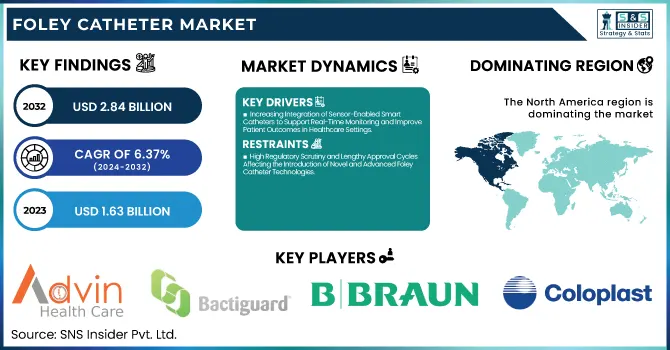

The Foley Catheter Market Size was valued at USD 1.63 Billion in 2023 and is expected to reach USD 2.84 Billion by 2032, growing at a CAGR of 6.37% over the forecast period of 2024-2032.

Get More Information on Foley Catheter Market - Request Sample Report

The Foley Catheter Market is undergoing notable transformation driven by rising urinary complications and an aging global population. Our report explores the regulatory landscape and compliance overview, shedding light on the frameworks guiding product approvals across key regions. It addresses the environmental impact and disposal practices, emphasizing the need for sustainable catheter solutions. Through patent analysis and innovation trends, the report uncovers breakthroughs like antimicrobial coatings and advanced designs. The clinical trial and efficacy outcome review offers data-driven insights into product performance. Lastly, demographic and patient population insights provide a lens into shifting healthcare demands, linking aging and disease trends to market growth. Together, these elements paint a holistic picture of a market evolving through need, regulation, and innovation.

The US Foley Catheter Market Size was valued at USD 451.29 Million in 2023 with a market share of around 76% and growing at a significant CAGR over the forecast period of 2024-2032.

The US Foley Catheter market is experiencing steady growth, driven by the rising prevalence of urinary incontinence, benign prostatic hyperplasia, and post-surgical urinary retention among the aging population. Increased hospitalization rates and expanding long-term care facilities are fueling demand. According to the Centers for Disease Control and Prevention (CDC), urinary tract infections associated with catheter use remain a major concern, prompting a shift toward antimicrobial and coated catheters. U.S.-based manufacturers such as Becton, Dickinson and Company (C.R. Bard) and Teleflex Incorporated are investing in advanced technologies, including infection-resistant designs, aligning with FDA regulatory focus on patient safety and innovation.

Drivers

Increasing Integration of Sensor-Enabled Smart Catheters to Support Real-Time Monitoring and Improve Patient Outcomes in Healthcare Settings

The Foley Catheter Market is witnessing strong momentum through the integration of smart catheter technologies, especially sensor-enabled solutions designed for real-time urinary monitoring. These advanced Foley catheters are equipped with pressure, flow, or temperature sensors to offer continuous feedback on urine output and bladder status, significantly improving patient care, especially in intensive care units. Hospitals across the United States are increasingly adopting these systems to reduce manual tracking errors, enhance data collection, and enable early detection of complications such as blockages or infections. The Veterans Health Administration and other federal health agencies have started evaluating these innovations for large-scale deployment, especially in post-operative care units. In addition, companies such as Potrero Medical and Stryker Corporation are developing sensor-based Foley catheters that can be connected to electronic health records (EHRs), improving diagnostic accuracy and clinical efficiency. This technology is also in line with ongoing trends in digital health and remote patient monitoring, which are being encouraged by both public and private healthcare entities in the United States. Furthermore, reimbursement policies from Medicare and Medicaid Services are gradually recognizing the value of these advanced devices in reducing hospital-acquired infections and readmission rates, thus making them financially viable for healthcare providers. With the growing demand for patient-centric solutions and the push for precision medicine, the integration of real-time monitoring into traditional Foley catheters is transforming the market, encouraging manufacturers to develop innovative products that bridge the gap between conventional urology and modern healthcare informatics.

