Get more information on Field Service Management Market - Request Sample Report

The Field Service Management (FSM) Market size was valued at USD 4.31 Billion in 2023 and is expected to grow to USD 13.68 Billion by 2032 and grow at a CAGR of 13.7 % over the forecast period of 2024-2032.

A major factor fuelling the growth of the field service management market is the increasing digitization of government services and initiatives towards a smart infrastructure. Based on the latest government statistics released by the U.S. Department of Commerce in 2023, public-sector spending on digital transformation projects has grown by 12.7% compared to the previous year. This growth is largely attributed to the increasing acceptance of advanced technologies in the roll-out of public utilities, transport, and infrastructure projects. To this end, governments globally are making substantial investments in digital tools tailored to monitor in real-time, automate, and otherwise manage field operations as a way of enhancing service delivery efficiency. Further, various governments globally are applying innovative initiatives towards sustaining the environment and reducing energy through the use of efficient smart grids and infrastructure management. Based on the inbuilt technology, smart grids require robust field management for operations and maintenance, consequently increasing the need for FSM. An example is the Latest funding by the European Union Smart Cities in 2023 with over €1.5 billion used to deploy the advanced service management technologies for urban utilities and energy projects. Such developments are fuelling the adoption of FSM platforms across multiple sectors, driving market growth.

Real-time field service systems are increasingly in demand across industries to enhance customer satisfaction by enabling efficient management of field technicians and solving queries on the first attempt. There is also a massive demand for real-time field service systems across various end-users aimed at maximizing the probability of the company life in solving a query by a field technician on the first attempt and also efficient management of field technician for exceptional customer satisfaction. These solutions offer credible real-time visibility benefiting organizations in the timely delivery of responses to clients, resource allocation, and operational efficiency. For instance, in March 2021, ORTEC’s cloud-based scheduling and dispatching software enhanced the real-time and continuous monitoring of all field technicians while also smoothing the service request process benefiting the customer satisfaction levels and overall business sustainability.

Field service employees and contractors are frequently sent to designated areas to install, repair, or maintain systems and equipment. To manage these operations, companies use a system called Field Service Management (FSM). FSM is a comprehensive tool that tracks various aspects of field operations, including inventory management, scheduling, vehicle tracking, dispatching, invoicing, billing, customer portals, and other features.

Drivers

The integration of AI and machine learning, enabling predictive maintenance, optimized scheduling, and real-time decision-making.

One of the latest trends driving the field service management market is the growing integration of artificial intelligence and machine learning technologies to enhance automation and predictive capabilities. AI and ML are being combined to affect FSM solutions with increasing regularity in applications; this allows for field operations to be optimized, decision-making processes to be improved, and operational efficiency to be raised. By employing AI technologies to analyze vast amounts of data collected through sensors, IoT devices, and the history of rendered services, FSM systems can predict the failure of equipment, provide routes for preventive maintenance, and plan optimal routes for field technicians. As a result, the implementation of these technologies helps companies decrease downtime and field force operational costs, raising the overall service quality. The trend is reinforced by The U.S. Department of Commerce the latest report states that investments into AI-driven instruments for field services have risen by 18% over the course of the year as current solutions utilizing the technology become more widespread. The growing popularity of AI-driven chatbots and other virtual assistants used to provide customer service or technical support is also reflected in their growth and will keep doing so as utilities, manufacturing, and telecom companies keep searching for more advanced ways to handle field operations, eliminate the needs for manual interference and boost customer satisfaction.

Rising Demand for Real-Time Visibility Services Will Drive Market Growth

Real-time field service solutions are in high demand across sectors to improve customer satisfaction. Real-time monitoring and control of field technicians enable organizations to resolve customer inquiries on the first try by linking them with the nearest service provider. As a result, these solutions are gaining popularity across all industries. These solutions assist organizations in promptly reacting to client concerns, hence increasing customer experience and connection. The real-time FSM system can effectively manage all field activities in order to make better business decisions.

