To get more information on Flexible Display Market - Request Sample Report

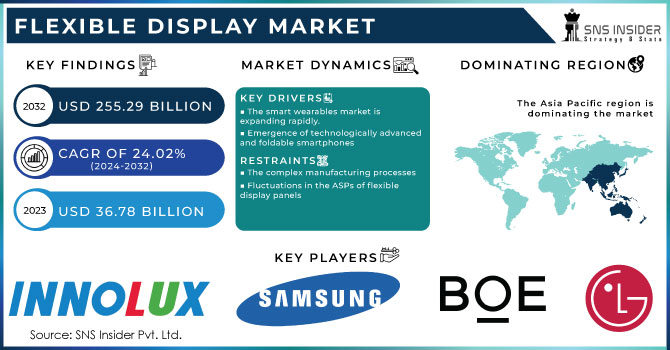

The Flexible Display Market Size was valued at USD 36.78 billion in 2023 and is expected to reach USD 255.29 billion by 2032 and grow at a CAGR of 24.02% over the forecast period 2024-2032.

The flexible display market is majorly driven by the consumer electronics market due to the production of mobile, unbreakable, and lighter electronics products. Flexible screens have become one of the most important alternatives for the next generation of devices. It can be highly valued for its additional functions, new applications, or design. For example, the Galaxy Z Fold series developed by Samsung, has visibly set the standards for foldable phones. The worldwide shipments of foldable phones including flip and fold reached 21.4 million units by 2023 from 14.2 million units by 2022 having an increase of more than 50% over 2022. Foldable phone shipments are estimated to reach 48.1 million units by 2027 with a CAGR of 27.6%. The forecast indicates the strength and volume of phones in the overall mobile phone market.

Moreover, the market demand for flexible displays is driven by the rapidly increasing pace of the smart wearable industry. Thus, manufacturers continue to invest actively in expanding their manufacturing capacity to meet the demand. Shipments of wearable devices experienced significant growth at the beginning of 2024 and increased by 8.8% in Q1 of 2024 to an all-time high of 113.1 million units. For example, Xiaomi with 43.4% year-over-year growth became the second-largest vendor by shipping 18.3 million wearable devices.

The automotive industry is currently experiencing a strong change owing to the development of new technologies and the shifting of consumers’ preferences. Flexible displays are becoming demandable equipment as they tend to provide higher functionality, improved safety, and a better look at automotive devices. Thus, one of the most important drivers behind their adoption in the industry is the increased popularity of advanced driver-assistance systems and in-car-infotainment systems. Now, the Lexus ES 300h luxury hybrid saloon is making its popular, convenient, and safe model, even safer and more convenient for drivers. This technology had been a world-first on a high-volume production car when it was made available on the ES in Japan, now this feature is offered as an option for the UK market ES Takumi model.

MARKET DYNAMICS

Drivers

Flexible displays are in high demand in wearable devices as they can substantially contribute to the development of more comfortable solutions. It means that such displays enable the creation of wearables that will better fit the human body. For example, it is possible to make a smartwatch with a flexible display that could occupy the entire wrist or part of an arm and thus provide users with more possibilities to interact with information. Nowadays, people search for devices that would allow them to control their heart rate, activity, sleep, and other important health parameters. Thus, flexible displays permit making lightweight, comfortable, and aesthetically beautiful devices that can be worn all day long. Many makers of smart bands are anticipating expanding their product lineup to include handheld displays. Small display screens are used in smart wearable products like watches and bracelets. The importance of smart wearables is expanding incorporating the newest industry applications, such as augmented and virtual reality (AR VR), which present new business potential for OLED display manufacturers. Large-sized display panel producers like Taiwan's AU Optronics Corp. and Innolux Corp. may benefit from the rising market for smart wearables. Businesses could make investments to concentrate on these apps, which would eventually boost their income.

