Food Coating Ingredients Market Report Scope & Overview:

Get More Information on Food Coating Ingredients Market - Request Sample Report

The Food Coating Ingredients Market size was USD 3.62 billion in 2023 and is expected to Reach USD 6.18 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

Food coating ingredients are compounds that are applied to food products' surfaces to improve its appearance, texture, flavor, shelf life, or other functional attributes. They are used in a wide variety of food products, including bakery, confectionery, snacks, dairy, meat, and seafood.

The food coating ingredients market is categorized based on type. The sugars and syrups segment is expected to dominate segment in the market with a CAGR of 8.5% in the forecast period. Sugars and syrups add a sweet taste and flavor to food, making them frequently utilized for food coating. They also have a smooth and shiny surface, which consumers like. Furthermore, the growing demand for natural and healthy food products has resulted in the development of novel sugar and syrup-based coating components, such as agave syrup and honey, which are projected to drive market growth further.

MARKET DYNAMICS

KEY DRIVERS

-

Increased demand of Confectioneries and bakery products

Consumers are spending more money on food and beverages and seeking more convenient and ready-to-eat options. Confectioneries and bakery products such as wafer bars, cakes, bread, pastries, and cookies have expanded dramatically in recent years due to growing demand from youngsters, particularly chocolate-coated products. According to the Government of Canada, retail sales of baked products in Canada are predicted to reach USD 7.9 billion by 2026. These coatings, in addition to increasing flavor and texture, enhance the shelf-life of the product by functioning as a moisture barrier.

RESTRAIN

-

High cost of ingredients in food coating

-

Strict laws and regulations

Strict laws and regulations governing clean-label coating chemicals might be a hindrance. For example, the FDA and the European Commission, due to carcinogenicity accusations, the FDA and the European Commission have prohibited the use of synthetic food colors as coating agents in the United States Food &Beverage business levels of some indulgent coating components limit market expansion.

OPPORTUNITY

-

Growing investment opportunities

-

Growing demand for functional food coating ingredients

Consumers are growing more health concerns, and they want food coating ingredients created from natural ingredients. As businesses develop organic and natural alternatives to conventional food coating ingredients, this opens up new potential for food coating ingredients. Functional food coating ingredients can help to make food more nutritious by adding vitamins, minerals, fiber, or other beneficial compounds. By replacing bad fatty acids with healthier ones or by adding fiber, functional food coating components can aid in reducing the number of calories and fat in a meal. Probiotics can be added to food products using functional food coating elements, making them a more wholesome and nutritious option.

CHALLENGES

-

Prolonged consumption of food-coating ingredients

Food coating ingredients are often manufactured using artificial substances, which can be harmful to one's health if consumed in huge numbers. Some food coating components, such as artificial colors and flavors, have been related to cancer. It may also include trans fats, which raise the risk of heart disease. Prolonged consumption of food coating components may stifle industry growth.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine war is significantly impacting the global food coating ingredients market. Both countries are major exporters of food coating ingredients, such as wheat, corn, and sunflower oil. The war has disrupted the production and exports of these commodities, leading to higher prices and supply shortages. This has led to a decrease in consumption of sugar, syrup chocolates, and other ingredients. Also, in 2023, the number of consumers purchasing a sweet treat several times a week from 36% pre-crisis to 22%.

IMPACT OF ONGOING RECESSION

Recession has led to an increase in prices of ingredients due to disruption in the supply chain of ingredients used in food coating due to war. Also, the war has reduced agriculture product production in 2022. This reduction in production has led to an increase in prices of all bakery & confectionery products, snacks, meat & seafood. This has indirectly affected the food coating ingredients market. In 2023, it was witnessed that confectionery sales declined by 3.5 % in 2022.

