Frozen Seafood Packaging Market Report Scope & Overview:

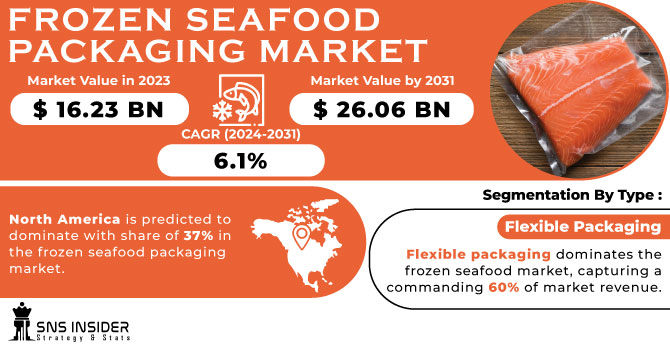

The Frozen Seafood Packaging Market Size was valued at USD 16.23 billion in 2023 and is projected to reach USD 26.06 billion by 2031 and grow at a CAGR of 6.1% over the forecast periods 2024 -2031.

The frozen seafood packaging market is flourishing due to a confluence of factors. Growing consumer recognition of the nutritional value of frozen options, particularly fruits and vegetables, and the development of innovative packaging solutions catering to various product sizes and types are driving demand.

Get More Information on Frozen Seafood Packaging Market - Request Sample Report

Market growth is further propelled by the expansion of organized retail chains like Walmart over 11,000 stores and Amazon aiming for 3,000 cashier-less stores. This trend aligns with consumer preferences for convenient shopping at large retailers and supermarkets. Notably, a study in the British Food Journal suggests that frozen food adoption can even contribute to environmental benefits by reducing household food waste by 47%.

Frozen food packaging advancements are revolutionizing the industry by improving consumer experience. Manufacturers are constantly innovating with materials, technologies, and designs. This includes improved films and laminates for better insulation, vacuum sealing and MAP for extended shelf life, and microwave/oven-safe options for added convenience. These advancements, along with a growing awareness of water-related diseases and the constant innovation in frozen seafood packaging itself, are expected to drive market growth.

MARKET DYNAMICS

KEY DRIVERS:

-

The increasing popularity of frozen seafood has a direct impact on the growth of the frozen seafood packaging market.

Frozen seafood's extended shelf life is a significant advantage for both convenience and quality. Consumers seeking flexibility in their meals can enjoy fresh-tasting seafood any time of year, regardless of seasonal limitations. Advancements in freezing and packaging technology ensure frozen seafood retains its taste, texture, and nutritional value. This quality assurance builds trust with health-conscious consumers who appreciate frozen seafood's health benefits and culinary versatility.

-

Frozen seafood can be a cost-effective option, offering savings for budget-conscious consumers.

RESTRAINTS:

-

Ensuring frozen seafood remains frozen throughout the supply chain can be a challenge.

Transporting and distributing frozen seafood requires maintaining a consistent cold chain, a complex task where even minor temperature fluctuations can compromise quality and safety. This necessitates uninterrupted temperature control from processing plants all the way to consumers' freezers. Fluctuations in ambient temperatures during transport are a constant threat, and inadequate cold storage infrastructure, particularly in remote areas, can further hinder efficient distribution.

-

The lack of readily available refrigerated storage facilities throughout the supply chain presents a challenge for the frozen seafood industry.

OPPORTUNITY:

-

Advancements in frozen seafood packaging solutions can create a significant opportunity for the market.

Frozen seafood packaging advancements target a three-way approach of benefits that are quality, convenience, and sustainability. Modified Atmosphere Packaging creates a controlled environment within the package, slowing down microbial growth and extending shelf life. Vacuum sealing removes air to prevent oxidation and freezer burn, locking in freshness. Active packaging takes it a step further by incorporating oxygen absorbent and antimicrobial agents to actively fight spoilage and enhance freshness.

-

Eco-friendly packaging options like biodegradable and recycled materials minimize environmental impact and embrace a circular economy approach.

CHALLENGES:

-

Loss of product due to improper temperature control or damage during transport is a major concern.

-

Expensive packaging solutions might not be feasible for all players.

Finding the right balance between cost-effective packaging solutions and sustainable practices is a major hurdle. While innovative packaging materials and technologies can improve temperature control and product integrity, these advancements often come at a premium. The challenge lies in optimizing packaging designs to leverage cost-effective and eco-friendly materials without sacrificing quality.

IMPACT OF RUSSIA UKRAINE WAR

While some Russian producers initially enjoyed relaxed sanctions and increased exports to certain regions like South Korea, overall trade has been negatively affected. European and American markets have seen a surge in Korean fish imports, likely due to a shift away from Russian seafood. Packaging companies are also experiencing difficulties, with Mondi, a major player, monitoring the situation as its Russian operations remain active despite a suspended plant in Ukraine. The ongoing conflict and supply chain issues have even led to industry event rescheduling. Overall, the war's impact on the frozen seafood packaging market is multifaceted, creating uncertainty and potentially leading to market reshuffling as trade patterns adjust.

IMPACT OF ECONOMIC SLOWDOWN

While an economic slowdown might lead consumers to prioritize essential goods over fresh seafood, the impact on frozen seafood packaging could be mitigated. Even though all seafood categories have experienced inflation, frozen options saw the smallest price increase at 10.1%. This relative affordability might position frozen seafood as a more attractive alternative for budget-conscious consumers during an economic downturn. As a result, the demand for frozen seafood packaging could potentially remain stable or even see a slight increase as consumers shift their purchasing habits.

