Get More Information on Flavor Enhancer Market - Request Sample Report

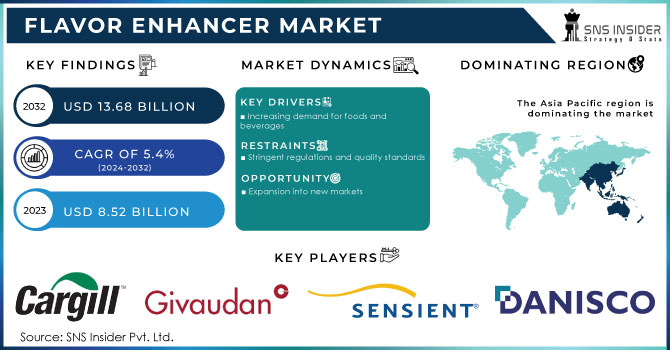

The Flavor Enhancer Market size was USD 8.52 billion in 2023, is expected to Reach USD 13.68 billion by 2032, and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

Flavor enhancers are substances that are added to food to enhance the taste of food. They do not have a taste of their own, but they are added by enhancing the existing flavors of food. Flavor enhancers are also used to make processed meats tastier and more appealing.

Based on Type, the Flavor enhancers are categorized into Acidulants, Glutamates, Yeast Extracts, Hydrolyzed Vegetable Proteins, and Others. The glutamates segment has a major share of 40% in 2022. Glutamates are amino acids found in a variety of meals, including meat, seafood, vegetables, and dairy products. They have a savory taste known as umami. Acidulants are the second most segment accounting for a share of 25%. Acidulants are food additives that are used to give food a sour or acidic flavor. They are also used to preserve food and to improve its flavor.

KEY DRIVERS

Increasing demand for foods and beverages

Flavor enhancers can be natural or synthetic additive materials. Some common natural flavor enhancers include salt, MSG, yeast extract, and hydrolyzed vegetable protein. Flavor enhancers are used to improve the taste and palatability of foods and beverages that have been processed and packaged. In processed meats such as hot dogs and sausages, yeast extract and hydrolyzed vegetable protein are widely employed. This is fueling demand for taste enhancers, which make these products more enticing to customers.

RESTRAIN

Stringent regulations and quality standards

The Codex Alimentarius Commission General Standard Food Additives establishes international guidelines for food additives. These criteria are used by regulatory agencies all across the world. specified criteria must be completed by manufacturers for their flavor enhancers to be of a specified standard. Stability, potency, and purity requirements may be added. Furthermore, producers must accurately and completely label their flavor enhancers.

OPPORTUNITY

Expansion into new markets

The need for flavor enhancers is rising in emerging nations since processed foods and beverages frequently contain a lot of flavor enhancers. Applications for flavor enhancers include processed convenience meals, meat and fish products, beverages, and many more. The demand for processed foods and beverages is rising in China, where the food industry is expanding quickly. The market for flavor enhancers is expanding into emerging markets, which is fueling this expansion. This expansion is brought by increased urbanization, rising disposable incomes, and shifting consumer preferences, as well as rising demand for processed foods and beverages.

CHALLENGES

Negative consumer perception

consumers who have a negative perception of flavor enhancers are less likely to purchase foods and beverages that contain flavor enhancers. Flavor enhancers can be complex chemicals, and some consumers may be concerned about the potential health risks associated with these chemicals. flavor enhancers have been linked to allergic reactions in some people.

Russia and Ukraine are major exporters of raw materials used in flavor enhancer manufacture, including cornstarch, yeast extract, and hydrolyzed vegetable proteins. The war has interrupted the availability of these raw materials, which is expected to result in higher pricing and flavor enhancer shortages. Flavor enhancer prices are predicted to rise by 5% in 2023. Flavor enhancer shortages are projected in various markets, including Europe and North America. The war's impact on the Asia Pacific flavor enhancers market is likely to be minimal. In Asia Pacific, flavor enhancer prices are predicted to rise by 6% in 2023.