MARKET SEGMENTATION

by Type

-

Sugars and Syrups

-

Cocoa and Chocolates

-

Fats and Oils

-

Spices and Seasonings

-

Flours

-

Batter and Crumbs

-

Other

by Form

-

Dry

-

Liquid

by Application

-

Bakery Products

-

Confectionery

-

Snacks

-

Dairy Products

-

Meat & Seafood

-

Other

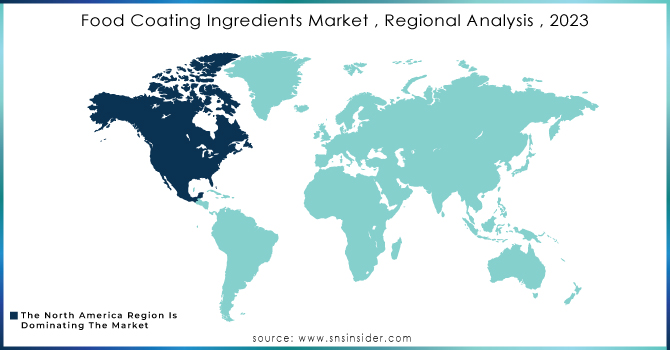

REGIONAL ANALYSIS

North America is the largest market for food coating ingredients, followed by Europe and Asia Pacific. The growth of the market in these regions is being driven by the demand for processed food, confectionary & bakery products, and ready-to-eat food.

Asia-Pacific region is the fastest-growing region for food coating ingredients, which is attributed to the robust demand for confectionery and bakery industries, along with the growing popularity of ready-to-eat meals and convenience foods among the working population has elevated the growth of the market. The United States Department of Agriculture estimates that ready meals generated USD 172.6 million in sales in India in 2022. Countries like India and China have a large demand due to their vast population, and busy lifestyles.

Europe has a significant market for food coating ingredients owing to similar factors as in North America, as well as the increasing demand for organic and functional food ingredient ingredients.

The major players in the market include Cargill, ADM, DuPont, Ingredion, and Tate & Lyle. These companies are focusing on developing new products and expanding their geographic reach to maintain their competitive edge.

Need any customization research on Food Coating Ingredients Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Food Coating Ingredients Market are Cargill, Archer Daniels Midland Company, Associated British Foods PLC, Agrana Beteiligungs-Ag, DuPont, Ingredion Incorporated, Tate & Lyle PLC, Ashland Global Holdings Inc., Bunge Limited, Pioneer Food Group, Puratos, Avebe, and other key players.

RECENT DEVELOPMENTS

In 2023, Corbion, a Spanish ingredient manufacturer, is expanding its Montmeló factory to include a sour candy powder production line.

In 2023 Avebe launched ElianeTM bind 12, a clean-label food coating based on potato starch that enables food manufacturers to create superior, crispy meat and fish crusts.

In 2023, Colorcon announced the release of a new Nutrafinish Dietary Supplement Coating to meet the needs of our nutritional market customers for tablet moisture protection without the usage of titanium dioxide.

In 2022, Puratos India introduced colored and flavored compound and compound filling in two varieties hard compound chocolate- Carat Cover Classic and fat-based filling- Carat Supercrem. According to the company, the solution is used to add flavor and color to final products without the hassle of acquiring ingredients.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.62 Billion |

| Market Size by 2032 | USD 6.18 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sugars and Syrups, Cocoa and Chocolates, Fats and Oils, Spices and Seasonings, Flours, Batter and Crumbs, and Other Types) • By Form (Dry, Liquid) • By Application (Bakery Products, Confectionery, Snacks, Dairy Products, Meat & Seafood, and Other Applications) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill, Archer Daniels Midland Company, Associated British Foods PLC, Agrana Beteiligungs-Ag, DuPont, Ingredion Incorporated, Tate & Lyle PLC, Ashland Global Holdings Inc., Bunge Limited, Pioneer Food Group, Puratos, Avebe |

| Key Drivers | • Increased demand of Confectioneries and bakery products |

| Market Restrain | • High cost of ingredients in food coating • Strict laws and regulations |