Restraints

High Regulatory Scrutiny and Lengthy Approval Cycles Affecting the Introduction of Novel and Advanced Foley Catheter Technologies

The Foley Catheter Market faces a significant restraint due to the stringent regulatory environment and prolonged approval timelines associated with introducing new catheter technologies. In the United States, the Food and Drug Administration (FDA) classifies Foley catheters as Class II medical devices, requiring manufacturers to undergo a 510(k) premarket notification process. While less rigorous than a premarket approval (PMA), the process still demands extensive documentation, clinical data, and safety evaluations, which can delay product launches. For manufacturers investing in innovation—such as smart catheters with embedded sensors or antimicrobial coatings—these requirements often mean years of testing before reaching commercial viability. Additionally, regulatory bodies are now more focused on post-market surveillance, requiring continuous monitoring and reporting of adverse events, which adds to the operational burden. The need for compliance with labeling standards, sterility assurance levels, biocompatibility testing, and human factor validations increases both the cost and complexity of product development. Smaller or emerging companies, in particular, may struggle to navigate this regulatory maze due to limited resources and experience. Moreover, changes in regulatory expectations, such as the shift toward Unique Device Identification (UDI) systems and environmental compliance norms, further complicate the pathway to market entry. While these regulations ensure patient safety, they also stifle the speed of innovation and discourage smaller players from entering the market, resulting in limited product diversity. This high barrier to entry remains a critical restraint in the market, particularly as healthcare providers increasingly demand next-generation solutions that are safer, smarter, and more sustainable.

Opportunities

Growing Market for Customizable Catheter Solutions Catering to Specific Urological and Post-Surgical Patient Requirements Across Demographics

The Foley Catheter Market is increasingly benefiting from the rising demand for customizable catheter solutions that cater to highly specific patient needs. This trend is especially evident in segments like pediatric care, urological abnormalities, spinal cord injuries, and post-surgical recovery, where standard catheter sizes or materials may not be ideal. Hospitals and specialty clinics across the United States are now opting for catheter solutions that can be tailored in terms of length, balloon capacity, tip configuration, and even material composition. For instance, pediatric Foley catheters often require softer materials and smaller diameters, while male patients recovering from prostate surgery may need catheters with enhanced drainage capacity. Companies such as B. Braun Melsungen AG and Cook Medical have introduced product lines that offer these levels of customization. The ability to personalize catheter characteristics not only improves patient comfort and reduces complications such as urethral trauma or infection but also aligns with the precision medicine movement. In addition, the demand for latex-free, antimicrobial-coated, and pre-lubricated variants has grown, especially among patients with allergies or long-term catheterization needs. Healthcare providers are increasingly seeking suppliers who offer versatile product portfolios and support services like on-demand sizing or specialist consultations. Customization also aids in improving compliance and reducing catheter-related readmissions, which are a key focus area for institutions monitored by the Centers for Medicare & Medicaid Services. This growing inclination toward tailored Foley catheter solutions is creating a significant opportunity for manufacturers who are agile, innovative, and responsive to specific clinical demands.

Challenge

Persistent Incidence of Catheter-Associated Urinary Tract Infections Challenges Long-Term Usage and Patient Compliance Rates

Despite technological advances, catheter-associated urinary tract infections (CAUTIs) remain a persistent challenge in the Foley Catheter Market. CAUTIs not only compromise patient health but also increase hospital stays, healthcare costs, and readmission rates. According to the Centers for Disease Control and Prevention (CDC), Foley catheters are responsible for over 75% of urinary tract infections in hospitalized patients. These infections often occur due to prolonged catheter use, poor insertion techniques, or lack of hygiene maintenance, making them difficult to completely eliminate. Although antimicrobial coatings and advanced designs have reduced infection risks, they have not eradicated the issue entirely. Moreover, frequent infections can lead to complications such as kidney damage, sepsis, and antibiotic resistance, deterring both physicians and patients from prolonged use. This negatively impacts the adoption of Foley catheters for chronic conditions, especially in homecare settings. Additionally, hospitals are becoming increasingly cautious about catheter use, opting for intermittent or suprapubic alternatives, when possible, to reduce infection risk. The presence of strict infection reporting guidelines by agencies like the U.S. Department of Health and Human Services (HHS) further pressures healthcare providers to minimize catheter use. This ongoing challenge creates a need for continuous product improvement, better training programs, and patient education initiatives. Until these infections can be significantly reduced or eliminated, they will continue to pose a barrier to growth, despite the undeniable utility of Foley catheters in both acute and chronic care scenarios.

