Fireproofing Materials Market Report Scope & Overview:

Get more information on Fireproofing Materials Market - Request Sample Report

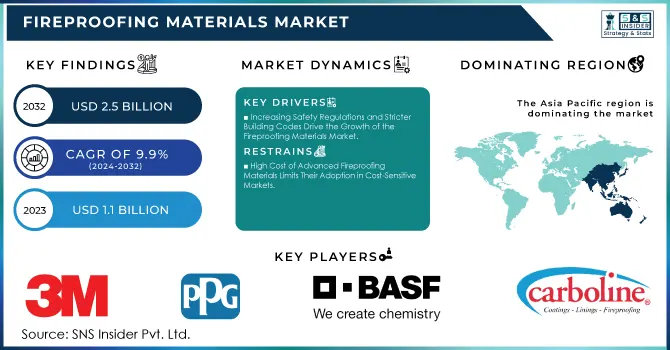

The Fireproofing Materials Market Size was valued at USD 1.1 billion in 2023 and is expected to reach USD 2.5 billion by 2032 and grow at a CAGR of 9.9% over the forecast period 2024-2032.

The fireproofing materials market has been experiencing significant growth, primarily driven by the demand for safety and regulatory compliance across various sectors, including construction, automotive, and industrial applications. Companies are continually innovating their fireproofing solutions to meet evolving industry requirements for enhanced fire resistance and sustainability. For example, Trelleborg introduced a lightweight fire-resistant material in June 2021, aimed at reducing weight while providing superior fire protection, particularly for high-risk environments like industrial and marine applications. This product demonstrates how companies are focusing on both performance and practicality in fireproofing materials, ensuring their solutions meet the needs of critical infrastructure projects.

Sustainability is increasingly becoming a central focus in the fireproofing materials market, with companies seeking eco-friendly alternatives to traditional fireproofing methods. In July 2023, researchers developed fireproof sheets made from fungal biomass that could serve as a sustainable, biodegradable option for residential buildings. These sheets, highlighted by New Scientist, mark a significant shift toward using organic materials for fire protection, showcasing the industry's move toward greener solutions. Similarly, Aludecor, in April 2024, showcased modern fire-retardant materials for architecture, emphasizing how fireproofing materials are being integrated into urban construction to meet aesthetic needs while adhering to stringent fire safety regulations. These advancements underscore the growing trend of combining sustainability with high-performance fire protection.

In the automotive sector, particularly for electric vehicles (EVs), fireproofing materials have become increasingly critical as companies address the fire risks associated with lithium-ion batteries. In April 2024, IDTechEx explored the role of fire-resistant materials in electric vehicle safety, as the demand for lightweight, high-performance materials continues to rise. As EV production ramps up globally, manufacturers are focusing on developing fireproof materials that not only ensure safety but also meet the performance needs of modern vehicles. This development highlights the importance of fireproofing in sectors beyond construction, reflecting how market dynamics are being shaped by emerging technologies and new applications.

The innovations in fireproofing materials are largely driven by companies' efforts to meet evolving regulatory standards and the increasing demand for sustainable, high-performance solutions. Trelleborg’s June 2021 release of a new lightweight fire-resistant material, New Scientist's July 2023 report on eco-friendly fungus-based fireproof sheets, and Aludecor’s April 2024 focus on modern fire-retardant materials for architecture exemplify the wide range of advancements in this market. Additionally, IDTechEx's April 2024 insights into fire protection materials for electric vehicles indicate how the fireproofing materials industry is expanding its scope beyond traditional applications, tapping into critical growth areas like electric mobility. These innovations, addressing both functional performance and sustainability, are reshaping the fireproofing materials market as companies continue to invest in cutting-edge technologies and eco-friendly solutions.

Market Dynamics:

Drivers:

-

Increasing Safety Regulations and Stricter Building Codes Drive the Growth of the Fireproofing Materials Market

The growing emphasis on fire safety regulations and stricter building codes is significantly driving the fireproofing materials market. Governments and regulatory bodies worldwide are introducing stringent standards for fire protection in construction and industrial applications to ensure public safety. This has led to increased demand for advanced fireproofing materials, such as intumescent coatings and cementitious materials, that meet these regulatory requirements. In sectors such as oil and gas, construction, and automotive, compliance with fire safety regulations has become a crucial factor for operational approvals and certifications. For example, in the automotive sector, particularly with electric vehicles, fireproofing materials are essential for battery safety, which has become a regulatory focus. This trend is not only boosting the consumption of fireproofing materials but also encouraging innovation, as manufacturers strive to develop new products that can provide superior fire resistance while complying with updated codes. The enforcement of these regulations has made fireproofing materials indispensable, fostering growth in both developed and developing economies.

