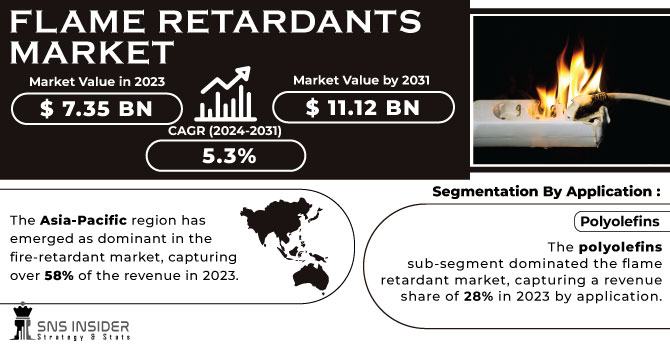

The Flame Retardants Market Size was valued at expected to reach USD 11.12 billion by 2031, and USD 7.35 billion in 2023 and grow at a CAGR of 5.3% over the forecast period 2024-2031.

The development of the flame retardants market plans to upgrade fire safety across different industries. The statistics are concerning: loss of lives, harm to property, and extreme burden on emergency services. Therefore, specialists are fixing fire wellbeing guidelines and carrying out more thorough structure principles, a pattern that is being noticed globally. In some cases, even non-combustible materials are expected for development projects in tall infrastructures. These factors can drive up the interest for flame retardants, which are used in a large number of utilizations, consequently reinforcing the market as producers endeavour to meet current safety goals. The U.S. fire safety landscape is receiving renewed attention, evidenced by the focus on standards and regulations at the recent 13th edition of "Fire Retardants in Plastics" conference held in April 2024. This industry event specifically addressed updates in testing, standards, and regulatory developments impacting the U.S. market for flame retardants.

Get More Information on Flame Retardants Market - Request Sample Report

The focus on sustainability and creative materials is driving the market towards eco-friendly fire extinguisher production in light of the rising interest for environmental cleanliness. Since the automotive industry focusses on plastics and minimizing weight to further develop vehicle range, there is a diminishing requirement for flame retardants. For instance, a recent study published in Flameretardants online (January 2023) underscores the critical need for advanced flame retardant solutions in the burgeoning electric vehicle (e-mobility) industry. This urgency stems from the inherent fire risks associated with the high energy densities and electrical currents present in electric vehicles. It shows a significant surge in flame retardant sales specifically for the e-mobility sector. Sales figures jumped from 2.2 million units to over 6.6 million in 2021, with projections exceeding 10.6 million units for 2022. This remarkable growth is attributed to the increasing use of plastics in electric vehicles to achieve weight reduction. To ensure safety, these plastics necessitate flame retardants in various components, including critical parts like cables, high-voltage connectors, battery housings, and adhesives. Because of the intrinsic instability of most plastics, fire retardants assume a critical part in wellbeing by preventing fires. These chemicals are essential in ensuring the wellbeing of electrical parts like cables, high-voltage connectors, composite battery casings, and components in vehicles. Also, fire retardants are utilized in adhesives and high-density foams normally utilized in vehicle manufacturing.

MARKET DYNAMICS

KEY DRIVERS:

Rising need for flame retardants across different industries is being fuelled by stringent fire safety regulations.

Severe fire security guidelines fiercely impact the flame retardants market. Because of the expanded implementation of strict fire safety guidelines by government and industrial firms, flame retardants are expected in different applications. This legal framework powers organizations in various industries to abide by the rules. Materials' fire execution necessities are framed in building guidelines, with an emphasis on demanding flame resistant characteristics in critical sectors like electrical wiring, insulation, and primary components. These regulations play a significant part in protecting the integrity of buildings and diminishing the risk of dangerous flames. In order to fulfil safety requirements and lower the risk of fires, flame retardants are frequently required by laws outside of the building industry. Numerous sectors, including electronics, transportation, furniture, and textiles, are subject to these restrictions.

RESTRAIN:

Flame retardants that are traditional raise concerns about the environment and health because they persist and may be linked to neurological problems.

