Frozen Food Packaging Market Report Scope & Overview:

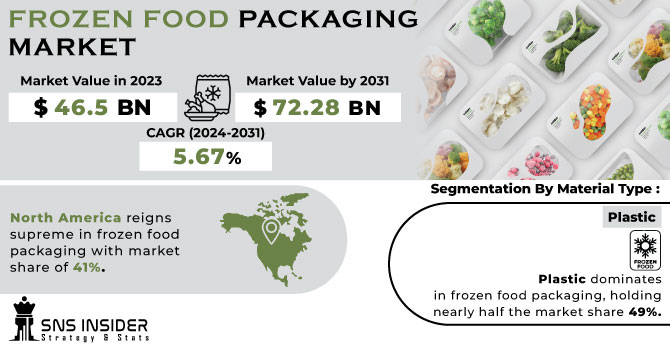

The Frozen Food Packaging Market Size was valued at USD 46.5 billion in 2023 and is projected to reach USD 72.28 billion by 2031 growing at a CAGR of 5.67% from 2024 to 2031.

The frozen food packaging market is experiencing a surge driven by a confluence of factors. A growing global population, particularly in urban areas with busy lifestyles, is increasingly seeking convenient meal solutions. This shift in consumer preferences, coupled with rising disposable incomes and the desire for easy-to-prepare options, fuels demand for ready-to-eat frozen food and its packaging.

Get More Information on Frozen Food Packaging Market - Request Sample Report

Additionally, growing awareness of food waste reduction and the increasing popularity of frozen meat and vegetables across regions like China further propel market expansion. Sustainability is driving a shift towards frozen food, with studies like one published in the British Food Journal demonstrating a significant reduction in household food waste over 47% when families switched to frozen options.

Manufacturers are responding by developing innovative, easy-to-carry, and attractive packaging solutions that prioritize convenience, food safety, and extended shelf life. However, challenges like food-borne illness and spoilage remain to be addressed by the packaging industry.

MARKET DYNAMICS

KEY DRIVERS:

-

The frozen food market is experiencing significant growth in both developed and developing countries, catering to a wider range of consumers.

-

The packaging industry is undergoing a dynamic transformation fueled by cutting-edge advancements in materials and designs.

Bioplastics derived from renewable resources like corn starch or cellulose are replacing traditional plastics, minimizing environmental impact.Materials actively interact with the product, such as absorbing oxygen to extend freshness or incorporating sensors that monitor temperature and spoilage.As research and development continue, we can expect even more innovative materials, intelligent designs, and seamless integration with technology.

RESTRAINTS:

-

Ensuring the quality and safety of our products remains a top priority.

Freezing creates ice crystals within food, disrupting the food's structure and potentially reducing its nutritional value. Consumers perception that frozen options are less nutritious than fresh. This perception shift from frozen being convenient to potentially unhealthy impacting buying decisions.

-

Consumers in the frozen food market increasingly express concerns about the use of preservatives and other artificial additives.

OPPORTUNITY:

-

Production, transportation, and investment sectors within the contract packaging market are seeing significant growth.

The contract packaging market is experiencing a multi-pronged growth spurt, with all sectors of the industry feeling the upswing. Production facilities are humming as demand for outsourced packaging solutions soars. This translates to increased investment in equipment and facilities, allowing companies to expand capacity and meet growing needs. The transportation sector is also reaping the benefits, with logistics providers playing a crucial role in efficiently moving raw materials, finished products, and packaging supplies across the globe.

-

The growing use of efficient processes like thermoforming and blow molding.

CHALLENGES:

-

Stringent food safety rules and packaging standards from regulators pose hurdles for manufacturers.

-

Frozen food market growth in developing countries faces challenges due to consumer preference for fresh foods and limited existing infrastructure.

Consumers often prioritize fresh produce due to cultural preferences and potentially lower prices. Additionally, the infrastructure needed for efficient cold chain storage and transportation may not be fully established, hindering widespread availability and quality of frozen food options. These factors combine to create a barrier to entry for frozen food companies in developing countries.

IMPACT OF RUSSIA UKRAINE WAR

The war in Ukraine disrupted the frozen food packaging market, adding uncertainty to an already complex landscape. Geopolitical tensions and sanctions sent ripples through the industry, impacting consumer spending and buying habits. This, in turn, has impacted consumer behavior, with rising household bills putting pressure on purchasing decisions in Europe. Businesses faced the challenge of adapting marketing strategies to this evolving consumer sentiment. The combined effect underscores the importance of strategic planning in the frozen food packaging market. Companies need agility and responsiveness to navigate both changing consumer preferences and the ongoing geopolitical flux.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns can be both a challenge and an opportunity for the Frozen Food Packaging Market. While recessions put pressure on producers and force them to seek cost-effective solutions from packaging partners, they can also trigger a surge in demand for frozen food. As consumers tighten their budgets, the convenience and affordability of frozen meals become more attractive. This increased demand translates to a rise in the need for frozen food packaging solutions, creating opportunities for manufacturers who can adapt their strategies to this changing landscape.

KEY MARKET SEGMENTS

By Packaging Type

-

Boxes

-

Bags

-

Tubs & Cups

-

Trays

-

Pouches

-

Wraps & Films

-

Others

Cardboard boxes holds major share in frozen food packaging. This dominance stems from their strength, branding space, and suitability for both stores and consumers. The surging popularity of frozen food adds fuel to the box market fire. Furthermore, advancements in eco-friendly box materials further solidify their lead as manufacturers prioritize convenience and sustainability.

