Finance and Accounting Business Process Outsourcing Market Report Scope and Overview:

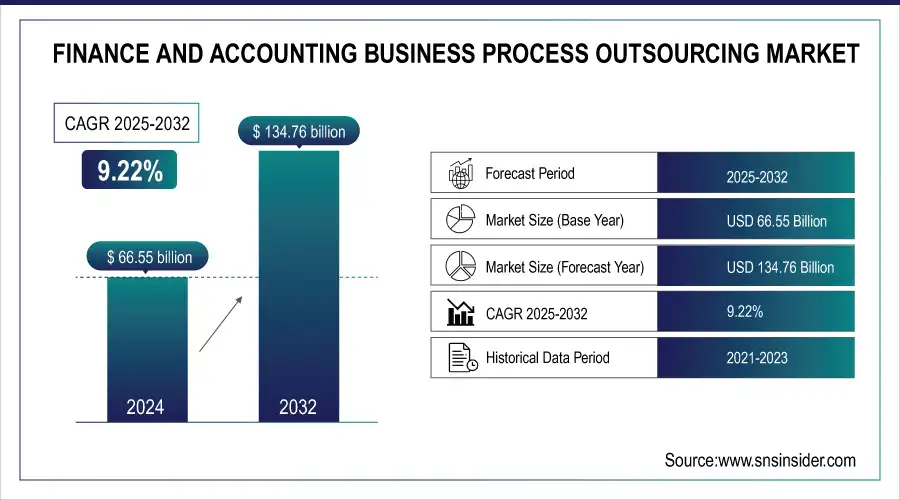

The Finance and Accounting Business Process Outsourcing Market size was valued at USD 66.55 Billion in 2024 and expected to Reach USD 134.76 Billion by 2032 and grow at a CAGR of 9.22% over the forecast period of 2025-2032.

Get More Information on Finance and Accounting Business Process Outsourcing Market - Request Sample Report

The Finance and Accounting BPO market is growing with the increasing demand for cost-effective services enhanced by advanced technologies and the increasing growth of the BPO industry in various emerging economies. Service providers, often based in developing countries, offer standardized operations like record-to-report, insurance claim processing, and accounting services to reduce operational costs for clients in developed nations. Knowledge Process Outsourcing (KPO) adds value by way of providing strategic consulting, market intelligence, and legal services.

Finance and Accounting Business Process Outsourcing Market Highlights:

-

BPO providers increasingly adopt cloud computing, social media marketing, business analytics, and process automation to enhance performance and reduce costs

-

Cloud-based solutions improve CRM services by adding transparency and meeting client requirements affordably

-

Outsourcing non-core functions such as call centers, IT, financial, and recruitment services allows companies to focus on core operations

-

Innovations in ICT and fragmented production processes enable outsourcing to countries like India and the Philippines, benefiting from low-cost labor and strong IT infrastructure

-

Advanced technologies such as AI, robotic process automation, and cloud computing improve efficiency, automate up to 80 percent of transactional work, and reduce operational costs

-

Outsourcing financial tasks provides scalability, flexibility, and cost savings while enabling businesses to invest resources into innovation and core functions

-

Regulatory compliance and evolving tax laws drive adoption of BPO services in highly regulated markets such as the US

-

Data security concerns and potential breaches remain key restraints, highlighting the importance of secure processes and risk management for long-term business sustainability

BPO providers increasingly undertake cloud computing, social media marketing, business analytics, and process automation to improve performance and decrease prices. Cloud-based solutions improve CRM services, adding transparency and fulfilling client needs affordably. Outsourcing non-core allows such as call centers, IT, financial, and recruitment services allows companies to focus on core competencies and reduce expenses. Innovations in ICT and fragmented production processes enable enterprises to outsource labour-intensive services to countries like India and the Philippines, benefiting from low-cost labour and advanced IT infrastructure. However, the sharing of sensitive financial data poses risks, leading to reluctance among companies to outsource these processes due to potential setbacks from errors, which may hinder market growth. The BPOs help companies reduce charges and grow income by leveraging advanced technology like AI, cloud computing, and process automation. Recent improvements up to 80% of transactional work is automated with Advanced technologies like Robotic Process Automation (RPA) can automate repetitive tasks in F&A processes. The threat of substitutes is low, as in-house finance and accounting operations are the simplest alternatives.

