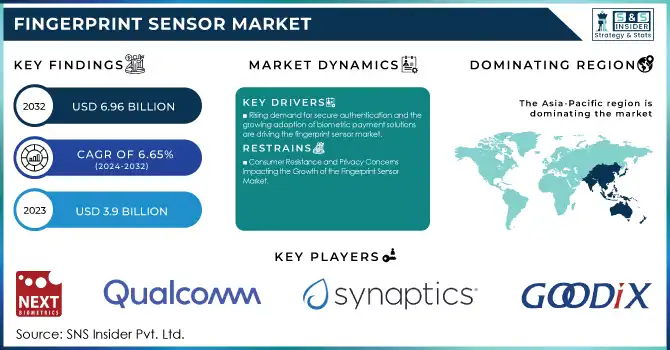

The Fingerprint Sensor Market Size was valued at USD 3.9 billion in 2023, and is expected to reach USD 6.96 billion by 2032 and grow at a CAGR of 6.65 % over the forecast period 2024-2032.

The fingerprint sensor market is experiencing significant growth, driven by advancements in technology, increased adoption across various industries, and the growing demand for biometric security solutions. In 2023, interest in AI applications for biometric sensors surged, with the Biometrics Institute reporting a rise from 8% in 2022 to 19% in 2023. This surge in AI adoption has enhanced the accuracy and reliability of fingerprint recognition systems, fostering broader applications in mobile devices, financial services, and beyond.

Get more information on Fingerprint Sensor Market - Request Sample Report

The industry is witnessing a shift toward more sophisticated solutions, particularly in-display fingerprint sensors and multi-modal biometric systems. Ultrasonic sensors have emerged as a major technological advancement, capable of reading fingerprints through materials such as glass and metal, allowing for more flexible and innovative device designs. The emergence of transparent sensors has also opened new possibilities for seamless integration into device displays, further enhancing their functionality. Improvements in processing capabilities have reduced recognition times and bolstered security features, making fingerprint sensors a preferred choice for authentication. In smartphones, manufacturers are increasingly integrating advanced fingerprint sensor technologies beneath display glass, contributing to the growing market.

The convergence of biometric authentication with payment technologies has created new opportunities, particularly in the financial sector. Biometrics-enabled payment cards are gaining popularity, allowing secure and convenient transactions without PIN entry. The automotive sector is also adopting fingerprint recognition for vehicle entry and ignition systems, while smart home security systems are increasingly incorporating fingerprint-based access control. The fingerprint sensor market is set to continue its growth, with multi-factor authentication systems gaining traction. Europe, in particular, is poised to lead the way in digital adoption, with GSMA projecting an 88% smartphone penetration rate and 82% internet penetration by 2025, providing a strong foundation for biometric applications. Standardization efforts are also underway, with stakeholders collaborating to establish unified protocols, ensuring consistent performance and security across platforms.

Drivers

Rising demand for secure authentication and the growing adoption of biometric payment solutions are driving the fingerprint sensor market.

Growing demand for secure and efficient authentication methods, especially in the financial services sector. Biometric payment cards, which integrate fingerprint recognition technology, are gaining significant traction. These cards enable secure, contactless transactions, eliminating the need for PINs and enhancing user convenience. A recent survey revealed that 77% of consumers who use biometrics on their smartphones or tablets are satisfied with the technology, underscoring the shift towards biometric identity authentication as a preferred method. This trend is further supported by a frictionless consumer experience, with next-generation biometric payment cards offering advanced features that encourage uptake. 62% of consumers expressed a willingness to switch banks to obtain a biometric payment card, signaling high demand for the enhanced security and convenience these cards provide. The biometric payment cards market is expected to continue expanding in the coming years, driven by increasing smartphone penetration and the rise of contactless payment methods. Biometric payment solutions are spreading rapidly, with notable deployments in regions like the UAE and Europe, which are set to further improve financial transaction security and efficiency. 91% of U.S. consumers are familiar with biometric payment technology, though only 36% have utilized it. These statistics indicate that the fingerprint sensor market's growth is closely tied to the continued evolution of biometric payment systems, which promise to reshape how consumers authenticate transactions across various industries.

