Fluid Handling Systems Market Scope & Overview:

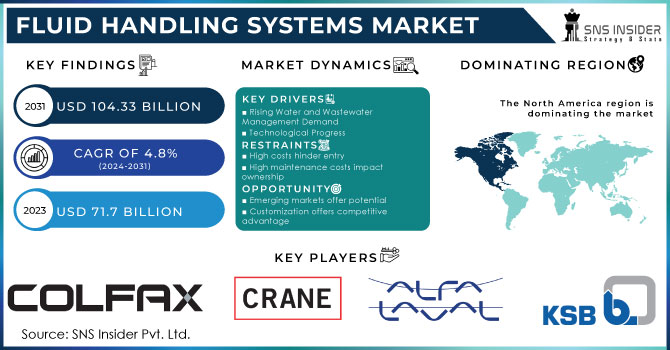

The Fluid Handling Systems Market Size was estimated at USD 74.55 billion in 2023 and is expected to arrive at USD 111.28 billion by 2032 with a growing CAGR of 4.55% over the forecast period 2024-2032. Examining technological innovation and adoption of fluid handling systems market trends across regions, this report provides original insights into the Fluid Handling Systems Market analysis by stressing system design and automation developments, and the report also provide insightful viewpoints on logistics optimization, such as regional supply chain and distribution statistics. It also looks at import and export patterns, therefore reflecting the changing dynamics of the global trade. Driven by industrial IoT integration and environmental initiatives, the research also notes increasing acceptance of smart fluid handling technologies.

To get more information on Fluid Handling Systems Market - Request Free Sample Report

The U.S. fluid handling systems market was worth USD 14.73 billion in 2023 and is projected to reach a valuation of USD 22.57 billion by 2032 expanding at a CAGR of 4.85% over the forecast period. The U.S. fluid handling systems market growth is driven by advancements in fluid handling technology, industrial automation, and increasing demand from key sectors, such as chemicals, pharmaceuticals, and energy. The U.S. fluid handling systems market is projected to maintain its dominance across North America due to high number of investments in sustainability, smart fluid-handling systems, and infrastructure across the country.

Fluid Handling Systems Market Dynamics:

Drivers:

-

Fast Development and Automation in Sectors Drive the Demand for Advanced and Effective Fluid Handling Systems Globally

The rapid surge in the expansion of industries including oil & gas, chemicals, food & beverage, and pharmaceuticals, is augmenting the demand for fluid handling systems significantly in the fluid handling systems market. With this growth comes the requirement for systems that can manage this flow, which means ensuring they are as efficient and reliable as possible. Also, increasing automation and technological advancements in these industries are elevating the demand for fluid handling solutions that are compatible with automation. Fluid handling systems are critical to operating at high performance as automation helps improve production efficiency, minimize human error, and increase safety.

Rising productivity requirements from industries have paved to the evolution of smart fluid handling systems with features, such as real-time monitoring, predictive maintenance, and remote-control solutions. The movement towards automation and modernization is also projected to keep fluid handling systems demand increase on an upward trajectory, with businesses focusing on more secure, economical, and easily scalable solutions.

Restraints:

-

High Upfront Cost of Installing Fluid Handling Systems, Especially for Complex Applications, Can be a Barrier for Small and Medium-sized Enterprises (SMEs)

The high primary investment required to set up fluid handling systems can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). They have complex components (pumps, valves, pipes, and control mechanisms) that require significant initial investments. Also, the cost of installation, customization for individual industrial applications, and integration with existing infrastructure can drive initial costs even higher.

For SMEs, the cost of implementing such systems may outweigh the benefits perceived from using them, resulting in hesitancy to invest. This financial barrier can limit market growth by forcing small companies to choose lower-end cost options or postpone their investment in fluid management systems. This, coupled with high implementation complexities, means manufacturers and vendors need to find more economical solutions and financing options which can help the systems penetrate to wider applicant base, but especially at businesses pitched after the budget.

Opportunities:

-

Growing Focus on Sustainability is Driving Industries to Adopt Eco-Friendly Fluid Handling Systems that Reduce Waste, Improve Water Treatment, and Lower Energy Consumption

As environmental sustainability becomes a key concern across industries, there is increasing pressure on companies to adopt eco-friendly practices, including in fluid handling systems. This is an important step for making sustainability progress in some industries, among others, especially water treatment, chemical processing, and food & beverage can all be improved by reducing waste, offering more effective water management capabilities, and reducing energy use.

