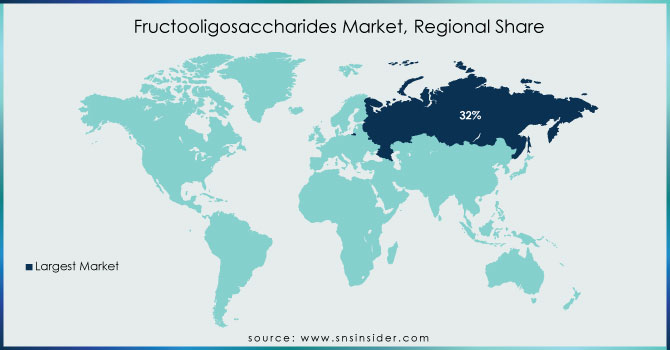

Regional Analysis

In 2023, Europe dominated the Fructooligosaccharides Market and accounted for a revenue share of 32%. One major driver behind this dominance in the Fructooligosaccharides Market by Europe is the enhancing consumer demand for natural and healthier food and beverage products. As people become more conscious about their diet, the allure of FOS, with its probable health benefits, grew multi-fold. This enhanced awareness has been one of the major driving factors for the market growth. In addition, EFSA is quite stringent about the safety and efficacy of FOS and approved it for both as a food ingredient and as a source of dietary fiber. Another reason which attributes to the dominance of Europe in the global market is the presence of a large number of infant formula manufacturers. With increased demand for food here, this has offered a great opportunity for the growth of the Fructo-oligosaccharides industry. Again, with the prevalence of obesity and an increasing number of diabetic patients in Europe, it added to its growth.

Moreover, in 2023, Asia-Pacific became the fastest-growing and held the highest revenue share of about 28% and finally the highest CAGR during the forecast period. The surge in growth may likely be because of increased consumer awareness about health and wellness coupled with increasing demand for functional foods and dietary supplements. Further, rising middle class and interest in natural and organic products increases FOS consumption in the region. This leading position is marked by a number of recent developments. For instance, in May 2023, an Indian company named Patanjali Ayurved announced its launch of new FOS-enriched health beverages targeting growing demand for digestive health products in the region. In a related development, the Chinese firm Baolingbao Biology Co., Ltd. increased its FOS production capacity in August 2023 to meet the rising demand from Asia-Pacific's food and beverages industries. Besides, shifting more focus toward health and well-being, combined with rapid economic growth in this region, further fuels the regional FOS market.

The major key players are Tata Chemicals Ltd., Cargill Inc., Galam, Beneo, Biosynth, Meiji Holdings Co. Ltd., Ingredion Inc., Tereos Group, Baolingbao Biological Co., Ltd., Prebiotin, and other key players are mentioned in the final report.

July 2024: Meiji launched new chocolate products that replace sugar with fructooligosaccharides, claiming they would adjust the intestinal flora to prevent various diseases.

May 2023: Beneo launched Beneo-scL85, an all-purpose short-chain Fructooligosaccharide (scFOS) for sugar reduction and enriching dietary fiber in a wide variety of food applications.

March 2023: Tereos had launched FOSbeauty, a breakthrough prebiotic ingredient for skin health that acts directly on the skin microbiota.

| Report Attributes | Details |

| Market Size in 2023 | US$ 2.6 Bn |

| Market Size by 2032 | US$ 5.5 Bn |

| CAGR | CAGR of 8.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | By Source (Sucrose, Inulin, and Chicory) By Form (Powder and Liquid) By Application (Infant Formulation, Pharmaceutical, Food & Beverages, Dietary Supplements, and Pet/Animal Feed) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Tata Chemicals Ltd., Cargill Inc., Galam, Beneo, Biosynth, Meiji Holdings Co. Ltd., Ingredion Inc., Tereos Group, Baolingbao Biological Co., Ltd., Prebiotin |

| Key Opportunities | • The expanding application of FOS in various industries, such as pharmaceuticals and animal feed • Growing research and development activities to enhance the functionality and applications of FOS |

| Market Challenges | • Adhering to strict quality control measures and ensuring product safety • Fluctuating prices of raw materials and the volatility of the global market |

Ans: The Fructooligosaccharides (FOS) Market was valued at USD 2.6 billion in 2023.

Ans: The expected CAGR of the global Fructooligosaccharides (FOS) Market during the forecast period is 8.7%.

