Get PDF Sample Copy of Food Packaging Films Market - Request Sample Report

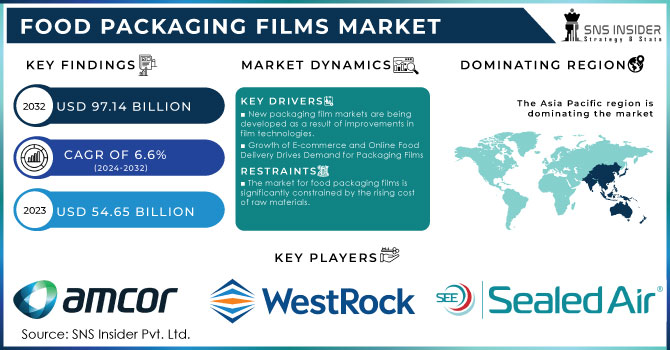

The Food Packaging Films Market size was valued at USD 54.65 billion in 2023 and is expected to Reach USD 97.14 billion by 2032 and grow at a CAGR of 6.6 % over the forecast period of 2024-2032.

The food packaging film market thrives on convenience. Consumers love ready-to-eat meals, and this fuels the demand for flexible pouches and stand-up bags that rely heavily on these films. Novolex's easy-open produce bags, launched in 2022, are a perfect example. But safety remains key. These films prevent spoilage and extend shelf life, a priority for both consumers and manufacturers. Technological advancements are creating films with even better barriers against contaminants and microbes.

Sustainability is also a major player. Governments are cracking down on plastic waste, with the EU aiming for zero landfill plastic by 2025. This is pushing companies towards eco-friendly packaging. "Green packaging" is on the rise, following the "3 R's" of reduce, reuse, recycle. Developing countries are even promoting natural biopolymers, a more flexible alternative to traditional plastic. The future of food packaging films is bright, with eco-friendly options like bioplastics, recycled paper, and even palm leaves taking center stage.

KEY DRIVERS:

New packaging film markets are being developed as a result of improvements in film technologies.

The food packaging films market is benefited by advancements in materials, film structures, protective coatings, and printing methods. As a result of these developments, it is now possible to produce films with enhanced barrier qualities, improved printing quality, and novel functionalities to satisfy the changing needs of the food industry.

Packaging films are now required due to the growth of e-commerce and online food delivery services.

RESTRAIN:

The market for food packaging films is significantly constrained by the rising cost of raw materials.

Resins, additives, and coatings are some of the primary raw materials whose prices have been rising recently and are used to make packaging films. These price hikes can be attributed to a variety of factors, including supply chain disruptions, changes in oil prices, and increased demand from various industries.

OPPORTUNITY:

Innovation and the creation of new products are made possible by the shift to returnable packaging.

Packaging films are required that not only adhere to environmental standards but also offer practical advantages like increased shelf life, improved product protection, and enhanced usability. Companies can gain market share and maintain an advantage over rivals by creating cutting-edge sustainable packaging solutions.

E-commerce and direct-to-consumer channels are expanding, which gives packaging films a chance.

CHALLENGES:

It can be difficult to inform consumers of the advantages and proper disposal of sustainable packaging.

The adoption of sustainable packaging solutions can be hampered by misconceptions or a lack of knowledge about composting, recycling, and the environmental effects of various packaging options. It is essential to explain to consumers the worth and sustainability of packaging films.

Russia, the world's second-largest oil producer, has the ability to significantly alter the petroleum market, which could have an indirect impact on the manufacturing of packaging.

Gas prices are expected to continue rising as long as the conflict lasts due to the disruption their sudden invasion of Ukraine caused. Logistics and shipping will face additional challenges as the price of gasoline rises significantly.

As manufacturers and distributors alike scramble to adjust their pricing as the price of gas continues to soar, these cost increases will likely be felt throughout the supply chain for various packaging products. Experts in the plastics industry are predicting potentially significant price increases for consumer goods made of plastic, which should come as no surprise given the rising costs in the global oil market.

Industry's worry that the cost of plastics will keep rising because the majority of flexible plastics packaging are made from resins derived from petroleum. The Ukrainian crisis may also lead to significant price increases for a variety of plastic packaging materials made from formulations derived from resin, such as polyethylene.

