Flexible Substrates Market Size & Trends:

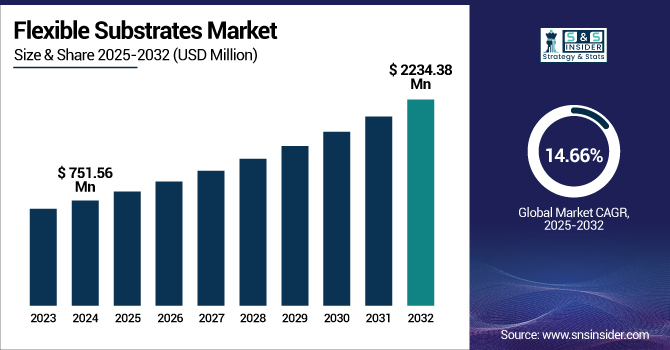

The Flexible Substrates Market Size was valued at USD 751.56 million in 2024 and is expected to reach USD 2234.38 million by 2032 and grow at a CAGR of 14.66% over the forecast period 2025-2032.

To Get more information on Flexible Substrates Market - Request Free Sample Report

The Flexible Substrates Market has been witnessing good growth with rising adoption rates in key applications like consumer electronics, solar energy, medical & healthcare, aerospace & defense, and more. Flexible targets offer numerous benefits, including lightweight construction, flexible support, and many others, making them ideal for foldable smart devices, wearable sensors, flexible photovoltaic solar panels, and advanced aerospace components. Recent updates introduced by top companies will also impact future market growth, driven by innovation and increased demand for small-volume smart technology.

DuPont introduced the Pyralux ML laminate series on April 9, 2024, featuring double-sided metal-clad laminates for high thermal management. The laminates are specifically designed for flexible and rigid-flex PCBs in industries such as aerospace, defense, EVs, and AI networking, further increasing the demand for sophisticated flexible substrates.

The U.S. Flexible Substrates Market size was USD 176.13 million in 2024 and is expected to reach USD 441.95 million by 2032, growing at a CAGR of 12.24% over the forecast period of 2025–2032.

The U.S. Flexible Substrates Market is witnessing robust expansion, driven by the increasing need for versatile, durable materials. The demand is fueled by technological advancements and a shift toward high-performance solutions across sectors. These substrates offer benefits like flexibility and thermal management, supporting innovations in various emerging applications.

In 2024, 3M introduced the Envision Flexible Substrate FS-1, a wide-width vinyl material designed for LED-illuminated backlit signage. With greater light transmission, it saves energy and boosts brightness. The substrate offers up to 9 years of outdoor life, supported by the MCS Warranty, and is an economical solution for medium to long-term installations.

Flexible Substrate Market Dynamics

Key Drivers:

-

Increasing Need for Lightweight, Durable, and Flexible Materials in Emerging Applications Drives Growth in the Flexible Substrates Market.

Increasing need of lightweight, durable, and flexible material for new applications is driving the demand for flexible substrates significantly. A continuous drive for high-performance flexible materials is needed with emerging sectors like aerospace, renewable energy, and consumer electronics. Lightweight design and superior durability, intra-epidermal sensors, and foldable products are contemporary use cases that achieve value-add benefits through flexible substrates with power and thermal management. They can enable development of flexible displays, solar cells and flexible PCBs providing a high performance device yet require less weight and power. The ability to address these evolving needs with quality, efficient substrates are what continue to fuel growth in vertically integrated industries and reinforce the increasing role of flexible substrates in enabling next-generation products.

In 2024, LG Display unveiled its new flexible OLED technology, offering enhanced performance and durability for applications in wearable devices, automotive displays, and foldable smartphones, driving growth in flexible substrate demand.

Restrain:

-

Technical Limitations in Performance and Durability of Flexible Substrates in Harsh Environments.

The Flexible Substrates Market is the technical limitation of these materials in harsh conditions. Although flexible substrates provide great benefits such as light weight and flexibility, their performance and longevity in extreme conditions high temperature, humidity, and chemical exposure can be an issue. Most flexible substrates struggle to maintain their integrity and long-term performance under these environmental stresses, particularly in high-reliability applications like aerospace, automotive, and medical devices. Despite the evolution of material science, it has been challenging to obtain the necessary compromise between flexibility, durability, and environmental resistance. This limits the large-scale use of flexible substrates in applications demanding high-performance products under extreme conditions, hence slowing down the overall market evolution in such markets.