Ans: The Liquid form segment dominated the Fructooligosaccharides (FOS) Market with the highest revenue share of about 55.1% in 2023.

Ans: Europe held the largest revenue share in 2023.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Fructooligosaccharides Market Segmentation, by Source

7.1 Introduction

7.2 Sucrose

7.3 Inulin

7.4 Chicory

8. Fructooligosaccharides Market Segmentation, by Form

8.1 Introduction

8.2 Powder

8.3 Liquid

9. Fructooligosaccharides Market Segmentation, by Application

9.1 Introduction

9.2 Infant Formulation

9.3 Pharmaceutical

9.4 Food & Beverages

9.5 Dietary Supplements

9.6 Pet/Animal Feed

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Fructooligosaccharides Market by Country

10.2.3 North America Fructooligosaccharides Market by Source

10.2.4 North America Fructooligosaccharides Market by Form

10.2.5 North America Fructooligosaccharides Market by Application

10.2.6 USA

10.2.6.1 USA Fructooligosaccharides Market by Source

10.2.6.2 USA Fructooligosaccharides Market by Form

10.2.6.3 USA Fructooligosaccharides Market by Application

10.2.7 Canada

10.2.7.1 Canada Fructooligosaccharides Market by Source

10.2.7.2 Canada Fructooligosaccharides Market by Form

10.2.7.3 Canada Fructooligosaccharides Market by Application

10.2.8 Mexico

10.2.8.1 Mexico Fructooligosaccharides Market by Source

10.2.8.2 Mexico Fructooligosaccharides Market by Form

10.2.8.3 Mexico Fructooligosaccharides Market by Application

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Fructooligosaccharides Market by Country

10.3.2.2 Eastern Europe Fructooligosaccharides Market by Source

10.3.2.3 Eastern Europe Fructooligosaccharides Market by Form

10.3.2.4 Eastern Europe Fructooligosaccharides Market by Application

10.3.2.5 Poland

10.3.2.5.1 Poland Fructooligosaccharides Market by Source

10.3.2.5.2 Poland Fructooligosaccharides Market by Form

10.3.2.5.3 Poland Fructooligosaccharides Market by Application

10.3.2.6 Romania

10.3.2.6.1 Romania Fructooligosaccharides Market by Source

10.3.2.6.2 Romania Fructooligosaccharides Market by Form

10.3.2.6.4 Romania Fructooligosaccharides Market by Application

10.3.2.7 Hungary

10.3.2.7.1 Hungary Fructooligosaccharides Market by Source

10.3.2.7.2 Hungary Fructooligosaccharides Market by Form

10.3.2.7.3 Hungary Fructooligosaccharides Market by Application

10.3.2.8 Turkey

10.3.2.8.1 Turkey Fructooligosaccharides Market by Source

10.3.2.8.2 Turkey Fructooligosaccharides Market by Form

10.3.2.8.3 Turkey Fructooligosaccharides Market by Application

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Fructooligosaccharides Market by Source

10.3.2.9.2 Rest of Eastern Europe Fructooligosaccharides Market by Form

10.3.2.9.3 Rest of Eastern Europe Fructooligosaccharides Market by Application

10.3.3 Western Europe

10.3.3.1 Western Europe Fructooligosaccharides Market by Country

10.3.3.2 Western Europe Fructooligosaccharides Market by Source

10.3.3.3 Western Europe Fructooligosaccharides Market by Form

10.3.3.4 Western Europe Fructooligosaccharides Market by Application

10.3.3.5 Germany

10.3.3.5.1 Germany Fructooligosaccharides Market by Source

10.3.3.5.2 Germany Fructooligosaccharides Market by Form

10.3.3.5.3 Germany Fructooligosaccharides Market by Application

10.3.3.6 France

10.3.3.6.1 France Fructooligosaccharides Market by Source

10.3.3.6.2 France Fructooligosaccharides Market by Form

10.3.3.6.3 France Fructooligosaccharides Market by Application

10.3.3.7 UK

10.3.3.7.1 UK Fructooligosaccharides Market by Source

10.3.3.7.2 UK Fructooligosaccharides Market by Form

10.3.3.7.3 UK Fructooligosaccharides Market by Application

10.3.3.8 Italy

10.3.3.8.1 Italy Fructooligosaccharides Market by Source

10.3.3.8.2 Italy Fructooligosaccharides Market by Form

10.3.3.8.3 Italy Fructooligosaccharides Market by Application

10.3.3.9 Spain

10.3.3.9.1 Spain Fructooligosaccharides Market by Source

10.3.3.9.2 Spain Fructooligosaccharides Market by Form

10.3.3.9.3 Spain Fructooligosaccharides Market by Application

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Fructooligosaccharides Market by Source

