Fire-Resistant Coatings Market Report Scope & Overview:

Get More Information on Fire-Resistant Coatings Market - Request Sample Report

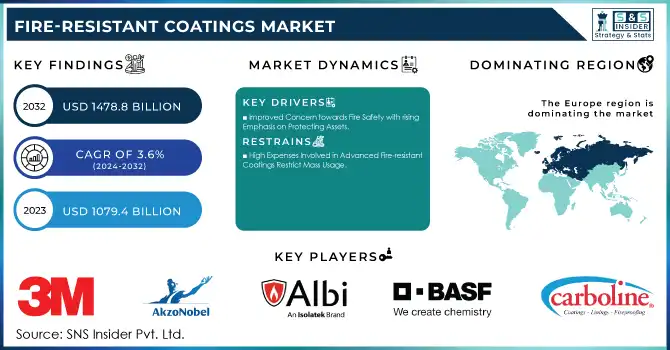

The Fire-resistant Coatings Market size was valued at USD 1079.4 million in 2023, and is expected to reach USD 1478.8 million by 2032, and grow at a CAGR of 3.6% over the forecast period 2024-2032.

The Fire-resistant Coatings Market is highly growth driven due to the increasing safety regulations, awareness of fire protection, and development in the construction and industrial sectors. Increasing demand for intumescent coatings, which expand upon heat exposure to form an insulating char layer, are among the significant market dynamics, while also developing eco-friendly and water-based formulations. Another reason for this influence is the requirement of multiple benefits coatings like corrosion resistance, aesthetic appeal, and fire protection. With the advancement of technology, more efficient and versatile fire-resistant coatings have been developed, which can resist higher temperatures and offer longer protection times.

Recent innovations of companies in the fire-resistant coatings market reflect the development and innovation of the industry. PPG launched PPG STEELGUARD 951 epoxy intumescent fire protection coating in the Americas in September 2024. The product can provide up to four hours of fire protection for advanced manufacturing facilities. In July 2023, Jotun increased the fire protection coating R&D facilities in Flixborough, UK. In August 2024, Hexion and Clariant announced an alliance that combines Hexion's vinyl ester-based binders with Clariant's intumescent additives for developing intumescent coatings. UNSW Sydney partnered with Flame Security International to produce a BAL-40 accredited fire-retardant paint called FSA FIRECOAT in November 2023. This fire-resistant paint is meant to safeguard homes from extreme bushfire conditions. December 2024: Cal Fire worked with universities to evaluate fire-resistant coatings under extreme conditions to improve wildfire protection strategies. An intumescent fire protective coating that improves steel protection was reported to be developed in April 2024, with improved performance in extreme fire scenarios. In September 2024, researchers found a chitosan itaconate-based fire-resistant coating for wood that was also non-flammable and highly effective in delaying ignition as well as flame spread. In June 2024, a bio-based PAbzPBA maize structure is introduced for improving fire protection along with the suppression of toxic gas and mechanical performance of intumescent flame-retardant epoxy coatings. During July 2024, scientists discovered an eco-friendly procedure to formulate waterborne polyurethane-based fire-resistant and waterproof coatings for wood protection. In March 2022, researchers at Texas A&M University developed a fire retardant coating made up of renewable, nontoxic material and revealed that there is work ongoing in developing sustainable protection mechanisms against fire.

Fire-resistant Coatings Market Dynamics:

Drivers:

-

Stricter Fire Safety Regulations and Codes Force Adoption of Fire Resistant Coatings

The adoption of more stringent fire safety regulations and building standards is a very significant driver for the industry of fire-resistant coatings in many countries. Authorities and regulatory bodies stress the requirement of fire protection in buildings, infrastructure, and industrial sites. Such regulations require construction and renovation projects to contain fire-resistant materials and coatings. Therefore, the builders, architects, and property owners are using fire-resistant coatings in their construction to meet the compliance requirements. This trend is most dominant in the commercial, residential, and industrial fields where fire safety is an important factor. The coatings industry has developed advanced formulations that meet or exceed these regulatory standards, which has contributed to the growth of the market.

-

Improved Concern towards Fire Safety with rising Emphasis on Protecting Assets

-

Growing investment into industrial safety and protection is what propels the growth for this market.