One of the main advances in the scope of smartphone design is the development of foldable devices that have high performance, convenient screen sizes and are more technologically advanced. This solution uses a flexible display that can be used when the smartphone is folded and open to two or three times the size. Such a model resolves the existing problem, which arose in connection with the increasing tendency to expand the screens of smartphones in the application. It created the risk of presenting extremely awkward and inconvenient devices for users. Instead, foldable phones provide both a small screen for folding and convenient use and a large screen that opens up many opportunities for users. The consideration of these advantages can be summarized in the statement that due to the introduction of foldable smartphones, a demand for flexible displays has been observed, which becomes one of the prospects for the group.

Restraints

The manufacture of flexible screens is a multi-stage, complicated process. Other rival display technologies now provide better design capabilities and need fewer production steps. The performance of rigid display and electronics technologies now on the market must be matched by flexible display technology. Many organic compounds used in flexible electronics and screens are flammable and sensitive to oxygen. Moisture and oxygen exposure shorten a material's lifespan. Consequently, they offer less defense. These materials also frequently function at high voltages and sluggish speeds. Extreme temperatures also affect them negatively.

The ASPs and shipping volumes of flexible display panels are the two main factors that affect the producers' revenues, especially the costs and volume changes that have an impact on this. Flexible display panel prices and shipping quantities are influenced by several variables, including raw material costs, yield rates, supply and demand, competition, pricing tactics, and transportation costs. The ASP of raw materials and flexible display panels has experienced significant changes in the flexible display sector. The ASP of flexible display panels may drop if production capacity quickly increases. In contrast, ASP may rise if supply cannot keep up with rising demand.

By Panel Size

The flexible display market by panel size is dominated by the up to 6” segment in terms of market share i.e. above 39% in 2023. Factors such as the compact size, ease of carry, and cost-effectiveness both for manufacturers and consumers have contributed to the segment growth.

The 20-50” segment is expected to emerge as the fastest-growing segment by a consistent CAGR over the forecast period. The market’s growth is driven by the demand for new automotive displays with advanced technology for better use. Moreover, the growth is due to manufacturers who are launching new products. For example, LG Electronics launched the LG OLED Flex model LX3 in September 2022, a 42-inch OLED screen that can bend.

By Substrate Material

In 2023, the plastic segment had the largest market share of more than 48.5%, and it is expanding at a steady CAGR. As plastic offers better scales, robustness, and weight, its demand as a material for flexible displays is increasing. Secondly, the preference for plastic to be used in the manufacture of low-cost and highly flexible exhibits in the electronics industry. However, glass substrates are waterproof, and gas-resistant which makes them durable. Hence, the glass substrate material is growing at a faster rate during the forecast period. The players in the display market are working on creating a durable glass substrate since the plastic substrates are prone to scratching, creasing, and donning of color with time

By Display Size

The OLED segment was the leading in 2023 with a market share of more than 50.15% and is expected to grow at the highest rate during the forecast period. The OLED flexible displays can be highly flexible, consume less energy, and therefore are increasingly adopted in smartphones. OLED flexible displays are sleeker and lighter than the LCD as they do not require a backlight or filters.

LED displays may become challenging for users in the coming years, as their reading performance declines in changing lighting conditions. On the other hand, the rising adoption of flexible display-based e-readers to drive the growth of the Electronic Paper Display segment in the coming years.

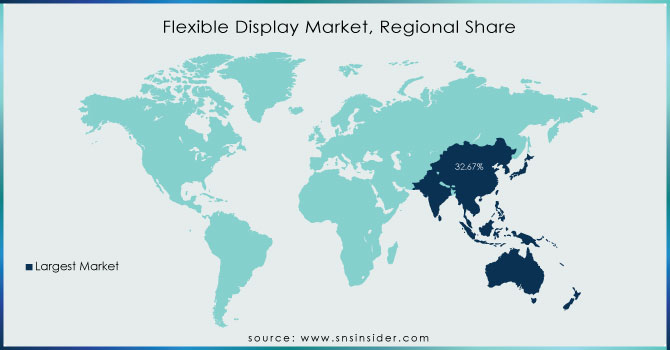

Asia Pacific accounted for more than 32.67 % of the overall revenue in 2023 and it is expected to grow at a stable CAGR during the forecast period. The demand for the flexible display market in the region is driven by the increasing number of electronic devices that are compact and lighter in weight. Besides, such growth is explained by the prevalence of smartphones and other advanced technologies, such as displays and the increasing use of augmented reality. Numerous electronics manufacturers like Samsung and LG are equally helping the regional growth. Moreover, the region’s population is also sizeable, so the demand for displays is not missing. The leading countries that have adopted flexible displays include Japan, South Korea, China, and India. China is the largest flexible OLED screen producer worldwide.

