Fire Protection System Market Size & Overview:

The Fire Protection System Market, valued at USD 67.35 billion in 2023, is projected to reach USD 116.17 billion by 2032, growing at a CAGR of 6.25% over the forecast period 2024-2032.

The drivers being more investments for installation and services, lower failure ranges, more installation rates, and wider industrial adoption. Increasing compliance with safety regulations is pushing businesses to adopt fire protection solutions to minimize risks and meet legal requirements.

Get more information on Fire Protection System Market - Request Sample Report

Fire Protection System Market Dynamics

Drivers:

-

Rising Demand and Advancements in Fire Protection Systems

Increasing awareness regarding fire hazards and preventive measures is fueling the demand for fire protection systems in residential and commercial sectors. Due to stricter regulations and an increase in fire-related events, spending on technologies related to fire protection system detection, suppression, and prevention are increasing. The forward-looking, data-driven solutions would reduce response times by 30%, aided by technological rise in fire protection system engineering. Recent fire protection system innovations in fire suppression are expected to reduce damage costs by 50%. The IoT solutions are already getting mainstream, more than 70% of deaths occur in buildings that are not built with the most modern safety codes to prevent nearly 80% of industrial fires

Restraints:

-

Improper installation and maintenance leads to detection failures that have a major impact on fire protector systems.

Several restraints seen in the Fire Protection System Market is due to misuse of fire security system, malfunctioning of fire detection system, improper maintenance of fire security system, inadequate response towards fire and failure to follow safety procedures. Poor installation and maintenance cause 60% of fire alarm failures while 30% percent of fire suppression systems fail when activated. Improper calibration or environmental interference accounts for 90% failure rate of fire startups. 70% of fire sprinkler systems were prematurely disabled because of poor inspections. Even minor problems, such as low-temperature sprinklers or human error damages (for example, wrong appliance operation) can cause flooding (which can be expensive, along with clean-up costing around USD 1,000), therefore proper maintenance and replacement in a timely manner is important.

Opportunities:

-

Foam-Based Fire Protection and Suppression Systems Growth Potential

Emerging demand for foam-based fire detection and suppression systems creates lucrative market opportunities. Foams are increasingly accepted as being more effective in fighting flammable liquid fires, with faster extinguishment and less water than traditional systems. Foam solution seems to gain popularity among industrial, commercial and manufacturing industries. They are also being increasingly used in high-risk environments, such as chemical and oil refineries, for their superior performance. Furthermore, technological advancements continue to provide more effective, economical, and environmentally sustainable foam-based fire protection options, which contribute to the overall growth of the fire protection market.

Challenges:

-

Maintenance and calibration issues affect reliability and efficacy of fire Protection systems.

Failure to maintain and calibrate are the considerable components, resulting in delayed reactions in emergencies. Wiring issue, environmental interference, and component wear are often period performance issues of fire detection systems. In fact, this failure rate increases dramatically without regular inspections as improper installation has been identified as one of the major contributors to faulty fire alarms insufficient maintenance is one of the biggest reasons why fire suppression systems do not function as designed. This includes the impact of environmental variables on the decreased accuracy of detection, ultimately stymying the proper response.

Fire Protection System Market Segmentation Insights:

By Product

Fire Detection segment accounted for around 35% of the Fire Protection System Market in 2023. This pertains to devices such as smoke, flame, and heat detectors, which are indispensable for early detection of a fire. Future developments of IoT and AI innovations will be expected to enhance system performance and reliability, which will become the major driving factor for future growth.

Fire Suppression segment estimates the highest growth rate in the forecast period 2024-2032 and is further segmented due to advancements in sprinklers, foam, and gaseous suppression systems. The segment's growth will be propelled by a surge in adoption among industrial and commercial industries.

By Service

In 2023, the Installation and Design Service segment of the Fire Protection System Market held the highest share at 40%. Divided by the installation of fire detection and suppression systems in certain environments and under specific regulations. As safety needs become more complicated, so the demand for these services increases.

the maintenance service segment would witness the fastest growth through 2024-2032, as the advanced, Internet of Things (IoT), integrated solutions require consistent servicing to monitor and preserve the system reliability, compliance, and performance.

By Application

In 2023, the Commercial segment dominated the Fire Protection system market with a 49% market share, driven by growing safety regulations and the need for advanced fire detection and Suppression systems in commercial properties like office buildings, retail spaces, and other commercial establishments.