-

Rising Demand for Fireproofing Solutions in High-Risk Industrial and Commercial Sectors Fuels Market Expansion

The increasing demand for fireproofing solutions in high-risk industrial and commercial sectors is driving market growth. Industries such as oil and gas, chemical manufacturing, power generation, and commercial construction are at high risk of fire hazards, making fireproofing a critical aspect of their safety protocols. In these industries, the use of fireproofing materials such as intumescent and cementitious coatings is essential to prevent structural damage and ensure safety in case of fire. As companies in these sectors expand and modernize their operations, the need for effective fireproofing solutions grows. Additionally, urbanization and infrastructure development in emerging economies have fueled the construction of high-rise buildings and commercial complexes, which require advanced fireproofing systems to comply with safety regulations. Fireproofing materials are also gaining traction in residential buildings, particularly in regions prone to wildfires. This expanding application base in high-risk sectors is boosting the demand for fireproofing materials across the globe.

Restraint:

-

High Cost of Advanced Fireproofing Materials Limits Their Adoption in Cost-Sensitive Markets

Despite the benefits offered by advanced fireproofing materials, their high cost is a significant restraint in the market, particularly in cost-sensitive regions. Products such as intumescent coatings and advanced passive fire protection materials, which offer superior fire resistance, tend to be more expensive than traditional fireproofing solutions. For industries operating on tight budgets or in emerging markets, where cost considerations are critical, the high price of these materials often limits their adoption. This can be especially challenging in regions where regulatory enforcement may not be as stringent, allowing businesses to opt for less costly, albeit less effective, fireproofing solutions. Furthermore, the installation and maintenance costs associated with some advanced fireproofing systems can add to the overall expenses, further deterring companies from investing in these technologies. As a result, the high cost remains a key barrier to widespread adoption, particularly in sectors and regions with cost constraints.

Opportunity:

-

Growing Adoption of Sustainable and Green Fireproofing Materials Creates New Opportunities for Market Players

The growing trend toward sustainability and the increasing demand for environmentally friendly building materials present a significant opportunity for the fireproofing materials market. As industries and governments worldwide push for greener solutions, manufacturers of fireproofing materials are focusing on developing eco-friendly alternatives to traditional fireproofing products. Materials made from natural, biodegradable, or recycled components are gaining popularity, especially in the construction and residential sectors. For instance, innovative fireproofing materials derived from fungal biomass or other organic sources have started to gain attention due to their lower environmental impact. These sustainable materials provide effective fire resistance while aligning with global sustainability goals, such as reducing carbon footprints and minimizing the use of hazardous chemicals. As the demand for green construction materials grows, market players that invest in the development of sustainable fireproofing solutions stand to gain a competitive edge. This trend is expected to open up new growth avenues for companies in the fireproofing materials market.

Challenge:

-

Technical Challenges in the Development of Highly Efficient and Lightweight Fireproofing Materials Hinder Market Progress

One of the major challenges in the fireproofing materials market is the technical complexity involved in developing highly efficient and lightweight fireproofing solutions. While there is a growing demand for materials that can provide superior fire resistance without adding excessive weight, particularly in industries like aerospace and automotive, achieving this balance is technically challenging. The development of such materials requires advanced formulations and manufacturing techniques, which can be both costly and time-consuming. Additionally, maintaining the integrity and durability of fireproofing materials under extreme conditions, such as high temperatures or prolonged exposure to fire, remains a significant challenge for manufacturers. Achieving the optimal combination of fire resistance, weight reduction, and durability often involves extensive research and testing, which can delay product launches and increase costs. As industries continue to push for more efficient solutions, overcoming these technical hurdles will be crucial for the advancement of the fireproofing materials market.

Key Market Segments

By Type

In 2023, intumescent coatings dominated the fireproofing materials market, holding a market share of over 35%. Intumescent coatings are widely preferred due to their ability to expand when exposed to heat, forming a protective char layer that insulates underlying structures from fire. This property makes them highly effective in applications such as structural steel protection in commercial and industrial buildings. Their aesthetic appeal and ease of application also contribute to their popularity. For example, in modern architectural projects, these coatings are increasingly used to ensure both safety and compliance with fire regulations without compromising the design. The demand for intumescent coatings has surged in sectors like oil and gas, where fire safety is critical.

By Application

In 2023, the industrial application segment dominated the fireproofing materials market with a market share of over 40%. Industrial facilities, particularly in high-risk sectors such as oil and gas, chemical manufacturing, and power generation, require advanced fireproofing solutions to safeguard critical infrastructure. These industries often use fireproofing materials to protect equipment, pipelines, and structural components from fire hazards. For instance, in oil refineries and chemical plants, fireproofing coatings are applied to steel structures to prevent catastrophic failures during fires. The strict safety regulations in these sectors further drive the demand for fireproofing materials, contributing to the dominance of the industrial segment in the market.