By Product Type

The 2-way Foley catheters segment accounted for a dominant 55.2% market share in 2023 due to their wide applicability, cost-effectiveness, and ease of use across healthcare settings. These catheters have become the standard in short to medium-term urinary catheterization, particularly in post-operative care and during hospital stays. Their dual-channel design one for urine drainage and the other for balloon inflation makes them suitable for most routine catheterization needs, which supports their high adoption rate. Additionally, the growing global burden of chronic conditions such as urinary retention and benign prostatic hyperplasia has increased hospital admissions, thereby fueling demand. According to the National Association for Continence (NAFC), nearly 33 million adults in the United States suffer from bladder control problems, prompting the widespread usage of Foley catheters in healthcare facilities. Moreover, various healthcare systems in countries like Canada and Germany include 2-way Foley catheters in their public procurement standards for hospitals due to their proven efficacy and affordability. The low complication rate and availability in both latex and silicone variants further boost their acceptance. Their reliability and compatibility with infection prevention protocols recommended by bodies such as the Centers for Disease Control and Prevention (CDC) have solidified their position as the preferred catheter type in medical institutions worldwide.

By Material

Silicone Foley catheters held the largest market share at 59.4% in 2023, primarily due to their superior biocompatibility, longer indwelling duration, and reduced risk of allergic reactions compared to latex-based alternatives. Silicone material is non-reactive and offers high tensile strength, making it ideal for patients requiring long-term catheterization, such as those in palliative care or suffering from chronic urinary retention. Healthcare facilities increasingly prefer silicone catheters due to their lower encrustation rates and compatibility with both male and female anatomies. A 2022 study published by the American Urological Association (AUA) emphasized that silicone catheters significantly reduce the risk of catheter-associated urinary tract infections (CAUTIs), especially among geriatric patients. Furthermore, regulatory organizations such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have issued updated guidelines promoting the use of hypoallergenic medical devices, which has propelled demand for silicone-based solutions. Large-scale hospital networks in the U.K. and Japan have already shifted towards silicone Foley catheters in standard patient care protocols. Their transparency also allows easy monitoring of urine flow, adding to clinical efficiency and patient safety, thus reinforcing their dominance in the global market.

By Indication

Urinary incontinence was the dominant indication segment in 2023, capturing 46.7% of the Foley catheter market, driven by the aging population and rising incidence of neurological and urological disorders. With the World Health Organization (WHO) projecting that the global elderly population will double by 2050, the number of individuals suffering from incontinence is expected to surge. Foley catheters are frequently used in managing both temporary and permanent incontinence conditions in elderly and immobile patients. According to the U.S. Centers for Medicare & Medicaid Services (CMS), over 50% of residents in long-term care facilities are affected by some form of incontinence, necessitating continuous catheter use. Moreover, awareness campaigns by associations like the International Continence Society (ICS) and the NAFC have helped destigmatize incontinence and promote early diagnosis and catheter-based treatment options. Hospitals and home care providers are increasingly deploying Foley catheters to ensure hygiene and prevent skin infections caused by urine leakage. This trend is especially evident in countries with a growing geriatric population like Germany, Japan, and Canada. With the focus on patient comfort, non-invasive urinary management, and institutional protocols for long-term care, urinary incontinence continues to drive catheter adoption globally.

By End-user

Hospitals emerged as the dominant end-user segment in 2023, securing a substantial 62.8% share of the Foley catheter market, primarily due to the volume of procedures requiring urinary catheterization in both inpatient and outpatient settings. Foley catheters are routinely used during surgeries, post-operative recovery, and intensive care to monitor urine output and maintain bladder drainage. As per data from the World Bank, hospital admissions per 1,000 people have seen a year-on-year rise globally, further increasing the demand for Foley catheters. Government-funded healthcare programs, such as Medicare in the U.S. and the National Health Service (NHS) in the U.K., have clear protocols recommending Foley catheters in specific clinical scenarios, thereby reinforcing institutional use. Additionally, hospitals are the first point of care for patients with trauma, neurological disorders, and urinary tract obstructions, all of which may necessitate catheter insertion. The dominance of hospitals is further supported by their in-house training and adherence to CAUTI prevention protocols issued by the CDC and European Centre for Disease Prevention and Control (ECDC), ensuring safe catheterization. Emerging markets such as Brazil and India are also witnessing significant hospital infrastructure development, expanding their procedural capacity and contributing to this segment’s continued growth.

