Fiber Supplements Market Report Scope And Overview:

Get More Information on Fiber Supplements Market - Request Sample Report

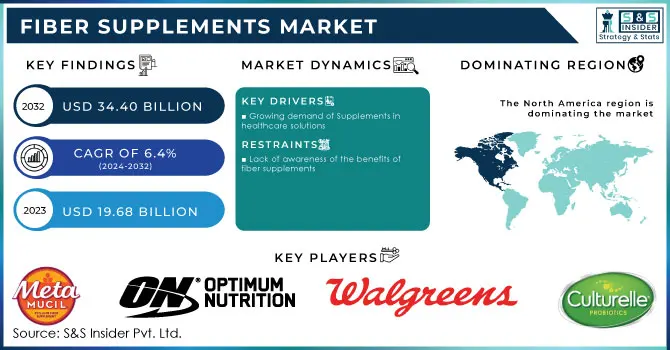

The Fiber Supplements Market size was valued at USD 19.68 billion in 2023 and is expected to grow to USD 34.40 billion by 2032, growing at a CAGR of 6.4% over the forecast period of 2024-2032.

Fiber supplements can be used to help persons who do not obtain enough fiber from their diet. This can be beneficial for persons suffering from digestive issues such as constipation and irritable bowel syndrome (IBS). Fiber supplements may also be beneficial for persons suffering from other medical disorders such as heart disease, stroke, type 2 diabetes, and some types of cancer.

Various lifestyle adjustments and medical interventions are needed to address obesity and its related consequences. Because they are available to the general public, dietary supplements are seen as a desirable substitute for conventional therapy.

Based on type the market is categorised as Capsules, Powder, Chewable Tablets, Others. Other include gummies, Softgels, Wafers, etc. The most popular form of fiber supplements is in capsule form. They can be taken with or without food, and they are convenient and simple to take. Additionally, capsules come in a range of doses, allowing you to select the best one. Based on applications, the market is Blood Cholesterol Reduction, Weight Management, Gastrointestinal Health, Others.

MARKET DYNAMICS

KEY DRIVERS

-

Growing demand of Supplements in healthcare solutions

Fiber is necessary for a healthy digestive system, and it has also been linked to a number of other health benefits, including a lower risk of heart disease, stroke, type 2 diabetes, and certain types of cancer. People are more likely to turn to fiber supplements to meet their demands as they become more aware of the importance of fiber in their diet. Digestive illnesses are the third greatest cause of death worldwide, according to the World Health Organization. A fiber-rich diet can help or avoid many of these disorders, including constipation, irritable bowel syndrome (IBS), and diverticulitis.

RESTRAIN

-

Lack of awareness of the benefits of fiber supplements

Many people may not understand the value of fiber in their diets or the advantages of fiber supplements. This may influence people to decide against using fiber supplements, even though they may benefit from doing so. Additionally, some people think fiber has negative consequences or is difficult to digest. Others think their diets alone can provide them with adequate amounts of fiber. This false information can make some people reluctant to take fiber supplements.

OPPORTUNITY

-

Increasing demand from emerging economies

For manufacturers of fiber supplements, emerging markets like China, India, Malaysia, Brazil, Mexico, and Indonesia present large unexplored prospects. Adoption of dietary supplements is sparked in these nations by rising disposable incomes, expanding health consciousness, and escalating digestive health problems. To take advantage of the huge potential given by emerging markets, market participants might concentrate on growing their distribution networks, customizing their products, offering competitive pricing, and undertaking marketing campaigns.

CHALLENGES

-

Preference for dietary modification

Rather than directly supplementing fiber, doctors frequently advise patients to make dietary adjustments and increase their intake of high-fiber foods. Many people would rather receive their fiber from foods like fruits, vegetables, and whole grains than from supplements. This is because fiber-rich foods are generally less expensive and more delicious than fiber supplements. Furthermore, many people believe that receiving their fiber through food is more natural and healthier than taking pills.

IMPACT OF RUSSIA UKRAINE WAR

The Russia-Ukraine conflict has had a substantial impact on fiber supplement demand and supply. Russia and Ukraine are important exporters of psyllium husk, but the war has hampered their capacity to do so. This has caused supply difficulties in markets that rely on psyllium husk and other raw materials for fiber supplements. Fiber supplement prices have risen as a result, and this trend is projected to continue shortly. In 2022, Britain's GlaxoSmithKline (GSK.L) announced that its consumer branch had ceased importing supplements and vitamins into Russia as the drugmaker sought to cut ties with Moscow following its invasion of Ukraine.