10.3.3.10.2 Netherlands Fructooligosaccharides Market by Form

10.3.3.10.3 Netherlands Fructooligosaccharides Market by Application

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Fructooligosaccharides Market by Source

10.3.3.11.2 Switzerland Fructooligosaccharides Market by Form

10.3.3.11.3 Switzerland Fructooligosaccharides Market by Application

10.3.3.12 Austria

10.3.3.12.1 Austria Fructooligosaccharides Market by Source

10.3.3.12.2 Austria Fructooligosaccharides Market by Form

10.3.3.12.3 Austria Fructooligosaccharides Market by Application

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Fructooligosaccharides Market by Source

10.3.3.13.2 Rest of Western Europe Fructooligosaccharides Market by Form

10.3.3.13.3 Rest of Western Europe Fructooligosaccharides Market by Application

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Fructooligosaccharides Market by Country

10.4.3 Asia-Pacific Fructooligosaccharides Market by Source

10.4.4 Asia-Pacific Fructooligosaccharides Market by Form

10.4.5 Asia-Pacific Fructooligosaccharides Market by Application

10.4.6 China

10.4.6.1 China Fructooligosaccharides Market by Source

10.4.6.2 China Fructooligosaccharides Market by Form

10.4.6.3 China Fructooligosaccharides Market by Application

10.4.7 India

10.4.7.1 India Fructooligosaccharides Market by Source

10.4.7.2 India Fructooligosaccharides Market by Form

10.4.7.3 India Fructooligosaccharides Market by Application

10.4.8 Japan

10.4.8.1 Japan Fructooligosaccharides Market by Source

10.4.8.2 Japan Fructooligosaccharides Market by Form

10.4.8.3 Japan Fructooligosaccharides Market by Application

10.4.9 South Korea

10.4.9.1 South Korea Fructooligosaccharides Market by Source

10.4.9.2 South Korea Fructooligosaccharides Market by Form

10.4.9.3 South Korea Fructooligosaccharides Market by Application

10.4.10 Vietnam

10.4.10.1 Vietnam Fructooligosaccharides Market by Source

10.4.10.2 Vietnam Fructooligosaccharides Market by Form

10.4.10.3 Vietnam Fructooligosaccharides Market by Application

10.4.11 Singapore

10.4.11.1 Singapore Fructooligosaccharides Market by Source

10.4.11.2 Singapore Fructooligosaccharides Market by Form

10.4.11.3 Singapore Fructooligosaccharides Market by Application

10.4.12 Australia

10.4.12.1 Australia Fructooligosaccharides Market by Source

10.4.12.2 Australia Fructooligosaccharides Market by Form

10.4.12.3 Australia Fructooligosaccharides Market by Application

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Fructooligosaccharides Market by Source

10.4.13.2 Rest of Asia-Pacific Fructooligosaccharides Market by Form

10.4.13.3 Rest of Asia-Pacific Fructooligosaccharides Market by Application

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Fructooligosaccharides Market by Country

10.5.2.2 Middle East Fructooligosaccharides Market by Source

10.5.2.3 Middle East Fructooligosaccharides Market by Form

10.5.2.4 Middle East Fructooligosaccharides Market by Application

10.5.2.5 UAE

10.5.2.5.1 UAE Fructooligosaccharides Market by Source

10.5.2.5.2 UAE Fructooligosaccharides Market by Form

10.5.2.5.3 UAE Fructooligosaccharides Market by Application

10.5.2.6 Egypt

10.5.2.6.1 Egypt Fructooligosaccharides Market by Source

10.5.2.6.2 Egypt Fructooligosaccharides Market by Form

10.5.2.6.3 Egypt Fructooligosaccharides Market by Application

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Fructooligosaccharides Market by Source

