Foam Glass Market Report Scope & Overview:

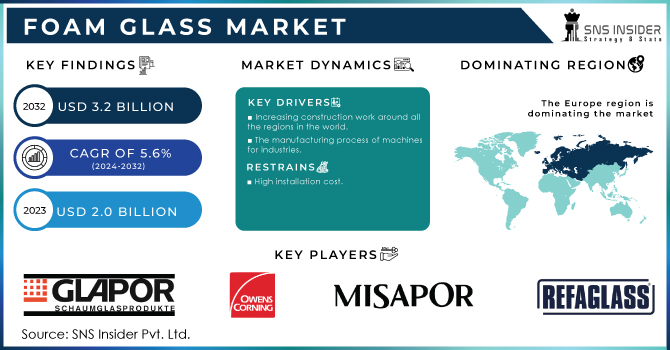

The Foam Glass Market Size was valued at USD 2.0 billion in 2023 and is expected to reach USD 3.3 billion by 2032 and grow at a CAGR of 5.6% over the forecast period 2024-2032.

Get more information on Foam Glass Market - Request Sample Report

The foam glass market is growing significantly because of increasing demand for it in the construction, industrial insulation, and environmental sectors. Foam glass is considered to be a lightweight, hard, and fire-resistant material for use as insulation; that is why it is one of the most favorite choices in modern construction and infrastructure projects. Another factor behind this market boost is the increased trend of sustainability along with energy efficiency. The foam glass material is known to be ecologically friendly because it frequently consists of recycled glass. Good insulating properties result in energy-efficient buildings. In some regions, very stringent building code regulations that involve conservations of energy have made the product rather popular. Also, the cryogenic insulation area of the industrial sector has increased its demand. Other innovations in the applications of foam glass, like green roofs and water management systems, also demonstrate how the industry is broadening its horizons with innovative means. Some of the other recent developments suggesting a dynamic market, are that Foamit Group has increased its capacity of foam glass by doubling the output at Ørland during March 2024. This expansion will allow the company to further strengthen its stand in the Nordic region, where foam glass is increasingly being used for construction and industrial insulation projects. Similarly, MISAPOR, one of the leaders in the market, have also been working on enhancing the product offerings by focusing on foam glass gravel, which has gained rapid acceptance for lightweight fills and drainage systems. This trend signifies that manufacturers are proactively engaged in increasing volume production and expanding diversified applications to meet the demands of the burgeoning markets.

The competitive dynamic of the foam glass market is also changing through technological advancements. For example, Glapor has concentrated on improving the thermal behavior of foam glass products to better meet requirements for high-performance building insulation applications. In contrast, Glapor's innovations have made it possible to use foam glass in demanding applications, such as passive houses, while Owens Corning has actively developed advanced systems for insulation that have a foam glass for applications that have high industrial temperature requirements. In June 2023, Owens Corning launched its new foam glass product line. This new set of products has improved the durability and fire resistance of industrial insulation systems, marking a new level of performance in that industry. Other major players have taken up new capacities and strategic initiatives for the expansion of these advances. In September 2023, UUSIOAINES OY released a notification indicating the improvement of its production techniques as follows the increasing demand for foam glass in Europe's infrastructural projects. This is a company that has been leading in the use of recyclable glass in the production of foam glass, contributing towards increased demands for green products. This investment can also be seen in Veriso Schaumglas GmbH, where the production of foam glass for infrastructure projects, such as developments, is further elaborated upon while extending its influence into the European market. These development cases show that foam glass manufacturers continue to expand their capabilities in terms of production as well as enhance product performance to stay competitive in the global market.