The Industrial segment is anticipated to be the fastest growing from 2024 to 2032 and this is attributed to the need for specialized fire protection in high-risk environments including manufacturing plants and chemical facilities. As a result, the growing adoption of sophisticated suppression systems and growing safety regulations in the industrial sector will contribute to this growth

Fire Protection System Market Regional Analysis:

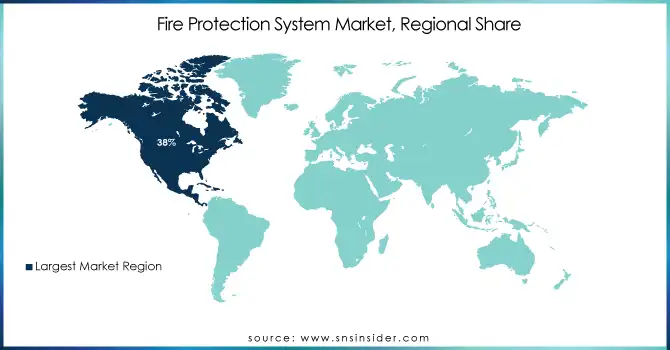

The Fire Protection System Market in North America accounted for nearly 38% of global revenue in 2023, supported by strict fire safety regulations, advancements in technology, and significant infrastructure investments. Smart fire detection and suppression systems, which rely on various components of IoT, AI and automation are strongest in the U.S. Canada's emphasis on high-risk industries by its regulatory framework, including oil and gas, also fosters growth in the market. As urbanization in the region continues, along with the growth of industrial establishments, and consistent integration of compliance into both commercial and residential spaces, North America is set to maintain its leading position in the Fire Protection System Market with integrated solutions becoming more popular.

Asia Pacific is the fastest-growing market for fire protection systems from 2024 to 2032 owing to rapid industrialization, urbanization, and regulatory pressure. With rapid infrastructure development, fire protection solutions are witnessing demand from countries like China, India, Japan, and South Korea. The market is further driven by increasing consciousness for fire safety and the implementation of sophisticated fire detection and suppression technologies in manufacturing, oil & gas, business and other sectors.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players:

Some of the major Players in Fire Protection System along with their products:

-

Carrier (U.S.) – Fire Protection & HVAC Systems

-

Eaton (Ireland) – Fire Protection Systems, Electrical Systems

-

Halma Plc (U.K.) – Fire Detection & Control Systems

-

Hochiki Corporation (Japan) – Fire Alarm Systems, Detection Systems

-

Honeywell International Inc. (U.S.) – Fire Detection, Suppression Systems

-

Johnson Controls (U.S.) – Fire Detection & Suppression Systems

-

Robert Bosch GmbH (Germany) – Fire Alarms, Security Systems

-

Schrack Seconet AG (Austria) – Fire Alarm Systems, Communication Systems

-

Schneider Electric (France) – Fire Detection, Control Systems

-

Siemens AG (Germany) – Fire Safety & Security Systems

-

GENTEX CORPORATION (U.S.) – Automotive Fire Detection Systems

-

Hitachi Ltd. (Japan) – Fire Detection & Control Systems

-

Iteris, Inc. (U.S.) – Fire Safety, Traffic Management Systems

-

Raytheon Technologies Corporation (U.S.) – Fire Detection Systems, Sensor Technology

-

Honeywell International Inc. (U.S.) – Fire Detection, Suppression Systems

List of suppliers providing raw materials and components for the Fire Protection System Market:

-

3M

-

Avery Dennison

-

ArcelorMittal

-

DuPont

-

Honeywell

-

Saint-Gobain

-

Owosso Motor Car Company

-

Dow Chemical Company

-

Firetrace

-

Lutron Electronics

-

Nitto Denko Corporation

-

Schneider Electric

-

Bosch

-

Tyco International

Recent Development

-

September 2, 2024 – ClassNK has granted its first-ever ‘AFVC’ notations to the LNG-fueled car carrier CERULEAN ACE operated by Mitsui O.S.K. Lines and managed by MOL Ship Management, in recognition of its advanced fire-fighting measures. The ship is classified with Fire Detection (FD), Fire Fighting (FF) and Enhanced Fixed Fire-extinguishing System (EFF) notations.

-

December 16, 2024 – Eaton Experience Centers in Pittsburgh and Houston provide real-world application environments, to train hands-on and advance education on electrical codes and standards including NFPA 70B. The 2023 edition of NFPA 70B includes new requirements for maintenance of energy transition technologies such as photovoltaic (PV) systems, wind power systems, battery energy storage systems, and EV power transfer systems.

| Report Attributes | Details |

| Market Size in 2023 | USD 67.35 Billion |

| Market Size by 2032 | USD 116.17 Billion |

| CAGR | CAGR of 6.25 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Fire Detection, Fire Suppression, Fire Response, Fire Analysis, Fire Sprinkler System) • By Service (Managed Service, Installation and Design Service, Maintenance Service, Others) • By Application(Commercial, Industrial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrier (U.S.), Eaton (Ireland), Halma Plc (U.K.), Hochiki Corporation (Japan), Honeywell International Inc. (U.S.), Johnson Controls (U.S.), Robert Bosch GmbH (Germany), Schrack Seconet AG (Austria), Schneider Electric (France), Siemens AG (Germany), GENTEX CORPORATION (U.S.), Hitachi Ltd. (Japan), Iteris, Inc. (U.S.), Raytheon Technologies Corporation (U.S.), Honeywell International Inc. (U.S.). |