Food Service Disposables Market Report Scope & Overview:

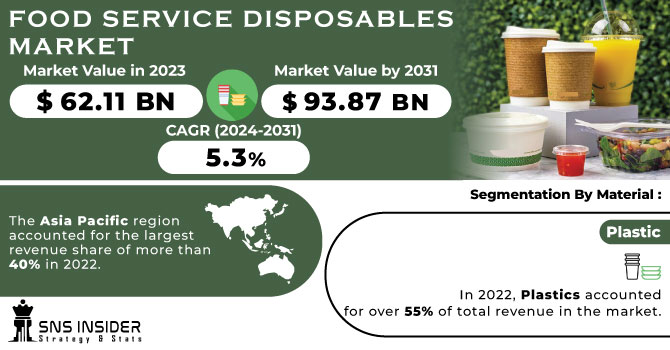

The Food Service Disposables Market size was USD 62.11 billion in 2023 and is expected to Reach USD 93.87 billion by 2031 and grow at a CAGR of 5.3% over the forecast period of 2024-2031.

Market growth is expected to be supported by the growing popularity of Quick Service Restaurants in particular in developing countries such as Asia Pacific because of busy lifestyles and stressful work schedules. Market growth is also expected to be driven by increasing demand for online delivery of foods as a result of the COVID-19 pandemic.

Get More Information on Food Service Disposables Market - Request Sample Report

In addition, in the overall delivery process these products offer convenience to customers and transport staff. Platforms like Uber Eats, Glovo, Grub Hub, Delivery Club, Postmates, JustEat and Deliveroo are contributing to the growth of online food delivery services. According to the 2021 Uber Eats Survey, 76% of restaurants in London, 75% in Paris and 68% in Warsaw indicated an overall increase in sales as a result of their arrival on its platform. Therefore, a rise in product usage is anticipated to support market growth through the expansion of online food delivery services.

MARKET DYNAMICS

KEY DRIVERS:

-

Increasing demand for food delivery services by using various online platforms

One of the fastest growing services in e commerce has been food delivery, through various online and offline platforms. A new platform for the food sector has been created by the presence of a diverse set of apps and tools on the Internet. Consumer interest has been enhanced by access to cash on delivery, as well as a large number of payment options such as Net banking and Digital wallets.

-

The use of disposables is increasing in the growing travel and tourism sector.

RESTRAIN:

-

Stringent government regulation in relation to use of single usage plastic products

The benefits of plastics are undeniable, the plastic products can be manufactured cheaper, more efficient and easier than any other material. As a consequence of its use since the late 1950s, plastics are used almost exclusively in every other product that's made available and out of these very few uses it cannot be recycled, which explains why half of all packaging has been contributed to world plastic waste.

OPPORTUNITY:

-

Developing tableware and containers using edible materials in the aim of zero waste

You can eat edible packaging with your food. Using edible packaging, through incineration and disposal of containers at sea, makes the consumption of food more sustainable, reducing packaging waste as well as protecting the environment from pollution. The process of food preparation and storage is more streamlined due to advances in packaging technology.

CHALLENGES:

-

Environmental Concerns

Single used foam plastic, which is extensively used to manufacture containers, plates, bottles and other products in the production of food service disposables are mainly used. In particular, polyurethane and polystyrene are the material used in foam plastics which have a toxicity that could lead to serious health concerns because of their excessive consumption.

IMPACT OF RUSSIAN UKRAINE WAR:

The absence of raw materials is expected to be a major factor affecting the food service disposable market in the course of the war. Wheat, paper and plastic are the most important exports from Russia and Ukraine as raw materials used to produce food service disposables. There were shortages of raw material and increased prices as a result of interruptions in supplies. The price increase of food service disposables has been caused by rising prices for raw materials and energy. This has increased the cost of purchasing food service disposables for companies that may have a negative impact on product demand. The price of the kraft paper stood at 5,911.7 tonnes by the end of January 2022 and subsequently increased US$1,000 per tonne in March 2022 as a result of the conflict. The price of the kraft paper has been set at $7,256.6 per tonne since 11 May 2022.

IMPACT OF ONGOING RECESSION:

During the economic downturn consumers are likely to lower their consumption of discretionary items and this may lead to a fall in demand for food service disposables. Due to the recession the spending on online food service delivery will decrease by 5-6%, which will affect the market growth. It may also lead to a reduction in the demand for food service disposables when restaurants and eating places close down as a result of the recession. Consumers are becoming more informed about the environmental impact of Single Use Plastics and this could lead to an increased use of recycled products, like plastic bags, utensils or containers.