Although flame retardants are essential for fire safety, there are drawbacks to many conventional methods. These are extremely dangerous for the environment and public health, especially if they include chlorine or bromine. These compounds are known as persistent organic pollutants (POPs) because of their long-term persistence in the environment, which causes them to accumulate in organisms and harm ecosystems. Regulations restricting the use of specific flame retardants and a drive for environmentally friendly substitutes have resulted from worries about these detrimental impacts on the environment. Regrettably, certain flame retardants cause health problems for people and may also function as endocrine disruptors, which might affect how the body regulates hormones. There is now more public desire to lessen or remove these chemicals from consumer items as a result of growing health concerns.

OPPORTUNITY:

Increase in global infrastructure, electric car usage, and renewable energy is driving up the demand for wires and cables.

The wire and cable manufacturing industry connects diverse systems and advances technology, making it the backbone of the modern world. These fundamental components enable the transfer of electricity and information across several sectors, supporting anything from utilities to structures and transportation networks. The growing urbanisation and infrastructural development in emerging nations is driving significant growth in this industry. Furthermore, the growing demand for electric cars calls for the creation of specialised cables to fulfil their particular power needs. This growing need is further amplified by the proliferation of renewable energy systems. In order to transfer renewable energy sources like solar and wind power effectively, which are becoming more and more prevalent on the global energy grid, specialised cables are essential.

KEY MARKET SEGMENTS

By Type

Aluminum Trihydrate

Antimony Oxide

Brominated

Chlorinated

Phosphorous

Nitrogen

Others

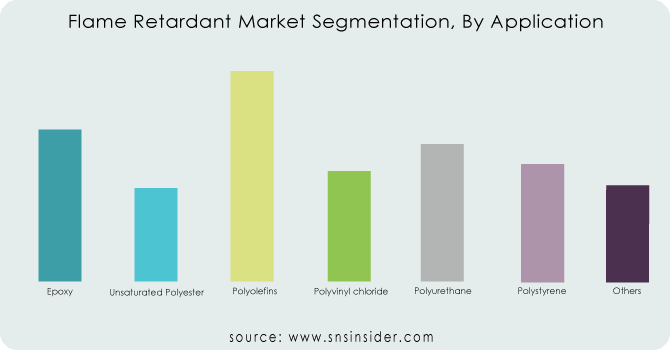

By Application

Epoxy

Unsaturated Polyester

Polyolefins

Polyvinyl chloride

Polyurethane

Polystyrene

Others

In 2023, polyolefins are the dominating segment in the flame retardants market, with a market share of 28% based on application. This dominance originates from wide utilization of polyolefins as polymers in different applications. These plastics consolidate flame retardants to accomplish three essential targets: confining the spread of blazes, preventing polymer leakage, and limiting smoke generation. Flame retardant polyolefins are fundamental for a range of products, including roofing materials, sleeping pad covers, development textures, and parts for vehicles and airplane. Regardless of being broadly used for link protection and family purposes, for example, window outlines, and showing solid protection from burning, polyvinyl chloride (PVC) presents security concerns.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By End-Use Industry

Building & Construction

Electronics & Appliances

Automotive & Transportation

Wires & Cable

Textile

Others

The electrical and appliances segment dominated the flame retardants market, which represented more than 40% of the market share in 2023. Flame retardants are coordinated into the plastic housings of electrical devices to ensure consumer safety and prevent fire. With the business' development and expanding public focus fire safety, there is a normal steady ascent in the demand for flame retardants all throughout the forecast period. This increase is basically credited to increasing awareness with fire risks and the growing focus on fire safety in building constructions. Integrating fire resistant materials into building plan and development has turned into a first concern for building experts, designers, and proprietors because of these reasons.

