Get more information on Fiber Cement Market - Request Sample Report

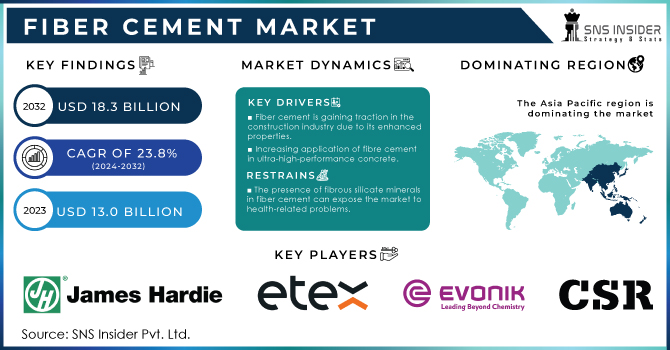

The Fiber Cement Market Size was valued at USD 17.10 Billion in 2023 and is expected to reach USD 24.87 Billion by 2032, growing at a CAGR of 4.25% over the forecast period of 2024-2032.

The fiber cement market is evolving rapidly, fueled by rising construction activities and a push for sustainability. Our report reveals insights into production capacity and utilization rates, highlighting efficiency trends among manufacturers. It provides a detailed pricing trends and cost structure analysis, illustrating the effects of raw material fluctuations. The assessment of import and export data uncovers trade dynamics that shape global positioning. Innovations are explored through patent analysis, while a comprehensive supply chain and value chain analysis identifies optimization opportunities. Lastly, the impact of government policies and regulations is examined, offering a complete view of the industry's growth trajectory.

Drivers

Increasing Demand for Sustainable and Environmentally Friendly Construction Materials Drives the Growth of the Fiber Cement Market

The rising focus on sustainability in the construction industry is a key driver for the growth of the fiber cement market. With increasing awareness about the environmental impact of traditional building materials like wood and concrete, fiber cement, known for its eco-friendly nature, has gained significant traction. Fiber cement is made using natural resources like cement, sand, and cellulose fibers, which are more sustainable compared to other construction materials. As governments and organizations push for greener building practices, there is growing demand for materials that offer durability, low maintenance, and environmental friendliness. Additionally, fiber cement products contribute to reducing carbon emissions in construction projects, which further aligns with the global shift toward sustainability. The development of green buildings, energy-efficient structures, and eco-friendly residential and commercial spaces is expected to continue driving the market forward, particularly in developed regions.

Restraints

High Raw Material Costs and Production Expenses Limit the Profitability of Fiber Cement Products in the Market

The cost of raw materials, including Portland cement, silica, and cellulose fibers, plays a crucial role in determining the overall production cost of fiber cement products. Volatile raw material prices can limit the profitability of manufacturers, as fluctuations in these costs can significantly impact pricing strategies. Additionally, the production process for fiber cement is complex, requiring specialized equipment and skilled labor, further adding to the overall production cost. These higher production costs, when passed on to consumers, may reduce the competitiveness of fiber cement against alternative, lower-cost construction materials, potentially limiting its widespread adoption. While fiber cement offers numerous benefits, including durability and sustainability, the price-sensitive nature of the construction industry could constrain its market share in cost-driven segments.

Opportunities

Rising Adoption of Eco-Friendly Construction Practices in Developing Economies Drives Demand for Fiber Cement Products

As emerging economies experience rapid urbanization and industrialization, there is a growing demand for eco-friendly and sustainable construction materials. Fiber cement products, with their environmental benefits, offer an attractive solution in these developing regions. Governments and construction companies are increasingly focusing on green building standards, which are driving the demand for sustainable materials like fiber cement. With the global push for carbon footprint reduction and sustainable development, developing countries are adopting eco-friendly construction practices, which further accelerates the adoption of fiber cement products. This trend is expected to create a significant opportunity for manufacturers to expand their presence in emerging markets, tapping into the increasing demand for environmentally conscious construction materials.

Challenge

Competition from Alternative Building Materials and Substitutes Impacts Fiber Cement Market Growth Potential

Fiber cement faces strong competition from alternative construction materials, such as vinyl siding, aluminum, and traditional concrete. These materials are often perceived as more cost-effective or easier to install, especially in markets where fiber cement has not yet gained widespread awareness. For instance, while fiber cement offers superior durability, fire resistance, and energy efficiency, alternative materials may offer lower upfront costs or simpler installation processes. As a result, in price-sensitive markets, consumers and contractors may opt for cheaper substitutes, limiting the growth potential of the fiber cement market. Manufacturers need to emphasize the long-term benefits of fiber cement, such as lower maintenance costs and superior performance, to overcome this challenge and gain a competitive edge in the marketplace.