The recession has impacted the flavor enhancer market. The global flavor enhancers market is predicted to grow at a slower rate in 2023 than it would have without the war. Food inflation is increase by 9% in 2022. Furthermore, the recession has reduced the supply and manufacture of enhancers. During a recession, food manufacturers may employ more flavor enhancers in their products to cut costs. In Europe, flavor enhancer prices are predicted to rise by 15% in 2023, with shortages conceivable.

by Type

Acidulants

Glutamates

Yeast Extracts

Hydrolyzed Vegetable Proteins

Others

by Application

Processed Convenience Foods

Meat and Fish Products

Beverages

Others

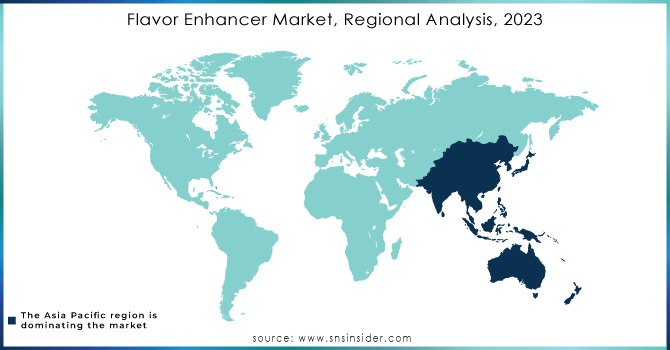

Asia Pacific is the fastest-growing market with a CAGR of 5.3% in 2022. The regional market is majorly driven by increasing demand for flavored milk and yogurt, which has been witnessing an increase in consumption across countries like Japan, China, Singapore, Thailand, and others that frequently use flavor enhancers in a variety of food preparations since they are low in salt and have other health advantages that are well-liked by the region's customers. China is the country with the highest MSG usage in noodles.

North America is the largest market for flavor enhancers market in 2022. The demand in the United States for flavor enhancers is estimated to grow at a CAGR of 4.8%. The increasing demand for processed foods and beverages, such as instant noodles, soups, sauces, and snacks, is driving the expansion of the flavor enhancers market. Flavor enhancers offer food manufacturers a convenient way to adjust shifting tastes and adapt to a wide range of taste preferences.

Europe has a significant market for flavor enhancers market in 2022. The increased demand for convenience foods and beverages, such as ready meals, soups, and sauces, is driving the expansion of the European flavor enhancers market. Ajinomoto Group, DuPont, Frutarom, and Symrise are among the major key players in the European flavor enhancers market.

Need any customization research on Flavor Enhancer Market- Enquiry Now

REGIONAL COVERAGE

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some major key players in the Torpedo Market are Cargill Inc., Givaudan, Tate & Lyle PLC, Sensient Technologies, Mane SA, Associated British Foods Plc., Danisco A/S, Corbion N.V., International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Firmenich SA, Quest Nutrition LLC, and other key players.

In 2023, International Flavors & Fragrances Inc. introduced ChoozIt Vintage to the American and Canadian markets. ChoozIt Vintage may be able to assist cheddar cheese producers in overcoming undesired flavor development during aging by giving highly consistent pH along with texture results through the ripening process.

In 2022, Givaudan launched NaNino+, a natural flavoring component that can be used to replace nitrites in processed meat. The product was initially introduced in Europe for emulsified cooked sausages, but its capabilities were later expanded to include cooked ham and bacon.

In 2022, International Trade Solutions introduced Vegan Boosts, a brand of natural flavor enhancers in powdered form. Additionally, businesses use flavor enhancers to boost the sensory appeal of bakery goods.

| Report Attributes | Details |

| Market Size in 2023 | USD 8.52 Billion |

| Market Size by 2032 | USD 13.68 Billion |

| CAGR | CAGR of 5.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acidulants, Glutamates, Yeast Extracts, Hydrolyzed Vegetable Proteins, Others) • By Application (Processed Convenience Foods, Meat and Fish Products, Beverages, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Cargill Inc., Givaudan, Tate & Lyle PLC, Sensient Technologies, Mane SA, Associated British Foods Plc., Danisco A/S, Corbion N.V., International Flavors & Fragrances Inc. (IFF), Takasago International Corporation, Firmenich SA, Quest Nutrition LLC |

| Key Drivers | • Increasing demand for foods and beverages |

| Market Restrain | • Stringent regulations and quality standards |

Ans: Flavor Enhancer Market is anticipated to expand by 5.4% from 2024 to 2032.