North America is growing fast in the regional analysis with a market share of over 27.15% in 2023. The demand for flexible displays in North America is high due to devices with high energy consumption capacity. The market in Europe is equally developing and shows substantial growth in demand because the automotive industry requires a sufficient number of flexible displays.

Need any customization research on Flexible Display Market - Enquiry Now

The Major Player are LG Display Co., Ltd. (South Korea), Samsung Electronics (South Korea), Innolux Corp. (Taiwan), AU Optronics (Taiwan), Japan Display Inc. (Japan), BOE Technology Group Co., Ltd. (China), Sharp Corp. (Japan), Visionox Corporation (China), E Ink Holdings, Inc. (Taiwan), Corning Incorporated (US), E. |. du Pont de Nemours and Company (US), FlexEnable Limited (UK), Kateeva (US), Cambrios Technologies Corp. (US), Royole Corporation (US) and other players are listed in a final report.

RECENT DEVELOPMENTS

| Report Attributes | Details |

| Market Size in 2023 | US$ 36.78 Bn |

| Market Size by 2032 | US$ 255.29 Bn |

| CAGR | CAGR of 24.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Panel Size (Up to 6”,6-20", 20-50" Above 50”) • By Substrate Material (Glass, Plastic, Others) • By Technology (OLED Display, E-paper Display, Quantum dot LED Display, LED-Backlit LCD) • By Application (smartphones & tablets, television & digital signage, automotive & transportation, e-reader, smartwatches & wearables, others) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | LG Display Co., Ltd. (South Korea), Samsung Electronics (South Korea), Innolux Corp. (Taiwan), AU Optronics (Taiwan), Japan Display Inc. (Japan), BOE Technology Group Co., Ltd. (China), Sharp Corp. (Japan), Visionox Corporation (China), E Ink Holdings, Inc. (Taiwan), Corning Incorporated (US), E. |. du Pont de Nemours and Company (US), FlexEnable Limited (UK), Kateeva (US), Cambrios Technologies Corp. (US), Royole Corporation (US) |

| Key Drivers |

|

| Market Restraints |

|

Ans: The Flexible Display Market is expected to grow at a CAGR of 24.02%.

Ans: The Flexible Display Market size was USD 36.78 billion in 2023 and is expected to Reach USD 255.29 billion by 2032.

Ans: The rise in demand for flexible displays in the automotive sector is majorly raising the growth of the Flexible Display Market.

Ans: The smartphones & tablets segment by application is dominating the Flexible Display Market.

Ans: Asia Pacific, regionally dominates the Flexible Display Market in 2023.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Flexible Display Market Segmentation, By Panel Size

7.1 Introduction

7.2 Up to 6"

7.3 6-20"

7.4 20-50"

