Get more information on Fluoropolymers Market - Request Sample Report

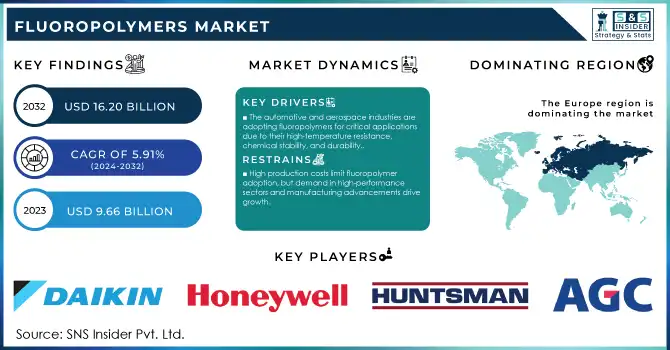

The Fluoropolymers Market size was estimated at USD 9.66 billion in 2023 and is expected to reach USD 16.20 billion by 2032 at a CAGR of 5.91% during the forecast period of 2024-2032.

The fluoropolymers market has shown steady growth, driven by their unique properties such as high chemical resistance, thermal stability, and low friction. These polymers are primarily used in applications across industries like automotive, electronics, aerospace, and chemicals. The demand for fluoropolymers has surged as industries focus on enhancing product performance and durability, particularly in harsh environments. In the automotive sector, fluoropolymers are utilized in fuel systems, electrical components, and under-the-hood applications to withstand extreme temperatures and corrosive substances. The electronics industry also contributes significantly to market growth, where fluoropolymers are used in wire coatings, insulating materials, and semiconductors, owing to their excellent electrical insulation properties. Trends in the market highlight a rising shift towards sustainability, with increasing demand for environmentally friendly alternatives like bio-based fluoropolymers. Additionally, advancements in technology are pushing the boundaries of fluoropolymer applications, leading to innovations in areas such as medical devices, energy storage solutions, and coatings. Companies are focusing on creating fluoropolymers that offer superior performance in energy efficiency, corrosion protection, and resistance to UV radiation, expanding the material’s use in industries like renewable energy.

Fluoropolymers have seen widespread adoption in chemical processing due to their resistance to harsh chemicals and ability to maintain their integrity in aggressive environments. As the demand for high-performance materials in industrial applications grows, the fluoropolymers market is expected to continue expanding. A notable trend is the increasing adoption of PTFE (polytetrafluoroethylene) in the aerospace and food processing sectors due to its superior properties.

DRIVERS

The automotive and aerospace industries are increasingly adopting fluoropolymers for their high-temperature resistance, chemical stability, and durability in critical applications like fuel lines, gaskets, and electrical insulation.

The automotive and aerospace industries are experiencing increased demand for fluoropolymers due to their exceptional properties, including high-temperature resistance, chemical stability, and durability. These materials are crucial in applications such as fuel lines, gaskets, seals, and coatings, where they enhance performance and longevity. The automotive sector's focus on lightweight materials to improve fuel efficiency and reduce emissions is fueling the adoption of fluoropolymers in components like hoses, cables, and bearings. Similarly, the aerospace industry benefits from fluoropolymers' ability to withstand extreme conditions, including high temperatures and aggressive chemicals. With advancements in materials technology, fluoropolymers are becoming more cost-effective, which supports their growing use in both industries. Furthermore, the rise in electric vehicles (EVs) and sustainable aviation fuel (SAF) initiatives is accelerating demand for fluoropolymers due to their role in electrical insulation and sealing applications. This trend is expected to continue as both industries seek advanced materials for next-generation vehicles and aircraft.

RESTRAIN

High production costs hinder fluoropolymer adoption, but growth persists due to increasing demand in high-performance sectors and advancements in manufacturing.

