Get E-PDF Sample Report on Fluorosurfactant Market - Request Sample Report

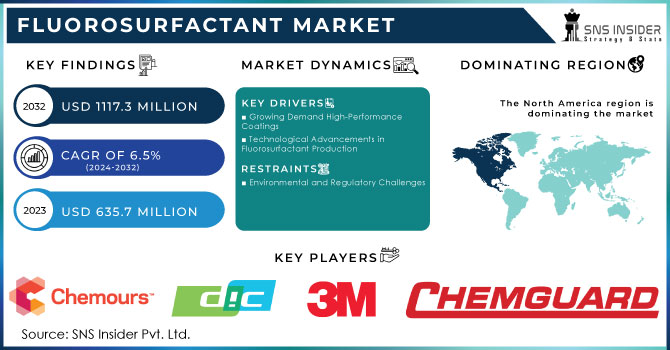

The Fluorosurfactant Market Size was valued at USD 635.7 million in 2023, and is expected to reach USD 1117.3 million by 2032, and grow at a CAGR of 6.5% over the forecast period 2024-2032.

Investments in fluorosurfactants, which are part of the specialty chemicals industry, have received a lot of change. Peculiar characteristics associated with their broad application include high stability, low surface tension, and exceptional wetting and spreading capability. Their characteristics make them indispensable in various applications, such as paints and coatings, electronics, oil recovery, and personal care products. These advanced materials represent a growth market because of their superior performance compared to traditional surfactants, particularly in demanding industrial and environmental conditions.

The market potential for the fluorosurfactant market has been highly increased, and the demand for high-performance coatings and materials applied in industries. Fluorosurfactants help to make the coatings resistant to staining, pollution, and water, hence maintaining a tie after exposure to nasty conditions. The automotive industry is, for example, resorting to more and more fluorosurfactants in making car coatings hardy to foster surface structure and appearance. Concurrently, the electronics industry makes enormous use of them for the expensive high-definition components.

Recent developments describe the continuous innovations of the market. In July 2023, DIC Corporation announced the introduction of a new series of fluorosurfactants for use in high-performance coatings. This new product series has been developed to meet demand-driven requirements for advanced materials with particular attention to stain-resistant and durable products. Such development of products illustrates the company's commitment to adding depths to its portfolio of fluorosurfactants to meet diverse industry needs.

Another important development was that the research has been published on advances in the synthesis of novel, improved environmental profiles of new fluorosurfactants in Nature Reviews Chemistry in August 2023. It is shown that, by designing new fluorosurfactant formulations, its environmental impact could be mitigated against the regular highly fluorinated compounds. This new development is in line with increased regulatory demand to lower the environmental footprint of chemical products, which will define the fluorosurfactant market's future.

Another new product is the collaboration between Solvay and a major European paint producer, which resulted in a new fluorosurfactant product developed for high-performance architectural coatings. This cooperation marks the trend within the industry, towards the formulation of tailor-made products that will directly address application needs, yet at the same time ensure environmental and performance standards. The new product claims to enhance the performance properties for coatings, offering outstanding resistance to weathering and staining, and extending the lifetime and decorative quality of painted surfaces.

Research for equally effective but more sustainable and environment-friendly alternatives also defines the direction in which the fluorosurfactant market is moving. Another such signal of this recent endeavor was given by the publication in Nature Reviews Chemistry, when the trend in the development of fluorosurfactants shifted towards prevention of risks for the environment and human health. That is, under tighter regulatory regimes, investment in research and innovation by firms in the quest to come out with products that, under new sets of regulations, could sustain the traditional performance advantage of fluorosurfactants, becomes inevitable.

The fluorosurfactant market is rapidly evolving in response to new needs that are rising for such high-performance materials across several industries. Recent innovations and product development efforts sharply mirror the industry's response to the needs of the market in the face of regulatory pressure. The importance of the role that continual research and development will play in influencing the fluorosurfactant future cannot be underemphasized.