Opportunities:

-

Growth in Sustainable Technologies and Green Solutions Opens New Avenues for Flexible Substrates Market Expansion.

The growing focus on sustainable technology and green solutions is a major opportunity for the flexible substrates market. The world is getting more conscious than ever about the environmental issues, and thus, several industries have started to move away from their conventional materials, rather looking to take on more sustainable or renewable ones. Especially hot topic in the development of solar energy devices is flexible substrates. These substrates are generally lighter, stronger, and recyclable, and so are ideal for applications like flexible solar panels, which are transformative for energy efficiency and carbon emissions reduction. Additionally, the growing demand for energy-efficient products across several industries, including transportation and construction, opens more avenues for flexible substrates to expand into new markets. As organizations increasingly focus on sustainability, flexible substrates will find more application in green applications, driving market growth.

Challenges:

-

Complex Regulatory Standards and Compliance Requirements Hinder Expansion of Flexible Substrates Market in Global Markets.

Managing complex regulatory requirements and compliance issues across multiple global markets presents serious challenges for the flexible substrates market. Adding to the complexity, companies must comply with an array of regulations on materials and environmental considerations, and product safety, which can vary widely from market to market. These regulatory requirements add costs for firms and can slow development and separate the introduction of new solutions using flexible substrate into the marketplace. Moreover, compliance with sustainability regulations such as recyclability and material safety requirements further complicates the development process. The long testing and certification processes that must be undertaken means that product innovations often take longer to be introduced into foreign markets, and are also more expensive in those markets. Most of these regulatory issues must be addressed to optimize further growth trajectories for the flexible substrates market and allow such innovations to be realized in the hands of global end-user customers.

Flexible Substrates Market Segment Analysis:

By Type

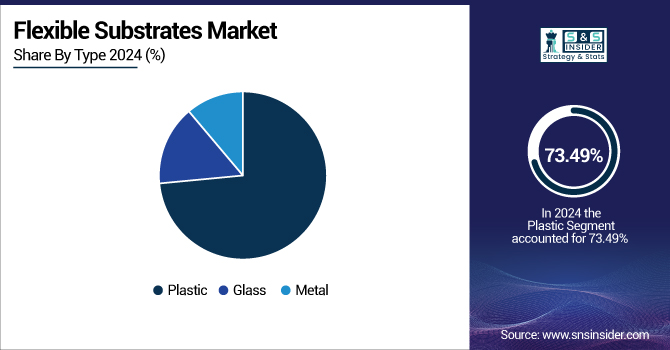

In 2024, the Plastic segment held the largest share of the flexible substrates market at 73.49% revenue share. The reason behind the dominance of this material is that it is light in weight, flexible, and cost-efficient, making it perfectly suitable for use in consumer electronics, packaging, and medical devices. Companies like Amcor and Mondi have developed innovative plastic-based flexible packaging solutions that have made products more sustainable and robust. Such innovations demonstrate the essential role of plastic substrates in the development of the market and meeting diverse industry needs.

The plastic category is expected to grow at the maximum CAGR of 14.69% over the forecast period from 2025 to 2032. Constant innovation together with the demand for lightweight, strong and flexible materials in a plethora of industries contribute to this growth.Informative trends were substantial jumps by Amcor with the launch of the AmFiber range of products and a move by Mondi into mono-material flexible appearing both recyclability and sustainability. The trends point towards the segment's ability to deliver consumers' changing needs as well as greater overall trends of more sustainable solutions which have only established it further still within the flexible substrates industry.

By Application

In 2024, the Consumer Electronics segment owned the highest share of revenue and held 48.22% of the Flexible Substrates Market, because the demand for light-weight, portable devices, such as smartphones, tablets, and wearables, increased. Samsung and LG have pioneered flexible OLED displays in devices that are more durable and can be rolled into any form. These trends indicate the crucial technical role of flexible substrates in leading consumer electronics, which still to date come in thin and rugged thinning varieties, in a more malleable direction that matches shifting consumer predilection for slimmer, more durable appliances.