KEY MARKET SEGMENTS

By Material

-

Plastic

-

Bagasse

-

Polylactic Acid

-

Others

In 2022, plastics accounted for over 55% of total revenue in the market. The segment is going to retain its dominance over the forecast period, given that plastic is the most preferred material choice for packaging due to its low cost, ease of use, lightness, temperature resistance and so on. For the production of a variety of products, including plates, bowls, cups, trays, knives and catering containers, plastics are an essential element.

By Packaging Type

-

Rigid

-

Flexible

The segment with the highest revenue share of more than 78% in 2022 was rigid packaging. In particular, rigid packaging is used for the purpose of protecting foodstuffs from spills and for the convenience of consumers. Restaurant operators use a variety of rigid packaging that is based on the temperatures, quantities and material condition of their food. Plate & containers, lids and other disposables are the type of rigid packaging. There are expected to be considerable increases in the production of plastic rigid products.

By Application

-

Food Service

-

Institutional

-

Online Delivery

In 2022, the application segment of food services accounted for a revenue share exceeding 53%. This is due to rapid changes in the dynamics of the food service sector which are expected to stimulate growth on the Disposable Food Service Market. In addition, the market growth will be stimulated by an increasing demand for takeaways and online food delivery services.

REGIONAL ANALYSIS:

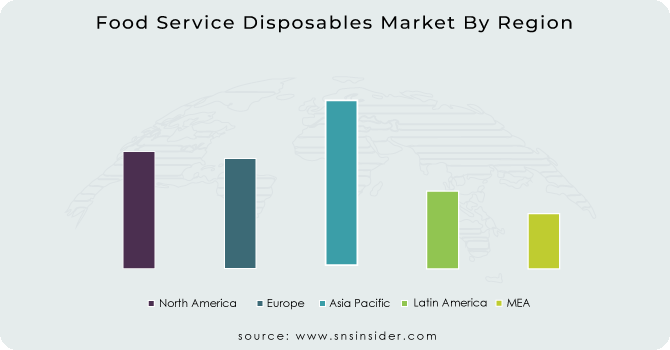

The Asia Pacific region accounted for the largest revenue share of more than 40% in 2022. The presence of the most rapidly expanding economies and a booming food service sector are expected to support growth in the region at an accelerated pace during the forecast period. In view of the high number of fast- food restaurants and the increasing adaptation to online food delivery systems, In the forecast period, China will be the biggest contributor and is predicted to maintain its dominant position in the region's market.

In addition to the changing economy and a high penetration of food service, India is also expected to register significant growth in its regional market. Japanese and South Korea are other major markets in the region. These countries are highly dependent upon Internet delivery services and, in consequence, will continue to be on the market for a long time; this trend is expected to benefit local markets as well.

In 2022, North America was identified as the second largest regional market. An extensive presence of both hotels and restaurants in the United States and Canada as well as a high percentage spent on hotel accommodation.

In the forecast period, Europe is expected to have a slow compound annual growth rate. The weak growth of the market in the forecast period is expected to be further compounded by stringent regulations related to use of single use plastics and plastic tableware.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

Some major key players in the Food Service Disposables market are Hoffmaster Group, Sonoco Products Company, Genpak LLC, Huhtamaki Food Service, Interplast Group, Pactiv LLC, Graphic Packaging International LLC, Sabert Corp, Contital Srl, Go Pak Group and other players.

Sonoco Products Company-Company Financial Analysis

RECENT DEVELOPMENT

-

A leading US manufacturer of premium disposable tableware, Hoffmaster Group recently acquired Paterson Pacific Parchment Company, one of the foremost producers of restaurant paper and parchment products. Hoffmaster will be taking over the Paterson operation within its family of production facilities.

| Report Attributes | Details |

| Market Size in 2023 | US$ 62.11 Bn |

| Market Size by 2031 | US$ 93.87 Bn |

| CAGR | CAGR of 5.3 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Material (Plastic, Bagasse, Paper & Paperboard, Polylactic Acid, Others) • by Packaging Type (Rigid, Flexible) • by Application (Food Service, Institutional, Online Delivery) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Hoffmaster Group, Sonoco Products Company, Genpak LLC, Huhtamaki Food Service, Interplast Group, Pactiv LLC, Graphic Packaging International LLC, Sabert Corp, Contital Srl, Go Pak Group |

| Key Drivers | • Increasing demand for food delivery services by using various online platforms • The use of disposables is increasing in the growing travel and tourism sector. |

| Key Restraints | • Stringent government regulation in relation to use of single usage plastic products |