Finance and Accounting Business Process Outsourcing Market Drivers:

-

The integration of superior technologies consisting of AI, machine learning, robotic process automation, and cloud computing complements the efficiency and accuracy of financial processes that drive the market..

-

BPO services provide the ability to scale operations up or down primarily based on business desires, making it easier for corporations to adapt to market adjustments and needs.

Businesses are increasing the number of outsourcing financial tasks to BPO services providers to lower operational costs and improve performance. According to a 2023 our recent survey, organizations can keep up to 39% on cost through outsourcing finance and accounting capabilities. This big price saving is mainly because of reduced labour prices, as BPO providers regularly operate in countries with lower salary requirements. For instance, India and the Philippines, outstanding hubs for BPO offerings, offer professional labour at a fragment of the fee as compared to Western nations. Moreover, outsourcing reduces the need for giant investments in infrastructure. BPO providers have advanced systems like AI and cloud computing that continue reducing client company costs.

The financial advantages enable businesses to redirect resources towards main operations, stimulating innovation and expansion. With businesses looking to stay competitive in a globalized market, the cost savings provided by F&A BPO services remain a significant motivator. In highly regulated nations just like the US, accounting and finance departments need to observe state and federal policies from groups such as the Federal Reserve, CFPB, and FINRA. The evolving regulatory landscape and modifications in income tax laws are in addition propelling the market growth. The presence of several regional and established service provider companies will increase shoppers' bargaining power, however, the growing demand for BPO services due to evolving commercial enterprise operations diminishes this power. Cost-effective solutions from certain vendors may additionally attract more end users, supporting market expansion.

Finance and Accounting Business Process Outsourcing Market Restraints:

-

Companies may experience a lack of authority over their financial procedures and activities if they are managed by an outside vendor, potentially resulting in concerns regarding quality and reliability.

Security of Data is a significant concern are a restraint inside the finance and accounting business process outsourcing market. When organizations outsource financial operations, they regularly proportion sensitive information, inclusive of data of customers, financial records, and proprietary enterprise info. In 2023, the common charge of a data breach globally accelerated to USD 4.45 million, For monetary institutions, the cost has become even higher, averaging USD 5.97 million per breach.

Moreover, regulatory frameworks just like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) within the United States impose strict necessities on statistics protection. Non-compliance can bring about sizable fines. For instance, under GDPR, fines can attain as a good deal as €20 million or 4% of a corporation’s annual global turnover, whichever is higher. These factors make statistics safety an important situation that could obstruct the boom of the finance and accounting BPO market. In 2022, 58% of customers said they could keep away from doing business with a business enterprise that had suffered from an information breach. This highlights the capability's long-time period impact on purchaser relationships and enterprise sustainability.

Finance and Accounting Business Process Outsourcing Market Segment Analysis:

By Enterprise Size

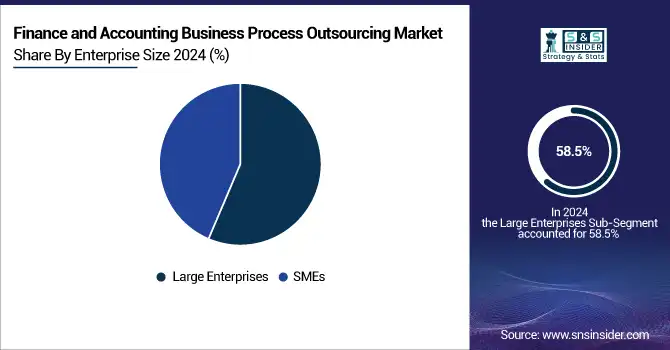

The large enterprises segment held the largest market share of more than 58.5% in 2024. Large businesses are turning to finance and accounting BPO (F&A BPO) to integrate technological improvements into their financial processes, thereby enhancing accuracy, performance, and the potential to derive actionable insights from financial facts. F&A BPO allows those businesses to focus on their core competencies and strategic goals by outsourcing habitual financial responsibilities to specialized providers. This shift enables them to allocate internal resources and understanding to sports that force innovation, increase, and competitiveness. It is expected that small and medium enterprises will experience significant growth with a high CAGR throughout the forecast period. For small businesses, outsourcing financial duties through F&A BPO lets them pay attention to their primary business capabilities. By delegating basic accounting, bookkeeping, and monetary reporting to specialized providers, small corporations can commit their sources and time to business improvement, customer engagement, and different critical activities. This approach enables SMEs to streamline operations and improve their recognition of growth and essential business responsibilities.