High production costs remain a significant challenge for the fluoropolymers market. The raw materials required, such as fluorspar and hydrofluoric acid, are often expensive and subject to supply fluctuations. Additionally, the manufacturing processes are energy-intensive, involving high-temperature techniques and specialized equipment to ensure the purity and quality of the final product. Stringent quality control measures further contribute to elevated production costs. These factors can limit the widespread adoption of fluoropolymers, particularly for small businesses or in cost-sensitive industries. Despite these challenges, the market is witnessing growth driven by the increasing demand for high-performance materials in sectors like automotive, aerospace, electronics, and medical devices. Moreover, technological advancements in manufacturing processes, such as more efficient production techniques and innovations in material formulations, are helping to mitigate some of the cost burdens, making fluoropolymers more accessible for a wider range of applications. The market is also leaning towards bio-based alternatives to address sustainability concerns.

By Product

The Polytetrafluoroethylene (PTFE) segment dominated with a market share of over 34% in 2023, commanding the largest market share due to its versatile properties and wide range of industrial applications. PTFE is renowned for its exceptional chemical resistance, making it ideal for use in harsh environments where corrosion or chemical exposure is a concern. Additionally, its high thermal stability allows it to withstand extreme temperatures, making it suitable for industries such as automotive, electronics, and chemicals. PTFE’s low friction characteristics also make it an excellent choice for coatings, gaskets, seals, and electrical insulation.

By End-User

The Industrial Equipment segment dominated with a market share of over 32% in 2023, due to the extensive use of fluoropolymers in critical industrial applications. Fluoropolymers are highly valued for their exceptional chemical resistance, thermal stability, and durability, making them ideal for use in harsh and demanding environments. These materials are widely employed in the manufacturing of seals, gaskets, and coatings, which are essential components in various industrial systems. Fluoropolymers help protect equipment from corrosion, wear, and degradation, thus enhancing the reliability and lifespan of industrial machinery. Industries such as chemicals, pharmaceuticals, and oil & gas rely heavily on fluoropolymers for their ability to withstand extreme temperatures and exposure to aggressive chemicals.

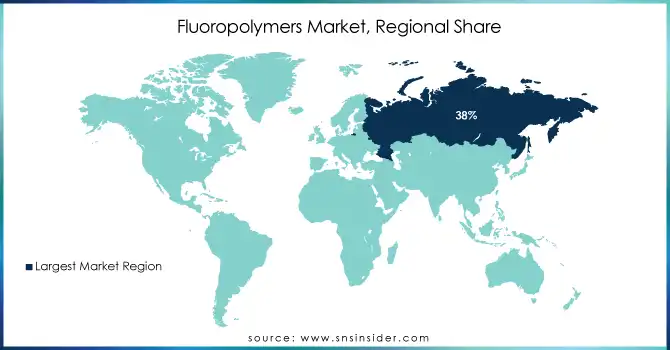

Europe region dominated with a market share of over 38% in 2023. The region's well-established industrial base and advanced manufacturing capabilities make it a dominant player in the market. Fluoropolymers are highly valued for their exceptional chemical resistance, high-temperature stability, and electrical insulation properties, which are essential for a wide range of applications. In the automotive sector, these materials are used in fuel systems, wiring, and seals, while in the electronics industry, they play a crucial role in the production of wires and cables.

Asia-Pacific is the fastest-growing region in the fluoropolymers market, driven by rapid industrialization and technological advancements. The region's booming automotive industry is a major contributor, with increased demand for high-performance materials like fluoropolymers used in automotive components. Additionally, the rise in electronics production, particularly in countries such as China and India, further fuels market growth, as fluoropolymers are vital for components in electrical insulation and wiring. The construction sector also contributes significantly, as these polymers are used for coatings, pipes, and seals due to their durability and resistance to high temperatures.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Fluoropolymers Market

AGC Chemicals Americas, Inc. (AF Series Fluoropolymer, Aflas)

Huntsman Corporation (Hylar Fluoropolymer)

Dongyue Group Ltd. (FEP, PTFE)

Poly Fluoro Ltd. (PFA, FEP, PTFE)

Solvay SA (Solef PVDF, Ryton PPS)

The Chemours Company (Teflon, Krytox)

Honeywell International Inc. (Aflas)

Daikin Industries Limited (Daiflon PTFE, PFA)

Kureha Corporation (Kureha PTFE, Kureha Fluoropolymer)