The food packaging film market may be impacted in a variety of ways while the recession is still going strong. Lower demand for packaged foods can indirectly affect demand for food packaging films due to decreased consumer spending and increased price sensitivity. The demand for specific kinds of packaging films may be impacted if consumer preferences change in favor of less expensive alternatives. Manufacturers may implement cost-cutting strategies to address economic challenges, which may include looking for more affordable packaging options or lowering overall packaging spending. The precise effect on the food packaging film market will depend on the depth and length of the recession, the state of the local economy, and the nature of the industry.

By Raw Material

PET

Polyamide

Polypropylene

Others

Polypropylene offers a selective barrier, allowing some gas exchange while excelling at blocking water vapor to keep food fresh. This versatility makes it ideal for diverse packaging, from salad dressing bottles to yogurt containers. It strikes a balance between slight stiffness and flexibility, reducing the risk of cracking. Finally, its lightweight nature minimizes storage space and simplifies transportation, making it a logistical winner.

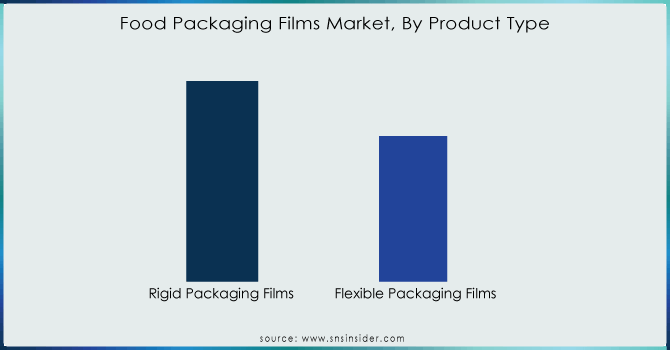

By Product Type

Rigid Packaging Films

Flexible Packaging Films

Get Customized Report as per Your Business Requiremrnt - Enquiry Now

By End Use

Food & Beverages

Healthcare

Homecare Products

Industrial Goods

Others

With over 35% of the market's revenue expected to come from Asia Pacific in 2023, it is predicted that this region will be the largest market, followed by Europe and North America. The rising per capita income, expanding population, and rising demand for packaged foods in developing nations like China, Japan, and India are predicted to be major drivers of the food packaging industry.

Because of its large population and expanding economy, China is the biggest consumer. Because of China's growing middle class and increasing purchasing power, the country's food packaging market is predicted to expand significantly. As a result of the product's expanding use in retail chains, India has the fastest-growing market.

Demand for packaging solutions in North America is anticipated to be driven by the region's thriving retail market and consumers' high consumption of packaged food. In addition, the presence of numerous manufacturers is anticipated to be advantageous for the area.

Though there is a high level of saturation, Europe is anticipated to have a promising future. The single market policy of Europe permits free trade within the area, which is anticipated to promote exports and subsequently fuel industry growth.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Food Packaging Films market are Amcor Plc, Coveris, Sealed Air Corporation, Mondi Group, WestRock, DS Smith, Graphic Packaging Holding Company, DuPont Tejin Films, Charter Next Generation, Berry Global, and other players.

ProAmpac, The ProActive Recyclable R-2200D Easy-Peel Open for food film, manufactured by ProAmpac, based on PE.

Thailand and Malaysia, Using the leftover pineapple stems, researchers produce a biodegradable film.

| Report Attributes | Details |

| Market Size in 2023 | US$ 54.65 Bn |

| Market Size by 2032 | US$ 97.14 Bn |

| CAGR | CAGR of 6.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Raw Material (PET, Polyethylene, Polyamide, Polypropylene, Others) • by Product Type (Rigid Packaging Films, Flexible Packaging Films) • by End Use (Food & Beverages, Healthcare, Homecare Products, Industrial Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, Coveris, Sealed Air Corporation, Mondi Group, WestRock, DS Smith, Graphic Packaging Holding Company, DuPont Tejin Films, Charter Next Generation, Berry Global |

| Key Drivers | • New packaging film markets are being developed as a result of improvements in film technologies. • Packaging films are now required due to the growth of e-commerce and online food delivery services. |

| Market Opportunities | • Innovation and the creation of new products are made possible by the shift to sustainable packaging. • E-commerce and direct-to-consumer channels are expanding, which gives packaging films a chance. |

Ans: Food Packaging Films Market is expected to grow at a CAGR of 6.6 % over the forecast period of 2024-2032.