Drivers:

Growing Demand High-Performance Coatings

The growing demand for high-performance coatings has multifaceted industries in this fluorosurfactant market. The contribution of fluorosurfactants in imparting the properties applied within coatings is most importantly exhibited in their ability to reduce surface tension, improve wetting properties, and provide resistance to staining, dirt, and weathering. These are very important attributes to the sectors of automotive, aerospace, and architecture because the coatings have to undergo very harsh conditions while they are supposed to maintain aesthetic appeal. Axalta Coating Systems, for example—one of the global leaders in coatings companies announced a new line of advanced automotive coatings that would use advanced fluorosurfactants for class-leading gloss retention and scratch resistance in August 2024. This is in line with the requirement in the automotive for durable, good-looking finishes. Also in November 2024, Benjamin Moore released a new generation of high-performance exterior paints that utilize fluorosurfactants to upgrade resistance to fading and environmental damage, in the architectural coatings segment. Meanwhile, growth in demand for fluorosurfactants continues its upward march, led by a parallel trend toward consumer applications and industrial users who are emphasizing durable, high-quality finishes: just where these chemicals are most essential to meeting the required performance characteristics of a coating.

Technological Advancements in Fluorosurfactant Production

Technological advances with fluorosurfactants are achieved in the fields of production and formulation. Recent innovations brought more effective and eco-friendly production. Further innovations have developed a new method of effective production which enable it to be used in large-scale production, thereby making the delivery more cost-effective and accessible. For instance, in February 2024, it was announced that the new production technology was effectively put into practice, which sharply reduces the degree of environmental contamination by fluorosurfactants production. This technological break-through does not only reduce the negative impact of fluorosurfactant production on the environment but also meets the booming demands that have tightened across the globe. Furthermore, 3M Company in April 2024 brought a new formulation of fluorosurfactants with an amalgamation of new production methods to be introduced to the market, along with improved performance in terms of better thermal stability and a minimized environmental footprint. It is these technological advantages that see fuller use of fluorosurfactants in most applications, and this is likely to be driving growth in the whole market.

Restraint:

Environmental and Regulatory Challenges

A major limitation to the fluorosurfactants market is their environmental impact, primarily towards persistence in the environment and causing ecological damage. Because research has shown harmful effects, stronger government regulations have been placed to increase scrutiny and even potential bans on some fluorinated compounds. Remarkably, following the environmental permanence and probable health risks related to the long-chain fluorinated substances, a novel regulatory era began for the European Union in November 2023. Clearly under this regulatory setting, it is bound to be very difficult for manufacturers to overcome extremely high regulatory barriers and invest in new alternative, eco-sustainable fluorosurfactants technology.

Opportunity:

Development of Sustainable Fluorosurfactants

The fluorosurfactant market presents a huge opportunity for developing sustainable, nonenvironmentally and nonhealth-impacting alternatives. This thus creates demand for eco-friendly, compliant products, and propels the drive for the formulation of fluorosurfactants that have low impact on the environment. More specialization and investment in research and development will follow pushed by the companies to come up with better alternatives to fluorosurfactants with similar performances but fewer ecological and health risks. For example, in February 2024, a collaborative research project was granted to BASF and Solvay for the development of innovative fluorosurfactant formulations that would deliver better environmental profiles. This will make the fluorosurfactants more degradable, with less potential to impact human health and the environment. Further, there is a move towards sustainability in the development of alternatives to traditional PFAS compounds, with reduced persistence and lower toxicity, such as short-chain fluorinated molecules. Tightened regulations and consumer preference for greener products, hence, create enormous market opportunities for those who can provide sustainable fluorosurfactants. This alignment will enable companies to meet the regulatory requirements and simultaneously differentiate in marketplaces, thereby making growth and innovation happen in fluorosurfactants.

Challenge:

Regulatory compliance and standards hamper the growth of the fluorosurfactant market

One of the major challenges for the fluorosurfactant market is how to sail through this ocean of compliance and standards. With growing concerns to the environment and human health from fluorinated compounds, various regulatory bodies across different regions have issued stringent rules and guidelines. This would pose very stringent challenges to fluorosurfactant companies needing to continually change and upgrade products and processes to meet new requirements. A case in point is the one experienced in March 2024, when updated European Union regulatory bodies tightened limits under the REACH (Registration, Evaluation, Authorisation, and restriction of Chemicals) framework covering the use of specific fluorosurfactants in that particular industrial application. The regulatory shift implies revisiting product formulations for companies and finding solutions without infringing on the new standards. Secondly, the market has gone global; dealing with different regulatory requirements in different regions is another issue. Lastly, being informed about the changes in regulations, the investments in reformulation of products, and the cost associated with it are big challenges for market players. It is of prime concern that the fluorosurfactant industry grow in its operational strategies without suffering any losses in product performance and market competitiveness through the process of regulatory compliance.