Restrains

Inexperienced Labor to Limit Market Growth

Because of the underskilled workforce, service providers and managers face a variety of issues in managing complex assets and services. Due to a shortage of skilled personnel, providers are experiencing on-the-job obstacles such as confusion regarding job requirements, increased return trips, scheduling conflicts, inability to grasp instruction, and other issues. The absence of technician training and information transfer is likely to impede on-field operations. Furthermore, due to the rising burden of on-field personnel, organizations are unable to maintain or recruit new staff. This is predicted to have a negative effect on market growth. Many businesses are employing distinct solutions, such as automation, to handle the problem.

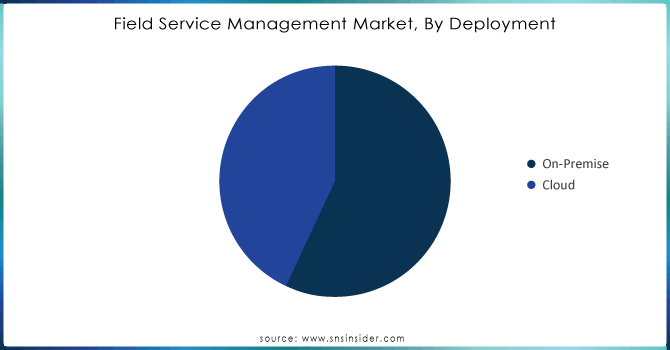

By Deployment

The cloud-based deployment model generated the highest revenue in the FSM market in 2023, accounting for a share of 66.3%. Service companies are increasingly adopting cloud solutions due to their scalability, cost-effectiveness, and easier deployment. Cloud-based FSM solutions promote real-time updates and better data access while enhancing collaboration among field teams that work across different regions. Another major factor contributing to the increasing cloud adoption rates is associated with government statistics, which indicated that the cloud expenditure of the U.S. federal government increased by 15.2% in 2023. Similar trends are observed in other developed and developing countries, where public and private sector organizations are actively using cloud-based platforms to streamline operations. The trend is not only expected to continue but also speed up because the need for remote work is increasing in the post-pandemic era, and cloud-based platforms are encouraged by the governments as part of the digital economy strategies. For instance, the Indian government has long implemented the “Digital India” initiative which integrated different cloud-based platforms to increase transparency, and accountability and minimize corruption in public service delivery. As a result, the need for large upfront investments in IT infrastructure is reducing, which makes cloud deployment a viable option for companies of all sizes.

Need any customization research on Field Service Management (FSM) Market - Enquiry Now

By Enterprise

In the FSM market, large enterprises commanded the highest revenue share of 65.3% in 2023, and this is primarily because large enterprises have ample resources and their field operations are detail-oriented and complex. Large organizations such as those in the utilities, energy, and telecommunications industries have extensive field forces that require technology that handles scheduling tasks, optimizes resources, and provides real-time monitoring solutions. According to government data, in 2023, large energy-based firms increased their IT budgets by 9.8 percent to cater to more sophisticated FSM solutions. Additionally, the prevalence of assets across large enterprises that require maintenance has propelled the adoption of FSM solutions that provide real-time analytics and predictive maintenance capabilities. According to the U.K. government’s 2023 industrial strategy report, large energy and utility companies are increasingly implementing FSM software to manage their geographically dispersed assets. These organizations are prioritizing tools that can enhance productivity, minimize operational costs, and ensure compliance with strict regulatory standards. This sector-wide adoption of FSM solutions in large enterprises is further amplified by the need for robust, scalable systems that can handle the complexity of large-scale operations.

By End-Use

The largest revenue share of the FSM market was held by telecom 31.1% in 2023. The telecommunications industry is characterized by extensive field operations for network maintenance, installation, and customer service. This major aspect has a direct impact on the high consumption of FSM solutions and is actively spurring the growth of this segment. According to data provided by the government, EMNOs raised their spending on FSM solutions by 11.5% in 2023. The objective of the industry’s considerable investment activity is network infrastructure and the operations supporting customer service improvement.

With the rollout of 5G technology and increased demand for fiber optic networks, telecom companies face rising field service demands. The U.S. government announced a new investment for the upgrading of 5G networks, which is estimated to reach $1.2 billion in 2023. This ongoing development of telecom infrastructure is the key factor behind the rising demand for FSM management that would allow effective real-time technician, equipment, and service support control.