7.5 Above 50"

8. Flexible Display Market Segmentation, By Display Size

8.1 Introduction

8.2 OLED Display

8.3 E-paper Display

8.4 Quantum dot LED Display

8.5 LED-Backlit LCD

9. Flexible Display Market Segmentation, By Substrate Material

9.1 Introduction

9.2 Glass

9.3 Plastic

9.4 Others

10. Flexible Display Market Segmentation, By Application

10.1 Introduction

10.2 Smartphones & Tablets

10.3 Television & Digital Signage

10.4 Automotive & Transportation

10.5 E-reader

10.6 Smartwatches & Wearables

10.7 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 Trend Analysis

11.2.2 North America Flexible Display Market by Country

11.2.3 North America Flexible Display Market By Panel Size

11.2.4 North America Flexible Display Market By Display Size

11.2.5 North America Flexible Display Market By Substrate Material

11.2.6 North America Flexible Display Market By Application

11.2.7 USA

11.2.7.1 USA Flexible Display Market By Panel Size

11.2.7.2 USA Flexible Display Market By Display Size

11.2.7.3 USA Flexible Display Market By Substrate Material

11.2.7.4 USA Flexible Display Market By Application

11.2.8 Canada

11.2.8.1 Canada Flexible Display Market By Panel Size

11.2.8.2 Canada Flexible Display Market By Display Size

11.2.8.3 Canada Flexible Display Market By Substrate Material

11.2.8.4 Canada Flexible Display Market By Application

11.2.9 Mexico

11.2.9.1 Mexico Flexible Display Market By Panel Size

11.2.9.2 Mexico Flexible Display Market By Display Size

11.2.9.3 Mexico Flexible Display Market By Substrate Material

11.2.9.4 Mexico Flexible Display Market By Application

11.3 Europe

11.3.1 Trend Analysis

11.3.2 Eastern Europe

11.3.2.1 Eastern Europe Flexible Display Market by Country

11.3.2.2 Eastern Europe Flexible Display Market By Panel Size

11.3.2.3 Eastern Europe Flexible Display Market By Display Size

11.3.2.4 Eastern Europe Flexible Display Market By Substrate Material

11.3.2.5 Eastern Europe Flexible Display Market By Application

11.3.2.6 Poland

11.3.2.6.1 Poland Flexible Display Market By Panel Size

11.3.2.6.2 Poland Flexible Display Market By Display Size

11.3.2.6.3 Poland Flexible Display Market By Substrate Material

11.3.2.6.4 Poland Flexible Display Market By Application

11.3.2.7 Romania

11.3.2.7.1 Romania Flexible Display Market By Panel Size

11.3.2.7.2 Romania Flexible Display Market By Display Size

11.3.2.7.3 Romania Flexible Display Market By Substrate Material

11.3.2.7.4 Romania Flexible Display Market By Application

11.3.2.8 Hungary

11.3.2.8.1 Hungary Flexible Display Market By Panel Size

11.3.2.8.2 Hungary Flexible Display Market By Display Size

11.3.2.8.3 Hungary Flexible Display Market By Substrate Material

11.3.2.8.4 Hungary Flexible Display Market By Application

11.3.2.9 Turkey

11.3.2.9.1 Turkey Flexible Display Market By Panel Size

11.3.2.9.2 Turkey Flexible Display Market By Display Size

11.3.2.9.3 Turkey Flexible Display Market By Substrate Material

11.3.2.9.4 Turkey Flexible Display Market By Application

11.3.2.10 Rest of Eastern Europe

11.3.2.10.1 Rest of Eastern Europe Flexible Display Market By Panel Size

11.3.2.10.2 Rest of Eastern Europe Flexible Display Market By Display Size

11.3.2.10.3 Rest of Eastern Europe Flexible Display Market By Substrate Material

11.3.2.10.4 Rest of Eastern Europe Flexible Display Market By Application

11.3.3 Western Europe

11.3.3.1 Western Europe Flexible Display Market by Country

11.3.3.2 Western Europe Flexible Display Market By Panel Size

11.3.3.3 Western Europe Flexible Display Market By Display Size

11.3.3.4 Western Europe Flexible Display Market By Substrate Material

11.3.3.5 Western Europe Flexible Display Market By Application

11.3.3.6 Germany

11.3.3.6.1 Germany Flexible Display Market By Panel Size

11.3.3.6.2 Germany Flexible Display Market By Display Size

11.3.3.6.3 Germany Flexible Display Market By Substrate Material

11.3.3.6.4 Germany Flexible Display Market By Application

11.3.3.7 France

11.3.3.7.1 France Flexible Display Market By Panel Size

11.3.3.7.2 France Flexible Display Market By Display Size

11.3.3.7.3 France Flexible Display Market By Substrate Material