By Services

The Order-to-Cash (O2C) segment held the highest share of the market at 52% in 2024. O2C encompasses enterprise operations and activities along with receiving and fulfilling consumer orders for items and services. This segment extensively affects diverse business functions, such as inventory management, supply chain management, and workforce management. O2C operations influence the organization's working capital and cash flow. Optimizing the O2C process offers benefits like advanced cash flow, superior customer experience, price savings, and increasing revenue generation, which are predicted to drive the growth of the segment in the forecast period.

Source-to-Pay (S2P) segment is projected to grow with an annual growth rate of 10.03% during the forecast period. S2P represents a comprehensive procurement process, covering all stages from sourcing and obtaining goods and services to managing providers, contracts, and payments. In the finance and accounting BPO sector, outsourcing S2P approaches to BPO vendors have gained popularity. This outsourcing allows corporations to lessen costs by leveraging the expertise of BPO businesses in managing the complete procurement lifecycle effectively.

By Vertical

In 2024, the IT and telecom segment dominated the market and held the largest revenue share 28% percentage based on verticals. IT and telecommunications organizations experience dynamic operations because of rapid technological advancements and converting market needs. These firms are pioneers in adopting new technologies. Firms benefit from F and A BPO providers incorporating technologies such as machine learning, artificial intelligence, robotic process automation, data analytics, and cloud-based systems into financial processes. These technologies help groups examine market trends, allowing them to swiftly reply to economic changes, client behaviours, and industry dynamics.

The BFSI segment is projected to obtain a widespread CAGR of 9.7% from 2025 to 2032. The BFSI sector's growing need for specialized F&A BPO offerings consists of fraud detection, anti-money laundering compliance, and monetary analytics. BPO organizations that specialize in those offerings are well-equipped to deal with the desires of BFSI corporations. Given the critical significance of risk management and compliance inside the BFSI industry, BPO companions must have a thorough understanding of legal frameworks and enforce strong security measures. This specialization helps BFSI businesses to effectively manage risks and adhere to regulatory requirements.

Finance and Accounting Business Process Outsourcing Market Regional Analysis:

North America Finance and Accounting Business Process Outsourcing Market Trends:

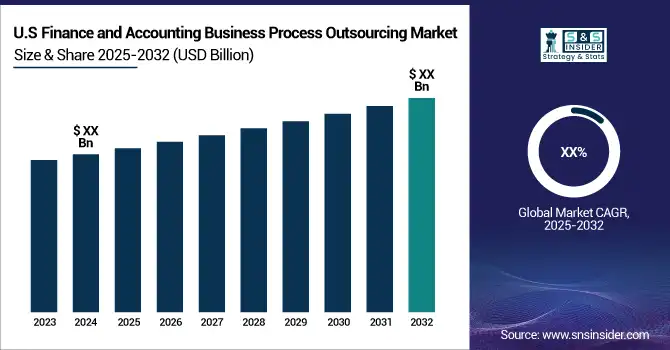

The North American region dominated the finance and accounting business process outsourcing (F&A BPO) market with an accounted revenue share of 36% in 2023, North America is projected to grow at a CAGR of 8.87% from 2024 to 2032, growing with the need for cost-effective, efficient outsourcing offerings that allow companies to focus on core features and expand globally. In the U.S., the marketplace is predicted to develop at a significant CAGR, with blockchain technology gaining traction for its steady and transparent economic transaction solutions, improving accuracy and performance.

Need any customization research on Finance and Accounting Business Process Outsourcing Market- Enquiry Now

Asia-Pacific Finance and Accounting Business Process Outsourcing Market Trends:

In the Asia Pacific region, the F&A BPO market is projected to grow at a CAGR of 10.24% from 2024 to 2032. The region's growth is fuelled by superior technology adoption and savings of cost from outsourcing. Countries like China, India, and Japan gain from skilled workers and strong technology infrastructure. China’s market, developing at a significant CAGR, is pushed by using cost efficiency and professional labours. In India, the marketplace's increase is supported with the aid of qualified professionals and authorities’ tasks. Japan emphasizes records safety and cybersecurity due to accelerated digital reliance. Europe's F&A BPO market is projected to increase at a 9.23% CAGR, supported by stringent data privacy regulations such as GDPR. The UK market, with a significant CAGR, emphasizes sustainability and efficiency amidst economic difficulties. The German market, requires specific financial knowledge to manage its intricate regulatory system, utilizing BPO services for precision and adherence.