Amco Polymers (Fluoroelastomers, FEP)

Saint-Gobain Performance Plastics (Fluoroloy, Norprene)

3M (Dyneon Fluoropolymers, 3M PTFE)

Arkema Group (Kynar® PVDF, Rilsan PA11)

Linde plc (Inovene Fluoropolymers)

Mitsubishi Chemical Corporation (Lumiflon)

Daikin America Inc. (Neoflon PTFE, PFA)

GFL (GFL PTFE)

Chongqing Changsheng Fluoro Materials Co. (PTFE, FEP)

Kraton Polymers (Kraton Fluoroelastomers)

Dynalene, Inc. (Dynalene Fluoropolymer-based solutions)

Suppliers for (innovative fluoropolymer products like PTFE, FEP, and PFA, offering advanced solutions in coatings, electrical insulation, and industrial applications) of Fluoropolymers Market

3M Company

Dupont

Solvay

Arkema Group

The Chemours Company

Honeywell International Inc.

Daikin Industries Ltd.

Saint-Gobain Performance Plastics

China Fluorine Chemical Co., Ltd.

AGC Inc.

Recent Development

In May 2024: Daikin Industries Ltd. formed a partnership with Miura, acquiring 4.67% of Miura’s shares. This collaboration is designed to broaden their solutions in various regions and support the decarbonization of manufacturing facilities.

In November 2023: Solvay and Orbia entered into a joint venture agreement to establish the largest producer of electric vehicle materials in North America. The partnership focuses on supplying materials like PVDF, essential for manufacturing electric vehicle batteries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 9.66 Billion |

| Market Size by 2032 | US$ 16.20 Billion |

| CAGR | CAGR of 5.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Polytetrafluoroethylene (PTFE), Polyvinylidene fluoride (PVDF), Fluorinated Ethylene Propylene (FEP), Polyvinylfluoride (PVF), Other)s • By Application (Films, Additives, Coatings, Others) • By End-Use (Industrial Equipment, Construction, Electrical & Electronics, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AGC Chemicals Americas, Inc., Huntsman Corporation, Dongyue Group Ltd., Poly Fluoro Ltd., Solvay SA, The Chemours Company, Honeywell International Inc., Daikin Industries Limited, Kureha Corporation, Amco Polymers, Saint-Gobain Performance Plastics, 3M, Arkema Group, Linde plc, Mitsubishi Chemical Corporation, Daikin America Inc., GFL, Chongqing Changsheng Fluoro Materials Co., Kraton Polymers, Dynalene, Inc., and Others |

| Key Drivers | • The automotive and aerospace industries are increasingly adopting fluoropolymers for their high-temperature resistance, chemical stability, and durability in critical applications like fuel lines, gaskets, and electrical insulation. |

| Restraints | • High production costs hinder fluoropolymer adoption, but growth persists due to increasing demand in high-performance sectors and advancements in manufacturing. |

The Fluoropolymers Market is expected to grow at a CAGR of 5.91% during 2024-2032.

The Fluoropolymers Market was USD 9.66 billion in 2023 and is expected to Reach USD 16.20 billion by 2032.

The automotive and aerospace industries are increasingly adopting fluoropolymers for their high temperature resistance, chemical stability, and durability in critical applications like fuel lines, gaskets, and electrical insulation.

The “Polytetrafluoroethylene (PTFE)” segment dominated the Fluoropolymers Market.

Europe dominated the Fluoropolymers Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics

4.1 Market Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type (2023)

5.2 Feedstock Prices, by Country, by Type (2023)

5.3 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.4 Innovation and R&D, by Type (2023)

5.5 Adoption Rates of Fluoropolymers Software, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fluoropolymers Market Segmentation, By Product

7.1 Chapter Overview

7.2 Polytetrafluoroethylene (PTFE)

7.1 Polytetrafluoroethylene (PTFE) Market Trends Analysis (2020-2032)

7.2 Polytetrafluoroethylene (PTFE) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyvinylidene fluoride (PVDF)

7.3.1 Polyvinylidene fluoride (PVDF) Market Trends Analysis (2020-2032)

7.3.2 Polyvinylidene fluoride (PVDF) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Fluorinated Ethylene Propylene (FEP)