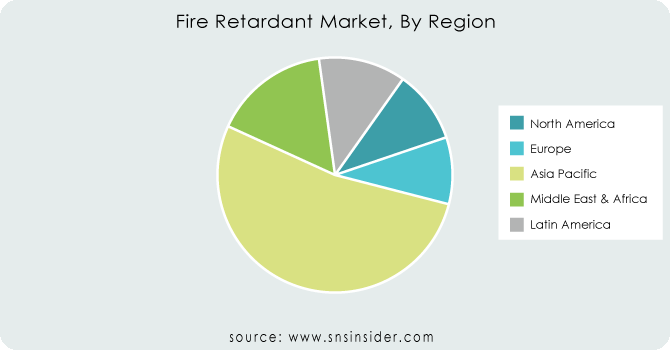

The Asia-Pacific region dominated the flame retardants market with a market share of more than 58% in 2023, laying down a good foundation for itself as a key part. This predominant position is credited to various factors. Strict fire safety regulations in different industries are moving the reception of insulating frameworks. The interest for these materials is on the ascent in areas like construction, automotive, and electrical and electronics. In 2021, around 4,348 fire incidents were accounted for in residential buildings, 274 in commercial infrastructures and around 64 cases in manufacturing plants. Various residential fires in India have been noticed mainly due to electrical reasons, including defective wiring, over-burden circuits, or the utilization of fake electrical parts. These flames frequently bring about losses and property damage. The risks of fire and the significance of fire safety measures, such as the use of flame-retardant materials, have been brought to people attention as a result of these incidents. Furthermore, the Asia-Pacific region is home to a critical number of facilities that produce flame resistant materials, with China and India starting to lead the pack. The market in this region is growing, driven to some degree by the rising spotlight on wellbeing and continuous foundation improvement endeavors in developed countries like China, India, and Japan.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Some of the major players in the Flame Retardants Market are Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), Avient Corporation (US), and other players.

January 2024: The LEHVOSS Group renewed its dedication to improving pultrusion technology in the business by entering the European Pultrusion Technology Association (EPTA).

September 2023: SAYTEX 621, a flame retardant that combines polyester resin and brominated polystyrene physically, was introduced by Albemarle Corporation. At around 64%, this low-dust pellet has a high bromine concentration.

October 2023: Huizhou's Daya Bay hosted the grand opening of an innovative production plant by sustainability Clariant, a pioneer in flame retardants. Their first production line, specializing in cutting-edge, environmentally safe Exolit OP flame retardants, is launched with this CHF 60 million investment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7.35 billion |

| Market Size by 2031 | US$ 11.12 Billion |

| CAGR | CAGR of 5.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Aluminum Trihydrate, Antimony Oxide, Brominated, Chlorinated, Phosphorous, Nitrogen) •By Application (Epoxy, Unsaturated Polyester, Polyolefin, Polyvinyl Chloride, Polyurethane, Polystyrene) •By End-Use Industry (Building & Construction, Electronics & Appliances, Automotive & Transportation, Wires & Cable, Textile and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Albemarle Corporation (US), Clariant AG (Switzerland), LANXESS AG (Germany), BASF SE (Germany), ICL Group Ltd. (Israel), Nabaltec AG (Germany), Huber Engineered Materials (US), ADEKA Corporation (Japan), Italmatch Chemicals S.p.A. (Italy), Avient Corporation (US), and other players |

| Key Drivers | • Rising need for flame retardants across different industries is being fuelled by stringent fire safety regulations. |

| Opportunities | •Increase in global infrastructure, electric car usage, and renewable energy is driving up the demand for wires and cables. |

| RESTRAINTS | • Flame retardants that are traditional raise concerns about the environment and health because they persist and may be linked to neurological problems. |

Ans: The Flame Retardants Market is expected to grow at a CAGR of 5.3%.

Ans: Flame Retardants Market size was USD 7.35 billion in 2023 and is expected to Reach USD 11.12 billion by 2031.

Ans: Stricter fire safety regulations and development of powerful flame retardant synergists.

Ans: flame retardants linger in the environment and might harm our brains, raising eco and health red flags.