Ans: Increased demand for food and beverage are the drivers of the Flavor Enhancer Market.

Ans: USD 13.68 billion is expected to grow by 2032.

Ans: Asia Pacific is the fastest-growing Flavor Enhancer Market.

Ans: Stringent regulations and quality standards are the restraints of the Flavor Enhancer Market.

TABLE OF CONTENT

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine War

4.2 Impact of Ongoing Recession

4.3. Introduction

4.3.1 Impact on Major Economies

4.3.1.1 US

4.3.1.2 Canada

4.3.1.3 Germany

4.3.1.4 France

4.3.1.5 United Kingdom

4.3.1.6 China

4.3.1.7 Japan

4.3.1.8 South Korea

4.3.1.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Flavor Enhancer Market Segmentation, By Type

8.1 Acidulants

8.2 Glutamates

8.3 Yeast Extracts

8.4 Hydrolyzed Vegetable Proteins

8.5 Others

9. Flavor Enhancer Market Segmentation, By Application

9.1 Processed Convenience Foods

9.2 Meat and Fish Products

9.3 Beverages

9.4 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 North America Flavor Enhancer Market by Country

10.2.2 North America Flavor Enhancer Market by Type

10.2.3 North America Flavor Enhancer Market by Application

10.2.4 USA

10.2.4.1 USA Flavor Enhancer Market by Type

10.2.4.2 USA Flavor Enhancer Market by Application

10.2.5 Canada

10.2.5.1 Canada Flavor Enhancer Market by Type

10.2.5.2 Canada Flavor Enhancer Market by Application

10.2.6 Mexico

10.2.6.1 Mexico Flavor Enhancer Market by Type

10.2.6.2 Mexico Flavor Enhancer Market by Application

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Eastern Europe Flavor Enhancer Market by Country