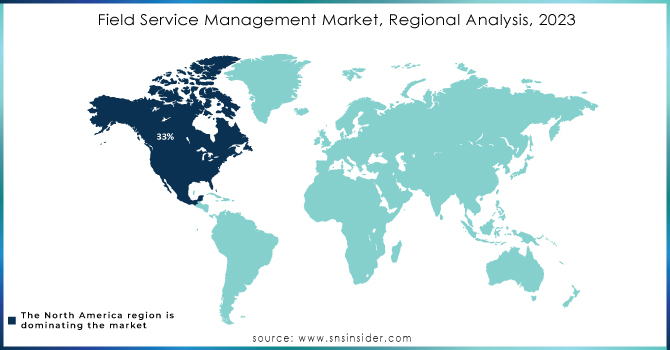

North America led the FSM market in 2023 and accounted for a market share of 33%. The contribution is due to the high technological infrastructure, which has seen the region digitize at a high rate. Both the public and private sectors have allocated substantial resources toward investments in field service technologies. For example, according to the U.S. Department of Commerce, field service automation investment in North America increased by 13.4% in 2023. The adoption of IoT devices, AI-driven analytics, and cloud-based platforms has fuelled these developments. In addition, there has been high demand for the enhancement of the U.S. infrastructure due to its old age, especially in utilities and transportation. The U.S. federal and state governments have invested heavily in smart city projects requiring highly developed field service operations. The U.S. Department of Transportation, for example, allocated $3.5 billion to the smart transportation infrastructure in 2023. A significant amount of the investment is utilized in FSM for monitoring and maintenance. Such a situation has served in maintaining North America as the FSM market leader.

However, Asia Pacific is expected to record the highest CAGR between 2023 and 2032. This growth can be attributed to the high economic growth and the ongoing development in the field service and inventory management ecosystem. Consequently, organizations will invest highly in the FSM market to maintain the industry’s growth and streamline efficiency. High digital transformation, cloud deployments, increased technological capabilities among the small and medium firms, and the ongoing modernization in workforce management strategies in emerging countries have highly contributed to the growth.

The U.S. Department of Commerce reports that in 2023, public sector spending on field service automation grew by 15%. The report emphasizes that more government agencies are adopting FSM tools to upgrade public services and manage public infrastructure.

April 2024, the Canadian government announced an additional CAD 750 million for the Smart Cities initiative. Evidently, the funding will raise the deployment rate of FSM software in utilities and public transport to increase service delivery and real-time monitoring.

February 2024, Comarch SA announced another collaboration. This time Kyivstar, a Ukrainian telecom company, will enter the fray and modernize their field service maintenance with Comarch FSM.

October 2023, Infor introduced a new platform for its industry-specific CloudSuites, designed to help enterprises operate more efficiently, swiftly, and dynamically than ever.

Oracle Corporation (Oracle Field Service Cloud, Oracle Service Cloud)

Microsoft Corporation (Dynamics 365 Field Service, Dynamics 365 Remote Assist)

Salesforce (Salesforce Field Service, Service Cloud)

SAP SE (SAP Field Service Management, SAP Service Cloud)

ServiceMax (ServiceMax Core, ServiceMax Asset 360)

IFS AB (IFS Field Service Management, IFS Mobile Workforce Management)

ClickSoftware (acquired by Salesforce) (Click Field Service Edge, ClickMobile)

Astea International (acquired by IFS) (Alliance Enterprise, FieldCentrix)

Zinier (Zinier Field Service Automation, Zinier Intelligent Automation)

Trimble Inc. (Trimble PULSE, Trimble Fleet Management)

FieldAware (FieldAware Mobile, FieldAware Scheduling)

Praxedo (Praxedo FSM, Praxedo Mobile)

Accruent (Kykloud, Maintenance Connection)

Comarch (Comarch FSM, Comarch IoT FSM)

GEOCONCEPT (Opti-Time, GeOptimization)

OverIT (Geocall, SPACE1)

Jobber (Jobber Business Management, Jobber Client Hub)

Mize (Mize Field Service Management, Mize Service Parts Management)

Coresystems (acquired by SAP) (Coresystems Field Service, Coresystems Now)