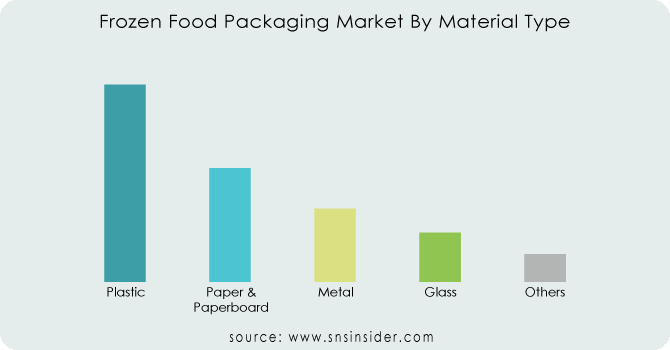

By Material Type

-

Plastic

-

Paper & Paperboard

-

Metal

-

Glass

-

Others

Plastic dominates in frozen food packaging, holding nearly half the market share 49%. It's affordable, adaptable, and keeps food fresh, despite some environmental concerns. New recyclable and biodegradable plastics aim to bridge the eco-gap. Additionaly, plastic's lightweight nature and variety of shapes and sizes make it convenient for both consumers and transportation. As the frozen food market expands globally, plastic's role is likely to stay significant.

Do You Need any Customization Research on frozen food packaging Market - Enquire Now

By Application

-

Fruits and Vegetables

-

Frozen Desserts

-

Meat and Seafood

-

Baked Products

-

Ready Meals

-

Others

The frozen food packaging market is particularly booming in the fruits and vegetables segment. This surge is driven by consumer demand for convenient and healthy options. Frozen fruits and vegetables offer extended shelf life, consistent availability, and preserved nutrients. Packaging innovations focus on keeping produce fresh and preventing freezer burn, while eco-friendly biodegradable materials gain traction. As health-conscious lifestyles and busy schedules become the norm, the fruits and vegetables segment is poised for steady growth, fueled by the demand for sustainable, hygienic, and convenient frozen food solutions.

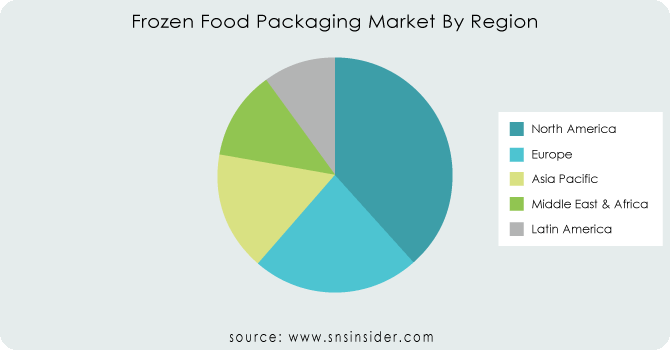

REGIONAL ANALYSIS

North America reigns supreme in frozen food packaging with market share of 41%. This dominance is driven by busy lifestyles, love for frozen food convenience, and a strong demand for easy-to-handle, long-lasting packaging solutions. With consumers increasingly focused on eco-friendly options, advancements in sustainable packaging materials are fueling further growth. North America's strong infrastructure and vast consumer base present exciting opportunities for companies to develop innovative packaging solutions and capitalize on the booming frozen food market.

The UK frozen food packaging market is projected to grow significantly. This growth is fueled by many key factors. Firstly, the UK is a major importer of frozen vegetables in Europe, creating a strong demand for packaging solutions in this segment. Secondly, the rising popularity of convenient, plant-based foods like veggie alternatives is driving market growth. Finally, with environmental concerns on the rise, UK manufacturers are increasingly focusing on sustainable packaging solutions and opting for rigid materials to extend the shelf life of frozen food products. China's frozen food packaging market is booming, driven by several factors. A growing population creates a rising demand for food options, and frozen food offers convenience and quality. Furthermore, growing awareness of food waste reduction and the increasing popularity of frozen meat and other items are fueling market expansion. However, the rise in food-borne illnesses and spoilage presents challenges that the packaging industry needs to address.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Frozen Food Packaging Market are Amcor PLC, Ampac Holdings LLC, Amerplast Ltd, International Paper Company, MOD-PAC Corporation, Alto Packaging, Berry Plastics Group Inc., Sealstrip Corporation, WestRock Company, Sonoco Products Company, Sealed Air Corporation, American Packaging Corporation, Uflex Limited And Others Players.

Amcor PLC-Company Financial Analysis

RECENT DEVELOPMENTS

-

The Paperboard Packaging Council recognized WestRock's 2022 advancements in food service packaging and recycling with an Innovator Award.

-

Mondi Group launched a groundbreaking frozen food packaging solution for Iceland, UK's top retailer, in December 2021. Made with 80% less plastic and fully recyclable, this innovation prioritizes sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 46.5 Bn |

| Market Size by 2031 | US$ 72.28 Bn |

| CAGR | CAGR of 5.67% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Packaging Type(Boxes, Bags, Tubs & Cups, Trays, Pouches, Wraps & Films, Others) • By Material Type(Plastic, Paper & Paperboard, Metal, Glass, Others) • By Application(Fruits And Vegetables, Frozen Desserts, Meat And Seafood, Baked Products, Ready Meals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor PLC, Ampac Holdings LLC, Amerplast Ltd, International Paper Company, MOD-PAC Corporation, Alto Packaging, Berry Plastics Group Inc., Sealstrip Corporation, WestRock Company, Sonoco Products Company, Sealed Air Corporation, American Packaging Corporation, Uflex Limited |

| Key Drivers | • The frozen food market is experiencing significant growth in both developed and developing countries, catering to a wider range of consumers. • The packaging industry is undergoing a dynamic transformation fueled by cutting-edge advancements in materials and designs. |

| Key Restraints | • Ensuring the quality and safety of our products remains a top priority. • Consumers in the frozen food market increasingly express concerns about the use of preservatives and other artificial additives. |