Restraints

Consumer Resistance and Privacy Concerns Impacting the Growth of the Fingerprint Sensor Market

A significant restraint for the fingerprint sensor market is consumer resistance to biometric authentication, driven by concerns over privacy, security, and a general lack of understanding of the technology. Many consumers remain skeptical about using fingerprint-based systems, particularly due to fears regarding the potential misuse of their biometric data. Despite the convenience and security offered by fingerprint sensors, traditional methods such as PINs and passwords are still perceived by many as safer and more private. 30% of consumers are uncomfortable using biometrics, especially in the context of data breaches or inadequate data protection measures. This concern is echoed by the Biometric Institute, with nearly 50% of respondents expressing doubts about the security of biometric data storage and usage. Privacy remains a top barrier, with 47% of consumers stating they would only adopt biometrics if companies could guarantee the security of their data. In certain regions, such as the United States, consumers continue to favor alternative authentication methods due to a lack of trust in biometric systems. A survey by Biometric Research found that discomfort with biometric sensors is particularly pronounced in markets with limited exposure to such technologies, suggesting that cultural factors also play a role in consumer hesitation. 29% of the global population is still hesitant to adopt biometrics, reflecting ongoing resistance to fingerprint-based systems.

By Type

The capacitive segment holds the largest share of approximately 47% in the fingerprint sensor market in 2023. This dominance can be attributed to the widespread use of capacitive fingerprint sensors in smartphones, laptops, and other consumer electronics due to their high accuracy, reliability, and fast response times. Capacitive sensors work by measuring the electrical charge from the ridges and valleys of a fingerprint, offering enhanced image quality compared to other sensor types. Additionally, they are more resistant to wear and tear, making them ideal for devices that require frequent use. The cost-effectiveness and the ability to integrate seamlessly into various devices further support their popularity, solidifying capacitive sensors as the preferred choice for most fingerprint recognition applications.

The ultrasonic fingerprint sensor segment is poised to be the fastest growing in the fingerprint sensor market during the forecast period from 2024 to 2032. This growth is driven by the increasing demand for advanced biometric authentication solutions that offer enhanced security and functionality. Unlike capacitive sensors, ultrasonic sensors use sound waves to capture 3D images of the fingerprint, enabling more precise recognition even in challenging conditions such as wet or dirty fingers. Additionally, they can be integrated under thicker materials like glass, making them ideal for use in smartphones with edge-to-edge displays and other devices requiring sleek, seamless designs. As consumer demand for secure and convenient authentication solutions rises, the ultrasonic sensor segment is expected to experience significant market expansion, benefiting from its superior performance and versatility.

By Application

The smartphones and tablets segment dominated the fingerprint sensor market in 2023, accounting for around 55% of the market share. This dominance is primarily due to the widespread adoption of fingerprint sensors in mobile devices as a convenient and secure method of user authentication. Consumers increasingly prefer biometric authentication over traditional PINs or passwords, as it offers faster and more reliable access to their devices. As smartphone manufacturers continue to innovate, integrating fingerprint sensors into displays and advancing security features, the demand for fingerprint sensors in this segment remains strong. Additionally, the growing trend of bezel-less and edge-to-edge displays has spurred the development of in-display fingerprint sensors, further fueling growth in the smartphones and tablets segment. With mobile devices becoming essential in daily life, this segment is expected to maintain its leading position in the fingerprint sensor market.

The IoT and Other Applications segment is expected to be the fastest growing segment in the fingerprint sensor market during the forecast period from 2024 to 2032. This growth is attributed to the rapid proliferation of IoT devices and the increasing demand for advanced security measures across various applications. As IoT devices become more integrated into everyday life, from smart home systems to healthcare and automotive industries, the need for secure and seamless user authentication is rising. Fingerprint sensors offer a highly efficient and reliable solution for access control and data protection. Additionally, the increasing focus on user convenience and privacy protection further drives the adoption of fingerprint sensors in a wide range of IoT-enabled devices, thereby boosting market growth in this segment.

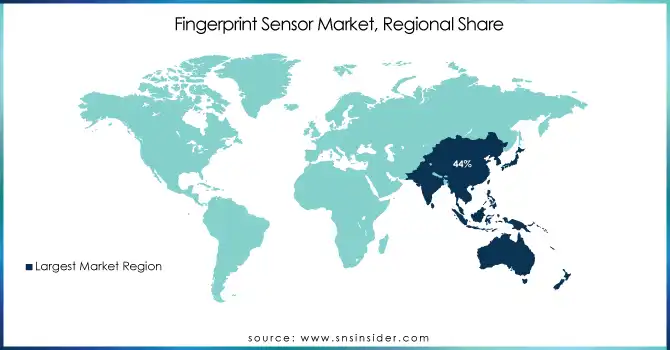

The Asia-Pacific region is the dominant player in the fingerprint sensor market, accounting for around 44% of the market share in 2023. This dominance can be attributed to rapid technological advancements, high smartphone penetration, and growing adoption of biometric authentication systems across various industries in countries such as China, India, Japan, and South Korea. China, in particular, leads the region with strong government support for the development of biometric technologies and a high rate of smartphone and IoT device usage. Japan and South Korea are also significant contributors, with a focus on advanced security solutions in sectors like banking, healthcare, and consumer electronics. Additionally, the increasing emphasis on security in mobile payments and the expansion of fingerprint sensors in consumer electronics, including wearables and automotive applications, further bolster the region's leadership in the fingerprint sensor market.