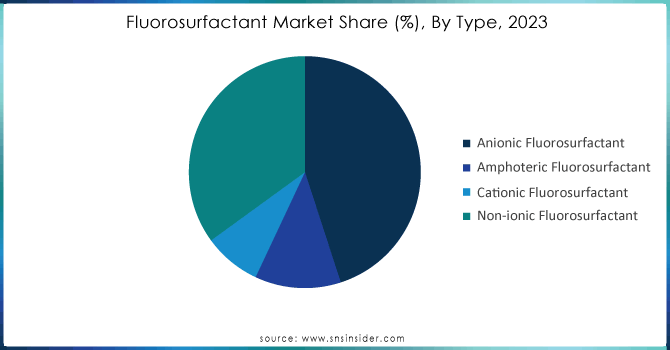

By Type

The Anionic Fluorosurfactant segment dominated the fluorosurfactant market with an estimated market share of approximately 45% in 2023. It will hold the dominant position throughout the forecast period due to the fact that anionic fluorosurfactants find extensive usage in applications requiring excellent wetting, leveling, and anti-blocking properties. They are employed mainly in the coatings industry and play a huge role in enhancing durability and finish quality of paints. For example, major players like Chemours and 3M have developed high-performance anionic fluorosurfactants that have major applications in automotive and architectural coatings. This has meant that due to the effectiveness of fluorosurfactants in delivering low surface tension and excellent spreading properties, they remain an important preference in applications that require leading-edge coatings performance, hence their dominant market share.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Application

In 2023, the paints and coatings segment dominated with the largest revenue share of 50% from the fluorosurfactant market due to their extensive use in enhancing performance and durability in coating products. Fluorosurfactants are highly valued in this segment due to their ability to reduce surface tension and improve wetting properties. In addition, they provide class-leading stain, dirt, and weather resistance. This makes them rather quite important for high-quality finishes in both automotive and architectural coatings. Fluorosurfactants, such as vehicle coatings, ensure brilliance retention and protection from damage by external environmental factors. For example, surfactants can greatly enhance the durability and appearance of painted surfaces, thus increasing the lifetime of architectural coatings.

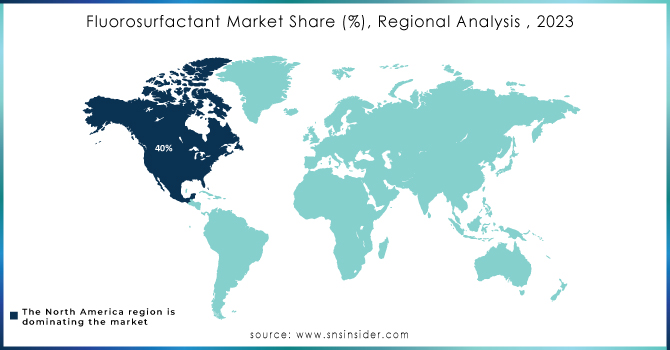

In 2023, North America dominated the fluorosurfactant market by accounting the largest regional share of 40% due to the well-built industrial base in that region. This is attributed to its well-established industrial base and high demand for advanced chemical solutions. Fluorosurfactants have huge applications in the automotive and architectural coating segment to provide better performance and durability, which is driving their leadership in the region. For instance, the lead in fluorosurfactant technologies is taken by major U.S.-based companies like 3M and Chemours; hence, this greatly supports its wide application in various industries and consumer uses. On the other hand, stringent regulations by North America further urge the development and adoptions of high-performance, environmentally compliant fluorosurfactants.

Moreover, the Asia-Pacific region emerged as the fastest-growing with a market share of 30% in the fluorosurfactant market. This could be supported by rapid industrialization, increasing demand for advanced coatings, and an expediting automotive and construction sector. Another set of factors that can fuel growth in this region includes the rising manufacturing hubs in countries like China and India, powered by the sizable demand for high-performance materials. For example, leading Chinese automobile companies are using fluorosurfactants to increase the class and longevity of the coating of a vehicle, which also indicates the increasing industrial activity in the region. Meanwhile, the rise in the construction industry of Asia-Pacific also increases demand for new coatings and materials.