North America dominated the Foley catheter market in 2023 with a market share of 36.4%, owing to the region’s advanced healthcare infrastructure, rising prevalence of chronic urological disorders, and favorable reimbursement landscape. The United States accounted for the largest share within North America, driven by a high rate of hospital admissions and surgical procedures requiring urinary catheterization. According to the Centers for Disease Control and Prevention (CDC), nearly 15–25% of hospitalized patients in the U.S. undergo urinary catheterization, and the prevalence of conditions such as urinary incontinence and benign prostatic hyperplasia (BPH) continues to rise due to an aging population. Furthermore, Medicare and private insurers provide reimbursement for catheter-related expenses, reducing the financial burden on patients and enhancing accessibility. Canada also contributes significantly to regional dominance through robust healthcare funding and a high geriatric population. The Canadian Institute for Health Information (CIHI) reported a steady increase in urinary disorder diagnoses, correlating with Foley catheter use. Additionally, the adoption of electronic health records and patient management systems in both countries enables better inventory and infection control of catheter usage. Strong market presence of key players such as Becton, Dickinson and Company and Teleflex Incorporated, along with the consistent introduction of antimicrobial-coated catheters, has further propelled North America’s leading position in the global Foley catheter market.

On the other hand, Asia Pacific registered to have the fastest growth in the Foley catheter market during the forecast period, with a significant growth rate, driven by a confluence of demographic, economic, and policy factors. Rapidly aging populations in countries like Japan, China, and South Korea have significantly increased the prevalence of urinary incontinence and age-related urological conditions that necessitate long-term catheter use. Japan, for instance, has one of the highest proportions of elderly citizens globally, and its Ministry of Health has initiated several home care and eldercare programs that include Foley catheter provisioning. In China, rising disposable incomes, healthcare reforms under the Healthy China 2030 initiative, and expansion of public hospitals in rural areas are driving medical consumable adoption, including urinary catheters. India is also witnessing strong market expansion due to the increasing number of surgeries and trauma cases, particularly in government and private hospitals. Additionally, regional awareness campaigns and government-sponsored health check-up schemes have improved early diagnosis of urological disorders, further boosting demand. Local manufacturing support and low-cost production have enabled domestic players to penetrate underserved markets, making Foley catheters more accessible. Organizations such as the Asia Pacific Continence Advisory Board are working toward standardizing urinary care, helping accelerate market adoption. As a result, Asia Pacific is positioned as a high-growth region in the global Foley catheter industry.

Need any customization research on Foley-Catheter-Market - Enquiry Now

Advin Health Care (Silicone Foley Catheter, Latex Foley Catheter, 3-Way Foley Catheter)

Angiplast Pvt Ltd (Foley Catheter 100% Silicone)

Bactiguard AB (BIP Foley Catheter – Latex, BIP Foley Catheter – Silicone)

B. Braun Melsungen AG (Folysil Silicone Foley Catheter, Ureofix Foley Catheter)

Becton, Dickinson and Company (C.R. Bard) (Bardex Lubricath Foley Catheter, Bardex I.C. Foley Catheter)

Cardinal Health (Dover Hydrogel Coated Latex Foley Catheter, Dover 100% Silicone Foley Catheter)

Coloplast Corp. (SpeediCath Compact Catheter, Self-Cath Straight Tip Catheter)

ConvaTec Group Plc (GentleCath Glide Catheter, Flexi-Seal SIGNAL Fecal Management Catheter)

Cook Medical (Silicone Foley Catheter, Hydrogel-Coated Latex Foley Catheter)

GWS Surgicals LLP (Silicone Foley Catheter, Latex Foley Catheter)

HEMC (Hospital Equipment Manufacturing Company) (Silicone Foley Catheter, Latex Foley Catheter)

Medline Industries, LP (Silicone-Elastomer Coated Foley Catheter, 100% Silicone Foley Catheter)

Optimum Medical Limited (Actreen Hi-Lite Cath, Actreen Mini Cath)

Polymedicure (Polytip Foley Catheter, Silicon Foley Catheter)

Ribbel International Limited (Silkygold Foley Catheter, All Silicone Foley Balloon Catheter)

Sterimed Group (Silicone Foley Catheter, Latex Foley Catheter)

SunMed (Silicone Foley Catheter, Latex Foley Catheter)

Teleflex Incorporated (Rüsch Gold Foley Catheter, Rüsch Silkolatex Foley Catheter)

Well Lead Medical Co., Ltd. (Silicone Foley Catheter, Latex Foley Catheter)

Wellspect HealthCare AB (LoFric Origo Catheter, LoFric Sense Catheter)

June 2024: Silq Technologies received an Innovative Technology contract from Vizient, Inc. for its ClearTract Foley Catheter. This catheter employs zwitterion technology to minimize biofilm formation and urinary tract infections. The contract was awarded based on recommendations from Vizient's customer-led councils, highlighting the product's potential to enhance clinical care and patient safety.