Ans: The Food Packaging Films Market size was USD 54.65 Bn in 2023 and is expected to Reach USD 97.14 Bn by 2032.

Ans: New packaging film markets are being developed as a result of improvements in film technologies.

Ans: Some major key players in the Food Packaging Films market are Amcor Plc, Coveris, Sealed Air Corporation, Mondi Group, WestRock, DS Smith, Graphic Packaging Holding Company, DuPont Tejin Films, Charter Next Generation, Berry Global.

Ans: Asia Pacific region is dominating the Food Packaging Films Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Food Packaging Films Market Segmentation, By Raw Material

9.1 Introduction

9.2 Trend Analysis

9.3 PET

9.4 Polyethylene

9.5 Polyamide

9.6 Polypropylene

9.7 Others

10. Food Packaging Films Market Segmentation, By Product Type

10.1 Introduction

10.2 Trend Analysis

10.3 Rigid Packaging Films

10.4 Flexible Packaging Films

11. Food Packaging Films Market Segmentation, By End Use

11.1 Introduction

11.2 Trend Analysis

11.3 Food & Beverages

11.4 Healthcare

11.5 Homecare Products

11.6 Industrial Goods

11.7 Others

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Food Packaging Films Market by Country

12.2.3 North America Food Packaging Films Market By Raw Material

12.2.4 North America Food Packaging Films Market By Product Type

12.2.5 North America Food Packaging Films Market By End Use

12.2.6 USA

12.2.6.1 USA Food Packaging Films Market By Raw Material

12.2.6.2 USA Food Packaging Films Market By Product Type

12.2.6.3 USA Food Packaging Films Market By End Use

12.2.7 Canada

12.2.7.1 Canada Food Packaging Films Market By Raw Material

12.2.7.2 Canada Food Packaging Films Market By Product Type

12.2.7.3 Canada Food Packaging Films Market By End Use

12.2.8 Mexico

12.2.8.1 Mexico Food Packaging Films Market By Raw Material

12.2.8.2 Mexico Food Packaging Films Market By Product Type

12.2.8.3 Mexico Food Packaging Films Market By End Use

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Food Packaging Films Market by Country

12.3.2.2 Eastern Europe Food Packaging Films Market By Raw Material

12.3.2.3 Eastern Europe Food Packaging Films Market By Product Type

12.3.2.4 Eastern Europe Food Packaging Films Market By End Use

12.3.2.5 Poland

12.3.2.5.1 Poland Food Packaging Films Market By Raw Material

12.3.2.5.2 Poland Food Packaging Films Market By Product Type

12.3.2.5.3 Poland Food Packaging Films Market By End Use

12.3.2.6 Romania

12.3.2.6.1 Romania Food Packaging Films Market By Raw Material

12.3.2.6.2 Romania Food Packaging Films Market By Product Type

12.3.2.6.4 Romania Food Packaging Films Market By End Use

12.3.2.7 Hungary

12.3.2.7.1 Hungary Food Packaging Films Market By Raw Material

12.3.2.7.2 Hungary Food Packaging Films Market By Product Type

12.3.2.7.3 Hungary Food Packaging Films Market By End Use

12.3.2.8 Turkey

12.3.2.8.1 Turkey Food Packaging Films Market By Raw Material

12.3.2.8.2 Turkey Food Packaging Films Market By Product Type

12.3.2.8.3 Turkey Food Packaging Films Market By End Use

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Food Packaging Films Market By Raw Material