By End-User

The construction segment dominated the fireproofing materials market in 2023, accounting for a market share of over 45%. The construction industry extensively uses fireproofing materials in residential, commercial, and infrastructural projects to comply with stringent fire safety regulations. With the rapid urbanization and growth of high-rise buildings, particularly in emerging economies, the demand for fireproofing materials in construction has surged. Passive fire protection materials like cementitious coatings are commonly used to protect steel structures in large commercial complexes and public infrastructure. Additionally, as sustainability becomes a growing concern, green construction practices are incorporating fireproofing solutions that meet both safety standards and environmental criteria.

Regional Analysis

In 2023, the Asia Pacific region dominated the fireproofing materials market with a market share of over 40%. The region's dominance is attributed to rapid urbanization, industrialization, and infrastructure development, particularly in countries like China, India, and Japan. The construction boom in these countries, driven by increasing investments in commercial, residential, and public infrastructure, has significantly boosted the demand for fireproofing materials. For example, large-scale projects such as smart cities, industrial parks, and high-rise buildings in China have led to a surge in the use of passive fire protection materials to ensure compliance with stringent safety regulations. Moreover, the growing oil and gas industry in countries like Indonesia and Malaysia further fuels the demand for fireproofing solutions in industrial applications.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

3M (3M Fire Barrier Sealant, 3M DBI-SALA ExoFit NEX Harness)

-

Akzo Nobel N.V. (Interchar 1120, Interchar 2020)

-

BASF SE (MasterProtect 200, MasterSeal 200)

-

Carboline (Carbozinc 11, Pyrocrete 241)

-

Etex Group (Promat DURASTEEL, Promat SUPALUX)

-

FlameOFF Coatings Inc. (FlameOFF Fireproofing, FlameOFF F-120)

-

Hempel Group (Hempafire 600, Hempafire Pro 400)

-

Intumescent Systems Ltd (ISOLATEK Type M-II, ISOLATEK Type B)

-

Iris Coatings S.r.l (FireSafe Coating, FireProof Paint)

-

Isolatek International (Isolatek Type 400, Isolatek Type 100)

-

Jotun Group (Jotachar JF750, Jotafire 90)

-

Knauf Insulation (Knauf FireWall, Knauf Rock Mineral Wool)

-

PPG Industries, Inc. (PPG Envirocron, PPG Fire Protection Coatings)

-

PK Companies (PK 3500 Fireproofing, PK 1000 Intumescent Coating)

-

Rolf Kuhn GmbH (Rolf Kuhn Fireproof Paint, Rolf Kuhn Intumescent Coating)

-

RPM International Inc. (Tremco T-REM Firestop, Rust-Oleum Fire Retardant)

-

Sika AG (Sika FlameStop, Sika PUMPING FIRESTOP)

-

Sherwin-Williams Company (Sherwin-Williams Firetex, Sherwin-Williams Pyro-Guard)

-

Ugam Chemicals (Ugam Fire Retardant Coating, Ugam Intumescent Coating)

-

W.R. Grace & Co. (Grace Firestop, Grace Pyro-Guard)

Recent Developments

- September 2024: The Bureau of Indian Standards (BIS) mandated the use of fireproof furniture in public spaces across India, effective from October. This regulation aims to improve fire safety in high-traffic areas like hotels, malls, and educational institutions, driving demand for fire-resistant materials in furniture manufacturing.

- February 2024: Saint-Gobain acquired eco-friendly insulation maker ICC to enhance its fireproofing and insulation portfolio. ICC’s sustainable products, made from plant-based fibers and recycled materials, align with Saint-Gobain’s goal of achieving net-zero carbon emissions by 2050.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.1 Billion |

| Market Size by 2032 | US$ 2.5 Billion |

| CAGR | CAGR of 9.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Intumescent Coatings, Cementitious Coatings, Passive Fire Protection Materials, Others) •By Application (Residential, Commercial, Industrial, Infrastructure) •By End-User (Construction, Oil & Gas, Aerospace, Automotive, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | 3M (US), Akzo Nobel N.V. (Netherlands), Isolatek International (US), Sika AG (Switzerland), Etex Group (Belgium), PPG Industries, Inc. (US), BASF SE (Germany), Carboline (US), RPM International Inc. (US), Jotun Group (Norway), Iris Coatings S.r.l (Italy), Knauf Insulation (US), Hempel Group (Denmark), W.R. Grace & Co.(US), Rolf Kuhn GmbH (Germany), Ugam Chemicals (India), Intumescent Systems Ltd (UK), PK Companies (US), FlameOFF Coatings Inc.(US), Sherwin-williams Campany and other key players |

| Drivers | • Increasing Safety Regulations and Stricter Building Codes Drive the Growth of the Fireproofing Materials Market • Rising Demand for Fireproofing Solutions in High-Risk Industrial and Commercial Sectors Fuels Market Expansion |

| Restraints | • High Cost of Advanced Fireproofing Materials Limits Their Adoption in Cost-Sensitive Markets |