Key Players

3M, the Chemours Company, DIC CORPORATION, Chemguard, Merck KGaA., Solvay, DYNAX, Maflo spa, Innovative Chemical Technologies, Alfa Chemicals., AGC SEIMI CHEMICALS CO.LTD, OMNOVA Solutions. Inc, and other key players mentioned in the final report.

Recent Developments

April 2024: Ghent-based biotech AmphiStar closed an €6 million round, led by Qbic III and FFTF, for local production of microbial biosurfactants to help businesses produce sustainable high-performance products.

March 2023: Alfa Chemistry has added a number of fluorosurfactants into the comprehensive catalogue, covering amphoteric, anionic, cationic, non-ionic, and natural surfactants.

| Report Attributes | Details |

| Market Size in 2023 | US$ 635.7 Mn |

| Market Size by 2032 | US$ 1117.3 Mn |

| CAGR | CAGR of 6.5% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Anionic, Non-ionic, Amphoteric, Cationic) • By Application (Paints & Coatings, Adhesives, Detergents & Cleaning Agents, Flame Retardants, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | 3M, the Chemours Company, DIC CORPORATION, Chemguard, Merck KGaA., Solvay, DYNAX, Maflo spa, Innovative Chemical Technologies, Alfa Chemicals., AGC SEIMI CHEMICALS CO.LTD, OMNOVA Solutions. Inc |

| Key Drivers | • Growing Demand High-Performance Coatings • Technological Advancements in Fluorosurfactant Production |

| Market Restraints | • Environmental and Regulatory Challenges |

Ans. The CAGR of the Fluorosurfactant Market over the forecast period is 6.5%.

Ans. USD 1117.3 Million is the projected Fluorosurfactant Market size of market by 2032.

Ans. Drivers are increasing investments in research and development by major players and paints & coatings are the major application segment.

Ans. Anionic is the leading segment in Fluorosurfactant Market.

Ans. USD 635.7 million was the market size in 2023 for Fluorosurfactant Market.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fluorosurfactant Market Segmentation, by Type

7.1 Chapter Overview

7.2 Anionic Fluorosurfactant

7.2.1 Anionic Fluorosurfactant Market Trends Analysis (2020-2032)

7.2.2 Anionic Fluorosurfactant Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Amphoteric Fluorosurfactant

7.3.1 Amphoteric Fluorosurfactant Market Trends Analysis (2020-2032)

7.3.2 Amphoteric Fluorosurfactant Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cationic Fluorosurfactant

7.4.1 Cationic Fluorosurfactant Market Trends Analysis (2020-2032)

7.4.2 Cationic Fluorosurfactant Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Non-ionic Fluorosurfactant

7.5.1 Non-ionic Fluorosurfactant Market Trends Analysis (2020-2032)

7.5.2 Non-ionic Fluorosurfactant Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fluorosurfactant Market Segmentation, by Application

8.1 Chapter Overview

8.2 Paints & Coatings

8.2.1 Paints & Coatings Market Trends Analysis (2020-2032)

8.2.2 Paints & Coatings Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Adhesives

8.3.1 Adhesives Market Trends Analysis (2020-2032)

8.3.2 Adhesives Market Size Estimates and Forecasts to 2032 (USD Billion)

8.2 Detergents & Cleaning Agents

8.2.1 Detergents & Cleaning Agents Market Trends Analysis (2020-2032)

8.2.2 Detergents & Cleaning Agents Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Flame Retardants

8.3.1 Flame Retardants Market Trends Analysis (2020-2032)

8.3.2 Flame Retardants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Oil & Gas

8.4.1 Oil & Gas Market Trends Analysis (2020-2032)

8.4.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.5.1 Others Market Trends Analysis (2020-2032)

8.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.6 USA

9.2.6.1 USA Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 USA Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.7 Canada

9.2.7.1 Canada Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Canada Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.2.8 Mexico

9.2.8.1 Mexico Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.8.2 Mexico Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.6 Poland

9.3.1.6.1 Poland Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Poland Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.7 Romania

9.3.1.7.1 Romania Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Romania Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.8 Hungary