The Medical & Healthcare segment, which is expected to Fastest CAGR of 15.96% during the forecast period 2025 to 2032,due to the rising adoption of wearables health monitors and implantable devices. Ground-breaking advances like DuPont's collaboration in flexible substrates for wearable health monitoring devices and MIT's research towards recyclable multilayer flexible circuits suggest growth in the sector. These advancements result from the growing influence of flexible substrates in enhancing patient welfare via more adaptable and effective medical devices.

Flexible Substrate Market Regional Outlook:

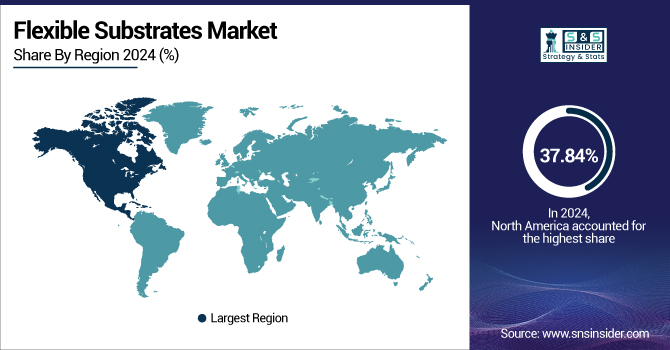

North America is to dominate the world flexible substrates market in 2024 with 37.84% revenue share. This is a result of strong growth in industries like automotive and consumer electronics, and high R&D spending. Companies like DuPont and 3M have developed breakthrough products, like next-generation flexible laminates and substrates, to further cement the region's place in building the market as well as technology advancements.

The Asia Pacific market for flexible substrates will record the Fastest CAGR of 15.93% in the period 2025 to 2032. It is driven by the growing demand for flexible substrates in electronics and healthcare applications. We will see businesses developing flexible materials including OLED displays and wearable health devices that are tearing the market, which makes the region to pass through a very strong growth in the forthcoming years.

Germany leads the European flexible substrates market, driven by its advanced automotive, aerospace, and consumer electronics sectors. The country’s strong manufacturing base and innovation focus have increased demand for flexible materials in applications like displays, sensors, and wearables, reinforcing its leadership role in the market.

Germany leads the flexible substrates market in Europe, fueled by its advanced automotive, aerospace, and consumer electronics sectors. Domestic manufacturing sector and emphasis on innovation have increased demand for flexible materials in applications such as displays, sensors, and wearables, making it the leading player in the market.

In Middle East & Africa, the market for flexible substrates is led by larger players such as the UAE and Saudi Arabia, fueled by increased demand from the construction, electronics, and renewable energy sectors. South Africa is also a significant player, most notably in industrial uses. Brazil is way ahead in terms of the market, followed by consumer electronics and automotive industries. Demand for the use of flexible substrates in medical, electronics and solar applications have also pushed both the markets' growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Flexible Substrates Market are:

Some of the major key players are Mitsui Chemicals, Inc., Kolon Industries, Inc., Toray Plastics (America), Inc., TDK Corporation, Teijin Limited, PARSEC Corporation, 3M, Avery Dennison Corporation, Dupont, Toyobo Co., Ltd and others.

Recent Development:

-

April 2024, Toyobo partnered with MC to form a joint venture focused on functional materials, advancing product capabilities in flexible substrates and related markets.

-

May 2024, Toray introduced a recyclable mono-material film and launched a PFAS-free mold release film, both enhancing eco-friendly solutions in semiconductor and flexible substrate manufacturing.

-

May 2024, Mitsui Chemicals launched a new company, Mitsui Chemicals ICT Materia, and invested in CNT pellicle production, supporting high-performance flexible films for advanced semiconductor and ICT applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 751.56 Million |

| Market Size by 2032 | USD 2234.38 Million |

| CAGR | CAGR of 14.66% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Plastic, Glass, Metal) •By Application (Consumer Electronics, Solar Energy, Medical & healthcare, Aerospace & Defense) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Mitsui Chemicals, Inc., Kolon Industries, Inc., Toray Plastics (America), Inc., TDK Corporation, Teijin Limited, PARSEC Corporation, 3M, Avery Dennison Corporation, Dupont, Toyobo Co., Ltd. |