The growing trend towards industrial safety and protection of assets is leading to an increased investment in fireproof coatings. Oil and gas, chemical manufacturing, as well as power generation units are more prone to fire hazards and are investing immensely in fire protection systems. This fire-resistant coating plays a very key role in protecting critical infrastructure, equipment, and personnel in such fire-prone environments. The coatings industry is actively responding by developing specialized products that possess the capability to withstand extreme temperatures and harsh chemical environments. This trend is not confined to new installations; there exists a burgeoning market for retrofitting existing industrial facilities with advanced fire-resistant coatings. The emphasis on minimizing downtime and safeguarding valuable assets is propelling the adoption of these coatings across a variety of industrial sectors.

Restraint:

-

High Expenses Involved in Advanced Fire-resistant Coatings Restrict Mass Usage

Opportunity:

-

Increasing Demand for Green and Environment-Friendly Fire-resistant Coating Products

The rising sustainability drive and growing environmental concern thus increase the significant opportunities for the fire-resistant coatings market. The demand for the latest eco-friendly coating solutions to provide fire protection effectively is on the rise while still having a benign effect on the environment. This drive promotes research and development towards water-based formulation, low-VOC, and coatings derived from renewable sources. Manufacturers are now working on bio-based materials and green chemistry approaches to develop sustainable fire-resistant coatings. Such eco-friendly options are more attractive in the sectors of green building construction and industries that are under strict environmental regulations. As sustainability is becoming a prime factor in the purchasing decision, companies that can provide effective, eco-friendly fire-resistant coatings will have a competitive advantage in the market.

-

Increasing Retrofitting and Upgrading Existing Structures Using Fire-resistant Coatings

Challenge:

-

Maintaining fire protection performance alongside other coating properties and aesthetic requirements

A key challenge in the fire-resistant coatings market is to reconcile fire protection performance with other desirable coating properties and aesthetic requirements. Fire resistance, the main purpose of such coatings, needs to be achieved along with durability, weather resistance, and ease of application performance criteria. Furthermore, in most applications, including architectural and decorative applications, the aesthetic appearance of the coating becomes an important aspect. It is tough to find the right balance between fire protection and appearance. Manufacturers have to find a formulation that not only would be good at giving good fire resistance but could also offer a wide range of colors, finishes, and textures to cater to the varying customer tastes. This has proven especially true in applications like high-end residential and commercial construction, where design aesthetics cannot be compromised when fire safety is concerned. Ongoing research is aimed at achieving multi-functional coatings that should meet these diverse requirements with no compromise on fire protection performance.

Environmental Impact Assessment of Fire-Resistant Coatings

Environmental Impact Assessment of fire-resistant coatings indicates a significant gap between powder coating and wet paint application. Powder coating has shown better environmental performance in various categories. There is almost no VOC, less energy consumption due to fewer curing times, and less waste generation due to high transfer efficiency. In addition, powder coating has less environmental impact on air quality and water pollution and also less carbon footprint than wet paint. All these factors make powder coating a more environmentally friendly fire-resistant coating that meets sustainability goals and regulatory requirements to reduce environmental impacts in the coating industry.

|

Impact Category |

Powder Coating |

Wet Paint |

|---|---|---|

|

VOC Emissions |

Minimal to zero |

Significant during application and drying |

|

Energy Efficiency |

Higher efficiency, shorter curing time |

Lower efficiency, longer drying time |

|

Waste Generation |

Low, with high transfer efficiency (60-90%) |

Higher, including liquid waste and solvents |

|

Resource Consumption |

Lower due to reusability of overspray |

Higher due to less efficient application |

|

Air Quality Impact |

Minimal impact on indoor and outdoor air quality |

Higher impact due to VOC emissions |

|

Water Pollution |

Minimal risk |

Higher risk from liquid waste and solvents |

|

Carbon Footprint |

Lower due to energy efficiency and minimal emissions |

Higher due to VOC emissions and energy use |

Fire-resistant Coatings Market Segments

By Type

Intumescent coatings dominated the Fire-resistant Coatings Market in 2023, accounting for more than 60% of the market. Intumescent coatings have emerged as the leading segment in the fire-resistant coatings market because of their excellent performance and versatility. When exposed to heat, they expand and create a protective char layer that insulates the underlying structure from fire. Their effectiveness in enhancing fire resistance across many applications-including steel, wood, and other substrates was the impetus behind their widespread acceptance. Of course, it is widely favored in construction because these coatings can maintain a building's aesthetic appeal but provide it with crucial protection against fires. Their ascendancy was furthered by research and development, which helped improve the formulations so that they could offer even better performance and environmental sustainability.