9.3.1.8.1 Hungary Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Hungary Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Turkey

9.3.1.9.1 Turkey Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Turkey Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.6 Germany

9.3.2.6.1 Germany Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 Germany Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.7 France

9.3.2.7.1 France Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 France Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.8 UK

9.3.2.8.1 UK Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 UK Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Italy

9.3.2.9.1 Italy Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Italy Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.12 Switzerland

9.3.2.12.1 Switzerland Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Switzerland Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.13 Austria

9.3.2.13.1 Austria Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Austria Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.3.2.14 Rest of Western Europe

9.3.2.14.1 Rest of Western Europe Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.14.2 Rest of Western Europe Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.6 China

9.4.6.1 China Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 China Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.7 India

9.4.7.1 India Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.7.2 India Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.8 Japan

9.4.8.1 Japan Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Japan Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 South Korea

9.4.9.1 South Korea Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 South Korea Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.9 Vietnam

9.4.9.1 Vietnam Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Vietnam Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.10 Singapore

9.4.10.1 Singapore Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Singapore Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.12 Australia

9.4.12.1 Australia Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.12.2 Australia Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.4.13 Rest of Asia Pacific

9.4.13.1 Rest of Asia Pacific Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.13.2 Rest of Asia Pacific Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.6 UAE

9.5.1.6.1 UAE Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 UAE Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.7 Egypt

9.5.1.7.1 Egypt Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Egypt Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.8 Saudi Arabia

9.5.1.8.1 Saudi Arabia Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Saudi Arabia Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Qatar

9.5.1.9.1 Qatar Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Qatar Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.6 South Africa

9.5.2.6.1 South Africa Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 South Africa Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.7 Nigeria

9.5.2.7.1 Nigeria Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Nigeria Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.5.2.8 Rest of Africa

9.5.2.8.1 Rest of Africa Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.8.2 Rest of Africa Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Fluorosurfactant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.6 Brazil

9.6.6.1 Brazil Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Brazil Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.7 Argentina

9.6.7.1 Argentina Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Argentina Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.8 Colombia

9.6.8.1 Colombia Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Colombia Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

9.6.9 Rest of Latin America

9.6.9.1 Rest of Latin America Fluorosurfactant Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.9.2 Rest of Latin America Fluorosurfactant Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10. Company Profiles

10.1 3M

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 SWOT Analysis

10.2 The Chemours Company

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 DIC CORPORATION

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Chemguard

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 Merck KGaA

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Solvay

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 DYNAX

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Maflo spa

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Innovative Chemical Technologies

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Alfa Chemicals.

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 SWOT Analysis

10.11 AGC SEIMI CHEMICALS CO.LTD

10.11.1 Company Overview

10.11.2 Financial

10.11.3 Products/ Services Offered

10.11.4 SWOT Analysis

10.12 OMNOVA Solutions. Inc

10.12.1 Company Overview

10.12.2 Financial

10.12.3 Products/ Services Offered

10.12.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Anionic Fluorosurfactant

Amphoteric Fluorosurfactant

Cationic Fluorosurfactant

Non-ionic Fluorosurfactant

By Application

Paints & Coatings

Adhesives

Detergents & Cleaning Agents

Flame Retardants

Oil & Gas

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Aerogel Insulation Market was valued at USD 897.28 million in 2023 and is expected to reach USD 5082.32 million by 2032, at a CAGR of 21.26% from 2024-2032.

The Allulose Market Size was valued at USD 250.5 million in 2023 and is expected to reach USD 522.1 million by 2032 and grow at a CAGR of 8.5% over the forecast period 2024-2032.

Corrosion Under Insulation (CUI) & Spray-On Insulation (SOI) Coatings Market is expected to reach USD 3.09 Bn by 2032, growing at a CAGR of 5.03 % by 2024-2032.

The Malonic Acid Market size was valued at USD 111.42 Million in 2023 and is expected to reach USD 142.95 Million by 2032, growing at a CAGR of 2.81% over the forecast period of 2024-2032.

CIP Chemicals Market was valued at USD 2.20 Billion in 2023 and is expected to reach USD 4.76 Billion by 2032, growing at a CAGR of 8.96% from 2024-2032.

The Isostatic Pressing Market Size was valued at USD 7.52 Billion in 2023 and is expected to grow at a CAGR of 6.86% to reach USD 13.66 Billion by 2032.

Hi! Click one of our member below to chat on Phone