11.3.3.7.4 France Flexible Display Market By Application

11.3.3.8 UK

11.3.3.8.1 UK Flexible Display Market By Panel Size

11.3.3.8.2 UK Flexible Display Market By Display Size

11.3.3.8.3 UK Flexible Display Market By Substrate Material

11.3.3.8.4 UK Flexible Display Market By Application

11.3.3.9 Italy

11.3.3.9.1 Italy Flexible Display Market By Panel Size

11.3.3.9.2 Italy Flexible Display Market By Display Size

11.3.3.9.3 Italy Flexible Display Market By Substrate Material

11.3.3.9.4 Italy Flexible Display Market By Application

11.3.3.10 Spain

11.3.3.10.1 Spain Flexible Display Market By Panel Size

11.3.3.10.2 Spain Flexible Display Market By Display Size

11.3.3.10.3 Spain Flexible Display Market By Substrate Material

11.3.3.10.4 Spain Flexible Display Market By Application

11.3.3.11 Netherlands

11.3.3.11.1 Netherlands Flexible Display Market By Panel Size

11.3.3.11.2 Netherlands Flexible Display Market By Display Size

11.3.3.11.3 Netherlands Flexible Display Market By Substrate Material

11.3.3.11.4 Netherlands Flexible Display Market By Application

11.3.3.12 Switzerland

11.3.3.12.1 Switzerland Flexible Display Market By Panel Size

11.3.3.12.2 Switzerland Flexible Display Market By Display Size

11.3.3.12.3 Switzerland Flexible Display Market By Substrate Material

11.3.3.12.4 Switzerland Flexible Display Market By Application

11.3.3.13 Austria

11.3.3.13.1 Austria Flexible Display Market By Panel Size

11.3.3.13.2 Austria Flexible Display Market By Display Size

11.3.3.13.3 Austria Flexible Display Market By Substrate Material

11.3.3.13.4 Austria Flexible Display Market By Application

11.3.3.14 Rest of Western Europe

11.3.3.14.1 Rest of Western Europe Flexible Display Market By Panel Size

11.3.3.14.2 Rest of Western Europe Flexible Display Market By Display Size

11.3.3.14.3 Rest of Western Europe Flexible Display Market By Substrate Material

11.3.3.14.4 Rest of Western Europe Flexible Display Market By Application

11.4 Asia-Pacific

11.4.1 Trend Analysis

11.4.2 Asia-Pacific Flexible Display Market by Country

11.4.3 Asia-Pacific Flexible Display Market By Panel Size

11.4.4 Asia-Pacific Flexible Display Market By Display Size

11.4.5 Asia-Pacific Flexible Display Market By Substrate Material

11.4.6 Asia-Pacific Flexible Display Market By Application

11.4.7 China

11.4.7.1 China Flexible Display Market By Panel Size

11.4.7.2 China Flexible Display Market By Display Size

11.4.7.3 China Flexible Display Market By Substrate Material

11.4.7.4 China Flexible Display Market By Application

11.4.8 India

11.4.8.1 India Flexible Display Market By Panel Size

11.4.8.2 India Flexible Display Market By Display Size

11.4.8.3 India Flexible Display Market By Substrate Material

11.4.8.4 India Flexible Display Market By Application

11.4.9 Japan

11.4.9.1 Japan Flexible Display Market By Panel Size

11.4.9.2 Japan Flexible Display Market By Display Size

11.4.9.3 Japan Flexible Display Market By Substrate Material

11.4.9.4 Japan Flexible Display Market By Application

11.4.10 South Korea

11.4.10.1 South Korea Flexible Display Market By Panel Size

11.4.10.2 South Korea Flexible Display Market By Display Size

11.4.10.3 South Korea Flexible Display Market By Substrate Material

11.4.10.4 South Korea Flexible Display Market By Application

11.4.11 Vietnam

11.4.11.1 Vietnam Flexible Display Market By Panel Size

11.4.11.2 Vietnam Flexible Display Market By Display Size

11.4.11.3 Vietnam Flexible Display Market By Substrate Material

11.4.11.4 Vietnam Flexible Display Market By Application

11.4.12 Singapore

11.4.12.1 Singapore Flexible Display Market By Panel Size

11.4.12.2 Singapore Flexible Display Market By Display Size

11.4.12.3 Singapore Flexible Display Market By Substrate Material

11.4.12.4 Singapore Flexible Display Market By Application

11.4.13 Australia

11.4.13.1 Australia Flexible Display Market By Panel Size

11.4.13.2 Australia Flexible Display Market By Display Size

11.4.13.3 Australia Flexible Display Market By Substrate Material

11.4.13.4 Australia Flexible Display Market By Application

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Flexible Display Market By Panel Size

