Flexible PCB Market Size & Trends:

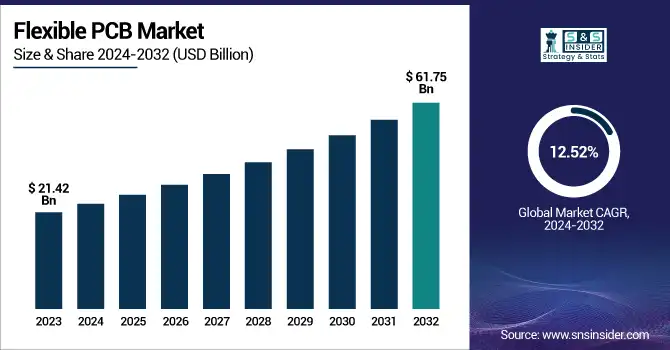

The Flexible PCB Market was valued at USD 21.42 billion in 2023 and is expected to reach USD 61.75 billion by 2032, growing at a CAGR of 12.52% over the forecast period 2024-2032.

To Get more information on Flexible PCB Market - Request Free Sample Report

Flexible PCB market designs are changing with a trend toward miniaturization, high-density interconnects, and improved thermal management. Thus, due to constant demand coming from both consumer electronics and automotive sectors, fabrication capacity utilization is on the rise. Innovation is fueled by emerging applications in wearables, foldable devices, and medical implants, and integration with 5G, IoT, and AI is helping to broaden their capabilities. New approaches to manufacturing like additive printing and laser direct imaging render the ability to produce future electronic devices to tighter tolerances with enhanced performance and cost-effectiveness. Robust demand across automotive, medical devices, and consumer electronics sectors owing to growth trends in electric vehicles, wearable health monitors, and small-size smart devices had a positive impact on the U.S. Flexible PCB market in 2024. To satisfy the demand for increasingly complex designs needed for high performance, manufacturers are balancing higher yield production with increased capacity and adopting flexible hybrid electronics during the process.

The U.S. Flexible PCB Market is estimated to be USD 1.80 Billion in 2023 and is projected to grow at a CAGR of 13.53%. The flexible PCB market in the U.S. is also driven by trends such as the growing acceptance of advanced driver-assistance systems (ADAS), increasing installation of flexible circuits in aerospace and defense apparatus, an ongoing preference for lightweight, space-optimized parts, and governmental programs to promote in-house electronics manufacturing and R&D regarding high-density interconnect and miniatured circuit technologies.

Flexible PCB Market Dynamics

Key Drivers:

-

Flexible PCBs Drive Growth with Rising Demand in Compact Electronics EVs and Advanced Automotive Systems

An increase in demand for miniaturized, lightweight, and high-end electronics especially in consumer electronics is one of the key segments of flexible PCB propelling the growth of the Flexible PCB market. Compact circuitry made of bendable materials is fundamental for flexible, foldable, and otherwise space-saving electronics such as smartphones, tablets, and wearables. Moreover, the rapid adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) in the automotive industry is increasing demand for flexible PCBs for better signal integrity, lightweight, and high durability in packed automotive modules.

Restrain:

-

Design Challenges and Manufacturing Issues Restrain Flexible PCB Growth in Critical High Performance Applications

The factors that are restraining the growth of flexible PCB are the design complexity and poor yield during the manufacturing process. Flexible circuits differ from conventional rigid PCBs in that they are much more sensitive to layout and structural rigidity concerning reliably functioning when bent, folded, or twisted. The increased complexity can cause higher rates of failure during the prototyping and early production phases that will need to be validated and tested at higher levels. Additionally, reliability and mechanical performance under dynamic stress are difficult to achieve and test, especially in mission-critical markets such as automotive, aerospace, and medical applications. Even a minor defect or design flaw will drastically influence the device's performance and reliability.

Opportunity:

-

5G IoT Medical Electronics and Advanced Materials Drive Growth of Flexible PCBs in Critical Industries

The growth of the 5G and IOT infrastructure is a massive opportunity, especially in IT & telecom. The development of ultra-fast data transmission and edge computer services has increased end-user demand for reliable, high-speed, flexible, and compact interconnect solutions, thereby serving as a significant driver for multilayer and rigid-flex FPCBs. Furthermore, the increasing demand for medical electronics such as wearable health monitors and minim invasive surgical tools provides strong opportunities for biocompatible and high-reliability flexible PCBs in the long term. Ongoing developments in materials, including polyimide and liquid crystal polymer substrates, are allowing for wider use in extreme environments such as aerospace and industrial electronics, which could also drive market growth.

Challenges:

-

Standardization Challenges and Rapid Technological Advances Hinder Flexible PCB Production and Innovation Efficiency

This limited standardization over the end-use industry and application continues to pose challenges to manufacturers. Various industries such as telecom, medical, and automotive require unique FPCB designs, combinations of materials, and performance levels, which makes scaling production or developing the process challenging. Furthermore, the rapid development cycle of electronic components and miniaturization trends demand continuous innovation and adaptation of FPCB design and assembly techniques. Adding to this complexity is how the integration of flexible PCs with emerging technologies and high-frequency RF components for 5G or bio-compatible circuits for medical devices, for example, necessitates specialized manufacturing machinery, and multidisciplinary expertise, and ultimately can delay time-to-market and operational efficiency.