North America is the fastest-growing region in the fingerprint sensor market from 2024 to 2032, driven by technological advancements, increasing adoption of biometric authentication in mobile payments, and growing security concerns. The U.S. and Canada lead the market, with companies like Apple and Google integrating fingerprint sensors into smartphones, tablets, and wearables. Additionally, the increasing demand for secure identification systems in banking, healthcare, and government sectors is contributing to market growth. The rise in IoT devices and the push for enhanced data privacy are expected to further fuel growth in the region, positioning North America as a key player in the global fingerprint sensor market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the Major Players in Fingerprint Sensor Market:

Shenzhen Goodix Technology Co., Ltd. (China) – (Fingerprint Sensors)

Fingerprints (Sweden) – (Fingerprint Biometrics Solutions)

Synaptics Incorporated (US) – (Fingerprint Sensors, Touchpads)

NEXT Biometrics (Norway) – (Fingerprint Sensors)

Novatek Microelectronics Corp. (Taiwan) – (Display Drivers, Fingerprint Sensors)

Qualcomm Technologies, Inc. (US) – (Fingerprint Sensors, Mobile Solutions)

THALES (France) – (Biometric Identification, Digital Security Solutions)

HID Global Corporation (US) – (Identity Solutions, Fingerprint Sensors)

SecuGen Corporation (US) – (Fingerprint Scanners, Biometrics)

IDEMIA (France) – (Biometric Solutions, Fingerprint Recognition Systems)

3M Cogent Inc. (US) – (Biometric Authentication Solutions)

Precise Biometrics (Sweden) – (Fingerprint Scanners, Software)

EGIS Technology Inc. (Taiwan) – (Fingerprint Sensors)

Crossmatch (US) – (Biometric Devices, Fingerprint Scanners)

OXI Technology (Germany) – (Fingerprint Sensors)

IDloop (Switzerland) – (Biometric Solutions, Fingerprint Sensors)

Sonavation Inc. (US) – (Fingerprint Sensors)

Touch Biometrix (UK) – (Fingerprint Sensor Technology)

Vkansee (China) – (Fingerprint Sensors)

ELAN Microelectronics (Taiwan) – (Fingerprint Sensors)

CMOS Sensor Inc. (South Korea) – (Fingerprint Sensor Technology)

ID3 Technologies (France) – (Biometric Solutions)

List of Suppliers who Provide Raw material and Component in for fingerprint sensors:

TSMC

SK Hynix

Lumentum Holdings Inc.

Murata Manufacturing Co., Ltd.

Texas Instruments

STMicroelectronics

Infineon Technologies

NXP Semiconductors

Shinko Electric Industries

ULVAC Technologies

In May 2024 Goodix Unveils New Ultrasonic Fingerprint Solution with vivo X100 Ultra Goodix launches its advanced ultrasonic fingerprint solution in collaboration with vivo, marking a major step in large-scale commercialization. The solution enhances security, recognition speed, and reduces power consumption, meeting the growing demand for ultrasonic fingerprint technology in mobile devices.

In Macrch 2024, Mastercards from Thales and FPC, Idex Biometrics Launch in Turkey Fingerprint Cards and Thales have rolled out Mastercard-certified biometric payment cards in Turkey, marking their eleventh global launch. The cards integrate with existing bank infrastructures and POS systems, requiring no upgrades, and are certified by major EMV payment plans.

| Report Attributes | Details |

| Market Size in 2023 | USD 3.9 Billion |

| Market Size by 2032 | USD 6.96 Billion |

| CAGR | CAGR of 6.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Optical, Capacitive, Thermal, Ultrasonic) • By Application (Smartphones/Tablets, Laptops, Smartcards, IoT and Other Applications) • By End User Industries (Military and Defense, Consumer Electronics, BFSI, Government, Other End-user Industries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shenzhen Goodix Technology Co., Ltd. (China), Fingerprints (Sweden), Synaptics Incorporated (US), NEXT Biometrics (Norway), Novatek Microelectronics Corp. (Taiwan), Qualcomm Technologies, Inc. (US), THALES (France), HID Global Corporation (US), SecuGen Corporation (US), IDEMIA (France), 3M Cogent Inc. (US), Precise Biometrics (Sweden), EGIS Technology Inc. (Taiwan), Crossmatch (US), OXI Technology (Germany), IDloop (Switzerland), Sonavation Inc. (US), Touch Biometrix (UK), Vkansee (China), ELAN Microelectronics (Taiwan), CMOS Sensor Inc. (South Korea), ID3 Technologies (France). |

| Key Drivers | • Rising demand for secure authentication and the growing adoption of biometric payment solutions are driving the fingerprint sensor market. |

| Restraints | • Consumer Resistance and Privacy Concerns Impacting the Growth of the Fingerprint Sensor Market. |

Ans: The Fingerprint Sensor Market size was valued at 3.9 Billion in 2023 at a CAGR of 6.65%.