By Cement Type

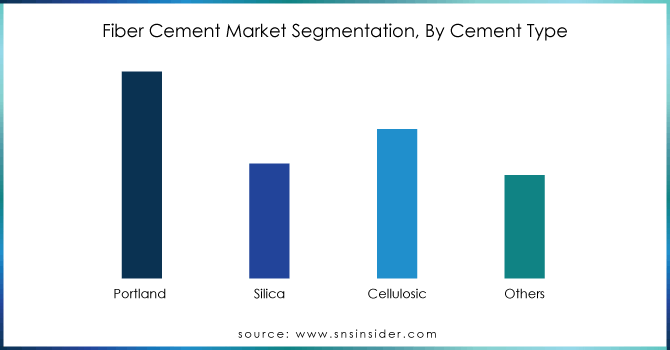

In 2023, the Portland cement segment dominated the fiber cement market with a market share of 55.2%. Portland cement's dominance is primarily due to its widespread availability, cost-effectiveness, and suitability for a variety of fiber cement applications, particularly in the construction industry. It offers excellent durability, strength, and workability, which makes it a preferred choice for manufacturers. Portland-based fiber cement is commonly used in both residential and commercial projects, including siding and cladding, due to its resistance to moisture and fire. Associations like the Portland Cement Association (PCA) have played a role in supporting the widespread use of Portland cement in construction, further solidifying its dominant position in the market.

By Application

In 2023, the siding segment dominated the fiber cement market with a market share of 32.4%. Fiber cement siding is highly favored for its aesthetic appeal, durability, and low maintenance compared to traditional siding materials like wood or vinyl. The popularity of fiber cement siding has been increasing due to its ability to withstand harsh weather conditions, fire resistance, and its environmentally friendly composition. Organizations such as the National Association of Home Builders (NAHB) have recognized fiber cement's benefits, contributing to its growing use in both residential and commercial construction. This segment’s growth is also driven by government initiatives promoting energy-efficient and sustainable building materials.

By End-Use

The residential segment dominated the fiber cement market in 2023 with a market share of 48.5%. Residential construction continues to be the largest application for fiber cement products, particularly for siding, roofing, and flooring due to their durability, cost-effectiveness, and eco-friendly properties. As urbanization increases and homebuilders emphasize sustainability, fiber cement’s appeal has surged in the residential sector. Government policies aimed at promoting energy-efficient housing have further accelerated demand. For example, the U.S. Green Building Council supports the use of fiber cement in residential buildings due to its minimal environmental impact and long lifespan, reinforcing the sector's dominance.

Get Customized Report as per your Business Requirement - Request For Customized Report

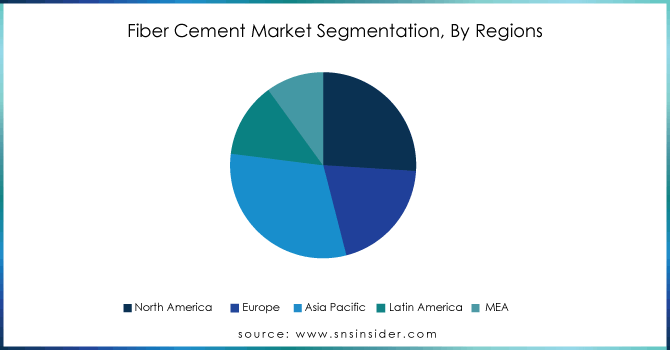

In 2023, the Asia Pacific region dominated the natural fiber composites market with a market share of 43.2%. This dominance can be attributed to the strong manufacturing base in countries like China and India, where the adoption of sustainable materials is growing rapidly across industries such as automotive, construction, and packaging. China, for instance, is a key producer of natural fiber composites, and its government has supported the market’s growth through policies encouraging green manufacturing. Additionally, India’s strong agricultural sector provides abundant natural fibers, such as jute, hemp, and sisal, which are increasingly being used in composite materials. Countries like Japan are also leveraging these composites in automotive manufacturing for lightweight and eco-friendly solutions. The regional growth is further driven by favorable regulations and growing awareness of the environmental benefits of using natural fibers as alternatives to traditional synthetic materials.