Europe Finance and Accounting Business Process Outsourcing Market Trends:

The European F&A BPO market is driven by stringent data privacy regulations such as GDPR and the growing adoption of automation in financial processes. The UK focuses on sustainability and efficiency, while Germany leverages BPO services for precision and compliance within its complex regulatory environment. France and other Western European countries are also adopting BPO services to optimize costs and enhance financial process efficiency.

Latin America Finance and Accounting Business Process Outsourcing Market Trends:

In Latin America, growth is fueled by cost efficiency, rising demand for digital financial solutions, and the increasing presence of multinational companies outsourcing financial processes. Brazil and Mexico are key markets, leveraging skilled professionals and favorable labor costs, with regulatory compliance and taxation expertise as important drivers.

Middle East & Africa (MEA) Finance and Accounting Business Process Outsourcing Market Trends:

The MEA market is expanding due to digital transformation initiatives, demand for cloud-based finance solutions, and the need for compliance with evolving regulations. The UAE and South Africa are leading contributors, focusing on advanced technology adoption, automation, and a skilled workforce to improve financial process efficiency.

Finance and Accounting Business Process Outsourcing Market Key Players:

-

Capgemini

-

CKH Group

-

Cognizant

-

Teleperformance SE

-

Fiserv, Inc.

-

HCL Technologies Limited

-

Infosys Limited

-

Accenture plc

-

Invensis Technologies Pvt Ltd

-

Wipro Limited

-

Outsourced Bookkeeping

-

International Business Machines Corporation

-

Sutherland

-

Tata Consultancy Services Limited

-

Genpact

-

DXC Technology

-

Tech Mahindra

-

Concentrix

-

EXL Service

-

CGI Inc.

Finance and Accounting Business Process Outsourcing Market Competitive Landscape:

CKH Group, established in 1970, is a diversified global conglomerate engaged in financial services, investment management, and technology-driven solutions. The company focuses on delivering innovative, efficient, and sustainable services to clients worldwide. CKH Group leverages strategic partnerships, advanced technologies, and skilled professionals to drive growth and long-term value creation.

-

In April 2024, CKH Group collaborated with local governments in 611 towns across Georgia to provide auditing services and assist with personnel. Local governments risk losing specific federal or state funding if they fail to keep up with their annual financial statement audits. The Government Auditing Division of CKH Group is experiencing rapid growth as it helps local governments meet this crucial need.

Genpact, established in 1997, is a global professional services firm specializing in finance and accounting outsourcing, digital transformation, and business process management. The company leverages advanced analytics, AI, and automation to deliver innovative, efficient, and scalable solutions, helping clients optimize operations, reduce costs, and achieve sustainable growth worldwide.

-

In August 2023, Genpact formed a partnership with Heubach GmbH, a top pigment producer, to revamp financial and supply chain operations. This partnership seeks to improve these processes by merging Genpact's knowledge in smart operations with Heubach GmbH's creative approaches. Genpact created Heubach Group Business Services (GBS) centers to enhance efficiency, digital capabilities, and operational flexibility, in line with the aim of fostering sustainable development and enhancing customer satisfaction.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 66.55 Billion |

| Market Size by 2032 | USD 134.76 Billion |

| CAGR | CAGR of 9.22 % From 2025to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Order-to-Cash, Source-to-Pay, Record-to-Report, Procure-to-Pay, Multi Processed) • By Enterprise Size (SMEs, Large Enterprises) • By Vertical, IT & Telecommunications, BFSI, Manufacturing, Healthcare, Media & Entertainment, Energy & Utilities, Travel & Logistics, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Capgemini, CKH Group, Cognizant, Teleperformance SE, Fiserv, Inc., HCL Technologies Limited, Infosys Limited, Accenture plc, Invensis Technologies Pvt Ltd, Wipro Limited, Outsourced Bookkeeping, International Business Machines Corporation, Sutherland, Tata Consultancy Services Limited, Genpact, DXC Technology, Tech Mahindra, Concentrix, EXL Service, CGI Inc. |