Furthermore, firms are also investing in new age technologies that emphasize reducing environmental impact, including systems that reuse and recycle fluid more efficiently or run on renewable energy. Switching to sustainable fluid handling practices allows businesses to comply with tighter environmental regulations, but also improves operational performance to save on long-term costs. The increasing focus on green technology innovation creates a notable opportunity for market development, enabling a new class of fluid handling systems to emerge as industries strive to meet developing sustainable practices while moving toward cleaner end-of-process technologies.

Challenges:

-

Supply Chain Disruptions Cause Delays in Procuring Critical Components, Impacting Production Schedules and Market Growth

Supply chain disruptions have become a significant challenge in recent years, causing delays in the procurement of critical components necessary for manufacturing fluid handling systems. Geopolitical tensions, natural disasters, and transportation bottlenecks can all significantly disrupt the timely flow of raw materials and specialized parts. This causes manufacturers a lot of headaches with scheduling production runs and potentially getting product deliveries out on time and at a reasonable cost.

Business continuity has taken a severe hit due to these disruptions, caused to a much larger extent by the pandemic, affecting inventory management and overall supply chain efficiency by rendering it difficult for businesses to meet growing demand. In fast-paced industries, this can result in lost opportunities and revenue growth as component lead times stretch. For fluid handling systems companies, the challenge will be to manage supply chain risks and create more resilient, more flexible supply chains to maintain competitive advantage in the current landscape, and to allow for continued growth despite unprecedented disruptions.

Fluid Handling Systems Market Segmentation Analysis:

By Component

The pumps segment dominated with a fluid handling systems market share of over 48% in 2023, owing to its critical part in transporting liquids and gases in different industries. Pumps are essential components in industries including oil & gas, chemicals, water treatment, and food processing, where the effective transportation of fluids is a core operational need. The systems can be found in applications spanning from water supply and waste management to industrial manufacturing processes.

The broad-based application and requirement of pumps in commercial and industrial sectors of the playing field are major factors driving this market share. Moreover, ongoing improvements in pump technology, such as greater energy efficiency and automation, also enhance their demand, and ensure that pumps hold the most share among all the components in fluid handling systems globally.

By End-Use Industry

The Chemical segment dominated with a market share of over 32% in 2023, due to its widespread use in these systems across multiple phases of chemical processing. They play a crucial role in safely moving, storing, and mixing chemicals during the production process, ensuring operations are efficient and safe. These systems are designed to handle all sorts of low and high temperature, volatile, corrosive fluids, and therefore require chemical equipment tailored to the requirements.

The growth of industries utilizing chemicals, including manufacturing, agriculture, and pharmaceuticals, necessitates dependable fluid handling solutions. Moreover, strict regulations on safety and environmental protection simply make the industry more inclined toward using state-of-the-art fluid handling technologies.

Fluid Handling Systems Market Regional Outlook:

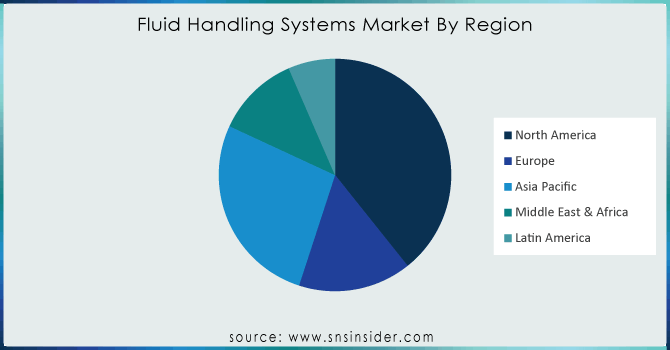

The Asia-Pacific region dominated with a market share of over 42% in 2023, which is expected to grow owing to rapid industrialization along with robust infrastructure development in countries, such as China, India, and Japan. Some of these countries are witnessing high growth in their manufacturing sectors, especially oil & gas, chemicals, and water treatment sectors, which require better fluid handling systems.