Foam Glass Market Dynamics:

Drivers:

-

Increasing Demand for Energy-Efficient Insulation Materials Drives the Foam Glass Market Growth

The demand for energy-efficient insulation materials is ever increasing, driven by environmental awareness and stringent energy regulations being implemented worldwide. Foam glass is well known for its excellent qualities of thermal insulation and is being highly used in construction and industrial applications. Its efficiency in giving relief from total energy consumption while maintaining uniform indoor temperatures finds high demand from the building and infrastructure sectors. Governments around the world, especially in Europe and North America, have been incorporating tougher energy efficiency standards, which has encouraged the general public to embrace foam glass as a more environmentally friendly option for insulation. Industrial insulation, particularly in cryogenic applications, is also gaining popularity because this material may be able to withstand extreme temperatures. With businesses and governments pushing toward greener solutions, foam glass has increasingly become the material of choice for environmentally conscious insulation projects. This is one reason why multiple sectors can expect increasing focus on energy conservation to continue fuelling demand for foam glass.

-

Rising Adoption of Recycled and Sustainable Materials Boosts Foam Glass Market Expansion

Foam glass is produced mainly from recycled glass. Foam glass, one of the most environmentally friendly materials, has experienced increased usage as global industries transition towards circular economies and reduce their carbon footprint. Foam glass not only offers great insulation properties but also gives glass a new lease on life instead of being discarded in landfills. The demand for foam glass in green construction industries, primarily across Europe, has been continuously increasing based on the importance of sustainability. Its lifecycle is also longer than that of many traditional insulation materials, thereby providing an additional boost to its demand in environmentally conscious industries. Foam glass market will be witnessing further growth as people become increasingly aware of sustainable building practices and governments continue offering incentives to the usage of environment-friendly materials. This technology is inline with all goals internationally projected by reducing waste and emissions that have positioned foam glass as a perfect solution for the construction of green buildings.

Restraint:

-

High Initial Production Costs and Limited Awareness Among End-Users Restrict Market Growth

The main restrains of the foam glass market are high initial production costs and limited end-users' awareness of this technology. Foam glass is an energy-intensive product and at the same time has high advanced processing techniques, which will raise the production cost compared to conventionally used insulators like fiberglass or polystyrene. That is why it will limit penetration, especially in price-sensitive markets, where cheaper alternatives are available. Further, not much is known about the long-term benefits of foam glass in terms of durability, sustainability, and energy savings. Many consumers and businesses are still unfamiliar with its capabilities and advantages, and adoption has been slow in regions where this product was relatively unknown. Industry players need to make concerted efforts to inform the market while continuing to bring down costs by product/process innovations in manufacturing and associated materials.

Opportunity:

-

Growing Investment in Sustainable Infrastructure Projects Presents Lucrative Opportunities for Market Players

Growing investments in sustainable infrastructure projects worldwide are generating feasible growth prospects for the foam glass market. A rising emphasis on green buildings, renewable energy projects, and environmentally friendly practices by governments and private firms is raising enormous demand for materials that support these initiatives-green buildings, for instance. Its excellent thermal insulation properties and eco-friendly profile make it well-suited to take advantage of this trend. With the increase for carbon neutrality and the acceptance of circular economy principles into the construction and industrial sectors, manufacturers of foam glass will have considerable potential to increase their market share. Moreover, as the concept of renewable energy gathers pace among nations, foam glass with its capacity to insulate equipment in high temperature and cryogenic conditions will be irreplaceable in energy project construction, such as LNG and solar energy plants.

Challenge:

-

Logistical and Supply Chain Challenges in Securing Raw Materials Hamper Market Expansion

The supply chain and logistics have been the core problem of foam glass, especially sourcing and securing a stable supply of high-quality recycled glass, which is the principal raw material to produce foam glass. Problems in the collection process, sorting, and recycling of waste glass greatly impact the manufacturing output of foam glass. The global supply chain is still experiencing ripple effects from disrupted activities, which have now included fluctuations in raw materials, transportation bottlenecks, and rising energy costs-logistics. Besides, erratic quality levels in the recycled glass sometimes discourages productive workflow, heightening operations expenses and delivery delays. Hence, the manufacturers of foam glass should create much more reliable and local supply chains to avoid such risks and ensure an uninterrupted supply of raw materials in response to a greater demand for sustainable insulating solutions.