Inseego Corp. (Inseego Field Service Automation, Ctrack Field Service Management) and other players

| Report Attributes | Details |

| Market Size in 2023 | USD 4.31 Billion |

| Market Size by 2032 | USD 13.68 Billion |

| CAGR | CAGR of 13.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution {Mobile field execution, Service contract management, Warranty management, Workforce management, Customer management, Inventory management, Others}, Services {Implementation, Training & support, Consulting & advisory}) • By Deployment (On-Premise, Cloud) • By Enterprise (Large enterprises, SMEs) • By End-use (Energy & utilities, Telecom, Manufacturing, Healthcare, BFSI, Construction & real estate, Transportation & logistics, Retail & wholesale, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Oracle Corporation, Microsoft Corporation, Salesforce, SAP SE, ServiceMax, ClickSoftware, Trimble Inc., FieldAware, Praxedo, Jobber, Mize |

| Key Drivers | • The integration of AI and machine learning, enabling predictive maintenance, optimized scheduling, and real-time decision-making. |

| Market Restraints | • Inexperienced Labor to Limit Market Growth |

Ans: 13.7% is the CAGR of the Field Service Management Market.

Ans: USD 4.31 billion in 2023 is the market share of the Field Service Management Market.

Ans. The major players are GEOCONCEPT SAS, Salesforce, Oracle, Infor, ServiceMax, Inc., OverIT, Microsoft, IFS, SAP, Trimble, FieldAware, Comarch, ServicePower, Accruent, Geoconcept, Zinier, PRAXEDO, Acumatica Inc, and others in the final report.

Ans: North America is the dominating region in Field Service Management Market.

Ans. The forecast period for the Field Service Management Market is 2024-2032.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Field Service Management (FSM) Market Segmentation, By Component

7.1 Chapter Overview

7.2 Solution

7.2.1 Solution Market Trends Analysis (2020-2032)

7.2.2 Solution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3 Mobile field execution

7.2.3.1 Mobile field execution Market Trends Analysis (2020-2032)

7.2.3.2 Mobile field execution Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.4 Service contract management

7.2.4.1 Service contract management Market Trends Analysis (2020-2032)

7.2.4.2 Service contract management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.5 Warranty management

7.2.5.1 Warranty management Market Trends Analysis (2020-2032)

7.2.5.2 Warranty management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.6 Workforce management

7.2.6.1 Workforce management Market Trends Analysis (2020-2032)

7.2.6.2 Workforce management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.7 Customer management

7.2.7.1 Customer management Market Trends Analysis (2020-2032)

7.2.7.2 Customer management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.8 Inventory management

7.2.8.1 Inventory management Market Trends Analysis (2020-2032)

7.2.8.2 Inventory management Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.9 Others

7.2.9.1 Others Market Trends Analysis (2020-2032)

7.2.9.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.5.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Implementation

7.3.3.1 Implementation Market Trends Analysis (2020-2032)

7.3.3.2 Implementation Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Training & support

7.3.4.1 Training & support Market Trends Analysis (2020-2032)

7.3.4.2 Training & support Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.5 Consulting & advisory

7.3.5.1 Consulting & advisory Market Trends Analysis (2020-2032)

7.3.5.2 Consulting & advisory Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Field Service Management (FSM) Market Segmentation, By Deployment

8.1 Chapter Overview

8.2 On-Premise

8.2.1 On-Premise Market Trends Analysis (2020-2032)

8.2.2 On-Premise Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Cloud

8.3.1 Cloud Market Trends Analysis (2020-2032)

8.3.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Field Service Management (FSM) Market Segmentation, By Enterprise

9.1 Chapter Overview

9.2 Large enterprises

9.2.1 Large enterprises Market Trends Analysis (2020-2032)

9.2.2 Large enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 SMEs

9.3.1 SMEs Market Trends Analysis (2020-2032)

9.3.2 SMEs Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Field Service Management (FSM) Market Segmentation, By End-use

10.1 Chapter Overview

10.2 Energy & utilities

10.2.1 Energy & utilities Market Trends Analysis (2020-2032)

10.2.2 Energy & utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Telecom

10.3.1 Telecom Market Trends Analysis (2020-2032)

10.3.2 Telecom Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Manufacturing

10.4.1 Manufacturing Market Trends Analysis (2020-2032)

10.4.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Construction & real estate