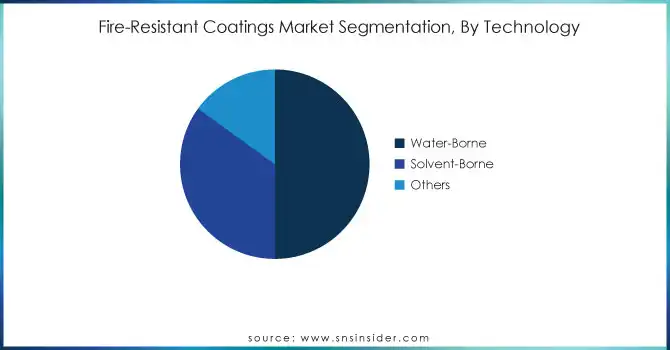

By Technology

Water-borne coatings dominated the Fire-resistant Coatings Market in 2023, with a market share of around 50%. The growing demand for fire-resistant coatings has been promoted through water-borne coatings since these coatings are environmentally friendly and easy to apply. In comparison to other coatings, the VOC emissions of these water-borne fire-resistant coatings are relatively low and satisfy stringent environmental regulations. These are key factors that support the growing focus on sustainability among the construction and industrial industries. These coating systems provide excellent adhesion to various substrates with good durability and hence could be used in both internal and external applications. With the increasing demand for ecological solutions in fire protection, water-borne coatings dominate the market.

By Resin Type

Epoxy-based coatings dominated and accounted for more than 40% of the market share in Fire-resistant Coatings Market in 2023. Epoxy-based fire-resistant coatings are enjoying a high market share as they offer excellent adhesion properties, durability, and chemical resistance. The epoxy-based coatings thus offer a robust barrier against fire and are more suitable to harsh environments, thus perfecting for industrial applications. Epoxy-based coatings have provided enhanced protection to steel structures in the oil and gas sector, manufacturing industry, and marine industries. They resist high temperatures, which helps protect these structures for an extended period, making it a choice in critical infrastructure projects where fire safety is highly essential.

By End Use Industry

Building & construction dominated and accounted for the highest market share of over 45% in 2023. The building and construction industry has emerged as the biggest end-user of fire-resistant coatings due to stringent fire safety regulations and growing awareness about fire protection in residential as well as commercial buildings. The rising number of tall buildings and focus on passive fire protection systems have increased the demand for fire-resistant coatings within this category. These are applied considerably on structural steel, concrete, and wood for improving fire resistance in buildings. Increasing urbanization trends and awareness of sustainable construction practices further speed up the adoption of fire-resistant coatings in the building and construction industries.

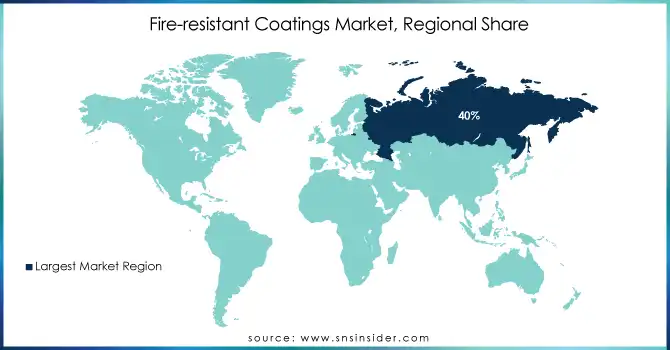

Fire-resistant Coatings Market Regional Analysis

Europe dominated the Fire-resistant Coatings Market in 2023, with a market share of over 40%. The dominance in the region can be ascribed to the stringent fire safety regulations, especially in the construction and industrial sectors. Europe's leadership can be ascribed to countries such as Germany and the UK, which have implemented more stringent fire protection standards. A strong focus on infrastructure development and renovation projects in the region has significantly boosted demand for fire-resistant coatings. For example, the European Union's focus on energy-efficient buildings has made these coatings more widely used in construction projects. Major industry players with products meeting European regulations, such as ICA Group's Prometea fire-retardant coatings, have furthered Europe's market position. Advanced manufacturing in the region, especially in the automotive and aerospace industries, has also boosted the demand for fire-resistant coatings. Countries like France, Italy, and Spain have witnessed increasing adoption in public buildings, including hospitals, theaters, and schools, which are aligned with EU fire prevention directives. In the Nordic countries, known for strict building codes, demand has been consistent for high-performance fire-resistant coatings, mainly in commercial and residential markets.

