Get PDF Sample Copy of Food Certification Market - Request Sample Report

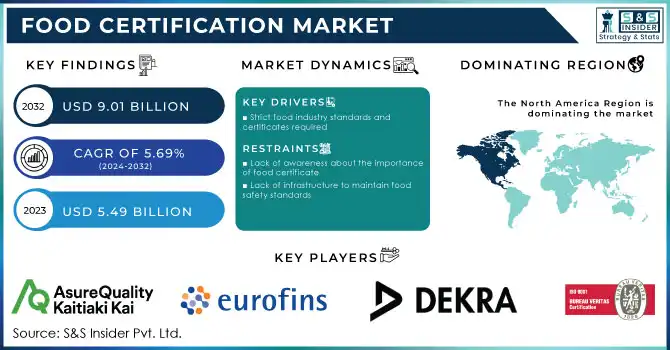

The Food Certification Market size was valued at USD 5.49 billion in 2023 and is expected to grow to USD 9.01 billion by 2032, at a CAGR of 5.69% over the forecast period of 2024-2032.

The food certification business is based on a certifying body that has been authorized and approved. Control Union Certifications offers third-party certification audits against the most important food safety standards. Food safety has been rapidly digitalized in the food business in recent years. Businesses began to adopt digital solutions to more correctly record food safety data, eliminate human error, and improve overall compliance. As new software programs and computerized apps for food businesses hit the market, the industry is projected to embrace this trend even more.

Rising consumer awareness about food safety, demanding food certification and requirements, and an increasing number of government measures to promote food safety are driving the Food Certification market. The high expense of food certification, which makes it difficult for small farmers to afford, as well as a lack of technical skills among small firms and a lack of universal food safety standards, are impeding the expansion of the Food Certification sector.

The market is further divided by type, with ISO 22000 - Food Safety Management System, BRCGS, SQF, IFS, Halal certification, GMP+/FSA, and Other being the most common.

KEY DRIVERS

Strict food industry standards and certificates required

Food certification helps to ensure the safety of food products by validating that they were produced, handled, stored, and transported in conformity with strict food safety regulations. Globally, governments and food safety groups are enforcing more strict laws to safeguard the safety and quality of food items. As firms seek to demonstrate compliance with these standards and enhance consumer confidence in their products, there is a growing demand for food certification. Non-GMO Food certification is given to food products that are free of genetically modified organisms (GMOs). It will be available in the United States in 2021. Vegan Food Certification was introduced in Europe in 2022 for vegan food products.

RESTRAIN

Lack of awareness about the importance of food certificate

Lack of infrastructure to maintain food safety standards

Many developing countries lack the resources needed to implement food safety and security measures, such as modern food processing facilities, well-trained food safety personnel, adequate water and sanitation facilities, and limited workplaces. Due to weak infrastructure and insufficient resources, developing countries rely heavily on small-scale and local food enterprises that are unable to attain global food certification.

OPPORTUNITY

Rising need for food certification in developing countries

Food safety and security systems in developing countries in North Africa and Asia region have inadequate infrastructure and implementation capabilities. This is due to a lack of basic supporting infrastructure for food product certification, the food certificate market in these nations is expected to grow at a slower rate. Furthermore, developing nations are increasingly exporting food to industrialized nations. These countries frequently have stringent food safety regulations that require imported food to meet particular requirements. This is boosting the demand for food certification for developing-country exports.

CHALLENGES

Lack of resources and financial support

Many small-scale food producers in developing countries may be unaware of the benefits of food certification or the steps required to achieve it. Small-scale food producers may find it challenging to take advantage of food certification prospects as a result of this. Small-scale food producers may lack the financial resources to afford food certification, as well as the resources required to develop food safety and quality management systems, such as trained employees and equipment.