IMPACT OF ONGOING RECESSION

Following the COVID-19 pandemic, people injured in the Russia-Ukraine war have degraded the health of people. The pandemic has increased the consumption of fiber supplements but high prices of supplements may decrease demand for supplements. The war in Ukraine has caused a shortfall that can result in numerous ailments. Price increases for fiber supplements may result from disruptions in the supply of raw ingredients in 2022. Fiber shortage can cause fatigue, stomach pain, and weight gain in addition to these health issues. Consumers might be less inclined to spend money on luxuries like fiber supplements. Producers can create novel fiber supplements that are more cost-effective and appealing to consumers.

MARKET SEGMENTATION

By Type

-

Capsules

-

Powder

-

Chewable Tablets

-

Others

By Nature

-

Organic

-

Conventional

By Application

-

Blood Cholesterol Reduction

-

Weight Management

-

Gastrointestinal Health

-

Others

REGIONAL ANALYSIS

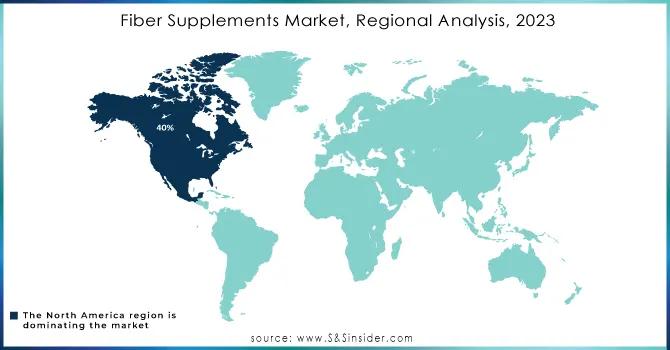

North America is estimated to be the dominant fiber supplements market, accounting for more than 40% of the market share in the upcoming period. The rising health concerns, growing geriatric population, and increasing fiber deficiency among consumers are driving market expansion in North America.

Europe is predicted to be the second-largest market for fiber supplements, accounting for more than 28% of the market throughout the projection period. The growing awareness of the health benefits of fiber, as well as the rising desire for easy and economical healthcare solutions, are driving market expansion in Europe.

Asia Pacific is expected to be the fastest-growing market for fiber supplements. The prevalence of obesity is on the rise and has reached epidemic proportions worldwide. Rising disposable incomes, increased urbanization, and growing knowledge of the health advantages of fiber are driving market expansion in the Asia Pacific.

Need Any Customization Research On Fiber Supplements Market - Inquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Fiber Supplements Market are Metamucil, Optimum Nutrition, Citrucel, Walgreens, Nature's Way, CVS Pharmacy, Culturelle, Prescript-Assist, Align Probiotics, Future Method, Konsyl Pharmaceuticals, Inc., Heather's Tummy Care, and other key players.

RECENT DEVELOPMENTS

In January 2023, Konsyl Pharmaceuticals, Inc., the makers of Konsyl Daily Psyllium Fiber and an established health and wellness brand for more than 85 years, announces the largest launch of a product in the company's history with the launch of four fiber gummies geared at gut health.

In Feb 2023, Future Method, the wellness business recognized for inventing science-backed products aimed at making worry-free sex accessible to everybody, announced the release of Butt & Gut Daily Fiber, its latest supplement.

In May 2023, the prebiotic carrot fiber from NutriLeads is featured in a new immune supplement. BeniCaros is a "soluble carrot fiber containing prebiotic properties that enable the immune system to be more efficient, intelligent, and stronger." It is made from repurposed carrot pomace.

| Report Attributes | Details |

| Market Size in 2023 | US$ 19.68 Billion |

| Market Size by 2032 | US$ 34.40 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Capsules, Powder, Chewable Tablets, Others) • By Nature (Organic, Conventional) • By Application (Blood Cholesterol Reduction, Weight Management, Gastrointestinal Health, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Metamucil, Optimum Nutrition, Citrucel, Walgreens, Nature's Way, CVS Pharmacy, Culturelle, Prescript-Assist, Align Probiotics, Future Method, Konsyl Pharmaceuticals, Inc., Heather's Tummy Care |

| Key Drivers | • Growing demand of Supplements in healthcare solutions |

| Market Opportunity | • Increasing demand from emerging economies |