Ans: Asia-Pacific is expected to hold the largest market share in the global Flame Retardants Market during the forecast period.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Flame Retardants Market Segmentation, By Type

7.1 Introduction

7.2 Aluminum Trihydrate

7.3 Antimony Oxide

7.4 Brominated

7.5 Chlorinated

7.6 Phosphorous

7.7 Nitrogen

7.8 Others

8. Flame Retardants Market Segmentation, By Application

8.1 Introduction

8.2 Epoxy

8.3 Unsaturated Polyester

8.4 Polyolefins

8.5 Polyvinyl chloride

8.6 Polyurethane

8.7 Polystyrene

8.8 Others

9. Flame Retardants Market Segmentation, By End-Use Industry

9.1 Introduction

9.2 Building & Construction

9.3 Electronics & Appliances

9.4 Automotive & Transportation

9.5 Wires & Cable

9.6 Textile

9.7 Others

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Flame Retardants Market by Country

10.2.3 North America Flame Retardants Market By Type

10.2.4 North America Flame Retardants Market By Application

10.2.5 North America Flame Retardants Market By End-Use Industry

10.2.6 USA

10.2.6.1 USA Flame Retardants Market By Type

10.2.6.2 USA Flame Retardants Market By Application

10.2.6.3 USA Flame Retardants Market By End-Use Industry

10.2.7 Canada

10.2.7.1 Canada Flame Retardants Market By Type

10.2.7.2 Canada Flame Retardants Market By Application

10.2.7.3 Canada Flame Retardants Market By End-Use Industry

10.2.8 Mexico

10.2.8.1 Mexico Flame Retardants Market By Type

10.2.8.2 Mexico Flame Retardants Market By Application

10.2.8.3 Mexico Flame Retardants Market By End-Use Industry

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Flame Retardants Market by Country

10.3.2.2 Eastern Europe Flame Retardants Market By Type

10.3.2.3 Eastern Europe Flame Retardants Market By Application

10.3.2.4 Eastern Europe Flame Retardants Market By End-Use Industry

10.3.2.5 Poland

10.3.2.5.1 Poland Flame Retardants Market By Type

10.3.2.5.2 Poland Flame Retardants Market By Application

10.3.2.5.3 Poland Flame Retardants Market By End-Use Industry

10.3.2.6 Romania

10.3.2.6.1 Romania Flame Retardants Market By Type

10.3.2.6.2 Romania Flame Retardants Market By Application

10.3.2.6.4 Romania Flame Retardants Market By End-Use Industry

10.3.2.7 Hungary

10.3.2.7.1 Hungary Flame Retardants Market By Type

10.3.2.7.2 Hungary Flame Retardants Market By Application

10.3.2.7.3 Hungary Flame Retardants Market By End-Use Industry

10.3.2.8 Turkey

10.3.2.8.1 Turkey Flame Retardants Market By Type

10.3.2.8.2 Turkey Flame Retardants Market By Application

10.3.2.8.3 Turkey Flame Retardants Market By End-Use Industry

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Flame Retardants Market By Type

10.3.2.9.2 Rest of Eastern Europe Flame Retardants Market By Application

10.3.2.9.3 Rest of Eastern Europe Flame Retardants Market By End-Use Industry

10.3.3 Western Europe

10.3.3.1 Western Europe Flame Retardants Market by Country

10.3.3.2 Western Europe Flame Retardants Market By Type

10.3.3.3 Western Europe Flame Retardants Market By Application

10.3.3.4 Western Europe Flame Retardants Market By End-Use Industry

10.3.3.5 Germany

10.3.3.5.1 Germany Flame Retardants Market By Type

10.3.3.5.2 Germany Flame Retardants Market By Application

10.3.3.5.3 Germany Flame Retardants Market By End-Use Industry

10.3.3.6 France

10.3.3.6.1 France Flame Retardants Market By Type

10.3.3.6.2 France Flame Retardants Market By Application

10.3.3.6.3 France Flame Retardants Market By End-Use Industry

10.3.3.7 UK

10.3.3.7.1 UK Flame Retardants Market By Type

10.3.3.7.2 UK Flame Retardants Market By Application

10.3.3.7.3 UK Flame Retardants Market By End-Use Industry

10.3.3.8 Italy

10.3.3.8.1 Italy Flame Retardants Market By Type

10.3.3.8.2 Italy Flame Retardants Market By Application

10.3.3.8.3 Italy Flame Retardants Market By End-Use Industry

10.3.3.9 Spain

10.3.3.9.1 Spain Flame Retardants Market By Type

10.3.3.9.2 Spain Flame Retardants Market By Application

10.3.3.9.3 Spain Flame Retardants Market By End-Use Industry

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Flame Retardants Market By Type