KEY MARKET SEGMENTS

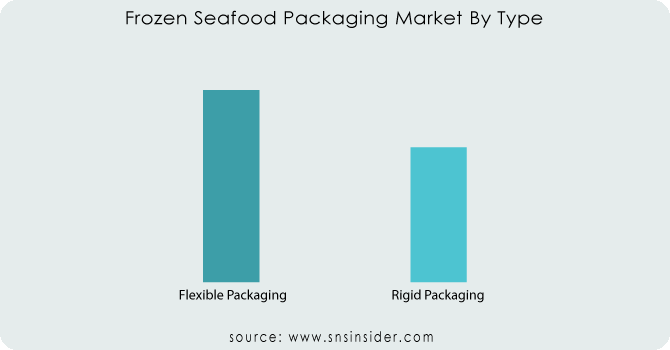

By Type

-

Flexible Packaging

-

Rigid Packaging

Flexible packaging dominates the frozen seafood market, capturing a commanding 60% of market revenue. This dominance is due to its versatility. Manufacturers utilize a wide range of flexible packaging materials to create options perfect for seafood delivery. These pouches often feature convenient steam valves, allowing consumers to easily cook frozen meals without needing additional cookware. Additionally, manufacturers are responding to environmental concerns by developing eco-friendly pouches suitable for direct microwave cooking, further enhancing the appeal of flexible packaging for frozen seafood.

Need any customization research on Frozen Seafood Packaging Market - Enquiry Now

By Application

-

Frozen Fish

-

Frozen Shrimp

-

Frozen Shellfish

-

Others

Frozen fish leads the frozen seafood packaging market, holding a 56% share. This dominance is driven by several factors such as global popularity of fish consumption, a health-conscious consumer base seeking chemical-free options with long shelf lives, and the growth of both industrial fishing and fish farming, which ensure consistent supply.

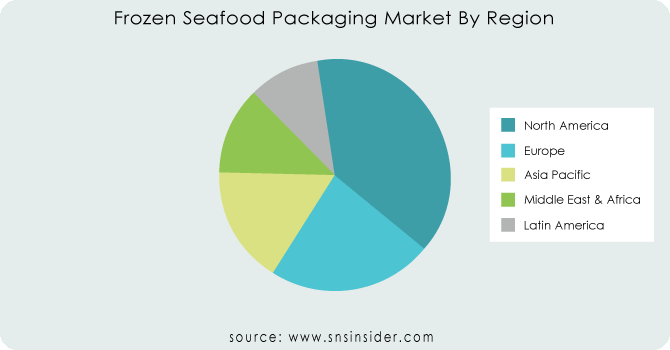

REGIONAL ANALYSIS

North America is predicted to dominate with share of 37% in the frozen seafood packaging market. This is driven by two factors like a strong consumer appetite for seafood and advancements in packaging technology. With high fish consumption rates and rising seafood exports, the demand for frozen packaging solutions is booming. Plastic flexible bags and trays with over wraps are the current go-to options for transporting frozen seafood within this region.

Europe follows North America in frozen seafood packaging market share, driven by a growing taste for fish, particularly for its heart-healthy benefits. This trend is fueling demand for sustainable packaging options for frozen fish, especially in eco-conscious markets like Germany, France, and the UK. Notably, Europe's frozen fish imports are on the rise, with the average price reaching $5,069 per ton. Germany leads the European market share, while the UK is experiencing the fastest growth. The Asia-Pacific region is projected to witness the fastest growth in frozen seafood packaging. This surge is driven by a rising preference for frozen food over traditional home-cooked meals, particularly as more women enter the workforce. The booming popularity of fast-food chains across the region further fuels demand for frozen seafood options. With China leading the market share and India experiencing the fastest growth, the increasing economic strength of these Asian nations presents a significant opportunity for the frozen seafood packaging market.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some the major players in Frozen Seafood Packaging Market are Crown Holdings, Amcor, Berry Group, DuPont, Genpak, LINPAC, Mondi Group, Sealed Air, Ardagh Group, DS Smith, Bemis, Sonoco Products Company, ProAmpac LLC, Cascades Inc., American Packaging Corporation And Others Players.

Crown Holdings-Company Financial Analysis

RECENT DEVELOPMENT

-

SABIC, Estiko, and Coldwater Prawns of Norway launched new sustainable packaging for frozen food, featuring 60% recycled ocean plastic in May 10, 2023.

-

In February 2021, ProAmpac launched the ProActive Recyclable R-2000F, a sustainable alternative for frozen food packaging. This recyclable option offers excellent heat resistance and durability, replacing traditional non-recyclable materials

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 16.23 Bn |

| Market Size by 2031 | US$ 26.06 Bn |

| CAGR | CAGR of 6.1% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flexible Packaging, Rigid Packaging) • By Application ( Frozen Fish, Frozen Shrimp, Frozen Shellfish, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Crown Holdings, Amcor, Berry Group, DuPont, Genpak, LINPAC, Mondi Group, Sealed Air, Ardagh Group, DS Smith, Bemis, Sonoco Products Company, ProAmpac LLC, Cascades Inc., American Packaging Corporation |

| Key Drivers | • The increasing popularity of frozen seafood has a direct impact on the growth of the frozen seafood packaging market. • Frozen seafood can be a cost-effective option, offering savings for budget-conscious consumers. |

| Key Restraints | • Ensuring frozen seafood remains frozen throughout the supply chain can be a challenge. • The lack of readily available refrigerated storage facilities throughout the supply chain presents a challenge for the frozen seafood industry. |