Flexible PCB Market Segment Analysis

By Type

Double-sided FPCBs held the largest share of flexible PCB marketing in 2023, at 44.3%. They are also more complex in ensuring a planar layout, but this complexity allows for more advanced circuit designs than a single-sided board would enable, and are therefore more commonly used as they remain less expensive (and require fewer materials) than newer technologies. These flexible printed circuit boards are commonly used within consumer electronics, automotive, and industrial applications and offer the right balance of performance, durability, and effective use of space.

Multilayer FPCBs are expected to grow at the highest CAGR between 2024 and 2032, due to the demand for high-density and compact electronics assemblies. They are suitable for advanced devices that need greater data transmission, increased thermal management, and increased circuit complexity like smartphones, medical, aerospace, and 5G-enabled devices. All this means, that multilayer FPCBs require the industry to take further levels of miniaturization and performance which are becoming increasingly critical as manufacturers continue to increase the level of functionalities integrated into limited footprint zones maintaining a high signal integrity and reliability.

By End Use

In 2023, the Flexible PCB market was led by the Consumer Electronics segment, which accounted for a significant 51.3% market share. This dominance mainly owes to the high adoption of FPCBs in smartphones, tablets, laptops, smartwatches many other handheld gadgets that require lightweight, compact, and flexible circuit solutions. The increasing trend towards miniaturization and multi-functionality of consumer gadgets is boosting the market for FPCBs that provide excellent performance in ever-slimmer packages.

The IT & Telecom segment is expected to register the fastest CAGR in the flexible PCB market from 2024 to 2032. The expansion is due to the worldwide growth of 5G infrastructure, rising investments within data centers, and demand from end-user domains like commercial IoT device adoption and increasing demand from high-speed communication equipment. The requirement of robust high-performance interconnect solutions, such as multilayer and rigid-flex FPCBs is crucial as telecom networks continue to evolve toward high-frequency and high-speed platforms, which also creates new opportunities for market growth.

Flexible PCB Market Regional Outlook

In 2023, Asia Pacific commanded nearly 74.7% of the Flexible PCB market share, owing to the available manufacturing ecosystem and multiple Electronic product manufacturers. China, Japan, South Korea and Taiwan are the world leaders of consumer and automotive electronics and semiconductor manufacturing. Major corporations like Samsung Electronics (South Korea), Sony (Japan), and Foxconn (Taiwan/China) have a deep dependence on flexible PCB for smartphones, smartwatches, and display modules. Moreover, increasing regional demand for electric vehicles and wearable devices also drives the market where it has become a center of production as well as a center of consumption.

North America is expected to have the highest CAGR from 2024 to 2032, driven by developments in 5G, aerospace, defense, and medical technologies. Particularly in the U.S. expanded investments are appearing for high-reliability electronics where flexible PCBs are key enablers. For instance, Lockheed Martin and Raytheon Technologies utilize rigid-flex PCBs within next-gen avionics and defense systems. The telecom sector is led by Cisco and Qualcomm, innovating in network infra and IoT devices, generating demand for advanced FPCB designs. High-end applications and rising R&D investments are likely to drive its adoption and propel market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players Listed in the Flexible PCB Market are:

-

Nippon Mektron (Flex Circuit Board)

-

Zhen Ding Technology Holding Ltd. (HDI Flexible PCB)

-

Sumitomo Electric Industries (Flexible Printed Wiring Board)

-

Interflex Co. Ltd. (Flexible Printed Circuit for Display Modules)

-

Career Technology (Mfg.) Co., Ltd. (Automotive FPC)

-

Ichia Technologies Inc. (Flexible Touch Panel PCB)

-

Multi-Fineline Electronix, Inc. (MFLEX) (High-Density Interconnect FPC)

-

NewFlex Technology Co., Ltd. (LED Lighting FPC)

-

FLEXium Interconnect, Inc. (Wearable Device FPC)

-

Daeduck GDS (Rigid-Flex PCB for Smartphones)

-

SIFlex Co., Ltd. (Mobile Application FPC)

-

BHflex Co., Ltd. (Camera Module FPC)

-

Interconnect Systems Inc. (Flex Assembly Subsystems)

-

Samsung Electro-Mechanics (Flexible OLED Display PCB)

-

Nitto Denko Corporation (Flexible Printed Circuit Substrates)

Recent Trends

-

In April 2024, Nippon Mektron Ltd. secured an order from Volkswagen to supply flexible printed circuits (FPCs) for the ID.2 electric vehicle's battery management system. Production is set to begin in 2026, with projected sales exceeding EURO 400 million.

-

In October 2024, DuPont and Zhen Ding Technology Group signed a strategic cooperation agreement to advance high-end printed circuit board technology. The partnership aims to enhance R&D, improve material performance, and drive innovation in smart manufacturing and sustainability for the electronics industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 21.42 Billion |

| Market Size by 2032 | USD 61.75 Billion |

| CAGR | CAGR of 12.52% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Single Sided FPCBs, Double Sided FPCBS, Multilayer FPCBS, Rigid-Flex PCBS, Others) • By End Use (Industrial Electronics, Aerospace & Defense, IT & Telecom, Automotive, Consumer Electronics, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Nippon Mektron, Zhen Ding Technology Holding Ltd., Sumitomo Electric Industries, Interflex Co. Ltd., Career Technology (Mfg.) Co., Ltd., Ichia Technologies Inc., Multi-Fineline Electronix, Inc. (MFLEX), NewFlex Technology Co., Ltd., FLEXium Interconnect, Inc., Daeduck GDS, SIFlex Co., Ltd., BHflex Co., Ltd., Interconnect Systems Inc., Samsung Electro-Mechanics, Nitto Denko Corporation. |