Ans: The growing demand for secure and convenient biometric authentication across various industries, including smartphones, banking, and IoT applications, is driving the fingerprint sensor market.

Ans: The market value is expected to reach USD 6.96 billion by 2032.

Ans: Asia-Pacific is dominating in Fingerprint Sensor Market

Ans: Capacitive is dominating in Fingerprint Sensor Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption Rate by Region

5.2 Logistics & Shipping Costs by Region

5.3 Regulatory & Compliance Data

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fingerprint Sensor Market Segmentation, by Type

7.1 Chapter Overview

7.2 Optical

7.2.1 Optical Market Trends Analysis (2020-2032)

7.2.2 Optical Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Capacitive

7.3.1 Capacitive Market Trends Analysis (2020-2032)

7.3.2 Capacitive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Thermal

7.4.1 Thermal Market Trends Analysis (2020-2032)

7.4.2 Thermal Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Ultrasonic

7.5.1 Ultrasonic Market Trends Analysis (2020-2032)

7.5.2 Ultrasonic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Forklift Vehicles

7.5.1 Forklift Vehicles Market Trends Analysis (2020-2032)

7.5.2 Forklift Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fingerprint Sensor Market Segmentation, by Application

8.1 Chapter Overview

8.2 Smartphones/Tablets

8.2.1 Smartphones/Tablets Market Trends Analysis (2020-2032)

8.2.2 Smartphones/Tablets Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Laptops

8.3.1 Laptops Market Trends Analysis (2020-2032)

8.3.2 Laptops Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Smartcards

8.4.1 Smartcards Market Trends Analysis (2020-2032)

8.4.2 Smartcards Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 IoT and Other Applications

8.5.1 IoT and Other Applications Market Trends Analysis (2020-2032)

8.5.2 IoT and Other Applications Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fingerprint Sensor Market Segmentation, by End User Industries

9.1 Chapter Overview

9.2 Military and Defense

9.2.1 Military and Defense Market Trends Analysis (2020-2032)

9.2.2 Military and Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Consumer Electronics

9.3.1 Consumer Electronics Market Trends Analysis (2020-2032)

9.3.2 Consumer Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 BFSI

9.4.1 BFSI Market Trends Analysis (2020-2032)

9.4.2 BFSI Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Government

9.5.1 Government Market Trends Analysis (2020-2032)

9.5.2 Government Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Other End-user Industries

9.6.1 Other End-user Industries Market Trends Analysis (2020-2032)

9.6.2 Other End-user Industries Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Fingerprint Sensor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Fingerprint Sensor Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Fingerprint Sensor Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Fingerprint Sensor Market Estimates and Forecasts, by End User Industries (2020-2032) (USD Billion)

11. Company Profiles

11.1 Shenzhen Goodix Technology Co., Ltd.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Fingerprints

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Synaptics Incorporated

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 NEXT Biometrics

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Novatek Microelectronics Corp.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Qualcomm Technologies, Inc.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 THALES

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 HID Global Corporation

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 SecuGen Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 IDEMIA

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Optical

Capacitive

Thermal

Ultrasonic

By Application

Smartphones/Tablets

Laptops

Smartcards

IoT and Other Applications

By End User Industries

Military and Defense

Consumer Electronics

BFSI

Government

Other End-user Industries

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Electric Drives Market Size was valued at USD 2.6 billion in 2023 and is expected to grow at a CAGR of 18.35% to reach USD 11.78 billion by 2032.

The Drone Sensor Market Size was valued at USD 1.26 Billion in 2023 and is expected to grow at a CAGR of 11.12% to reach USD 3.25 Billion by 2032.

The Next Generation Display Market was valued at USD 208.08 billion in 2023 and is expected to reach USD 417.61 billion by 2032, growing at a CAGR of 8.09% over the forecast period 2024-2032.

The Sports Technology Market Size was valued at USD 15.51 Billion in 2023 and is expected to grow at a CAGR of 20.45% to reach USD 82.70 Billion by 2032.

The Collision Avoidance Sensors Market Size was valued at USD 5.65 billion in 2023 and is expected to grow at 13.61% CAGR to reach USD 17.8 billion by 2032.

The Logic Analyzer Market Size was valued at USD 2.09 billion in 2023 and is projected to grow at a CAGR of 4.97% to reach USD 3.23 billion by 2032.

Hi! Click one of our member below to chat on Phone