Foam Glass Market Segments

By Type

The Closed cell foam glass dominated the foam glass market in 2023, accounting for a market share of around 70%. Closed cell foam glass is used in a wide range of applications, including building insulation and cryogenic systems, where its superior thermal insulation capabilities are more relevant. However, the demand for energy efficiency and moisture resistance is critical. Such is because it has high compressive strength with chemical corrosion resistance hence fit for industrial use in the oil & gas and petrochemical industries. For instance, the uses of Owens Corning's FOAMGLAS in industrial environments strengthen the dominance of closed cell foam glass due to the fact that it is durable and offers superior insulation.

By Process

In 2023, the physical process segment dominated the foam glass market and accounted for approximately 60% of market share. This process involves using recycled glass content materials, which are heated without chemical additives to manufacture foam glass-that is more green or environmentally friendly and cheaper. The Glapor and Foamit Group manufacturers embraced this method since they needed good-quality, low-impact foamed glass that could hit the growing environmental demand as well. Such is the ascendancy of this process due to the simplicity and the cost-effectiveness the physical process possesses, along with its capability of producing consistent quality products.

By Application

In 2023, building & industrial insulation dominated the foam glass market with a revenue share of around 65%. Foam glass is of extreme value since it has exceptional thermal insulation and fire-resistant properties that make it a suitable insulating material for buildings and industrial equipment. Its use in cryogenic insulation for the oil & gas industry and its widespread use in green buildings have fueled this segment. For example, in case of building foundations and industrial systems, with the aim of energy efficiency as well as structural strength, leads to the domination of foam glass products in MISAPOR.

By End-Use Industry

In 2023, the building and construction industry dominated the foam glass market and accounted for a market share of around 60%. This is because foam glass has increasingly been used by various residential and commercial construction projects due to their environment-friendly nature as an insulation material. Growing emphasis on energy-efficient buildings and the use of environmentally friendly products have led to rising demand for foam glass in this sector. Companies, like GEOCELL and Refaglass, that have been aggressively supplying foam glass for carbon-footprint-reduced constructions will also further strengthen their position at the market leadership level.

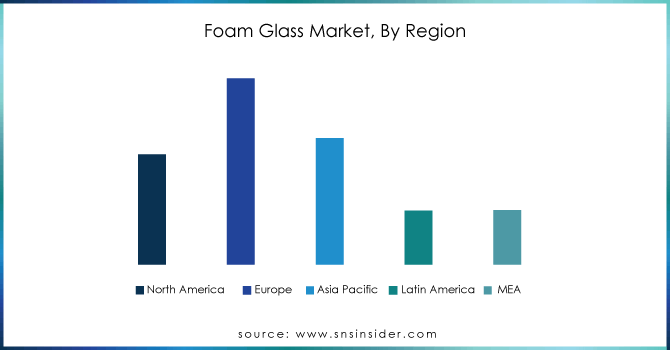

Foam Glass Market Regional Analysis

The North American region dominated the foam glass market and accounted for about 40% of the market share in 2023. This is primarily due to stringent building codes in the region and emphasis on energy efficiency in the construction practices. Increased adoption of sustainable materials in the building and construction sectors has also led to significant growth for foam glass products in this particular region. As such, it has turned into a stronghold for the leading players such as Owens Corning and Pittsburgh Corning; high technologies are being employed for manufacturing the foamed glass insulation products to face the raised demand in North America. Furthermore, growing investment in the infrastructure, infra development, and renovation of the structures in that region has led the market for foam glass as well.

Moreover, the Asia-Pacific region emerged as the fastest growing market for foam glass in 2023, with a CAGR of about 7% in the forecast period of 2024-2032. The reason behind this fast growth can be realized in booming construction industries-particularly in China and India-where rising urbanization and industrialization have driven the demand for modern insulating materials. Additionally, awareness of sustainable building practices, as well as plans from the government to push for green construction in this region, also added to the increase in foam glass in this region. Anhui Huichang New Material Co., Ltd. and Zhejiang Dehe Insulation Technology are boosting their capacity to raise a quota in the expanding Asia-Pacific market, thus improving its prospects for further growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Anhui Huichang New Material Co., Ltd. (Foam Glass Blocks, Foam Glass Granules)