12.3.2.9.2 Rest of Eastern Europe Food Packaging Films Market By Product Type

12.3.2.9.3 Rest of Eastern Europe Food Packaging Films Market By End Use

12.3.3 Western Europe

12.3.3.1 Western Europe Food Packaging Films Market by Country

12.3.3.2 Western Europe Food Packaging Films Market By Raw Material

12.3.3.3 Western Europe Food Packaging Films Market By Product Type

12.3.3.4 Western Europe Food Packaging Films Market By End Use

12.3.3.5 Germany

12.3.3.5.1 Germany Food Packaging Films Market By Raw Material

12.3.3.5.2 Germany Food Packaging Films Market By Product Type

12.3.3.5.3 Germany Food Packaging Films Market By End Use

12.3.3.6 France

12.3.3.6.1 France Food Packaging Films Market By Raw Material

12.3.3.6.2 France Food Packaging Films Market By Product Type

12.3.3.6.3 France Food Packaging Films Market By End Use

12.3.3.7 UK

12.3.3.7.1 UK Food Packaging Films Market By Raw Material

12.3.3.7.2 UK Food Packaging Films Market By Product Type

12.3.3.7.3 UK Food Packaging Films Market By End Use

12.3.3.8 Italy

12.3.3.8.1 Italy Food Packaging Films Market By Raw Material

12.3.3.8.2 Italy Food Packaging Films Market By Product Type

12.3.3.8.3 Italy Food Packaging Films Market By End Use

12.3.3.9 Spain

12.3.3.9.1 Spain Food Packaging Films Market By Raw Material

12.3.3.9.2 Spain Food Packaging Films Market By Product Type

12.3.3.9.3 Spain Food Packaging Films Market By End Use

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Food Packaging Films Market By Raw Material

12.3.3.10.2 Netherlands Food Packaging Films Market By Product Type

12.3.3.10.3 Netherlands Food Packaging Films Market By End Use

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Food Packaging Films Market By Raw Material

12.3.3.11.2 Switzerland Food Packaging Films Market By Product Type

12.3.3.11.3 Switzerland Food Packaging Films Market By End Use

12.3.3.1.12 Austria

12.3.3.12.1 Austria Food Packaging Films Market By Raw Material

12.3.3.12.2 Austria Food Packaging Films Market By Product Type

12.3.3.12.3 Austria Food Packaging Films Market By End Use

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Food Packaging Films Market By Raw Material

12.3.3.13.2 Rest of Western Europe Food Packaging Films Market By Product Type

12.3.3.13.3 Rest of Western Europe Food Packaging Films Market By End Use

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Food Packaging Films Market by Country

12.4.3 Asia-Pacific Food Packaging Films Market By Raw Material

12.4.4 Asia-Pacific Food Packaging Films Market By Product Type

12.4.5 Asia-Pacific Food Packaging Films Market By End Use

12.4.6 China

12.4.6.1 China Food Packaging Films Market By Raw Material

12.4.6.2 China Food Packaging Films Market By Product Type

12.4.6.3 China Food Packaging Films Market By End Use

12.4.7 India

12.4.7.1 India Food Packaging Films Market By Raw Material

12.4.7.2 India Food Packaging Films Market By Product Type

12.4.7.3 India Food Packaging Films Market By End Use

12.4.8 Japan

12.4.8.1 Japan Food Packaging Films Market By Raw Material

12.4.8.2 Japan Food Packaging Films Market By Product Type

12.4.8.3 Japan Food Packaging Films Market By End Use

12.4.9 South Korea

12.4.9.1 South Korea Food Packaging Films Market By Raw Material

12.4.9.2 South Korea Food Packaging Films Market By Product Type

12.4.9.3 South Korea Food Packaging Films Market By End Use

12.4.10 Vietnam

12.4.10.1 Vietnam Food Packaging Films Market By Raw Material

12.4.10.2 Vietnam Food Packaging Films Market By Product Type

12.4.10.3 Vietnam Food Packaging Films Market By End Use

12.4.11 Singapore

12.4.11.1 Singapore Food Packaging Films Market By Raw Material

12.4.11.2 Singapore Food Packaging Films Market By Product Type

12.4.11.3 Singapore Food Packaging Films Market By End Use

12.4.12 Australia

12.4.12.1 Australia Food Packaging Films Market By Raw Material

12.4.12.2 Australia Food Packaging Films Market By Product Type

12.4.12.3 Australia Food Packaging Films Market By End Use

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Food Packaging Films Market By Raw Material

12.4.13.2 Rest of Asia-Pacific Food Packaging Films Market By Product Type

12.4.13.3 Rest of Asia-Pacific Food Packaging Films Market By End Use

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Food Packaging Films Market by Country

12.5.2.2 Middle East Food Packaging Films Market By Raw Material

12.5.2.3 Middle East Food Packaging Films Market By Product Type

12.5.2.4 Middle East Food Packaging Films Market By End Use

12.5.2.5 UAE

12.5.2.5.1 UAE Food Packaging Films Market By Raw Material

12.5.2.5.2 UAE Food Packaging Films Market By Product Type

12.5.2.5.3 UAE Food Packaging Films Market By End Use

12.5.2.6 Egypt

12.5.2.6.1 Egypt Food Packaging Films Market By Raw Material

12.5.2.6.2 Egypt Food Packaging Films Market By Product Type

12.5.2.6.3 Egypt Food Packaging Films Market By End Use

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Food Packaging Films Market By Raw Material