10.5.1 Construction & real estate Market Trends Analysis (2020-2032)

10.5.2 Construction & real estate Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Banking, Financial Services, & Insurance (BFSI)

10.6.1 Banking, Financial Services, & Insurance (BFSI) Market Trends Analysis (2020-2032)

10.6.2 Banking, Financial Services, & Insurance (BFSI) Market Size Estimates and Forecasts to 2032 (USD Billion)

10.7 Healthcare

10.7.1 Healthcare Market Trends Analysis (2020-2032)

10.7.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.8 Transportation & logistics

10.8.1 Transportation & logistics Market Trends Analysis (2020-2032)

10.8.2 Transportation & logistics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.9 Retail & wholesale

10.9.1 Retail & wholesale Market Trends Analysis (2020-2032)

10.9.2 Retail & wholesale Market Size Estimates and Forecasts to 2032 (USD Billion)

10.10 Others

10.10.1 Others Market Trends Analysis (2020-2032)

10.10.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.5 North America Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.2.6 North America Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.7.3 USA Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.2.7.4 USA Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.8.3 Canada Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.2.8.4 Canada Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.2.9.3 Mexico Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.2.9.4 Mexico Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.7.3 Poland Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.7.4 Poland Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.8.3 Romania Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.8.4 Romania Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.5 Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.6 Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.7.3 Germany Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.7.4 Germany Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.8.3 France Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.8.4 France Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.9.3 UK Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.9.4 UK Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.10.3 Italy Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.10.4 Italy Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.11.3 Spain Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.11.4 Spain Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.14.3 Austria Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.14.4 Austria Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.5 Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.6 Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.7.3 China Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.7.4 China Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.8.3 India Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.8.4 India Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.9.3 Japan Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.9.4 Japan Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.10.3 South Korea Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.10.4 South Korea Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.11.3 Vietnam Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.11.4 Vietnam Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.12.3 Singapore Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.12.4 Singapore Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.13.3 Australia Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.13.4 Australia Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.5 Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.6 Middle East Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.7.3 UAE Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.7.4 UAE Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.5 Africa Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.2.6 Africa Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Field Service Management (FSM) Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.5 Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.6.6 Latin America Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.7.3 Brazil Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.6.7.4 Brazil Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.8.3 Argentina Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.6.8.4 Argentina Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.9.3 Colombia Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.6.9.4 Colombia Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Deployment (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Field Service Management (FSM) Market Estimates and Forecasts, By Enterprise (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Field Service Management (FSM) Market Estimates and Forecasts, By End-use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Oracle Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 Microsoft Corporation

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 Salesforce

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 SAP SE

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 ServiceMax

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 ClickSoftware

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Trimble Inc.

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 FieldAware

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Praxedo

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Jobber

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Component

Solution

Mobile field execution

Service contract management

Warranty management

Workforce management

Customer management

Inventory management

Others

Services

Implementation

Training & support

Consulting & advisory

By Deployment

On-Premise

Cloud

By Enterprise

Large enterprises

SMEs

By End-use

Energy & utilities

Telecom

Manufacturing

Healthcare

BFSI

Construction & real estate

Transportation & logistics

Retail & wholesale

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 5G Network Slicing Market Size was USD 396.2 Million in 2023 & is expected to reach USD 9815.9 Million by 2032, growing at a CAGR of 42.9% by 2024-2032.

The GCC in the Retail and Consumer Goods Market size was USD 19.1 Billion in 2023, Will Reach to USD 76.9 Bn by 2032 & grow at a CAGR of 15.1% by 2024-2032.

The Digital Assurance Market size was valued at USD 6.14 Billion in 2023 and will reach USD 19.20 Bn by 2032 and grow at a CAGR of 13.51% by 2024-2032.

The IoT in Construction Market Size was valued at USD 13.5 Billion in 2023 and will USD 50.4 Billion by 2032, growing at a CAGR of 15.8% by 2032.

The P2P Payment Market Size was USD 256.5 Billion in 2023 & is expected to reach USD 901.3 Bn by 2032 & grow at a CAGR of 15%, forecast period of 2024-2032.

Cloud Database And DBaaS Market was valued at USD 17.51 billion in 2023 and is expected to reach USD 77.65 billion by 2032, growing at a CAGR of 18.07% from 2024-2032.

Hi! Click one of our member below to chat on Phone