10.5.2.7.2 Saudi Arabia Fructooligosaccharides Market by Form

10.5.2.7.3 Saudi Arabia Fructooligosaccharides Market by Application

10.5.2.8 Qatar

10.5.2.8.1 Qatar Fructooligosaccharides Market by Source

10.5.2.8.2 Qatar Fructooligosaccharides Market by Form

10.5.2.8.3 Qatar Fructooligosaccharides Market by Application

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Fructooligosaccharides Market by Source

10.5.2.9.2 Rest of Middle East Fructooligosaccharides Market by Form

10.5.2.9.3 Rest of Middle East Fructooligosaccharides Market by Application

10.5.3 Africa

10.5.3.1 Africa Fructooligosaccharides Market by Country

10.5.3.2 Africa Fructooligosaccharides Market by Source

10.5.3.3 Africa Fructooligosaccharides Market by Form

10.5.3.4 Africa Fructooligosaccharides Market by Application

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Fructooligosaccharides Market by Source

10.5.3.5.2 Nigeria Fructooligosaccharides Market by Form

10.5.3.5.3 Nigeria Fructooligosaccharides Market by Application

10.5.3.6 South Africa

10.5.3.6.1 South Africa Fructooligosaccharides Market by Source

10.5.3.6.2 South Africa Fructooligosaccharides Market by Form

10.5.3.6.3 South Africa Fructooligosaccharides Market by Application

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Fructooligosaccharides Market by Source

10.5.3.7.2 Rest of Africa Fructooligosaccharides Market by Form

10.5.3.7.3 Rest of Africa Fructooligosaccharides Market by Application

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Fructooligosaccharides Market by country

10.6.3 Latin America Fructooligosaccharides Market by Source

10.6.4 Latin America Fructooligosaccharides Market by Form

10.6.5 Latin America Fructooligosaccharides Market by Application

10.6.6 Brazil

10.6.6.1 Brazil Fructooligosaccharides Market by Source

10.6.6.2 Brazil Fructooligosaccharides Market by Form

10.6.6.3 Brazil Fructooligosaccharides Market by Application

10.6.7 Argentina

10.6.7.1 Argentina Fructooligosaccharides Market by Source

10.6.7.2 Argentina Fructooligosaccharides Market by Form

10.6.7.3 Argentina Fructooligosaccharides Market by Application

10.6.8 Colombia

10.6.8.1 Colombia Fructooligosaccharides Market by Source

10.6.8.2 Colombia Fructooligosaccharides Market by Form

10.6.8.3 Colombia Fructooligosaccharides Market by Application

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Fructooligosaccharides Market by Source

10.6.9.2 Rest of Latin America Fructooligosaccharides Market by Form

10.6.9.3 Rest of Latin America Fructooligosaccharides Market by Application

11. Company Profiles

11.1 Tata Chemicals Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Cargill Inc.

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Galam

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 Beneo

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Biosynth

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Meiji Holdings Co. Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Ingredion Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Tereos Group

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Baolingbao Biological Co., Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Prebiotin

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Source

Sucrose

Inulin

Chicory

By Form

Powder

Liquid

By Application

Infant Formulation

Pharmaceutical

Food & Beverages

Dietary Supplements

Pet/Animal Feed

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Fiberglass Market size was USD 12.33 Billion in 2023 and is expected to reach USD 20.38 Billion by 2032, growing at a CAGR of 5.74% from 2024 to 2032.

The Aluminum Nitride Market was Valued at USD 150.250 Million in 2023 and is now anticipated to grow to USD 245.58 Million by 2032, displaying a compound annual growth rate (CAGR) 4.98% of during the forecast Period 2024 - 2032.

Natural Fiber Composites Market was valued at USD 7.13 Billion in 2023 and is expected to reach USD 18.98 Billion by 2032, at a CAGR of 11.50% from 2024-2032

The Alkyl Polyglucosides Market size was valued at USD 1.1 Billion in 2023. It is expected to grow to USD 1.9 Billion by 2032 and grow at a CAGR of 6.5% over the forecast period of 2024-2032.

The Long-chain Polyamide Market size was USD 2.1 billion in 2023 and is expected to reach USD 3.2 billion by 2032 and grow at a CAGR of 5.0% over the forecast period of 2024-2032.

Acoustic Insulation Market was valued at USD 14.85 billion in 2023 and is expected to reach USD 23.14 billion by 2032, growing at a CAGR of 5.08% by 2024-2032.

Hi! Click one of our member below to chat on Phone