7.4.1 Fluorinated Ethylene Propylene (FEP) Market Trends Analysis (2020-2032)

7.4.2 Fluorinated Ethylene Propylene (FEP) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Polyvinylfluoride (PVF)

7.4.1 Polyvinylfluoride (PVF) Market Trends Analysis (2020-2032)

7.4.2 Polyvinylfluoride (PVF) Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fluoropolymers Market Segmentation, By Application

8.1 Chapter Overview

8.2 Films

8.2.1 Films Market Trends Analysis (2020-2032)

8.2.2 Films Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Additives

8.3.1 Additives Market Trends Analysis (2020-2032)

8.3.2 Additives Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Coatings

8.3.1 Coatings Market Trends Analysis (2020-2032)

8.3.2 Coatings Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Others

8.3.1 Others Market Trends Analysis (2020-2032)

8.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fluoropolymers Market Segmentation, By End-Use

9.1 Chapter Overview

9.2 Industrial Equipment

9.2.1 Industrial Equipment Market Trends Analysis (2020-2032)

9.2.2 Industrial Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Construction

9.3.1 Construction Market Trends Analysis (2020-2032)

9.3.2 Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Electrical & Electronics

9.4.1 Electrical & Electronics Market Trends Analysis (2020-2032)

9.4.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Automotive

9.5.1 Automotive products Market Trends Analysis (2020-2032)

9.5.2 Automotive products Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.4 North America Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.6.2 USA Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.7.2 Canada Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.2.8.2 Mexico Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.6.2 Poland Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.7.2 Romania Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.4 Western Europe Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.6.2 Germany Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.7.2 France Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.8.2 UK Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.9.2 Italy Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.10.2 Spain Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.13.2 Austria Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.6.2 China Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.7.2 India Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.8.2 Japan Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.9.2 South Korea Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.10.2 Vietnam Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.11.2 Singapore Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.12.2 Australia Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.4 Middle East Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.6.2 UAE Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.4 Africa Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Fluoropolymers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.4 Latin America Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.6.2 Brazil Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.7.2 Argentina Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.8.2 Colombia Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Fluoropolymers Market Estimates and Forecasts, By Product (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Fluoropolymers Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Fluoropolymers Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 AGC Chemicals Americas, Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Huntsman Corporation

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Dongyue Group Ltd.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Poly Fluoro Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Solvay SA

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 The Chemour Company

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Honeywell International Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Daikin Industries Limited

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Kureha Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Amco Polymers

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Market Segments:

By Product

Polytetrafluoroethylene (PTFE)

Polyvinylidene fluoride (PVDF)

Fluorinated Ethylene Propylene (FEP)

Polyvinylfluoride (PVF)

Others

By Application

Films

Additives

Coatings

Others

By End-Use

Industrial Equipment

Construction

Electrical & Electronics

Automotive

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Oxidized Polyethylene Wax Market was valued at USD 811.70 Mn in 2023 and is expected to reach USD 1,313.78 Mn by 2032, at a CAGR of 5.50% from 2024 to 2032.

The Narrow Range Ethoxylates Market size was valued at USD 5545 thousand in 2023. It is expected to grow to USD 10280.30 thousand by 2032 and grow at a CAGR of 7.10% over the forecast period of 2024-2032.

The Cyanoacrylate Adhesives market size was USD 2.35 Billion in 2023 and is expected to touch USD 3.88 Billion by 2032, at a CAGR of 5.73 % from 2024 to 2032.

The Ceramic Membranes Market size was USD 10.21 Billion in 2023 and is expected to reach USD 25.83 Billion by 2032, at a CAGR of 10.87% from 2024-2032.

Biogas Market Size was valued at USD 63.91 billion in 2023 and is expected to reach USD 95.80 billion by 2032, growing at a CAGR of 5.01% from 2024 to 2032.

The Liquid Ring Vacuum Pumps Market Size was USD 1.5 billion in 2023 and is expected to reach USD 2.4 Bn by 2032 and grow at a CAGR of 5.3% by 2024-2032.

Hi! Click one of our member below to chat on Phone