12.5.2.7.2 Saudi Arabia Food Packaging Films Market By Product Type

12.5.2.7.3 Saudi Arabia Food Packaging Films Market By End Use

12.5.2.8 Qatar

12.5.2.8.1 Qatar Food Packaging Films Market By Raw Material

12.5.2.8.2 Qatar Food Packaging Films Market By Product Type

12.5.2.8.3 Qatar Food Packaging Films Market By End Use

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Food Packaging Films Market By Raw Material

12.5.2.9.2 Rest of Middle East Food Packaging Films Market By Product Type

12.5.2.9.3 Rest of Middle East Food Packaging Films Market By End Use

12.5.3 Africa

12.5.3.1 Africa Food Packaging Films Market by Country

12.5.3.2 Africa Food Packaging Films Market By Raw Material

12.5.3.3 Africa Food Packaging Films Market By Product Type

12.5.3.4 Africa Food Packaging Films Market By End Use

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Food Packaging Films Market By Raw Material

12.5.3.5.2 Nigeria Food Packaging Films Market By Product Type

12.5.3.5.3 Nigeria Food Packaging Films Market By End Use

12.5.3.6 South Africa

12.5.3.6.1 South Africa Food Packaging Films Market By Raw Material

12.5.3.6.2 South Africa Food Packaging Films Market By Product Type

12.5.3.6.3 South Africa Food Packaging Films Market By End Use

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Food Packaging Films Market By Raw Material

12.5.3.7.2 Rest of Africa Food Packaging Films Market By Product Type

12.5.3.7.3 Rest of Africa Food Packaging Films Market By End Use

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Food Packaging Films Market by country

12.6.3 Latin America Food Packaging Films Market By Raw Material

12.6.4 Latin America Food Packaging Films Market By Product Type

12.6.5 Latin America Food Packaging Films Market By End Use

12.6.6 Brazil

12.6.6.1 Brazil Food Packaging Films Market By Raw Material

12.6.6.2 Brazil Food Packaging Films Market By Product Type

12.6.6.3 Brazil Food Packaging Films Market By End Use

12.6.7 Argentina

12.6.7.1 Argentina Food Packaging Films Market By Raw Material

12.6.7.2 Argentina Food Packaging Films Market By Product Type

12.6.7.3 Argentina Food Packaging Films Market By End Use

12.6.8 Colombia

12.6.8.1 Colombia Food Packaging Films Market By Raw Material

12.6.8.2 Colombia Food Packaging Films Market By Product Type

12.6.8.3 Colombia Food Packaging Films Market By End Use

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Food Packaging Films Market By Raw Material

12.6.9.2 Rest of Latin America Food Packaging Films Market By Product Type

12.6.9.3 Rest of Latin America Food Packaging Films Market By End Use

13. Company Profiles

13.1 Amcor Plc

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Coveris

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Sealed Air Corporation

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Mondi Group

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 WestRock

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 DS Smith

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Graphic Packaging Holding Company

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 DuPont Tejin Films

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Charter Next Generation

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Berry Global

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Aseptic Packaging Market size was USD 79.19 billion in 2023 and is expected to Reach USD 178.74 billion by 2031 and grow at a CAGR of 10.68 % over the forecast period of 2024-2031.

The Liquid Packaging Market was valued at USD 389.05 billion in 2023 and it will reach USD 613.97 billion by 2032 and grow at a CAGR of 5.22% by 2032.

The Brick Carton Packaging Market size was USD 11.54 Billion in 2023 and will reach USD 17.60 Billion by 2032 and grow at a CAGR of 4.81% by 2024-2032.

The Cassava Bags Market Size was valued at USD 67 million in 2023 and is projected to reach USD 130.62 million by 2032 and grow at a CAGR of 7.7% over the forecast periods 2024 -2032.

The Transit Packaging Market size was USD 78.06 billion in 2023 and is expected to Reach USD 213.45 billion by 2031 and grow at a CAGR of 13.4 % over the forecast period of 2024-2031.

The Dairy Product Packaging Market size was USD 30.5 billion in 2023 and is expected to Reach USD 38.63 billion by 2031 and grow at a CAGR of 3% over the forecast period of 2024-2031.

Hi! Click one of our member below to chat on Phone