10.3.1.2 Eastern Europe Flavor Enhancer Market by Type

10.3.1.3 Eastern Europe Flavor Enhancer Market by Application

10.3.1.4 Poland

10.3.1.4.1 Poland Flavor Enhancer Market by Type

10.3.1.4.2 Poland Flavor Enhancer Market by Application

10.3.1.5 Romania

10.3.1.5.1 Romania Flavor Enhancer Market by Type

10.3.1.5.2 Romania Flavor Enhancer Market by Application

10.3.1.6 Hungary

10.3.1.6.1 Hungary Flavor Enhancer Market by Type

10.3.1.6.2 Hungary Flavor Enhancer Market by Application

10.3.1.7 Turkey

10.3.1.7.1 Turkey Flavor Enhancer Market by Type

10.3.1.7.2 Turkey Flavor Enhancer Market by Application

10.3.1.8 Rest of Eastern Europe

10.3.1.8.1 Rest of Eastern Europe Flavor Enhancer Market by Type

10.3.1.8.2 Rest of Eastern Europe Flavor Enhancer Market by Application

10.3.2 Western Europe

10.3.2.1 Western Europe Flavor Enhancer Market by Country

10.3.2.2 Western Europe Flavor Enhancer Market by Type

10.3.2.3 Western Europe Flavor Enhancer Market by Application

10.3.2.4 Germany

10.3.2.4.1 Germany Flavor Enhancer Market by Type

10.3.2.4.2 Germany Flavor Enhancer Market by Application

10.3.2.5 France

10.3.2.5.1 France Flavor Enhancer Market by Type

10.3.2.5.2 France Flavor Enhancer Market by Application

10.3.2.6 UK

10.3.2.6.1 UK Flavor Enhancer Market by Type

10.3.2.6.2 UK Flavor Enhancer Market by Application

10.3.2.7 Italy

10.3.2.7.1 Italy Flavor Enhancer Market by Type

10.3.2.7.2 Italy Flavor Enhancer Market by Application

10.3.2.8 Spain

10.3.2.8.1 Spain Flavor Enhancer Market by Type

10.3.2.8.2 Spain Flavor Enhancer Market by Application

10.3.2.9 Netherlands

10.3.2.9.1 Netherlands Flavor Enhancer Market by Type

10.3.2.9.2 Netherlands Flavor Enhancer Market by Application

10.3.2.10 Switzerland

10.3.2.10.1 Switzerland Flavor Enhancer Market by Type

10.3.2.10.2 Switzerland Flavor Enhancer Market by Application

10.3.2.11 Austria

10.3.2.11.1 Austria Flavor Enhancer Market by Type

10.3.2.11.2 Austria Flavor Enhancer Market by Application

10.3.2.12 Rest of Western Europe

10.3.2.12.1 Rest of Western Europe Flavor Enhancer Market by Type

10.3.2.12.2 Rest of Western Europe Flavor Enhancer Market by Application

10.4 Asia-Pacific

10.4.1 Asia Pacific Flavor Enhancer Market by Country

10.4.2 Asia Pacific Flavor Enhancer Market by Type

10.4.3 Asia Pacific Flavor Enhancer Market by Application

10.4.4 China

10.4.4.1 China Flavor Enhancer Market by Type

10.4.4.2 China Flavor Enhancer Market by Application

10.4.5 India

10.4.5.1 India Flavor Enhancer Market by Type

10.4.5.2 India Flavor Enhancer Market by Application

10.4.6 Japan

10.4.6.1 Japan Flavor Enhancer Market by Type

10.4.6.2 Japan Flavor Enhancer Market by Application

10.4.7 South Korea

10.4.7.1 South Korea Flavor Enhancer Market by Type

10.4.7.2 South Korea Flavor Enhancer Market by Application

10.4.8 Vietnam

10.4.8.1 Vietnam Flavor Enhancer Market by Type

10.4.8.2 Vietnam Flavor Enhancer Market by Application

10.4.9 Singapore

10.4.9.1 Singapore Flavor Enhancer Market by Type

10.4.9.2 Singapore Flavor Enhancer Market by Application

10.4.10 Australia

10.4.10.1 Australia Flavor Enhancer Market by Type

10.4.10.2 Australia Flavor Enhancer Market by Application

10.4.11 Rest of Asia-Pacific

10.4.11.1 Rest of Asia-Pacific Flavor Enhancer Market by Type

10.4.11.2 Rest of Asia-Pacific Flavor Enhancer Market by Application

10.5 Middle East & Africa

10.5.1 Middle East

10.5.1.1 Middle East Flavor Enhancer Market by Country

10.5.1.2 Middle East Flavor Enhancer Market by Type

10.5.1.3 Middle East Flavor Enhancer Market by Application

10.5.1.4 UAE

10.5.1.4.1 UAE Flavor Enhancer Market by Type

10.5.1.4.2 UAE Flavor Enhancer Market by Application

10.5.1.5 Egypt

10.5.1.5.1 Egypt Flavor Enhancer Market by Type

10.5.1.5.2 Egypt Flavor Enhancer Market by Application

10.5.1.6 Saudi Arabia

10.5.1.6.1 Saudi Arabia Flavor Enhancer Market by Type

10.5.1.6.2 Saudi Arabia Flavor Enhancer Market by Application

10.5.1.7 Qatar

10.5.1.7.1 Qatar Flavor Enhancer Market by Type

10.5.1.7.2 Qatar Flavor Enhancer Market by Application

10.5.1.8 Rest of Middle East

10.5.1.8.1 Rest of Middle East Flavor Enhancer Market by Type

10.5.1.8.2 Rest of Middle East Flavor Enhancer Market by Application

10.5.2 Africa