On the other hand, the North America region emerged as the fastest-growing region in the natural fiber composites market during the forecast period, with a significant growth rate. The demand for natural fiber composites in North America is growing due to an increasing focus on sustainability, coupled with the adoption of eco-friendly solutions in various sectors, particularly automotive, construction, and consumer goods. The United States stands as the leading contributor in the region, driven by the automotive sector's need for lightweight, fuel-efficient materials. Government initiatives, such as the Renewable Energy and Energy Efficiency Program, promote the use of sustainable materials in manufacturing. Canada is also witnessing rapid growth in the use of natural fiber composites in automotive components and consumer products, bolstered by advancements in green technologies and an active push towards reducing carbon footprints in manufacturing. These factors collectively contribute to the region’s dominance in the market's future growth.

March 2024: Shera invested US$36 million to establish its first production hub in the Philippines. Announced by Thunnop Jumpasri, president and country head for the Philippines and Malaysia, this would represent a significant expansion in response to robust growth in the local construction sector.

December 2023: ETEX Group acquired BCG's fiber cement business, this strategic acquisition is aimed at boosting ETEX's revenue stream specifically within the fiber cement segment.

December 2023: Etex has acquired SCALAMID, this Polish company boasts a cutting-edge production line with room for growth, but the real game-changer is the technology. SCALAMID's innovative process allows direct printing of designs onto fiber cement boards, giving architects and designers exciting new creative possibilities.

Beijing Hocreboard Building Materials Co. Ltd. (HBD Fiber Cement Board, HBD Calcium Silicate Board)

Cembrit Group A/S (Cembrit Plank, Cembrit Panel)

CSR Limited (Hebel PowerPanel, Cemintel Territory)

Etex Group (Equitone Facade Panels, Cedral Lap Siding)

Evonik Industries (Aerosil Fumed Silica, Dynasylan Organofunctional Silanes)

James Hardie Industries PLC (HardiePlank Lap Siding, HardiePanel Vertical Siding)

Nichiha Corporation (VintageWood Siding, Illumination Series Panels)

Plycem Corporation (Allura Fiber Cement Siding, Plycem Fiber Cement Trim)

Saint-Gobain (CertainTeed WeatherBoards, GlasRoc Sheathing)

The Siam Cement Public Company Limited (SCG Smartboard, SCG Smartwood)

Allura USA (Allura Lap Siding, Allura Panel Siding)

American Fiber Cement Corporation (Cembonit Cladding, Minerit HD Panels)

BGC Fibre Cement (Duragrid Facade System, Nuline Plus Weatherboard)

Everest Industries (Everest Heavy Duty Boards, Everest Designer Boards)

Hekim Yapi A.S. (HekimBoard Fiber Cement Board, HekimPanel Sandwich Panel)

Hyderabad Industries Limited (Charminar Fortune Cement Sheets, Aerocon Panels)

Mahaphant Fibre Cement Co. Ltd. (SHERA Board, SHERA Plank)

P.A.L. Chandra Builders Pvt. Ltd. (PALCO Fiber Cement Sheets, PALCO Roofing Sheets)

Soben International Ltd. (Soben FireProtect Board, Soben WeatherProtect Board)

Visaka Industries Limited (Vnext Boards, Vnext Premium Planks)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.10 Billion |

| Market Size by 2032 | USD 24.87 Billion |

| CAGR | CAGR of 4.25% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Cement Type (Portland, Silica, Cellulosic, Others) •By Application (Sliding, Roofing, Cladding, Backer Boards, Wall Partitions, Molding & Trimming, Others) •By End-Use (Residential, Commercial, Industrial and Institutional, Infrastructure) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | James Hardie Industries PLC, ETEX Group, Evonik Industries, Saint Gobain, CSR Limited, Nichiha Corporation, Cembrit Group A/S, The Siam Cement Public Company Limited, Plycem Corporation, Beijing Hocreboard Building Materials Co. Ltd. and other key players |

Ans: The Asia Pacific region dominated the Fiber Cement Market with a market share of 43.2% in 2023 due to the growing demand for sustainable materials.

Ans: The siding segment dominated the Fiber Cement Market with a market share of 32.4% in 2023 due to its durability and aesthetic appeal.

Ans: The increasing demand for sustainable and environmentally friendly construction materials is driving the growth of the Fiber Cement Market.

Ans: The Portland cement segment dominated the Fiber Cement Market with a market share of 55.2% in 2023 due to its widespread availability and cost-effectiveness.