January 2025: Dr. Bruce Gardner, a radiologist at Sanford Health in Bismarck, secured FDA approval for his modified catheter design. Motivated by patient injuries from forcefully removed catheters, Dr. Gardner developed a device incorporating a metal filament that allows the anchoring balloon to deflate when pulled, thereby reducing injury risks. InnoCare Urologics plans to distribute the new catheters to select hospitals within the year.

January 2025: UNOQUIP GmbH announced the global launch of its expanded postoperative silicone Foley catheter range. The portfolio includes 2-way and 3-way prostatic and haematuria catheters made from 100% pure silicone, designed for efficient postoperative drainage, irrigation, and haemostasis. These catheters are compliant with the European Medical Devices Regulation (EU) 2017/745 and are intended to enhance patient comfort and recovery after surgery.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.63 Billion |

| Market Size by 2032 | USD 2.84 Billion |

| CAGR | CAGR of 6.37% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (2-way Foley Catheters, 3-way Foley Catheters, 4-way Foley Catheters) •By Material (Silicone Foley Catheters, Latex Foley Catheters) •By Indication (Urinary Incontinence, Enlarged Prostate Gland/BPH, Spinal Cord Injury, Others) •By End-user (Hospitals, Long Term Care Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company (C.R. Bard), Teleflex Incorporated, Coloplast Corp., Cardinal Health, B. Braun Melsungen AG, Medline Industries, LP, Cook Medical, ConvaTec Group Plc, Wellspect HealthCare AB, Bactiguard AB and other key players |

Ans: The Foley Catheter Market was valued at USD 1.63 Billion in 2023.

Ans: The Foley Catheter Market is projected to grow at a CAGR of 6.37% from 2024 to 2032.

Ans: The Foley Catheter Market is driven by rising urinary complications and increasing aging population.

Ans: Sensor-enabled smart catheters are transforming the Foley Catheter Market by enabling real-time urinary monitoring.

Ans: The U.S. accounted for approximately 76% of the Foley Catheter Market in 2023, valued at USD 451.29 Million.

Table Of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Regulatory Landscape and Compliance Overview

5.2 Environmental Impact and Disposal Practices

5.3 Patent Analysis and Innovation Trends

5.4 Clinical Trial and Efficacy Outcome Review

5.5 Demographic and Patient Population Insights

6. Competitive Landscape

6.1 List of Major Companies By Region

6.2 Market Share Analysis By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Foley Catheter Market Segmentation By Product Type

7.1 Chapter Overview

7.2 2-way Foley Catheters

7.2.1 2-way Foley Catheters Market Trends Analysis (2020-2032)

7.2.2 2-way Foley Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 3-way Foley Catheters

7.3.1 3-way Foley Catheters Market Trends Analysis (2020-2032)

7.3.2 3-way Foley Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 4-way Foley Catheters

7.4.1 4-way Foley Catheters Market Trends Analysis (2020-2032)

7.4.2 4-way Foley Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Foley Catheter Market Segmentation By Material

8.1 Chapter Overview

8.2 Silicone Foley Catheters

8.2.1 Silicone Foley Catheters Market Trends Analysis (2020-2032)

8.2.2 Silicone Foley Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Latex Foley Catheters

8.3.1 Latex Foley Catheters Market Trends Analysis (2020-2032)

8.3.2 Latex Foley Catheters Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Foley Catheter Market Segmentation By Indication

9.1 Chapter Overview

9.2 Urinary Incontinence

9.2.1 Urinary Incontinence Market Trends Analysis (2020-2032)

9.2.2 Urinary Incontinence Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Enlarged Prostate Gland/BPH

9.3.1 Enlarged Prostate Gland/BPH Market Trends Analysis (2020-2032)

9.3.2 Enlarged Prostate Gland/BPH Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Spinal Cord Injury

9.4.1 Spinal Cord Injury Market Trends Analysis (2020-2032)

9.4.2 Spinal Cord Injury Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Foley Catheter Market Segmentation By End-user

10.1 Chapter Overview

10.2 Hospitals

10.2.1 Hospitals Market Trends Analysis (2020-2032)

10.2.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Long Term Care Facilities