Food security is a complicated issue with numerous factors, such as violence, supply chain interruptions, weather conditions, other disasters, and so on. Food production and supply lines in Ukraine and Russia have been interrupted by the war, increasing demand for food certification from businesses and consumers worldwide. This is because food certification can help to ensure that food products are safe and of good quality, especially during times of crisis. Food certification standards are also expected to change as food certification agencies react to the additional challenges provided by the war. Food certification authorities, for example, may need to set new requirements for food items coming from Ukraine or Russia.

The recession has had the greatest impact on food certification standards for small-scale food producers. Export restrictions on wheat, rice, and citrus crops have resulted in price hikes predicted at 9%, 12.3%, and 8.9% respectively in 2022. This has resulted in higher food prices, which has indirectly resulted in higher production costs and the maintenance of food safety requirements. Food certification expenses have also risen as a result of the war since food certification organizations face additional transportation and logistics expenditures. This is likely to increase the cost of food certification for businesses, which may harm future demand for food certification.

by Type

ISO 22000

BRCGS

SQF

IFS

Halal certification

GMP+/FSA

Other

by End-user

Meat

Poultry

Seafood Products

Dairy Products

Bakery and Confectionery

Baby Food

Beverages

Other

The food certificate market in North America is predicted to grow at a rapid pace. In the North American region, certification authorities ensure that enterprises involved in food and beverage manufacturing follow acceptable food management standards through follow-up and rigorous audits. Due to the region's growing concern for health and customer awareness of the adverse effects of contaminated food goods, the United States leads the North American market.

Asia Pacific is the fastest-growing region for the food certification market owing to the growing middle class in the region, which is leading to increased demand for safe and high-quality food products. China is the largest market for food certification in the Asia Pacific, followed by India, Japan, Australia, and South Korea. This is due to the large and growing population in China, as well as the increasing demand for safe and high-quality food products in the country.

Europe is expected to be the largest market for food and beverages, as well as for food certifications. Europe's food business is massive. Europe has put in place strong regulatory systems for food safety and quality. Hygiene Packaging, General Food Laws, and Special Food Regulations are examples of regulations. As a result, there is a considerable demand for food certificates across Europe.

Get Customised Report as per Your Business Requirement - Enquiry Now

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Bureau Veritas, DEKRA, NSF International, Eurofins Scientific, AsureQuality, Intertek Group PLC, Eagle Certification Group, DNV GL, SGS Group, TUV NORD GROUP, Underwriters Laboratories Inc, Lloyd’s Register Group Ltd, and other key players are mentioned in the final report.

In 2023, According to the NSF International organization, Serim Hyunmi Ltd, a South Korean rice bran oil firm, successfully obtained certification of BeVeg Vegan standards for its production facility, validating claims that they are Vegan, free of animal components, and cruelty-free.

In 2023, Intertek Cristal revealed that it has received five separate certifications from the Sheraton Abu Dhabi Hotel & Resort, based on the Intertek Cristal standards of health and safety, water safety hygiene, and food safety criteria.

In 2022, SCS Global Services has introduced a plant-based certification scheme. The initiative encourages the use of plant-based alternatives and acknowledges creativity in a variety of consumer items. The SCS-109 Standard allows for certification of food & beverages, Cannabidiol oil, and body care items. The certification certifies that no animal-derived components are used in the product's manufacturing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 5.49 Billion |

| Market Size by 2032 | US$ 9.01 Billion |

| CAGR | CAGR of 5.69% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ISO 22000, BRCGS, SQF, IFS, Halal certification, GMP+/FSA, and Other) • By End-user Industry (Meat, Poultry, Seafood Products, Dairy Products, Bakery and Confectionery, Baby Food, Beverages, and Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Bureau Veritas, DEKRA, NSF International, Eurofins Scientific, AsureQuality, Intertek Group PLC, Eagle Certification Group, DNV GL, SGS Group, TUV NORD GROUP, Underwriters Laboratories Inc, Lloyd’s Register Group Ltd |

| Key Drivers | • Strict food industry standards and certificates required |

| Market Opportunity | • Rising need for food certification in developing countries |

Ans: Food Certification Market is anticipated to expand by 5.6 % from 2023 to 2030.

Ans: Food Certification Market size was valued at USD 5.4 billion in 2022

Ans: USD 8.35 billion is expected to grow by 2030.

Ans: Asia Pacific is the fastest-growing Market for Food Certification.

Ans: Restrains are a Lack of awareness about the importance of food certificates and a lack of infrastructure to maintain food safety standards

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Ukraine- Russia War

4.2 Impact of Ongoing Recession

4.3. Introduction

4.3.1 Impact on Major Economies

4.3.1.1 US

4.3.1.2 Canada

4.3.1.3 Germany

4.3.1.4 France

4.3.1.5 United Kingdom

4.3.1.6 China

4.3.1.7 Japan

4.3.1.8 South Korea

4.3.1.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Food Certification Market Segmentation, By Type

8.1 ISO 22000

8.2 BRCGS

8.3 SQF

8.4 IFS

8.5 Halal certification

8.6 GMP+/FSA

8.7 Other

9. Food Certification Market Segmentation, By End-user

9.1 Meat

9.2 Poultry

9.3 Seafood Products

9.4 Dairy Products

9.5 Bakery and Confectionery

9.6 Baby Food

9.7 Beverages

9.8 Other

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 North America Food Certification Market by Country

10.2.2 North America Food Certification Market by Type

10.2.3 North America Food Certification Market by End-user

10.2.4 USA

10.2.4.1 USA Food Certification Market by Type

10.2.4.2 USA Food Certification Market by End-user

10.2.5 Canada

10.2.5.1 Canada Food Certification Market by Type

10.2.5.2 Canada Food Certification Market by End-user

10.2.6 Mexico

10.2.6.1 Mexico Food Certification Market by Type

10.2.6.2 Mexico Food Certification Market by End-user

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Eastern Europe Food Certification Market by Country

10.3.1.2 Eastern Europe Food Certification Market by Type

10.3.1.3 Eastern Europe Food Certification Market by End-user

10.3.1.4 Poland

10.3.1.4.1 Poland Food Certification Market by Type

10.3.1.4.2 Poland Food Certification Market by End-user

10.3.1.5 Romania

10.3.1.5.1 Romania Food Certification Market by Type

10.3.1.5.2 Romania Food Certification Market by End-user

10.3.1.6 Hungary

10.3.1.6.1 Hungary Food Certification Market by Type

10.3.1.6.2 Hungary Food Certification Market by End-user

10.3.1.7 Turkey

10.3.1.7.1 Turkey Food Certification Market by Type

10.3.1.7.2 Turkey Food Certification Market by End-user

10.3.1.8 Rest of Eastern Europe

10.3.1.8.1 Rest of Eastern Europe Food Certification Market by Type

10.3.1.8.2 Rest of Eastern Europe Food Certification Market by End-user

10.3.2 Western Europe

10.3.2.1 Western Europe Food Certification Market by Country

10.3.2.2 Western Europe Food Certification Market by Type

10.3.2.3 Western Europe Food Certification Market by End-user

10.3.2.4 Germany

10.3.2.4.1 Germany Food Certification Market by Type

10.3.2.4.2 Germany Food Certification Market by End-user

10.3.2.5 France

10.3.2.5.1 France Food Certification Market by Type

10.3.2.5.2 France Food Certification Market by End-user

10.3.2.6 UK

10.3.2.6.1 UK Food Certification Market by Type

10.3.2.6.2 UK Food Certification Market by End-user

10.3.2.7 Italy

10.3.2.7.1 Italy Food Certification Market by Type

10.3.2.7.2 Italy Food Certification Market by End-user

10.3.2.8 Spain

10.3.2.8.1 Spain Food Certification Market by Type

10.3.2.8.2 Spain Food Certification Market by End-user

10.3.2.9 Netherlands

10.3.2.9.1 Netherlands Food Certification Market by Type

10.3.2.9.2 Netherlands Food Certification Market by End-user

10.3.2.10 Switzerland

10.3.2.10.1 Switzerland Food Certification Market by Type

10.3.2.10.2 Switzerland Food Certification Market by End-user

10.3.2.11 Austria

10.3.2.11.1 Austria Food Certification Market by Type

10.3.2.11.2 Austria Food Certification Market by End-user

10.3.2.12 Rest of Western Europe

10.3.2.12.1 Rest of Western Europe Food Certification Market by Type

10.3.2.12.2 Rest of Western Europe Food Certification Market by End-user

10.4 Asia-Pacific

10.4.1 Asia Pacific Food Certification Market by Country

10.4.2 Asia Pacific Food Certification Market by Type

10.4.3 Asia Pacific Food Certification Market by End-user

10.4.4 China

10.4.4.1 China Food Certification Market by Type

10.4.4.2 China Food Certification Market by End-user

10.4.5 India

10.4.5.1 India Food Certification Market by Type

10.4.5.2 India Food Certification Market by End-user

10.4.6 Japan

10.4.6.1 Japan Food Certification Market by Type

10.4.6.2 Japan Food Certification Market by End-user

10.4.7 South Korea

10.4.7.1 South Korea Food Certification Market by Type

10.4.7.2 South Korea Food Certification Market by End-user

10.4.8 Vietnam

10.4.8.1 Vietnam Food Certification Market by Type

10.4.8.2 Vietnam Food Certification Market by End-user

10.4.9 Singapore

10.4.9.1 Singapore Food Certification Market by Type

10.4.9.2 Singapore Food Certification Market by End-user

10.4.10 Australia

10.4.10.1 Australia Food Certification Market by Type

10.4.10.2 Australia Food Certification Market by End-user

10.4.11 Rest of Asia-Pacific

10.4.11.1 Rest of Asia-Pacific Food Certification Market by Type

10.4.11.2 Rest of Asia-Pacific Food Certification Market by End-user

10.5 Middle East & Africa

10.5.1 Middle East

10.5.1.1 Middle East Food Certification Market by Country

10.5.1.2 Middle East Food Certification Market by Type

10.5.1.3 Middle East Food Certification Market by End-user

10.5.1.4 UAE

10.5.1.4.1 UAE Food Certification Market by Type

10.5.1.4.2 UAE Food Certification Market by End-user

10.5.1.5 Egypt

10.5.1.5.1 Egypt Food Certification Market by Type

10.5.1.5.2 Egypt Food Certification Market by End-user

10.5.1.6 Saudi Arabia

10.5.1.6.1 Saudi Arabia Food Certification Market by Type

10.5.1.6.2 Saudi Arabia Food Certification Market by End-user

10.5.1.7 Qatar

10.5.1.7.1 Qatar Food Certification Market by Type

10.5.1.7.2 Qatar Food Certification Market by End-user

10.5.1.8 Rest of Middle East