Ans: The Fiber Cement Market size was valued at USD 17.10 billion in 2023 and is expected to reach USD 24.87 billion by 2032, growing at a CAGR of 4.25%.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Rates

5.2 Pricing Trends and Cost Structure Analysis

5.3 Import and Export Data

5.4 Patent Analysis and Innovation Trends

5.5 Supply Chain and Value Chain Analysis

5.6 Government Policies and Regulatory Impact

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fiber Cement Market Segmentation, by Cement Type

7.1 Chapter Overview

7.2 Portland

7.2.1 Portland Market Trends Analysis (2020-2032)

7.2.2 Portland Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Silica

7.3.1 Silica Market Trends Analysis (2020-2032)

7.3.2 Silica Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cellulosic

7.4.1 Cellulosic Market Trends Analysis (2020-2032)

7.4.2 Cellulosic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fiber Cement Market Segmentation, by Application

8.1 Chapter Overview

8.2 Sliding

8.2.1 Sliding Market Trends Analysis (2020-2032)

8.2.2 Sliding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Roofing

8.3.1 Roofing Market Trends Analysis (2020-2032)

8.3.2 Roofing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Cladding

8.4.1 Cladding Market Trends Analysis (2020-2032)

8.4.2 Cladding Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Backer Boards

8.5.1 Backer Boards Market Trends Analysis (2020-2032)

8.5.2 Backer Boards Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Wall Partitions

8.6.1 Wall Partitions Market Trends Analysis (2020-2032)

8.6.2 Wall Partitions Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Molding & Trimming

8.7.1 Molding & Trimming Market Trends Analysis (2020-2032)

8.7.2 Molding & Trimming Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fiber Cement Market Segmentation, by End-Use

9.1 Chapter Overview

9.2 Residential

9.2.1 Residential Market Trends Analysis (2020-2032)

9.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Commercial

9.3.1 Commercial Market Trends Analysis (2020-2032)

9.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Industrial and Institutional

9.4.1 Industrial and Institutional Market Trends Analysis (2020-2032)

9.4.2 Industrial and Institutional Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Infrastructure

9.5.1 Infrastructure Market Trends Analysis (2020-2032)

9.5.2 Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.2.4 North America Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.5 North America Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.2.6.2 USA Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6.3 USA Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.2.7.2 Canada Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7.3 Canada Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8.3 Mexico Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.7.2 France Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7.3 France Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8.3 UK Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.6.2 China Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6.3 China Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.7.2 India Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7.3 India Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.8.2 Japan Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8.3 Japan Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9.3 South Korea Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11.3 Singapore Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.12.2 Australia Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12.3 Australia Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.5 Middle East Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.2.4 Africa Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.5 Africa Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Fiber Cement Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.6.4 Latin America Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.5 Latin America Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6.3 Brazil Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7.3 Argentina Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8.3 Colombia Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Fiber Cement Market Estimates and Forecasts, by Cement Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Fiber Cement Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Fiber Cement Market Estimates and Forecasts, by End-Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 James Hardie Industries PLC

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 ETEX Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Evonik Industries

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Saint Gobain

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 CSR Limited

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Nichiha Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Cembrit Group A/S

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 The Siam Cement Public Company Limited

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Plycem Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Beijing Hocreboard Building Materials Co. Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Cement Type

Portland

Silica

Cellulosic

Others

By Application

Sliding

Roofing

Cladding

Backer Boards

Wall Partitions

Molding & Trimming

Others

By End-Use

Residential

Commercial

Industrial and Institutional

Infrastructure

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Rodenticides market size was valued at USD 5.52 billion in 2023 and is expected to reach USD 9.10 billion by 2032, growing at a CAGR of 5.72% over the forecast period of 2024-2032.

The Allulose Market Size was valued at USD 250.5 million in 2023 and is expected to reach USD 522.1 million by 2032 and grow at a CAGR of 8.5% over the forecast period 2024-2032.

Succinic Acid Market was valued at USD 216.3 Million in 2023 and is expected to grow to USD 466.7 Million by 2032, growing at a CAGR of 5.4% from 2024-2032.

The Composites Market Size was USD 104.6 Billion in 2023 and is expected to reach USD 231.2 Billion by 2032 and grow at a CAGR of 9.2% by 2024-2032.

The Benzoates Market Size was valued at USD 3.42 Billion in 2023 and is expected to reach USD 5.73 Billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2024-2032.

The Ketones Market size was valued at USD 23.4 billion in 2023 It is estimated to hit USD 32.1 billion by 2032 and grow at a CAGR of 3.6% over the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone