Get more information on Fintech-as-a-Service (FaaS) Market - Request Sample Report

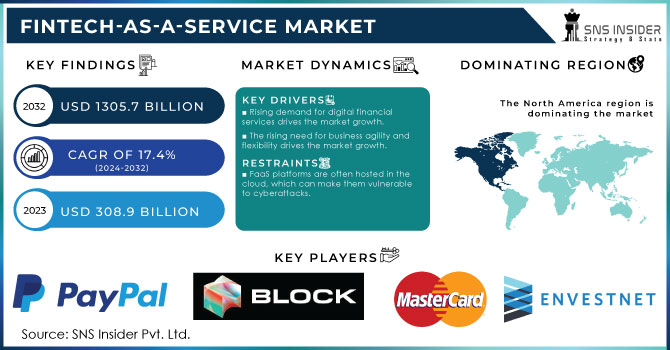

The Fintech-as-a-Service Market size was valued at USD 308.9 Billion in 2023. It is expected to grow to USD 1305.7 Billion by 2032 and grow at a CAGR of 17.4% over the forecast period of 2024-2032.

Solutions for fintech as a service provide a wide range of functions, such as card issuance, payment processing, and fraud detection. The market's expansion can be due to elements including the growing use of Artificial Intelligence technologies, mobile payments, and increased financial technology infrastructure investments. This growth was driven by the increasing adoption of FaaS by businesses of all sizes. The market is expanding as a result of the growing consumer preference for digital financial services. The market is expected to increase as a result of the widespread adoption of cutting-edge technologies including speech bots, open banking, blockchain technology, and big data analytics.

The continuous growth of a market is caused by two significant trends, including the increasing demand for the provision of digital solutions and the growth of regulatory requirements. Nowadays, clients and organizations try to use financial services that are available, operative, and convenient, which predetermines the demand for digital payment systems, lending solutions, and tools for investment management. According to the US. Census Bureau, US e-Commerce Sales Reach USD 1,000 billion in 2022, which underlines the focus on digital transactions and the necessity to develop Fintech solutions.

In addition, financial institutions are driven to look for FaaS solutions due to the dynamic of the regulatory environment. As standards for transparency, security, and consumer protections have become increasingly strict, fintech providers have developed tools that help streamline compliance. Therefore, while the customers seek digitalization, the credit institutions are often necessitated to adopt FaaS model due to the strictness of the regulations. As such, the combination of demands from customers and the need from the side of the regulatory entities creates an excellent environment for the FaaS market to grow. Therefore, Fintech-as-a-Service is poised for significant growth as it allows businesses to quickly adapt to the changes in the customer and the regulatory attitude.

Drivers

Rising demand for digital financial services drives the market growth.

The rising need for business agility and flexibility drives the market growth.

Increasing adoption of cloud computing drives the market growth.

The introduction of cloud computing emerges as a relevant trend that revolutionizes diverse industries and benefits market growth. Notable advancements in technology prompt businesses to adopt innovative solutions to optimize operational performance and extend their capabilities. Indeed, the U.S. Government Accountability Office report identified that implementation of cloud computing in the federal sector would allow taxpayers to save as much as USD 2 billion per annum related to IT spending by 2022. Furthermore, similar trends are identified in other industries, with companies relying on cloud technologies to reduce costs, facilitate work, and ensure collaboration.

Rapid deployment options provided by cloud services support the innovation process and help businesses adopt relevant services to meet market goals. Overall, as technologies continue to develop, demand for cloud computing increases, creating adequate market opportunities and facilitating future improvements in business model operations.

Restraint

FaaS platforms are often hosted in the cloud, which can make them vulnerable to cyberattacks.

FaaS platforms can be expensive, especially for small businesses.

Though highly scalable and flexible, function as a service may become the source of considerable financial problems for small businesses. Their cost structure typically includes charges for every function invocation, data transfer, and storage. As many small companies have unstable loads and grow fast, these costs can grow rapidly to become a significant burden for businesses that have tight budgets and can hardly choose to divert the company’s funds from organizational needs. On the other hand, the increased complexity of FaaS environments and the expertise they require may also cause the need to pay more for skilled personnel. This makes it impossible for many small businesses to consider the persistent implementation of this IT option as a sound approach since it will be impossible for them to afford it.

OPPORTUNITY

Competition from traditional banks Provides Various Opportunities.

The integration of AI and blockchain technologies in FaaS solutions provides financial institutions with the opportunity to improve their services and processes

The incorporation of artificial intelligence and blockchain technologies in Function as a Service solution can provide financial institutions with transformative opportunities to improve their products and streamline their services. With the help of AI, banks will be able to analyze significant amounts of data in real-time, providing personalized financial products to their clients, as well as facilitating the process of detecting fraud and improving customer service through the employment of chatbots and automatic help. As a result of using blockchain, security and transparency in transactions will be improved, which will also enhance the efficiency of a bank’s operations and even reduce the risks stemming from the operational processes.

Key Segmentation Analysis

By Type

The payment segment held a market share of about 42.23% in 2023. The phenomenon could be attributed to the substantial transformation in consumer preferences, as they switched to digital and cashless payments. As a result, a large number of fintech companies developed a wide range of technologies and instruments to facilitate and enhance the payment processes. To some extent, this segment can reflect the overall versatility and inclusivity of most fintech solutions that embrace a vast variety of tools, from mobile wallets to peer-to-peer transactions, from contactless to cross-border payments. It is particularly important that an array of actors, be it individuals, enterprises, or even governments, can benefit from the differing platforms.

The fund transfer segment can witness the most significant growth over the projected period. Overall, the activity is directly associated with the process of money transfer and withdrawal from another, executed via the technologies supported by the payment system. At the same time, an increasing number of people choose to use funds and transfer money around the globe, and the application is expected to find its customers. There are numerous efforts made by different fintech start-ups around the globe to create fund transfer applications that can incorporate the best user interface principles, thus promoting a better experience.

By Technology

The blockchain segment held the largest market share around 38% in 2023. The demand for blockchain technology is growing among large enterprises. More prominent companies are trying to adopt blockchain due to its increased transparency and automation benefits. Financial institutions are one of the other adopters of this technology as it brings more security and efficiency. Due to the technology offered by blockchain, users can have sole ownership of their wealth, and only they can access their assets. This offers financial institutions more security, and their clients will not lose their assets from unauthorized access. Considerable benefits of the technology are expected to drive the growth of the segment.

The artificial intelligence segment is expected to grow with the highest CAGR over the forecast period. AI’s increasing acceptance by multiple companies drives the segment increase, as it helps in better decision-making, query resolution, shorter processing time, and efficiency. Nordic Moreover, AI assists in ensuring the companies’ innovation, which eventually delivers more customized, quick, and secure facilities with a greater degree of customer satisfaction and global reach. Improvements pursued by several companies to prosper and benefit the market position are expected to boost segmental growth.

By Application

The compliance and regulatory Support segment dominated the market in 2023 and accounted for over 34.0% share of the global revenue. Moreover, numerous financial institutions around the world are offering customer support on the app to continually enhance their operations and to cater to their customers better. Also, there has been a growing number of cases of fraud and money laundering worldwide, which further drives companies to offer excellent customer support. Thus, this will increase the efficiency of the market segment to cater to the needs across the globe, thereby propelling growth over the forecast period.

By End-Use

The insurance segment held the largest market share around 36.0% of the total global revenue. The development may be attributed to the growing acknowledgment of technology as a transformative force that could reshape and optimize the insurance industry. Solutions in the field of fintech typically offer a variety of services within the insurance domain, such as digital underwriting, processing of claims, management of policy, and assessment of risk. Their value proposition is the use of modern data analytics, algorithms driven by artificial intelligence, and automation to improve quality, efficiency, and user experience in insurance operations.

Do You Need any Customization Research on Fintech-as-a-Service Market - Inquire Now

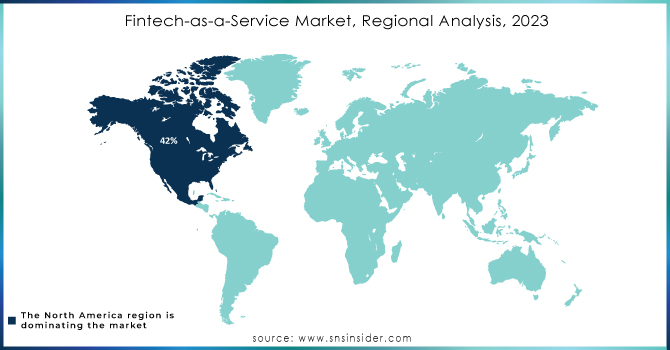

North America held the largest market share around 42% in 2023. North America is one of the most competitive markets in the world. It is home to all major tech giants and features a wide range of emerging technologies and start-ups. Additionally, in North America, the degree of digitalization is extremely high, with many advanced technological solutions and platforms being widely used by the industry. For instance, cloud computing services, artificial intelligence, and blockchain are becoming increasingly important and are the key enablers of innovation and efficiency. The North American market concentration is complemented by particularly high expenditure on research and development and the innovation of services and products. According to the U.S. Bureau of Economic Analysis, technology-related sectors of the economy manifested significant growth. Furthermore, the expansion of the digitalization-friendly legal framework there strongly supports new technologies, services, and platform development. All of these factors allow North America to maintain its market dominance, which is a prerequisite for the development of new digital technologies and economic growth in general.

Asia-Pacific is the second largest market for FaaS, with a market share of 25% in 2022. This is due to the rapid growth of the region's economy and the increasing adoption of digital financial services. Asia-Pacific is also home to several emerging economies, such as China and India, where the demand for FaaS is growing rapidly. The expansion of the regional market can be due to a growing understanding of the advantages of FaaS platforms in nations like China, India, and Japan. Fintech companies are receiving aggressive funding from venture capitalists and governments to encourage the use of digital services and fintech as a service platform.

Raw Key Manufacturers

PayPal Holdings, Inc. (PayPal)

Block, Inc. (Square)

Mastercard Incorporated (Mastercard Payment Gateway)

Envestnet, Inc. (Envestnet | Yodlee)

Upstart Holdings, Inc. (Upstart Platform)

Rapyd Financial Network Ltd. (Rapyd Wallet)

Solid Financial Technologies, Inc. (Solid API)

Railsbank (Railsbank Banking Engine)

Synctera Inc. (Synctera Platform)

Braintree (Braintree Payments)

Stripe, Inc. (Stripe Connect)

Adyen N.V. (Adyen Payment Solutions)

Dwolla, Inc. (Dwolla API)

WePay (a JPMorgan Chase Company) (WePay Payments API)

Finastra (FusionFabric.cloud)

Plaid Inc. (Plaid Link)

Tink (Tink Platform)

N26 GmbH (N26 Banking App)

Kabbage, Inc. (a subsidiary of American Express) (Kabbage Funding)

Zelle (operated by Early Warning Services, LLC) (Zelle Payment Service)

Key User

Robinhood

Chime

LendingClub

Betterment

Wealth front

SoFi

Acorns

Kiva

Credit Karma

N26

Recent Development:

In March 2023, Synctera Inc., a provider of FaaS for banking, announced that it had partnered with Google Cloud to offer its platform on Google Cloud Platform. The partnership will make it easier for banks to adopt Synctera's platform and build innovative financial services applications.

In February 2023, Railsba, a provider of FaaS for the financial industry, announced that it had raised USD 10 million in Series A funding. The funding will be used to expand Railsba's product offerings and customer base.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 308.9 Billion |

| Market Size by 2032 | US$ 1305.7 Billion |

| CAGR | CAGR of 17.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Payment, Fund Transfer, Loan, Others), • By Technology (Artificial Intelligence, API, RPA, Blockchain, Others), • By Application (KYC Verification, Fraud Monitoring, Compliance & Regulatory Support, Others), • By End-use (Banks, Financial Lending Companies, Insurance, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | PayPal Holdings, Inc.; Block, Inc.; Mastercard Incorporated; Envestnet, Inc.; Upstart Holdings, Inc.; Rapyd Financial Network Ltd.; Solid Financial Technologies, Inc.; Railsba, Synctera Inc., Braintree, and others |

| Key Drivers | • Rising demand for digital financial services drives the market growth. • The rising need for business agility and flexibility drives the market growth. • Increasing adoption of cloud computing drives the market growth. |

| RESTRAINTS | •FaaS platforms are often hosted in the cloud, which can make them vulnerable to cyberattacks. • FaaS platforms can be expensive, especially for small businesses |

Ans: The Fintech-as-a-Service Market was valued at USD 308.9 Billion in 2023.

Ans: The expected CAGR of the global Fintech-as-a-Service Market during the forecast period is 17.4%.

Ans: The Payment type will grow rapidly in the Fintech-as-a-Service Market from 2024-2032.

Ans: Increasing adoption of cloud computing drives market growth.

Ans: The U.S. led the Fintech-as-a-Service Market in North America region with the highest revenue share in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Insurance Type

3.2 Bottom-up Insurance Type

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fintech-as-a-Service Market Segmentation, By Type

7.1 Chapter Overview

7.2 Payment

7.2.1 Payment Market Trends Analysis (2020-2032)

7.2.2 Payment Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Fund Transfer

7.3.1 Fund Transfer Market Trends Analysis (2020-2032)

7.3.2 Fund Transfer Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Loan

7.4.1 Loan Market Trends Analysis (2020-2032)

7.4.2 Loan Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fintech-as-a-Service Market Segmentation, By Technology

8.1 Chapter Overview

8.2 Artificial Intelligence

8.2.1 Artificial Intelligence Market Trends Analysis (2020-2032)

8.2.2 Artificial Intelligence Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 API

8.3.1 API Market Trends Analysis (2020-2032)

8.3.2 API Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 RPA

8.4.1 RPA Market Trends Analysis (2020-2032)

8.4.2 RPA Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Blockchain

8.5.1 Blockchain Market Trends Analysis (2020-2032)

8.5.2 Blockchain Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Others

8.6.1 Others Market Trends Analysis (2020-2032)

8.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fintech-as-a-Service Market Segmentation, By Application

9.1 Chapter Overview

9.2 KYC Verification

9.2.1 KYC Verification Market Trends Analysis (2020-2032)

9.2.2 KYC Verification Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Fraud Monitoring

9.3.1 Fraud Monitoring Market Trends Analysis (2020-2032)

9.3.2 Fraud Monitoring Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Compliance & Regulatory Support

9.4.1 Compliance & Regulatory Support Market Trends Analysis (2020-2032)

9.4.2 Compliance & Regulatory Support Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Fintech-as-a-Service Market Segmentation, By End-Use

10.1 Chapter Overview

10.2 Banks

10.2.1 Banks Market Trends Analysis (2020-2032)

10.2.2 Banks Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Financial Lending Companies

10.3.1 Financial Lending Companies Market Trends Analysis (2020-2032)

10.3.2 Financial Lending Companies Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Insurance

10.4.1 Insurance Market Trends Analysis (2020-2032)

10.4.2 Insurance Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Others

10.5.1 Others Market Trends Analysis (2020-2032)

10.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.4 North America Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.5 North America Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.6 North America Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.7.2 USA Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7.3 USA Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7.4 USA Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.8.2 Canada Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8.3 Canada Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8.4 Canada Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.2.9.2 Mexico Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9.3 Mexico Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9.4 Mexico Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.7.2 Poland Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7.3 Poland Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7.4 Poland Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.8.2 Romania Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8.3 Romania Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8.4 Romania Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turke Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.4 Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.5 Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.6 Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.7.2 Germany Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7.3 Germany Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7.4 Germany Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.8.2 France Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8.3 France Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8.4 France Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.9.2 UK Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9.3 UK Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9.4 UK Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.10.2 Italy Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10.3 Italy Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10.4 Italy Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.11.2 Spain Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11.3 Spain Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11.4 Spain Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.14.2 Austria Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14.3 Austria Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14.4 Austria Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.4 Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.5 Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.6 Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.7.2 China Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7.3 China Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7.4 China Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.8.2 India Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8.3 India Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8.4 India Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.9.2 Japan Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9.3 Japan Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9.4 Japan Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.10.2 South Korea Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10.3 South Korea Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10.4 South Korea Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.11.2 Vietnam Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11.3 Vietnam Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11.4 Vietnam Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.12.2 Singapore Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12.3 Singapore Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12.4 Singapore Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.13.2 Australia Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13.3 Australia Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13.4 Australia Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.4 Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.5 Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.6 Middle East Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.7.2 UAE Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7.3 UAE Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7.4 UAE Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.4 Africa Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.5 Africa Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.6 Africa Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Afric Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Fintech-as-a-Service Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.4 Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.5 Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.6 Latin America Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.7.2 Brazil Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7.3 Brazil Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7.4 Brazil Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.8.2 Argentina Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8.3 Argentina Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8.4 Argentina Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.9.2 Colombia Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9.3 Colombia Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9.4 Colombia Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Fintech-as-a-Service Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Fintech-as-a-Service Market Estimates and Forecasts, By End-Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 PayPal Holdings, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Block, Inc.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 Mastercard Incorporated

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Envestnet, Inc.

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 Upstart Holdings, Inc

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 Rapyd Financial Network Ltd

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Solid Financial Technologies, Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Railsba

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Synctera Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Braintree

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Payment

Fund Transfer

Loan

Others

By Technology

Artificial Intelligence

API

RPA

Blockchain

Others

By Application

KYC Verification

Fraud Monitoring

Compliance & Regulatory Support

Others

By End-Use

Banks

Financial Lending Companies

Insurance

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Data Exfiltration Market Size was valued at USD 73.35 Billion in 2023 and will reach USD 203.39 Billion by 2032 and grow at a CAGR of 12.0% by 2032.

The AI in cybersecurity Market Size was valued at USD 22.1 Billion in 2023 and will reach USD 120.8 Bn by 2032, growing at a CAGR of 20.8% by 2024-2032.

The Embedded Software Market Size was valued at USD 17.35 billion in 2023 and will reach USD 38.39 billion by 2032 and grow at a CAGR of 9.3% by 2032.

The Retail Cloud Market size was valued at USD 48.55 billion in 2023 and is expected to grow at USD 234.45 billion by 2032 with a growing CAGR of 19.13% over the forecast period of 2024-2032.

The Network Function Virtualization (NFV) Market Size was valued at USD 30.78 Billion in 2023 and will reach USD 229.20 Billion by 2032 and grow at a CAGR of 25.03% by 2032.

Educational Robot Market was valued at USD 1.38 billion in 2023 and is expected to reach USD 7.77 billion by 2032, growing at a CAGR of 21.34% by 2032.

Hi! Click one of our member below to chat on Phone