11.4.14.2 Rest of Asia-Pacific Flexible Display Market By Display Size

11.4.14.3 Rest of Asia-Pacific Flexible Display Market By Substrate Material

11.4.14.4 Rest of Asia-Pacific Flexible Display Market By Application

11.5 Middle East & Africa

11.5.1 Trend Analysis

11.5.2 Middle East

11.5.2.1 Middle East Flexible Display Market by Country

11.5.2.2 Middle East Flexible Display Market By Panel Size

11.5.2.3 Middle East Flexible Display Market By Display Size

11.5.2.4 Middle East Flexible Display Market By Substrate Material

11.5.2.5 Middle East Flexible Display Market By Application

11.5.2.6 UAE

11.5.2.6.1 UAE Flexible Display Market By Panel Size

11.5.2.6.2 UAE Flexible Display Market By Display Size

11.5.2.6.3 UAE Flexible Display Market By Substrate Material

11.5.2.6.4 UAE Flexible Display Market By Application

11.5.2.7 Egypt

11.5.2.7.1 Egypt Flexible Display Market By Panel Size

11.5.2.7.2 Egypt Flexible Display Market By Display Size

11.5.2.7.3 Egypt Flexible Display Market By Substrate Material

11.5.2.7.4 Egypt Flexible Display Market By Application

11.5.2.8 Saudi Arabia

11.5.2.8.1 Saudi Arabia Flexible Display Market By Panel Size

11.5.2.8.2 Saudi Arabia Flexible Display Market By Display Size

11.5.2.8.3 Saudi Arabia Flexible Display Market By Substrate Material

11.5.2.8.4 Saudi Arabia Flexible Display Market By Application

11.5.2.9 Qatar

11.5.2.9.1 Qatar Flexible Display Market By Panel Size

11.5.2.9.2 Qatar Flexible Display Market By Display Size

11.5.2.9.3 Qatar Flexible Display Market By Substrate Material

11.5.2.9.4 Qatar Flexible Display Market By Application

11.5.2.10 Rest of Middle East

11.5.2.10.1 Rest of Middle East Flexible Display Market By Panel Size

11.5.2.10.2 Rest of Middle East Flexible Display Market By Display Size

11.5.2.10.3 Rest of Middle East Flexible Display Market By Substrate Material

11.5.2.10.4 Rest of Middle East Flexible Display Market By Application

11.5.3 Africa

11.5.3.1 Africa Flexible Display Market by Country

11.5.3.2 Africa Flexible Display Market By Panel Size

11.5.3.3 Africa Flexible Display Market By Display Size

11.5.3.4 Africa Flexible Display Market By Substrate Material

11.5.3.5 Africa Flexible Display Market By Application

11.5.3.6 Nigeria

11.5.3.6.1 Nigeria Flexible Display Market By Panel Size

11.5.3.6.2 Nigeria Flexible Display Market By Display Size

11.5.3.6.3 Nigeria Flexible Display Market By Substrate Material

11.5.3.6.4 Nigeria Flexible Display Market By Application

11.5.3.7 South Africa

11.5.3.7.1 South Africa Flexible Display Market By Panel Size

11.5.3.7.2 South Africa Flexible Display Market By Display Size

11.5.3.7.3 South Africa Flexible Display Market By Substrate Material

11.5.3.7.4 South Africa Flexible Display Market By Application

11.5.3.8 Rest of Africa

11.5.3.8.1 Rest of Africa Flexible Display Market By Panel Size

11.5.3.8.2 Rest of Africa Flexible Display Market By Display Size

11.5.3.8.3 Rest of Africa Flexible Display Market By Substrate Material

11.5.3.8.4 Rest of Africa Flexible Display Market By Application

11.6 Latin America

11.6.1 Trend Analysis

11.6.2 Latin America Flexible Display Market by Country

11.6.3 Latin America Flexible Display Market By Panel Size

11.6.4 Latin America Flexible Display Market By Display Size

11.6.5 Latin America Flexible Display Market By Substrate Material

11.6.6 Latin America Flexible Display Market By Application

11.6.7 Brazil

11.6.7.1 Brazil Flexible Display Market By Panel Size

11.6.7.2 Brazil Flexible Display Market By Display Size