10.3.3.10.2 Netherlands Flame Retardants Market By Application

10.3.3.10.3 Netherlands Flame Retardants Market By End-Use Industry

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Flame Retardants Market By Type

10.3.3.11.2 Switzerland Flame Retardants Market By Application

10.3.3.11.3 Switzerland Flame Retardants Market By End-Use Industry

10.3.3.12 Austria

10.3.3.12.1 Austria Flame Retardants Market By Type

10.3.3.12.2 Austria Flame Retardants Market By Application

10.3.3.12.3 Austria Flame Retardants Market By End-Use Industry

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Flame Retardants Market By Type

10.3.3.13.2 Rest of Western Europe Flame Retardants Market By Application

10.3.3.13.3 Rest of Western Europe Flame Retardants Market By End-Use Industry

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Flame Retardants Market by Country

10.4.3 Asia-Pacific Flame Retardants Market By Type

10.4.4 Asia-Pacific Flame Retardants Market By Application

10.4.5 Asia-Pacific Flame Retardants Market By End-Use Industry

10.4.6 China

10.4.6.1 China Flame Retardants Market By Type

10.4.6.2 China Flame Retardants Market By Application

10.4.6.3 China Flame Retardants Market By End-Use Industry

10.4.7 India

10.4.7.1 India Flame Retardants Market By Type

10.4.7.2 India Flame Retardants Market By Application

10.4.7.3 India Flame Retardants Market By End-Use Industry

10.4.8 Japan

10.4.8.1 Japan Flame Retardants Market By Type

10.4.8.2 Japan Flame Retardants Market By Application

10.4.8.3 Japan Flame Retardants Market By End-Use Industry

10.4.9 South Korea

10.4.9.1 South Korea Flame Retardants Market By Type

10.4.9.2 South Korea Flame Retardants Market By Application

10.4.9.3 South Korea Flame Retardants Market By End-Use Industry

10.4.10 Vietnam

10.4.10.1 Vietnam Flame Retardants Market By Type

10.4.10.2 Vietnam Flame Retardants Market By Application

10.4.10.3 Vietnam Flame Retardants Market By End-Use Industry

10.4.11 Singapore

10.4.11.1 Singapore Flame Retardants Market By Type

10.4.11.2 Singapore Flame Retardants Market By Application

10.4.11.3 Singapore Flame Retardants Market By End-Use Industry

10.4.12 Australia

10.4.12.1 Australia Flame Retardants Market By Type

10.4.12.2 Australia Flame Retardants Market By Application

10.4.12.3 Australia Flame Retardants Market By End-Use Industry

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Flame Retardants Market By Type

10.4.13.2 Rest of Asia-Pacific Flame Retardants Market By Application

10.4.13.3 Rest of Asia-Pacific Flame Retardants Market By End-Use Industry

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Flame Retardants Market by Country

10.5.2.2 Middle East Flame Retardants Market By Type

10.5.2.3 Middle East Flame Retardants Market By Application

10.5.2.4 Middle East Flame Retardants Market By End-Use Industry

10.5.2.5 UAE

10.5.2.5.1 UAE Flame Retardants Market By Type

10.5.2.5.2 UAE Flame Retardants Market By Application

10.5.2.5.3 UAE Flame Retardants Market By End-Use Industry

10.5.2.6 Egypt

10.5.2.6.1 Egypt Flame Retardants Market By Type

10.5.2.6.2 Egypt Flame Retardants Market By Application

10.5.2.6.3 Egypt Flame Retardants Market By End-Use Industry

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Flame Retardants Market By Type

10.5.2.7.2 Saudi Arabia Flame Retardants Market By Application

10.5.2.7.3 Saudi Arabia Flame Retardants Market By End-Use Industry

10.5.2.8 Qatar

10.5.2.8.1 Qatar Flame Retardants Market By Type

10.5.2.8.2 Qatar Flame Retardants Market By Application

10.5.2.8.3 Qatar Flame Retardants Market By End-Use Industry

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Flame Retardants Market By Type