As industries including oil & gas, chemicals, and food & beverage continue to expand and modernize to meet growing production demands and regulatory requirements, the need for advanced fluid handling solutions is increasing. Furthermore, due to the enhanced industrial base and continuous developments in infrastructure projects, the demand for efficient and high-performance fluid handling systems is increasing in this region, thus contributing to Asia-Pacific being the largest region in terms of market share.

North America is experiencing the fastest growth in the Fluid Handling Systems Market, owing to the key industries, including oil & gas, chemicals, pharmaceuticals, and food & beverages. The U.S. and Canada are significant parts of a strong industrial base that the region enjoys. Rising demand for redefined fluid handling systems for enhanced productivity and safety drives market growth.

In addition, the increasing adoption of automation and intelligent technologies in fluid management processes is improving operational productivity across several sectors. Such advances, coupled with massive investments in the infrastructure and industrial processes sector, have been substantially expanding the fluid handling solutions market, and North America is one of the prominent regions in the overall fluid handling solutions market.

Need any customization research on Fluid Handling Systems Market - Enquiry Now

Key players in the Fluid Handling Systems Market

-

Alfa Laval, (Heat Exchangers, Pumps, Valves)

-

KSB Company (Pumps, Valves, Fluid Handling Systems)

-

Crane Co. (Valves, Actuators, Control Systems)

-

Colfax Fluid Handling (Pumps, Filtration Systems)

-

Graco (Pumps, Dispensing Systems, Lubrication Equipment)

-

VRC Industrial Solutions (Fluid Handling Equipment, Pumps, Compressors)

-

Watec Fluid Handling Systems Co., Ltd. (Water Pumps, Fluid Handling Solutions)

-

Raymond Network (Fluid Handling and Storage Systems, Conveyors)

-

Parker Hannifin (Pumps, Valves, Filters, Hoses, Actuators)

-

Chesterton (Sealing Solutions, Pumps, Valves, Lubrication Systems)

-

LobePro (Positive Displacement Pumps)

-

IFH Group (Fluid Handling, Industrial Systems, Pumps)

-

Alemite Lubrication (Lubrication Equipment, Fluid Handling Systems)

-

Des-Case Corporation (Filtration Systems, Fluid Handling Solutions)

-

Dover (Fluid Handling, Pumping Systems, Dispensing Equipment)

-

Alfa Wasserman (Fluid Handling Equipment, Pumps)

-

Fraser Ross Ltd. (Pumps, Fluid Transfer Systems, Filtration Equipment)

-

Verder Group (Pumps, Fluid Handling, Filtration Systems)

-

SPX FLOW (Pumps, Valves, Heat Exchangers, Filtration Systems)

-

Pentair (Pumps, Valves, Filtration Systems, Water Treatment Solutions)

Suppliers for (pumps, valves, and filtration solutions for water treatment, energy, and industrial sectors) on the Fluid Handling Systems Market

-

Flowserve Corporation

-

ITT Inc.

-

Alfa Laval

-

Graco Inc.

-

Pentair plc

-

SPX Flow

-

KSB SE & Co. KGaA

-

Verder Group

-

Crane Co.

-

Xylem Inc.

Recent Development

In October 2023: Flowserve Corporation announced the signing of a definitive agreement to acquire Velan, a leading manufacturer of industrial valves with a strong presence in the nuclear, cryogenic, and defense sectors.

In September 2023: CIRCOR International, Inc. revealed the expansion of its Allweiler screw pump portfolio, now including vertical pump configurations in the SNA series, designed for installation in lube and hydraulic oil reservoirs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 74.55 Billion |

| Market Size by 2032 | USD 111.28 Billion |

| CAGR | CAGR of 4.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Pumps (Centrifugal, Positive Displacement),Cntrol Valves) Sliding, Rotary, Others (Storage Tanks) Others) • By End-Use Industry (Chemical, Food Processing, Power Generation, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alfa Laval, KSB Company, Crane Co., Colfax Fluid Handling, Graco, VRC Industrial Solutions, Watec Fluid Handling Systems Co., Ltd., Raymond Network, Parker Hannifin, Chesterton, LobePro, IFH Group, Alemite Lubrication, Des-Case Corporation, Dover, Alfa Wasserman, Fraser Ross Ltd., Verder Group, SPX FLOW, Pentair. |