10.3.1 Long Term Care Facilities Market Trend Analysis (2020-2032)

10.3.2 Long Term Care Facilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Others

10.4.1 Others Market Trends Analysis (2020-2032)

10.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.2.3 North America Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.2.4 North America Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.2.5 North America Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.2.6 North America Foley Catheter Market Estimates and Forecasts By End-user(2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.2.7.2 USA Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.2.7.3 USA Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.2.7.4 USA Foley Catheter Market Estimates and Forecasts By End-user(2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.2.8.2 Canada Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.2.8.3 Canada Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.2.8.4 Canada Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.2.9.3 Mexico Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.2.9.4 Mexico Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trend Analysis

11.3.1.2 Eastern Europe Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Foley Catheter Market Estimates and Forecasts By End-user(2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.7.3 Poland Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.7.4 Poland Foley Catheter Market Estimates and Forecasts By End-user(2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.8.3 Romania Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.8.4 Romania Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trend Analysis

11.3.2.2 Western Europe Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.5 Western Europe Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.6 Western Europe Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.7.3 Germany Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.7.4 Germany Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.8.2 France Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.8.3 France Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.8.4 France Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.9.3 UK Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.9.4 UK Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.10.3 Italy Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.10.4 Italy Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.11.3 Spain Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.11.4 Spain Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.14.3 Austria Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.14.4 Austria Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trend Analysis

11.4.2 Asia Pacific Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.5 Asia Pacific Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.6 Asia Pacific Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.7.2 China Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.7.3 China Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.7.4 China Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.8.2 India Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.8.3 India Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.8.4 India Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.9.2 Japan Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.9.3 Japan Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.9.4 Japan Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.10.3 South Korea Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.10.4 South Korea Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.11.3 Vietnam Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.11.4 Vietnam Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.12.3 Singapore Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.12.4 Singapore Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.13.2 Australia Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.13.3 Australia Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.13.4 Australia Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trend Analysis

11.5.1.2 Middle East Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.5 Middle East Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.6 Middle East Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.7.3 UAE Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.7.4 UAE Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trend Analysis

11.5.2.2 Africa Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.2.4 Africa Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.2.5 Africa Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.2.6 Africa Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Foley Catheter Market Estimates and Forecasts by Country (2020-2032) (USD Billion)

11.6.3 Latin America Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.6.4 Latin America Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.6.5 Latin America Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.6.6 Latin America Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.6.7.3 Brazil Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.6.7.4 Brazil Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.6.8.3 Argentina Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.6.8.4 Argentina Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.6.9.3 Colombia Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.6.9.4 Colombia Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Foley Catheter Market Estimates and Forecasts By Product Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Foley Catheter Market Estimates and Forecasts By Material (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Foley Catheter Market Estimates and Forecasts By Indication (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Foley Catheter Market Estimates and Forecasts By End-user (2020-2032) (USD Billion)

12. Company Profiles

12.1 Becton, Dickinson and Company (C.R. Bard)

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Teleflex Incorporated

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Coloplast Corp.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Cardinal Health

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 B. Braun Melsungen AG

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Medline Industries, LP

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Cook Medical

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 ConvaTec Group Plc

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Wellspect HealthCare AB

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Bactiguard AB

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

2-way Foley Catheters

3-way Foley Catheters

4-way Foley Catheters

By Material

Silicone Foley Catheters

Latex Foley Catheters

By Indication

Urinary Incontinence

Enlarged Prostate Gland/BPH

Spinal Cord Injury

Others

By End-user

Hospitals

Long Term Care Facilities

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Cardiac Monitoring Devices Market size is projected to grow from USD 29.15 billion in 2023 to USD 48.58 billion by 2032, at a Compound Annual Growth Rate (CAGR) of 5.84% during the forecast period 2024-2032.

The Sanger Sequencing Market Size was valued at USD 2,901.15 Million in 2023, and is expected to reach USD 12,356.57 Million by 2032, and grow at a CAGR of 18.63% Over the Forecast Period of 2024-2032.

The Topical Drug Delivery Market Size was valued at USD 210.03 Billion in 2023 and is expected to reach USD 499.39 Billion by 2032 and grow at a CAGR of 10.62% over the forecast period 2024-2032.

The Nanomedicine Market was valued at USD 223.6 billion in 2023 and is expected to reach USD 634.2 billion by 2032 and grow at a CAGR of 12.2% from 2024 to 2032.

Tangential Flow Filtration Market was valued at USD 2.02 billion in 2023 and is expected to reach USD 5.75 billion by 2032, growing at a CAGR of 12.24% from 2024-2032.

The Diabetes Drug Market Size was valued at USD 79.4 billion in 2023 and is expected to reach USD 145.0 billion by 2032, growing at a CAGR of 6.9%.

Hi! Click one of our member below to chat on Phone