-

Beijing HuaYu New Materials Co., Ltd. (Foam Glass Insulation, Cellular Glass)

-

CNUD-EFCO GFT (Foam Glass Insulating Systems, Foam Glass Granulate)

-

Earthstone International (Foam Glass Aggregate, Foam Glass Abrasives)

-

GEOCELL Schaumglas (GEOCELL Foam Glass Gravel, GEOCELL Insulating Fill)

-

Glapor (Foam Glass Boards, Foam Glass Gravel)

-

GLAPOR Werk Mitterteich GmbH (Foam Glass Panels, Foam Glass Slabs)

-

JSC Gomelglass (Foam Glass Blocks, Foam Glass Thermal Insulation)

-

MISAPOR (Foam Glass Gravel, Foam Glass Insulating Fill)

-

Owens Corning, Ltd. (FOAMGLAS Insulation, FOAMGLAS Perinsul HL)

-

Pittsburgh Corning Europe NV (FOAMGLAS F, FOAMGLAS HLB)

-

Polydros S.A (Foam Glass Insulating Panels, Foam Glass Blocks)

-

Refaglass (Foam Glass Granulate, Foam Glass Insulating Boards)

-

SHUANGXING Glass Co., Ltd. (Foam Glass Blocks, Foam Glass Insulation)

-

Taiwan Glass Industry Corporation (Foam Glass Panels, Cellular Glass)

-

Technoglass Industries (Foam Glass Insulating Material, Foam Glass Granules)

-

UUSIOAINES OY (Foam Glass Aggregate, Foam Glass Powder)

-

Veriso Schaumglas GmbH (Foam Glass Insulation Boards, Foam Glass Granulate)

-

Zhejiang Dehe Insulation Technology Co. (Foam Glass Thermal Insulation, Foam Glass Blocks)

-

Zhejiang Zhenshen Insulation Technology Corp. (Foam Glass Blocks, Foam Glass Granules)

Key Suppliers and Distributors in the Foam Glass Industry:

-

Owens Corning

-

Pittsburgh Corning Europe NV

-

MISAPOR

-

Glapor

-

Refaglass

-

Foamit Group

-

Zhejiang Zhenshen Insulation Technology Corp.

-

Polydros S.A.

-

Technoglass Industries

-

SHUANGXING Glass Co., Ltd.

Recent Developments

- March 2024: Foamit Group increased the production capacity of foam glass at Onsoy to handle rapidly increasing demand for green insulation products. It has considerably strengthened its position in the foam glass market and strengthened delivery capabilities for high quality products.

- May 2023: Schlüsselbauer and Reiling merged their German operations under the company name Veriso GmbH & Co. KG. New company to which Schlüsselbauer and Reiling would both contribute 50%, which would incorporate Schlüsselbauer Geomaterials GmbH and Veriso Schaumglas GmbH, and four furnaces sintering across three sites, therefore becoming one of the largest foam glass gravel manufacturers in Europe.

Owens Corning, Ltd-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.0 Billion |

| Market Size by 2032 | USD 3.3 Billion |

| CAGR | CAGR of 5.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Open Cell, Closed Cell) •By Process (Physical, Chemical) •By Application (Building & Industrial Insulation, Chemical Processing Systems, Consumer Abrasive, Others) •By End-Use Industry (Building & Construction, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Glapor, Polydros S.A, Owens Corning, Ltd., Anhui Huichang New Material Co., Ltd., MISAPOR, Refaglass, Zhejiang Dehe Insulation Technology Co., Earthstone International, Zhejiang Zhenshen Insulation Technology Corp. and other key players |

| Drivers | •Increasing Demand for Energy-Efficient Insulation Materials Drives the Foam Glass Market Growth •Rising Adoption of Recycled and Sustainable Materials Boosts Foam Glass Market Expansion |

| Restraints | •High Initial Production Costs and Limited Awareness Among End-Users Restrict Market Growth |