10.5.2.1 Africa Flavor Enhancer Market by Country

10.5.2.2 Africa Flavor Enhancer Market by Type

10.5.2.3 Africa Flavor Enhancer Market by Application

10.5.2.4 Nigeria

10.5.2.4.1 Nigeria Flavor Enhancer Market by Type

10.5.2.4.2 Nigeria Flavor Enhancer Market by Application

10.5.2.5 South Africa

10.5.2.5.1 South Africa Flavor Enhancer Market by Type

10.5.2.5.2 South Africa Flavor Enhancer Market by Application

10.5.2.6 Rest of Africa

10.5.2.6.1 Rest of Africa Flavor Enhancer Market by Type

10.5.2.6.2 Rest of Africa Flavor Enhancer Market by Application

10.6 Latin America

10.6.1 Latin America Flavor Enhancer Market by Country

10.6.2 Latin America Flavor Enhancer Market by Type

10.6.3 Latin America Flavor Enhancer Market by Application

10.6.4 Brazil

10.6.4.1 Brazil Flavor Enhancer Market by Type

10.6.4.2 Brazil Flavor Enhancer Market by Application

10.6.5 Argentina

10.6.5.1 Argentina Flavor Enhancer Market by Type

10.6.5.2 Argentina Flavor Enhancer Market by Application

10.6.6 Colombia

10.6.6.1 Colombia Flavor Enhancer Market by Type

10.6.6.2 Colombia Flavor Enhancer Market by Application

10.6.7 Rest of Latin America

10.6.7.1 Rest of Latin America Flavor Enhancer Market by Type

10.6.7.2 Rest of Latin America Flavor Enhancer Market by Application

11. Company Profile

11.1 Cargill Inc.

11.1.1 Company Overview

11.1.2 Financials

11.1.3 Product/Services Offered

11.1.4 SWOT Analysis

11.1.5 The SNS View

11.2 Tate & Lyle PLC

11.2.1 Company Overview

11.2.2 Financials

11.2.3 Product/Services Offered

11.2.4 SWOT Analysis

11.2.5 The SNS View

11.3 Givaudan

11.3.1 Company Overview

11.3.2 Financials

11.3.3 Product/Services Offered

11.3.4 SWOT Analysis

11.3.5 The SNS View

11.4 Sensient Technologies

11.4 Company Overview

11.4.2 Financials

11.4.3 Product/Services Offered

11.4.4 SWOT Analysis

11.4.5 The SNS View

11.5 Mane SA

11.5.1 Company Overview

11.5.2 Financials

11.5.3 Product/Services Offered

11.5.4 SWOT Analysis

11.5.5 The SNS View

11.6 Associated British Foods Plc.

11.6.1 Company Overview

11.6.2 Financials

11.6.3 Product/Services Offered

11.6.4 SWOT Analysis

11.6.5 The SNS View

11.7 Danisco A/S

11.7.1 Company Overview

11.7.2 Financials

11.7.3 Product/Services Offered

11.7.4 SWOT Analysis

11.7.5 The SNS View

11.8 Corbion N.V.

11.8.1 Company Overview

11.8.2 Financials

11.8.3 Product/Services Offered

11.8.4 SWOT Analysis

11.8.5 The SNS View

11.9 International Flavors & Fragrances Inc.

11.9.1 Company Overview

11.9.2 Financials

11.9.3 Product/ Services Offered

11.9.4 SWOT Analysis

11.9.5 The SNS View

11.10 Takasago International Corporation

11.10.1 Company Overview

11.10.2 Financials

11.10.3 Product/Services Offered

11.10.4 SWOT Analysis

11.10.5 The SNS View

11.11 Firmenich SA

11.11.1 Company Overview

11.11.2 Financials

11.11.3 Product/Services Offered

11.11.4 SWOT Analysis

11.11.5 The SNS View

11.12 Quest Nutrition LLC

11.12.1 Company Overview

11.12.2 Financials

11.12.3 Product/Services Offered

11.12.4 SWOT Analysis

11.12.5 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. USE Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Modified Starch market was valued at US$ 11.22 billion in 2022, and is projected to reach at US$ 17.78 billion by 2030, growing at a CAGR of 5.92 % from 2023 to 2030.

The Alternative Protein Market size was valued at USD 14.84 billion in 2023 and is expected to grow to USD 32.36 billion by 2032, with a growing at CAGR of 9.08% over the forecast period of 2024-2032.

The Chicory Market Size was esteemed at USD 739.61 million in 2022 and is supposed to arrive at USD 1224.50 million by 2030 and develop at a CAGR of 6.5 % over the forecast period 2023-2030.

The Distillation Systems Market size was USD 7.7 billion in 2023 and is expected to reach USD 15.2 billion by 2032 and grow at a CAGR of 7.9 % over the forecast period of 2024-2032.

The Microencapsulation Market size was USD 11.9 billion in 2022 and is expected to Reach USD 25.88 billion by 2030 and grow at a CAGR of 10.2 % over the forecast period of 2023-2030.

The CBD-Infused Confectionery Market was worth USD 3.90 billion in 2023 and is expected to increase to USD 15.08 billion by 2032, experiencing a 16.22% CAGR from 2024 to 2032.

Hi! Click one of our member below to chat on Phone