10.5.2.9.2 Rest of Middle East Flame Retardants Market By Application

10.5.2.9.3 Rest of Middle East Flame Retardants Market By End-Use Industry

10.5.3 Africa

10.5.3.1 Africa Flame Retardants Market by Country

10.5.3.2 Africa Flame Retardants Market By Type

10.5.3.3 Africa Flame Retardants Market By Application

10.5.3.4 Africa Flame Retardants Market By End-Use Industry

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Flame Retardants Market By Type

10.5.3.5.2 Nigeria Flame Retardants Market By Application

10.5.3.5.3 Nigeria Flame Retardants Market By End-Use Industry

10.5.3.6 South Africa

10.5.3.6.1 South Africa Flame Retardants Market By Type

10.5.3.6.2 South Africa Flame Retardants Market By Application

10.5.3.6.3 South Africa Flame Retardants Market By End-Use Industry

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Flame Retardants Market By Type

10.5.3.7.2 Rest of Africa Flame Retardants Market By Application

10.5.3.7.3 Rest of Africa Flame Retardants Market By End-Use Industry

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Flame Retardants Market by country

10.6.3 Latin America Flame Retardants Market By Type

10.6.4 Latin America Flame Retardants Market By Application

10.6.5 Latin America Flame Retardants Market By End-Use Industry

10.6.6 Brazil

10.6.6.1 Brazil Flame Retardants Market By Type

10.6.6.2 Brazil Flame Retardants Market By Application

10.6.6.3 Brazil Flame Retardants Market By End-Use Industry

10.6.7 Argentina

10.6.7.1 Argentina Flame Retardants Market By Type

10.6.7.2 Argentina Flame Retardants Market By Application

10.6.7.3 Argentina Flame Retardants Market By End-Use Industry

10.6.8 Colombia

10.6.8.1 Colombia Flame Retardants Market By Type

10.6.8.2 Colombia Flame Retardants Market By Application

10.6.8.3 Colombia Flame Retardants Market By End-Use Industry

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Flame Retardants Market By Type

10.6.9.2 Rest of Latin America Flame Retardants Market By Application

10.6.9.3 Rest of Latin America Flame Retardants Market By End-Use Industry

11. Company Profiles

11.1 Albemarle Corporation (US)

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Clariant AG (Switzerland)

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 LANXESS AG (Germany)

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 BASF SE (Germany)

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 ICL Group Ltd. (Israel)

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 Nabaltec AG (Germany)

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Huber Engineered Materials (US)

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 ADEKA Corporation (Japan)

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Italmatch Chemicals S.p.A. (Italy)

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Avient Corporation (US)

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Graphene Market Size was valued at USD 366.5 Million in 2023. It is expected to grow to USD 4997.1 Million by 2032 and grow at a CAGR of 33.2% over the forecast period of 2024-2032.

The Cross Laminated Timber Market size was USD 1.39 billion in 2023 and is expected to reach USD 4.38 billion by 2032, growing at a CAGR of 13.6% during the forecast period from 2024 to 2032.

Explore the Fatty Acid Ester Market, including its applications in personal care, pharmaceuticals, and food. Learn about the rising demand for bio-based esters, eco-friendly products, and how fatty acid esters are used in cosmetics, lubricants, and more.

The Butyric Acid Market size was valued at USD 290.4 Million in 2023 and will reach to USD 715.6 Million by 2032 and grow at a CAGR of 10.6% by 2024-2032.

The Lignin Derivatives Market Size was USD 11.1 Billion in 2023 and is expected to reach USD 16.7 Billion by 2032 and grow at a CAGR of 4.7% by 2024-2032.

The Nano Adhesives Market Size was valued at USD 21.90 billion in 2023, and will reach USD 33.01 billion by 2032, and grow at a CAGR of 4.70% by 2024-2032.

Hi! Click one of our member below to chat on Phone