10.5.1.8.1 Rest of Middle East Food Certification Market by Type

10.5.1.8.2 Rest of Middle East Food Certification Market by End-user

10.5.2 Africa

10.5.2.1 Africa Food Certification Market by Country

10.5.2.2 Africa Food Certification Market by Type

10.5.2.3 Africa Food Certification Market by End-user

10.5.2.4 Nigeria

10.5.2.4.1 Nigeria Food Certification Market by Type

10.5.2.4.2 Nigeria Food Certification Market by End-user

10.5.2.5 South Africa

10.5.2.5.1 South Africa Food Certification Market by Type

10.5.2.5.2 South Africa Food Certification Market by End-user

10.5.2.6 Rest of Africa

10.5.2.6.1 Rest of Africa Food Certification Market by Type

10.5.2.6.2 Rest of Africa Food Certification Market by End-user

10.6 Latin America

10.6.1 Latin America Food Certification Market by Country

10.6.2 Latin America Food Certification Market by Type

10.6.3 Latin America Food Certification Market by End-user

10.6.4 Brazil

10.6.4.1 Brazil Food Certification Market by Type

10.6.4.2 Brazil Food Certification Market by End-user

10.6.5 Argentina

10.6.5.1 Argentina Food Certification Market by Type

10.6.5.2 Argentina Food Certification Market by End-user

10.6.6 Colombia

10.6.6.1 Colombia Food Certification Market by Type

10.6.6.2 Colombia Food Certification Market by End-user

10.6.7 Rest of Latin America

10.6.7.1 Rest of Latin America Food Certification Market by Type

10.6.7.2 Rest of Latin America Food Certification Market by End-user

11 Company Profile

11.1 Bureau Veritas

11.1.1 Company Overview

11.1.2 Financials

11.1.3 Product/Services Offered

11.1.4 SWOT Analysis

11.1.5 The SNS View

11.2 NSF International

11.2.1 Company Overview

11.2.2 Financials

11.2.3 Product/Services Offered

11.2.4 SWOT Analysis

11.2.5 The SNS View

11.3 Eurofins Scientific

11.3.1 Company Overview

11.3.2 Financials

11.3.3 Product/Services Offered

11.3.4 SWOT Analysis

11.3.5 The SNS View

11.4 AsureQuality

11.4 Company Overview

11.4.2 Financials

11.4.3 Product/Services Offered

11.4.4 SWOT Analysis

11.4.5 The SNS View

11.5 Intertek Group PLC

11.5.1 Company Overview

11.5.2 Financials

11.5.3 Product/Services Offered

11.5.4 SWOT Analysis

11.5.5 The SNS View

11.6 SGS Group

11.6.1 Company Overview

11.6.2 Financials

11.6.3 Product/Services Offered

11.6.4 SWOT Analysis

11.6.5 The SNS View

11.7 Eagle Certification Group

11.7.1 Company Overview

11.7.2 Financials

11.7.3 Product/Services Offered

11.7.4 SWOT Analysis

11.7.5 The SNS View

11.8 Underwriters Laboratories Inc

11.8.1 Company Overview

11.8.2 Financials

11.8.3 Product/Services Offered

11.8.4 SWOT Analysis

11.8.5 The SNS View

11.9 Lloyd’s Register Group Ltd

11.9.1 Company Overview

11.9.2 Financials

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.9.5 The SNS View

11.10 DNV GL

11.10.1 Company Overview

11.10.2 Financials

11.10.3 Product/Services Offered

11.10.4 SWOT Analysis

11.10.5 The SNS View

11.11 TUV NORD GROUP

11.11.1 Company Overview

11.11.2 Financials

11.11.3 Product/Services Offered

11.11.4 SWOT Analysis

11.11.5 The SNS View

11.12 DEKRA SE

11.12.1 Company Overview

11.12.2 Financials

11.12.3 Product/Services Offered

11.12.4 SWOT Analysis

11.12.5 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. USE Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Complete Nutrition Products Market Size was esteemed at USD 3.58 billion out of 2022 and is supposed to arrive at USD 5.95 billion by 2030 and develop at a CAGR of 6.57% over the forecast period 2023-2030.

Sweeteners Market Size was valued at USD 90.2 billion in 2021 and is expected to reach USD 111.6 billion by 2028, and grow at a CAGR of 3.1% over the forecast period 2022-2028.

The Aloe Vera Market size was USD 2.39 billion in 2022 and is expected to Reach USD 4.39 billion by 2030 and grow at a CAGR of 7.9% over the forecast period of 2023-2030.

Cold Pressed Oil Market Report Scope & Overview: Cold Pressed Oil Market Size was valued at USD 3

Shrimp Market Report Scope & Overview: Shrimp Market

Sourdough Market Size was esteemed at USD 2.80 billion out of 2022 and is supposed to arrive at USD 6.11 billion by 2030, and develop at a CAGR of 10.25% over the forecast period 2023-2030.

Hi! Click one of our member below to chat on Phone