11.6.7.3 Brazil Flexible Display Market By Substrate Material

11.6.7.4 Brazil Flexible Display Market By Application

11.6.8 Argentina

11.6.8.1 Argentina Flexible Display Market By Panel Size

11.6.8.2 Argentina Flexible Display Market By Display Size

11.6.8.3 Argentina Flexible Display Market By Substrate Material

11.6.8.4 Argentina Flexible Display Market By Application

11.6.9 Colombia

11.6.9.1 Colombia Flexible Display Market By Panel Size

11.6.9.2 Colombia Flexible Display Market By Display Size

11.6.9.3 Colombia Flexible Display Market By Substrate Material

11.6.9.4 Colombia Flexible Display Market By Application

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Flexible Display Market By Panel Size

11.6.10.2 Rest of Latin America Flexible Display Market By Display Size

11.6.10.3 Rest of Latin America Flexible Display Market By Substrate Material

11.6.10.4 Rest of Latin America Flexible Display Market By Application

12. Company Profiles

12.1 LG Display Co., Ltd.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 The SNS View

12.2 Samsung Electronics

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 The SNS View

12.3 Innolux Corp.

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 The SNS View

12.4 AU Optronics

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 The SNS View

12.5 Japan Display Inc.

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 The SNS View

12.6 BOE Technology Group Co. Ltd.

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 The SNS View

12.7 Sharp Corp.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 The SNS View

12.8 Visionox Corporation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 The SNS View

12.9 E Ink Holdings, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 The SNS View

12.10 Kateeva

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 The SNS View

13. Competitive Landscape

13.1 Competitive Benchmarking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Panel Size

Up to 6"

6-20"

20-50"

Above 50"

By Substrate Material

Glass

Plastic

Others

By Technology

OLED Display

E-paper Display

Quantum dot LED Display

LED-Backlit LCD

By Application

Smartphone & Tablet

Smartwatches & Wearables

Television & Digital Signage Systems

PC Monitors & Laptops

E-reader

Electronic Shelf Labels (ESLS)

Vehicles & Public Transports

Smart Home Appliances

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Soil Moisture Sensor Market size was valued at USD 337 Million in 2023 and is expected to reach USD 1124.30 Million by 2032 at a CAGR of 14.33% during the forecast period of 2024-2032.

The Volumetric Video Market was valued at USD 2.4 Billion in 2023 and is expected to reach USD 21.5 Billion by 2032, growing at a CAGR of 27.74% from 2024-2032.

The Chiplet Market Size was valued at USD 6.70 Billion in 2023 and is Projected to grow at a CAGR of 73.01% to reach USD 1720.62 Billion by 2032.

The Physical Security Market Size was valued at USD 122.92 Billion in 2023 and will reach USD 200.81 Billion by 2032 & grow at a CAGR of 5.65% by 2024-2032.

The Gesture Recognition and touchless Sensing Market Size was valued at USD 19.4 billion in 2023 and is expected to reach USD 127.78 billion by 2032 and grow at a CAGR of 23.3 % over the forecast period 2024-2032.

The Automotive Backup Camera Market was valued at USD 1.70 billion in 2023 and is expected to grow at a CAGR of 12.50% to reach USD 4.91 billion by 2032.

Hi! Click one of our member below to chat on Phone