Moreover, Asia Pacific is the fastest-growing region in the Fire-resistant Coatings Market, growing at more than 6% CAGR. This high growth rate is attributed mainly to the region's fast-growing construction industry, rising urbanization, and growing fire safety measures awareness. China is at the top of the growth in the region, with massive infrastructure projects and stringent fire safety regulations in urban developments. The recent initiative of China to build Belt and Road has raised a strong demand for fire-resistant coatings, especially in the huge constructions across the country. Following it closely is India with its Smart Cities Mission, driving demand for advanced fire protection solutions for urban development. It's more so with IT and manufacturing sectors expanding across Bangalore, Chennai, and Hyderabad that have raised demand for fire-resistant coatings in industrial facilities. Countries like Vietnam, Indonesia, and Malaysia also are contributing factors for market growth, driven by rapid industrialization and foreign investments in construction. Japan, having an earthquake-resistant and fire-safe buildings concept, has remained a steady market for advanced fire-resistant coatings. Industrial applications have seen increasing adoption by automotive and electronics manufacturing hubs of this region, particularly South Korea and Taiwan. Due to the severe building codes and a heavy focus on bushfire protection, innovative applications of fire-resistant coatings are observed in urban and rural construction projects in Australia.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

3M (Fire Barrier Sealant IC 15WB+, Fire Barrier Water Tight Sealant 3000 WT)

-

AkzoNobel (Interchar 212, Interchar 3120)

-

Albi Protective Coatings (Albi Clad TF, Albi Clad TF+)

-

BASF SE (KBS Foamcoat, Palusol fire-protection panels)

-

Benjamin Moore & Co (Insl-x Fire Retardant Paint)

-

Carboline (Firefilm A4, A/D Firefilm III)

-

Contego International Inc. (Contego High Solids Intumescent Paint, Contego Reactive Fire Barrier Original Formula Intumescent Paint)

-

ETEX group (fire-resistant boards, fire-resistant spray mortar)

-

Flame Control Coatings, LLC (No. 10-10A, No. 20-20A)

-

Hempel (Hempafire Pro 400, Hempafire Pro 315)

-

Isolatek International (ISOLATEK Type 300, Firesolve SB)

-

Jotun (SteelMaster 1200WF, SteelMaster 600WF)

-

Kansai Paints (Kansai Nerolac Fire Coating)

-

Nippon Paint Co., Ltd. (HI-PON 600 HT PRIMER, HI-PON 600 HT TOP COAT)

-

No-Burn, Inc. (No-Burn Plus, No-Burn Original)

-

PPG Industries (PPG STEELGUARD, PPG PITT-CHAR NX)

-

RPM International (A/D FIREFILM III, Pyroclad)

-

Sherwin-Williams (FIRETEX FX6002, FIRETEX FX5120)

-

Sika (Sikaflex-400 Fire, SikaSeal-623 Fire+)

-

Teknos (TEKNOSAFE FLAME PROTECT 2408-00, HENSOTHERM 920 KS)

Recent Developments

-

March 2024: Max Tritremmel, fire protection specialist at Sherwin-Williams, will present the latest innovations in epoxy fireproofing, including Firetex FX9502. This novel coating makes shop-applied fire protection a competitive option against traditional methods.

-

June 2024: Evonik expands its TEGO Therm product line. These novel coatings offer heat protection and fire resistance for EV battery housings and covers, which is critical for preventing thermal runaway.

-

March 2023: RMP International Inc. acquired the company, NOW Specialties LLC. Based in Texas, the business specializes in producing and distributing Metal Composite Material and Aluminum Composite Material panels with an annual sales output of approximately $20 million. The acquisition will help reinforce RPM's Tremco Construction Products Group (Tremco CPG), even though terms of the transaction as well as NOW installation business are not disclosed.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1079.4 Billion |

| Market Size by 2032 | US$ 1478.8 Billion |

| CAGR | CAGR of 3.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (Intumescent, Cementitious) •By Technology (Water-borne, Solvent-borne, Others) •By Resin Type (Acrylic Epoxy, Silicone, Vinyl, Others) •By End Use Industry (Building & construction, Industrial, Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AkzoNobel, PPG, Jotun, Sherwin-Williams, Hempel, RPM International, Sika, ETEX group, Kansai Paints, Teknos and other key players |

| Key Drivers | •Improved Concern towards Fire Safety with rising Emphasis on Protecting Assets •Growing investment into industrial safety and protection is what propels the growth for this market |

| Restraints | •High Expenses Involved in Advanced Fire-resistant Coatings Restrict Mass Usage |